Avoid Taking Auto Loans For More Than 5 Years – The Negative Equity Wave

There is a negative equity problem building within the U.S. auto industry. Negative equity is when you go to trade in your car for a new one but the outstanding balance on your car loan is GREATER than the value of your car. You have the option to either write a check for the remaining balance on the loan or “roll” the negative equity into your new car loan. More and more consumers are getting caught in this negative equity trap.

There is a negative equity problem building within the U.S. auto industry. Negative equity is when you go to trade in your car for a new one but the outstanding balance on your car loan is GREATER than the value of your car. You have the option to either write a check for the remaining balance on the loan or “roll” the negative equity into your new car loan. More and more consumers are getting caught in this negative equity trap. Below is a chart of the negative equity trend over the past 10 years.

In 2010, 22% of new car buyers with trade-ins had negative equity when they went to go purchase a new car. In 2020, that number doubled to 44% (source Edmunds.com). The dollar amount of the negative equity also grew from an average of $3,746 in 2010 to $5,571 in 2020.

Your Car Is A Depreciating Asset

The first factor that is contributing to this trend is the simple fact that a car is a depreciating asset, meaning, it decreases in value over time. Since most people take a loan to buy a car, if the value of your car drops at a faster pace than the loan amount, when you go to trade in your car, you may find out that your car has a trade-in value of $5,000 but you still owe the bank $8,000 for the outstanding balance on your car loan. In these cases, you either have to come out of pocket for the $3,000 to payoff the car loan or some borrowers can roll the $3,000 into their new car loan which right out of gates put them in the same situation over the life of the next car.

Compare this to a mortgage on a house. A house, historically, appreciates in value over time, so you are paying down the loan, while at the same time, your house is increasing in value a little each year. The gap between the value of the asset and what you owe on the loan is called “wealth”. You are building wealth in that asset over time versus the downward spiral horse race between the value of your car and the amount due on the loan.

How Long Should You Take A Car Loan For?

When I’m consulting with younger professionals, I often advise them to stick to a 5-year car loan and not be tempted into a 6 or 7 year loan. The longer you stretch out the payments, the more “affordable” your car payment will be, but you also increase the risk of ending up in a negative equity situation when you go to turn in your car for a new one. In my opinion, one of the greatest contributors to this negative equity issue is the rise in popularity of 6 and 7 year car loan. Can’t afford the car payment on the car you want over a 5 year loan, no worries, just stretch out the term to 6 or 7 years so you can afford the monthly payment.

Let’s say the car you want to buy costs $40,000 and the interest rate on the auto loan is 3%. Here is the monthly loan payment on a 5 year loan versus a 7 year loan:

5 Year Loan Monthly Payment: $718.75

7 Year Loan Monthly Payment: $528.53

A good size difference in the payment but what happens if you decide to trade in your car anytime within the next 7 years, it increases your chances of ending up in a negative equity situation when you go to trade in your car. Also, when comparing the total interest that you would pay on the 5-year loan versus the 7 year loan, the 7 year car loan costs you another $1,271 in interest.

But Cars Last Longer Now……

The primary objection I get to this is “well cars last longer now than they did 10 years ago so it justifies taking out a 6 or 7 year car loan versus the traditional 5 year loan.” My response? I agree, cars do last longer than what they used to 10 years ago BUT you are forgetting the following life events which can put you in a negative equity scenario:

Not everyone keeps their car for 7+ years. It’s not uncommon for car owners to get bored with the car they have and want another one 3 – 5 years later. Within the first 3 years of buying your car that is when you have the greatest negative equity because your car depreciates by a lot within those first few years, and the loan balance does not decrease by a proportionate amount because a larger portion of your payments are going toward interest at the onset of the loan.

Something breaks on the car, you are out of the warrantee period, and you worry that new problems are going to continue to surface, so you decide to buy a new car earlier than expected.

Change in the size of your family (more kids)

You move to a different climate. You need a car for snow or would prefer a convertible for down south

You move to a major city and no longer need a car

You get in an accident and total your car before the loan is paid off

The moral of the story is this, it’s difficult to determine what is going to happen next year, let alone what’s going to happen over the next 7 years, the longer the car loan, the greater the risk that a life event will take place that will put you in a negative equity position.

The Negative Equity Snowball

A common solution to the negative equity problem is just to roll the negative equity into your next car loan. If that negative equity keeps building up car, after car, after car, at some point you hit a wall, and the bank will no longer lend you the amount needed to buy the new car and absorb the negative equity amount within the new car loan.

Payoff Your Car Loan

Too many people think it’s normal to just always have a car loan, so they dismiss the benefit of taking a 5-year car loan, paying it off in 5 years, and then owning the car for another 2 to 3 years without a car payment, not only did you save a bunch of interest but now you have extra income to pay down debt, increase retirement savings, or build up your savings.

Short Term Pain for Long Term Gain

Rarely is the best financial decision, the easiest one to make. Taking a 5-year car loan instead of a 6-year loan will result in a higher monthly car payment which will eat into your take home pay, but you will thank yourself down the road when you go to trade in your current car and you have equity in your current car to use toward the next down payment as opposed to having to deal with headaches that negative equity brings to the table.

Post COVID Problem

Unfortunately, we could see this problem get worse over the next 7 years due to the rapid rise in the price of automobiles in the U.S. post COVID due to the supply shortages. When people trade in their cars they are getting a higher value for their trade in which is helping them to avoid a negative equity situation now but they are simultaneously purchasing a new car at an inflated price, which could cause more people to end up in a negative equity event when the price of cars normalizes, the car is worth far less than what they paid for it, and they still have a sizable outstanding loan against the vehicle.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What does negative equity mean when trading in a car?

Negative equity occurs when your car loan balance is higher than the car’s trade-in or market value. To complete the trade, you must either pay the difference out of pocket or roll the negative balance into your next car loan, which can make the new loan more expensive and prolong debt.

Why are more car buyers ending up with negative equity?

A key reason is that cars are depreciating assets—they lose value faster than the loan balance is repaid. The growing use of 6- and 7-year car loans also contributes to the problem, as longer repayment terms slow down how quickly equity builds in the vehicle.

How do long-term car loans increase the risk of negative equity?

While longer loan terms reduce monthly payments, they extend the repayment period and increase total interest costs. Because cars depreciate quickly in the first few years, borrowers often owe more than their car is worth if they trade it in before the loan is paid off.

Is it better to choose a 5-year car loan instead of a 6- or 7-year loan?

Yes, shorter loan terms help you build equity faster and reduce total interest paid over time. Although monthly payments are higher, a 5-year loan minimizes the risk of owing more than the car’s value if you sell or trade it in early.

What life events can cause negative equity even if cars last longer now?

Unexpected changes—such as job relocation, growing family needs, vehicle breakdowns, or accidents—often lead people to replace cars sooner than planned. These early trades typically occur when depreciation is steepest, making negative equity more likely.

What happens if you keep rolling negative equity into new car loans?

Rolling negative balances into new loans compounds the problem over time. Each new loan starts “underwater,” increasing total debt and eventually making it difficult to qualify for future car financing.

How can you avoid negative equity when buying a car?

Limit loan terms to five years or less, make a meaningful down payment, and hold the car long enough to pay it off before buying another one. Owning a paid-off car for several years frees up cash flow and helps avoid the debt cycle associated with long-term car loans.

How Much Should You Have In An Emergency Fund?

Establishing an emergency fund is an important step in achieving financial stability and growth. Not only does it help protect you when big expenses arise or when a spouse loses a job but it also helps keep your other financial goals on track.

