Avoid Taking Auto Loans For More Than 5 Years – The Negative Equity Wave

There is a negative equity problem building within the U.S. auto industry. Negative equity is when you go to trade in your car for a new one but the outstanding balance on your car loan is GREATER than the value of your car. You have the option to either write a check for the remaining balance on the loan or “roll” the negative equity into your new car loan. More and more consumers are getting caught in this negative equity trap.

There is a negative equity problem building within the U.S. auto industry. Negative equity is when you go to trade in your car for a new one but the outstanding balance on your car loan is GREATER than the value of your car. You have the option to either write a check for the remaining balance on the loan or “roll” the negative equity into your new car loan. More and more consumers are getting caught in this negative equity trap. Below is a chart of the negative equity trend over the past 10 years.

In 2010, 22% of new car buyers with trade-ins had negative equity when they went to go purchase a new car. In 2020, that number doubled to 44% (source Edmunds.com). The dollar amount of the negative equity also grew from an average of $3,746 in 2010 to $5,571 in 2020.

Your Car Is A Depreciating Asset

The first factor that is contributing to this trend is the simple fact that a car is a depreciating asset, meaning, it decreases in value over time. Since most people take a loan to buy a car, if the value of your car drops at a faster pace than the loan amount, when you go to trade in your car, you may find out that your car has a trade-in value of $5,000 but you still owe the bank $8,000 for the outstanding balance on your car loan. In these cases, you either have to come out of pocket for the $3,000 to payoff the car loan or some borrowers can roll the $3,000 into their new car loan which right out of gates put them in the same situation over the life of the next car.

Compare this to a mortgage on a house. A house, historically, appreciates in value over time, so you are paying down the loan, while at the same time, your house is increasing in value a little each year. The gap between the value of the asset and what you owe on the loan is called “wealth”. You are building wealth in that asset over time versus the downward spiral horse race between the value of your car and the amount due on the loan.

How Long Should You Take A Car Loan For?

When I’m consulting with younger professionals, I often advise them to stick to a 5-year car loan and not be tempted into a 6 or 7 year loan. The longer you stretch out the payments, the more “affordable” your car payment will be, but you also increase the risk of ending up in a negative equity situation when you go to turn in your car for a new one. In my opinion, one of the greatest contributors to this negative equity issue is the rise in popularity of 6 and 7 year car loan. Can’t afford the car payment on the car you want over a 5 year loan, no worries, just stretch out the term to 6 or 7 years so you can afford the monthly payment.

Let’s say the car you want to buy costs $40,000 and the interest rate on the auto loan is 3%. Here is the monthly loan payment on a 5 year loan versus a 7 year loan:

5 Year Loan Monthly Payment: $718.75

7 Year Loan Monthly Payment: $528.53

A good size difference in the payment but what happens if you decide to trade in your car anytime within the next 7 years, it increases your chances of ending up in a negative equity situation when you go to trade in your car. Also, when comparing the total interest that you would pay on the 5-year loan versus the 7 year loan, the 7 year car loan costs you another $1,271 in interest.

But Cars Last Longer Now……

The primary objection I get to this is “well cars last longer now than they did 10 years ago so it justifies taking out a 6 or 7 year car loan versus the traditional 5 year loan.” My response? I agree, cars do last longer than what they used to 10 years ago BUT you are forgetting the following life events which can put you in a negative equity scenario:

Not everyone keeps their car for 7+ years. It’s not uncommon for car owners to get bored with the car they have and want another one 3 – 5 years later. Within the first 3 years of buying your car that is when you have the greatest negative equity because your car depreciates by a lot within those first few years, and the loan balance does not decrease by a proportionate amount because a larger portion of your payments are going toward interest at the onset of the loan.

Something breaks on the car, you are out of the warrantee period, and you worry that new problems are going to continue to surface, so you decide to buy a new car earlier than expected.

Change in the size of your family (more kids)

You move to a different climate. You need a car for snow or would prefer a convertible for down south

You move to a major city and no longer need a car

You get in an accident and total your car before the loan is paid off

The moral of the story is this, it’s difficult to determine what is going to happen next year, let alone what’s going to happen over the next 7 years, the longer the car loan, the greater the risk that a life event will take place that will put you in a negative equity position.

The Negative Equity Snowball

A common solution to the negative equity problem is just to roll the negative equity into your next car loan. If that negative equity keeps building up car, after car, after car, at some point you hit a wall, and the bank will no longer lend you the amount needed to buy the new car and absorb the negative equity amount within the new car loan.

Payoff Your Car Loan

Too many people think it’s normal to just always have a car loan, so they dismiss the benefit of taking a 5-year car loan, paying it off in 5 years, and then owning the car for another 2 to 3 years without a car payment, not only did you save a bunch of interest but now you have extra income to pay down debt, increase retirement savings, or build up your savings.

Short Term Pain for Long Term Gain

Rarely is the best financial decision, the easiest one to make. Taking a 5-year car loan instead of a 6-year loan will result in a higher monthly car payment which will eat into your take home pay, but you will thank yourself down the road when you go to trade in your current car and you have equity in your current car to use toward the next down payment as opposed to having to deal with headaches that negative equity brings to the table.

Post COVID Problem

Unfortunately, we could see this problem get worse over the next 7 years due to the rapid rise in the price of automobiles in the U.S. post COVID due to the supply shortages. When people trade in their cars they are getting a higher value for their trade in which is helping them to avoid a negative equity situation now but they are simultaneously purchasing a new car at an inflated price, which could cause more people to end up in a negative equity event when the price of cars normalizes, the car is worth far less than what they paid for it, and they still have a sizable outstanding loan against the vehicle.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

College Savings Account Options

There are a lot of different types of accounts that you can use to save for college. But, certain accounts have advantages over others such as:

· Tax deductions for contributions

· Tax free accumulation and withdrawal

· The impact on college financial aid

· Who has control over the account

· Accumulation rate

The types of college savings account that I will be covering in this article are:

· 529 accounts

· Coverdell accounts (also know as ESA’s)

· UTMA / UGMA accounts

· Brokerage Accounts

· Savings Accounts

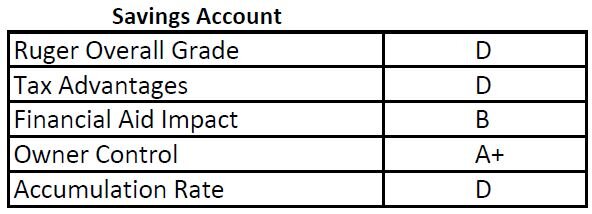

To make it easy to compare and contrast each option, I will have a grading table at the beginning of each section that will provide you with some general information on each type of account, as well as my overall grade on the effectiveness of each college saving option.

529 Plans

I’ll start with my favorite which are 529 College Savings Plan accounts. As a Financial Planner, I tend to favor 529 accounts as primary college savings vehicles due to the tax advantages associated with them. Many states offer state income tax deductions for contributions up to specific dollar amounts, so there is an immediate tax benefit. For example, New York provides a state tax deduction for up to $5,000 for single filers, and $10,000 for joint filers for contributions to NYS 529 accounts year. There is no income limitation for contributing to these accounts.

