Requesting Mortgage Forbearance: Be Careful

Due to the rapid rise in the unemployment rate as a result of the Coronavirus, Congress passed the CARES Act which includes a provision that provides mortgage relief to homeowners that have federally-backed mortgages.

Due to the rapid rise in the unemployment rate as a result of the Coronavirus, Congress passed the CARES Act which includes a provision that provides mortgage relief to homeowners that have federally-backed mortgages. Homeowners are eligible for a 180 day forbearance on their mortgage payments which can provide much needed financial relief for individuals and families that are struggling due to the COVID-19 containment efforts. Even if you do not have a federally-back mortgage, some banks are voluntarily offering homeowners forbearance options on their mortgage payments. But before you choose this option, you should be aware of the following items:

How does forbearance work?

Who qualifies for mortgage forbearance?

What is the process for requesting a forbearance?

Does forbearance hurt your credit score?

What are the repayment options?

The hidden costs of forbearance

Other options for mortgage relief

How Does Mortgage Forbearance Work?

Mortgage forbearance allows homeowners to defer monthly mortgage payments for a specific period of time. Under the CARES Act, homeowners that qualify, will be able to delay their mortgage payments for the next 6 months. But it’s important to understand that “forbearance” delays mortgage payments, it does not forgive those payment. At some point in the future, you will have to make up for those missed payments.

Who Is Eligible For Mortgage Forbearance?

Under the CARES Act, homeowners that have federally-backed mortgages are eligible for a forbearance up to 180 days. But as I mentioned above, homeowners that do not have federally-backed mortgages may also be eligible but it’s at the discretion of the loan servicer. How do you know if you have a federally-backed mortgage? Here is a list of the federal agencies:

FHA

VA

Freddie Mac

Fannie Mae

USDA

Do You Have A Government Backed Mortgage?

If you are not sure whether or not your mortgage is backed by the federal government, there are a few ways to find out but we recommend not blindly calling the bank that issued your mortgage. The bank that issued your mortgage may be different than the company that “services” your mortgage. It’s not uncommon for lenders to sell the servicing rights of their mortgages to other companies. If you are considering applying for forbearance, you will need to consult with the loan servicer.

As you can image, these loan servicing companies are being overwhelmed right now with homeowners requesting forbearance of their mortgage payments. If you are able to determine whether or not you have a federally-backed mortgage yourself, it will save you time and frustration. Here are a few different ways to determine if your mortgage is backed by a federal agency:

FHA Insurance Payments: If you look at your mortgage statement and you see FHA insurance payments being made, your loan is backed by the FHA. You can also look at your mortgage closing documents, specifically your HUD form.

Fannie Mae & Freddie Mac Websites: Almost 50% of all mortgages issued in U.S. are backed by either Fannie Mae or Feddie Mac. You can run a search on their websites to determine if your mortgage is backed by either of those two agencies.

Contact Loan Servicer: If you are still unable to determine whether or not your mortgage is federally-backed, you can contact your loan servicer. The contact information for your loan servicer is usually listed on your monthly mortgage statement but if you don’t have access to your statement, you may be able to locate your loan servicer via the Mortgage Electronic Registration System

Mortgages Not Backed By A Federal Agency

If your mortgage is not backed by a federal agency, you still may be eligible for a mortgage forbearance but that will be at the complete discretion of your loan servicing company. You will need to contact your loan servicer but unlike federally-backed loans, they are not required to offer you a forbearance. You should be prepared to answer a number of questions such as:

Why are you applying for the forbearance?

How long do you need the forbearance for?

Details about the status of your income, expenses, and employment

The Forbearance Process

Whether you have a federally-backed mortgage or not, you will have to pro-actively reach out to your loan servicing company to request the forbearance; it does not happen automatically. If you qualify for the forbearance, there are two key pieces of information that you should obtain before that call is finished.

Determine the repayment terms for those missed payments

Request your forbearance agreement in writing

Repayment Options

Since you have to repay these missed mortgage payments at some point in the future, it’s incredibly important to understand the terms of the repayment. Some loan servicing companies are requesting a “balloon payment” which means if you are granted a 6 month forbearance, when you reach the end of that 6 month period, all of the missed mortgage payments are due in a lump sum amount; not a favorable situation for most homeowners. Here are the three most common repayment options:

Balloon Payment: All of the missed payments are due as a single lump sum payment at the end of the forbearance term. This is the least favorable option for homeowners.

Extended Term: This option extends the term of your mortgage by the length of the forbearance. If you receive a 3 month forbearance and you have a 30 year mortgage, they will extend the term of your 30 year mortgage by an additional 3 months. This is usually the most favorable option for borrowers.

Re-amortize The Loan: Unlike the “extend the term” option, the maturity date of your mortgage stays the same, and when you restart mortgage payments at the end of the forbearance period, they spread those missed payments over the remaining life of the mortgage. This will result in a slightly higher mortgage payment compared to your mortgage payment prior to the forbearance period.

Get The Forbearance Offer In Writing

With all of these moving parts, it’s extremely important to request that your loan servicer sends you the forbearance agreement in writing. You definitely want to make sure nothing was missed or miscommunicated otherwise you could damage your credit score, end up in a foreclosure situation, or have an unexpectedly large mortgage payment waiting for you at the end of the forbearance period.

Does Mortgage Forbearance Affect Credit?

If done correctly, a mortgage forbearance will not negatively impact your credit score.

Hidden Cost of Forbearance

While there are no late fees assessed on these missed mortgage payments associated with a forbearance agreement, there is additional interest that accumulates over the remaining life of the mortgage when the repayment option involves either an extended term or re-amortization.

Example: Homeowner has a $250,000 federally-backed mortgage, 4% interest rate, with 20 years left on the mortgage. This homeowners was financially impacted by COVID-19 and is granted a 6 month forbearance with an extended term repayment. How much additional mortgage interest did that individual pay over the remaining life of the mortgage due to that 6-month forbearance?

Answer: $3,159

So this option is not “free” by any means but it may be a reasonable price for homeowners to pay compared to the negative financial impact of missing mortgage payments without forbearance.

