Paying Tax On Inheritance?

Not all assets are treated the same tax wise when you inherit them. It’s important to know what the tax rules are and the distribution options that are available to you as a beneficiary of an estate. In this video we will cover the tax treatment on inheriting a:

· House

· Retirements Accounts

· Stock & Mutual Funds

· Life Insurance

· Annuities

· Trust Assets

We will also cover the:

· Distribution options available to spouse and non-spouse beneficiaries of retirement accounts

· Federal Estate Tax Limits

· Biden’s Proposed Changes To The Estate Tax Rules

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

DISCLOSURE: This material is for informational purposes only. Neither American Portfolios nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions. Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors

Retirement Account Withdrawal Strategies

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you in more ways than one. Click to read more on how this can effect you.

The order in which you take distributions from your retirement accounts absolutely matters in retirement. If you don’t have a formal withdraw strategy it could end up costing you more in taxes long-term, causing you to deplete your retirement assets faster, pay higher Medicare premiums, and reduce the amount of inheritance that your heirs would have received. Retirees will frequently have some combination of the following income and assets in retirement:

· Pretax 401(k) and IRA’s

· Roth IRA IRA’s

· After tax brokerage accounts

· Social Security

· Pensions

· Annuities

As Certified Financial Planner’s®, we look at an individual’s income needs, long-term goals, and map out the optimal withdraw strategy. In this article, I will be sharing with you some of the considerations that we use with our clients when determining the optimal withdrawal strategy.

Layer One : Pension Income

When you develop a withdrawal strategy for your retirement assets it’s similar to building a house. You have to start with a foundation which is taxable income that you expect to receive before you begin taking withdrawals from your retirement accounts. For retirees that have pensions, this is the first layer. Income from pensions are typically taxable income at the federal level but may or may not be taxable at the state level depending on which state you live in and who the sponsor of the pension plan is. While pensions are great, retirees that have pension income have to be very careful about how they make withdrawals from their retirement accounts because any withdraws from pre-tax accounts will stack up on top of their pension income making those withdrawal potentially subject to higher tax rates or cause you to lose tax deductions and credits that were previously received.

Layer Two: Social Security

Social Security income is also something that has to be factored into the mix. Most retirees will have to pay federal income tax on a large portion of their Social Security benefit. When we are counseling clients on their Social Security filing strategy, one of the largest influencers in that decision is what type of retirement accounts that have and how much is in each account. Delaying Social Security each year, increases the amount that an individual receives in the range of 6% to 8% per year forever. As financial planners, we view this as a “guaranteed rate of return” which is tough to replicate in other asset classes. Not turning your Social Security benefit prior to your normal retirement age can:

· Increase 50% spousal benefit

· Increase the survivor benefit

· Increase the value of SS cost of living adjustments

· Reduce the amount required to be withdrawn for other sources

For purposes of this article, we will just look at Social Security as another layer of income but know that depending on your financial situation your Social Security filing strategy does factor into your asset withdrawal strategy.

Roth Accounts: Last To Touch

In most situations, Roth assets are typically the last asset that you touch in retirement. Since Roth assets accumulate and are withdrawn tax free, they are by far the most valuable vehicle to accumulate wealth long-term. The longer they accumulate, the more valuable they are.

The other wonderful feature about Roth IRAs is that there is no required minimum distributions (RMD’s) at age 72. Meaning the government does not force you to take distributions once you have reached a certain age so you can continue to accumulate wealth within that asset class.

Roth’s are also one of the most valuable assets to pass onto beneficiaries because they can continue to accumulate tax free and are withdrawn tax free. For spousal beneficiaries, they can roll over the balance into their own Roth IRA and continue to accumulate wealth tax free. For non-spouse beneficiaries, under the new 10 year rule, they can continue to accumulate wealth for a period of up to 10 years after inheriting the Roth before they are required to distribute the full balance but they don’t pay tax on any of it.

Financial Nerd Note: While Roth are great accumulation vehicles, it’s impossible to protect them from a long term care event spend down situation. They cannot be transferred into a Medicaid trust and they are subject to full spend down for purposes of qualifying for Medicaid in New York since there is no RMD requirements. It’s just a risk that I want you to be aware of.

Pre-tax Assets

Pre-taxed retirement assets often include:

· Traditional & Rollover IRAs

· 401k / 403b / 457 plans

· Deferred compensation plans

· Qualified Annuities

When you withdraw money from these pre-tax sources you have to pay federal income tax on the amount withdrawn but you may also have to pay state income tax as well. If you live in a state that has state income tax, it’s very important to understand the taxation rules for retirement accounts within your state.

For example, New York has a unique rule that each person over the age of 59½ is allowed to withdraw $20,000 from a pre-tax retirement account without having to pay state income tax. Any amounts withdrawn over that threshold in a given tax year are subject to state income tax.

Pretax retirement accounts are usually subject to something called a required minimum distribution (RMD). The IRS requires you to start taking small distributions out of your pre-tax retirement accounts at 72. Without proper guidance, retirees often make the mistake of withdrawing from their after tax assets first, and then waiting until they are required to take the RMD’s from their pre-tax retirement accounts at age 72 and beyond. But this creates a problem for many retirees because it causes:

· The distribution to be subject to higher tax rates

· Loss of tax deductions and credits

· Increase the tax ability of Social Security Increase Medicare premiums Loss of certain property tax credits for

seniors

· Other adverse consequences……

Instead as planners, we proactively plan ahead and ask questions like:

“instead of waiting until age 72 and taking larger RMD’s from the pre-tax account, does it make sense to start making annual distribution from the pre-tax retirement accounts leading up to age 72, thus spreading those distribution in lower amounts, across more tax year resulting in:

· Lower tax liability

· Lower Medicare premiums

· Maintaining tax deductions and credits

· The assets last longer due to a lower aggregate tax liability

· More inheritance for their family members

Since everyone’s tax situation and retirement income situation is different, we have to work closely with their tax professional to determine what the right amount is to withdraw out of the pre-tax retirement accounts each year to optimize their net worth long-term.

