How Much Money Do I Need To Save To Retire?

This is by far the most popular question that we come across as financial planners. You may have heard some of the "rules of thumb" like “80% of your current take-home pay” or “1 million dollars”. In reality, the answer varies greatly on an individual by individual basis. This article will outline the procedures that we follow as financial planners to help

This is by far the most popular question that we come across as financial planners. You may have heard some of the "rules of thumb" like “80% of your current take-home pay” or “1 million dollars”. In reality, the answer varies greatly on an individual by individual basis. This article will outline the procedures that we follow as financial planners to help individuals answer this very important question.

Step 1: Estimate Your Annual Expenses In Retirement

The first step is to get a ballpark idea of what your annual expenses might look like in retirement. The best place to start is to list your current monthly and annual expenses. Then create a separate column labeled “expenses in retirement”. Whether you are 2 years, 10 years, or 20 years away from retirement the idea is to pretend as if you were retiring tomorrow and determining what your annual expenses might look like. Some of your expenses in retirement will be lower, others may be higher, but most people find that a lot of their current expenses will carry over at the same level into the retirement years. This is because most people have become accustom to a certain standards of living and they intend to maintain that standard of living in retirement. Here are a few important questions that you should ask yourself when forecasting your retirement expenses:

How much should I budget for health insurance?

Will I have a mortgage or debt when I retire?

Do I plan to move when I retire?

Since I will not be working, should I budget additional expenses for vacations and hobbies?

Will I need to keep my life insurance policies after I retire?

Step 2: Adjust Your Retirement Expenses For Inflation

Now that you have a ballpark number of your annual expenses in retirement, you will need to adjust those expenses for inflation. Inflation is just a fancy word for “the price of everything that we buy today will gradually go up in price over time”. If the price of a gallon of milk today is $2 then most likely 20 years from now that same gallon of milk will cost $3.51. A 75% increase!! Historically inflation has grown at a rate of about 3% per year. There are periods of time when the rate of inflation grows faster or slower but on average it grows at 3% per year.

Another way to look at inflation is $20,000 in today’s dollars will not buy the same amount of goods and services 10 years from now because inflation erodes the purchasing power of your $20,000. If I did my annual expense planner and it tells me that I need $50,000 per year in retirement to meet all of my estimated expenses, let’s look at what adjusting that $50,000 for inflation does over different periods of time assuming a 3% rate of inflation:

Today’s Dollars 5 Years From Now 10 Years From Now 20 Years From Now

$50,000 $56,275 $65,238 $87,675

In the above example, if I am retiring in 10 years, and my estimated annual expenses in retirement will be $50,000 in today’s dollars, by the time I retire 10 years from now my annual expenses will increase to $65,238 per year just to stay in the same place that I am in today. Also, inflation does not stop when you retire, it continues into the retirement years. If I am 50 today and plan to live until 90, I have to apply this inflation adjustment for 40 years. It’s clear to see how inflation can have a significant impact on the amount that you may need to withdrawal for your account to meet you estimated expenses at a future date.

Step 3: Gather The Information On Your Current Assets

Once you know your expenses, you now need to gather all of the information on your retirement accounts and pension plans. You should collect the most recent statement for all of your investment accounts (401K, 403B, IRA’s, brokerage accounts, stocks, etc.), pension statements (if applicable), obtain your most recent social security statement, and gather information on the other sources of income and/or assets that may be available when you retire. Such as:

Sale of a business

Downsizing the primary residence

Rental income

Part-time employment

Step 4: Project The Growth Of Your Retirement Assets

There are three main categories to consider when calculating the growth rate of your retirement assets:

Annual contributions

Withdrawals

Investment rate of return

For annual contributions, it’s determining which accounts you plan on making deposits too each year and how much? For most individuals, their employer sponsored retirement plan is the main source of new contributions to their retirement nest egg. If your employer makes regular employer contributions to your retirement plan, you should factor those in as well. For example, if I am contributing 8% of my pay into the plan and my employer is providing me with a 4% matching contributions, I would reasonably assume that I’m adding 12% of my pay to my 401(k) plan each year.

The most popular question that we get in this category is “how much should I be contributing each year to my retirement account with my employer?” We advise employees that they should have a goal of contributing 10% of their pay each year to their retirement accounts. This is an aggregate total between your personal contributions and the employer contributions. Even if you cannot reach that level right now, 10%+ is the target.

Let’s move onto the next category…….withdrawals. Pre-retirement withdrawals from retirement accounts have become much more common in recent years due largely to the rising cost of college education. Parents will take loans from their 401K/403B plans or take early withdrawals from IRA accounts to fulfill the need for additional income during the years that their children are in college. If part of your overall financial plan is to use your retirement accounts to pay for one-time expenses such as college, you will need to factor that into your projections.