Other Options Beside Forbearance

If your bank does not grant you forbearance, or you want to consider other options, the CARES Act did open up other forms of financial relief to taxpayers in the form of:

Each option has it’s own pros and cons but you can read more about these options via the links above.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

IRS Stimulus Checks To Individuals: Eligibility & Timing

The U.S. Senate recently passed the CARES Act which was put in place to help stabilize the economy in the wake of the Coronavirus containment efforts. One of the key items in the bill are the stimulus checks that the IRS will issue to

The U.S. Senate recently passed the CARES Act which was put in place to help stabilize the economy in the wake of the Coronavirus containment efforts. One of the key items in the bill are the stimulus checks that the IRS will issue to individuals and their children. In this article we will review:

The amount of the IRS checks

What makes you eligible to receive a check

Income Limitations & Phaseouts

When To Expect The Payment

Direct Deposit vs Physical Check

Unanswered Questions That Need Clarification

IRS Checks To Individuals

The government plans to immediately begin issuing checks directly to individual taxpayers. Individuals that qualify will be eligible to receive a check for $1,200 plus $500 for each child.

Example: A household that has 2 parents and 3 children may be eligible to receive a payment from the IRS in the amount of $3,900.

Parent 1: $1,200

Parent 2: $1,200

Child 1: $500

Child 2: $500

Child 3: $500

Are You Eligible To Receive A Check From The IRS?

Whether or not you receive a check from the IRS will be depend on your taxable income for either 2019 or 2018.

Single Filer: Less than $75,000

Married Filing Joint: Less Than $150,000

There is a phaseout of the payments between:

Single Filer: $75,000 – $99,000

Married Filing Joint: $150,000 – $198,000

Once above the income limits for a single filer of $99,000 and the joint filer of $198,000, you will not be eligible to receive a check.

If you already filed your taxes for 2019, the IRS will look at your 2019 tax return. If you have not filed your taxes for 2019, then the IRS will look at your income on your 2018 tax return. If you did not file a tax return for either year, then the IRS will look at your wages that were reported to social security in those tax years.

What If You Have Less Income In 2020?

But what happens if you were over those income limits for 2018 and 2019 but because of the Coronavirus, your income will be lower in 2020 making you eligible for the payments? You will not receive a check like everyone else but you will be able to capture the payments as a tax credit when you file your 2020 tax return. The payments from the IRS are really “tax credits” that the government is sending to individuals in advance of the filing of their 2020 tax return. Instead of making individuals wait to file their 2020 tax return, the IRS is sending the money to these individuals now.

Second scenario, what if your income was lower in 2018 and 2019 qualifying you for the IRS check but in 2020 your income will be above the threshold. Answer, we don’t know. As of right now there does not seem to be language in the bill saying that they’re going to recapture the credit when you file your 2020 tax return but this is one of those items that will need to be addressed by the IRS after the fact.

How Long Will It Take To Get The IRS Check?

This is the biggest question mark right now. It seems like the IRS is going to direct deposit these payments to your checking account for anyone that has ACH instructions on file with the IRS. If you have ever received a refund or made tax payments directly from your checking account, this would apply to you. However, what if someone no longer has that bank account? We are not sure how that is going to work. The direct deposits may happen sometime in April.

If the IRS does not have bank account instructions on file, they will have to cut physical checks. The last time Congress issued checks to people as part of a stimulus package was 2008 and it took 2 months for those checks to arrive. If this follows a similar path, individual taxpayers might not receive these IRS checks until May but this is another item that still needs to be addressed by the IRS.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

$5,000 Penalty Free Distribution From An IRA or 401(k) After The Birth Of A Child or Adoption

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child without having to pay the 10% early withdrawal penalty. To take advantage of this new distribution option, parents will need to know:

Effective date of the change

Taxes on the distribution

Deadline to make the withdrawal

Is it $5,000 for each parent or a total per couple?

Do all 401(k) plans allow these types of distributions?

Is it a per child or is it a one-time event?

Can you repay the money to your retirement account at a future date?

How does it apply to adoptions?

This article will provide you with answers to these questions and also provide families with advanced tax strategies to reduce the tax impact of these distributions.

SECURE Act

The SECURE Act was passed in December 2019 and Section 113 of the Act added a new exception to the 10% early withdrawal penalty for taking distributions from retirement accounts called the “Qualified Birth or Adoption Distribution.”

Prior to the SECURE Act, if you were under the age of 59½ and you distributed pre-tax money from an IRA or 401(k) plan, in addition to having to pay ordinary income tax on the amount distributed, you were also hit with a 10% early withdrawal penalty from the IRS. The IRS prior to the SECURE Act did have a list of exceptions to the 10% penalty but having a child or adopting a child was not on that list. Now it is.

How It Works

After the birth of a child, a parent is allowed to distribute up to $5,000 out of either an IRA or a 401(k) plan. Notice the word “after”. You are not allowed to withdraw the money prior to the child being born. New parents have up to 12 months following the date of birth to process the distribution from their retirement accounts and avoid the 10% early withdrawal penalty.

Example: Jim and Sarah have their first child on May 5, 2020. To help with some of the additional costs of a larger family, Jim decides to withdraw $5,000 out of his rollover IRA. Jim’s window to process that distribution is between May 5, 2020 – May 4, 2021.

The Tax Hit

Assuming Jim is 30 years old, he would avoid having to pay the 10% early withdrawal penalty on the $5,000 but that $5,000 still represents taxable income to him in the year that the distribution takes place. If Jim and Sarah live in New York and make a combined income of $100,000, in 2020, that $5,000 would be subject to federal income tax of 22% and state income tax of 6.45%, resulting in a tax liability of $1,423.

Luckily under the current tax laws, there is a $2,000 federal tax credit for dependent children under the age of 17, which would more than offset the total 22% in fed tax liability ($1,100) created by the $5,000 distribution from the IRA. Essentially reducing the tax bill to $323 which is just the state tax portion.

TAX NOTE: While the $2,000 fed tax credit can be used to offset the federal tax liability in this example, if the IRA distribution was not taken, that $2,000 would have reduced Jim & Sarah’s existing tax liability dollar for dollar.

