College Savings Account Options

There are a lot of different types of accounts that you can use to save for college. But, certain accounts have advantages over others such as:

· Tax deductions for contributions

· Tax free accumulation and withdrawal

· The impact on college financial aid

· Who has control over the account

· Accumulation rate

The types of college savings account that I will be covering in this article are:

· 529 accounts

· Coverdell accounts (also know as ESA’s)

· UTMA / UGMA accounts

· Brokerage Accounts

· Savings Accounts

To make it easy to compare and contrast each option, I will have a grading table at the beginning of each section that will provide you with some general information on each type of account, as well as my overall grade on the effectiveness of each college saving option.

529 Plans

I’ll start with my favorite which are 529 College Savings Plan accounts. As a Financial Planner, I tend to favor 529 accounts as primary college savings vehicles due to the tax advantages associated with them. Many states offer state income tax deductions for contributions up to specific dollar amounts, so there is an immediate tax benefit. For example, New York provides a state tax deduction for up to $5,000 for single filers, and $10,000 for joint filers for contributions to NYS 529 accounts year. There is no income limitation for contributing to these accounts.

NOTE: Every now and then I come across individuals that have 529 accounts outside of their home state and they could be missing out on state tax deductions.

However, the bigger tax benefit is that fact that all of the investment returns generated by these accounts can be withdrawn tax free, as long as they are used for a qualified college expense. For example, if you deposit $5K into a 529 account when your child is 2 years old, and it grows to $15,000 by the time they go to college, and you use the account to pay qualified expenses, you do not pay tax on any of the $15,000 that is withdrawn. That is huge!! With many of the other college savings options like UTMA or brokerage accounts, you have to pay tax on the gains.

There is also a control advantage, in that the parent, grandparent, or whoever establishes the accounts has full control as to when and how much is distributed from the account. This is unlike UTMA / UGMA accounts, where once the child reaches a certain age, the child can do whatever they want with the account without the account owner’s consent.

A 529 account does count against the financial aid calculation, but it is a minimal impact in most cases. Since these accounts are typically owned by the parents, in the FAFSA formula, 5.6% of the balance would count against the financial aid reward. So, if you have a $50,000 balance in a 529 account, it would only set you back $2,800 per year in financial aid.

I gave these account an “A” for an accumulation rating because they have a lot of investment option available, and account owners can be as aggressive or conservative as they would like with these accounts. Many states also offer “age based portfolios” where the account is allocated based on the age of the child, and when the will turn 18. These portfolios automatically become more conservative as they get closer to the college start date.

The contributions limits to these accounts are also very high. Lifetime contributions can total $400,000 or more (depending on your state) per beneficiary.

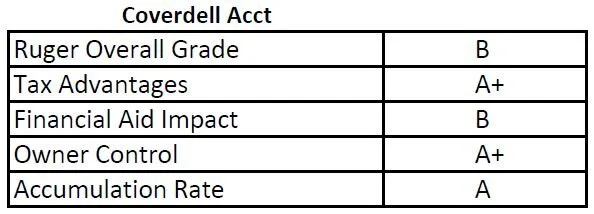

Coverdell Accounts (Education Savings Accounts)

Coverdell accounts have some of the benefits associated with 529 accounts, but there are contribution and income restrictions associated with these types of accounts. First, as of 2021, only taxpayers with adjusted gross income below $110,000 for single filers and $220,000 for joint filers are eligible to contribute to Coverdell accounts.

The other main limiting factor is the contribution limits. You are limited to a $2,000 maximum contribution each year until the beneficiary’s 18th birthday. Given the rising cost of college, it is difficult to accumulate enough in these accounts to reach the college savings goals for many families. Similar to 529 accounts, these accounts are counted as an asset of the parents for purposes of financial aid.

The one advantage these accounts have over 529 accounts is that the balance can be used without limitations for qualified expenses to an elementary or secondary public, private, or religious school. The federal rules recently changed for 529 accounts allowing these types of qualified withdrawal, but they are limited to $10,000 and depending on the state you live in, the state may not recognize these as qualified withdrawals from a 529 account.

