Gifting Your House with a Life Estate vs. Medicaid Trust

I recently published an article called “Don’t Gift Your House To Your Children” which highlighted the pitfalls of gifting your house to your kids versus setting up a Medicaid Trust to own your house, as an asset protection strategy to manage the risk of a long-care care event taking place in the future. That article prompted a few estate attorneys to reach out to me to present a third option which involves gifting your house to your children with a life estate. While the life estate does solve some of the tax issues of gifting the house to your kids with no life estate, there are still issues that persist even with a life estate that can be solved by setting up a Medicaid trust to own your house.

I recently published an article titled “Don’t Gift Your House To Your Children” which highlighted the pitfalls of gifting your house to your kids versus setting up a Medicaid Trust to own your house, as an asset protection strategy to manage the risk of a long-care care event taking place in the future. That article prompted a few estate attorneys to reach out to me to present a third option which involves gifting your house to your children with a life estate. While the life estate does solve some of the tax issues of gifting the house to your kids with no life estate, there are still issues that persist even with a life estate that can be solved by setting up a Medicaid trust to own your house.

In this article, I will cover the following topics:

What is a life estate?

What is the process of gifting your house with a life estate?

How does the life estate protect your assets from the Medicaid spend-down process?

Tax issues associated with a life estate

Control issues associated with a life estate

Comparing the life estate strategy to setting up a Medicaid Trust to own your house

3 Asset Protection Strategies

There are three main asset protection strategies when it comes to protecting your house from the Medicaid spend-down process triggered by a long-term care event:

Gifting your house to your children

Gifting your house to your children with a life estate

Gifting your house to a Medicaid Trust

Gifting Your House To Your Children

Gifting your house outright to your children without a life estate is probably the least advantageous of the three asset protection strategies. While gifting your house to your kids may be a successful strategy for getting the house out of your name to begin the Medicaid 5-Year Lookback Period, it creates a whole host of tax and control issues that can arise both while you are still alive and when your children inherit your house after you pass away.

Note: The primary residence is not usually a countable asset for purposes of Medicaid BUT some counties may place a lien against the property for any payments that Medicaid makes on your behalf for long-term care services. While Medicaid can’t make you sell the house while you are still alive, once you pass away, Medicaid may be waiting to recoup the money they paid, so your house ends up going to Medicaid instead of passing to your children.

Here is a quick list of the issues:

No Control: When you gift your house to your kids, you no longer have any control of that asset, meaning if the kids wanted to, they could sell the house whenever they want without your permission.

Tax Issue If You Sell Your House: If you gift your house to your kids and then you sell your house while you are still alive it creates numerous issues. First, from a tax standpoint, if you sell your house for more than you purchased it for, your children have to pay tax on the gain in the house. Normally, when you sell your primary residence, a single filer can exclude $250,000 of gain and a married filer can exclude $500,000 of gain from taxation. However, since your kids own the house, and it’s not their primary residence, you lose the exclusion, and your kids have to pay tax on the property as if it was an investment property.

No Step-up In Cost Basis: When you gift an asset to your kids while you are still alive, they inherited your cost basis in the property, meaning if you paid $100,000 for your house 30 years ago, their cost basis in your house is $100,000. After you pass away, your children do not receive a step-up in cost basis, which means when they go to sell the house, they have to pay tax on the full gain amount of the property. If your kids sell your house for $500,000 and you purchase it for $100,000, they could incur a $60,000+ tax bill.

Life Estate Option

Now let’s move on to option #2, gifting your house to your kids with a life estate. What is a life estate? A life estate allows you to gift your house to your children but you reserve the right to live in your house for the rest of your life, and your children cannot sell the house while you are still alive without your permission.

Here are the advantages of gifting your house with a life estate versus gifting your house without a life estate:

More Control: The life estate gives the person gifting the house more control because your kids cannot make you sell your house against your will while you are still alive.

Medicaid Protection: Similar to the outright gift your kids, a gift with a life estate, allows you to begin the Medicaid 5-year look back on your primary residence so a lien cannot be placed against the property if a long-term care event occurs.

Step-up in Cost Basis: One of the biggest advantages of the life estate is that the beneficiaries of your estate receive a step-up in costs basis when they inherit your house. If you purchase your house for $100,000 30 years ago but your house is worth $500,000 when you pass away, your children receive a step-up in the cost basis to the $500,000 fair market value when you pass, meaning if they sell the house the next day for $500,000, there are no taxes due on the full $500,000. This is because when you pass away, the life estate expires, and then your house passes through your estate, which allows the step-up in basis to take place.

Lower-Cost Option: Gifting your house to your children with a life estate only requires a simple deed change which may be a lower-cost option compared to the cost of setting up a Medicaid Trust which can range from $1,500 - $5,000.

Disadvantages of Life Estate

However, there are numerous disadvantages associated with life estates:

Control Problems If You Want To Sell Your House: While the life estate allows you to live in the house for the rest of your life, you give up control as to whether or not you can sell your house while you are still alive. If you want to sell your house while you are still alive, you, and ALL of your children that have a life estate, would all have to agree to sell the house. If you have three children and they all share in the life estate, if one of your children will not agree to sell the house, you won’t be able to sell it.

Tax Problem If You Sell It: If you want to sell your house while you are still alive and all of your children with the life estate agree to the sale, it creates a tax issue similar to the outright gift to your kids without a life estate. Since you gifted the house to your kids, they inherited your cost basis in the property and would not be eligible for the primary gain exclusion of $250,000 / $500,000, so they would have to pay tax on the gain.