For more info on the “The Child Tax Credit” see our article: More Taxpayers Will Qualify For The Child Tax Credit

$5,000 Per Parent

But it gets better. The $5,000 limit is available to EACH parent meaning if both parents have a pre-tax IRA or 401(k) plan, they can each distribute up to $5,000 from their retirement accounts within 12 months following the birth of their child and avoid the 10% early withdrawal penalty.

ADVANCED TAX STRATEGY: If both parents are planning to distribute the full $5,000 out of their retirement accounts and they are in a medium to high tax bracket, it may make sense to split the two distributions between separate tax years.

Example: Scott and Linda have a child on October 3, 2020 and they both plan to take the full $5,000 out of their IRA accounts. If they are in a 24% federal tax bracket and they process both distributions prior to December 31, 2020, the full $10,000 would be taxable to them in 2020. This would create a $2,400 federal tax liability. Since this amount is over the $2,000 child tax credit, they will have to be prepared to pay the additional $400 federal income tax when they file their taxes since it was not fully offset by the $2,000 tax credit.

In addition, by taking the full $10,000 in the same tax year, Scott and Linda also run the risk of making that income subject to a higher tax rate. If instead, Linda processes her distribution in November 2020 and Scott waits until January 2021 to process his $5,000 IRA distribution, it could result in a lower tax liability and less out of pocket expense come tax time.

Remember, you have 12 months following the date of birth to process the distribution and qualify for the 10% early withdrawal exemption.

$5,000 For Each Child

This 10% early withdrawal exemption is available for each child that is born. It does not have a lifetime limit.

Example: Building on the Scott and Linda example above, they have their first child October 2020, and both of them process a $5,000 distribution from their IRA’s avoiding the 10% penalty. They then have their second child in November 2021. Both Scott and Linda would be eligible to withdraw another $5,000 each out of their IRA or 401(k) within 12 months after the birth of their second child and again avoid having to pay the 10% early withdrawal penalty.

IRS Audit

One question that we have received is “Do I need to keep track of what I spend the money on in case I’m ever audited by the IRS?” The short answer is “No”. The new law does not require you to keep track of what the money was spent on. The birth of your child is the “qualifying event” which makes you eligible to distribute the $5,000 penalty free.

Not All 401(k) Plans Will Allow These Distributions

Starting in 2020, this 10% early withdrawal exception will apply to all pre-tax IRA accounts but it does not automatically apply to all 401(k), 403(b), or other types of qualified employer sponsored retirement plans.

While the SECURE Act “allows” these penalty free distributions to be made, companies can decide whether or not they want to provide this special distribution option to their employees. For employers that have existing 401(k) or 403(b) plans, if they want to allow these penalty free distributions to employees after the birth of a child, they will need to contact their third-party administrator and request that the plan be amended.

For companies that intend to add this distribution option to their plan, they may need to be patient with the timeline for the change. 401(k) providers will most likely need to update their distribution forms, tax codes on their 1099R forms, and update their recordkeeping system to accommodate this new type of distribution.

Ability To Repay The Distribution

The new law also offers parents the option to repay the amounts to their retirement account that were distributed due to a qualified birth or adoption. The repayment of the amounts previously distributed from the IRA or 401(k) would be in addition to the annual contribution limits. There is not a lot of clarity at this point as to how these “repayments” will work so we will have to wait for future guidance from the IRS on this feature.

Adoptions

The 10% early withdrawal exception also applies to adoptions. An individual is allowed to take a distribution from their retirement account up to $5,000 for any children under the age of 18 that is adopted. Similar to the timing rules of the birth of a child, the distribution must take place AFTER the adoption is finalized, but within 12 months following that date. Any money distributed from retirement accounts prior to the adoption date will be subject to the 10% penalty for individuals under the age of 59½.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

4 Things That Elite Millennials Do To Fast Track Their Careers

As a young professional, your most valuable asset is your career. While you can watch endless videos on the benefits of making Roth IRA contributions or owning real estate, at the end of the day if you're making $400,000 instead of

As a young professional, your most valuable asset is your career. While you can watch endless videos on the benefits of making Roth IRA contributions or owning real estate, at the end of the day if you're making $400,000 instead of $70,000 before reaching the age of 40, you will have the opportunity to build real wealth faster.

As the owner of an investment firm, I have had the opportunity to work with a lot of very success Millennials that have either successfully grown a business or have climbed the corporate ladder much faster than their peers. Even though these elite young professionals all have different backgrounds, personalities, and skill sets, I have noticed that there are 4 things that make them similar and I’m going to share them with you today.

They Take Risks Early & Often

Think about the last time you left a job; whether it was to take a job with a different company, start your own business, or take a new position within your current company, you probably spent days or maybe weeks in mental turmoil asking yourself questions like:

“Am I making the right decision?”

“What if I get to this new company and the position is not what they say it’s going to be?”

“Should I risk going out on my own and starting a company?”

We have all been there, and it’s awful. All you can think about is, “What if this does not work out the way I expect?”. What I have noticed with this group of successful millennials is that they are able to recognize the uncertainty in those situations, but still choose to jump forward without ever looking back. They are like cats in the way that no matter where they land down the road, the one thing they feel certain about is that they will land on their feet.

This is not just something that they do once or twice, but rather multiple times throughout their working careers. In general, the young professionals that really surge forward are the ones that take risks early on in their careers. Starting a business or making a big career change when you are 25 with no mortgage and no family to support is typically easier to manage then taking that same risk when you have a mortgage and/or family to support. We have seen young professionals start businesses and in year two or three the business nearly goes under, but they somehow held on, pushed forward, and they turned it into a wildly successful business. There is no perfect age to take these leaps, but it’s just acknowledging that without a lot of advanced planning it becomes much more difficult to take these risks as your personal expenses grow.

Sense Of Purpose

When you talk with this group of successful Millennials, they all have a very strong sense of purposes. Now, sense of purpose does not necessarily mean that they have life all figured out. Many of the professionals in this elite group will jokingly admit that they have no idea what the future holds for them, however, they can tell you at length what they love about their career and their explanation will often sound very different than if you were to ask their coworkers what they love about their job.