If there is money left over in these Coverdell account, they also have to be liquidated by the time the beneficiary of the account turns age 30. 529 accounts do not have this restriction.

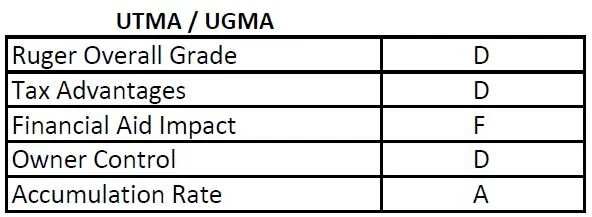

UTMA & UGMA Accounts

UGMA & UTMA accounts get the lowest overall grade from me. With these accounts, the child is technically the owner of the account. While the child is a minor, the parent is often assigned as the custodian of the account. But once the child reaches legal age, which can be 18, 19, or 21, depending on the state you live in, the child is then awarded full control over the account. This can be a problem when your child decides at age 18 that buying a Porsche is a better idea than spending that money on college tuition.

Also, because these accounts are technically owned by the child, they are a wrecking ball for the financial aid calculation. As I mentioned before, when it is an asset of the parent, 5.6% of the balance counts against financial aid, but when it is an asset of the child, 20% of the account balance counts against financial aid.

There are no special tax benefits associated with UTMA and UGMA accounts. No tax deductions for contributions and the child pays taxes on the gains.

Unlike 529 and Coverdell accounts, where you can change the beneficiary list on the account, with UTMA and UGMA accounts, the beneficiary named on the account cannot be changed.

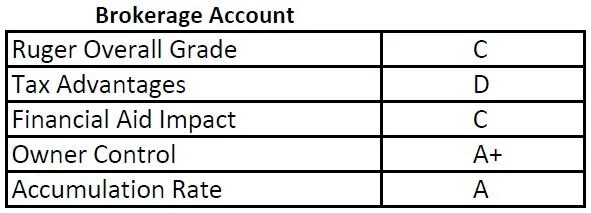

Brokerage Accounts

Parents can use brokerage accounts to accumulate money for college instead of the cash sitting in their checking account earning 0.25% per year. The disadvantage is the parents have to pay tax on all of the investment gains in the account once they liquidate them to pay for college. If the parents are in a higher tax bracket, they could lose up to 40%+ of those gains to taxes versus the 529 accounts where no taxes are paid on the appreciation. But, it also has the double whammy that if the parents realize capital gains from the liquidation, their income will be higher in the FAFSA calculation two years from now.

Sometimes, a brokerage account can complement a 529 account as part of a comprehensive college savings strategy. Many parents do not want to risk “over funding” a 529 account, so once the 529 accounts have hit a comfortable level, they will begin contributing the rest of the college savings to a brokerage account to maintain flexibility.

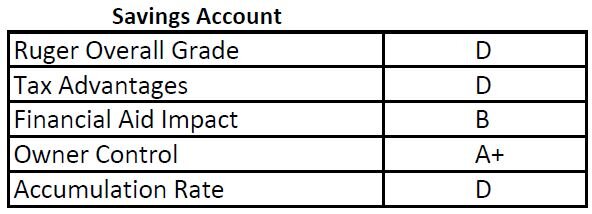

Savings Accounts

The pros and cons of a savings account owned by the parent or guardian of the child will have similar pros and cons of a brokerage account with one big drawback. Last I checked, most savings accounts were earning under 1% in interest. The cost of college since 1982 has increased by 6% per year (JP Morgan College Planning Essentials 2021). If the cost of college is going up by 6% per year, and your savings is only earning 1% per year, even though the balance in your savings account did not drop, you are losing ground to the tune of 5% PER YEAR. By having your college savings accounts invested in a 529, Coverdell, or brokerage account, it will at least provide you with the opportunity to keep pace with or exceed the inflation rate of college costs.

