Don’t Gift Your House To Your Children

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

Asset Protection Strategy

As individuals enter their retirement years, they become rightfully more concerned about a long-term care event happening at some point in the future. The most recent statistic that I saw stated that “someone turning age 65 today has almost a 70% chance of needing some type of long-term care services at some point in the future” (Source: longtermcare.gov).

Long-term care is expensive, and most states require you to spend down your countable assets until you reach a level where Medicaid starts to pick up the tab. Different states have different rules about the spend-down process. However, there are ways to protect your assets from this Medicaid spend-down process.

In New York, the primary residence is not subject to the spend-down process but Medicaid can place a lien against your estate, so after you pass, they force your beneficiaries to sell the house, so Medicaid can recoup the money that they paid for your long-term care expenses. Since most people would prefer to avoid this situation and have their house passed to their children, they we'll sometimes gift the house to their kids while they're still alive to get it out of their name.

5 Year Look Back Rule

Gifting your house to your kids may be an effective way to protect the primary residence from a Medicaid lien, but this has to be done well before the long-term care event. In New York, Medicaid has a 5-year look back, which means anything that was gifted away 5 years before applying for Medicaid is back on the table for the spend down and Medicaid estate lien. However, if you gift your house to your kids more than 5 years before applying for Medicaid, the house is completely protected.

Tax Gifting Rules

So what’s the problem with this strategy? Answer, taxes. When you gift someone a house, they inherit your cost basis in the property. If you purchased your house 30 years ago for $100,000, you gift it to your children, and then they sell the house after you pass for $500,000; they will have to pay tax on the $400,000 gain in the value of the house. It would be taxed at a long-term capital gains rate, but for someone living in New York, tax liability might be 15% federal plus 7% state tax, resulting in a total tax rate of 22%. Some quick math:

$400,000 gain x 22% Tax Rate = $88,000 Tax Liability

Medicaid Trust Solution

Good news: there is a way to altogether avoid this tax liability to your beneficiaries AND protect your house from a long-term care event by setting up a Grantor Irrevocable Trust (Medicaid Trust) to own your house. With this solution, you establish an Irrevocable Trust to own your house, you gift your house to your trust just like you would gift it to your kids, but when you pass away, your house receives a “step-up in cost basis” prior to it passing to your children. A step-up in cost basis means the cost basis of that asset steps up the asset’s value on the day you pass away.

From the earlier example, you bought your house 30 years ago for $100,000, and you gift it to your Irrevocable Trust; when you pass away, the house is worth $500,000. Since a Grantor Irrevocable Trust owned your house, it passes through your estate, receives a step-up to $500,000, and your children can sell the house the next day and have ZERO tax liability.

The Cost of Setting Up A Medicaid Trust

So why doesn’t every one set up a Medicaid Trust to own their house? Sometimes people are scared away by the cost of setting up the trust. Setting up the trust could cost between $2,000 - $10,000 depending on the trust and estate attorney that you engage to set up your trust. Even though there is a cost to setting up the trust, I always compare that to the cost of not setting up your trust and leaving your beneficiaries with that huge tax liability. In the example we looked at earlier, paying the $3,000 to set up the trust would have saved the kids from having to pay $88,000 in taxes when they sold the house after you passed.

Preserves $500,000 Primary Residence Exclusion

By gifting your house to a grantor irrevocable trust instead of your children, you also preserve the long-term capital gain exclusion allowance if you decide to sell your house at some point in the future. When you sell your primary residence, you are allowed to exclude the following gain from taxation depending on your filing status:

Single Filer: $250,000

Joint Filer: $500,000

If you gift your house to your children and then five years from now, you decide to sell your house for whatever reason while you are still alive, it would trigger a tax event for your kids because they technically own your house, and it’s not their primary residence. By having your house owned by your Grantor Irrevocable Trust, if you were to sell your house, you would be eligible for the primary residence gain exclusion, and the trust could either buy your next house or you could deposit the proceeds to a trust account so the assets never leave the trust and remain protected for the 5-year lookback rule.

How Do Medicaid Trusts Work?

This article was meant to highlight the pitfall of gifting your house to your kids; however, if you would like to learn more about the Medicaid Trust solution and the Medicaid spend down process, please feel free to watch our videos on these topics below:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Secure Act 2.0: RMD Start Age Pushed Back to 73 Starting in 2023

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

This is the second time within the past 3 years that Congress has changed the start date for required minimum distributions from IRAs and employer-sponsored retirement plans. Here is the history and the future timeline of the RMD start dates:

1986 – 2019: Age 70½

2020 – 2022: Age 72

2023 – 2032: Age 73

2033+: Age 75

You can also determine your RMD start age based on your birth year:

1950 or Earlier: RMD starts at age 72

1951 – 1959: RMD starts at age 73

1960 or later: RMD starts at age 75

What Is An RMD?

An RMD is a required minimum distribution. Once you hit a certain age, the IRS requires you to start taking a distribution each year from your various retirement accounts (IRA, 401(K), 403(b), Simple IRA, etc.) because they want you to begin paying tax on a portion of your tax-deferred assets whether you need them or not.

What If You Turned Age 72 In 2022?

If you turned age 72 anytime in 2022, the new Secure Act 2.0 does not change the fact that you would have been required to take an RMD for 2022. This is true even if you decided to delay your first RMD until April 1, 2023, for the 2022 tax year.

If you are turning 72 in 2023, under the old rules, you would have been required to take an RMD for 2023; under the new rules, you will not have to take your first RMD until 2024, when you turn age 73.

Planning Opportunities

By pushing the RMD start date from age 72 out to 73, and eventually to 75 in 2033, it creates more tax planning opportunities for individuals that do need to take distributions out of their IRAs to supplement this income. Since these distributions from your retirement account represent taxable income, by delaying that mandatory income could allow individuals the opportunity to process larger Roth conversions during the retirement years, which can be an excellent tax and wealth-building strategy.

Delaying your RMD can also provide you with the following benefits:

Reduce the amount of your Medicare premiums

Reduce the percentage of your social security benefit that is taxed

Make you eligible for tax credits or deductions that you would have phased out of

Potentially allow you to realize a 0% tax rate on long-term capital gains

Continue to keep your pre-tax retirement dollars invested and growing

Additional Secure Act 2.0 Articles

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Turn on Social Security at 62 and Your Minor Children Can Collect The Dependent Benefit

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications.

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications. In this article, I will walk you through the following:

The age limit for your children to be eligible to receive SS benefits

The amount of the payments to your kids

The family maximum benefit calculation

How the benefits are taxed to your children

How to apply for the social security dependent benefits

Pitfall: You may have to give the money back to social security…..

Eligibility Requirements for Dependent Benefits

Three requirements make your children eligible to receive social security payments based on your earnings history:

You have to be age 62 or older

You must have turned on your social security benefit payments

Your child must be unmarried and meet one of the following eligibility requirements:

Under the age of 18

Between the ages of 18 and 19 and a full-time student K – 12

Age 18 or older with a disability that began before age 22

How Much Does Your Child Receive?

