Selecting The Best Pension Payout Option

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

Lump sum

Single Life Benefit

100% Survivor Benefit

50% Survivor Benefit

Survivor Benefit Plus Pop-up Election

The right option varies person by person but some of the primary considerations are:

Marital status

Your age

Your spouse’s age

Income needed in retirement

Retirement assets that you have outside of the pension

Health considerations

Life expectancy

Financial stability of the company sponsoring the plan

Tax Strategy

Risk Tolerance

There are a lot of factors because the decision is not an easy one. In this article, I’m going to walk you through how we evaluate these options for our clients so you can make an educated decision when selecting your pension payout option.

Understanding The Options

To give you a better understanding of the various payout options, I’m going to walk you through how each type of benefit works. Not all pension plans are the same, some plans may only offer some of these options, others after all of these options, and some plans have additional payout options available.

Lump Sum: Some pension plans will give you the option of receiving a lump sum dollar amount instead of receiving monthly payment for the rest of your life. Retirees will typically rollover these lump sum amounts into their IRA’s, which is a non-taxable event, and then take distributions as needed from their IRA.

Single Life Benefit: This is also referred to as the “straight life benefit”. This option usually offers the highest monthly pension payments because there are no survivor benefits attached to it. You receive a monthly payment for the rest of your life but when you pass away, all pension payments stop.

Survivor Benefits: There are usually multiple survivor benefit payout options. They are typically listed as:

100% Survivor Benefit

75% Survivor Benefit

50% Survivor Benefit

25% Survivor Benefit

The percentages represent the amount of the benefit that will continue to your spouse should you pass away first. The higher the survivor benefit, typically the lower your monthly pension payment will be because the pension plans realize they may have to make payments for longer because it’s based on two lives instead of one.

Example: If the Single Life pension payment is $3,000, if instead you elect a 50% survivor benefit, your pension payment may only be $2,800, but if you elect the 100% survivor benefit it may only be $2,700. The monthly pension payments go down as the survivor benefits go up.

Here is an example of the survivor benefit, let’s say you elect the $2,800 pension payment with a 50% survivor benefit. Your pension will pay you $2,800 per month when you retire but if you were to pass away, the pension plan will continue to pay your spouse $1,400 per month (50% of the benefit) for the rest of their life.

Pop-Up Elections: Some pension plans, like the New York State Pension Plan, provide retirees with a “Pop-Up Election”. With the pop-up, if you select a survivor benefit which provides you with a lower monthly pension payment amount but your spouse passes away first, thus eliminating the need for a survivor benefit, your monthly pension payment “pops-up” to the amount that you would have received if you elected the Single Life Benefit.

Example: You are married, getting ready to retire, and you have the following pension payout options:

Single Life: $3,000 per month

50% Survivor Benefit: $2,800 per month

50% Survivor Benefit with Pop-Up: $2,700 per month

If you elect the Single Life option, you would receive $3,000 per month, but when you pass away the pension payments stop.

If you elect the 50% Survivor Benefit, you would receive $2,800 per month, but if you pass away before your spouse, they will continue to receive $1,400 for the rest of their life.

If you elect the 50% Survivor Benefit WITH the Pop-Up, you would receive $2,700 per month, if you were to pass away before your spouse, your spouse would continue to receive $1,350 per month. But if your spouse passes away before you, your pension payment pops-up to the $3,000 Single Life amount for the rest of your life.

Why do people select the pop-up? It’s more related to what happens to the social security benefits when a spouse passes away. If your spouse were to pass away, one of the social security benefits is going to stop, and you receive the higher of the two but some of that lost social security income could be made up by the higher pop-up pension amount.

Marital Status

The easiest variable to address is marital status. If you are not married or there are no domestic partners that depend on your pension payments to meet their expenses, then typically it makes sense to elect either the Lump Sum or Straight Life payment option. Whether or not the lump sum or straight life benefit makes sense will depend on your age, tax strategy, income need, if you want to preserve assets for your children, and other factors.