Example, we have a client that provides custom software to companies and they have rising star on their team. Looking at this employee’s resume and position within the company you would say “Ok, typical software developer, coder, very techy, etc.” However, this employee has taken it upon himself to post videos to social media everyday as he builds robot armies, provides free strategies for solving problems using custom software, and he has amassed a huge following of tech fans wanting more.

This was not something that his supervisor asked him to do or a task that is at all part of his job description. Nope, he is sincerely passionate about helping companies to solve everyday problems using custom software and he puts it all out there for the world to see. Such a clear sense of purposes that has allowed him to turn something ordinary into something extraordinary. The tip here: figure out what you love and try to incorporate it into your career.

They Say “No”

This is kind of an odd one, but I have noticed this trait to be common among successful younger business owners and executives. They know when to say “No” to an opportunity. For most professionals, the power of “No” comes later on in their careers after they have seen enough opportunities turn into complete train wrecks. Most younger professionals do not have 30 years of battle tested experience in an effort to execute their growth plans, they dine at what I call “the buffet of opportunity”.

When you start a company or lead a team of executives, usually the main goal is to grow the company as fast as possible, so when you are presented with 3 growth ideas, you may decide to chase 2 or all 3 in an effort to grow the company. Sometimes that’s ok, but what I have seen these successful Millennials recognize is that by committing all of their resources toward what they feel is the single best opportunity they are able to either succeed or fail FASTER. A concept that was identified by Elon Musk of Tesla.

I was able to identify this trait through the actions of one of our clients. A young business owner that had a company in the energy sector and the company had been experiencing double digit growth for a number of years. Since they had cash and they were looking for ways to grow the company, instead of just selling their product and then hiring third party contractors for the install, they decided that they could produce additional revenue by handling the installation themselves.

Two years after that decision was made, I was having breakfast with the owner of the company and he said that decision almost bankrupted the company. While they were very good at producing their product, they were horrible at running construction teams and managing the liability associated with the installation process. He said, “I should have just said no and stuck to what we were good at.”

That experience made me aware of the Power of No being used by other young business owners and executives. We have had clients that have said “No” to:

A large new client because it would tie the fate of their company to that client

Joint working relationship with other companies

Providing services related too but not associated with their core business

New investors in the company

Selling the company

All of these decisions are tough decisions to make, but I have noticed that our most successful young professionals are not afraid to look opportunity in the eye and say “not today”.

The L-Factor

An executive from Yahoo named Tim Sanders wrote a book a number of years ago called The Likeability Factor. The main idea of the book is people choose who they like and they tend to buy from them, hire them, and purposefully spend more time with them. It may not be a surprise that many of the successful young professionals that we see growing businesses and sprinting up the corporate ladder have what Tim Sanders calls a high “L-Factor”.

Think of the clients and co-workers that show up at your office door and you know it’s going to be a fun and engaging conversation. Those are the high L-factor people in our lives. It’s been shown that those High L-factor executives tend to survive layoffs time after time because even though their actual position may be getting eliminated, the powers that be sometimes find a place for that person to land for no other reason than they liked them and wanted to keep them with the company.

While I’m sure all of us can think of someone that is in a position of power that has an L-factor of zero, there are far many more business owners and executives that have made it to where they are today because they are likeable.

I feel like I could give you endless examples of instances where I have seen likeability play out in favor of successful young professionals, but I think everyone understands the general idea. The one thing that I will point out though that is also in Tim’s book is that any level, you have the ability to raise your L-Factor. Likeability is a skill like listening, negotiating, or public speaking. It comes very natural to some people, but others have to work at it.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Payoff My Mortgage Early?

As a financial planner, clients will frequently ask me the following question, “Should I apply extra money toward my mortgage and pay it off early?”. The answer depends on several factors such as:

As a financial planner, clients will frequently ask me the following question, “Should I apply extra money toward my mortgage and pay it off early?”. The answer depends on several factors such as:

The status of your other financial goals

Interest rate

How long you plan to live in the house

How close you are to retirement

The rate of return for other available investment options

Status of your other financial goals

Before you start applying additional payments toward your mortgage, you should first conduct an assessment of the status of your various financial goals.

For clients that have children, we usually start with the following questions:

“What are your plans for paying for college for your kids? Are the college savings accounts appropriately funded?”

The cost of college keeps rising which requires more advanced planning on behalf of parents that have children that are college bound, but before committing more money toward the mortgage, you should have an idea as to what your financial aid package might look like, so you have a ballpark idea of what you will have to pay out of pocket each year for college.

If you have an extra $5,000 sitting in your savings account, you can either apply that toward the mortgage, which is a one-time benefit, or you can put that money into a college 529 account when your child is 5 years old, and let it accumulate for 13 the next years. Assuming you get a 6% rate of return within that 529 account, you will be able to withdrawal $10,665 all tax free when it comes time to pay for college.

Here is the list of other questions that we typically ask clients before we give them the green light to escalate the payments on their mortgage:

Is there enough money in your retirement accounts to fulfill your plans for retirement?

Do you have any other debt? Student loan debt, credit card debt, HELOC?

How many months of living expense have you put aside in an emergency fund?

Are there any big one-time expenses coming up?

Do you have the appropriate amount of life insurance?

Do you foresee any career changes in the near future?

If there are financial shortfalls in some of these other areas, it may be better to shore up some of the weaknesses in your overall financial plan before applying additional cash toward the mortgage.

What is the interest rate on your mortgage?

The interest rate that the bank or credit union is charging you on your mortgage has a significant weight in the decision as to whether or not you should pay off your mortgage early. We tell clients that you should look at the interest rate on debt as a “risk free rate of return”. If you have a mortgage with a 4% interest rate and you have $5,000 in cash sitting in your savings account, by applying that $5,000 toward your mortgage you are technically earning a 4% rate of return on that money because you are not paying it to the bank. The reason it is “risk free” is because you would have paid that money to the bank otherwise.

It’s important to understand the risk-free concept of paying off debt. Clients will sometimes ask me “Why would I put more money toward my mortgage with an interest rate of 4% when I can invest it in the stock market and get an 8% rate of return?”