One slight difference, the life estate that you retained has value when you sell the house, so if you sell your house for $500,000, depending on the life expectancy tables, your life estate may be worth $50,000, so that $50,000 would be returned to you, and your children would receive the remaining $450,000.

Medicaid Eligibility Issue: Building on the house sale example that we just discussed, if you sell your house, and the value of your life estate is paid to you, if you or your spouse are currently receiving Medicaid benefits, it could put you over the asset allowance, and make you or your spouse ineligible for Medicaid.

Even if you are not receiving Medicaid benefits when you sell the house, the cash coming back to you would be a countable asset subject to the Medicaid 5-Year Lookback period, so the proceeds from the house may now become an asset that needs to be spent down if a long-term care event happens within the next 5 years.

Your Child’s Financial Problems Become Your Problem: If you gift your house to your children with a life estate, similar to an outright gift, you run the risk that your child’s financial problems may become your financial problem. Since they have an ownership interest in your house, their ownership interest could be exposed to personal lawsuits, divorce, and/or tax liens.

Your Child Predeceases You: If your child dies before you, their ownership interest in your house could be subject to probate, and their ownership interest could pass to their spouse, kids, or other beneficiaries of their estate which might not have been your original intention.

Medicaid Trust

Setting up a Medicaid Trust to protect your house from a long-term care event solves many of the issues that arise compared to gifting your house to your children with a life estate.

Control: You can include language in your trust documents that would allow you to live in your house for the rest of your life and your trustee would not have the option of selling the house while you are still living.

Protection From Medicaid: If you gift your house to a grantor irrevocable trust, otherwise known as a Medicaid Trust, you will have made a completed gift in the eyes of Medicaid, and it will begin the Medicaid look back period.

Step-up In Cost Basis: Since it’s a grantor trust, when you pass away, your house will go through your estate, and your beneficiaries will receive a step-up in cost basis.

Retain The Primary Residence Tax Exclusion: If you decide to sell your house in the future, since it’s a grantor trust, you preserve the $250,000 / $500,000 capital gain exclusion when you sell your primary residence.

Ability to Choose 1 or 2 Trustees: When you set up your trust, you will have to select at least 1 trustee, the trustee is the person that oversees the assets that are owned by the trust. If you have multiple children, you have the choice to designate one of the children as trustee, so if you want to sell your house in the future, only your child that is trustee would need to authorize the sale of the house. You do not need to receive approval from all of your children like you would with a life estate.

Protected From Your Child’s Financial Problems: It’s common for parents to list their children as beneficiaries of the trust, so after they pass, the house passes to them. But the trust is the owner of the house, not your children, so it protects you from any financial troubles that could arise from your children since they are not currently owners of the house.

Protect House Sale Proceeds from Medicaid: If your trust owns the house and you sell the house while you are still alive, at the house closing, they would make the check payable to your trust, and your trust could either purchase your next house, or you could set up an investment account owned by your trust. The key planning item here is the money never leaves your trust. As soon as the money leaves your trust, it’s no longer protected from Medicaid, and you would have to restart the Medicaid look back period.

A Trust Can Own Other Assets: Trusts can own other assets besides real estate. A trust can own an investment account, savings account, business interest, vehicle, and other assets. The only asset a trust typically cannot own is a retirement account like an IRA or 401(k) account. For individuals that have more than just a house to protect from Medicaid, a trust may be the ideal solution.

Comparing Asset Protection Strategies

When you compare the three Medicaid asset protection options:

Gifting your house to your children

Gifting your house to your children with a life estate

Gifting your house to a Medicaid Trust

The Medicaid Trust tends to offer individuals a higher degree of control, flexibility, tax efficiency, and asset protection compared to the other two options. The reason why people will sometimes shy away from setting up a trust is the cost. You typically have to retain the services of a trust and estate attorney to set up your trust which may cost between $1,500 - $5,000. The cost varies depending on the attorney that you use and the complexity of your trust.

Does A Trust Have To File A Tax Return

For individuals that are using the Medicaid trust to protect just their primary residence, their only cost may be to set up the trust without the need for an annual trust tax filing because a primary residence is usually not an income-producing property. However, if your trust owns assets other than your primary residence, depending on the level of income produced by the trust assets, an annual tax filing may be required each year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Top 10: Little-Known Facts About 529 College Savings Accounts

While 529 college savings accounts seem relatively straightforward, there are a number of little-known facts about these accounts that can be used for advanced wealth planning, tax strategy, and avoiding common pitfalls when taking distributions from these college savings accounts.

While 529 college savings accounts seem relatively straightforward, there are a number of little-known facts about these accounts that can be used for advanced wealth planning, tax strategy, and avoiding common pitfalls when taking distributions from these accounts.

1: Roth Transfers Will Be Allowed Starting in 2024

Starting in 2024, the IRS will allow direct transfers from 529 accounts to Roth IRAs. This is a fantastic new benefit that opens up a whole new basket of multi-generation wealth accumulation strategies for families.

2: Anyone Can Start A 529 Account For A Child

Do you have to be the parent of the child to open a 529 account? No. 529 account can be opened by parents, grandparents, aunts, or friends. Even if a parent has already established a 529 for their child there is no limit to the number of 529 accounts that can be opened for a single beneficiary.

