The Marriage Penalty: Past and Present

Whether you're currently married or not, the new tax legislation may impact how the "Marriage Penalty" affects you. Never heard of such a thing? Let's take a look at a simple example and show how it may be different under the new tax regulation.

The Marriage Penalty: Past and Present

Whether you're currently married or not, the new tax legislation may impact how the "Marriage Penalty" affects you. Never heard of such a thing? Let's take a look at a simple example and show how it may be different under the new tax regulation.

The Past (kind of)

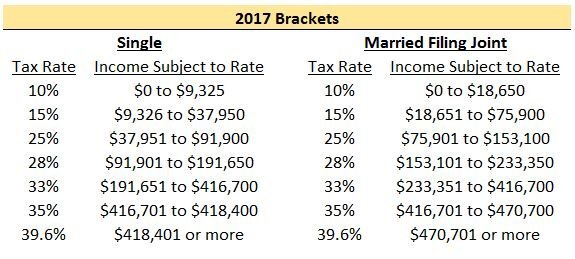

I say "kind of" because most people still have to file their 2017 tax return. Here is the 2017 tax table for Single Filers and Married Filing Joint Filers:

A reasonable person would think that the income subject to tax would simply double if you went from filing Single to Married Filing Joint. As you can see, this isn't the case once you are in the 25%+ tax bracket and it can mean big dollars! Let's take a look at a simple example where each person makes the same amount of money. We will also assume they will be taking the standard deduction in 2017.

Note: To calculate the “Federal Income Tax” amount above, you can use the IRS tables here 2017 1040 Tax Table Instructions. All of your income is not taxed at your top rate. For example, if your top income falls in the 25% tax bracket, as a single payer you will only pay 25% on income from $37,951 to $91,900. Everything below that range will be taxed at either 10% or 15%.

As you can see, because of the change in filing status, this couple owed a total of $771 more to the federal government. This is the “Marriage Penalty”. Typically as incomes rise, the dollar amount of the penalty becomes larger. For this couple, their top tax bracket went from 25% each when filing single to 28% filing joint.

The Present

Here is the 2018 tax table in the new tax legislation for Single Filers and Married Filing Joint Filers:

Upon review, you can see that the top income brackets are not doubled for Married Filing Joint. At 37%, a single person filing would reach the top rate at $500,001 while married filing joint would reach at $600,001. That being said, the “Marriage Penalty” appears to kick in at higher income levels compared to the past and therefore should impact less people. The income bracket for Married Filing Joint is doubled up until $400,000 of combined income compared to just $75,901 under the 2017 brackets.

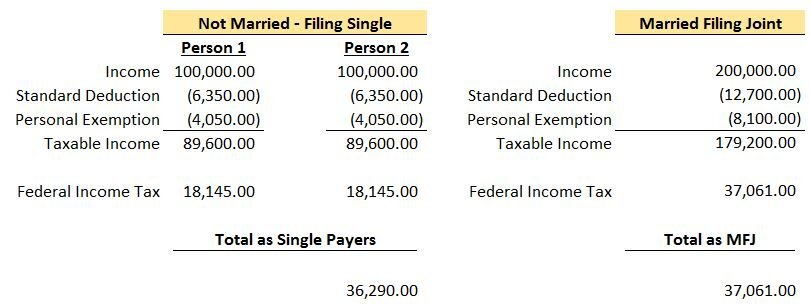

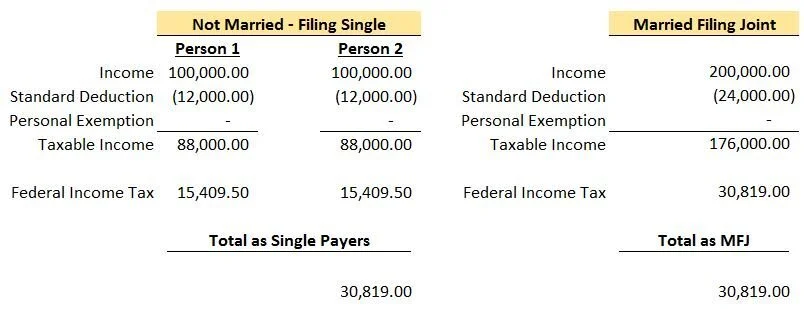

Let’s take a look at the same couple in the example above.