If you are 62 or older, you have turned on your social security benefits, and your child meets the criteria above, your child would be eligible to receive 50% of your Full Retirement Age (FRA) Social Security Benefit EVERY YEAR, until they reach age 18. This can sometimes change a parent’s decision to turn on their social security benefit at age 62 instead of waiting until their Full Retirement Age of 67 (for individuals born in 1960 or later). But it gets better because the 50% of your FRA social security benefit is for EACH child.

For example, Jim is retired, age 62, and he has one child under age 18, Josh, who is age 12. If he turns on his social security benefit at age 62, he would receive $1,200 per month, but if he waits until his FRA of 67, he would receive $1,700 per month. Even though Jim would receive a lower social security benefit at age 62, if he turns on his benefit at age 62, Jim and his child Josh would receive the following monthly payments from social security:

Jim: $1,200 ($14,400 per year)

Josh: $850 ($10,200 per year)

Even though Jim receives a reduced SS benefit by turning on his benefit at age 62, the 50% dependent child benefit is still calculated based on Jim’s Full Retirement Age benefit of $1,700. Josh will be eligible to continue to receive monthly payments from social security until the month of his 18th birthday. That’s a lot of money that could go towards college savings, buying a car, or a down payment on their first house.

The Family Maximum Benefit Limit

If you have 10 children, I have bad news; social security imposes a “family maximum benefit limit” for all dependents eligible to collect on your earnings history. The family benefits are limited to 150% to 188% of the parent’s full retirement age benefit.

I’ll explain this via an example. Let’s assume everything is the same as in the previous example with Jim, but now Jim has four children, all under 18. Let’s also assume that Jim’s Family maximum benefit is 150% of his FRA benefit, which would equal a maximum family benefit of $2,550 per month ($1,700 x 150%). We now have the following:

Jim: $1,200

Child 1: $850

Child 2: $850

Child 3: $850

Child 4: $850

If you total up the monthly social security benefits paid to Jim and his children, it equals $4,600, which is $2,050 over the $2,550 family maximum benefit limit.

Always Use Your FRA Benefit In The Family Max Calculation

Here is another important rule to note when calculating the family maximum benefit, regardless of when your file for your social security benefits, age 62, 64, 67, or 70, you always use your Full Retirement Age benefit when calculating the Family Maximum Benefit amount. In the example above, Jim filed for social security benefits early at age 62. Instead of using Jim’s age $1,200 social security benefit to calculate the remaining amount available for his children, Jim has to use his FRA benefit of $1,700 in the formula before determining how much his children are eligible to receive.

Social security would reduce the children’s benefits by an equal amount until their total benefit is reduced to the family maximum limit.

These are the steps:

Jim Max Family Benefit = $1,700 (FRA) x 150% = $2,550

$2,550 (Family Max) - $1,700 (Jim FRA) = $850

Divide $850 by Jim’s 4 eligible children = $212.50 for each child

This results in the following social security benefits paid to Jim and his 4 children:

Jim: $1,200

Child 1: $212.50

Child 2: $212.50

Child 3: $212.50

Child 4: $212.50

A note about ex-spouses, if someone was married for more than 10 years, then got divorced, the ex-spouse may still be entitled to the 50% spousal benefit, but that does not factor into the family maximum calculation, nor is it reduced for any family maximum benefit overages.

Social Security Taxation

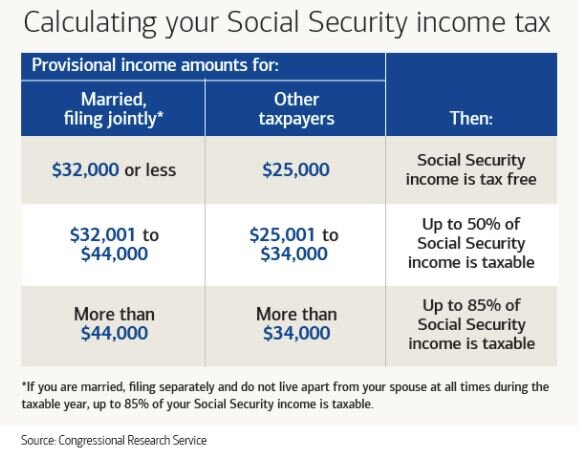

Social security payments received by your children are considered taxable income, but that does not necessarily mean that they will owe any tax on the amounts received. Let me explain, your child’s income has to be above a specific threshold before they owe any federal taxes on the social security benefits they receive.

You have to add up all of their regular taxable income and tax-exempt income and then add 50% of the social security benefits that they received. If your child has no other income besides the social security benefits, it’s just 50% of the social security benefits that were paid to them. If that total is below $25,000, they do not have to pay any federal tax on their social security benefit. If it’s above that amount, then a portion of the social security benefits received will be taxable at the federal level.

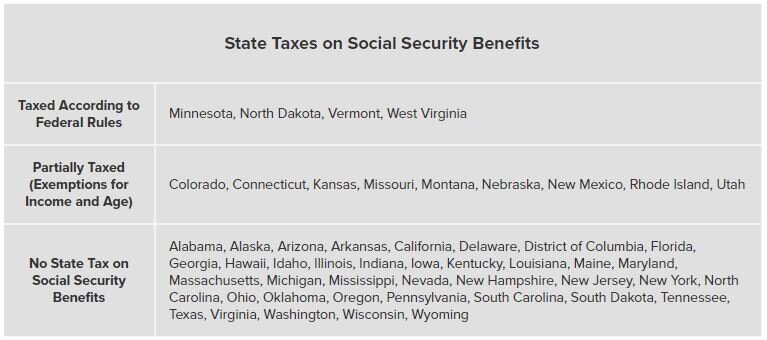

States have different rules when it comes to taking social security benefits. Most states do not tax social security benefits, but there are about 13 states that assess state taxes on social security benefits in one form or another, but our state New York, is thankfully not one of them.

You Can Still Claim Your Child As A Dependent On Your Tax Return

More good news, even though your child is showing income via the social security payment, you can still claim them as a dependent on your tax return as long as they continue to meet the dependent criteria.

How To Apply For Social Security Dependent Benefits

You cannot apply for your child’s dependent benefits online; you have to apply by calling the Social Security Administration at 800-772-1213 or scheduling an appointment at your local Social Security office.

Be Care of This Pitfall

There is one pitfall to the social security payment received by your child or children, it’s not a pitfall about the money received, but the issue revolves around the titling of the account that the social security benefits are deposited into when they are received on behalf of the child.

The premise behind social security providing these benefits to the minor children of retirees is that if someone retires at age 62 and still has minor children as dependents, they may need additional income to support the household expenses. Whether that is true or not does not prevent you from taking advantage of these dependent payments to your children, but it does raise the issue of the “conserved benefits” letter that many people receive once the child turns age 18.