NOTE: Every now and then I come across individuals that have 529 accounts outside of their home state and they could be missing out on state tax deductions.

However, the bigger tax benefit is that fact that all of the investment returns generated by these accounts can be withdrawn tax free, as long as they are used for a qualified college expense. For example, if you deposit $5K into a 529 account when your child is 2 years old, and it grows to $15,000 by the time they go to college, and you use the account to pay qualified expenses, you do not pay tax on any of the $15,000 that is withdrawn. That is huge!! With many of the other college savings options like UTMA or brokerage accounts, you have to pay tax on the gains.

There is also a control advantage, in that the parent, grandparent, or whoever establishes the accounts has full control as to when and how much is distributed from the account. This is unlike UTMA / UGMA accounts, where once the child reaches a certain age, the child can do whatever they want with the account without the account owner’s consent.

A 529 account does count against the financial aid calculation, but it is a minimal impact in most cases. Since these accounts are typically owned by the parents, in the FAFSA formula, 5.6% of the balance would count against the financial aid reward. So, if you have a $50,000 balance in a 529 account, it would only set you back $2,800 per year in financial aid.

I gave these account an “A” for an accumulation rating because they have a lot of investment option available, and account owners can be as aggressive or conservative as they would like with these accounts. Many states also offer “age based portfolios” where the account is allocated based on the age of the child, and when the will turn 18. These portfolios automatically become more conservative as they get closer to the college start date.

The contributions limits to these accounts are also very high. Lifetime contributions can total $400,000 or more (depending on your state) per beneficiary.

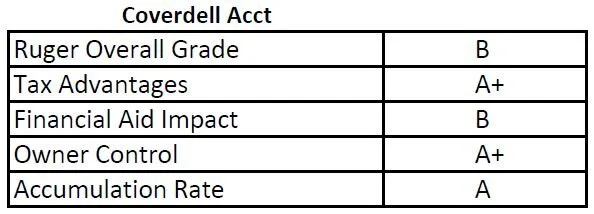

Coverdell Accounts (Education Savings Accounts)

Coverdell accounts have some of the benefits associated with 529 accounts, but there are contribution and income restrictions associated with these types of accounts. First, as of 2021, only taxpayers with adjusted gross income below $110,000 for single filers and $220,000 for joint filers are eligible to contribute to Coverdell accounts.

The other main limiting factor is the contribution limits. You are limited to a $2,000 maximum contribution each year until the beneficiary’s 18th birthday. Given the rising cost of college, it is difficult to accumulate enough in these accounts to reach the college savings goals for many families. Similar to 529 accounts, these accounts are counted as an asset of the parents for purposes of financial aid.

The one advantage these accounts have over 529 accounts is that the balance can be used without limitations for qualified expenses to an elementary or secondary public, private, or religious school. The federal rules recently changed for 529 accounts allowing these types of qualified withdrawal, but they are limited to $10,000 and depending on the state you live in, the state may not recognize these as qualified withdrawals from a 529 account.

If there is money left over in these Coverdell account, they also have to be liquidated by the time the beneficiary of the account turns age 30. 529 accounts do not have this restriction.

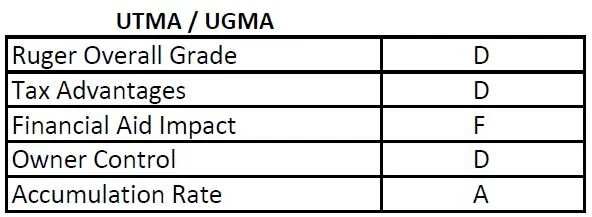

UTMA & UGMA Accounts

UGMA & UTMA accounts get the lowest overall grade from me. With these accounts, the child is technically the owner of the account. While the child is a minor, the parent is often assigned as the custodian of the account. But once the child reaches legal age, which can be 18, 19, or 21, depending on the state you live in, the child is then awarded full control over the account. This can be a problem when your child decides at age 18 that buying a Porsche is a better idea than spending that money on college tuition.

Also, because these accounts are technically owned by the child, they are a wrecking ball for the financial aid calculation. As I mentioned before, when it is an asset of the parent, 5.6% of the balance counts against financial aid, but when it is an asset of the child, 20% of the account balance counts against financial aid.

There are no special tax benefits associated with UTMA and UGMA accounts. No tax deductions for contributions and the child pays taxes on the gains.

Unlike 529 and Coverdell accounts, where you can change the beneficiary list on the account, with UTMA and UGMA accounts, the beneficiary named on the account cannot be changed.

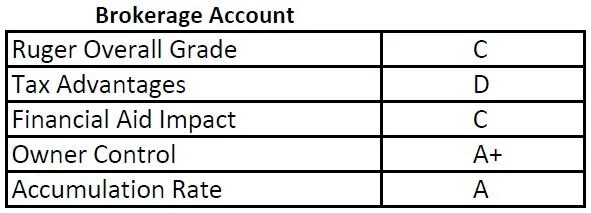

Brokerage Accounts

Parents can use brokerage accounts to accumulate money for college instead of the cash sitting in their checking account earning 0.25% per year. The disadvantage is the parents have to pay tax on all of the investment gains in the account once they liquidate them to pay for college. If the parents are in a higher tax bracket, they could lose up to 40%+ of those gains to taxes versus the 529 accounts where no taxes are paid on the appreciation. But, it also has the double whammy that if the parents realize capital gains from the liquidation, their income will be higher in the FAFSA calculation two years from now.

Sometimes, a brokerage account can complement a 529 account as part of a comprehensive college savings strategy. Many parents do not want to risk “over funding” a 529 account, so once the 529 accounts have hit a comfortable level, they will begin contributing the rest of the college savings to a brokerage account to maintain flexibility.

Savings Accounts

The pros and cons of a savings account owned by the parent or guardian of the child will have similar pros and cons of a brokerage account with one big drawback. Last I checked, most savings accounts were earning under 1% in interest. The cost of college since 1982 has increased by 6% per year (JP Morgan College Planning Essentials 2021). If the cost of college is going up by 6% per year, and your savings is only earning 1% per year, even though the balance in your savings account did not drop, you are losing ground to the tune of 5% PER YEAR. By having your college savings accounts invested in a 529, Coverdell, or brokerage account, it will at least provide you with the opportunity to keep pace with or exceed the inflation rate of college costs.

Can The Cost of College Keep Rising?

Let’s say the cost of attending college keeps rising at 6% per year, and you have a 2-year-old child that you want to send to state school which may cost $25,000 per year today. By the time they turn 18, it would cost $67,000 PER YEAR, times 4 years of college, which is $268,000 for a bachelor’s degree! The response I usually get when people hear these number is “there is no way that they can allow that to happen!!”. People were saying that 10 years ago, and guess what? It happened. This is what makes having a solid college savings strategy so important for your overall financial plan.