Income Need

If you are married or have someone that depends on your pension income, by far, the number one factors becomes your income need in retirement when making your pension election. If the primary source of your retirement income is your pension and you were to pass away, your spouse would need to continue to receive all or a portion of those pension payments to meet their expenses, you have to weigh very heavily the survivor benefit options. We have seen people make the mistake of electing the Single Life Option because it was the highest monthly payout and then the spouse with the pension unexpectedly passes away at an earlier age. It’s a devastating financial event for the surviving spouse because the pension payments just stop. If someone were to pass away 5 years after leaving their company, they worked all of those year to receive 5 years worth of pension payments, and then they just stopped.

We usually have to run projections for clients to answer this question, if the spouse with the pension passes away will their surviving spouse need 50%, 75%, or 100% of the pension payments to meet their income needs? In most cases it’s worth accepting a slightly lower monthly pension payment to reduce this survivor risk.

Retirement Assets Outside Of The Pension

If you have substantial retirement savings outside of your pension like 401(k) accounts, investment accounts, 457, IRA’s, 403(b) plans, this may give you more flexibility with your pension options. Having those outside assets almost creates a survivor benefit for your spouse that if the pension payments were to stop or be reduced, there are other retirement assets to draw from to meet their income needs.

Example: You have a retired couple, both have pensions, and they have also accumulated $1M in retirement accounts outside the pension, if one spouse were to pass away, even though the pension payments may stop or be reduced, there may be enough assets to draw from the outside retirement accounts to make up for that lost pension income. This may allow a couple to elect a 50% survivor benefit and receive a higher monthly pension payment compared to electing the 100% survivor benefit with the lower monthly pension payment.

Risk Management

This last example usually leads us into another discussion about long-term risk. Even though you may have the outside assets to accept a higher monthly pension payment with a lower survivor benefit, should you? When we create retirement plans for clients we have to make a lot of assumptions about assumed rates of return, life expectancy, expenses, etc. But what if your investment accounts take a big hit during the next recession or a spouse passes away much sooner than expected, accepting a lower survivor benefit may increase the impact of those risks on your plan. If you and your spouse are both able to elect the 100% survivor benefit on your pensions, you then know, that no matter what happens in the future, that pension income will always be there, so it’s one less variable in your long-term financial plan.

While this could be looked at as a less risky path, there is also the flip side to that. If you lock up the 100% survivor benefit on the pension, that may allow you to take more risk in your outside retirement accounts, because you are not as dependent on those accounts to supplement a survivor benefit depending on which spouse passes away first.

Age

The age of you and your spouse can also be a factor. If the spouse with the pension is quite a bit older than the spouse without pension, it may make sense for normal life expectancy reasons, to elect a larger survivor benefit. Visa versa, if the spouse with then pension is much younger, it may warrant a lower survivor benefit elect. But in the end, it all goes full circle back to the income need if the pension payments were to stop, are there enough other assets to supplement income for the surviving spouse?

Health Considerations / Life Expectancy

When conducting a pension analysis, we will typically use age 90 as a life expectancy for most clients. But there are factors that can alter the use of age 90 such as special health considerations and longevity. If the spouse that has the pension is forced to retire for health reasons, it gives greater weight to electing a pension benefit with a higher survivor benefit. When a client tells us that their father, mother, and grandmother, all lived past age 93, that can impact the pension decision. Since people are living longer, it increases the risk of spending through their traditional retirement savings, whereas the pension payments will be there for as long as they live.

Financial Stability Of The Company / Organization

You are seeing more and more stories about workers that were promised a pension but then their company, union, or not-for-profit goes bankrupt. This is a real risk that should factor into your pension decision. While there are government agencies like the PBGC that are there to help backstop these failed pension plans, there have been so many bankrupt pensions over the past two decades that the PBGC fund itself is at risk of running out of assets. If a retiree is worried about the financial solvency of their employer, it may give greater weight to electing the “Lump Sum Option”, taking your money out of the plan, getting it over to your IRA, and then taking monthly payments from the IRA. Since this is becoming a greater risk to employees, we created a video dedicated to this topic: What Happens To Your Pension If The Company Goes Bankrupt?

Tax Strategy

Tax strategy also comes into play when electing your pension benefit. If we have retirees that have both a pension and retirement accounts outside the pension plan, we have to map out the distribution / tax strategy for the next 10 to 20 years. Depending on who you worked for and what state you live in, the monthly pension payments may be taxed at the federal level, state level, or both. Also, many retirees don’t realize that social security will also be considered taxable income in retirement. Then, if you have pre-tax retirement accounts, at age 72, you have to begin taking Required Minimum Distributions which are taxable.