Establishing an emergency fund is an important step in achieving financial stability and growth. Not only does it help protect you when big expenses arise or when a spouse loses a job but it also helps keep your other financial goals on track. When we educate clients on emergency funds, the follow questions typically arise:

How much should you have in an emergency fund?

Does the amount vary if you are retired versus still working?

Should your emergency fund be held in a savings account or invested?

When is your emergency fund too large?

How do you coordinate this with your other financial goals?

Emergency Fund Amount

In general, your emergency fund should typically be 4 to 6 months of your total monthly expenses. To calculate this, you will have to complete a monthly budget listing all of your expenses. Here is a link to an excel spreadsheet that we provide to our clients to assist them with this budgeting exercise: GFG Expense Planner.

Big unforeseen expenses come in all shapes and sizes but frequently include:

You or your spouse lose a job

Medical expenses

Unexpected tax bill

Household expenses (storm, flooding, roof, furnace, fire)

Major car expenses

Increase in childcare expenses

Family member has an emergency and needs financial support

Without a cash reserve, surprise financial events like these can set you back a year, 5 years, 10 years, or worse, force you into bankruptcy, require you to move, or to sell your house. Having the discipline to establish an emergency fund will help to insulate you and your family from these unfortunate events.

Cash Is King

We usually advise clients to keep their emergency fund in a savings account that is liquid and readily available. That will usually prompt the question: “But my savings account is earning minimal interest, isn’t it a waste to have that much sitting in cash earning nothing?” The purpose of the emergency fund it to be able write a check on the spot in the event of a financial emergency. If your emergency fund is invested in the stock market and the stock market drops by 20%, it may be an inopportune time to liquidate that investment, or your emergency fund amount may no longer be the adequate amount.

Even though that cash is just sitting in your savings account earning little to no interest, it prevents you from having to go into debt, take a 401(k) loan, or liquidate investments at an inopportune time to meet the unforeseen expense.

Cash Reserve When You Retire

I will receive the question from retirees: “Should your cash reserve be larger once you are retired because you are no longer receiving a paycheck?” In general, my answer is “no”, as long as you have your 4 months of living expenses in cash, that should be sufficient. I will explain why in the next section.

Your Cash Reserve Is Too Large

There is such a thing as having too much cash. Cash can provide financial security but beyond that, holding cash does not provide a lot of financial benefits. If 4 months of your living expenses is $20,000 and you are holding $100,000 in cash in your savings account, whether you are retired or not, that additional $80,000 in cash over and above your emergency fund amount could probably be working harder for you doing something else. There is a long list of options, but it could include:

Paying down debt (including the mortgage)

Making contributions to retirement accounts to lower your income tax liability

Roth conversions

College savings accounts for your kids or grandchildren\

Gifting strategies

Investing the money in an effort to hedge inflation and receive a higher long-term return

Emergency Fund & Other Financial Goals

It’s not uncommon for individuals and families to find it difficult to accumulate 4 months worth of savings when they have so many other bills. If you are living paycheck to paycheck right now and you have debt such as credit cards or student loans, you may first have to focus on a plan for paying down your debt to increase the amount of extra money you have left over to begin working toward your emergency fund goal. If you find yourself in this situation, a great book to read is “The Total Money Makeover” by Dave Ramsey.

The probability of achieving your various financial goals in life increases dramatically once you have an emergency fund in place. If you plan to retire at a certain age, pay for your children to go college, be mortgage and debt free, purchase a second house, whatever the goal may be, large unexpected expenses can either derail those financial goals completely, or set you back years from achieving them.

Remember, life is full of surprises and usually those surprises end up costing you money. Having that emergency fund in place allows you to handle those surprise expenses without causing stress or jeopardizing your financial future.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

How much should you have in an emergency fund?

Most financial experts recommend saving between four and six months’ worth of essential living expenses. To determine your target amount, create a monthly budget of housing, utilities, insurance, food, transportation, and other recurring costs, then multiply that total by the desired number of months.

Should your emergency fund be different if you’re retired?

Not necessarily. A reserve of about four months of living expenses is usually sufficient for retirees, provided that regular income sources such as pensions or Social Security are stable. Holding too much cash in retirement can limit growth opportunities and reduce purchasing power over time.

Where should you keep your emergency fund?

An emergency fund should be kept in a liquid, low-risk account such as a savings or money market account. While the interest rate may be modest, the priority is accessibility and protection from market fluctuations, ensuring the money is available when needed.

Can an emergency fund be too large?

Yes. Once your fund exceeds four to six months of expenses, the extra cash could be more productive elsewhere—such as paying down debt, contributing to retirement accounts, or investing for long-term goals. Cash beyond what you truly need for emergencies often loses value to inflation.

How can you build an emergency fund while managing debt or other goals?

If you’re living paycheck to paycheck or carrying high-interest debt, start small and automate savings to gradually build your fund. Paying off debt first can free up monthly cash flow, making it easier to reach your savings goal without sacrificing progress toward other financial priorities.

Why is an emergency fund important for long-term financial success?

An emergency fund protects you from having to use credit cards, take loans, or sell investments at a loss when unexpected expenses occur. It provides peace of mind and keeps your retirement, education, and other financial goals on track even during difficult times.

Kiddie Tax & Other Pitfalls When Gifting Assets To Your Kids

Before you gift assets to your children make sure you fully understand the Kiddie Tax rule and other pitfalls associated with making gift to your children……….

There are a number of reasons why parents gift assets to their kids which include:

Reduce tax liability

Protecting assets from the nursing home

Estate planning: Avoiding probate

But the pitfalls are many and most people do not find out about the pitfalls until it’s too late. These pitfalls include:

Kiddie tax rules

Children with self-directed investment accounts

Treatment of long-term capital gains

Gifting cost basis rules

College financial aid impact

Control of the assets

5 Year look-back rule

Divorce

Lawsuits

Distributions from Inherited IRA’s

Kiddie Tax

The strategy of shifting assets from a parent to a child on the surface seems like a clever tax strategy in an effort to shift investment income or capitals gains from the parent that may be in a high tax bracket to their child that is in a low tax backet. Unfortunately, the IRS is aware of this strategy, and they have been aware of it since 1986, which is the year the “Kiddie Tax” was signed into law.

Here is how the Kiddie tax works; if your child’s income is over a certain amount, then the income is taxed NOT at the child’s tax rate, but at the PARENT’S tax rate. Kiddie tax rules do NOT apply to earned income which includes wages, salary, tips, or income from self-employment. Kiddie tax ONLY applies to UNEARNED INCOME which includes:

Taxable interest

Dividends

Capital gains

Taxable Scholarships

Income produced by gifts from grandparents

Income produced by UTMA or UGMA accounts

IRA distributions

There are some exceptions to the rule but in general, your child would be subject to the Kiddie tax if they are:

Under the age of 19; or

Between the ages of 19 and 23, and a full-time student

The only exceptions that apply are if your child:

Has earned income totaling more than half the cost of their support; or

Your child files their tax return as married filing joint

Kiddie Tax Calculation

Here is how the Kiddie tax calculation works. For 2025, the first $1,350 of a child’s unearned income is tax-free, the next $1,350 is taxed at the child’s rate, and any unearned income above $2,700 is taxed at the parent’s marginal income tax rate.