NOTE: As Financial Planners, we are seeing a lot more retirees carry mortgages and HELOC’s into retirement and the reason is usually “I helped the kids pay for college”.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

DISCLOSURE: This material is for informational purposes only. Neither American Portfolios nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions. Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors. Investment advisory services offered through Greenbush Financial Group, LLC. Greenbush Financial Group, LLC is a Registered Investment Advisor. Securities offered through American Portfolio Financial Services, Inc (APFS). Member FINRA/SIPC. Greenbush Financial Group, LLC is not affiliated with APFS. APFS is not affiliated with any other named business entity. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against market risk. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Guarantees apply to certain insurance and annuity products (not securities, variable or investment advisory products) and are subject to product terms, exclusions and limitations and the insurer's claims-paying ability and financial strength. Before investing, consider the investment objectives, risks, charges, and expenses of the annuity and its investment options. Please submit using the same generated coversheet for this submission number. Potential investors of 529 plans may get more favorable tax benefits from 529 plans sponsored by their own state. Consult your tax professional for how 529 tax treatments and account fees would apply to your particular situation. To determine which college saving option is right for you, please consult your tax and accounting advisors. Neither APFS nor its affiliates or financial professionals provide tax, legal or accounting advice. Please carefully consider investment objectives, risks, charges, and expenses before investing. For this and other information about municipal fund securities, please obtain an offering statement and read it carefully before you invest. Investments in 529 college savings plans are neither FDIC insured nor guaranteed and may lose value.

At What Age Does A Child Have To File A Tax Return?

When your children begin working and they receive their first W2, the question from parents is often “Do they have to file a tax return?” In this video we will cover

When your children begin working and they receive their first W2, the question from parents is often “Do they have to file a tax return?” In this video we will cover:

At what age are you required to file a tax return

The $12,400 income threshold

Tax refunds for children

Impact on the IRS Stimulus Checks

Can you still claim them as a dependent if they file a tax return?

Kiddie Tax

DISCLOSURE: This is for educational purposes only. This is not tax advice. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.Money Smart Board blog

4 Things That Elite Millennials Do To Fast Track Their Careers

As a young professional, your most valuable asset is your career. While you can watch endless videos on the benefits of making Roth IRA contributions or owning real estate, at the end of the day if you're making $400,000 instead of

As a young professional, your most valuable asset is your career. While you can watch endless videos on the benefits of making Roth IRA contributions or owning real estate, at the end of the day if you're making $400,000 instead of $70,000 before reaching the age of 40, you will have the opportunity to build real wealth faster.

As the owner of an investment firm, I have had the opportunity to work with a lot of very success Millennials that have either successfully grown a business or have climbed the corporate ladder much faster than their peers. Even though these elite young professionals all have different backgrounds, personalities, and skill sets, I have noticed that there are 4 things that make them similar and I’m going to share them with you today.

They Take Risks Early & Often

Think about the last time you left a job; whether it was to take a job with a different company, start your own business, or take a new position within your current company, you probably spent days or maybe weeks in mental turmoil asking yourself questions like:

“Am I making the right decision?”

“What if I get to this new company and the position is not what they say it’s going to be?”

“Should I risk going out on my own and starting a company?”

We have all been there, and it’s awful. All you can think about is, “What if this does not work out the way I expect?”. What I have noticed with this group of successful millennials is that they are able to recognize the uncertainty in those situations, but still choose to jump forward without ever looking back. They are like cats in the way that no matter where they land down the road, the one thing they feel certain about is that they will land on their feet.

This is not just something that they do once or twice, but rather multiple times throughout their working careers. In general, the young professionals that really surge forward are the ones that take risks early on in their careers. Starting a business or making a big career change when you are 25 with no mortgage and no family to support is typically easier to manage then taking that same risk when you have a mortgage and/or family to support. We have seen young professionals start businesses and in year two or three the business nearly goes under, but they somehow held on, pushed forward, and they turned it into a wildly successful business. There is no perfect age to take these leaps, but it’s just acknowledging that without a lot of advanced planning it becomes much more difficult to take these risks as your personal expenses grow.

Sense Of Purpose

When you talk with this group of successful Millennials, they all have a very strong sense of purposes. Now, sense of purpose does not necessarily mean that they have life all figured out. Many of the professionals in this elite group will jokingly admit that they have no idea what the future holds for them, however, they can tell you at length what they love about their career and their explanation will often sound very different than if you were to ask their coworkers what they love about their job.

Example, we have a client that provides custom software to companies and they have rising star on their team. Looking at this employee’s resume and position within the company you would say “Ok, typical software developer, coder, very techy, etc.” However, this employee has taken it upon himself to post videos to social media everyday as he builds robot armies, provides free strategies for solving problems using custom software, and he has amassed a huge following of tech fans wanting more.

This was not something that his supervisor asked him to do or a task that is at all part of his job description. Nope, he is sincerely passionate about helping companies to solve everyday problems using custom software and he puts it all out there for the world to see. Such a clear sense of purposes that has allowed him to turn something ordinary into something extraordinary. The tip here: figure out what you love and try to incorporate it into your career.

They Say “No”

This is kind of an odd one, but I have noticed this trait to be common among successful younger business owners and executives. They know when to say “No” to an opportunity. For most professionals, the power of “No” comes later on in their careers after they have seen enough opportunities turn into complete train wrecks. Most younger professionals do not have 30 years of battle tested experience in an effort to execute their growth plans, they dine at what I call “the buffet of opportunity”.

When you start a company or lead a team of executives, usually the main goal is to grow the company as fast as possible, so when you are presented with 3 growth ideas, you may decide to chase 2 or all 3 in an effort to grow the company. Sometimes that’s ok, but what I have seen these successful Millennials recognize is that by committing all of their resources toward what they feel is the single best opportunity they are able to either succeed or fail FASTER. A concept that was identified by Elon Musk of Tesla.

I was able to identify this trait through the actions of one of our clients. A young business owner that had a company in the energy sector and the company had been experiencing double digit growth for a number of years. Since they had cash and they were looking for ways to grow the company, instead of just selling their product and then hiring third party contractors for the install, they decided that they could produce additional revenue by handling the installation themselves.

Two years after that decision was made, I was having breakfast with the owner of the company and he said that decision almost bankrupted the company. While they were very good at producing their product, they were horrible at running construction teams and managing the liability associated with the installation process. He said, “I should have just said no and stuck to what we were good at.”

That experience made me aware of the Power of No being used by other young business owners and executives. We have had clients that have said “No” to:

A large new client because it would tie the fate of their company to that client

Joint working relationship with other companies

Providing services related too but not associated with their core business

New investors in the company

Selling the company

All of these decisions are tough decisions to make, but I have noticed that our most successful young professionals are not afraid to look opportunity in the eye and say “not today”.

The L-Factor

An executive from Yahoo named Tim Sanders wrote a book a number of years ago called The Likeability Factor. The main idea of the book is people choose who they like and they tend to buy from them, hire them, and purposefully spend more time with them. It may not be a surprise that many of the successful young professionals that we see growing businesses and sprinting up the corporate ladder have what Tim Sanders calls a high “L-Factor”.

Think of the clients and co-workers that show up at your office door and you know it’s going to be a fun and engaging conversation. Those are the high L-factor people in our lives. It’s been shown that those High L-factor executives tend to survive layoffs time after time because even though their actual position may be getting eliminated, the powers that be sometimes find a place for that person to land for no other reason than they liked them and wanted to keep them with the company.