There are situations where we will have a retiree forego the monthly pension payment from the pension plan and elect the Lump Sum Benefit option, so they can rollover the full balance to an IRA, and then we have more flexibility as to what their taxable income will be each year to execute a long term tax strategy that can save them thousands and thousands of dollars in taxes over their lifetime. We may have them process Roth conversions, or realize long term capital gains at a 0% tax rate, neither of which may be available if the pension income is pushing them up into the higher tax brackets.

There are so many other tax strategies, long term care strategies, and wealth accumulation strategies that come into the mix when deciding whether to take the monthly pension payments or the lump sum payment of your pension benefit.

Pension Option Analysis

These pension decisions are very important because you only get one shot at them. Once the decision is made you are not allowed to go back and change your mind to a different option. We run this pension analysis for clients all of the time, so before you make the decision, feel free to reach out to us and we can help you to determine which pension benefit is the right one for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Happens To My Pension If The Company Goes Bankrupt?

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should know the answer to. While some employees are aware of the PBGC (Pension Benefit Guarantee Corporation) which is an organization that exists to step in and provide pension benefits to employees if the employer becomes insolvent, very few are aware that the PBGC itself may face insolvency within the next ten years. So if the company can’t make the pension payments and the PBGC is out of money, are employees left out in the cold?

Pension shortfall

When a company sponsors a pension plan, they are supposed to make contributions to the plan each year to properly fund the plan to meet the future pension payments that are due to the employees. However, if the company is unable to make those contributions or the underlying investments that the pension plan is invested in underperform, it can lead to shortfalls in the funding.

We have seen instances where a company files for bankruptcy and the total dollar amount owed to the pension plan is larger than the total assets of the company. When this happens, the bankruptcy courts may allow the company to terminate the plan and the PBGC is then forced to step in and continue the pension payments to the employees. While this seems like a great system since up until now that system has worked as an effective safety net for these failed pension plans, the PBGC in its most recent annual report is waiving a red flag that it faces insolvency if Congress does not make changes to the laws that govern the premium payments to the PBGC.

What is the PBGC?

The PBGC is a federal agency that was established in 1974 to protect the pension benefits of employees in the private sector should their employer become insolvent. The PBGC does not cover state or government sponsored pension plans. The number of employees that were plan participants in an insolvent pension plan that now receive their pension payments from the PBGC is daunting. According to the 2017 PBGC annual report, the PBGC “currently provides pension payments to 840,000 participants in 4,845 failed single-employer plans and an additional 63,000 participants across 72 multi-employer plans.”

Wait until you hear the dollar amounts associate with those numbers. The PBGC paid out $5.7 Billion dollars in pension payments to the 840,000 participants in the single-employer plans and $141 Million to the 63,000 participants in the multi-employer plans in 2017.

Where Does The PBGC Get The Money To Pay Benefits?

So where does the PBGC get all of the money needed to make billions of dollars in pension payments to these plan participants? You might have guessed “the taxpayers” but for once that’s incorrect. The PBGC’s operations are financed by premiums payments made by companies in the private sector that sponsor pension plans. The PBGC receive no taxpayer dollars. The corporations that sponsor these pension plans pay premiums to the PBGC each year and the premium amounts are set by Congress.

Single-Employer vs Multi-Employer Plans

The PBGC runs two separate insurance programs: “Single-Employer Program” and “Multi-Employer Program”. It’s important to understand the difference between the two. While both programs are designed to protect the pension benefits of the employees, they differ greatly in the level of benefits guaranteed. The assets of the two programs are also kept separate. If one programs starts to fail, the PBGC is not allowed to shift assets over from the other program to save it.

The single-employer program protects plans that are sponsored by single employers. The PBGC steps in when the employer goes bankrupt or can no longer afford to sponsor the plan. The Single-Employer Program is the larger of the two programs. About 75% of the annual pension payments from the PBGC come from this program. Some examples of single-employer companies that the PBGC has had to step into to make pension payments are United Airlines, Lehman Brothers, and Circuit City.