Here is an example, the parents bought Apple stock a long time ago and the stock now has a $30,000 unrealized long term capital gain. Assuming the parents make $200,000 per year in income, if they sell the stock, they will have to pay the Federal 15% long term capital gains tax on the $30,000 gain. But they have a child that is age 16 with no income, so they gift the stock to them, have them sell it, with the hopes of the child capturing the 0% long term cap gains rate since they have no income. Kiddie tax is triggered!! The first $2,700 would be tax free but the rest would be taxed at the parent’s federal 15% long term cap gain rate; oh and if that family was expecting to receive college financial aid two years from now, they might have just made a grave mistake because now that teenager is showing income. A topic for later.

That was an example using long term capital gains rates but if we used a source of unearned income subject to ordinary income tax rates, the jump could go from an assumed 0% to the parents 37% tax rate if they are in the highest fed bracket.

Putting Your Kids on Payroll

While we are on the subject of Kiddie Tax, our clients that own small businesses will sometimes ask “Do I have to worry about the Kiddie tax if I put my kids on payroll through my company?” Fortunately the answer is “No”. Paying your child W2 wages through your company is considered “earned income” and earned income is not subject to the kiddie tax rules.

Children with Self-Directed Investment Accounts

It’s becoming more common for high school and college students to have their own brokerage accounts where they are trading stocks, ETFs, options, cryptocurrency, and mutual funds. But the kiddie rules can come into play when they are buying and selling investments in their accounts. If the parents claim the child as a dependent on their tax return and they buy and then sell an investment within a 12 month period, that would create a short term gain subject to ordinary income tax rates. If that gain is above $2,700, then the kiddie tax is triggered, and the gain would be taxed at the parent’s tax rate not the child’s tax rate. This can lead to tax surprises when the child receives the tax forms from the brokerage platform and then realizes there are big taxes due, and the child may or may not have the money to pay it.

For the child to file their own tax return to avoid this Kiddie tax situation, the child must be earning enough income to provide at least half of their financial support.

Kiddie Tax Form 8615

How do you report the Kiddie tax on your tax return? I spoke with a few CPA’s about this and they normally advise their clients that once the child has unearned income over $2,700, the child, even though they may be a dependent on your tax return, files their own tax return, and with their tax return they file Form 8615 which calculates the Kiddie Tax liability based on their parent’s tax rate.

Impact on College Financial Aid

Before gifting any assets to your child, income producing or not, if you are expecting to receive any form of need based financial aid for your child for college in the future, be very very careful. The FAFSA calculation weighs assets and income differently depending on whether it belongs to the parent or the child.

For assets, if the parent owns it, the balance counts 5.64% against the aid awarded. If the child owns it, the balance counts 20% against the aid awarded. You move a stock into your child’s name that is worth $30,000, if you would have qualified for financial aid, you just cost yourself $4,300 PER YEAR in financial aid.

Income is worse. If you gift your child an asset that produces income or capital gains, income of the parents counts 22% - 47% against college financial aid depending on the size of the household. If the income belongs to the child, it counts 50% against the FAFSA award. Another note, the FAFSA process looks back 2 years for purposes of determining the financial aid award, so even though they may only be a sophomore or junior in high school, you don’t find out about that mistake until 2 years later when they are applying for FAFSA as a freshman in college.

Long Term Capital Gains Treatment

The example that I used earlier with the Apple stock highlights another useful tax lesson. If you are selling a stock, mutual fund, or investment property that you have owned for more than a year, it’s taxed at the preferential long term capital gain rate of 15% as long as your taxable income does not exceed $533,400 for single filers or $600,050 for married filing joint in 2025, it’s a flat 15% tax rate whether it’s a $20,000 gain or a $200,000 gain because the rate does not increase like it does for “earned income”. I make this point because long term capital gain rates are already taxed at a relatively low rate, and if realized by your child, are subject to Kiddie tax so before you jump through all the hoops of making the gift, make sure the tax strategy is going to work.

Gift Cost Basis Rules

When you make a gift, it’s important to understand how the cost basis rules work. When you make a gift, there typically is not an immediate tax event, but the recipient inherits your cost basis in that asset. Gifting an asset does not provide the person making the gift with a tax deduction or erase the unrealized gains, unless of course you are gifting it to a charity or not-for-profit. Let’s keep running with that Apple stock example, you gift the Apple stock to your child with a $30,000 unrealized gain, there is no tax event when the gift is made, but if the child sells the stock the next day, they will have to pay tax on the $30,000 realized gain, and if the kiddie tax applies, it will be taxed at the parent’s tax rate.

Estate Tax Planning: Avoid Probate

Sometimes people will gift assets to their kids in an effort to remove those assets from their estate to avoid probate, a big tax issue surfaces with this strategy. Normally when someone passes away and their kids inherit a house or investments, they receive a “step-up in basis”. A step-up in basis means no matter what the gain was in the house or investment prior to a person passing away, the cost basis to the person that inherits the assets is now the fair market value of that asset as of decedent’s date of death.

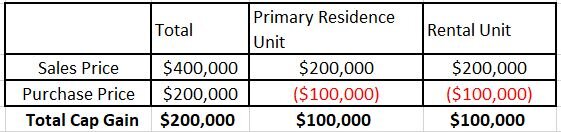

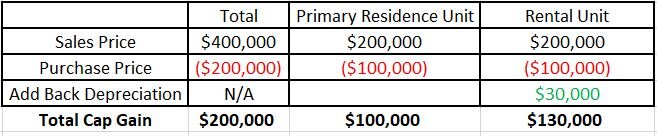

Example: You bought your house 20 years ago for $200,000 and it’s now worth $400,000. If you were to pass away tomorrow and your kids inherit your house, they receive a step-up in basis to $400,000 so if they sell the house the next day, they have no tax liability. A huge tax benefit.

But if you gift the house to your kids while you are still alive in an effort to avoid the probate process, your kids now lose the step-up in cost basis because the house never passes through your estate. If you kids sell your house the next day, they will realize a $200,000 gain and have to pay tax on it which at the Federal level of 15%, could cost them $30,000 in taxes which could have been avoided.

There are other ways to avoid probate besides gifting that asset to your kids which allows the asset to avoid the probate process and receive a step up in basis. You could setup a trust to own the asset or change the registration on the account to a “transfer on death” account.

Distributions From An IRA Owned By The Child

If your child inherits an IRA, they may be required to take RMD’s (required minimum distributions) each year from the IRA. Distribution are not only subject to ordinary income tax but they are also subject to Kiddie tax since IRA distributions are considered unearned income. If you child inherits a pre-tax IRA or 401(k) be very careful when taking distribution from the account, especially taking into consideration the new distribution rules for non-spouse beneficiaries.

Control of the Asset

As financial planners, we have seen a lot of crazy things happen. While some teenagers are very responsible, others are not. When you gift an asset directly to child, they may not use that gift as intended. Even with UTMA and UGMA account, the parents only have control until the child reaches age of majority, and then account belongs to them. If there is any concern about how the gifted asset will be managed or distributed, you may want to consider a trust or another type of account that provides the you with more control of the asset.

Lawsuits

From a liability standpoint, if you gift assets to your child, and those assets have a meaningful amount of value, those assets could be exposed to a lawsuit if your child were to ever be sued.

Divorce

If you gift assets to your child and they are already married or get married in the future, depending on what state they live in or how those assets are titled, they could be considered marital property. If a divorce happens at some point in the future, their soon to be ex-spouse could now be entitled to a portion of those gifted assets.