While I’m sure all of us can think of someone that is in a position of power that has an L-factor of zero, there are far many more business owners and executives that have made it to where they are today because they are likeable.

I feel like I could give you endless examples of instances where I have seen likeability play out in favor of successful young professionals, but I think everyone understands the general idea. The one thing that I will point out though that is also in Tim’s book is that any level, you have the ability to raise your L-Factor. Likeability is a skill like listening, negotiating, or public speaking. It comes very natural to some people, but others have to work at it.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Use Your Retirement Accounts To Start A Business

One of the most challenging aspects of starting a new business is finding the capital that is needed to support your expenses as you begin to build up a revenue stream since it’s not always easy to ask friends and family for money to invest in a startup business. Luckily, for new entrepreneurs, there are some little-known ways on how you can use

One of the most challenging aspects of starting a new business is finding the capital that is needed to support your expenses as you begin to build up a revenue stream since it’s not always easy to ask friends and family for money to invest in a startup business. Luckily, for new entrepreneurs, there are some little-known ways on how you can use retirement accounts as a funding source for your new business. However, before you cash out your 401(k) account to start a business, you have to fully understand the pros and cons of each option.

ROBS Plans

ROBS stands for “Rollover for Business Startups”. ROBS is a special program that allows you to use the balance in your 401(k) or IRA account to fund your new business while avoiding having to pay taxes and the 10% early withdrawal penalty for business owners under age 59.5. Unlike a 401(k) loan that has limits, loan payments, and interest, ROBS plans allow you to use your full retirement account balance without having to enter into a repayment plan.

Why do business owners use ROBS plans?

The benefits are fairly obvious. First off, by using your own retirement assets to fund your new business, you don’t have to ask friends and family for money. Secondly, if you were to embark on the traditional lending route from a bank for your start-up, most would require you to pledge personal assets, such as your house, as collateral for the loan. Doing this puts an added pressure on the new entrepreneur because if the business fails you not only lose the business, but potentially your house as well. By using the ROBS plan, you are only risking your own assets, you have quick and easy access to those funds, and if the business fails, worst case scenario, you just have to work longer than you expected.

Is this too good to be true?

When I explain this funding strategy to new business owners, the question I usually get is, “Why haven’t I heard of these plans before?”, and here are a few reasons why. To begin, you are using retirement plan dollars and accessing the tax benefits, and in doing so there are a lot of complex rules surrounding these types of plans. It’s not uncommon for accountants, third-party administrators, and financial advisors to not know what a ROBS plan is, let alone understand the compliance rules surrounding these plans; thus, it’s rarely presented as a viable option. Over the course of this article we will cover the pros and cons of this funding mechanism.

How do ROBS plans work?

The concept is fairly simple, your retirement account essentially buys shares of stock in your new business which provides the business with the cash needed to grow. You do not have to be a publicly traded company for your retirement account to buy shares, however, you are required to establish your new company as a C-Corp in order for this plan to work.

This process entails incorporating your new business, as well as establishing a new 401(k) plan within that business, that contains the special ROBS features. Then, you can transfer assets from your various retirement accounts into the new 401(k) plan allowing the 401(k) plan to then buy shares in your new company. While this sounds easy, I cannot stress enough that you must work with a firm that fully understands these types of plans and the funding strategy. These plans are perfectly legal, but there are a lot of rules to follow. Since this funding strategy allows you to access retirement account dollars without having to pay tax to the IRS, the IRS will sometimes audit these plans hoping that you did not fully understand or comply with the rules surrounding the establishment and operations of these ROBS plans.

The steps to set up a ROBS plan

Here are the steps for setting up the plan:

1) Establish your new business as a C-Corp.

2) Establish a new 401(k) plan for your new business

3) Process direct rollovers from your 401(k) accounts and IRA accounts into your new 401(k) plan

4) Use the balance in your 401(k) account to purchase shares of the corporation

5) Now you have cash in your business checking account to pay expenses

You must be a C-Corp

The only type of corporate structure that works for a ROBS plan is a C-Corp because only a C-Corp can sell shares of the business to a retirement account legally. That means that LLCs, sole proprietorships, partnerships or even S-Corps will not work for this funding option.

Establishing the new 401(k) plan

ROBS plans have all the same features and benefits of a traditional 401(k) plan, profit-sharing plan, or defined benefit plan, except they also have special features that allow the plan to invest plan assets in the privately held C-Corp.

You need to work with a firm that knows these plans well because not all custodians will allow you to hold shares of a privately held corporation in a qualified retirement account. For many investment firms and custodians, this is considered either a “private placement” or an “alternative investment”. There is typically a special approval process that you must go through with the custodian before they allow your 401(k) account to purchase the shares of stock in your new company. Be ready, there are a lot of mainstream 401(k) providers that will not only not know what a ROBS plan is, but they often times limit the plan investment options to mutual funds; to avoid this, make sure you are aligning yourself with the right provider.

Transferring funds from your retirement accounts to your new 401(k) plan

Your new investment provider should assist you with coordinating the rollovers into your 401(k) account to avoid paying taxes and penalties. Also, if you have 401(K) Roth or after-tax money in your retirement accounts, special preparations need to be made prior to the rollover occurring for those sources.

Purchasing stock in the business

It’s not as easy as simply transferring money into the business checking account since you have to go through the process of issuing shares to the 401(k) account. In most cases, the percentage of ownership attributed to the 401(k) plan is based upon your total funding picture to start up the company. If your retirement accounts are the sole resource to fund the business, then technically your 401(k) plan owns 100% of the company. It’s not uncommon for new business owners to use multiple funding sources including personal savings, funding from friends and family, or a home-equity loan. In these instances, a ROBS plan is still allowed but the plan will own less than 100% of the business.

I don’t want to get too deep in the weeds with this point, but it’s usually advisable not to issue 100% of the shares of the business to your 401(k) plan. This could limit your ability to raise additional capital down the road because you don’t have any additional shares to issue to new investors or to share equity with a new partner.

Using the capital to grow your business

Once the share purchase is complete, the cash will be transferred from your retirement account into the business checking account allowing use those funds to start growing the business.

There is a very important rule when it comes to what you can use these funds for within the new business. First and foremost, you cannot use these funds to pay yourself compensation as the business owner. This is probably the biggest ‘no-no’ associated with these types of plans. The IRS does not want you circumnavigating income taxes and penalties just to pay yourself under a ROBS plan. In order to pay yourself as the business owner, you have to be able to generate revenue from the business. The assets from the stock purchase can be used to pay all of your expenses but before you’re able to take any money out of the business to pay yourself compensation you have to be showing revenue.

Once new business owners hear this, it’s often disheartening. It’s great that they have access to capital to build their business, but how do they pay their bills while they’re building up the revenue stream? Luckily, I have good news on this front. We have additional strategies that we can implement using your retirement accounts outside of the ROBS plan that will allow you to pay yourself compensation as the owner and it can work out better tax wise than paying yourself as a W2 income through the C-corp.

Requirements for ROBS plans

There are a few requirements you have to meet for this funding strategy to work.

1) The funds have to be held in a pre-tax retirement account. This means that money in Roth IRA’s and Roth 401(k)’s are not eligible for this funding strategy.