After Tax Accounts

After tax assets can include:

· Savings accounts

· Brokerage accounts

· Non-qualified annuities

· Life Insurance with cash value

Just because I’m listing them as “after tax assets” does not mean the whole account value is free and clear of taxes. What I’m referring to is the accounts listed above typically have some “cost basis” meaning a portion of the account it what was originally contributed to the account and can be withdrawal tax fee. The appreciation within the account would be taxes at either ordinary income or capital gains rates depending on the type of the account and how long the assets have been held in the account.

Having after tax assets often provides retirees with a tax advantage because they may be able to “choose their tax rate” when they retire. Meaning they can choose to withdrawal “X” amount from an after tax source and pay little know taxes and show very little taxable income in any given year which opens the door for more long term advanced tax planning.

Withdrawal Strategies

Now that have covered all of the different types of retirement assets and how they are taxed, let move into some of the common withdrawal strategies that we use with our clients:

Retirees With All Three: Pre-tax, Roth, and After-tax Assets

When retirees have all three types of retirement account sources, the strategy usually involves leaving the Roth assets for last, and then meeting with their accountant to determine the amount that should be withdrawn out of their pre-tax and after tax accounts year to minimize the amount of aggregate taxes that they pay long term.

Example: Jim and Carol are both age 67 and just retired and they financial picture consists of the following:

Joint brokerage account: $200,000

401(k)’s: $500,000

Roth IRA‘s: $50,000

Combined Social Security: $40,000

Annual Expenses $100,000

Residents of New York State

An optimal withdrawal strategy may include the following:

Assuming we recommend that they turn on Social Security at their normal retirement age, it will provide them with $40,000 pre-tax Income, 85% of their Social Security benefit will be taxed at the federal level but there will be no state tax deal, resulting in an estimated $35,000 after tax.

That means we need an additional $65,000 after-tax per year from another source to meet their $100,000 per year in expenses. Instead of taking all the money from their joint brokerage account, we could have them rollover their 401(k) balances into Traditional IRAs and then take $20,000 distributions each from their accounts which they not have to pay state income tax on because it’s below the $20K threshold. That would result in another $40,000 in pre-tax income, translating to $35,000 after-tax.

The final $30,000 that is needed to meet their annual expenses would most likely come from their after tax brokerage account unless their accountant advises differently.

This strategy accomplishes a number of goals:

1) We are withdrawing pre-tax retirement assets in smaller increments and taking advantage of the New York

State tax free portion every year. This should result in lower total taxes paid over their lifetime as opposed to waiting until RMD’s start at age 72 and then being required to take larger distributions which could push them over the $20,000 annual limit making them subject in your state tax income tax and higher federal tax rates.

2) We are preserving the after-tax brokerage account for a longer period of time as opposed to using it all to supplement their expenses which would only last for about two years and then they would be forced to take all of their distributions from their pre-tax retirement account making them subject to a higher tax liability

3) For the Roth accounts, we are law allowing them to continue to accumulate as much as possible resulting in more tax free dollars to be withdrawn in the future, or if they pass onto their children, they are inheriting a larger assets that can be withdrawn tax free.

All Pre-Tax Retirement Savings

It’s not uncommon for retirees to have 100% of their retirement savings all within a pre-tax sources like 401(k)s, 403(b)s, traditional IRA‘s, and other types of pre-tax retirement account. This makes the withdrawal strategy slightly more tricky because if there are any big one-time expenses that are incurred during retirement, it forces the retiree to take a large withdrawal from a pre-tax source which also increases the tax liability associate the distribution.

A common situation that we often have to maneuver around is retirees that have plans to purchase a second house in retirement but in order to do that they need to have the cash to come up with a down payment. If they don’t have any after-tax retirement savings, those amounts will most likely have to come from a pre-tax account. Withdrawing $60,000 or more for a down payment can lead to a higher tax liability, higher Medicare premiums the following year, and make a larger portion of your Social Security taxable. For clients in the situation, we often have to plan a few year ahead, and will begin taking pre-text Distributions over multiple tax years leading up to the purchase of the retirement house in an effort to spread the tax liability over multiple years and avoiding the adverse tax and financial consequences of taking one large distribution.

Since many retirees are afraid of taking on debt in retirement, we often get the question in these second house situations is “Should I just take a big distribution from my retirement, pay for the house in full, and not have a mortgage?” If all of the retirement assets are tied up in pre-tax sources, it typically makes the most sense to take a mortgage which allows you to then take smaller distributions from your IRA accounts over multiple tax years to make the mortgage payments compared to taking an enormous tax hit by withdrawing $200,000+ out of a pre-tax return account in a single year.

Pensions With No Need For Retirement Accounts

For retirees that have pensions, it’s not uncommon for their pension and Social Security to provide enough income to meet all of their expenses. But these individual may also have pre-tax retirement accounts and the question becomes “what do we do with them if we don’t need them, and we expect the kids to inherit them?”

This situation often involves a Roth conversion strategy where each year we convert money from the pre-tax IRA’s over to Roth IRA’s. This allows those retirement accounts to accumulate tax free and ultimately withdrawn tax free by the beneficiaries. Versus if they continue to accumulate in pre-tax retirement accounts, the beneficiaries will have to distribute those accounts within 10 years and pay tax on the full balance.

Also when those retirees turn age 72 they have to start taking required minimum distributions which they don’t necessarily need. Since they are receiving pension and Social Security income, those distributions from the retirement accounts could be subject to higher tax rates. By proactively moving assets from a pre-tax source to a Roth source we are essentially reducing the amount of retirement assets that will be subject to RMD’s at age 72 because Roth assets are not subject to RMD‘s.

Using this Roth conversion strategy, it’s also not uncommon for us to have these retirees delay their Social Security. Since Social Security is taxable at the federal level, if we delay Social Security, it gives us more room to process larger Roth conversions because it free up those lower tax brackets. At the same time, it also allows Social Security to accumulate at a guaranteed rate of 6% - 8%.