3: State Tax Deduction For Contributions

There are currently 38 states that offer either state tax deductions or tax credits for contributions to 529 accounts. Here is the list. There are no federal tax deductions for contributions to 529 accounts. Also, you don’t have to be the parent of the child to receive the state tax benefits.

4: A Tax Deduction For Kids Already In College

For parents that already have kids in college, if you have not already established a 529 account and you are issuing checks for college tuition, for states that offer tax deductions for contributions, you may be able to open a 529 account, contribute to the account up to the state tax deduction limit, and as soon as the check clears, request a distribution to pay the college expenses. This allows you to capture the state tax deduction for the contributions to the account in that tax year.

5: Rollovers Count Toward State Tax Deduction

If you just moved to New York and have a 529 with another state, like Vermont, you are allowed to roll over the balance of the Vermont 529 account into a New York 529 account for the same beneficiary and those rollover amounts count toward the state tax deduction for that year. We had a New York client that had a Vermont 529 for their daughter with a $30,000 balance, and we had them rollover $10,000 per year over a 3-year period to capture the maximum NYS 529 state tax deduction of $10,000 each year.

6: Not All States Allow Distributions for K – 12 Tuition Expenses

In 2018, the federal government changes the tax laws allowing up to $10,000 to be distributed from a 529 account each year to pay for K – 12 tuition expenses. However, if you live in a state that has state income taxes, states are not required to adopt changes that are made at the federal level. There are a number of states, including New York, that do not recognize K – 12 tuition expenses as qualified expenses so the earnings portion of those withdrawals would be subject to state income tax and recapture of the tax deductions that were awarded for those contributions.

7: Transfers Between Beneficiaries

529 rules can vary state by state but most 529 accounts allow account owners to transfer all or a portion of balances between 529 account with different beneficiaries. This is common for families that have multiple children and a 529 account for each child. If the oldest child does not use their full 529 balance, all or a portion of their 529 account can be transferred the 529 accounts of their younger siblings.

8: Contributions Can Be Withdrawn Tax and Penalty Free

If you ever need to withdraw money from a 529 account that is not used for qualified college expenses, ONLY the earnings are subject to taxes and the 10% penalty. The contributions that you made to the account can always be withdrawn tax and penalty-free.

9: 529 Accounts May Reduce College Financial Aid

The balance in a 529 account that is owned by the parent of the student counts against the FAFSA calculation. Fortunately, assets of the parents only count 5.64% against the financial aid award, so if you have a $50,000 balance, it may only reduce the financial aid award by $2,820. However, 529 accounts owned by a grandparent or another relative, are invisible to the FAFSA calculation.

10: Maximum Balance Restrictions

529 plans do not have annual contribution limits but each state has “aggregate 529 plan limits”. These limits apply to the total 529 balances for any single 529 beneficiary in a particular state. Once the combined 529 plan balances for that beneficiary reach a state’s aggregate limit, no additional contributions can be made to any 529 plan administered by that state. Luckily, the limits for most states are very high. For example, the New York limit is $520,000 per beneficiary.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Don’t Gift Your House To Your Children

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

A common financial mistake that I see people make when attempting to protect their house from a long-term care event is gifting their house to their children. While you may be successful at protecting the house from a Medicaid spend-down situation, you will also inadvertently be handing your children a huge tax liability after you pass away. A tax liability, that with proper planning, could be avoided entirely.

Asset Protection Strategy

As individuals enter their retirement years, they become rightfully more concerned about a long-term care event happening at some point in the future. The most recent statistic that I saw stated that “someone turning age 65 today has almost a 70% chance of needing some type of long-term care services at some point in the future” (Source: longtermcare.gov).

Long-term care is expensive, and most states require you to spend down your countable assets until you reach a level where Medicaid starts to pick up the tab. Different states have different rules about the spend-down process. However, there are ways to protect your assets from this Medicaid spend-down process.

In New York, the primary residence is not subject to the spend-down process but Medicaid can place a lien against your estate, so after you pass, they force your beneficiaries to sell the house, so Medicaid can recoup the money that they paid for your long-term care expenses. Since most people would prefer to avoid this situation and have their house passed to their children, they we'll sometimes gift the house to their kids while they're still alive to get it out of their name.

5 Year Look Back Rule

Gifting your house to your kids may be an effective way to protect the primary residence from a Medicaid lien, but this has to be done well before the long-term care event. In New York, Medicaid has a 5-year look back, which means anything that was gifted away 5 years before applying for Medicaid is back on the table for the spend down and Medicaid estate lien. However, if you gift your house to your kids more than 5 years before applying for Medicaid, the house is completely protected.

Tax Gifting Rules

So what’s the problem with this strategy? Answer, taxes. When you gift someone a house, they inherit your cost basis in the property. If you purchased your house 30 years ago for $100,000, you gift it to your children, and then they sell the house after you pass for $500,000; they will have to pay tax on the $400,000 gain in the value of the house. It would be taxed at a long-term capital gains rate, but for someone living in New York, tax liability might be 15% federal plus 7% state tax, resulting in a total tax rate of 22%. Some quick math:

$400,000 gain x 22% Tax Rate = $88,000 Tax Liability

Medicaid Trust Solution

Good news: there is a way to altogether avoid this tax liability to your beneficiaries AND protect your house from a long-term care event by setting up a Grantor Irrevocable Trust (Medicaid Trust) to own your house. With this solution, you establish an Irrevocable Trust to own your house, you gift your house to your trust just like you would gift it to your kids, but when you pass away, your house receives a “step-up in cost basis” prior to it passing to your children. A step-up in cost basis means the cost basis of that asset steps up the asset’s value on the day you pass away.