2) You typically need at least $50,000 in your new 401(k) account for the ROBS plan to make sense since there are special costs associated with establishing and maintaining a ROBS 401(k) plan. If your balance is less than $50,000, the cost to establish and maintain the plan begins to outweigh the benefit of executing this funding strategy.

3) If you’re rolling over a 401(k) plan to fund your ROBS 401(k) plan, it cannot be from a current employer. In other words, if you are still working for a company and you’re running this new business on the side, you are not able to rollover your 401(k) balance into your newly established 401(k) plan and implement this ROBS strategy. The 401(k) account must be coming from a former employer that you no longer work for.

4) You have to be an active employee in the business

There are special IRS rules that define if an employee is actively or materially participating in a business. Since ROBS plans do not work for passive business owners, it is difficult to use these plans for real estate investments unless you can prove that you are an active employee of that real estate corporation. If your new business is your only employer, you work over 1000 hours per year, and it’s your primary source of revenue, then you should not have a problem qualifying as an active employee. If you have multiple businesses however, you really need to consult your accountant and ROBS provider to make sure you satisfy the IRS definition of materially participating.

A ROBS plan can be used for more than just start-ups

While we have talked a lot about using ROBS plans to start up a business, they can also be used for other purposes. These plans can be a funding source to:

1) Buy an existing business

2) Recapitalize a business

3) Build a franchise

These plans can offer fast access to large amounts of capital without having to go through the traditional lending channels.

Cost of setting up and maintaining a ROBS plan

It typically costs $4,000 – $5,000 to set up a ROBS plan and you cannot use the balance in your retirement account to pay this fee. It must be paid with outside funds.

As for ongoing fees, you will have the regular administrative, recordkeeping, and investment advisory fees associated with sponsoring a 401(k) plan which vary from provider to provider. You may also have additional fees charged each year by the custodian for holding the privately held C-Corp shares in your retirement account. Make sure you clearly understand what the custodian will require from you each year to value those shares. If you wind up with a custodian that requires audited financial statements, this could easily run you an additional $8,000+ per year to obtain those audited financial statements from an accounting firm. If you are sponsoring one of these plans, you probably want to try to avoid this large additional cost.

Complications if you have employees

For start-up companies or established companies that have employees that would otherwise be eligible for the 401(k) plan, there are special issues that need to be addressed. The rules within the 401(k) world state that all investment options available within the plan must be made available to all eligible employees. That means if the business owner is able to purchase shares of the company within the retirement plan, the other eligible employees must also be given the same investment opportunity. You can see immediately where this would pose a challenge to the ROBS plan if you have eligible employees.

However, investment options can be changed which is why ROBS plans are the most common in start-ups where there are no employees yet, allowing the 401(k) plan to setup the only eligible plan participant, the business owner, allowing them to buy shares of the company. Once the share purchases are complete, the business owner can then remove those shares as an investment option in the plan going forward.

The Cons of a ROBS plan

Up until now we have presented the advantages of the ROBS plan but there are some disadvantages.

1) The first one is pretty obvious. You are risking your retirement account dollars in a start-up business. If the business fails, not only will you be looking for a new job, but you’ve depleted your retirement assets.

2) You are required to sponsor a C-Corp which may not be the most advantageous corporate structure.

3) You are required to sponsor a 401(k) plan. When running a start-up business, it’s sometimes more advantageous to sponsor a Simple IRA or SEP IRA which requires less cost and time to maintain, but you don’t have that option using this funding strategy.

4) The business owners can’t pay themselves compensation from the stock purchase

5) The cost to setup and maintain the plan. Paying $5,000 just to establish the plan isn’t exactly cheap. Plus, you’re looking at $2,000+ in annual maintenance costs for the plan. Other options like taking a home-equity loan or establishing a Solo 401(K) plan and taking a $50,000 401(k) loan from the plan may be the better funding option.

6) Audit risk. While it’s not the case that all these plans are audited, they do present an audit opportunity for the IRS given the compliance rules surrounding the operation of these plans. However, this risk can be managed with knowledgeable providers.

7) Asset sale of the business becomes complex. If 10 years from now you sell your company, there are two ways to sell it. An asset sale or a stock sale. While a stock sale jives very easily with this ROBS funding strategy, an asset sale becomes more complex.

Summary

Finding the capital to start up a business is never easy. Each funding option comes with its own set of pros and cons. The ROBS plan is just another option for consideration. While I have greatly simplified how these plans work and how they operate, if you are strongly considering using this plan as a funding vehicle for your new business, please reach out to us so we can have an open discussion about what you are trying to accomplish, and how the ROBS plan stacks up against other funding options that you may have available.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Traditional vs. Roth IRA’s: Differences, Pros, and Cons

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research report with some interesting statistics regarding IRA’s which can be found at the following link, ICI Research Perspective. The article states, “In mid-2014, 41.5 million, or 33.7 percent of U.S. households owned at least one type of IRA”. At first I was slightly shocked and asked myself the following question: “If IRA’s are the most important investment vehicle and source of income for most retirees, how do only one third of U.S. households own one?” Then when I took a step back and considered how money gets deposited into these retirement vehicles this figure begins making more sense.

Yes, a lot of American’s will contribute to IRA’s throughout their lifetime whether it is to save for retirement throughout one’s lifetime or each year when the CPA gives you the tax bill and you ask “What can I do to pay less?” When thinking about IRA’s in this way, one third of American’s owning IRA’s is a scary figure and leads one to believe more than half the country is not saving for retirement. This is not necessarily the case. 401(k) plans and other employer sponsored defined contribution plans have become very popular over the last 20 years and rather than individuals opening their own personal IRA’s, they are saving for retirement through their employer sponsored plan.

Employees with access to these employer plans save throughout their working years and then, when they retire, the money in the company retirement account will be rolled into IRA’s. If the money is rolled directly from the company sponsored plan into an IRA, there is likely no tax or penalty as it is going from one retirement account to another. People roll the balance into IRA’s for a number of reasons. These reasons include the point that there is likely more flexibility with IRA’s regarding distributions compared to the company plan, more investment options available, and the retiree would like the money to be managed by an advisor. The IRA’s allow people to draw on their savings to pay for expenses throughout retirement in a way to supplement income that they are no longer receiving through a paycheck.

The process may seem simple but there are important strategies and decisions involved with IRA’s. One of those items is deciding whether a Traditional, Roth or both types of IRA’s are best for you. In this article we will breakdown Traditional and Roth IRA’s which should illustrate why deciding the appropriate vehicle to use can be a very important piece of retirement planning.

Why are they used?

Both Traditional and Roth IRA’s have multiple uses but the most common for each is retirement savings. People will save throughout their lifetime with the goal of having enough money to last in retirement. These savings are what people are referring to when they ask questions like “What is my number?” Savers will contribute to retirement accounts with the intent to earn money through investing. Tax benefits and potential growth is why people will use retirement accounts over regular savings accounts. Retirees have to cover expenses in retirement which are likely greater than the social security checks they receive. Money is pulled from retirement accounts to cover the expenses above what is covered by social security. People are living longer than they have in the past which means the answer to “What is my number?” is becoming larger since the money must last over a greater period.

How much can I contribute?