You may receive a letter from social security once your child is 18 instructing you to return any of the social security dependent payments received on your child’s behalf and saved. So wait, if you save this money for our child to pay for college, you have to hand it back to social security, but if you spend it, you get to keep it? On the surface, the answer is “yes,” but it all depends on who is listed as the account owner that the social security payments are deposited into on behalf of your child.

If the parent is listed as an owner or joint owner of the account, you are expected to return the saved or “conserved” payment to the Social Security Administration. However, if the account that the social security payments are deposited into is owned 100% by your child, you do not have to return the saved money to social security.

Then I will get the question, “Well, what type of account can you set up for a 12-year-old that they own 100%?” Some banks will allow you to set up savings accounts in the name of a child at age 14, UTMA accounts can be set up at any age, and they are considered accounts owned 100% by the child even though a parent is listed as a custodian.

Watch out for the 529 account pitfall. For parents that want to use these Social Security payments to help subsidize college savings, they will sometimes set up a 529 account and deposit the payments into that account to take advantage of the tax benefits. Even though these 529 accounts are set up with the child listed as the beneficiary, they are often considered assets of the parents because the parent has control over the distributions from the account. However, you can set up 529 accounts as UTMA 529, which avoids this issue since the child is now technically the owner and has complete control over the assets at the age of majority.

FAFSA Considerations

Be aware that if your child is college bound and you expect to qualify for need-based financial aid, assets owned by the child count against the FAFSA calculation. The way the calculation works is that about 20% of any assets owned by the child count against the need-based financial aid that is awarded. There is no way around this issue, but it’s not the end of the world because that means 80% of the balance does not count against the FAFSA calculation and it was free money from Social Security that can be used to pay for college.

Social Security Filing Strategy

If you are age 62 or older and have minor children, it may very well make sense to file for Social Security early, even though it may permanently reduce your Social Security benefit once you factor in the Social Security payments that will be made to your children as dependents. But, you have to make sure you understand how Social Security is taxed, the Security earned income penalty, the impact of Social Security survivor benefits for your spouse, and many other factors before making this decision.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Self-Employment Income In Retirement? Use a Solo(k) Plan To Build Wealth

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy

Self-Employment Income In Retirement? Use a Solo(k) Plan To Build Wealth

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy.”

What Is A Solo(K)

A Solo(k) plan is an employer-sponsored retirement plan that is only allowed to be sponsored by owner-only entities. It works just like a 401(k) plan through a company but without the high costs or administrative hassles. The owner of the business is allowed to make both employee deferrals and employer contributions to the plan.

Solo(k) Deferral Limits

For 2023, a business owner is allowed to contribute employee deferrals up to a maximum of the LESSER of:

100% of compensation; or

$30,000 (Assuming the business owner is age 50+)

Pre-tax vs. Roth Deferrals

Like a regular 401(K) plan, the business owner can contribute those employee deferrals as all pre-tax, all Roth, or some combination of the two. Herein lies the ample wealth-building opportunity. Roth assets can be an effective wealth accumulation tool. Like Roth IRA contributions, Roth Solo(k) Employee Deferrals accumulate tax deferred, and you pay NO TAX on the earnings when you withdraw them as long as the account owner is over 59½ and the Roth account has been in place for more than five years.

Also, unlike Roth IRA contributions, there are no income limitations for making Roth Solo(k) Employee Deferrals and the contribution limits are higher. If a business owner has at least $30,000 in compensation (net profit) from the business, they could contribute the entire $30,000 all Roth to the Solo(K) plan. A Roth IRA would have limited them to the max contribution of $7,500 and they would have been excluded from making that contribution if their income was above the 2023 threshold.

A quick note, you don’t necessarily need $30,000 in net income for this strategy to work; even if you have $18,000 in net income, you can make an $18,000 Roth contribution to your Solo(K) plan for that year. The gem to this strategy is that you are beginning to build this war chest of Roth dollars, which has the following tax advantages down the road……

Tax-Free Accumulation and Withdrawal: If you can contribute $100,000 to your Roth Solo(k) employee deferral source by the time you are 70, if you achieve a 6% rate of return at 80, you have $189,000 in that account, and the $89,000 in earnings are all tax-free upon withdrawal.

No RMDs: You can roll over your Roth Solo(K) deferrals into a Roth IRA, and the beautiful thing about Roth IRAs are no required minimum distributions (RMD) at age 72. Pre-tax retirement accounts like Traditional IRAs and 401(k) accounts require you to begin taking RMDs at age 72, which are forced taxable events; by having more money in a Roth IRA, those assets continue to build.

Tax-Free To Beneficiaries: When you pass assets on to your beneficiaries, the most beneficial assets to inherit are often a Roth IRA or Roth Solo(k) account. When they changed the rules for non-spouse beneficiaries, they must deplete IRAs and retirement accounts within ten years. With pre-tax retirement accounts, this becomes problematic because they have to realize taxable income on those potentially more significant distributions. With Roth assets, not only is there no tax on the distributions, but the beneficiary can allow that Roth account to grow for another ten years after you pass and withdraw all the earnings tax and penalty-free.

Why Not Make Pre-Tax Deferrals?

It's common for these self-employed retirees to have never made a Roth contribution to retirement accounts, mainly because, during their working years, they were in high tax brackets, which warranted pre-tax contributions to lower their liability. But now that they are retired and potentially showing less income, they may already be in a lower tax bracket, so making pre-tax contributions, only to pay tax on both the contributions and the earnings later, may be less advantageous. For the reasons I mentioned above, it may be worth foregoing the tax deduction associated with pre-tax contributions and selecting the long-term benefits associated with the Roth contributions within the Solo(k) Plan.

Now there are situations where one spouse retires and has a small amount of self-employment income while the other spouse is still employed. In those situations, if they file a joint tax return, their overall income limit may still be high, which could warrant making pre-tax contributions to the Solo(k) plan instead of Roth contributions. The beauty of these Solo(k) plans is that it’s entirely up to the business owner what source they want to contribute to from year to year. For example, this year, they could contribute 100% pre-tax, and then the following year, they could contribute 100% Roth.

Solo(k) versus SEP IRA

Because this question comes up frequently, let's do a quick walkthrough of the difference between a Solo(k) and a SEP IRA. A SEP IRA is also a popular type of retirement plan for self-employed individuals; however, SEP IRAs do not allow Roth contributions, and SEP IRAs limit contributions to 20% of the business owner’s net earned income. Solo(K) plans have a Roth contribution source, and the contributions are broken into two components, an employee deferral and an employer profit sharing.

As we looked at earlier, the employee deferral portion can be 100% of compensation up to the Solo(K) deferral limit of the year, but in addition to that amount, the business owner can also contribute 20% of their net earned income in the form of a profit sharing contribution.