5 Year Lookback Rule

Some parents will gift assets to their children to avoid the spend down process should a long term care event happen at some point in the future and they need to go into a nursing home. Different states have different Medicaid rules but in New York, the gift has to take place 5 years prior to the Medicaid application otherwise the assets are subject to spend down.

The other pitfall of gifting assets to your children is that while you may be able to successfully protect those assets from a Medicaid lookback period, the cost basis issue that we discussed earlier still exists. If you gift the house to your kids, they inherit your cost basis, so when they go to sell the house after you pass, they have to pay tax on the full gain amount, versus if you established a grantor irrevocable trust to own your house, it could satisfy the gift for the 5 year look back period in NY, but then your kids receive a step up in basis when you pass away since the house passes through your estate, and they can sell the house with no tax liability.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are common reasons parents gift assets to their children?

Parents often gift assets to reduce future tax liabilities, protect assets from potential nursing home costs, or simplify estate transfers by avoiding probate. While these goals can be achieved, gifting assets can also create unintended tax and legal consequences if not properly structured.

What is the Kiddie Tax and when does it apply?

The Kiddie Tax applies to a child’s unearned income—such as dividends, interest, or capital gains—above $2,700 (in 2025). Any income over that amount is taxed at the parents’ marginal tax rate instead of the child’s lower rate. It generally applies to dependents under age 19, or under 24 if they are full-time students.

How does gifting affect college financial aid?

Assets and income in a child’s name significantly reduce eligibility for need-based aid. Parental assets count about 5.6% against aid eligibility, while a child’s assets count 20%. Additionally, a child’s income can count as high as 50% against financial aid calculations for two years following the income year.

What are the tax implications of gifting appreciated assets?

When you gift an asset like stock or real estate, your cost basis carries over to the recipient. If the recipient sells the asset, they owe tax on the gain from your original purchase price. This means gifting appreciated assets can shift, but not eliminate, future tax liability.

How does gifting differ from inheritance when it comes to taxes?

Inherited assets generally receive a “step-up in basis” to their fair market value on the date of the decedent’s death, eliminating unrealized capital gains. Gifting assets during your lifetime forfeits this step-up, potentially leaving your heirs with larger future tax bills if they sell the asset.

Can gifting affect Medicaid eligibility or nursing home planning?

Yes. Medicaid’s five-year lookback rule allows the state to review gifts made within five years before a long-term care application. Assets transferred during that period may still be counted toward Medicaid eligibility, delaying benefits and forcing asset spend-down.

What are the risks of gifting assets directly to children?

Once assets are gifted, they legally belong to the child. This means they could be lost in a lawsuit, subject to division in a divorce, or spent irresponsibly. Parents concerned about control or protection may prefer using trusts or transfer-on-death designations instead of outright gifts.

Should You Pay Down Debt or Invest Idle Cash?

When you have a large cash reserve, should you take that opportunity to pay down debt or should you invest it? The answer is “it depends”.

It depends on: ….

When you have a large cash reserve, should you take that opportunity to pay down debt or should you invest it? The answer is “it depends”. It depends on:

What is the interest rate on your debt?

What is the funding level of your emergency fund?

Do you have any big one-time expenses planned within the next 12 months?

What is the status of your financial goals? (college savings, retirement, house purchase)

How close are you to retirement?

What type of economic environment are you in?

Understanding the debt secret of the super wealthy

All too often, we see people make the mistake of investing money that they should be using to pay down debt, and this statement is coming from an investment advisor. In this article, I am going to walk you through the conversation that we have with our clients when trying to determine the best use of their idle cash.

What Is The Interest Rate On Your Debt?

Our first question is typically, what is the current interest rate on your debt? As you would expect, the higher the interest rate, the higher the payoff priority. As financial planners, we look at the interest rate on debt as a risk-free rate of return, similar to a return that you might receive on a bank CD or a money market account. If you have a credit card with a balance of $10,000 and the interest rate is 15%, you are paying that credit card company $1,500 in interest each year. If you use your $10,000 in idle cash to payoff you credit card balance, you get to keep that $1,500. We considered it a “risk-free” rate of return because you don’t have to take any risk to obtain it. By paying off the balance, you are guaranteed to not have to pay the credit card company that $1,500 in interest.

If instead you decided to invest that money, you would have to invest in something that earns over a 15% annual rate of return to be ahead of the game. To obtain a 15% rate of return is most likely going to involve taking a high level of risk, meaning you could lose some or all of your $10,000 investment so it’s not an apple to apple comparison because the risk level is different. I will bluntly ask clients: “can you get a bank CD right now that pays you 15%?” When they say “no way”, then I repeat the guidance to pay down the debt because every dollar that you pay toward the debt is receiving a 15% rate of return which you are not paying to the credit card company.

A Tough Decision

A 15% interest rate on debt makes the decision pretty easy but what happens when we are talking about a mortgage that carries a 3% interest rate. Clearly a more difficult decision. Someone who is 40 years old, that has 25 years until retirement might ask, “why would I use my cash to pay down the mortgage with a 3% interest rate when I could be earning 8% per year plus in the stock market over the next 25 years?” The answer can be found in the rest of the variables below.

Emergency Fund

When unexpected events happen in life, it is common for those unexpected events to cost money, which is why we encourage our clients to maintain an emergency fund. Maintaining an adequate cash reserve prevents these unexpected financial events from disrupting your plans for retirement, paying for college, from having to liquidate investments at an inopportune time in the market, or worse to go into debt to pay those expenses. While it is painful to see cash sitting there in a savings account earning minimal interest, it serves the purpose of insulting your overall financial plan from setbacks cause by unplanned events which in turn increases your probability of achieving your financial goals over the long term.

What is the right level of cash to fund an emergency fund? In most cases, we recommend 4 to 5 months of your living expenses. There is a balance between having adequate cash reserves and holding too much cash. There is an opportunity cost associated with holding too much cash. By holding cash earning less than 1% in interest, you may be giving up the opportunity to earn a higher return on that cash, whether that involves investing it or paying down debt with it.

Here is a common scenario, let’s say someone has $50,000 in cash in their savings account, and 4 months of living expenses is $30,000, that means there is $20,000 in excess cash that could be potentially earning a higher return than it sitting in their bank account. If they are willing to accept some risk, they may be willing to invest that $20,000 in an attempt to generate a higher return on that idle cash, or the cash may be used to fund a college savings account or retirement account which could carry tax benefits as well as advancing one or more of their personal financial goals.

But what if you don’t want to take any risk with that additional $20,000? If you have a mortgage with a 3% interest rate, by applying that $20,000 toward the mortgage, it is technically earning 3% because you are not paying that 3% interest to the bank. Since the interest rate on the mortgage is probably higher than the interest rate you are receiving in your savings account, that cash is working harder for you, and you have the added benefit of paying off your mortgage sooner.

Big One-Time Expenses

Once we have determined the appropriate funding level of a client’s emergency fund and there is excess cash over and above that amount, our next question is “do you have any larger one-time expenses that you foresee over the next 12 months?” For example, you may be planning a kitchen renovation, purchase of a house, or tuition payments for a child. If you will need that excess cash to meet expenses within the next 12 months, you may want to just hold onto the cash. If you use the cash to pay down debt, you won’t have the cash to meet those anticipated expenses in the future, or if you invest the cash, and the value of the investment drops, you may not have time to wait for the investment to recover the lost value before you need to liquidate the investment.