Can The Cost of College Keep Rising?

Let’s say the cost of attending college keeps rising at 6% per year, and you have a 2-year-old child that you want to send to state school which may cost $25,000 per year today. By the time they turn 18, it would cost $67,000 PER YEAR, times 4 years of college, which is $268,000 for a bachelor’s degree! The response I usually get when people hear these number is “there is no way that they can allow that to happen!!”. People were saying that 10 years ago, and guess what? It happened. This is what makes having a solid college savings strategy so important for your overall financial plan.

NOTE: As Financial Planners, we are seeing a lot more retirees carry mortgages and HELOC’s into retirement and the reason is usually “I helped the kids pay for college”.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

DISCLOSURE: This material is for informational purposes only. Neither American Portfolios nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions. Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors. Investment advisory services offered through Greenbush Financial Group, LLC. Greenbush Financial Group, LLC is a Registered Investment Advisor. Securities offered through American Portfolio Financial Services, Inc (APFS). Member FINRA/SIPC. Greenbush Financial Group, LLC is not affiliated with APFS. APFS is not affiliated with any other named business entity. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against market risk. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Guarantees apply to certain insurance and annuity products (not securities, variable or investment advisory products) and are subject to product terms, exclusions and limitations and the insurer's claims-paying ability and financial strength. Before investing, consider the investment objectives, risks, charges, and expenses of the annuity and its investment options. Please submit using the same generated coversheet for this submission number. Potential investors of 529 plans may get more favorable tax benefits from 529 plans sponsored by their own state. Consult your tax professional for how 529 tax treatments and account fees would apply to your particular situation. To determine which college saving option is right for you, please consult your tax and accounting advisors. Neither APFS nor its affiliates or financial professionals provide tax, legal or accounting advice. Please carefully consider investment objectives, risks, charges, and expenses before investing. For this and other information about municipal fund securities, please obtain an offering statement and read it carefully before you invest. Investments in 529 college savings plans are neither FDIC insured nor guaranteed and may lose value.

Tax Reform: Changes To 529 Accounts & Coverdell IRA's

Included in the new tab bill were some changes to the tax treatment of 529 accounts and Coverdell IRA's. Traditionally, if you used the balance in the 529 account to pay for a "qualified expense", the earnings portion of the account was tax and penalty free which is the largest benefit to using a 529 account as a savings vehicle for college.So what's the

Included in the new tab bill were some changes to the tax treatment of 529 accounts and Coverdell IRA's. Traditionally, if you used the balance in the 529 account to pay for a "qualified expense", the earnings portion of the account was tax and penalty free which is the largest benefit to using a 529 account as a savings vehicle for college.So what's the change? Prior to the Tax Cuts and Jobs Act (tax reform), qualified distributions were only allowed for certain expenses associated with the account beneficiary's college education. Starting in 2018, 529 plans can also be used to pay for qualified expenses for elementary, middle school, and high school.

Kindergarten – 12th Grade Expenses

Tax reform included a provision that will allow owners of 529 account to take tax-free distributions from 529 accounts for K – 12 expenses for the beneficiary named on the account. This is new for 529 accounts. Prior to this provision, 529 accounts could only be used for college expenses. Now 529 account holders can distribute up to $10,000 per student per year for K – 12 qualified expenses. Another important note, this is not limited to expenses associated with private schools. K – 12 qualified expense will be allowed for:

Private School

Public School

Religious Schools

Homeschooling

529 Accounts Will Largely Replace Coverdell IRA's

Prior to this rule change, the only option that parents had to save and accumulate money tax-free to K – 12 expenses for their children were Coverdell IRA's. But Coverdell IRA's had a lot of hang ups

Contributions were limited to $2,000 per year

You could only contribute to a Coverdell IRA if your income was below certain limits