When comparing the two, in most cases, the Solo(K) plan allows business owners to make larger contributions in a given year and opens up the Roth source.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Grandparent Owned 529 Accounts Just Got Better

A 529 account owned by a grandparent is often considered one of the most effective ways to save for college for a grandchild. But in 2023, the rules are changing………

Grandparent Owned 529 Accounts Just Got Better

A 529 account owned by a grandparent is often considered one of the most effective ways to save for college for a student. Mainly because 529 accounts owned by the grandparents are invisible to the college financial aid calculation (FAFSA) when determining the financial aid package that will be awarded to a student. But there is a little-known pitfall about distributions from grandparent owned 529 accounts and the rules are changing in 2023. In this article, we will review:

Advantages of grandparent owned 529 accounts

The FAFSA pitfall of distributions from grandparent owned 529 accounts

The FAFSA two-year lookback period

The change to the 529 rules starting in 2023

Tax deductions for contributions to 529 accounts

What if your grandchild does not go to college?

Paying K – 12 expenses with a 529 account

Pitfall of Grandparent Owned 529 Accounts

Historically, there has been a major issue when grandparents begin distributing money out of these 529 accounts to pay college expenses for their grandchildren which can hurt their financial aid eligibility. While these accounts are invisible to the FAFSA calculation as an asset, in the year that the distribution takes place from a grandparent owned 529 account, those distributions now count as “income of the student” in the year that the distribution takes place. Income of the student counts heavily against the need-based financial aid award. Currently, any income of the student above the $7,040 threshold counts 50% against the financial aid award.

For example, if a grandparent distributes $30,000 from the 529 account to pay college expenses for the grandchild, in that determination year, assuming the child has no other income, that distribution could reduce the financial aid award two years later by $11,480.

FAFSA Two-Year Lookback

FAFSA has a two-year lookback for purposes of determining income in the EFC calculation (expected family contribution), so the family doesn’t realize the misstep until two years later. For example, if the distribution takes place in the fall of the student’s freshman year, the financial aid package would not be reduced until the fall of their junior year.

Since we are aware of this income two-year lookback rule, the workaround has been to advise grandparents not to distribute money from the 529 accounts until the spring of their sophomore year. If the child graduates in four years by the time they are submitting the FAFSA application for their senior year, that determination year that 529 distribution took place is no longer in play.

Quick Note: All of this only matters if the student qualifies for need-based financial aid. If the student, through their parent’s FAFSA application, does not qualify for any need-based financial aid, then the impact of these distributions from the grandparent owned 529 accounts is irrelevant because they were not receiving any financial aid anyways.

New Rules Starting in 2023

But the rules are changing starting in 2023 to make these grandparent owned 529 accounts even more advantageous. Under the new rules, distribution from grandparent owned 529 account will no longer count as income of the student. These 529 accounts owned by the grandparents are now completely invisible to the FAFSA calculation for both assets and income, which makes them even more valuable.

Tax Deduction For 529 Contributions

There can also be tax benefits for grandparents contributing to 529 accounts for their grandkids. Certain states allow state income tax deductions for contributions up to a certain thresholds. In New York State, there is a $5,000 state tax deduction for single filers and a $10,000 deduction for joint filers each tax year. The amounts vary from state to state and some states have no deduction, so you have to do your homework.

What If The Grandchild Does Not Go To College?

What happens if you fund this 529 account for your grandchild but then they decide not to go to college? There are a few options here. The grandparent can change the beneficiary of the account to another grandchild or family member. The second option, you can just take a distribution of the account balance. If the balance is distributed but it’s not used for college expenses, the contribution amounts are returned tax and penalty-free but the earnings portion of the account is subject to ordinary income taxes and a 10% penalty since it wasn’t used for qualified college expenses.

K - 12 Qualified Expenses

The federal government made changes to the tax rules in 2017 which also allow up to $10,000 per year to be distributed from 529 accounts for K - 12 expenses. If you have grandchildren that are attending a private k -12 school, this is another way for grandparents to potentially capture a tax deduction, and help pay those expenses.

However, and this is very important, while the federal government recognizes the K – 12 $10,000 per year as a qualified distribution, the states which sponsor these 529 plans may not adhere to those same rules. In fact, in New York State, not only does New York not recognize K – 12 expenses as “qualified expenses” for purposes of distributions from a 529 account, but these nonqualified withdrawals also require a recapture of any New York State tax benefits that have accrued on the contributions. Double ouch!! These rules vary state by state so you have to do your homework before paying K – 12 expenses out of a 529 account.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Potential investors of 529 plans may get more favorable tax benefits from 529 plans sponsored by their own state. Consult your tax professional for how 529 tax treatments and account fees would apply to your particular situation. To determine which college saving option is right for you, please consult your tax and accounting advisors. Neither APFS nor its affiliates or financial professionals provide tax, legal or accounting advice. Please carefully consider investment objectives, risks, charges, and expenses before investing. For this and other information about municipal fund securities, please obtain an offering statement and read it carefully before you invest. Investments in 529 college savings plans are neither FDIC insured nor guaranteed and may lose value.

Self-employed Individuals Are Allowed To Take A Tax Deduction For Their Medicare Premiums

If you are age 65 or older and self-employed, I have great news, you may be able to take a tax deduction for your Medicare Part A, B, C, and D premiums as well as the premiums that you pay for your Medicare Advantage or Medicare Supplemental coverage.

Self-employed Individuals Are Allowed To Take A Tax Deduction For Their Medicare Premiums

If you are age 65 or older and self-employed, I have great news, you may be able to take a tax deduction for your Medicare Part A, B, C, and D premiums as well as the premiums that you pay for your Medicare Advantage or Medicare Supplemental coverage. This is a huge tax benefit for business owners age 65 and older because most individuals without businesses are not able to deduct their Medicare premiums, so they have to be paid with after-tax dollars.

Individuals Without Businesses

If you do not own a business, you are age 65 or older, and on Medicare, you are only allowed to deduct “medical expenses” that exceed 7.5% of your adjusted gross income (AGI) for that tax year. Medical expenses can include Medicare premiums, deductibles, copays, coinsurance, and other noncovered services that you have to pay out of pocket. For example, if your AGI is $80,000, your total medical expenses would have to be over $6,000 ($80,000 x 7.5%) for the year before you would be eligible to start taking a tax deduction for those expenses.

But it gets worse, medical expenses are an itemized deduction which means you must forgo the standard deduction to claim a tax deduction for those expenses. For 2022, the standard deduction is $12,950 for single filers and $25,900 for married filing joint. Let’s look at another example, you are a married filer, $70,000 in AGI, and your Medicare premiums plus other medical expenses total $12,000 for the year since the 7.5% threshold is $5,250 ($70,000 x 7.5%), you would be eligible to deduct the additional $6,750 ($12,000 - $5,250) in medical expenses if you itemize. However, you would need another $13,600 in tax deductions just to get you up to the standard deduction limit of $25,900 before it would even make sense to itemize.