Typically, when we talk about investing, whether it’s in stocks, bonds, mutual funds, or some other type of security, it involves taking more risk than just sitting in cash. The shorter the timeline on the one-time expense, the more risk you take on by investing the cash. Historically, riskier asset classes like stocks behave in more consistent patterns over 10+ year time periods, but it’s impossible to predict how a specific stock or even a bond mutual fund will perform over a specific 3 month period.

Now, if interest rates ever get higher again, and you can find a 6 month or 1 year CD, or money market that pays a decent interest rate, then you may consider allocating some of that short term excess to work in a guaranteed security. Be careful of products liked fixed annuities, even through they may carry an attractive guaranteed interest rate, many annuities have surrender fees if you cash in the annuity prior to a specified number of years.

Status Of Your Various Financial Goals

Our next series of question revolves around assessing the status of a client’s various financial goals:

When do you plan to retire? Are your retirement savings adequate?

Do you have children that will be attending college? Have you started college savings accounts?

You just bought a house. Do you have an adequate amount of term life insurance?

Do you expect to be in a higher tax bracket this year? We may need to find ways to reduce your taxes.

Do you have estate documents in place like wills, health proxies, and a power of attorney?

What are your various financial goals over the next 10 years?

If we find that there is a shortfall in one of these areas, we may advise clients to use their excess cash to shore up a weakness in their overall financial picture. For example, if we meet with a client that has 3 children, ages 8, 5, and 3, and we ask them if they plan to help their children to pay for college, and they say “yes” but they have not yet determined how much financial aid they may receive, how much college is going to cost, and the best type of account to save money in to meet that goal, we will probably run projections for them, discuss how 529 accounts work, and potentially allocate some of their excess cash to fund those accounts.

How Close Are You To Retirement?

One factor that normally weighs heavily on our guidance as to whether someone should use excess cash to pay down debt or invest it is how close they are to retirement. Regardless of the market environment that we are in, we typically encourage our clients to reduce their fixed expenses as much as possible leading up to retirement. But when the stock market is going up by 10%+ and someone has $50,000 left on a mortgage with a 3% interest rate, they will ask me, why would I use my excess cash to pay down debt with a 3% interest rate when I’m earning a lot more keeping it invested in the market?

My response. I have been doing retirement projections for a very long time and when we do these projections, we are making assumptions about:

Annual rates of return on your investments

Inflation rates

Tax rates in the future

The fate of a broken social security system

How long you are going to live?

Probability of a long-term care event

These assumptions are estimated guesses based on historical data but who’s to say they are going to be right. In retirement you don’t have control over the stock market, inflation, or unexpected health events. The only thing you have full control over in retirement is how much you spend. The lower your annual expenses are, the more flexibility you will have within your plan, should one or more of the assumptions in your plan fall short of expectations. There will always be recessions but recessions are a lot more scary when you are retired and drawing money out of your retirement account, while at the same time your accounts may be losing value due to a drop in the stock or bond market. If you have lower expenses, it may allow you to reduce the distributions from your retirement accounts while you are waiting for the market to recover, which could greatly reduce the risk of running out of assets in retirement.

Type of Market Environment

While no one has a crystal ball, there are definitely market environments that we as investment advisors view as more risky than others. When economic data is providing us with mixed signals, there are geopolitical events unfolding that we have no way of predicting the outcome, or we are navigating through a challenging economic environment, it increases the risk level of investing excess cash in an effort to generate a return greater than the interest rate that someone may be paying on an outstanding debt. We definitely take that into account when advising clients whether to invest their cash or to use it to pay down debt.

The Debt Secret of The Super Wealthy

I have recognized a trend as it pertains to high net worth individual and how they invest, which is a concept that can be applied at any level of wealth. Having less debt, can provide individuals with the opportunity to take greater risk, which in turn can lead to a faster and greater accumulation of wealth.

If someone has no debt and they have $90,000 in cash to invest, because they have no debt, they may not need any of that cash to meet their future expense. Assuming they have a high tolerance for risk, they may choose to invest in 3 start-up companies, $30,000 each. Since investing in start-ups is known to be very risky, all three companies could go bankrupt. If 2 companies go bust, but the third company gets acquired by a public company that results in a 10x return on the investment, that $30,000 initial investment grows to $300,000, which subsidizes the losses from the other 2 companies, and still generates a giant return for the investor.

Someone with debt and corresponding higher fixed expenses to service the debt, may find it difficult and even unwise to enter into a similar investment strategy, because if they lose all or a portion of their $90,000 initial investment, it could upend their entire financial picture.

Just an additional note, investors that are successful with these higher risk strategies do not blindly throw money around at high risk investments. They do their homework but having no debt provides them with the opportunity to adopt investment strategies that may be out of reach of the average investor.

In summary, there are situation where it will make sense to invest idle cash in lieu if paying down debt but there are also situations that may not be as obvious, where it makes to pay down debt instead of investing the idle cash. Before just playing the interest rate game, it’s important to weigh all of these factors before making the decision as to the best use of your idle cash.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Should you pay down debt or invest excess cash?

The right choice depends on several factors, including your debt’s interest rate, the strength of your emergency fund, upcoming expenses, financial goals, time until retirement, and the current economic environment. In general, paying down high-interest debt (like credit cards) offers a risk-free return, while investing may make more sense when debt rates are low.

How does the interest rate on your debt affect this decision?

The higher the interest rate, the greater the benefit of paying it off. Eliminating a 15% credit card balance provides a guaranteed 15% “return” by saving that interest cost. With lower-rate debt (like a 3% mortgage), the decision becomes more nuanced and depends on your investment time horizon and risk tolerance.

Should you still keep an emergency fund before paying off debt?

Yes. Always maintain at least 4–5 months of essential living expenses in cash. Without a safety net, unexpected costs could force you back into debt or require you to sell investments at the wrong time.

What if you have large expenses coming up within a year?

If you’ll need cash within the next 12 months—for example, a remodel, tuition payment, or down payment—it’s often best to keep that money liquid rather than investing or using it to pay down debt. Short-term investments can fluctuate, and repaying debt may leave you cash-poor when expenses arrive.

How do your financial goals influence whether to invest or pay off debt?

If you’re behind on retirement savings, college funding, or insurance protection, using cash to shore up these goals may provide a better long-term payoff. Financial planning should focus on your broader goals, not just short-term returns.

Does proximity to retirement change the recommendation?

Yes. As retirement approaches, reducing fixed expenses—such as debt payments—can lower financial stress and improve flexibility. With less income predictability in retirement, a smaller expense base helps protect against market downturns or rising costs.

How does the economic environment impact this decision?

When markets are volatile or economic data is uncertain, using cash to pay down debt provides a guaranteed benefit with no risk. In strong, stable markets, investing excess cash may offer better long-term growth potential.

What is the “debt secret” of the super wealthy?

Many wealthy investors minimize personal debt, freeing up cash flow and reducing financial pressure. Having little to no debt may allow these individuals to invest in more risky investments with the goal of achieving higher returns, without jeopardizing their financial security.

How Much Does Your Car Insurance Increase When You Add A Teenager To Your Policy?

How much will the cost of your car insurance increase once you add a teenager to your policy. Here are a few strategies for reducing the cost……

You have probably heard the phrase “kids are expensive“. That phrase takes on a whole new meaning when you find out how much your car insurance is going to increase when you add your teenage child to your policy. In this article I’m going to share with you:

How much you can expect your car insurance premiums to increase when a teenager is added

What does the insurance company look at when determining the premium?

Are car insurance premiums higher for males or females?

Ways to reduce the cost

How much does the cost go up if they get into a car accident?

When your child turns 18, should you move them to their own policy?