Nerd Note: When you process these Roth conversions, make sure you’re taking into account the tax liability that’s being generated. You have to have a way to pay the taxes on the amounts converted because the money goes directly from your traditional IRA to your Roth IRA. Retirees that implement this strategy typically have large cash holdings, after tax retirement holdings, or we convert some of the money, and take pre-tax IRA distribution to cover the taxes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

DISCLOSURE: This material is for informational purposes only. Neither American Portfolios nor its Representatives provide tax, legal or accounting advice. Please consult your own tax, legal or accounting professional before making any decisions. Any opinions expressed in this forum are not the opinion or view of American Portfolios Financial Services, Inc. and have not been reviewed by the firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors

Estimated Tax Payments Still Due April 15th

The IRS extended the tax filing deadline for 2020 from April 15th to May 15th. Click to read more on the questions that we are getting from business owners, retirees, and individuals taxpayers.

The IRS extended the tax filing deadline for 2020 from April 15th to May 15th. The question that we are getting from business owners, retirees, and individuals taxpayer are:

1) Are my 1st Quarter Estimated Tax Payments Due On 4/15 or 5/15?

2) When is the deadline for making IRA contributions for 2020?

3) When is my 2020 tax liability due: April 15th or May 15th?

4) How are the $10,200 in tax free unemployment benefits begin handled? Do you have to amend your 2020 tax return?

DISCLOSURE: This is for educational purposes only. This is not tax advice. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

COVID-19 Distribution Tax Forms!!!

If you took a COVID distribution from a retirement account, IRA, 401(K), in 2020, you will have to report it on your taxes. Here are the special tax forms that you will need to report your COVID distribution. DISCLOSURE: This is for…

If you took a COVID distribution from a retirement account, IRA, 401(K), in 2020, you will have to report it on your taxes. Here are the special tax forms that you will need to report your COVID distribution.

DISCLOSURE: This is for educational purposes only. This is not tax advice. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

At What Age Does A Child Have To File A Tax Return?

When your children begin working and they receive their first W2, the question from parents is often “Do they have to file a tax return?” In this video we will cover

When your children begin working and they receive their first W2, the question from parents is often “Do they have to file a tax return?” In this video we will cover:

At what age are you required to file a tax return

The $12,400 income threshold

Tax refunds for children

Impact on the IRS Stimulus Checks

Can you still claim them as a dependent if they file a tax return?

Kiddie Tax

DISCLOSURE: This is for educational purposes only. This is not tax advice. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.Money Smart Board blog

Will Moving From New York to Florida In Retirement Save You Taxes?

I am getting the question much more frequently from clients - "When I retire, does it make sense from a tax standpoint to change my residency from New York to Florida?". When I explain how the taxes work

I am getting the question much more frequently from clients - "When I retire, does it make sense from a tax standpoint to change my residency from New York to Florida?". When I explain how the taxes work between New York and Florida, most people are disappointed to find out that it either makes no difference tax wise, or it is less of a difference than they thought. I think too many people wrongly assume that changing your state domicile from New York to Florida is a no-brainer. Whether or not it will have a big impact for you depends on your personal financial situation for retirement. For some individuals, it will save them a lot of taxes, but for most, the tax impact may be minimal. You have to consider:

How Social Security is taxed in NY

The $20,000 NYS exemption on the distributions from retirement accounts

How state pensions are taxed

The property tax breaks in NY once you are over 65

Hidden Medicare cost if you leave New York

How much your NY tax liability would be in retirement

Cost of Living

Estate tax laws

It probably seems like a lot of factors to consider, but all of them should be factored in before you decide to pack up the car and move to Florida for retirement.

How Social Security Is Taxed In New York

Many people do not realize that when you receive Social Security payments in retirement, it is considered taxable income at the federal level for most individuals. While most individuals will pay federal income tax on their Social Security benefits, you do not have to pay NYS income taxes on social security. If you are married, you and your spouse are each receiving $25,000 for social security, and you do not save any state income taxes on the $50,000 by moving to Florida, since New York does not tax your social security benefits.

NYS Tax Exemption On First $20,000 Distributed From Retirement Accounts

If you are NYS resident and over the age of 59½, New York does not make you pay state tax on the first $20,000 distributed from a corporate pension, IRA, 401(k) or other retirement plan. Married couples get to double that at $20,000 each for a total of $40,000.

If we build on the social security example above, assume you and your spouse are each getting $25,000 in Social Security, and you can withdraw $20,000 each out of your IRA account without having to pay NYS income tax:

So, now you are up to $90,000 in annual income without a dime in income tax paid to New York State.

Taxes on Public Pension

If you have a pension with New York State, local government, federal government, or certain public authorities, you do not have to pay state taxes on that pension income in retirement.

Given that we are based out of Albany, NY, we have a lot of financial planning clients that have pensions through New York State. Building again on the social security and IRA example above, now assume we have a married couple that both worked for New Year State and each have pensions for $50,000 each. They do not have to pay NYS income tax on the pension income, they have no NYS income tax on social security, and no state income tax on the first $20K each out of their NYS 457 Plan or IRA’s.

We are now up to $190,000 in annual income with zero dollars paid in NYS income taxes.

Property Tax Credits

It is no secret that New York State has high property taxes compared to other states which can often be one of the larger expenses in retirement after the mortgage is paid off. Most New York residents are familiar with the STAR program which reduces the property taxes for homeowners that make less than $500,000 in income. What many retirees do not realize is that there is something called the “Enhanced STAR” credit once you reach age 65, which can further reduce your school taxes.

However, the income limitation for the Enhanced STAR credit is much lower than the regular STAR program. The extra exemption is limited to individuals age 65 and older making less than $86,000 per year in income. A special note: income from annuities and IRA’s do not count toward the $86,000 income limitation.