My answer is, “It’s not an apple to apple comparison because you are comparing two different risk classes.” You have to take risk in the stock market to obtain that possible 8% rate of return, as compared to applying the money toward your mortgage which is guaranteed because you are guaranteed to not pay the bank that interest. It would be more appropriate to compare the interest rate on your mortgage to a CD rate at a bank, or the interest rate for a money market account.

After this exchange, the client will frequently comment, “Well, I can’t get 4% in a CD at a bank these days”. In those cases, if they have idle cash, it may be advantageous to apply the cash toward the mortgage instead of letting it sit in their savings account or a CD with a lower interest rate.

Interest rate below 5%

When the interest rate on your mortgage is below 5%, it makes the decision more difficult. Depending on the interest rate environment, there may be lower risk investments other than stocks that could earn a higher rate of return compared to the interest rate on your mortgage. You may also have some long term financial goal like retirement that allows you to comfortably take more risk and assume a higher long term annualized rate of return in those higher risk asset classes. When you have a lower interest rate on your mortgage, applying additional cash toward the mortgage may still be the prudent decision, but it requires more analysis.

Interest rate above 5%

When we see the interest rates on a mortgage above 5% the decision to pay off the mortgage early gets easier. Based on the examples that we have already covered, if the interest rate on your mortgage is 6%, by applying more cash toward the mortgage you are earning a risk-free rate of return of 6%, that’s a pretty good risk-free rate of return in most market environments. For our readers that had mortgages in the early 80’s, they saw mortgage rates north of 15%. That’s a nice risk-free rate of return, but hopefully we never see the interest rate on mortgages that high ever again.

How long do you plan to live in the house?

If you plan to sell your house within the next 5 years, applying additional payments toward the mortgage has a positive financial impact, but it’s typically not as strong as when you compare it to someone that has 20 years left on mortgage and they plan to be living in the house for the next 20+ years.

It’s a lesson in compounding interest. Example, you have the following mortgage:

Outstanding balance: $200,000

Interest rate: 4%

Years left on the mortgage: 20 Years

You have $20,000 sitting in your savings account that you are considering applying toward the mortgage. If you plan to sell the house a year from now, applying $20,000 toward the mortgage would save you $800 in interest.

If you plan to stay in the house for the full 20 years, applying the $20,000 toward your mortgage today would save you $9,086 in interest over the remaining life of the mortgage.

Should I payoff my mortgage before I retire?

When we are helping clients prepare for retirement, we remind them that with all of the unknowns that the future holds, the one thing that you have 100% control over both now and in the future are your annual expenses. You don’t have control over market returns, inflation, tax rates, etc, so the goal is to give you the most flexibility in retirement and minimize your expenses. It not uncommon for the mortgage to be your largest monthly expense.

It is for this reason that retirement serves as kind of a wild card in this rate of return analysis. During the accumulation years, you may be assuming an 8% rate of return on your retirement account because you had an overweight to stocks in your portfolio. Now that you are transitioning over to the distribution phase, it’s common for investors to decrease the risk level in their retirement accounts, which is often accompanied by a lower assumed rate of return over longer time periods. It makes that gap between the interest rate on your mortgage and the assumed rate on your investment accounts smaller, thus giving more weight to escalating the payoff of the mortgage.

Additionally, no mortgage means less money coming out of your retirement accounts each year, which helps investors manage the risk of outliving their retirement savings.

While we like our clients to retire with as little debt as possible, there are scenarios that arise where it does make sense to have a mortgage in retirement. Both of these scenarios stem from the situation where 100% of the client’s assets are tied up in pre-tax retirement accounts.

If they have $50,000 left on the mortgage and they are about to retire, we typically would not advise them to distribute $50,000 from their retirement account to pay off the mortgage because they will take a big income tax hit by realizing all of that additional taxable income in a single tax year. In these cases, it may make sense to continue to make the regular monthly mortgage payments until the mortgage is paid in full.

In a similar situation when clients want to buy a second house in retirement, but most of their money is tied up in pre-tax retirement, instead of incurring a big tax hit by taking a large distribution from their retirement accounts, it may make sense for them to just take the mortgage and make regular monthly payments. This strategy spreads the distributions from the retirement accounts over multiple tax years which could more than offset the interest that you are paying to the bank over the life of the loan. In addition, the money in your retirement accounts is allowed to accumulate tax deferred for a longer period of time.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Have To Pay Tax On A House That I Inherited?

The tax rules are different depending on the type of assets that you inherit. If you inherit a house, you may or may not have a tax liability when you go to sell it. This will largely depend on whose name was on the deed when the house was passed to you. There are also special exceptions that come into play if the house is owned by a trust, or if it was gifted

Do I Have To Pay Tax On A House That I Inherited?

The tax rules are different depending on the type of assets that you inherit. If you inherit a house, you may or may not have a tax liability when you go to sell it. This will largely depend on whose name was on the deed when the house was passed to you. There are also special exceptions that come into play if the house is owned by a trust, or if it was gifted with the kids prior to their parents passing away. On the bright side, with some advanced planning, heirs can often times avoid having to pay tax on real estate assets when they pass to them as an inheritance.

Step-up In Basis

Many assets that are included in the decedent’s estate receive what’s called a step-up in basis. As with any asset that is not held in a retirement account, you must be able to identify the “cost basis”, or in other words, what you originally paid for it. Then when you eventually sell that asset, you don’t pay tax on the cost basis, but you pay tax on the gain.

Example: You buy a rental property for $200,000 and 10 years later you sell that rental property for $300,000. When you sell it, $200,000 is returned to you tax free and you pay long-term capital gains tax on the $100,000 gain.

Inheritance Example: Now let’s look at how the step-up works. Your parents bought their house 30 years ago for $100,000 and the house is now worth $300,000. When your parents pass away and you inherit the house, the house receives a step-up in basis to the fair market value of the house as of the date of death. This means that when you inherit the house, your cost basis will be $300,000 and not the $100,000 that they paid for it. Therefore, if you sell the house the next day for $300,000, you receive that money 100% tax-free due to the step-up in basis.