Coverage mistakes

Ruger Personal Note: I have an 18 year old daughter that we added to our auto policy about a year ago. The two main things that I have learned so far are:

The cost increase was higher than I expected

New drivers hit stuff with their cars

By the time my oldest daughter was 18, she had already hit a deer, a post, and my car which was parked in our driveway. Yea, that last one was a rough day because I had to fix both cars. I’m writing this article because there are strategies that you can implement to reduce the cost of the insurance for your children and it’s also important to understand the liability that you take on by having a new driver on your policy.

How Much Does Your Car Insurance Increase?

The million dollar question: How much is your car insurance premium going to increase once you add your child to the policy?

Like so many other things in life, there is not a 100% straight answer because it depends on a number of variables such as:

Credit Score of the parents

Driving record of the parents

Will they have their own car or sharing a car with their parents?

What type of car will they be driving?

What state do you live in?

Coverage limits of the policy

The Insurance company issuing the policy

But let me give you a base case scenario to work with before we get into discussing all of the variables that factor into the premium calculation. In this example we have:

A 16 year old driver that is being added to their parent’s auto policy

Parents have a good credit score

Parents both have good driving records

Your child will have their own 2016 Honda Civic to drive

The annual INCREASE in your auto insurance premium may be between $1,000 - $1,500. This is more of a best case scenario. If the parents have poor credit scores or poor driving records, the premium could increase by $3,000+ per year in some cases. To get a better idea of where you might fall within this wide spectrum, let’s look at the variables that influence the cost of auto insurance when a new driver is added.

Credit Score of the Parent

I was surprised to learn that the credit score of the parents is one of the largest factors that many insurance companies use to determine the amount of the premium increase. They have apparently identified a trend that parents that are financially responsible tend to have children that are less likely to get in car accidents. Even though this will not be true for all families, insurance companies have accumulated a lot of data over a long period to reach these conclusions.

This brings us to our first strategy for reducing the cost of the car insurance for your children. If the parents are able to improve their credit score before adding the child to their auto policy, it could reduce the premium increase. There are many ways to do accomplish this but it is beyond the scope of this article. However, here is a good article from Nerd Wallet that can help.

The Parents Driving Record

This one is pretty self-explanatory. If the parents have a lot of marks on their driving records such as multiple accidents or speeding tickets, it could make the premium increase higher when you go to add your child to the policy. Again, the insurance company must have made a connection between the driving behavior of the parents and the driving behavior of their children.

Are car insurance premiums higher for males or females?

The answer to this one is “it depends on what insurance company you go with”. Some insurance companies do charge more depending on whether you are adding a son or a daughter to your policy, others do not. How do you know which insurance companies are gender bias? You can either ask the insurance company directly if it influences the premium or you engage the services of an independent insurance agency that knows the underwriting criteria of each insurance company.

Will The New Driver Have Their Own Car?

Another big factor in the insurance cost will be what vehicle your teenager will be driving. If you are adding a new driver to your policy and adding an additional car to your policy as well, the premium increase will obviously be larger than if you are just adding a new driver who will be driving the current cars listed on your policy. In the Honda Civic example above, adding the car and the new driver increased the annual premium by $1,000 - $1,500. If you are adding the new driver to your current policy but they will be co-driving a car with you, the premium may only increase a few hundred dollars but it depends on the value of the cars that you drive.

A Driver Assigned To Each Car

I asked about a work around here. Let’s say there are 2 parents and 1 child. If you add a third car to your policy for the new driver, most insurance carriers do not allow you to say that two of the cars belong to Parent A, the third car to Parent B, and the child shares each of the three cars. If there are 3 cars and 3 drivers covered by the policy, the insurance company typically wants to assign a “primary driver” to each vehicle listed on the policy.

NOTE: Be careful when you add new drivers to your policy. Make sure you provide them with clear direction as to who the primary driver is for each vehicle. If you buy your child a car and you drive a more expensive car than your child, you don’t want the insurance company assigning your child as the primary driver to your car which could result in a larger increase in the annual premium. It’s worth taking the time to review your auto policy after any changes have been made.

Not telling the insurance company about the new driver

Unfortunately, some families may decide not to tell their insurance company about the new driver in the family. Not a good idea. This opens you up to a whole host of liability issues. While car insurance does “follow the car”, meaning whoever is driving your car will most likely be covered in some fashion by your auto policy, however, if there is a claim and the insurance company finds out that you intentionally did not add the new driver to your policy, they may pay the claim, but they may also drop your coverage after that.

Ways To Reduce The Cost

There are a number of ways that you may be able to reduce the cost of the insurance for your teenager:

Defensive Driving Course

Good Student Discount

Student Away from Home Discount

Removing collision coverage on an older car

Notice I did not mention anything about Drivers Education. I was surprised to find out that in New York, more insurance carriers no longer offer a discount for the child completing a Drivers Ed course. Some carriers offer the “Good Student Discount” which provides a small discount for students that maintain over a certain GPA. The “Student Away From Home” discount is for children that go away to college, they are not allowed to bring their cars, but they will be driving when they come home for breaks. With this discount, the insurance company is recognizing that they will be driving less in that situation. Having your child complete a defensive driving course can decrease the premium and many of these courses are now available online.

Removing collision coverage on an older car can also reduce the cost of the coverage. If your child is driving a car that is worth $5,000 and you feel like you are in a position financially to replace that car if you needed to, then you may elect to waive collision coverage on the car which can lower the premium. For vehicles of higher value, this is a larger risk, and if there is a car loan against the car, most lenders will require you to maintain collision coverage until the loan is paid off.

Moving Your Child To Their Own Car Insurance Policy

One of the questions I asked the insurance agent was:

“When does it make sense for the child to obtain their own car insurance policy as opposed to being covered under their parent’s policy?”

The general rule of thumb is if your children are still living at home, in many cases it will make sense, from a cost standpoint, to keep them covered under your policy. If you want your child to be responsible for the car insurance payment, you can just charge them for their share of the coverage.

One of the largest discounts that most insurance carriers offer is a “multi vehicle discount” while could reduce the annual cost of the car insurance by around 25% for some carriers. So, let’s say that the Honda Civic for your child costs $1,000 per year under your policy, if your child goes and obtains their own insurance policy, they will lose the multi car discount that you are receiving under your policy, and it could increase their cost by 25%.

Also, remember that I mentioned before that the parents credit score can be a big factor in determining the amount of the auto premium for their child’s coverage. Most young adults have little to no credit history so if they go to obtain their own insurance policy, it could increase the cost. Previously, they may have been benefiting from their parent’s strong credit scores and driving history which leads me to my next planning tip. At some point, your child will leave home, and they will obtain their own car insurance policy. As a parent, you can help them but encourage them to begin establishing some credit history early on so when they go to obtain their first car insurance policy, they have a good credit score, and it could reduce that annual expense.

How Much Does The Cost Increase If They Get Into A Car Accident?

I’ll go back to my original point that “new drivers hit stuff”. There is a high likelihood that the new driver in your family is going to hit a mailbox, a garbage can backing out of the driveway, another car, or one of their friends could hit their car in a high school parking lot. When these life events happen, the question becomes, how much are your car insurance premiums going to increase? Does $1,000 go to $3,000 per year? The answer unfortunately is it depends on what happened. The size of the insurance claim can influence the amount of the premium increase.