From the earlier example, you bought your house 30 years ago for $100,000, and you gift it to your Irrevocable Trust; when you pass away, the house is worth $500,000. Since a Grantor Irrevocable Trust owned your house, it passes through your estate, receives a step-up to $500,000, and your children can sell the house the next day and have ZERO tax liability.

The Cost of Setting Up A Medicaid Trust

So why doesn’t every one set up a Medicaid Trust to own their house? Sometimes people are scared away by the cost of setting up the trust. Setting up the trust could cost between $2,000 - $10,000 depending on the trust and estate attorney that you engage to set up your trust. Even though there is a cost to setting up the trust, I always compare that to the cost of not setting up your trust and leaving your beneficiaries with that huge tax liability. In the example we looked at earlier, paying the $3,000 to set up the trust would have saved the kids from having to pay $88,000 in taxes when they sold the house after you passed.

Preserves $500,000 Primary Residence Exclusion

By gifting your house to a grantor irrevocable trust instead of your children, you also preserve the long-term capital gain exclusion allowance if you decide to sell your house at some point in the future. When you sell your primary residence, you are allowed to exclude the following gain from taxation depending on your filing status:

Single Filer: $250,000

Joint Filer: $500,000

If you gift your house to your children and then five years from now, you decide to sell your house for whatever reason while you are still alive, it would trigger a tax event for your kids because they technically own your house, and it’s not their primary residence. By having your house owned by your Grantor Irrevocable Trust, if you were to sell your house, you would be eligible for the primary residence gain exclusion, and the trust could either buy your next house or you could deposit the proceeds to a trust account so the assets never leave the trust and remain protected for the 5-year lookback rule.

How Do Medicaid Trusts Work?

This article was meant to highlight the pitfall of gifting your house to your kids; however, if you would like to learn more about the Medicaid Trust solution and the Medicaid spend down process, please feel free to watch our videos on these topics below:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

3 New Startup 401(k) Tax Credits

When Congress passed the Secure Act 2.0 in December 2022, they introduced new tax credits and enhanced old tax credits for startup 401(k) plans for plan years 2023 and beyond. There are now 3 different tax credits that are available, all in the same year, for startup 401(k) plans that now only help companies to subsidize the cost of sponsoring a retirement plan but also to offset employer contributions made to the employee to enhance a company’s overall benefits package.

When Congress passed the Secure Act 2.0 in December 2022, they introduced new tax credits and enhanced old tax credits for startup 401(k) plans. There are now 3 different tax credits that are available for startup 401(k) plans that were put into place to help companies to subsidize the cost of sponsoring a retirement plan and also to subsidize employer contributions made to the employees to enhance the company’s overall benefits package. Here are the 3 startup 401(k) credits that are now available to employers:

Startup Tax Credit (Plan Cost Credit)

Employer Contribution Tax Credit

Automatic Enrollment Tax Credit

Startup Tax Credit

To incentivize companies to adopt an employer-sponsored retirement plan for their employees, Secure Act 2.0 enhanced the startup tax credits available to employers starting in 2023. This tax credit was put into place to help businesses offset the cost of establishing and maintaining a retirement plan for their employees for the first 3 years of the plan’s existence. Under the new Secure 2.0 credit, certain businesses will be eligible to receive a tax credit for up to 100% of the annual plan costs.

A company must meet the following requirement to be eligible to capture this startup tax credit:

The company may have no more than 100 employees who received compensation of $5,000 or more in the PRECEDING year; and

The company did not offer a retirement plan covering substantially the same employees during the PREVIOUS 3 YEARS.

The plan covers at least one non-HCE (non-Highly Compensated Employee or NHCE)

To identify if you have a NHCE, you have to look at LAST YEAR’s compensation and both this year’s and last year’s ownership percentage. For the 2023 plan year, a NHCE is any employee that:

Does NOT own more than 5% of the company; and

Had less than $135,000 in compensation in 2022. For the compensation test, you look back at the previous year’s compensation to determine who is a HCE or NHCE in the current plan year. For 2023, you look at 2022 compensation. The IRS typically increases the compensation threshold each year for inflation.

A note here about “attribution rules”. The IRS is aware that small business owners have the ability to maneuver around ownership and compensation thresholds, so there are special attribution rules that are put into place to limit the “creativity” of small business owners. For example, ownership is shared or “attributed” between spouses, which means if you own 100% of the business, your spouse that works for the business, even though they are not an owner and only earn $30,000 in W2, they are considered a HCE because they are attributed your 100% ownership in the business.

Besides just attribution rules, employer-sponsored retirement plans also has control group rules, affiliated service group rules, and other fun rules that further limit creativity. Especially for individuals that are owners of multiple businesses, these special 401(k) rules can create obstacles when attempting to qualify for these tax credits. Bottom line, before blindly putting a retirement plan in place to qualify for these tax credits, make sure you talk to a professional within the 401(k) industry that understands all of these rules.

401(k) Startup Tax Credit Amount

Let’s assume your business qualifies for the 401(k) startup tax credit, what is the amount of the tax credit? Here are the details:

For companies with 50 employees or less: The credit covers 100% of the company’s plan costs up to an annual limit of the GREATER of $500 or $250 multiplied by the number of plan-eligible NHCE, up to a maximum credit of $5,000.