You could not contribution to the Coverdell IRA after your child turned 18

Account balance had to be spend by the time the student was age 30

By contrast, 529 accounts offer a lot more flexibility and higher contributions limits. For example, 529 accounts have no contribution limits. The only limits that account owners need to be aware of are the "gifting limits" since contributions to 529 accounts are considered a "gift" to the beneficiary listed on the account. In 2018, the annual gift exclusion will be $15,000. However, 529 accounts have a provision that allow account owners to make a "5 year election". This election allows account owners to make an upfront contribution of up to 5 times the annual gift exclusion for each beneficiary without trigger the need to file a gift tax return. In 2018, a married couple could contribution up to $150,000 for each child to a 529 account without trigger a gift tax return.If I have a child in private school, they are in 6th grade, and I'm paying $20,000 in tuition each year, that means I have $140,000 that I'm going to spend in tuition between 6th grade – 12th grade and then I have college tuition to pile on top of that amount. Instead of saving that money in an after-tax investment account which is not tax sheltered and I pay capital gains tax when I liquidate the account to pay those expenses, why not setup a 529 account and shelter that huge dollar amount from income tax? It will probably saves me thousands, if not tens of thousands of dollars in taxes, in taxes over the long run. Plus, if I live in a state that allows tax deductions for 529 contributions, I get that benefit as well.

Income Limits and Tax Deductions

Unlike Coverdell IRA's, 529 accounts do not have income restrictions for making contributions. Plus, some states have a state tax deduction for contributions to 529 account. In New York, a married couple filing joint, receive a state tax deduction for up to $10,000 for contribution to 529 account. A quick note, that is $10,000 in aggregate, not $10,000 per child or per account.

Rollovers Count Toward State Tax Deductions

Here is a fun fact. If you live in New York and you have a 529 account established in another state for your child, if you rollover the balance into a NYS 529 account, the rollover balance counts toward your $10,000 annual NYS state tax deduction. Also, you can rollover balances in Coverdell IRA's into 529 accounts and my guess is many people will elect to do so now that 529 account can be used for K – 12 expenses.

Contributions Beyond Age 18

Unlike Coverdell IRA's which restrict contributions once the child reaches age 18, 529 accounts have no age restriction for contributions. We will often encourage clients to continue to contribute their child's 529 account while they are attending college for the sole purpose of continuing to capture the state tax deduction. If you receive the tuition bill in the mail today for $10,000, you can send in a $10,000 check to your 529 account provider as a current year contribution, as soon as the check clears the account you can turn around and request a qualified withdrawal from the account for the tuition bill, and pay the bill with the cash that was distributed from the 529 account. A little extra work but if you live in NYS and you are in a high tax bracket that $10,000 deduction could save you $600 - $700 in state taxes.

What Happens If There Is Money Left In The 529 Account?

If there is money left over in a 529 account after the child has graduated from college, there are a number of options available. For more on this, see our article "5 Options For Money Left Over In College 529 Plans"

Qualified Expenses

The most frequent question that I get is "what is considered a qualified expense for purposes of tax-free withdrawals from a 529 account?" Here is a list of the most common:

Tuition

Room & Board

Technology Items: Computers, Printers, Required Software

Supplies: Books, Notebooks, Pens, Etc.

Just as important, here are a list of expense that are NOT considered a "qualified expense" for purposes of tax free withdrawals from a 529 account:

Transportation & Travel: Expense of going back and forth from school / college

Student Loan Repayment

General Electronics and Cell Phone Plans

Sports and Fitness Club Memberships

Insurance

If there is ever a question as to where or not an expense is a qualified expense or not, I would recommend that you contact the provider of your 529 account before making the withdrawal form your 529 account. If you take a withdrawal for an expense that is not a "qualified expenses" you will pay income taxes and a 10% penalty on the earnings portion of the withdrawal.

Do I Have To Close My Coverdell IRA?

While 529 accounts have a number of advantages compared to Coverdell IRA's, current owners of Coverdell IRAs will not be required to close their accounts. They will continue to operate as they were intended. Like 529 accounts, Coverdell IRA withdrawals will also qualify for the tax-free distributions for K – 12 expenses including the provision for expenses associated with homeschooling.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.