For both Traditional and Roth IRA’s, the limit in 2021 for individuals under 50 is the lesser of $6,000 or 100% of MAGI and those 50 or older is the lesser of $7,000 or 100% of MAGI. More limit information can be found on the IRS website Retirement Topics - IRA Contribution Limits

What are the important differences between Traditional and Roth?

Taxation

Traditional (Pre-Tax) IRA: Typically people are more familiar with Traditional IRA’s as they’ve been around longer and allow individuals to take income off the table and lower their tax bill while saving. Each year a person contributes to a Pre-Tax IRA, they deduct the contribution amount from the income they received in that tax year. The IRS allows this because they want to encourage people to save for retirement. Not only are people decreasing their tax bill in the year they make the contribution, the earnings of Pre-Tax IRA’s are not taxed until the money is withdrawn from the account. This allows the account to earn more as money is not being taken out for taxes during the accumulation phase. For example, if I have $100 in my account and the account earns 10% this year, I will have $10 of earnings. Since that money is not taxed, my account value will be $110. That $110 will increase more in the following year if the account grows another 10% compared to if taxes were taken out of the gain. When the money is used during retirement, the individual will be taxed on the amount distributed at ordinary income tax rates because the money was never taxed before. A person’s tax rate during retirement is likely to be lower than while they are working because total income for the year will most likely be less. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed.

Roth (After-Tax) IRA: The Roth IRA was established by the Taxpayer Relief Act of 1997. Unlike the Traditional IRA, contributions to a Roth IRA are made with money that has already been subject to income tax. The money gets placed in these accounts with the intent of earning interest and then when the money is taken during retirement, there is no taxes due as long as the account has met certain requirements (i.e. has been established for at least 5 years). These accounts are very beneficial to people who are younger or will not need the money for a significant number of years because no tax is paid on all the earnings that the account generates. For example, if I contribute $100 to a Roth IRA and the account becomes $200 in 15 years, I will never pay taxes on the $100 gain the account generated. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed on the earnings taken.

Eligibility

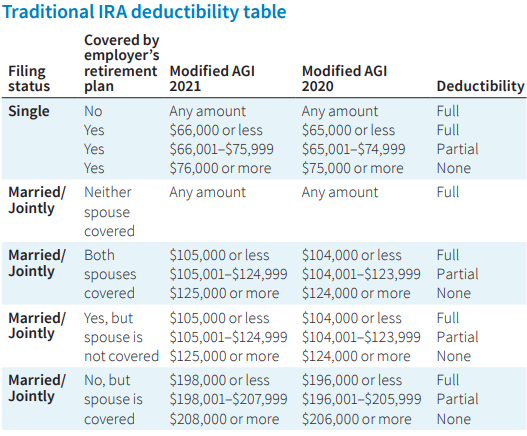

Traditional IRA: Due to the benefits the IRS allows with Traditional IRA’s, there are restrictions on who can contribute and receive the tax benefit for these accounts. Below is a chart that shows who is eligible to deduct contributions to a Traditional IRA:

There are also Required Minimum Distributions (RMD’s) associated with Pre-Tax dollars in IRA’s and therefore people cannot contribute to these accounts after the age of 70 ½. Once the account owner turns 70 ½, the IRS forces the individual to start taking distributions each year because the money has never been taxed and the government needs to start receiving revenue from the account. If RMD’s are not taken timely, there will be penalties assessed.

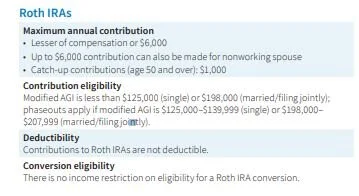

Roth IRA: As long as an individual has earned income, there are only income limitations on who can contribute to Roth IRA’s. The limitations for 2021 are as follows:

There are a number of strategies to get money into Roth IRA’s as a financial planning strategy. This method is explained in our article Backdoor Roth IRA Contribution Strategy.

Investment Strategies

Investment strategies are different for everyone as individuals have different risk tolerances, time horizons, and purposes for these accounts.

That being said, Roth IRA’s are often times invested more aggressively because they are likely the last investment someone touches during retirement or passes on to heirs. A longer time horizon allows one to be more aggressive if the circumstances permit. Accounts that are more aggressive will likely generate higher returns over longer periods. Remember, Roth accounts are meant to generate income that will never be taxed, so in most cases that account should be working for the saver as long as possible. If money is passed onto heirs, the Roth accounts are incredibly valuable as the individual who inherits the account can continue earning interest tax free.

Choosing the correct IRA is an important decision and is often times more complex than people think. Even if you are 30 years from retiring, it is important to consider the benefits of each and consult with a professional for advice.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

What is a Bond?

A bond is a form of debt in which an investor serves as the lender. Think of a bond as a type of loan that a company or government would obtain from a bank but in this case the investor is serving as the bank. The issuer of the bond is typically looking to generate cash for a specific use such as general operations, a specific project, and staying current or

What is a Bond?

A bond is a form of debt in which an investor serves as the lender. Think of a bond as a type of loan that a company or government would obtain from a bank but in this case the investor is serving as the bank. The issuer of the bond is typically looking to generate cash for a specific use such as general operations, a specific project, and staying current or paying off other debt.

How do Investors Make Money on a Bond?

Your typical bonds will generate income for investors in one of two ways: periodic interest payments or purchasing the bond at a discount. There are also bonds where a combination of the two are applicable but we will explain each separately.

Interest Payments

There are interest rates associated with the bonds and interest payments are made periodically to the investor (i.e. semi-annual). When the bonds are issued, a promise to pay the interest over the life of the bond as well as the principal when the bond becomes due is made to the investor. For example, a $10,000 bond with a 5% interest rate would pay the investor $500 annually ($250 semi-annually). Typically tax would be due on the interest each year and when the bond comes due, the principal would be paid tax free as a return of cash basis.

Purchasing at a Discount

Another way to earn money on a bond would be to purchase the bond at a discount and at some time in the future get paid the face value of the bond. A simple example would be the purchase of a 10 year, $10,000 bond for a discounted price of $9,000. 10 years from the date of the purchase the investor would receive $10,000 (a $1,000 gain). Typically, the investor would be required to recognize $100 of income per year as “Original Issue Discount” (OID). At the end of the 10 year period, the gain will be recognized and the $10,000 would be paid but only $100, not $1,000, will have to be recognized as income in the final year.

Is There Risk in Bonds?

Investment grade bonds are often used to make a portfolio more conservative and less volatile. If an investor is less risk oriented or approaching retirement/in retirement they would be more likely to have a portfolio with a higher allocation to bonds than a young investor willing to take risk. This is due to the volatility in the stock market and impact a down market has on an account close to or in the distribution phase.

That being said, there are risks associated with bonds.

Interest Rate Risk – in an environment of rising interest rates, the value of a bond held by an investor will decline. If I purchased a 10 year bond two years ago with a 5% interest rate, that bond will lose value if an investor can purchase a bond with the same level of risk at a higher interest rate today. This will make the bond you hold less valuable and therefore will earn less if the bond is sold prior to maturity. If the bond is held to maturity it will earn the stated interest rate and will pay the investor face value but there is an opportunity cost with holding that bond if there are similar bonds available at higher interest rates.