For companies with 51 to 100 employees: The credit covers 50% of the company’s plan costs up to an annual limit of the GREATER of $500 or $250 multiplied by the number of plan-eligible NHCE, up to a maximum credit of $5,000.

This is a federal tax credit that is available to eligible employers for the first 3 years that the new plan is in existence. If you have enough NHCE’s, you could technically qualify for $5,000 each year for the first 3 years that the retirement plan is in place.

A note on the definition of “plan-eligible NHCEs”. These are NHCEs that are also eligible to participate in your plan in the current plan year. NHCEs that are not eligible to participate because they have yet to meet the eligibility requirement, do not count toward the max credit calculation.

What Type of Plan Costs Qualify For The Credit?

Qualified costs include costs paid by the employer to:

Setup the Plan

Administer the Plan (TPA Fees)

Recordkeeping Fees

Investment Advisory Fees

Employee Education Fees

To be eligible for the credit, the costs must be paid by the employer directly to the service provider. Fees charged against the plan assets or included in the mutual fund expense ratios do not qualify for the credit. Since historically many startup plans use 401(k) platforms that utilize higher expense ratio mutual funds to help subsidize some of the out-of-pocket cost to the employer, these higher tax credits may change the platform approach for start-up plans because the employer and the employee may both be better off by utilizing a platform with low expense ratio mutual funds, and the employer pays the TPA, recordkeeping, and investment advisor fees directly in order to qualify for the credit.

Note: It’s not uncommon for the owners of the company to have larger balances in the plan compared to the employees, so they also benefit by not having the plan fee paid out of plan assets.

Startup Tax Credit Example

A company has 20 employees, 2 HCEs and 18 NHCEs, and all 20 employees are currently eligible to participate in the new 401(k) plan that the company just started in 2023. During 2023, the company paid $3,000 in total plan fees directly to the TPA firm, investment advisor, and recordkeeper of the plan. Here is the credit calculation:

18 Eligible NHCEs x $250 = $4,500

Total 401(k) Startup Credit for 2023 = $3,000

Even though this company would have been eligible for a $4,500 tax credit, the credit cannot exceed the total fees paid by the employer to the 401(k) service providers, and the total plan fees in this example were $3,000.

No Carry Forward

If the company incurs plan costs over and above the credit amount, the new tax law does not allow plan costs that exceed the maximum credit to be carried forward into future tax years.

Solo(k) Plans Are Not Eligible for Startup Tax Credit

Due to the owner-only nature of a Solo(K) plan, there would not be any NHCEs in a Solo(K) plan, so they would not be eligible for the startup tax credit.

401(k) Employer Contribution Tax Credit

This is a new tax credit starting in 2023 that will provide companies with a tax credit for all or a portion of the employer contribution that is made to the 401(k) plan for employees earning no more than $100,000 in compensation.

The eligible requirement for this employer contribution credit is similar to that of the startup tax credit with one difference:

The company may have no more than 100 employees who received compensation of $5,000 or more in the PRECEDING year; and

The company did not offer a retirement plan covering substantially the same employees during the PREVIOUS 5 YEARS.

The plan makes an employer contribution for at least one employee whose annual compensation is not above $100,000.

Employer Contribution Tax Credit Calculation

The maximum credit is assessed on a per-employee basis and for each employee is the LESSER of:

Actual employer contribution amount; or

$1,000 for each employee making $100,000 or less in FICA wages

$1,000 Per Employee Limit

The $1,000 limit is applied to each INDIVIDUAL employee’s employer contribution. It is NOT a blindfolded calculation of $1,000 multiped by each of your employees under $100,000 in comp regardless of the amount of their actual employer contribution.

For example, Company RTE has two employees making under $100,000 per year, Sue and Rick. Sue receives an employer contribution of $3,000 and Rick received an employer contribution of $400. The max employer contribution credit would be $1,400, $400 for Rick’s employer contribution, and $1,000 for Sue’s contribution since she would be subject to the $1,000 per employee cap.

S-Corp Owners

As mentioned above, the credit only applies to employees with less than $100,000 in annual compensation but what about S-corp owners? The only compensation that is taken into account for S-corp owners for purposes of retirement plan contributions is their W2 income. So what happens when an S-corp owner has W2 income of $80K but takes a $500,000 dividend from the S-corp? Good news for S-corp owners, the $100,000 comp threshold only looks at the plan compensation which for S-corp owners is just their W2 income, so an employer contribution for an S-corp would be eligible for this credit as long as their W2 is below $100,000 but they would still be subject to the $1,000 per employee cap.

5-Year Decreasing Scale

Unlike the startup tax credit that stays the same for the first 3 years of the plan’s existence, the Employer Contribution Tax Credit decreases after year 2 but lasts for 5 years instead of just 3 years. Similar to the startup tax credit, there is a deviation in the calculation depending on whether the company has more or less than 50 employees.

For companies that have 50 or fewer employees, the employer contribution tax credit phase-down schedule is as follows:

Year 1: 100%

Year 2: 100%

Year 3: 75%

Year 4: 50%

Year 5: 25%

50 or Less Employee Example

Company XYZ starts a new 401(k) plan for their employees in 2023 and offers a safe harbor employer matching contribution. The company has 20 eligible employees, 18 of the 20 are making less than $100,000 for the year in compensation, all 18 employees contribute to the plan and each employee is eligible for a $1,250 employer matching contribution.