With any damage to a vehicle, you have three options:

Don’t fix it

Pay to fix it out of pocket

Submit an insurance claim and fix it

The first question to answer in this analysis is “what is your deductible?” It’s common for car insurance policies to have deductibles which means when you submit a claim, you must pay a certain amount out of pocket before the insurance company picks up the rest; a $500 deductible is common. So, if your child hits something, does some minor damage, and the total cost to fix it is $600, if your deductible is already $500, submitting an insurance claim will only pay $100, and you run the risk of your annual insurance premiums increasing. It may be better to just pay the $600 out of pocket instead of submitting the insurance claim.

If there is more significant damage like $3,000+, it may make sense to just submit the claim, pay the deductible, and let the insurance company pay for the rest. My friend that is in the insurance industry will remind people, “This is why you have insurance….use it.”

It’s a more difficult decision when the dollar amount of the fix is somewhere in the middle of these examples. If the car has $1,000 of damage but you have a $500 deductible, what should you do? This is where having an independent insurance broker can help. You can call your broker, explain the situation, and they may be able to provide you with an estimate of how much your insurance premium will increase each year if you submit the claim, then you can make an informed decision based on that information.

Know Your Coverage

All car insurance policies are not the same!! While, of course, everyone wants their car insurance premium as low as possible, do not make the mistake of just blindly running to the lowest cost option. Lower cost can mean lower coverage. The day that your child gets into a car accident is going to be a very bad day. That day will get even worse if your child hits a $75,000 Tesla and you find out that your auto policy only covers $25,000 of property damage so you are on the hook for the other $50,000!!! Make sure you are not being sold a watered-down car insurance policy that will open you up to gaps in coverage. You may have saved $400 per year on the insurance premium but when an accident happens, you could be out of pocket $10,000+.

Two more points to make about knowing your coverage:

No one ever gets up in the morning and says “I’m going to get into a car accident today”

New drivers hit stuff

Thank You to HMS Agency

I want to send out a special thank you to Steve Mather, a partner at HMS Agency, for helping me collect the information that I needed to write this article. As a financial planner, I enjoy helping people to save money, but I know very little about the inner workings of car insurance which is why I rely on experts like Steve and his team.

This information is for educational purposes only. For information specific to your insurance needs, please contact a licensed insurance agent.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

How much does car insurance typically increase when adding a teenage driver to a parent’s policy?

For many families, adding a teenage driver increases the annual premium by $1,000–$1,500 if the parents have good credit and clean driving records. However, if the parents have poor credit or driving histories, the cost can exceed $3,000 per year.

Why does a parent’s credit score affect the cost of adding a teen to their car insurance?

Insurance companies use credit-based insurance scores to predict claim risk. Parents with higher credit scores are statistically viewed as more financially responsible, and their children are assumed to pose a lower risk, which can reduce the premium increase.

Does it cost more to insure a male teenager than a female?

That depends on the insurance company. Some insurers charge higher rates for males due to statistical differences in accident frequency, while others do not factor gender into premium calculations at all.

Is it cheaper if my teen shares a car instead of having their own?

Yes, premiums are typically lower when a new driver shares a family vehicle rather than having a separate car assigned to them. Adding both a teen and a new vehicle can significantly increase costs compared to simply adding an additional driver.

What should parents consider before deciding to file a claim after their teen causes minor damage?

If repair costs are close to the deductible amount, it may be better to pay out of pocket rather than filing a claim that could raise future premiums. For larger repairs, submitting a claim makes more sense, but it’s wise to consult your insurance agent to estimate how much premiums might increase afterward.

When should a young adult move to their own car insurance policy?

Generally, it’s more cost-effective to keep children on their parents’ policy while they still live at home, as they benefit from multi-vehicle discounts and the parents’ stronger credit and driving records. Once they move out or own their own vehicle, transitioning to an individual policy may make more sense.

How can families lower the cost of insuring a teenage driver?

Common strategies include taking a defensive driving course, maintaining a high GPA for a “Good Student Discount,” or applying for a “Student Away from Home” discount. Parents may also consider removing collision coverage on older vehicles to reduce overall costs.

College Savings Account Options

To make it easy to compare and contrast each option, I will have a grading table at the beginning of each section that will provide you with some general information on each type of account, as well as my overall grade on the effectiveness of each college saving option.

529 Plans

I’ll start with my favorite which are 529 College Savings Plan accounts. As a Financial Planner, I tend to favor 529 accounts as primary college savings vehicles due to the tax advantages associated with them. Many states offer state income tax deductions for contributions up to specific dollar amounts, so there is an immediate tax benefit. For example, New York provides a state tax deduction for up to $5,000 for single filers, and $10,000 for joint filers for contributions to NYS 529 accounts year. There is no income limitation for contributing to these accounts.

NOTE: Every now and then I come across individuals that have 529 accounts outside of their home state and they could be missing out on state tax deductions.

However, the bigger tax benefit is that fact that all of the investment returns generated by these accounts can be withdrawn tax free, as long as they are used for a qualified college expense. For example, if you deposit $5K into a 529 account when your child is 2 years old, and it grows to $15,000 by the time they go to college, and you use the account to pay qualified expenses, you do not pay tax on any of the $15,000 that is withdrawn. That is huge!! With many of the other college savings options like UTMA or brokerage accounts, you have to pay tax on the gains.

There is also a control advantage, in that the parent, grandparent, or whoever establishes the accounts has full control as to when and how much is distributed from the account. This is unlike UTMA / UGMA accounts, where once the child reaches a certain age, the child can do whatever they want with the account without the account owner’s consent.

A 529 account does count against the financial aid calculation, but it is a minimal impact in most cases. Since these accounts are typically owned by the parents, in the FAFSA formula, 5.6% of the balance would count against the financial aid reward. So, if you have a $50,000 balance in a 529 account, it would only set you back $2,800 per year in financial aid.

I gave these account an “A” for an accumulation rating because they have a lot of investment option available, and account owners can be as aggressive or conservative as they would like with these accounts. Many states also offer “age based portfolios” where the account is allocated based on the age of the child, and when the will turn 18. These portfolios automatically become more conservative as they get closer to the college start date.

The contributions limits to these accounts are also very high. Lifetime contributions can total $400,000 or more (depending on your state) per beneficiary.

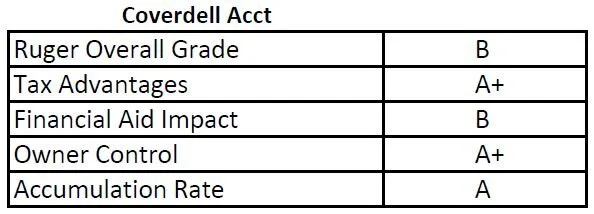

Coverdell Accounts (Education Savings Accounts)

Coverdell accounts have some of the benefits associated with 529 accounts, but there are contribution and income restrictions associated with these types of accounts. First, as of 2025, only taxpayers with adjusted gross income below $110,000 for single filers and $220,000 for joint filers are eligible to contribute to Coverdell accounts.

The other main limiting factor is the contribution limits. You are limited to a $2,000 maximum contribution each year until the beneficiary’s 18th birthday. Given the rising cost of college, it is difficult to accumulate enough in these accounts to reach the college savings goals for many families. Similar to 529 accounts, these accounts are counted as an asset of the parents for purposes of financial aid.

The one advantage these accounts have over 529 accounts is that the balance can be used without limitations for qualified expenses to an elementary or secondary public, private, or religious school. The federal rules recently changed for 529 accounts allowing these types of qualified withdrawal, but they are limited to $10,000 and depending on the state you live in, the state may not recognize these as qualified withdrawals from a 529 account.