Default Risk – most relevant with high risk bonds, default risk is the risk that the issuer will not be able to pay the face value of the bond. This is the same as someone defaulting on a loan. A bond held by an investor is only as good as the ability of the issuer to pay back the amount promised.

Call Risk – often times there are call features with a bond that will allow the issuer to pay off the bond earlier than the maturity date. In a declining interest rate environment, an issuer may issue new bonds at a lower interest rate and use the profits to pay off other outstanding bonds at higher interest rates. This would negatively impact the investor because if they were receiving 5% from a bond that gets called, they would likely use the proceeds to reinvest in a bond paying a lower rate or accept more risk to earn the same interest rate as the called bond.

Inflation Risk – a high inflation rate environment will negatively impact a bond because it is likely a time of rising interest rates and the purchasing power of the revenue earned on the bond will decline. For example, if an investor purchases a bond with a 3% interest rate but inflation is increasing at 5% the purchasing power of the return on that bond is eroded.

Below is a chart showing the risk spectrum of investing between asset classes and gives a visual on the different classes of bonds and their most susceptible risks.

Types of Bonds

Federal Government

Bonds issued by the federal government are backed by the full faith and credit of the U.S. Government and therefore are often referred to as “risk-free”. There are always risks associated with investing but in this case “risk-free” is referring to the idea that the U.S. Government is not likely to default on a bond and therefore the investor has a high likelihood of being paid the face value of the bond if held to maturity but like any investment there is risk.

There are a number of different federal bonds known as Treasuries and below we will touch on the more common:

Treasuries – Sold via auction in $1,000 increments. An investor will purchase the bond at a price below the face value and be paid the face value when the bond matures. You can bid on these bonds directly through www.treasurydirect.gov, or you can purchase the bonds through a broker or bank.

Treasury Bills – Short term investments sold in $1,000 increments. T-Bills are purchased at a discount with the promise to be paid the face value at maturity. These bonds have a period of less than a year and therefore, in a normal market environment, rates will be less than those of longer term bonds.

Treasury Notes – Sold in $1,000 increments and have terms of 2, 5, and 10 years. Treasury notes are often purchased at a discount and pay interest semi-annually. The 10 year Treasury note is most often used to discuss the U.S. government bond market and analyze the markets take on longer term macroeconomic trends.

Treasury Bonds – Similar to Treasury Notes but have periods of 30 years.

Treasury Inflation-Protected Securities (TIPS) – Sold in 5, 10, and 20 year terms. Not only will TIPS pay periodic interest, the face value of the bond will also increase with inflation each year. The increase in face value will be taxable income each year even though the principal is not paid until maturity. Interest rates on TIPS are usually lower than bonds with like terms because of the inflation protection.

Savings Bonds – There are two types of savings bonds still being issued, Series EE and Series I. The biggest difference between the two is that Series EE bonds have a fixed interest rate while Series I bonds have a fixed interest rate as well as a variable interest rate component. Savings bonds are purchased at a discount and accrue interest monthly. Typically these bonds mature in 20 years but can be cashed early and the cash basis plus accrued interest at the time of sale will be paid to the investor.

Municipal Bonds (Munis) – Bonds issued by states, cities, and local governments to fund specific projects. These bonds are exempt from federal tax and depending on where you live and where the bond was issued they may be tax free at the state level as well. There are two categories of Munis: Government Obligation Bonds and Revenue Bonds. Government Obligation Bonds are secured by the full faith and credit of the issuer’s taxing power (property/income/other). These bonds must be approved by voters. Revenue Bonds are secured by the revenues derived from specific activities the bonds were used to finance. These can be revenues from activities such as tolls, parking garages, or sports arenas.

Agency Bonds – These bonds are issued by government sponsored enterprises such as the Federal Home Loan Mortgage Association (Freddie Mac), the Federal Home Loan Mortgage Association (Fannie Mae), and the Federal Agricultural Mortgage Corporation (Farmer Mac). Agency bonds are used to stimulate activity such as increasing home ownership or agriculture production. Although they are not backed by the full faith and credit of the U.S. Government, they are viewed as less risky than corporate bonds.

Corporate Bonds – These bonds are issued by companies and although viewed as more risky than government bonds, the level of risk depends on the company issuing the bond. Bonds issued by a company like GE or Cisco may be viewed by investors as less of a default risk than a start-up company or company that operates in a volatile industry. The level of risk with the bond is directly related to the interest rate of the bond. Generally, the riskier the bond the higher the interest rate.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

First Time Homebuyer Tips

Buying your first home is one of life’s milestones that everyone should have the opportunity to experience if they choose. Owning a home gives you a feeling of accomplishment and as you make payments a portion is going to your personal net worth rather than a landlord. The process is exciting but one surefire piece of information that I wish I

Buying your first home is one of life’s milestones that everyone should have the opportunity to experience if they choose. Owning a home gives you a feeling of accomplishment and as you make payments a portion is going to your personal net worth rather than a landlord. The process is exciting but one surefire piece of information that I wish I knew when buying my first home is that you will come across surprises. Whether it be a delay in closing, an issue with financing, or closing costs being higher than expected, it is important to know that you can do all the preparation possible and still be hit in the face with some setbacks.

This article will not only touch on some of the important considerations when buying your first home but will give examples of possible setbacks and how to avoid them.

Know Your Number

The most important piece of information to have when purchasing your home is how much you can spend. The purchase of your home should not be the only goal to consider. All of your other financial objectives such as paying off debt (i.e. college and unsecured) and saving for retirement must be taken into consideration. Also, it is recommended you have an emergency fund in place that would cover at least 4 months of your fixed expenses in case something happens with your job or some other event occurs. Knowing your number does not only include what you can afford today but how much you can afford monthly moving forward. If your monthly cash flow becomes dangerously low or negative with the addition of a mortgage payment (including mortgage/property taxes/homeowners), the house may be too expensive.

NOTE: Just because you are preapproved for a certain amount does not mean you need to spend that amount.

Choose An Agent You Trust

You will be spending a lot of time with your agent so choose them wisely. It should be someone you get along with and someone you can trust will look out for your best interests. If your agent just cares about receiving a commission, they may push you to purchase a home before looking at all of your options or buying a home you can’t afford. Remember, you are the client and therefore should be treated as such.

NOTE: Just because you never physically cut a check to your real estate agent doesn’t mean you aren’t paying them. In a typical transaction the seller will pay the commissions. An agreed upon percentage will come out of the sales proceeds and go to both real estate agents (the buyer’s and the seller’s) and therefore the cost is built into the price you pay.

Use Your Agent As An Asset

Your agent is likely much more knowledgeable about home buying than you so use that knowledge to your benefit. The agent should be able to help you value homes and determine whether the house is fairly priced. Ask them as many questions as possible throughout the entire process.

On The Fence

If you are on the fence whether or not to buy a home then take your time. If you may relocate because of your job or family don’t jump into purchasing a home. It is not worth paying the closing costs and going through the hassle of home buying if you may move in the near future. We typically use the “5 Year Rule” when making the determination. If you don’t see yourself being in the house for at least 5 years you should consider whether or not you will get your money back when you sell.