Due to the income brackets doubling from single to married filing joint for this couple, the “Marriage Penalty” they would have incurred in 2017 appears to go away. In this example, they would also pay less in federal taxes in both situations. This article is more focused on the impact on the “Marriage Penalty” but having a lower tax bill is always a plus.

Standard vs. Itemized Deductions

The tax brackets aren’t the only penalty. Another common tax increase people see when going from single to married filing joint are the deductions they lose. If I’m single and own a home, it is likely I will itemized because the sum of my property taxes, mortgage interest, and state income taxes exceed the standard deduction amount. Assume the couple in the example above is still not married but Person 1 owns a home and rather than taking the standard deduction, Person 1 itemizes for an amount of $15,000. For 2017, their total deductions will be $21,350 ($15,000 Person 1 plus $6,350 Person 2) and for 2018, their total deductions will be $27,000 ($15,000 Person 1 plus $12,000 Person 2).

Now they get married and have to choose whether to itemize or take the standard deduction.

2017: Assuming they live together in the same house, in 2017 they would still itemize because they have deductions of $15,000 for Person 1 and some additional items that Person 2 would bring to the table (i.e. their state income taxes). Say their total itemized deductions are $18,000 when married filing joint. They would still itemize because $18,000 is more than the Married Filing Joint standard deduction of $12,700. But now compare the $18,000 to the $21,350 they got filing single. They lose out on $3,350 of deductions. Usually, less deductions equals more taxes.

2018: Assuming they live together in the same house, in 2018 they would no longer itemize. Assuming their total itemized deductions are still $18,000, that is less than the $24,000 standard deduction they can take when married filing joint. $24,000 standard deduction in 2018 is still less than the $27,000 they got filing separately by $3,000. Again, less deductions usually means more taxes. The “Marriage Penalty” lives on!

A lot of people will still lose out on deductions in 2018 but the “Marriage Penalty” will hit less people because of the increase in the standard deduction. If Person 1 has itemized deductions of $10,000 in 2017, they would itemize if they filed single and possibly take the standard deduction of $12,700 filing joint. In 2018 however, Person 1 would take the standard deduction both as a single tax payer ($12,000) and married filing joint ($24,000) which takes away the “Marriage Penalty” related to the deduction.

The Why?

Why do tax brackets work this way? Like most taxes, I assume the idea was to generate more income for the government. Some may also argue that typical couples don't make the same salaries which seems like an archaic point of view.Was it all fixed with the new tax legislation? It doesn't appear so but it does look like less people will be struck by Cupid's Marriage Penalty.

About Rob.........

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Tax Reform: At What Cost?

The Republicans are in a tough situation. There is a tremendous amount of pressure on them to get tax reform done by the end of the year. This type of pressure can have ugly side effects. It’s similar to the Hail Mary play at the end of a football game. Everyone, including the quarterback, has their eyes fixed on the end zone but nobody realizes that no

The Republicans are in a tough situation. There is a tremendous amount of pressure on them to get tax reform done by the end of the year. This type of pressure can have ugly side effects. It’s similar to the Hail Mary play at the end of a football game. Everyone, including the quarterback, has their eyes fixed on the end zone but nobody realizes that no one is covering one of the defensive lineman and he’s just waiting for the ball to be hiked. The game ends without the ball leaving the quarterback’s hands.

The Big Play

Tax reform is the big play. If it works, it could lead to an extension of the current economic rally and more. I’m a supporter of tax reform for the purpose of accelerating job growth both now and in the future. It’s not just about U.S. companies keeping jobs in the U.S. That has been the game for the past two decades. The new game is about attracting foreign companies to set up shop in the U.S. and then hire U.S. workers to run their plants, companies, subsidiaries, etc. Right now we have the highest corporate tax rate in the world which has not only prevented foreign companies from coming here but it has also caused U.S. companies to move jobs outside of the United States. If everyone wants more pie, you have to focus on making the pie bigger, otherwise we are all just going to sit around and fight over who’s piece is bigger.

Easier Said Than Done

How do we make the pie bigger? We have to lower the corporate tax rate which will entice foreign companies to come here to produce the goods and services that they are already selling in the U.S. Which is easy to do if the government has a big piggy bank of money to help offset the tax revenue that will be lost in the short term from these tax cuts. But we don’t.