If there is money left over in these Coverdell account, they also have to be liquidated by the time the beneficiary of the account turns age 30. 529 accounts do not have this restriction.

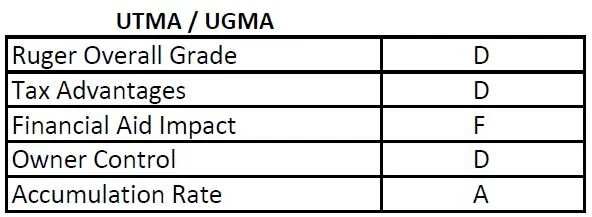

UTMA & UGMA Accounts

UGMA & UTMA accounts get the lowest overall grade from me. With these accounts, the child is technically the owner of the account. While the child is a minor, the parent is often assigned as the custodian of the account. But once the child reaches legal age, which can be 18, 19, or 21, depending on the state you live in, the child is then awarded full control over the account. This can be a problem when your child decides at age 18 that buying a Porsche is a better idea than spending that money on college tuition.

Also, because these accounts are technically owned by the child, they are a wrecking ball for the financial aid calculation. As I mentioned before, when it is an asset of the parent, 5.6% of the balance counts against financial aid, but when it is an asset of the child, 20% of the account balance counts against financial aid.

There are no special tax benefits associated with UTMA and UGMA accounts. No tax deductions for contributions and the child pays taxes on the gains.

Unlike 529 and Coverdell accounts, where you can change the beneficiary list on the account, with UTMA and UGMA accounts, the beneficiary named on the account cannot be changed.

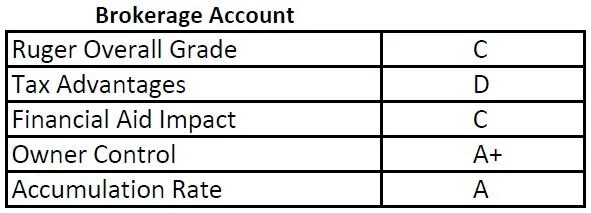

Brokerage Accounts

Parents can use brokerage accounts to accumulate money for college instead of the cash sitting in their checking account earning 0.25% per year. The disadvantage is the parents have to pay tax on all of the investment gains in the account once they liquidate them to pay for college. If the parents are in a higher tax bracket, they could lose up to 40%+ of those gains to taxes versus the 529 accounts where no taxes are paid on the appreciation. But, it also has the double whammy that if the parents realize capital gains from the liquidation, their income will be higher in the FAFSA calculation two years from now.

Sometimes, a brokerage account can complement a 529 account as part of a comprehensive college savings strategy. Many parents do not want to risk “over funding” a 529 account, so once the 529 accounts have hit a comfortable level, they will begin contributing the rest of the college savings to a brokerage account to maintain flexibility.

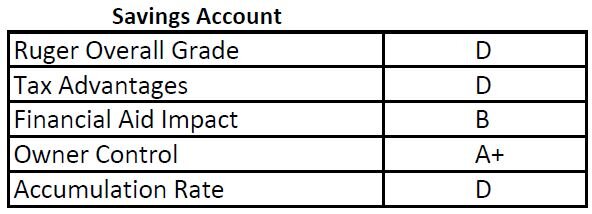

Savings Accounts

The pros and cons of a savings account owned by the parent or guardian of the child will have similar pros and cons of a brokerage account with one big drawback. Last I checked, most savings accounts were earning under 1% in interest. The cost of college since 1982 has increased by 6% per year (JP Morgan College Planning Essentials 2021). If the cost of college is going up by 6% per year, and your savings is only earning 1% per year, even though the balance in your savings account did not drop, you are losing ground to the tune of 5% PER YEAR. By having your college savings accounts invested in a 529, Coverdell, or brokerage account, it will at least provide you with the opportunity to keep pace with or exceed the inflation rate of college costs.

Can The Cost of College Keep Rising?

Let’s say the cost of attending college keeps rising at 6% per year, and you have a 2-year-old child that you want to send to state school which may cost $25,000 per year today. By the time they turn 18, it would cost $67,000 PER YEAR, times 4 years of college, which is $268,000 for a bachelor’s degree! The response I usually get when people hear these number is “there is no way that they can allow that to happen!!”. People were saying that 10 years ago, and guess what? It happened. This is what makes having a solid college savings strategy so important for your overall financial plan.

NOTE: As Financial Planners, we are seeing a lot more retirees carry mortgages and HELOC’s into retirement and the reason is usually “I helped the kids pay for college”.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

When You Make Cash Gifts To Your Children, Who Pays The Tax?

A very common question that we frequently receive from clients is “If I want to make a cash gift to my kids, do I have to pay gift taxes?” The answer to that question depends on number of items such as: The amount of the gift

A very common question that we frequently receive from clients is “If I want to make a cash gift to my kids, do I have to pay gift taxes?”

The answer to that question depends on number of items such as:

• The amount of the gift

• Your lifetime exclusion limit

• What state you live in

However, there are other things to consider beyond just these items that I'm going to cover in this article such as:

• How gifts are taxed

• The annual gifting limit

• Your lifetime gifting limit

• Cash vs Non-cash gifts (cars, houses, stock)

• Tax forms that need to be submitted to the IRS

• Advanced gifting strategies

• Beware the cost basis pitfall when gifting

The Annual Gift Limits

Each year The IRS sets a limit on the amount that you can gift to any one person without it counting towards your lifetime exclusion amount. In 2025, the annual gifting limit is $19,000 but that amount can change from year to year. Many people assume that as long as their gifts are below that dollar threshold that no gift tax has to be paid but if they gift over that annual limit then someone has to pay gift tax. For most individuals, that is not the case due to the lifetime exclusion limits.

Lifetime Gifting Limits

There is something in the federal tax law called the lifetime estate and gifting exclusion. This is the dollar limit that you are allowed to either gift away during your lifetime or that you are able to pass onto your heir after you die without having to pay federal income tax. The limits in 2025 are very high. Each individual has a $13.99 million lifetime exemption ($27.98M combined for married couples) before anyone would owe federal tax on a gift or inheritance.

In other words, you could gift your son or daughter $10 million dollars today, and no one would owe any federal gift tax on that amount. So wait……..then what’s the deal with the $19,000 annual gift limit? Each year you are allowed to gift away $19,000 to ANY NUMBER OF PEOPLE and it will not count AGAINST your $13.99M lifetime exclusion allowance.

Example: You have 5 children and you gift each of them $19,000. Since you did not exceed the $19,000 annual limit to any one person, no one owes any federal tax on the gift, and you still have your full $13.99M lifetime exclusion amount.

If instead, you made a $100,000 gift to one child, that’s $81,000 over the $19,000 annual limit, your $13.99M lifetime exclusion amount is reduced by $81,000 so you only have $13.909M left.

As you can see, gift tax is only an issue for individuals that plan to gift very large amounts over their lifetime or will have big estates when they pass away because the gift and estate exclusion is an aggregate amount.

Filing A Gift Tax Return

If you keep your gifts below $19,000 per year to any one person, it’s not a taxable event, and there is nothing that you need to file with your tax return. If however, you decide to make a gift to someone above the $19,000 per year annual limit, no one will owe any federal gift tax, but you will have to file a gift tax return with your personal tax return which provides the IRS with the amount that you gifted over the annual gift exclusion limit. This is how the IRS tracks how much of your lifetime exclusion you have used.

State Taxes