Appreciation After Date of Death

Let’s build on the example above. There are additional tax considerations if you inherit a house and continue to hold it as an investment and then sell it at a later date. While you receive the step-up in basis as of the date of death, the appreciation that occurs on that asset between the date of death and when you sell it is going to be taxable to you.

Example: Your parents passed away June 2019 and at that time their house is worth $300,000. The house receives the step-up in basis to $300,000. However, lets say this time you rent the house or don’t sell it until September 2020. When you sell the house in September 2020 for $350,000, you will receive the $300,000 tax-free due to the step-up in basis, but you’ll have to pay capital gains tax on the $50,000 gain that occurred between date of death and when you sold house.

Caution: Gifting The House To The Kids

In an effort to protect the house from the risk of a long-term event, sometimes individuals will gift their house to their kids while they are still alive. Some see this as a way to remove themselves from the ownership of their house to start the five-year Medicaid look back period, however, there is a tax disaster waiting for you with the strategy.

When you gift an asset to someone, they inherit your cost basis in that asset, so when you pass away, that asset does not receive a step-up in basis because you don’t own it and it’s not part of your estate.

Example: Your parents change the deed on the house to you and your siblings while they’re still alive to protect assets from a possible nursing home event. They bought the house 30 years ago for $100,000, and when they pass away it’s worth $300,000. Since they gifted the assets to the kids while they were still alive, the house does not receive a step-up in basis when they pass away, and the cost basis on the house when the kids sell it is $100,000; in other words, the kids will have to pay tax on the $200,000 gain in the property. Based on the long-term capital gains rates and possible state income tax, when the children sell the house, they may have a tax bill of $44,000 or more which could have been completely avoided with better advanced planning.

How To Avoid Paying Capital Gains Tax On Inherited Property

There are ways to both protect the house from a long-term event and still receive the step-up in basis when the current owners pass away. This process involves setting up an irrevocable trust to own the house which then protects the house from a long-term event as long as it’s held in the trust for at least five years.

Now, we do have to get technical for a second. When an asset is owned by an irrevocable trust, it is technically removed from your estate. Most assets that are not included in your estate when you pass do not receive a step-up in basis; however, if the estate attorney that drafts the trust document puts the correct language within the trust, it allows you to protect the assets from a long-term event and receive a step-up in basis when the owners of the house pass away.

For this reason, it’s very important to work with an attorney that is experienced in handling trusts and estates, not a generalist. It only takes a few missing sentences from that document that can make the difference between getting that asset tax free or having a huge tax bill when you go to sell the house.

Establishing this trust can sometimes cost between $3,000 and $6,000. But by paying this amount upfront and doing the advance planning, you could save your heirs 10 times that amount by avoiding a big tax bill when they inherit the house.

Making The House Your Primary

In the case that the house is gifted to the children prior to the parents passing away and the house is not awarded the step-up in basis, there is an advance tax planning strategy if the conditions are right to avoid the big tax bill. If one of the children would be interested in making their parent’s house their primary residence for two years, then they are then eligible for either the $250,000 or $500,000 capital gains exclusion.

According to current tax law, if the house you live in has been your primary residence for two of the previous five years, when you go to sell the house you are allowed to exclude $250,000 worth of gain for single filers and $500,000 worth of gain for married filing joint. This advanced tax strategy is more easily executed when there is a single heir and can get a little more complex when there are multiple heirs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Emergency Fund Should You Have And How To Get There

If you watched the nightly news during the latest government shutdown you would have seen stories about how people struggle when they aren’t getting a paycheck. Most Americans are not immune to having a set back at a job and it is a scary feeling to not know when the next paycheck will come. The emergency fund is what will help you bridge the

How Much Emergency Fund Should You Have And How To Get There

If you watched the nightly news during the latest government shutdown you would have seen stories about how people struggle when they aren’t getting a paycheck. Most Americans are not immune to having a set back at a job and it is a scary feeling to not know when the next paycheck will come. The emergency fund is what will help you bridge the gap in these hard times. This article should help determine how much emergency fund you should have and strategies on how you can get there.

We make a point of this in every financial plan we put together because of its importance. A lot of people will say their job is secure so they don’t need to worry about having an emergency fund. This may be true, nevertheless the emergency fund is not only for the most extreme circumstances but any unexpected expense. Anyone can have an unforeseen cost of $1,000 to $5,000 and most people would have to pay for this expense on a credit card that will accrue interest and take time to payoff.

Another common thought is, “I have disability insurance, so I don’t need an emergency fund”. Most disability insurance will not start until a 90-day elimination period has been met. This means you will be out of a check for that period but still have all the expenses you normally would.

Current Savings In The United States

“Smartasset” came out with a study in November 2018 that stated; of those Americans with savings accounts, the average savings account balance was $33,766.49. This seems like an amount that would be enough for most people to have in a “rainy day fund”. But that is the average. Super Savers with very large balances will skew this calculation so we use the median which more accurately reflects the state of most Americans. The median balance is only approximately $5,200 per “Smartasset”.

With a median balance of only $5,200, it doesn’t take much misfortune for that to be spent down to $0. At $5,200, it is safe to assume that most Americans are living paycheck to paycheck.

If your income only meets your normal expenses, you need to ask yourself the question “where am I coming up with the money for an unexpected cost?”. For a lot of people, it is a credit card, another type of loan, or dipping into their retirement assets. By taking care of the immediate need, you shift the burden to another part of your financial wellbeing.

Emergency Fund Calculator

There is no exact dollar amount but a consensus in the planning industry is between 4-6 months of living expenses. This is usually enough to cover expenses while you are searching for the next paycheck or to have other assistance kick in.

It is important for everyone to put together a budget. How do you know what 4-6 months of living expenses is if you don’t know what you spend? Putting together a budget takes time but you need to know where your money is going in order to make the adjustments necessary to save. If you are in a position that you don’t see your savings account increasing, or at least remaining the same, you are likely just meeting expenses with your current income.

Resource: EXPENSE PLANNER to help you focus on your spending.

I Know My Number, How Do I get There?