Compare Lenders

The banking industry is extremely competitive and it is worth shopping around for the best offer when choosing a mortgage provider. If you aren’t comfortable with numbers, don’t be afraid to ask for help. A difference of 0.10% on a 30 year mortgage could be the difference of thousands of dollars wasted on interest.

Don’t Cheap Out On Homeowners

Don’t choose your homeowners policy based on price. Of course price is one of the considerations but it is not the only one. Make sure your policy is the most comprehensive you can comfortably afford as the cost of increased premiums is likely much less than the cost of coming out of pocket for something not covered. Remember, insurance companies, like banks, are in a competitive industry so shop around.

Down Payment

Most lenders require a 20% down payment of the home value to avoid paying additional costs. This means if the value of the home is $200,000, you will have to pay $40,000 out of pocket! Most lenders offer Federal Housing Administration (FHA) loans that allow you to put down as little as 3.5%. If you choose this type of loan you also have to purchase Private Mortgage Insurance (PMI). This will be a cost added to your mortgage payment until the value of your home is adequate enough to remove the PMI. It is important to factor this in as a cost similar to interest because a 5% interest rate could quickly look like 6-7% if you have to pay PMI.

Closing And Other Additional Costs

There are a lot of out of pocket costs to consider when purchasing a home. Examples of these costs are listed below. An important piece of knowing your number is to consider all the costs that may come up during the process.

Loan Origination Fee

Attorney Fees

Property Taxes

Home Owners Insurance

Appraisal Fee

Inspection Fee

Title Insurance

Recording Fee

Government Recording Charges

Credit Report Fee

Flood Determination Fee

How To Help Avoid Certain Complications

Situation: I bought a house at the top of my budget that I thought was move in ready but needs repairs.

Recommendation: Choose an inspector that has a great reputation and knows the location. There may be issues that are common to the area that one inspector may be more likely to identify. Also, bring a contractor or someone of similar background for a walk through. Repairs can be extremely costly and if you purchased a home at the top end of your budget you may not be able to afford certain fixes. It should be known that all issues cannot be foreseen but taking the necessary steps to diminish these situations will not hurt. Don’t purchase a home that will bankrupt you if repairs need to be done.

Situation: I bought a home I can’t fill.

Recommendation: Closing costs and repairs won’t be the only out of pocket expenses. Complete a summary of items you think you may need to buy after the purchase. This may include furniture, appliances, décor, and fixtures. In these situations it is always better to overestimate.

Situation: My lease is up in a month and I would like to purchase a home.

Recommendation: Purchasing a home is something that requires time and planning. The home will likely be the largest purchase you’ve ever made (depending on the college you choose) so it is not something to rush. If you are thinking of moving after your lease is up or when you relocate jobs, start planning as soon as possible. Feeling forced into purchasing something as important as a home will likely lead to regrets.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Paying Down Debt: What is the Best Strategy?

Living with debt is not easy. It can be a constant burden and easily disrupt day-to-day life. Having debt will also ruin your credit score too. The worse your credit score gets, the less likely you will be accepted for any type of loan. One of the fastest ways to get rid of your debt is to pay your debt off in the correct order.

Living with debt is not easy. It can be a constant burden and easily disrupt day-to-day life. Having debt will also ruin your credit score too. The worse your credit score gets, the less likely you will be accepted for any type of loan. One of the fastest ways to get rid of your debt is to pay your debt off in the correct order.

STEP 1: Create a list of all your current debts

The first step is understanding what you owe. To start, make a master list of all your monthly credit card and loan statements. For each bill, include:

The creditor's name

The total amount you owe on that bill

The minimum required monthly payment

The interest rate (also known as APR)

The payment due date

STEP 2: List all of your monthly expenses

Add up all your monthly expenses: rent, car, food, utilities, health insurance and the minimum payments on your debts; as well as regular spending on things such as entertainment and clothing. Subtract that figure from your monthly after-tax income. The remaining amount is what you could put toward debt repayment each month-though it may make sense for you to save some.

STEP 3: Call your lenders

Call your lenders and explain your situation. They may be willing to lower your interest rate temporarily or waive late fees. You may also be able to lower your interest rate by transferring some high-interest credit card debt onto a new credit card with a lower rate (though that's not a long-term solution).

STEP 4: Payoff high interest rate or small balances first

You can start with the bill carrying the highest interest, or the one with the smallest balance. Prioritizing the highest-rate debt can save you more money: You pay off your most expensive debt sooner. Paying off the smallest debt can eliminate a bill faster, providing a motivating boost. Whichever you choose, make sure to pay at least the minimum on all your debts.

Pay the monthly minimum on each debt. The exception: your target bill. Put more money toward this one to pay it down faster. Once you pay off that bill, choose another to pay down aggressively. Your monthly debt repayment total shouldn't change, even when you eliminate bills. This way you gain momentum as you go, putting more and more money toward each remaining bill.

STEP 5: Get creative

You can use your annual tax refund or holiday bonus to pay down debt. Look for small ways to save money every day, such as riding your bike to work, or eating in instead of dining out. Another way to make a dent quickly is to sell unused or unnecessary belongings-maybe downgrading your car to a more affordable model with lower monthly payments.

STEP 6: Break the cycle

As you start to escape debt, it can be tempting to reward yourself by splurging on a new smartphone or an expensive dinner but just a few purchases can erase all your hard work. Instead, buy things with cash or your debit card, and think long and hard before taking on any new debt.

Read this book

If you want to live a debt free life, I strongly recommend you read the book "Total Money Makeover" by Dave Ramsey. Ramsey's book really paves the way to get out of debt and stay out of debt.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How to Create a Business Plan

Starting your own business can be an exciting and rewarding experience. It can offer numerous advantages such as being your own boss, setting your own schedule and making a living doing something you enjoy. But, becoming a successful entrepreneur requires thorough planning, creativity, and hard work. After making the decision to start your

Starting your own business can be an exciting and rewarding experience. It can offer numerous advantages such as being your own boss, setting your own schedule and making a living doing something you enjoy. But, becoming a successful entrepreneur requires thorough planning, creativity, and hard work. After making the decision to start your own business, you'll need to be realistic about the sort of goals and targets you want to achieve at first. Businesses need targets though, so be sure to set some. Meeting targets does usually indicate business growth and success, so that's why they are so important. As with any business though, it all starts with a solid plan...

Learn from those before you

Before you make the leap to start your own business, make sure you talk or work for the person that you want to be 5 years from now. Working in the industry before taking your leap of faith will most likely increase your success rate. On the surface some businesses seem simple and straight forward. No business ever is. You have to figure out how the successful companies in that industry currently make money, what are their margins, who are the customers, who are the competitors, and more importantly what are the missteps that you should avoid when building you own business.

You must be able to answer these questions

Why am I starting a business?

What kind of business do I want?

Who is my ideal customer?

What products or services will my business provide?

Am I prepared to spend the time and money needed to get my business started?

What differentiates my business idea and the products or services I will provide from others in the market?

Where will my business be located?

How many employees will I need?

What types of suppliers do I need?

How much money do I need to get started?

Will I need to get a loan?

How soon will it take before my products or services are available?

How long do I have until I start making a profit?