While Florida may have lower property taxes compared to New York State, if you can qualify for the Enhanced STAR program, the difference in property taxes may be closer than you think.

SNOW BIRDS: This Enhanced STAR program is a big deal for our clients that are snowbirds that go back and forth from New York to Florida. If you plan to maintain a residence in New York and the have a second house in Florida, if you formally change your state of domicile to Florida, your are no longer Eligible for the STAR program, because you are no longer a New York State resident. So, you think you might be saving property taxes by making this move, but your property taxes for your house in New York could actually go up by thousands of dollars since you are no longer eligible for the STAR credit.

Medicare Consideration

When you retire, what is often the largest expenses for retirees? The answer is healthcare. While New York is known for its higher property taxes and higher income taxes, not many people realize are lucrative health insurance benefits until after they have left the state. When you turn age 65, you typically have to enroll in Medicare, which provides you with your healthcare coverage. But Medicare does not pay for everything, so most individuals will enroll in either a Medicare Supplemental or Medicare Advantage Plan to fill on the cost gaps that Medicare does not cover. Unfortunately, most retirees do not understand the difference between a Medicare Supplemental Plan and a Medicare Advantage Plan.

If you do not know the difference, here is our YouTube Video on the topic: Medicare Supplemental Plans (Medigap) vs Medicare Advantage Plans

Here is a quick summary of the issue: Medicare advantage plans can carry a lower monthly cost but you sign up for a Medicare Advantage Plan, you are no longer covered by Medicare. With Medicare supplemental plans, you are covered by Medicare, and the insurance policy supplements your Medicare coverage. In New York, we have the luxury that each year you can decide whether you want to switch from a Medicare Advantage Plan to a Medicare Supplement Plan and visa versa if your health needs change. That is only allowed in two states right now, New York and Connecticut.

If you were to change your state of domicile from New York to Florida, as soon as you become a Florida resident, you no longer have that option available to you. If you are enrolled in a Medicare Advantage plan, you may not be able to change back to Medicare coverage with a Supplemental Plan in the future if your healthcare need change. That is a big deal in retirement, so you really to analyze what type of coverage you when you make the move to Florida.

What Is Your New Tax State Liability

It is a given that no one likes to pay taxes and we would all like to pay less, but before you go through all of these maneuvers to save taxes, you should quantify how much you are actually saving. For example, let us say we have a marriage couple, and their retirement expenses required them to withdraw $30,000 annually from their retirement accounts over and above the NYS $20K exemption amount. Ignoring for now any standard deduction for tax purposes, they would have a New York State tax liability of approximately $2,200. So you have to ask yourself the question, “Is moving to Florida worth saving $2,200 per year in taxes?”.

Cost of Living

There are a few other factors that should be considered in this decision. The first being the difference in the cost of living between New York and Florida. It is not uncommon for the cost of living to be lower in the southern states compared to the northeaster so your retirement dollar may go further.

Estate Planning

While it is kind of morbid to think about, estate laws vary state by state, meaning, depending on the size of your state, your state tax liability may vary depending on whether you're a resident of New York versus Florida. For individuals that have large estates, this could me a bigger factor in their decision of whether or not to make the move.

People That Save Taxes By Moving

All things considered, for some individuals, making the decision to change you state of domicile from New York to Florida, could save them a tremendous amount of tax dollars but it depends on what your income picture will look like in retirement. For individuals that plan to take larger distributions out of retirement accounts and may have earned income in retirement, it could give more weight did the decision to change your state of domicile but it is important to talk with a tax professional to fully evaluate all the moving pieces before making the decision.

Changing Your State of Residency

If you plan to maintain houses in both New York and Florida but plan to change your state of domicile to Florida for tax purposes make sure you know all of the rules. It is not as easy as just declaring that I am a Florida resident because I spent more than half of the year in Florida. Below is our video that details all of the items that need to be consider when changing your state of domicile from New York to Florida.

Video: How Do I Change My State Residency For Tax Purposes

Disclosure: This is for educational purposes only. It is not tax advice. For tax advice, please consult your financial professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

When You Make Cash Gifts To Your Children, Who Pays The Tax?

A very common question that we frequently receive from clients is “If I want to make a cash gift to my kids, do I have to pay gift taxes?” The answer to that question depends on number of items such as: The amount of the gift

A very common question that we frequently receive from clients is “If I want to make a cash gift to my kids, do I have to pay gift taxes?” The answer to that question depends on number of items such as:

The amount of the gift

Your lifetime exclusion limit

What state you live in

However, there are other things to consider beyond just these items that I'm going to cover in this article such as:

How gifts are taxed

The annual gifting limit

Your lifetime gifting limit

Cash vs Non-cash gifts (cars, houses, stock)

Tax forms that need to be submitted to the IRS

Advanced gifting strategies

Beware the cost basis pitfall when gifting

The Annual Gift Limits

Each year The IRS sets a limit on the amount that you can gift to any one person without it counting towards your lifetime exclusion amount. In 2021, the annual gifting limit is $15,000 but that amount can change from year to year. Many people assume that as long as their gifts are below that dollar threshold that no gift tax has to be paid but if they gift over that annual limit then someone has to pay gift tax. For most individual, that is not the case due to the lifetime exclusion limits.

Lifetime Gifting Limits

There is something in the federal tax law called the lifetime estate and gifting exclusion. This is the dollar limit that you are allowed to either gift away during your lifetime or that you are able to pass onto your heir after you die without having to pay federal income tax. The limits in 2021 are very high. Each individual has a $11.7 million lifetime exemption ($23.4M combined for married couples) before anyone would owe federal tax on a gift or inheritance.

In other words, you could gift your son or daughter $10 million dollars today, and no one would owe any federal gift tax on that amount. So wait……..then what’s the deal with the $15,000 annual gift limit? Each year you are allowed to gift away $15,000 to ANY NUMBER OF PEOPLE and it will not count AGAINST your $11.58M lifetime exclusion allowance.