Since the tax credit is capped at $1,000 per employee, that credit would be calculated as follows:

$1,000 x 18 Employees = $18,000

The total employer contribution for these 18 employees would be $1,250 x 18 = $22,250 but the company would be eligible to receive a tax credit in year 1 for $18,000 of the $22,250 that was contributed to the plan on behalf of these 18 employees in Year 1.

Note: If an employee only receives a $600 employer match, the tax credit for that employee is only $600. The $1,000 per employee cap only applies to employees that receive an employer contribution in excess of $1,000.

51 to 100 Employees

For companies with 51 – 100 employees, the employer contribution credit calculation is slightly more complex. Same 5 years phase-down schedule as the 1 – 50 employee companies but the amount of the credit is reduced by 2% for EACH employee over 50 employees. To determine the amount of the discount you multiply 2% by the number of employees that the company has over 50, and then subtract that amount from the full credit percentage that is available for that plan year.

For example, a new startup 401K has 80 employees, and they are in Year 1 of the 5-year discount schedule, the tax credit would be calculated as follows:

100% - (2% x 30 EEs) = 40%

So instead of receiving a 100% tax credit for the eligible employer contributions for the employees making under $100,000 in compensation, this company would only receive a 40% tax credit for those employer contributions.

Calculation Crossroads

There is a second step in this employer contribution tax credit calculation for companies with 51 – 100 that has the 401(K) industry at a crossroads and will most likely require guidance from the IRS on how to properly calculate the tax credit for these companies when applying the $1,000 per employee cap.

I’m seeing very reputable TPA firms (third-party administrators) run the second half of this calculation differently based on their interpretation of WHEN to apply the $1,000 per employee cap and it creates different results in the amount of tax credit awarded.

Calculation 1: Some firms are applying the $1,000 per employee cap to the employer contributions BEFORE the discounted tax credit percentage is applied.

Calculation 2: Other firms apply the $1,000 per employee cap AFTER the discounted tax credit is applied to each employee’s employer contribution for purposes of assessing the $1,000 cap per employee.

I’ll show you why this matters in a simple example just using 2 employees:

Sue and Peter both make under $100,000 in compensation and work for Company ABC which has 80 employees. Company ABC just implemented a 401(K) plan this year with an employer matching contribution, both Sue and Peter contribute to the plan, Sue is entitled to a $1,300 matching contribution and Peter is entitled to a $900 matching contribution.

Since the company has over 80 employees, the company is only entitled to a 40% credit for the eligible employer contribution:

100% - (2% x 30 EEs) = 40%

Calculation 1: If Company ABC applies the $1,000 per employee limit BEFORE applying the 40% credit, Sue’s contribution would be capped at $1,000 and Peter’s contribution would be $900, resulting in a total employer contribution of $1,900. To determine the credit amount:

$1,900 x 40% = $760

Calculation 2: If Company ABC applies the $1,000 per employee limit AFTER applying the 40% credit:

Sue: $1,300 x 40% = $520

Peter: $900 x 40% = $360

Total Credit = $880

Calculation 2 naturally produces a high tax credit because the credit amount is being applied against Sue’s total employer contribution of $1,300 which is then bringing her contribution in the calculation below the $1,000 per employee limit.

Which calculation is right? At this point, I have no idea. We will have to wait and see if we get guidance from the IRS.

Capturing Both Tax Credits In The Same Year

Companies are allowed to claim both the 401(K) Startup Tax Credit and the Employer Contribution Tax Credit in the same plan year. For example, you could have a company that establishes a new 401(k) plan in 2023, that qualifies for a $4,000 credit to cover plan costs and another $40,000 credit for employer contributions to total $44,000 in tax credits for the year.

Automatic Enrollment Tax Credit

The IRS and DOL are also incentivizing startup and existing 401(K) plans to adopt automatic enrollment in their plan design by offering an additional $500 credit per year for the first 3 years that this feature is included in the plan. This credit is only available to employers that have no more than 100 employees with at least $5,000 in compensation in the preceding year. The automatic enrollment feature must also meet the eligible automatic contribution arrangement (EACA) requirements to qualify.

For 401(k) plans that started after December 29, 2022, Secure Act 2.0 REQUIRES those plans to adopt an automatic enrollment by 2025. While a new plan could technically opt out of auto-enrollment in 2023 and 2024, since it’s now going to be required starting in 2025, it might be easier just to include that feature in your new plan and capture the tax credit for the next three years.

Note: Automatic enrollment will not be required in 2025 for plans that were in existence prior to December 30, 2022.

Simple IRA & SEP IRA Tax Credits

Both the Startup Tax Credit and Employer Contribution Tax Credits can also be claimed by companies that sponsor Simple IRAs and SEP IRAs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Why Did Silicon Valley Bank Fail? The Contagion Risk

This week, Silicon Valley Bank (SVB), the 16th largest bank in the United States, became insolvent in a matter of 48 hours. The bank now sits in the hands of the FDIC which has sent ripples across the financial markets.

This week, Silicon Valley Bank (SVB), the 16th largest bank in the United States, became insolvent in a matter of 48 hours. The bank now sits in the hands of the FDIC which has sent ripples across the financial markets. In this article, I’m going to address:

What caused SVB to fail?

The contagion risk for the banking sector

The business fallout for start-ups

How this could impact Fed policy

FDIC insurance coverage

Silicon Valley Bank

SVB has been in business for 40 years and at the time of the failure, had about $209 Billion in total assets, ranking it as the 16th largest bank in the U.S., so not a small or new bank. But it’s important to acknowledge that this bank was unique when compared to its peers in the banking sector. This bank was known for its concentrated lending to start-up tech companies and venture capital firms.