The third variable to consider when determining the growth of your assets is the assumed annual rate of return on your investments. There are many items to consider when determining a reasonable annual rate of return for your accounts. Some of those considerations include:

Time horizon to retirement

Allocation of your portfolio (stocks vs bonds)

Concentrated holdings (10%+ of your portfolio allocated to a single investment)

Accumulation phase versus distribution phase

The answer to the question: “what rate of return should I expect from my retirement accounts?”, can really only be determine on a case by case basis. Using an unreasonable rate of return assumption can create a significant disconnect between your retirement projections versus what is likely to actually occur within your investment accounts. Be careful with this step.

Step 5: Factor In Taxes

Don’t forget about the lovely IRS. All assets are not treated equally from a tax standpoint. For most individuals, the majority of their retirement savings will be in pre-tax retirement vehicles such as 401(k), 403(b), and Traditional IRA’s. That means when you take distributions from those accounts, you will realize earned income, and have to pay tax. For example, if you have $400,000 in your 401K account and you are in the 25% tax bracket, $100,000 of that $400,000 will be lost to taxes as withdrawals are made from the account.

If you have after tax investment accounts, it’s possible that you may owe little to no taxes on withdrawals. However, if there are unrealized investment gains built up in your after tax investment accounts then you may owe capital gains tax when liquidating positons.

Also note, you may have to pay taxes on a portion of your social security benefit. The amount of your social security benefit that is taxable varies based on your level of income.

Step 6: Spend Down Your Assets

In the final step, you should run long term projections to illustrate the spend down of your assets in retirement. Here are the steps:Example

Start with your annual after tax expense number $60,000

Subtract social security less taxes: ($20,000)

Subtract pension payments less taxes (if applicable): ($10,000)

Annual Expenses Net SS and Pensions: $30,000

In the example above, this individual would need an additional $30,000 after-tax to meet their anticipated annual expenses in Year 1 of retirement. I stress “after-tax” because if all of the retirement assets are in a pre-tax retirement account then they would need to gross up their distributions for taxes to get to the $30,000 after tax. If it is assumed that $40,000 has to be withdrawn from an IRA each year, the 3% inflation rate is applied to the annual expenses, and the life expectancy of this individual is 20 years from the date that they retire, this individual would need to withdrawal $1,074,814 out of their retirement accounts over the next 20 years to meet their income needs.

Step 7: Identify Multiple Solutions

There are often times multiple roads to reach a destination and the same is true when planning for retirement. If you find that you assets are falling short of the amount that is needed to sustain your expenses in retirement, you should work with a knowledgeable financial planner to identify alternative solutions. It may help you to answer questions like:

If I decided to work part-time in retirement how much would I have to earn?

If I downsize my primary residence in retirement how does this impact the overall picture?

If I can’t retire at age 63, what age can I comfortably retire at?

What are the pros and cons of taking social security benefits prior to normal retirement age

I also encourage clients to spend time looking at their annual expenses. If you find that your are cutting it close on income versus expenses in retirement, it's usually easier to cut expenses than it is to create more income in the retirement year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Target Date Mutual Funds and Their Role in the 401(k) Space

A target date mutual fund is a fund in the hybrid category that automatically resets the asset mix of stocks, bonds and cash equivalents in its portfolio according to a selected time frame that is appropriate for a particular investor. In simpler terms, an investor can purchase a target date fund based on their anticipated retirement date and the fund will

In recent years, a growing trend in the 401(k) space has been the use of target date mutual funds.

Target Date Mutual Funds

A target date mutual fund is a fund in the hybrid category that automatically resets the asset mix of stocks, bonds and cash equivalents in its portfolio according to a selected time frame that is appropriate for a particular investor. In simpler terms, an investor can purchase a target date fund based on their anticipated retirement date and the fund will automatically become more conservative as the investor approaches retirement.

This is often times a suitable investment for the average investor or participant in a 401(k) plan that would not typically make allocation adjustments on their own. During the financial crisis of 2008 and 2009, many investors approaching retirement were overexposed to the stock market and lost half of their savings with no time to make it back before retirement. This is where the benefit of a well-managed target date fund would have been useful as investors who needed an allocation change as they approached retirement would have got it. Emphasis on the well-managed.

At year end 2013, there was approximately $595.5 billion dollars invested in target date mutual funds, up from approximately $111.9 billion in 2006 based on a study conducted by Morningstar. With so much money being placed in these funds, it is important to know how they work and what to look for when choosing the correct fund for your risk tolerance and time horizon.

As mentioned previously, the allocation of assets within a target date fund will automatically rebalance throughout the life of the investment to focus more on income. With that being said, how does the rebalancing happen and how often does the rebalancing take place? The rebalancing takes place automatically when fund managers of that target date fund determine the allocation in the fund no longer meets its intentions. It is argued that most target date mutual funds do not rebalance nearly enough as some can be as long as 4-5 years.