Self-Employed Medicare Tax Deduction

Self-employed individuals do not have that 7.5% of AGI threshold, they are able to deduct the Medicare premiums against the income generated by the business. A special note in that sentence, “against the income generated by the business”, in other words, the business has to generate a profit in order to take a deduction for the Medicare premiums, so you can’t just create a business, that has no income, for the sole purpose of taking a tax deduction for your Medicare premiums. Also, the IRS does not allow you to use the Medicare expenses to generate a loss.

For business owners, it gets even better, not only can the business owner deduct the Medicare premiums for themselves but they can also deduct the Medicare premiums for their spouse. The standard Medicare Part B premium for 2022 is $170.10 per month for EACH spouse, now let’s assume that they both also have a Medigap policy that costs $200 per month EACH, here’s how the annual deduction would work:

Business Owner Medicare Part B: $2,040 ($170 x 12 months)

Business Owner Medigap Policy: $2,400

Spouse Medicare Part B: $2,040

Spouse Medigap Policy: $2,400

Total Premiums: $8,880

If the business produces $10,000 in net profit for the year, they would be able to deduct the $8,880 against the business income, which allows the business owner to pay the Medicare premiums with pre-tax dollars. No 7.5% AGI threshold to hurdle. The full amount is deductible from dollar one and the business owner could still elect the standard deduction on their personal tax return.

The Tax Deduction Is Limited Only To Medicare Premiums

When we compare the “medical expense” deduction for individual taxpayers that carries the 7.5% AGI threshold and the deduction that business owners can take for Medicare premiums, it’s important to understand that for business owners the deduction only applies to Medicare premiums NOT their total “medical expenses” for the year which include co-pays, coinsurance, and other out of pocket costs. If a business owner has large medical expenses outside of the Medicare premiums that they deducted against the business income, they would still be eligible to itemize on their personal tax return, but the 7.5% AGI threshold for those deductions comes back into play.

What Type of Self-Employed Entities Qualify?

To be eligible to deduct the Medicare premiums as an expense against your business income your business could be set up as a sole proprietor, independent contractor, partnership, LLC, or an S-corp shareholder with at least 2% of the common stock.

The Medicare Premium Deduction Lowers Your AGI

The tax deduction for Medicare Premiums for self-employed individuals is considered an “above the line” deduction, which lowers their AGI, an added benefit that could make that taxpayer eligible for other tax credits and deductions that are income based. If your company is an S-corp, the S-corp can either pay your Medicare Premiums on your behalf as a business expense or the S-corp can reimburse you for the premiums that you paid, report those amounts on your W2, and you can then deduct it on Schedule 1 of your 1040.

Employer-Subsidized Health Plan Limitation

One limitation to be aware of, is if either the business owner or their spouse is eligible to enroll in an employer-subsidized health plan through their employer, you are no longer allowed to deduct the Medicare Premiums against your business income. For example, if you and your spouse are both age 66, and you are self-employed, but your spouse has a W2 job that offers health benefits to cover both them and their spouse, you would not be eligible to deduct the Medicare Premiums against your business income. This is true even if you voluntarily decline the coverage. If you or your spouse is eligible to participate, you cannot take a deduction for their Medicare premiums.

I receive the question, “What if they are only employed for part of the year with health coverage available?” For the month that they were eligible for employer-subsidized health plan, a deduction would not be able to be taken during those months for the Medicare premiums.

On the flip side, if the health plan through their employer is considered “credible coverage” by Medicare, you may not have to worry about Medicare premiums anyways.

Multiple Businesses

If you have multiple businesses, you will have to select a single business to be the “sponsor” of your health plan for the purpose of deducting your Medicare premiums. It’s usually wise to select the business that produces a consistent net profit because net profits are required to deduct all or a portion of the Medicare premium expense.

Forms for Tax Reporting

You will have to keep accurate records to claim this deduction. If you collect Social Security, the Medicare premiums are deducted directly from the social security benefit, but they issue you a SSA-1099 Form at the end of the year which summarized the Medicare Premiums that you paid for Part A and Part B.

If you have a Medigap Policy (Supplemental) with a Part D plan or a Medicare Advantage Plan, you normally make premium payments directly to the insurance company that you have selected to sponsor your plan. You will have to keep records of those premium payments.

No Deduction For Self-Employment Taxes

As a self-employed individual, the Medicare premiums are eligible for a federal, state, and local tax deduction but they do not impact your self-employment taxes which are the taxes that you pay to fund Medicare and Social Security.

Amending Your Tax Returns

If you have been self-employed for a few years, paying Medicare premiums, and are just finding out now about this tax deduction, the IRS allows you to amend your tax returns up to three years from the filing date. But again, the business had to produce a profit during those tax years to be eligible to take the deduction for those Medicare premiums.

DISCLOSURE: This information is for educational purposes only. For tax advice, please consult a tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Selecting The Best Pension Payout Option

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

Lump sum

Single Life Benefit

100% Survivor Benefit

50% Survivor Benefit

Survivor Benefit Plus Pop-up Election

The right option varies person by person but some of the primary considerations are:

Marital status

Your age

Your spouse’s age

Income needed in retirement

Retirement assets that you have outside of the pension

Health considerations

Life expectancy

Financial stability of the company sponsoring the plan

Tax Strategy

Risk Tolerance

There are a lot of factors because the decision is not an easy one. In this article, I’m going to walk you through how we evaluate these options for our clients so you can make an educated decision when selecting your pension payout option.

Understanding The Options

To give you a better understanding of the various payout options, I’m going to walk you through how each type of benefit works. Not all pension plans are the same, some plans may only offer some of these options, others after all of these options, and some plans have additional payout options available.

Lump Sum: Some pension plans will give you the option of receiving a lump sum dollar amount instead of receiving monthly payment for the rest of your life. Retirees will typically rollover these lump sum amounts into their IRA’s, which is a non-taxable event, and then take distributions as needed from their IRA.

Single Life Benefit: This is also referred to as the “straight life benefit”. This option usually offers the highest monthly pension payments because there are no survivor benefits attached to it. You receive a monthly payment for the rest of your life but when you pass away, all pension payments stop.

Survivor Benefits: There are usually multiple survivor benefit payout options. They are typically listed as:

100% Survivor Benefit

75% Survivor Benefit

50% Survivor Benefit

25% Survivor Benefit

The percentages represent the amount of the benefit that will continue to your spouse should you pass away first. The higher the survivor benefit, typically the lower your monthly pension payment will be because the pension plans realize they may have to make payments for longer because it’s based on two lives instead of one.

Example: If the Single Life pension payment is $3,000, if instead you elect a 50% survivor benefit, your pension payment may only be $2,800, but if you elect the 100% survivor benefit it may only be $2,700. The monthly pension payments go down as the survivor benefits go up.