The Multi-Employer program covers pension plans created and funded through collective bargaining agreements between groups of employers, usually in related industries, and a union. These pension plans are most commonly found in construction, transportation, retail food, manufacturing, and services industries. When a plan runs out of money, the PBGC does not step in and takeover the plan like it does for single-employer plans. Instead, it provides “financial assistance” and the guaranteed amounts of that financial assistants are much lower than the guaranteed amounts offered under the single-employer program. For example, in 2017, the PBGC began providing financial assistance to the United Furniture Workers Pension Fund A (UFW Plan), which covers 10,000 participants.

Maximum Guaranteed Amounts

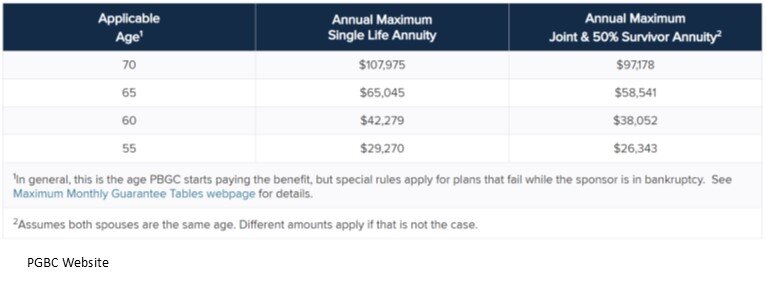

The million dollar question. What is the maximum monthly pension amount that the PBGC will guarantee if the company or organization goes bankrupt? There are maximum dollar amounts for both the single-employer and multi-employer program. The maximum amounts are indexed for inflation each year and are listed on the PBGC website. To illustrate the dramatic difference between the guarantees associated with the pension pensions in a single-employer plan versus a multi-employer plan; here is an example from the PBGC website based on the 2018 rates.

“PBGC’s guarantee for a 65-year-old in a failed single-employer plan can be up to $60,136 annually, while a participant with 30 years of service in a failed multi-employer plan caps out at $12,870 per year. The multi-employer program guarantee for a participant with only 10 years of service caps out at $4,290 per year.”

It’s a dramatic difference.

For the single-employer program the PBGC provides participants with a nice straight forward benefits table based on your age. Below is a sample of the 2018 chart. However, the full chart with all ages can be found on the PBGC website.

Unfortunately, the lower guaranteed amounts for the multi-employer plans are not provided by the PBGC in a nice easy to read table. Instead they provide participant with a formula that is a headache for even a financial planner to sort through. Here is a link to the formula for 2018 on the PBGC website.

PBGC Facing Insolvency In 2025

If the organization guaranteeing your pension plan runs out of money, how much is that guarantee really worth? Not much. If you read the 138 page 2017 annual report issued by the PBGC (which was painful), at least 20 times throughout the report you will read the phase:

“The Multi-employer Program faces very serious challenges and is likely to run out of money by the end of fiscal year 2025.”

They have placed a 50% probability that the multi-employer program runs out of money by 2025 and a 99% probability that it runs out of money by 2036. Not good. The PBGC has urged Congress to take action to fix the problem by raising the premiums charged to sponsors of these multi-employer pension plans. While it seems like a logical move, it’s a double edged sword. While raising the premiums may fix some of the insolvency issues for the PBGC in the short term, the premium increase could push more of the companies that sponsor these plans into bankruptcy.

There is better news for the Single-Employer Program. As of 2017, even though the Single-Employer Program ran a cumulative deficit of $10.9 billion dollars, over the next 10 years, the PBGC is expected to erase that deficit and run a surplus. By comparison the multi-employer program had accumulated a deficit of $65.1 billion dollars by the end of 2017..

Difficult Decision For Employees

While participants in Single-Employer plans may be breathing a little easier after reading this article, if the next recession results in a number of large companies defaulting on their pension obligations, the financial health of the PBGC could change quickly without help from Congress. Employees are faced with a one-time difficult decision when they retire. Option one, take the pension payments and hope that the company and PBGC are still around long enough to honor the pension payments. Or option two, elect the lump sum, and rollover then present value of your pension benefit to your IRA while the company still has the money. The right answer will vary on a case by case basis but the projected insolvency of the PBGC’s Multi-employer Program makes that decision even more difficult for employees.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.