Determining the amount is the easy part, now it is getting there. The less likely option would be going to your boss asking, “I need to replenish my emergency fund, can you increase my pay?”. Winning the lottery would also be nice but not something you can count on.Changing spending habits is an extremely difficult thing to do. Especially if you don’t know what you’re spending money on. Once you have an accurate budget, you should take a hard look at it and make cuts to some of the discretionary items on the list. It will likely take a combination of savings strategies that will get you to an appropriate emergency fund level. Below is a list of some ideas;

Skip a vacation one year

Put any potential tax refund in savings

Put a bonus check into savings

Increase the amount of your paycheck that goes to savings when you get a raise

Side work

Don’t upgrade a phone every time your due

Downgrade a vehicle or use the vehicle longer once paid off

Reward Yourself

There is no doubt some pain will be felt if you are trying to save more and it also takes time. Set a goal and stick to it but work in some rewards to yourself. If you are making good progress after say 3 months, splurge on something to keep your sanity but won’t impact the main objective.

Where To Keep Your Emergency Fund?

This account is meant to be liquid and accessible. So locking it up in some sort of long term investment that may have penalties for early withdrawal would not be ideal. We typically suggest using an institution you are familiar with and putting it in a savings account that can earn some interest.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Can I Open A Roth IRA For My Child?

Parents always want their children to succeed financially so they do everything they can to set them up for a good future. One of the options for parents is to set up a Roth IRA and we have a lot of parents that ask us if they are allowed to establish one on behalf of their son or daughter. You can, as long as they have earned income. This can be a

Parents will often ask us: “What type of account can I setup for my kids that will help them to get a head start financially in life"?”. One of the most powerful wealth building tools that you can setup for your children is a Roth IRA because all of accumulation between now and when they withdrawal it in retirement will be all tax free. If your child has $10,000 in their Roth IRA today, assuming they never make another deposit to the account, and it earns 8% per year, 40 years from now the account balance would be $217,000.

Contribution Limits

The maximum contribution that an individual under that age of 50 can make to a Roth IRA in 2022 is the LESSER of:

$6,000

100% of earned income

For most children between the age of 15 and 21, their Roth IRA contributions tend to be capped by the amount of their earned income. The most common sources of earned income for young adults within this age range are:

Part-time employment

Summer jobs

Paid internships

Wages from parent owned company

If they add up all of their W-2's at the end of the year and they total $3,000, the maximum contribution that you can make to their Roth IRA for that tax year is $3,000.

Roth IRA's for Minors

If you child is under the age of 18, you can still establish a Roth IRA for them. However, it will be considered a "custodial IRA". Since minors cannot enter into contracts, you as the parent serve as the custodian to their account. You will need to sign all of the forms to setup the account and select the investment allocation for the IRA. It's important to understand that even though you are listed as a custodian on the account, all contributions made to the account belong 100% to the child. Once the child turns age 18, they have full control over the account.

Age 18+

If the child is age 18 or older, they will be required to sign the forms to setup the Roth IRA and it's usually a good opportunity to introduce them to the investing world. We encourage our clients to bring their children to the meeting to establish the account so they can learn about investing, stocks, bonds, the benefits of compounded interest, and the stock market in general. It's a great learning experience.

Contribution Deadline & Tax Filing

The deadline to make a Roth IRA contribution is April 15th following the end of the calendar year. We often get the question: "Does my child need to file a tax return to make a Roth IRA contribution?" The answer is "no". If their taxable income is below the threshold that would otherwise require them to file a tax return, they are not required to file a tax return just because a Roth IRA was funded in their name.

Distribution Options

While many of parents establish Roth IRA’s for their children to give them a head start on saving for retirement, these accounts can be used to support other financial goals as well. Roth contributions are made with after tax dollars. The main benefit of having a Roth IRA is if withdrawals are made after the account has been established for 5 years and the IRA owner has obtained age 59½, there is no tax paid on the investment earnings distributed from the account.

If you distribute the investment earnings from a Roth IRA before reaching age 59½, the account owner has to pay income tax and a 10% early withdrawal penalty on the amount distributed. However, income taxes and penalties only apply to the “earnings” portion of the account. The contributions, since they were made with after tax dollar, can be withdrawal from the Roth IRA at any time without having to pay income taxes or penalties.

Example: I deposit $5,000 to my daughters Roth IRA and four years from now the account balance is $9,000. My daughter wants to buy a house but is having trouble coming up with the money for the down payment. She can withdrawal $5,000 out of her Roth IRA without having to pay taxes or penalties since that amount represents the after tax contributions that were made to the account. The $4,000 that represents the earnings portion of the account can remain in the account and continue to accumulate tax-free. Not only did I provide my daughter with a head start on her retirement savings but I was also able to help her with the purchase of her first house.

We have seen clients use this flexible withdrawal strategy to help their children pay for their wedding, pay for college, pay off student loans, and to purchase their first house.

Not Limited To Just Your Children

This wealth accumulate strategy is not limited to just your children. We have had grandparents fund Roth IRA's for their grandchildren and aunts fund Roth IRA's for their nephews. They do not have to be listed as a dependent on your tax return to establish a custodial IRA. If you are funded a Roth IRA for a minor or a college student that is not your child, you may have to obtain the total amount of wages on their W-2 form from their parents or the student because the contribution could be capped based on what they made for the year.

Business Owners

Sometime we see business owners put their kids on payroll for the sole purpose of providing them with enough income to make the $6,000 contribution to their Roth IRA. Also, the child is usually in a lower tax bracket than their parents, so the wages earned by the child are typically taxed at a lower tax rate. A special note with this strategy, you have to be able to justify the wages being paid to your kids if the IRS or DOL comes knocking at your door.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Moving Expenses Are No Longer Deductible

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and moving. Even things like how you are going to transport your car over to your new home, can take up a lot of your time, and on top of that, you have to think about how much it's going to cost. Prior to the tax law changes that took effect January 1, 2018, companies would often offer new employees a "relocation package" or "moving expense reimbursements" to help subsidize the cost of making the move. From a tax standpoint, it was great benefit because those reimbursements were not taxable to the employee. Unfortunately that tax benefit has disappeared in 2018 as a result of tax reform.