Example: You have 5 children and you gift each of them $15,000. Since you did not exceed the $15,000 annual limit to any one person, no one owes any federal tax on the gift, and you still have your full $11.58M lifetime exclusion amount.

If instead, you made a $100,000 gift to one child, that’s $85,000 over the $15,000 annul limit, your $11.58M lifetime exclusion amount is reduced by $85,000 so you only have $11.49M left.

As you can see, gift tax is only an issue for individuals that plan to gift very large amounts over their lifetime or will have big estates when they pass away because the gift and estate exclusion is an aggregate amounts.

Filing A Gift Tax Return

If you keep your gifts below $15,000 per year to any one person, it’s not a taxable event, and there is nothing that you need to file with your tax return. If however, you decide to make a gift to someone above the $15,000 per year annual limit, no one will owe any federal gift tax, but you will have to file a gift tax return with your personal tax return which provides the IRS with the amount that you gifted over the annual gift exclusion limit. This is how the IRS tracks how much of your lifetime exclusion you have used.

State Taxes

You also have to be aware of your state gifting laws because they can vary from the federal limits. While many states have annual gift exclusions and lifetime exclusion limits similar to the IRS, the limits can vary.

For example, in New York for 2021, the lifetime estate and gifting limit for an individual is $5.93 million. Still a large amount but only half of the federal limit. If you gift someone $8M, you may not own federal tax but you could owe state taxes. When you get to these higher gifting thresholds you also have to be aware of generation skipping tax (GST) depending on who the recipient is of the gift.

Gifting Limits Subject To Change In The Future

Be aware that these limits have changed in the pasts and they will most likely change at some point in the future. Given the size of our federal and state government deficits, at some point these government entities may need to make changes to the tax laws to generate more income for the government to repay the debt. For example, they could reduce the federal lifetime exemption from $11.5M to $1M per person which would generate more income for the government when people pass away or make large gifts.

There are two lessons here. First, don't be wasteful with your lifetime exemption amount because the limits could be reduced in the future and you may need it to avoid taxes when your assets past your heirs. Second, if you have a large estate, now is the time to be consider making large gifts while the federal lifetime limits are still at historically higher levels so those gifts are hopefully grandfathered in under the current tax laws.

Advanced Gifting Strategies

Some clients have a desire to give large amounts but do not want to eat into their lifetime a estate and gift exclusion allowance. Promissory notes can sometimes be used to execute these advanced gifting strategies.

For example, your daughter is starting a business, and you would like to gift her $200,000 to help get the business off the ground. Instead of gifting her $200,000 in a single year eating up $185,000 of your lifetime exclusion, you could structure the gift as a loan. You draft a promissory note for the $200,000 loan, can you make the loan duration such that the annual loan payments are below $15,000 per year. You issue her a $200,000 check for the loan which is no longer considered a gift and then each year you gift her $15,000 to basically make the loan payments back to you. If you are married, you can gift her $30,000 per year to make loan payments, $15,000 from you and $15,000 from your wife. You would then write into your will that if you pass away before the loan is paid in full that they loan is forgiven.

Cost Basis Pitfall

The annual and lifetime gifting limits exist whether you are gifting someone cash or a non-cash items like a car or a house but you have to be aware of the cost basis pitfalls associated with gifting non-cash assets. When you make a gift to someone, the amount of the gift is based on the fair market value of that asset when the gift is made, however the person receiving the gift inherits your cost basis in that asset. Versus, if they inherit the assets from you, they receive a step-up in basis.

Let me explain this via an example. The most common example that we see is parents gifting their house to their kids while they're still alive. Assume the parents bought the house 30 years ago for $50,000 and now the house is worth $300,000. If they give the house to their kids today, they have made a $300,000 gift in a single year, it does not trigger a tax event because it's still below their lifetime exclusion, but the kids inherit their cost basis of $50,000. Meaning, when they pass away and the kids sell the house, assuming the house sells for $300,000, they would have to pay tax on the $250,000 gain.

Instead, if the parents retained ownership of the house, when the parents pass away, their kids would receive a “step-up in basis” meaning their cost basis in the house is the value of the house as of the date of death. If they sell the house for $300,000 and their cost basis in the house is now stepped up to $300,000, they would not owe any tax saving thousand of dollars in taxes that would have been paid under the gifting scenario.

Lesson: When gifting non-cash assets that have appreciated in value, make sure you're aware of the tax impact. A little advantage tax strategy, if you have a desire to gift money to a charity or not-for-profit, sometimes it makes sense to do so with assets that have appreciated in value because when they sell them they don't have to pay taxes given their not-for-profit status. Be sure to consult wit your tax advisor when executing these advanced gifting strategies.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Have to Pay Tax When I Sell My House?

When you sell your primary residence, and meet certain requirements, you may be able to exclude all or a portion of your capital gain in the property from taxes. In this article, I am going to cover the $250,000

When you sell your primary residence, and meet certain requirements, you may be able to exclude all or a portion of your capital gain in the property from taxes. In this article, I am going to cover the $250,000 capital gains exclusion for single filers, and the $500,000 capital gains exclusion for married couples filing joint. However, as financial planners, we have also run into some unique situations where clients:

Live in an owner-occupied duplex and rent one half of the property

Have a home office and have been taking depreciation as a tax benefit

Moving into a rental property and made it their primary residence

For homeowners that fall into one of the unique categories, they may face an unexpected tax consequence when the go to sell their property. They may wrongly assume the large capital gains exclusion associated with selling a primary residence will cover gains and depreciation that was taken on the rental portion of the property.

