Need to Know College Savings Strategies

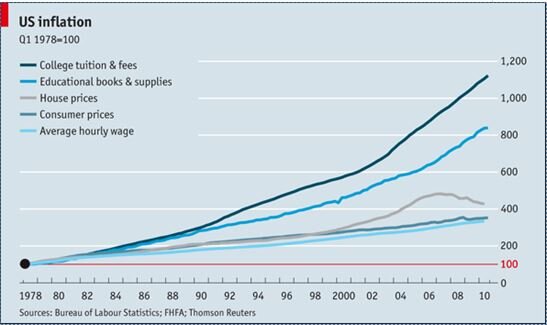

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control. The year over year increase in the cost of tuition and fees since 1978 to date has far outpaced any reasonable rate of inflation, and demands a new look at college savings strategies. In the chart below, you will see the increase in the price of college tuition and fee versus other comparable expenses over the past 30 years. Its mind blowing!!

Fund A 529 Account*

As far as college savings strategies go, there are very few options that beat 529 accounts as a savings vehicle for college. In these accounts you make after tax contribution to the account and when the amounts are withdrawn, as long as those withdrawals are attributed to a qualified college expenses, the earnings generated by the account are tax free. Depending on the state you live in you may be eligible to receive a state tax deduction for contribution up to specified dollar amount. In New York, single filers receive a NYS tax deduction up to $5,000 and married filing joint $10,000.

Also for financial aid purposes these account are looked at very favorably in the EFC (Expected Family Contribution) calculation. They are looked at by FASFA as an asset of the "parent" not the asset of the "child". There are many contribution and withdrawal strategies associated with these accounts that can produce big tax benefits for individuals accumulating savings for themselves or their children.

Roth IRAs Are Not Just For Retirement

When clients have the dual goal of saving for retirement and saving for college, the Roth IRA is often times a great option. Even if you make too much to contribute directly to a Roth, you can implement a "non-deductible IRA to Roth IRA conversion strategy" that will allow you to still get money into a Roth IRA.

Contributions to Roth IRAs are made with after tax dollars but unlike a traditional IRA if you hold a Roth IRA for at least 5 years and make withdrawals after age 59 1/2 you pay no tax on the earnings.

Here is one college savings strategy technique: You are allowed at any time and at any age to withdrawal the contribution portion of your account balance from a Roth IRA tax and penalty free. For example, if I contribute $5,000 to a Roth IRA and 5 years later it is worth $10,000, I can contact my IRA provider and request that they distribute just my basis ($5,000) and leave the earnings in the account to continue to accumulate tax free. You can then use that basis distribution to fund college expenses but the earnings in the Roth IRA continue to accumulate tax free.

Maximize Your Financial Aid

There are strategies that can be implemented leading up to the filing of the FASFA form that can increase that amount of financial aid that you receive. When you apply for financial aid, FASFA has a complex EFC calculation that takes a snapshot of your assets and income to determine how much financial aid you will qualify for. There are ways to shift assets and shelter income from this calculation that can save individuals and families thousands of dollars when it come to paying for college. Here are a few of the strategies that can help to improve a EFC calculation:

Save money in the parents or grandparents name, not the childs name

Pay off consumer debt, such as credit cards and auto loans

Spend down the students asset and income first

Accelerate necessary expenses (such as computer purchase) to reduce cash

Minimize capital gains

Maximize your contributions to a retirement plan

Do not withdrawal money from a retirement plan to pay for college

Ask grandparents to wait to give grandchildren money until after college

Trust funds are generally ineffective at sheltering money from EFC

Prepay your mortgage

Contribute to 529 plans owned by the parent or grandparent

Choose the date to submit the FASFA carefully

About Michael...

Hi, Im Michael Ruger. Im the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.