It is important to know that the date of a target date fund is the date the investor plans to retire and is not the date in which the fund is at its most conservative allocation. Fund families operate their target date mutual funds very differently. For example, one fund family may have a 2020 fund that is 30% stocks and 70% bonds compared to another more aggressive fund family that is allocated 60% stocks and 40% bonds in their 2020 target date fund.

There are arguments for both allocations. Since an investor is at their retirement age, they should typically be more conservative. On the other hand, just because the investor hit their retirement age they may not be taking distributions from the account for another 5-10 years, and therefore could possibly achieve more growth.

A target date fund can be a suitable investment option for investors who would like a hands off approach in their 401(k), but participants must be aware that there is still due diligence necessary throughout the life of the investment. Below is a chart showing the results of a study conducted by Morningstar in 2010. It shows the allocation of target date mutual funds for different fund families during the financial crisis of 2008 and 2009. These target date mutual funds were meant for investors retiring in 2010 and therefore should have been allocated in a way that would not over expose them to a significant decline in the market two years from retirement.

As you can see, the equity (stock) allocation varies greatly between fund families and the over exposure led to significant declines in investors accounts. Too many people had their retirement account nearly halved two years from retirement which is devastating for an individuals quality of life.

There are definitely pitfalls to target date mutual funds but they can be appropriate in the right circumstances. It is important that investors are educated on what target date mutual funds are and more importantly what they are not. Here are a few takeaways that may help you determine which, if any, target date fund is appropriate for you.

Determine Your Risk Tolerance First

The first questions an investment advisor will typically have for a client are: “What is your time horizon?” and “What is your risk tolerance?”. Since target date mutual funds allocate assets for a group of investors based on a date in the future, the only piece that is somewhat satisfied is time horizon. Just because a group of investors have the same time horizon does not mean they should be invested the same way. Fund managers cannot allocate funds in a way that satisfies both questions without knowing the risk tolerance for each individual investor. That means, the risk tolerance piece relies on you. Two 45 year old investors may be 20 years from retirement and have completely different portfolio allocations due to their risk tolerance. One may be more aggressive and tolerant of stock market fluctuations while the other may be conservative and less willing to risk their savings. Even though each investor has the same time horizon, the appropriate portfolio for each would vary greatly. It is important to know your risk tolerance and apply that knowledge to the appropriate target date fund.

Research the Different Target Date Fund Options

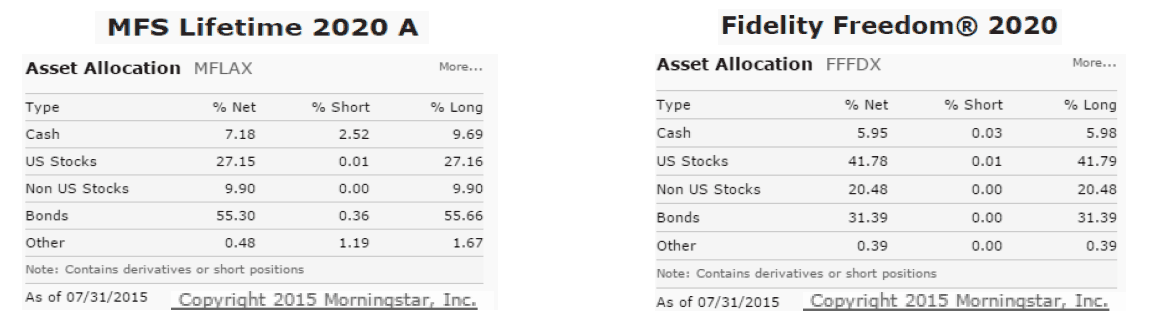

As shown in the chart on the previous page, the asset allocation for a target date fund for one fund family could be drastically different when compared to the same target date fund for another fund family. This can be confusing for investors which is why it is important to research the fund and the current allocation before investing. The charts below show the asset allocation of two 2020 target date mutual funds from different families.

Both target date mutual funds are the same in terms of retirement date but drastically different in exposure to the stock market. The MFS 2020 fund with approximately 63% allocated to bonds/cash and 37% to stocks is a much more conservative portfolio than the Fidelity 2020, which is approximately 37% bonds/cash and 63% stocks. An investor with 5 years to retirement could have very different objectives with their retirement account and therefore each fund may be appropriate as a 2020 fund. An over exposure to the stock market for someone retiring in 5 years could be devastating as shown in 2008/2009 which is why it is important for each individual to determine their time horizon, risk tolerance, and investment objectives when selecting the correct target date fund for their portfolio.

Difference Between Target Date and Active Management

Although target date mutual funds are often referred to as “set it and forget it”, there are a number of factors that must be taken into consideration. Most target date mutual funds are typically managed exclusively on time horizon. Fund managers traditionally do not make significant allocation adjustments to these types of funds based on changing market conditions which can leave investors exposed to big drops in the stock market as they approach retirement. Investors within 10 years to retirement should work closely with their investment advisor to make sure they have the right mix of stocks and bonds in their portfolio.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.