$250,000 / $500,000 Capital Gain Exclusion

When you sell an asset that is appreciated in value, in most cases you must pay tax on the amount of value that that asset has gained since you purchased it. For real estate, if you have held the property for more than 12 months, you typically have to pay long term capital gains tax on the amount of the appreciation. However, for your primary residence, the IRS offers taxpayers some relief if certain requirements are met. These conditions are that:

The home must be considered your primary residence based on IRS rules

You must have occupied the house for at least 2 of the last 5 years

If you meet these requirements, when you go to sell your house the IRS offers the following capital gains exclusion amounts:

Single Filers: $250,000

Married Filing Joint: $500,000

If you are a single tax filer, meet the primary residence requirements, and the gain in your house is not more than $250,000, you will not pay any tax when you sell it. For married couples filing joint, as long as the gain in the property is not more than $500,000, you will not pay any tax when you sell it. Do not mistake the sales price of the house with the amount of the capital gain. If you are married and sell your house for $600,000, that does not necessarily mean that you are going to have to pay tax when you sell it. If you purchased the property 10 years ago for $400,000, and you sell it today for $600,000, you have a $200,000 gain in the property. Since the capital gain exclusion for married couples filing joint is $500,000, you do not have to pay any tax on the gain when you sell your house.

Calculation of Your Cost Basis

When you calculate the gain in your house, you take the sales price of the house, minus the purchase price of the house, minus the cost of any capital improvements that you made to the house while you owned it, minus any commissions that you paid to the realtor. For example, I'm a single filer and I bought a house for $200,000, 10 years later I sell the house for $500,000. when I lived in the house I made $50,000 of capital improvements and when I sold the house I paid the realtor a 5% Commission.

Since the total capital gain is below the $250,000 threshold, I will not pay any tax when I sell the house.

NOTE ABOUT CAPITAL IMPROVEMENTS: You should have documented proof of your capital improvements. Anytime you make major house renovations, you should keep the receipts in case you are ever audited by the IRS and have to justify those capital improvements.

You Can Use The Exemption Multiple Times

This capital gains exception on your primary residence can be used more than once during your lifetime. The only restriction is the exemption can be used only once every two years. For example, let us say you are married and file a joint tax return. You buy your first house for $200,000, and 10 years later sell it for $400,000. In this scenario, you will not pay any tax when you sell your primary residence. Now assume you then take that $200,000 gain and use it as a down payment on your new house and the purchase price of that new house is $400,000, you live in that house for 15 years, and then sell it for $700,000. You will again be able to exclude the full gain in that property when you sell it.

Capital Gains Rule For A Rental That Is Owner Occupied

Here is our first unique situation: It is not uncommon for someone to buy a duplex, live in 1/2 as their primary residence, and rent the other half to a tenant. The question becomes when you go to sell the duplex, how does the capital gains exclusion work since technically it was also your primary residence. This is tricky. In the eyes of the IRS, the duplex is 2 separate properties. The half that you live in is your primary residence, and the half that is rented is actually an investment property. Only the half that you live in as your primary residence is eligible for the primary residence capital gains exclusion. The rented portion of the property is not eligible for the capital gains exclusion.

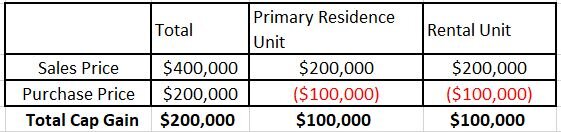

For example, I found a duplex for $200,000, I live in 1/2 as my primary residence and I rent the other half to a tenant. 10 years later I decide to sell the duplex for $400,000. even though I'm a single filer and technically have a $250,000 gain exclusion for my primary residence, that unfortunately will not cover the full gain in the property when I sell it. Here is how I have to allocate the gain between the two units:

The $100,000 gain associated with my principal residence unit is exempt from taxes because it's below the $250,000 exclusion for a single filer. However, the $100,000 capital gain associated with the rental unit, I will have to pay tax on. Since I also owned the house for more than a year, I would pay long-term capital gains rates on the $100,000 which could mean 15% Federal Tax and State Tax. Assuming the State Tax is 5%, I would owe 20% in taxes on the $100,000 gain equaling a $20,000 tax bill.

Recapture of Deprecation

When individuals own rental properties, it is not uncommon for the owner to be taking depreciation on the value of the rental property. Depreciation is a tax strategy which allows you to realize the expense of the property and use those expense to offset income from the property, thus reducing the owner’s tax liability. However, when you sell a property, you have to recapture the depreciation that was previously taken as a tax benefit. Therefore, not only would you potentially have to pay tax on the gain of the rental unit, but you have to factor in that appreciation which is taxed at a different rate than long-term capital gains.

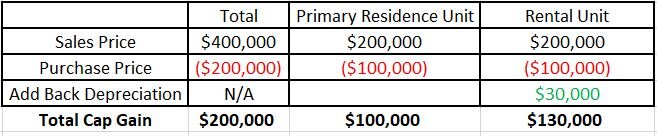

Let us build on the example with the duplex we just discussed. Over the course of the 10 years that I own the property, I took $30,000 worth of depreciation against the property to reduce the tax liability against the rental income I was receiving from the tenant. When I sell the house, the cost basis of my primary residence unit and the rental unit will be different due to the depreciation adjustment. See below:

As you see in the example above, I have a larger gain on the rental unit because I had to add the $30,000 appreciation amount to the gain (or in the accounting terms, it reduced my cost basis by another $30,000). In this situation the $100,000 gain associated with the primary residence unit is 100% excluded from taxes because it is below my $250,000 single filer exemption. However, on the rental unit I will have to pay tax on the $130,000 gain, but the $130,000 is not all taxed at the long-term capital gains rate. The $30,000 in depreciation recapture is taxed at a flat 25% tax rate, whereas the remaining $100,000 and gain is entirely taxed at long-term cap gains rates.

Why does the IRS tax depreciation recapture at a different rate? They recognize that you use the depreciation to offset income that was originally taxed at ordinary income tax rates, which could be as high as 37% or more. So, they are essentially asking you to pay more tax on the portion of the game assigned to the tax deductions you took while you owned it.

A SPECIAL NOTE ABOUT DEPRECIATION: Depreciation recapture is limited to the lesser of the gain or the depreciation previously taken. For example, if you took $100,000 in depreciation against the property but the gain when you sold the property was only $50,000, when you sell the property you have to pay tax on the $50,000 gain, but it will be at the full 25% depreciation recapture rate. You do not have to pay tax on the full $100,000 depreciation recapture when you sell the property.