SVB Isolated Event?

Before we discuss the contagion factors associated with the SVB failure, there are definitely catalysts for this insolvency that were probably specific just to Silicon Valley Bank. Since the bank had such a high concentration of lending practices to start-ups and venture capital firms, that in itself exposed the bank to higher risk when comparing it to traditional bank lending practices. While most major banks in some form or another, lend money to start-up companies, it’s typically not a high percentage of their overall loan portfolio. Over the years, Silicon Valley Bank has become known as the “go-to lender” for start-ups and venture capital firms.

What is a venture capital firm?

Venture capital firms, otherwise known as “VC’s”, are large investment companies that essentially raise money, and then invest that capital primarily and start-up companies. Venture capital firms will sometimes take loans from banks, like SVB, and then invest that money in start-up companies with the hopes of earning a superior rate of return. For example, a venture capital firm could requests a $50 million loan at a 5% interest rate and then invests that money into 5 different start-up companies, with the hopes of earning a return greater than 5% interest rate that they are paying to the bank.

Start-up lending is risky

Lending money to start-up companies generally carries a higher risk than lending money to long-term, cash-stable companies. It’s not uncommon for start-up companies to be producing little to no revenue because they have a promising business idea that has yet to see wide spread adoption. Then add into the mix, the reality that a lot of these start-up companies fail before reaching profitability.

For this reason, if you have a bank, like SVB that has a high concentration of lending activity to start-ups and venture capital firms, they are naturally going to have more risk than a bank that does not engage in concentrated lending activities to this sector of the market.

A Challenging Market Environment For Start-Ups

In 2020 in 2021, the start-up market was booming because there was so much capital injected into the US economy from the Covid stimulus packages issued by the US government. That favorable liquidity environment changed dramatically in 2022 when inflation got out of control, and then the Federal Reserve started quantitative tightening, essentially pulling that cash back out of the economy. This lack of liquidity and higher interest rates put stress on the start-up industry, who depends, mainly on loans and new capital investment to keep operations going. Given this adverse market environment for start-ups, there has been an increase in the number of start-up defaulting on their loans, running out of cash, and going bankrupt. Since SVB’s loan portfolio is heavily concentrated in that start-up sector of the market, they would naturally feel more pain than their peers that have less exposure.

This gives way to the argument that this could in fact just be an unfortunate isolated incident by a bank that overextended its level of risk to a sector of the market that due to monetary tightening by the Fed has gotten crushed over the past year.

However, in the midst of the failure of SVB, another risk has surfaced that could spell trouble for the rest of the banking industry in the coming weeks.

The Contagion Risk

There is some contagion risk associated with what has happened with the failure of SVB which is why I think you saw a rapid drop in the price of other bank stocks, especially small regional banks, over the past two days. The contagion risk centers around, not their loan portfolio, but rather the assets that SVB was holding as reserves that many other banks hold as well, which rendered them unable to meet the withdrawal request of their depositors, and ultimately created a run on the bank.

The Treasury Bond Issue

When banks take in money from depositors, one of the ways that a bank makes money is by taking those deposits that are sitting on the bank’s balance sheet and investing them in “safe” securities which allow the bank to earn interest on that money until their clients request withdrawals. It’s not uncommon for banks to invest that money in low-risk fixed-income investments like U.S. Treasury Bonds which principal and interest payments are backed by U.S. government.

SVB was holding many of these Treasuries and other fixed-income securities when these start-up companies began to default on their loans which then spooked the individuals and companies that still had money on deposit with SVB, worried that the bank might fail, and they started requesting large withdrawals, which then required SVB to begin selling their fixed income assets to raise cash to meet the redemption requests.

Herein lies the problem. While the value of a U.S. Treasury Bond is backed by the U.S. Government, meaning they promise to hand you back the face value of that bond when it matures, the value of that bond can fluctuate in value while it’s waiting to reach maturity. In other words, if you sell the bond before its maturity date, you could lose money.

The enemy of bond prices is rising interest rates because when interest rates go up, bond prices go down. Over the past 12 months, in an effort to fight inflation, the Fed has increased interest rates bigger and faster than it ever has within the past 50 years. So banks, like SVB, that were most likely buying bonds back in 2017, 2018, and 2019 before interest rates skyrocketed, if they were holding longer duration bonds hoping to hold them to maturity, the prices of those bonds are most likely underwater.