Here is an example of the survivor benefit, let’s say you elect the $2,800 pension payment with a 50% survivor benefit. Your pension will pay you $2,800 per month when you retire but if you were to pass away, the pension plan will continue to pay your spouse $1,400 per month (50% of the benefit) for the rest of their life.

Pop-Up Elections: Some pension plans, like the New York State Pension Plan, provide retirees with a “Pop-Up Election”. With the pop-up, if you select a survivor benefit which provides you with a lower monthly pension payment amount but your spouse passes away first, thus eliminating the need for a survivor benefit, your monthly pension payment “pops-up” to the amount that you would have received if you elected the Single Life Benefit.

Example: You are married, getting ready to retire, and you have the following pension payout options:

Single Life: $3,000 per month

50% Survivor Benefit: $2,800 per month

50% Survivor Benefit with Pop-Up: $2,700 per month

If you elect the Single Life option, you would receive $3,000 per month, but when you pass away the pension payments stop.

If you elect the 50% Survivor Benefit, you would receive $2,800 per month, but if you pass away before your spouse, they will continue to receive $1,400 for the rest of their life.

If you elect the 50% Survivor Benefit WITH the Pop-Up, you would receive $2,700 per month, if you were to pass away before your spouse, your spouse would continue to receive $1,350 per month. But if your spouse passes away before you, your pension payment pops-up to the $3,000 Single Life amount for the rest of your life.

Why do people select the pop-up? It’s more related to what happens to the social security benefits when a spouse passes away. If your spouse were to pass away, one of the social security benefits is going to stop, and you receive the higher of the two but some of that lost social security income could be made up by the higher pop-up pension amount.

Marital Status

The easiest variable to address is marital status. If you are not married or there are no domestic partners that depend on your pension payments to meet their expenses, then typically it makes sense to elect either the Lump Sum or Straight Life payment option. Whether or not the lump sum or straight life benefit makes sense will depend on your age, tax strategy, income need, if you want to preserve assets for your children, and other factors.

Income Need

If you are married or have someone that depends on your pension income, by far, the number one factors becomes your income need in retirement when making your pension election. If the primary source of your retirement income is your pension and you were to pass away, your spouse would need to continue to receive all or a portion of those pension payments to meet their expenses, you have to weigh very heavily the survivor benefit options. We have seen people make the mistake of electing the Single Life Option because it was the highest monthly payout and then the spouse with the pension unexpectedly passes away at an earlier age. It’s a devastating financial event for the surviving spouse because the pension payments just stop. If someone were to pass away 5 years after leaving their company, they worked all of those year to receive 5 years worth of pension payments, and then they just stopped.

We usually have to run projections for clients to answer this question, if the spouse with the pension passes away will their surviving spouse need 50%, 75%, or 100% of the pension payments to meet their income needs? In most cases it’s worth accepting a slightly lower monthly pension payment to reduce this survivor risk.

Retirement Assets Outside Of The Pension

If you have substantial retirement savings outside of your pension like 401(k) accounts, investment accounts, 457, IRA’s, 403(b) plans, this may give you more flexibility with your pension options. Having those outside assets almost creates a survivor benefit for your spouse that if the pension payments were to stop or be reduced, there are other retirement assets to draw from to meet their income needs.

Example: You have a retired couple, both have pensions, and they have also accumulated $1M in retirement accounts outside the pension, if one spouse were to pass away, even though the pension payments may stop or be reduced, there may be enough assets to draw from the outside retirement accounts to make up for that lost pension income. This may allow a couple to elect a 50% survivor benefit and receive a higher monthly pension payment compared to electing the 100% survivor benefit with the lower monthly pension payment.

Risk Management

This last example usually leads us into another discussion about long-term risk. Even though you may have the outside assets to accept a higher monthly pension payment with a lower survivor benefit, should you? When we create retirement plans for clients we have to make a lot of assumptions about assumed rates of return, life expectancy, expenses, etc. But what if your investment accounts take a big hit during the next recession or a spouse passes away much sooner than expected, accepting a lower survivor benefit may increase the impact of those risks on your plan. If you and your spouse are both able to elect the 100% survivor benefit on your pensions, you then know, that no matter what happens in the future, that pension income will always be there, so it’s one less variable in your long-term financial plan.

While this could be looked at as a less risky path, there is also the flip side to that. If you lock up the 100% survivor benefit on the pension, that may allow you to take more risk in your outside retirement accounts, because you are not as dependent on those accounts to supplement a survivor benefit depending on which spouse passes away first.

Age

The age of you and your spouse can also be a factor. If the spouse with the pension is quite a bit older than the spouse without pension, it may make sense for normal life expectancy reasons, to elect a larger survivor benefit. Visa versa, if the spouse with then pension is much younger, it may warrant a lower survivor benefit elect. But in the end, it all goes full circle back to the income need if the pension payments were to stop, are there enough other assets to supplement income for the surviving spouse?

Health Considerations / Life Expectancy

When conducting a pension analysis, we will typically use age 90 as a life expectancy for most clients. But there are factors that can alter the use of age 90 such as special health considerations and longevity. If the spouse that has the pension is forced to retire for health reasons, it gives greater weight to electing a pension benefit with a higher survivor benefit. When a client tells us that their father, mother, and grandmother, all lived past age 93, that can impact the pension decision. Since people are living longer, it increases the risk of spending through their traditional retirement savings, whereas the pension payments will be there for as long as they live.

Financial Stability Of The Company / Organization

You are seeing more and more stories about workers that were promised a pension but then their company, union, or not-for-profit goes bankrupt. This is a real risk that should factor into your pension decision. While there are government agencies like the PBGC that are there to help backstop these failed pension plans, there have been so many bankrupt pensions over the past two decades that the PBGC fund itself is at risk of running out of assets. If a retiree is worried about the financial solvency of their employer, it may give greater weight to electing the “Lump Sum Option”, taking your money out of the plan, getting it over to your IRA, and then taking monthly payments from the IRA. Since this is becoming a greater risk to employees, we created a video dedicated to this topic: What Happens To Your Pension If The Company Goes Bankrupt?

Tax Strategy

Tax strategy also comes into play when electing your pension benefit. If we have retirees that have both a pension and retirement accounts outside the pension plan, we have to map out the distribution / tax strategy for the next 10 to 20 years. Depending on who you worked for and what state you live in, the monthly pension payments may be taxed at the federal level, state level, or both. Also, many retirees don’t realize that social security will also be considered taxable income in retirement. Then, if you have pre-tax retirement accounts, at age 72, you have to begin taking Required Minimum Distributions which are taxable.

There are situations where we will have a retiree forego the monthly pension payment from the pension plan and elect the Lump Sum Benefit option, so they can rollover the full balance to an IRA, and then we have more flexibility as to what their taxable income will be each year to execute a long term tax strategy that can save them thousands and thousands of dollars in taxes over their lifetime. We may have them process Roth conversions, or realize long term capital gains at a 0% tax rate, neither of which may be available if the pension income is pushing them up into the higher tax brackets.