$1.5 Trillion In Debt Approved

Tax reform made some headway in mid-October when the Senate passed the budget. Within that budget was a provision that would allow the national debt to increase by approximately $1.5 trillion dollars to help offset the short-term revenue loss cause by tax reform. While $1.5 trillion sounds like a lot of money, and don’t get me wrong, it is, let’s put that number in context with some of the proposals that are baked into the proposed tax reform.

Pass-Through Entities

One of the provisions in the proposed tax reform is that income from “pass-through” businesses would be taxed at a flat rate of 25%.

A little background on pass-through business income: sole proprietorships, S corporations, limited liability companies (LLCs), and partnerships are known as pass-through businesses. These entities are called pass-throughs, because the profits of these firms are passed directly through the business to the owners and are taxed on the owners’ individual income tax returns.

How many businesses in the U.S. are pass-through entities? The Tax Foundation states on its website that pass-through entities “make up the vast majority of businesses and more than 60 percent of net business income in America. In addition, pass-through businesses account for more than half of the private sector workforce and 37 percent of total private sector payroll.”

At a conference in D.C., the American Society of Pension Professionals and Actuaries (ASPPA), estimated that the “pass through 25% flat tax rate” will cost the government $6 trillion - $7 trillion in tax revenue. That is a far cry from the $1.5 trillion that was approved in the budget and remember that is just one of the many proposed tax cuts in the tax reform package.

Are Democrats Needed To Pass Tax Reform?

Since $1.5 trillion was approved in the budget by the senate, if the proposed tax reform is able to prove that it will add $1.5 trillion or less to the national debt, the Republicans can get tax reform passed through a “reconciliation package” which does not require any Democrats to step across the aisle. If the tax reform forecasts exceed that $1.5 trillion threshold, then they would need support from a handful of Democrats to get the tax reformed passed which is unlikely.

Revenue Hunting

To stay below that $1.5 trillion threshold, the Republicans are “revenue hunting”. For example, if the proposed tax reform package is expected to cost $5 trillion, they would need to find $3.5 trillion in new sources of tax revenue to get the net cost below the $1.5 trillion debt limit.

State & Local Tax Deductions – Gone?

One for those new revenue sources that is included in the tax reform is taking away the ability to deduct state and local income taxes. This provision has created a divide among Republicans. Since many southern states do not have state income tax, many Republicans representing southern states support this provision. Visa versa, Republicans representing states from the northeast are generally opposed to this provision since many of their states have high state and local incomes taxes. There are other provisions within the proposed tax reform that create the same “it depends on where you live” battle ground within the Republican party.

Obamacare

One of the main reasons why the Trump administration pushed so hard for the Repeal and Replace of Obamacare was “revenue hunting”. They needed the tax savings from the repeal and replace of Obamacare to carrry over to fill the hole that will be created by the proposed tax reform. Since that did not happen, they are now looking high and low for other revenue sources.

Retirement Accounts At Risk?

If the Republicans fail to get tax reform through they run the risk of losing face with their supporters since they have yet to get any of the major reforms through that they campaigned on. Tax reform was supposed to be a layup, not a Hail Mary and this is where the hazard lies. Republicans, out of the desperation to get tax reform through, may start making cuts where they shouldn’t. There are rumors that the Republican Party may consider making cuts to the 401(k) contribution limits and employers sponsored retirement plan. Even though Trump tweeted on October 23, 2017 that he would not touch 401(k)’s as part of tax reform, they are running out of the options for other places that they can find new sources of tax revenue. If it comes down to the 1 yard line and they have the make the decision between making deep cuts to 401(k) plans or passing the tax reform, retirement plans may end up being the sacrificial lamb. There are other consequences that retirement plans may face if the proposed tax reform is passed but it’s too broad to get into in this article. We will write a separate article on that topic.

Tax Reform May Be Delayed

Given all the variables in the mix, passing tax reform before December 31st is starting to look like a tall order to fill. If the Republicans are looking for new sources of revenue, they should probably look for sources that are uniform across state lines otherwise they risk splintering the Republican Party like we saw during the attempt to Repeal and Replace Obamacare. We are encouraging everyone to pay attention to the details buried in the tax reform. While I support tax reform to secure the country’s place in the world both now and in the future, if provisions that make up the tax reform are rushed just to get something done, we run the risk of repeating the short lived glory that tax reform saw during the Reagan Era. They passed sweeping tax cuts, the deficits spiked, and they were forced to raise tax rates a few years later.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.