Moving Into A Rental Property To Avoid Capital Gains Tax

This is another unique situation that we run into sometimes. Individuals that own rental property that has appreciated in value, or sometimes get the idea that if I move into the property and make it my primary residence for two years, all of the gain in that property will then be sheltered by my primary residence capital gains exclusion. The rule of thumb in these situations is if you have thought of it, the IRS has probably thought of it as well, and has probably put some form of restrictions in place. That is unfortunately true of this strategy as well. In 2009 The IRS created a “qualified vs non-qualified use” test:

Qualified uses the period of time that the house is considered your primary residence. Non-qualified uses the period of time that that house was an investment property. The test applies to ownership periods beginning in 2009, and it ultimately determines that even if you have met all the requirements in making that house your primary residence, when you go to sell it the test will determine how much of the gain exclusion you get to apply when you sell the house.

For example, if you rented out a vacation home for 10 years and then you moved into the house for three years as your primary residence, when you go to sell, the capital gains exclusion is limited to 3/13 of the capital gain the property.

Let's assume I buy a vacation home for $300,000, and rented it out as an investment property for 10 years. I move into the house and make it my primary residence for three, but now have decide to sell it for $700,000. Since I am married and file a joint tax return, it is easy to assume I am eligible for a $500,000 capital gains exclusion on my primary residence. However, in this situation I cannot shelter the full gain because the IRS would apply the qualified use test.

$400,000 Capital Gain x 3/13 = $92,307

When I sell the property and realize the $400,000 gain, I am only able to exclude $92,307 from taxes using the primary residence gain exclusion. The remainder of the gain would be taxed at long term capital gains rate and any depreciation recapture would apply.

Selling Your Primary Residence With A Home Office

For an individual that has been claiming a tax deduction for a home office, a word of caution: If you have taken depreciation over the years for the home office, when you sell the primary residence, you will be eligible for the capital gains exclusion, but you will have to recapture the depreciation that you claimed over the years.

DISCLOSURE: This article does not contain tax advice and is for educational purposes only. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus RMD Relief: Ability To Waive Mandatory IRA Distributions In 2020

Congress passed the CARES Act in March 2020 which provides individuals with IRA, 401(k), and other employer sponsored retirement accounts, the option to waive their required minimum distribution (RMD) for the 2020 tax year.

Congress passed the CARES Act in March 2020 which provides individuals with IRA, 401(k), and other employer sponsored retirement accounts, the option to waive their required minimum distribution (RMD) for the 2020 tax year. This option is available to both individual over the age of 70½ and non-spouse beneficiaries of inherited IRA’s. In this article we will review:

The new RMD waiver rules

RMD’s for individuals age 70.5

RMD’s for beneficiaries of Inherited IRA’s

What happens if you already took your distribution for 2020?

Options for putting the RMD back into your IRA

Who Qualifies For The RMD Waiver?

Unlike other provisions in the CARES Act that require an individual to demonstrate that they have been impacted by the Coronavirus to gain access, the waiver of 2020 required minimum distributions is available to everyone. If you were age 70½ prior to December 31, 2019 or are the non-spouse beneficiary of an IRA, you are typically required to take a small distribution from your IRA each year, called an “RMD”, and pay tax on those distributions. However, for 2020, if you want to keep that money in your IRA in 2020 and avoid the tax hit associated with taking the distribution, you have the option to do so.

What If You Already Took Your RMD for 2020?

If you already received the RMD amount from your IRA for 2020, you may be able to return it to your IRA, and avoid the tax hit.

If the distribution came from your own personal IRA, not an inherited IRA, you will have two options:

OPTION 1: If the distribution happened within the last 60 days, you can simply return the money to your IRA. For this option, you are utilizing the 60-day rollover rule which allows you to take money out of an IRA, return it within 60 days, and avoid the tax liability. You are only allowed one 60-day rollover every 12 months.

OPTION 2: If the distribution took place more than 60 days ago, you will only be allowed to return it to your IRA if you qualify based on one of the four Coronavirus-Related Distribution criteria:

You, your spouse, or a dependent was diagnosed with the COVID-19

You are unable to work due to lack of childcare resulting from COVID-19

You own a business that has closed or is operating under reduced hours due to COVID-19

You have experienced adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced because of COVID-19

If you qualify under one of these items, then you will have 3-years from the date of the distribution to return the money back to your IRA and avoid the tax hit. However, while you have 3-years to return it to the IRA, if you don’t return the money to your IRA prior to December 31, 2020, you will have a tax liability in 2020 for all or a portion of that IRA distribution. It’s only when you actually return the money to your IRA that the tax liability is nullified. If you return it in a future tax year, you would have to go back and amend your 2020 tax return to recapture the taxes that were paid.

Inherited IRA – Non-spouse Beneficiary

However, if you are a non-spouse beneficiary of an IRA, the rules for returning the money to your IRA are different. If you are a non-spouse beneficiary of an IRA and you already received your RMD for 2020, you cannot return that money to your IRA to avoid the tax liability. Why is this? Beneficiaries are not eligible to make rollovers, so that disqualifies them from return the money to the IRA under the rollover rules in the CARES Act.

A Note To Our Greenbush Financial Clients

If you wish to waiver your RMD to 2020 or if have already received your RMD, and wish to process a rollover back into your IRA, 401(k), or employer sponsored plan, please contact us.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

$5,000 Penalty Free Distribution From An IRA or 401(k) After The Birth Of A Child or Adoption

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child without having to pay the 10% early withdrawal penalty. To take advantage of this new distribution option, parents will need to know:

Effective date of the change

Taxes on the distribution

Deadline to make the withdrawal

Is it $5,000 for each parent or a total per couple?

Do all 401(k) plans allow these types of distributions?

Is it a per child or is it a one-time event?