There are so many other tax strategies, long term care strategies, and wealth accumulation strategies that come into the mix when deciding whether to take the monthly pension payments or the lump sum payment of your pension benefit.

Pension Option Analysis

These pension decisions are very important because you only get one shot at them. Once the decision is made you are not allowed to go back and change your mind to a different option. We run this pension analysis for clients all of the time, so before you make the decision, feel free to reach out to us and we can help you to determine which pension benefit is the right one for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Buying A Second House In Retirement

More and more retires are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

More and more retirees are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

Do you have enough retirement savings to maintain two houses in retirement?

Should you purchase the house before you officially retire or after?

Are you planning on paying for the house in cash or taking a mortgage?

If you are taking mortgage, where will the down payment come from?

Will you have the option to claim domicile in another state for tax purposes?

Should you setup a trust to own your real estate in retirement?

Adequate Retirement Savings

The most important question is do you have enough retirement income and assets to support the carrying cost of two houses in retirement? This requires you to run detailed retirement projection to determine what your total expense will be in retirement including the expenses associates with the second house, and the spending down of your assets over your life expectancy to make sure you do not run out of money. Here are some of the most common mistakes that we see retirees make:

They underestimated the impact of inflation. The ongoing costs associated with maintaining a house such as property taxes, utilities, association dues, maintenance, homeowners insurance, water bills, etc, tend to go up each year. While it may look like you can afford both houses now, if those expenses go up by 3% per year, will you have enough income and assets to pay those higher cost in the future?

They forget about taxes. If you will have to take larger distributions out of your pre-tax retirement accounts to maintain the second house, those larger distributions could push you into a higher tax bracket, cause your Medicare premiums to increase, lose property tax credits, or change the amount of your social security benefits that are taxable income.

A house is an illiquid asset. When you look at your total net worth, you have to be careful how much of your net worth is tied up in real estate. Remember, you are retired, you are no longer receiving a paycheck, if the economy hits a big recession, and your retirement accounts take a big hit, you may be forced to sell that second house when everyone else is also trying to sell their house. It could put you a in a difficult situation if you do not have adequate retirement assets outside of your real estate holdings.

Should You Purchase A Second House Before You Retire?

Many retirees wrestle with the decision as to whether to purchase their second house before they retire or after they have retired. There are two primary advantages to purchasing the second house prior to retirement:

If you plan on taking a mortgage to buy the second house, it is usually easier to get a mortgage while you are still working. Banks typically care more about your income than they do about your level of assets. We have seen clients retire, have over $2M in retirement assets, and have difficulties getting a mortgage, due to a lack of income.

There can be large expenses associated with acquiring a new piece of real estate. You move into your second house and you learn that it needs new appliances, a new roof, or you have to buy furniture to fill the house. We typically encourage our clients to get these big expenses out of the way before their paychecks stop in case they incur larger expenses than anticipated.

Mortgage or No Mortgage?

The decision of whether or not to take a mortgage on the second house is an important one. Sometimes it makes sense to take a mortgage and sometimes is doesn’t. Many retirees are hesitant to take a mortgage because they realize having a mortgage in retirement means higher annual expenses. While we generally encourage our client to reduce their debt by as much as possible leading up to retirement, there are situations where taking out a mortgage to buy that second house makes sense.

But it’s not for the reason that you may think. It’s not because you may be able to get a mortgage rate of 3% and keep your retirement assets invested with hopes of achieving a return of over 3%. While many retirees are willing to take on that risk, we remind our clients that you will be retired, therefore there is no more money going into your retirement accounts. If you are wrong and the value of your retirement accounts drop, now you have less in assets, no more contributions going in, and you have a new mortgage payment.

In certain situations, it makes sense to take a mortgage for tax purposes. If most of your retirement saving are in pre-tax sources like Traditional IRA’s or 401(k)’s, you withdrawal a large amount from those accounts in a single year to buy your second house, you may avoid having to take a mortgage, but it may also trigger a huge tax bill. For example, if you want to purchase a second house in Florida and the purchase price is $300,000. You take a distribution out of your traditional IRA to purchase the house in full, you will have federal and state income tax on the full $300,000, meaning if you are married filer you may have to withdrawal over $400,000 to get to the $300,000 that you need after tax to purchase the house.

If you are pre-tax heavy, it may be better to take out a mortgage, withdrawal just the down payment out of your IRA or preferably from an after tax source, and then you can make the mortgage payments with monthly withdrawals out of your IRA account. This spreads the tax liability of the house purchase over multiple years potentially keeping you out of those higher tax brackets.

But outside of optimizing a tax strategy, if you have adequate after-tax resources to purchase the second house in full, more times than not, we will encourage retirees to go that route because we are big fans of lowering your fixed expenses by as much as possible in retirement.

Planning For The Down Payment

If we meet with someone who plans to purchase a second house in retirement and we know they are going to have to take a mortgage, we have to start planning for the down payment on that house. Depending on what their retirement picture looks like we may:

Determine what amount of their cash reserves they could safely commit to the down payment

Reduce contributions to retirement accounts to accumulate more cash

If their tax situation allows, take distributions from certain types of accounts prior to retirement

Weigh the pros and cons of using equity in their primary residence for the down payment

If they have permanent life insurance policies, discuss pros and cons of taking a loan against the policy

Becoming A Resident of Another State

If you maintain two separate houses in different states, you may have the opportunity to have your retirement income taxed in the more tax favorable state. This topic could be an article all in itself, but it’s a tax strategy that should not be overlook because it can have a sizable impact on your retirement projections. If your primary residence is in New York, which is a very tax heavy state, and you buy a condo in Florida and you are splitting your time between the two houses in retirement, knowing what it requires to claim domicile in Florida could save you a lot of money in state taxes. To learn more about this I would recommend watching the following two videos that we created specifically on this topic:

Video 1: Will Moving From New York to Florida In Retirement Save You Taxes?

Video 2: How Do I Change My State Residency For Tax Purposes?

Should A Trust Own Your Second House

The final topic that we are going to cover are the pros and cons of a trust owning your house in retirement. For any house that you plan to own during the retirement years, it often makes sense to have the house owned by either a Revocable Trust or Irrevocable Trust. Trust are not just for the ultra wealthy. Trust have practical uses for everyday families just as protecting the house from the spend down process triggered by a long term care event or to avoid the house having to go through probate when you or your spouse pass away. Again, this is a relate topic but one that requires its own video to understand the difference between Revocable Trust and Irrevocable Trusts:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Why Are Long-Term Care Insurance Premiums Skyrocketing?

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain……

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain:

Why this is happening

Are these premium increases going to continue?