Taxable To The Employee

Starting in 2018, moving expense reimbursements paid to employee will now represent taxable income. Due to the change in the tax treatment, employees may need to negotiate a higher expense reimbursement rate knowing that any amount paid to them from the company will represent taxable income.

For example, let’s say you plan to move from New York to California and you estimate that your moving expense will be around $5,000. In 2017, your new employer would have had to pay you $5,000 to fully reimburse you for the moving expense. In 2018, assuming you are in the 35% tax bracket, that same employer would need to provide you with $6,750 to fully reimburse you for your moving expenses because you are going to have to pay income tax on the reimbursement amount.

Increased Expense To The Employer

For companies that attract new talent from all over the United States, this will be an added expense for them in 2018. Many companies limit full moving expense reimbursement to executives. Coincidentally, employees at the executive level are usually that highest paid. Higher pay equals higher tax brackets. If you total up the company's moving expense reimbursements paid to key employees in 2017 and then add another 40% to that number to compensate your employees for the tax hit, it could be a good size number.

Eliminated From Miscellaneous Deductions

As an employee, if your employer did not reimburse you for your moving expenses and you had to move at least 50 miles to obtain that position, prior to 2018, you were allowed to deduct those expenses when you filed your taxes and you were not required to itemize to capture the deduction. However, this expense will no longer be deductible even for employees that are not reimbursed by their employer for the move starting in 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented.

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented. While lower tax rates and more money in your paycheck sounds like a good thing, it may come back to bite you when you file your taxes.

The Tax Withholding Guessing Game

Knowing the correct amount to withhold for federal and state income taxes from your paycheck is a bit of a guessing game. Withhold too little throughout the year and when you file your taxes you have a tax bill waiting for you equal to the amount of the shortfall. Withhold too much and you will receive a big tax refund but that also means you gave the government an interest free loan for the year.

There are two items that tell your employer how much to withhold for federal income tax from your paycheck:

Income Tax Withholding Tables

Form W-4

The IRS provides your employer with the Income Tax Withholding Tables. On the other hand, you as the employee, complete the Form W-4 which tells your employer how much to withhold for taxes based on the “number of allowances” that you claim on the form.

What Is A W-4 Form?

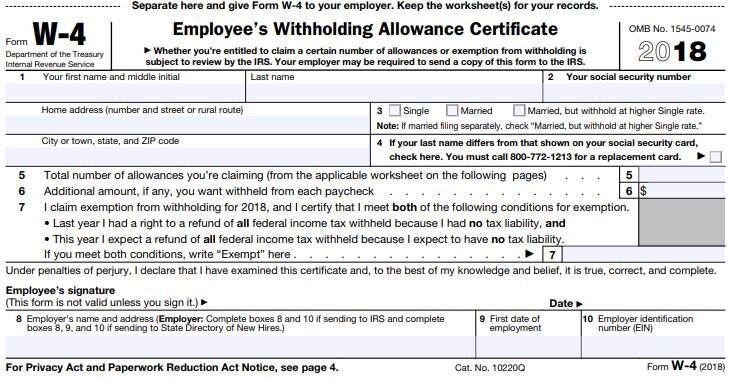

The W-4 form is one of the many forms that HR had you complete when you were first hired by the company. Here is what it looks like:

Section 3 of this form tells your employer which withholding table to use:

Single

Married

Married, but withhold at higher Single Rate

Section 5 tells your employer how many "allowances" you are claiming. Allowance is just another word for "dependents". The more allowances your claim, the lower the tax withholding in your paycheck because it assumes that you will have less "taxable income" because in the past you received a deduction for each dependent. This is where the main problem lies. Due to the changes in the tax laws, the tax deduction for personal exemptions was eliminated. This may adversely affect some taxpayers the were claiming a high number of allowances on their W-4 form because even though the number of their dependents did not change, their taxable income may be higher in 2018 because the deduction for personal exemptions no longer exists.

Even though everyone should review their Form W-4 form this year, employees that claimed allowances on their W-4 form are at the highest risk of either under withholding or over withholding taxes from their paychecks in 2018 due to the changes in the tax laws.

How Much Should I Withhold From My Paycheck For Taxes?

So how do you go about calculating that right amount to withhold from your paycheck for taxes to avoid an unfortunate tax surprise when you file your taxes for 2018? There are two methods:

Ask your accountant

Use the online IRS Withholding Calculator

The easiest and most accurate method is to ask your personal accountant when you meet with them to complete your 2017 tax return. Bring them your most recent pay stub and a blank Form W-4. Based on the changes in the tax laws, they can assist you in the proper completion of your W-4 Form based on your estimated tax liability for the year.If you complete your own taxes, I would highly recommend visiting the updated IRS Withholding Calculator. The IRS calculator will ask you a series of questions, such as:

How many dependents you plan to claim in 2018

Are you over the age of 65

The number of children that qualify for the dependent care credit

The number of children that will qualify for the new child tax credit

Estimated gross wages

How much fed income tax has already been withheld year to date

Payroll frequency

At the end of the process it will provide you with your personal results based on the data that you entered. It will provide you with guidance as to how to complete your Form W-4 including the number of allowances to claim and if applicable, the additional amount that you should instruct your employer to withhold from your paycheck for federal income taxes. Additional withholding requests are listed in Section 6 of the Form W-4.

Avoid Disaster

Having this conversation with your accountant and/or using the new IRS Withholding Calculator will help you to avoid a big tax disaster in 2018. Unfortunately, many employees may not learn about this until it's too late. Employees that are used to getting a tax refund may find out in the spring of next year that they owe thousands of dollars to the IRS because the combination of the new tax tables and the changes in the tax law that caused them to inadvertently under withhold federal income taxes throughout the year.

Action Item!!

Take action now. The longer you wait to run this calculation or to have this conversation with your accountant, the larger the adjustment may be to your paycheck. It's easier to make these adjustments now when you have nine months left in the year as opposed to waiting until November.I would strongly recommend that you share this article with your spouse, children in the work force, and co-workers to help them avoid this little known problem. The media will probably not catch wind of this issue until employees start filing their tax returns for 2018 and they find out that there is a tax bill waiting for them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.