Can you repay the money to your retirement account at a future date?

How does it apply to adoptions?

This article will provide you with answers to these questions and also provide families with advanced tax strategies to reduce the tax impact of these distributions.

SECURE Act

The SECURE Act was passed in December 2019 and Section 113 of the Act added a new exception to the 10% early withdrawal penalty for taking distributions from retirement accounts called the “Qualified Birth or Adoption Distribution.”

Prior to the SECURE Act, if you were under the age of 59½ and you distributed pre-tax money from an IRA or 401(k) plan, in addition to having to pay ordinary income tax on the amount distributed, you were also hit with a 10% early withdrawal penalty from the IRS. The IRS prior to the SECURE Act did have a list of exceptions to the 10% penalty but having a child or adopting a child was not on that list. Now it is.

How It Works

After the birth of a child, a parent is allowed to distribute up to $5,000 out of either an IRA or a 401(k) plan. Notice the word “after”. You are not allowed to withdraw the money prior to the child being born. New parents have up to 12 months following the date of birth to process the distribution from their retirement accounts and avoid the 10% early withdrawal penalty.

Example: Jim and Sarah have their first child on May 5, 2020. To help with some of the additional costs of a larger family, Jim decides to withdraw $5,000 out of his rollover IRA. Jim’s window to process that distribution is between May 5, 2020 – May 4, 2021.

The Tax Hit

Assuming Jim is 30 years old, he would avoid having to pay the 10% early withdrawal penalty on the $5,000 but that $5,000 still represents taxable income to him in the year that the distribution takes place. If Jim and Sarah live in New York and make a combined income of $100,000, in 2020, that $5,000 would be subject to federal income tax of 22% and state income tax of 6.45%, resulting in a tax liability of $1,423.

Luckily under the current tax laws, there is a $2,000 federal tax credit for dependent children under the age of 17, which would more than offset the total 22% in fed tax liability ($1,100) created by the $5,000 distribution from the IRA. Essentially reducing the tax bill to $323 which is just the state tax portion.

TAX NOTE: While the $2,000 fed tax credit can be used to offset the federal tax liability in this example, if the IRA distribution was not taken, that $2,000 would have reduced Jim & Sarah’s existing tax liability dollar for dollar.

For more info on the “The Child Tax Credit” see our article: More Taxpayers Will Qualify For The Child Tax Credit

$5,000 Per Parent

But it gets better. The $5,000 limit is available to EACH parent meaning if both parents have a pre-tax IRA or 401(k) plan, they can each distribute up to $5,000 from their retirement accounts within 12 months following the birth of their child and avoid the 10% early withdrawal penalty.

ADVANCED TAX STRATEGY: If both parents are planning to distribute the full $5,000 out of their retirement accounts and they are in a medium to high tax bracket, it may make sense to split the two distributions between separate tax years.

Example: Scott and Linda have a child on October 3, 2020 and they both plan to take the full $5,000 out of their IRA accounts. If they are in a 24% federal tax bracket and they process both distributions prior to December 31, 2020, the full $10,000 would be taxable to them in 2020. This would create a $2,400 federal tax liability. Since this amount is over the $2,000 child tax credit, they will have to be prepared to pay the additional $400 federal income tax when they file their taxes since it was not fully offset by the $2,000 tax credit.

In addition, by taking the full $10,000 in the same tax year, Scott and Linda also run the risk of making that income subject to a higher tax rate. If instead, Linda processes her distribution in November 2020 and Scott waits until January 2021 to process his $5,000 IRA distribution, it could result in a lower tax liability and less out of pocket expense come tax time.

Remember, you have 12 months following the date of birth to process the distribution and qualify for the 10% early withdrawal exemption.

$5,000 For Each Child

This 10% early withdrawal exemption is available for each child that is born. It does not have a lifetime limit.

Example: Building on the Scott and Linda example above, they have their first child October 2020, and both of them process a $5,000 distribution from their IRA’s avoiding the 10% penalty. They then have their second child in November 2021. Both Scott and Linda would be eligible to withdraw another $5,000 each out of their IRA or 401(k) within 12 months after the birth of their second child and again avoid having to pay the 10% early withdrawal penalty.

IRS Audit

One question that we have received is “Do I need to keep track of what I spend the money on in case I’m ever audited by the IRS?” The short answer is “No”. The new law does not require you to keep track of what the money was spent on. The birth of your child is the “qualifying event” which makes you eligible to distribute the $5,000 penalty free.

Not All 401(k) Plans Will Allow These Distributions

Starting in 2020, this 10% early withdrawal exception will apply to all pre-tax IRA accounts but it does not automatically apply to all 401(k), 403(b), or other types of qualified employer sponsored retirement plans.

While the SECURE Act “allows” these penalty free distributions to be made, companies can decide whether or not they want to provide this special distribution option to their employees. For employers that have existing 401(k) or 403(b) plans, if they want to allow these penalty free distributions to employees after the birth of a child, they will need to contact their third-party administrator and request that the plan be amended.

For companies that intend to add this distribution option to their plan, they may need to be patient with the timeline for the change. 401(k) providers will most likely need to update their distribution forms, tax codes on their 1099R forms, and update their recordkeeping system to accommodate this new type of distribution.

Ability To Repay The Distribution

The new law also offers parents the option to repay the amounts to their retirement account that were distributed due to a qualified birth or adoption. The repayment of the amounts previously distributed from the IRA or 401(k) would be in addition to the annual contribution limits. There is not a lot of clarity at this point as to how these “repayments” will work so we will have to wait for future guidance from the IRS on this feature.

Adoptions

The 10% early withdrawal exception also applies to adoptions. An individual is allowed to take a distribution from their retirement account up to $5,000 for any children under the age of 18 that is adopted. Similar to the timing rules of the birth of a child, the distribution must take place AFTER the adoption is finalized, but within 12 months following that date. Any money distributed from retirement accounts prior to the adoption date will be subject to the 10% penalty for individuals under the age of 59½.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.