Options for managing the cost of these policies

If you cancel the policy, alternative solutions for managing the financial risk of a LTC event

Premium Increases & Insolvency

Unfortunately, it’s not just the current premium increases that are presenting LTC policyholders with these difficult decisions. Within the letters, some of these insurance carriers are threatening that if they’re not able to raise premiums by 250% within the next 6 years, that the insurance company may not have enough assets to pay the promised benefit. What good is an insurance policy if there’s no insurance company to pay the benefit? I won’t mention any of the insurance companies by name but here is some of the word for word statements in those letters:

“This represents a 69% rate increase in the premiums for your policy.”

“A.M. Best has downgraded its rating of (NAME OF INSURANCE COMPANY) financial strength to C++ in September 2019, indicating A.M. Best’s view that (NAME OF INSURANE COMPANY) has marginal ability to meet its ongoing insurance obligations.”

“Please be aware that as of 06/06/21 over the next 3-6 years we are planning to seek additional rate increases of up to 250% for lifetime benefits”

This creates a very difficult decision for the policyholder to either:

Keep the policy and pay the higher premiums

Cancel the policy

Make adjustments to the current policy to make it more affordable in the short-term

These Policies Are Not Cheap

In most cases, these long-term care insurance premiums were not cheap to begin with. Prior to these premium increases, it was not uncommon for a robust policy in New York to cost between $2,500-$4,000 per year, per person. LTC policies tend to carry a higher cost because they have a higher probability of paying out when compared to other types of insurance policies. For example, with life insurance, they expect you to pay your premiums, you live a long happy life, and the insurance policy never pays out. Compare this to the risk of a long-term event, where in 2021 HealthView Services produced a study that stated:

“An Average healthy 65-year-old couple living to their projected actuarial longevity has a 75% chance that one partner will require a significant level of long term care. There is a 25% probability that both partners will need long-term care” (source: Think Advisor)

Couple that with the fact that long-term care expenses are very high and insurance companies have to charge more in premiums to balance the dollars in versus dollars out.

With these premium increases now in play, some retired couples are faced with a situation where they previously may have been paying $5,000 per year for both policies and they find out their premiums are going up by 70%, increasing that annual cost to $8,500 per year.

Affordability Issue

So what happens when a retired couple, on a fixed amount of income, gets one of these letters, and realizes they can’t afford the premium increase. They essentially have two options:

Cancel the policy

Make amendments to the policy (if the insurance company allows)

Let’s start off by looking at the amendment option. Many insurance companies, in exchange for a lower premium increase, may allow you to reduce the benefits offered by the policy to make it more affordable. You may have options like

Extending the elimination period

Reducing inflation riders

Reducing the daily benefit

Reducing the maximum lifetime benefit

Reducing home care options

These are just some of the adjustments that could be made, but remember, you are taking what you have now, and watering it down to make it more affordable. Caution, at some point you have to ask yourself:

“If I reduce the benefits of this policy, will it provide me enough coverage to meet my financial needs should I have a long-term event?”

If the answer is “No”, then you may have to look more closely at the option of canceling the policy. But what happens if you cancel the policy and you are now exposed to the financial risk of a long-term care event? Answer, you will have to identify another financial strategy to manage that risk. Two of the most common that we have implemented for clients are

Self-insuring

Setting up Medicaid trusts

Self-Insuring Alternative

The way this solution works is you are essentially setting money aside for yourself, acting as your own insurance company, should a long-term care event arise later in life, you will have money set aside to pay those expenses. If you were previously paying an insurance company $4,000 per year for your LTC policy, then cancel the policy, you would set up a separate investment account where you continue to deposit the amount of the premium payments that you were previously making each year so there will be a pool of assets to draw from should a long-term event arise.

But, you have to run projections to determine how much money is estimated to be in those accounts at future ages to make sure it is sufficient to cover enough of those costs that it won’t put you in a tough financial situation later on. There is an upside benefit to this strategy that if you never have a long-term care event, there are assets sitting there that your beneficiaries could inherit. If instead that money was going toward long-term care insurance premiums and there’s not a long-term care event, all that money has essentially been wasted. However, this strategy does take more planning because your self-insurance strategy may be not cover the same dollar for dollar amount that your LTC policy would have covered if a long-term care event arises.

Medicaid trust

Understanding how Medicaid trusts works is a whole article in itself and we have a video dedicated just to this topic. But the general idea behind the strategy is this, if you have a long-term event and you do not have a LTC insurance policy, you essentially have to spend through all of your countable assets to pay for your care. Note, the annual costs of assisted living or a nursing home is often $100,000+ per year. For those that do not have assets, Medicaid will often pay for the cost of assisted-living or nursing home care. By setting up a trust and placing your assets in a trust ahead of time, if those assets are owned by the trust for a specific number of years, if there is a long-term care event, you do not have to spend those assets down, and Medicaid picks up the tab for your care. Like I said, there’s a lot more detail regarding the strategy and if you’d like to know more watch this video:

Medicaid Trust Video: https://www.youtube.com/watch?v=iBVQtrGiUso

Future Premium Increases

You also have to include in your analysis the risk of future premium increases which seem likely. These letters from the insurance companies themselves state that they may have to increase premiums by a lot more just to stay in business. So it’s not just evaluating the current premium increase in these situations but also considering what decisions you could face within the next 5 – 10 years if the premiums double again. This variable can definitely influence the decisions that you are making now.

Why Are These Premium Increases Happening?

This is a 20 year problem in the making. For decades insurance companies have miscalculated how long people were going to live and the rising cost of long-term care. Since they weren’t charging enough at the onset of these policies, they have not collected enough in insurance premiums to cover the insurance claims that are now being filed by policyholders. Thus, the policyholders that currently have policies are now being required to pay more to make up for those underwriting mistakes.

The second issue is that there is less competition in the long term care insurance market. Insurance companies in general do not want to issue policies in a sector of the market where the probability of a payout is high and the dollar amount of the payout is also high; they want to operate in sectors of the market where the probability of a payout is low so they get to just keep your premium payments. Many insurance companies have completely exited the Long Term Care Insurance market. For example, in New York state, there are only two insurance companies remaining that are issuing traditional long-term care policies. Less competition, higher prices.

The third issue is due to the dramatic rise in the annual premium amounts, they have become less affordable for new policyholders. Many retirees can’t afford to pay $4,000+ per year for each spouse’s LTC policy so the issuance of new policies is dropping; that again, saddles the current policy holders with the premium increases.

A Difficult Decision

For all of these reasons, if you are currently a holder of a LTC insurance policy, instead of just blindly paying the higher premiums, it really makes sense to evaluate your options with the anticipation that the premiums may continue to increase in the future. For those that decide to amend their policy to reduce the cost, you really have to evaluate if the policy covers enough going forward to make it worth continuing on with the policy. I strongly recommend seeking professional help with this decision. Professionals in the industry can help you evaluate your options because these decisions can be irreversible and the right solution will vary individual by individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.