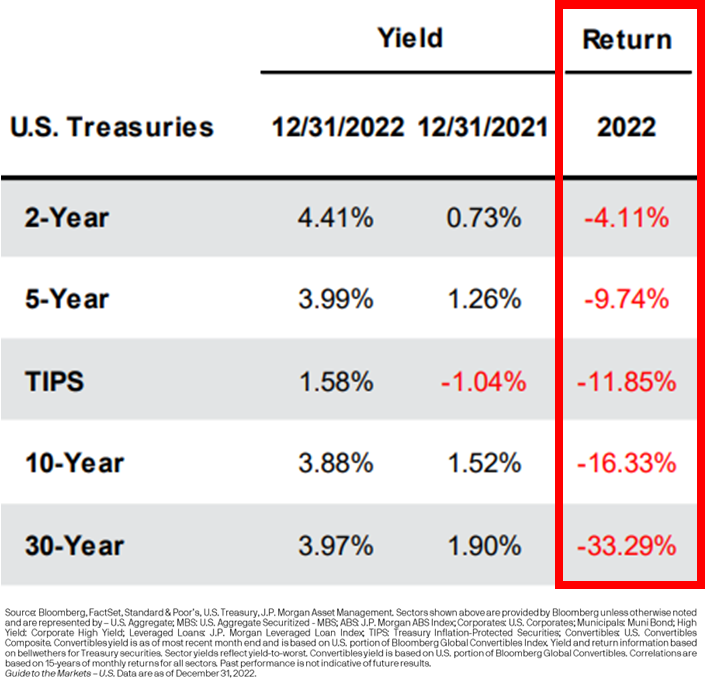

Below is a chart that shows price decline of U.S. Treasury Bonds in 2022 based on the duration of the bonds:

As you can see on the chart, in 2022, the price of a 5 Year US Treasury Bond declined by 9.74% but if you owned a 30 Year U.S. Treasury Bond, the price of that bond declines by 33.29% in 2022. Ouch!!

SVB Forced To Sell Assets At A Bad Time

When a bank needs to raise capital to either make up for loan defaults or because depositors are requesting their cash back, if they do not have enough liquid cash on hand, then they have to begin selling their reserve investments to raise cash. Again, if SVB was buying longer duration bonds back in 2018 and 2019, the intent might have been to hold those bonds until maturity, but the run on their bank forced them to sell those bonds at a loss, so they no longer had the cash to meet the redemption requests.

Will This Problem Spread To Other Banks?

While other banks may not lend as heavily to start-up companies, it is not uncommon at all for banks to purchase Treasuries and other fixed-income securities with their cash reserves. With the economy facing a potential recession in 2023, this has investors asking, what if defaults begin to rise on auto loans, mortgages, and lines of credit during a recession, and then these other banks are forced to liquidate their fixed-income assets at a loss, rendering them unable to meet redemption requests?

Over the next few weeks, this is the exact type of analysis that is probably going to take place at banks across the U.S. banking sector. It’s no longer just a question of “how much does a bank have in reserve assets?” but “What type of assets are being held by the bank and if redemptions increased dramatically would they have the cash to meet those redemption requests?”

The answer may very well be “Yes, there is no reason to panic.” SVB may end up being an isolated incident, not only because they had overexposure to high-risk start-up companies but also because they made poor choices with the fixed-income securities that they purchased with longer durations which compounded the issues when redemptions flooded in and they were forced to sell them at a loss. It’s too early to know for sure so we will have to wait and see.

Change In Fed Policy

This SVB failure could absolutely have an impact on Fed policy. If the Fed realizes that by continuing to push interest rates higher, it could create larger losses in these Treasury cash reserve portfolios at banks across the U.S., a recession shows up, redemptions at banks increase, and then more banks face the same fate as SVB due to the forced selling of those bonds at a loss, it may prompt the Fed to only raise rates by 25bps at the next Fed meeting instead of 50bps.

The reality is we have not seen interest rates rise this fast or by this magnitude within the last 50 years, so the Fed has to be aware that things can begin to break within the U.S. economy that were not intended to break. While getting inflation back down to the 2% - 3% level is the Fed’s primary focus right now, it will be interesting to see if they acknowledge some of these outlier events like SVB failure at the next Fed meeting.

FDIC Insurance

The FDIC has stepped in and taken control of Silicon Valley Bank. Banks have something called FDIC insurance which basically protects an individual’s deposits at a bank up to $250,000 if the bank were to be rendered insolvent. The FDIC saw the run on the bank and basically stepped in to make sure the remainder of the bank’s assets were being preserved as much as possible to meet their $250,000 protection obligation. But there is no protection for individuals and companies that had balances over $250,000 and considering this was a big bank, there are probably a lot of clients of the bank that fall into that category. Not just small companies either. For example, Roku came out on Friday and announced they had approximately $487 Million on deposit with Silicon Valley Bank (Source: CNBC).

The FDIC has issued preliminary guidance that the $250,000 protected amount should be available to depositors for withdrawal but Monday, March 13th, but there has been little to no guidance on what is going to happen to clients of SVB that had balances over $250,000. How much are they going to be able to recoup? When will they have access to that money?

The Business Fallout

Investors are probably going to see a lot of headlines over the next few weeks about businesses not being able to meet payroll or businesses going bankrupt due to SVB failure. Since SVB had a large concentration of start-up companies as clients, this may be more pronounced because many start-ups are not producing enough cash yet to sustain operations. If a company had their business checking account at SVB, depending on the answers from the FDIC as to how much money over the $250,000 they will be able to recoup, and when will they have access to the cash, some of these companies could fold just because they lost access to their cash which is very sad and unfortunate collateral damage from this banking fallout.

Isolated Incident or Contagion?

On the surface, the failure of Silicon Valley Bank may end up being an isolated event that does not spread to the rest of the banking industry but sitting here today, it’s too early to know that for sure. If there are other banks out there that have made similar mistakes by taking on too much duration in their bond portfolio prior to the rapid rise in interest rates, they could potentially face similar redemption problems if the U.S. economy sinks into a recession and defaults and redemption requests start piling up. A lot will depend on the results of these bank asset stress tests, Fed policy, and the direction of the economy over the next 12 months.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

529 to Roth IRA Transfers: A New Backdoor Roth Contribution Strategy Is Born

With the passing of the Secure Act 2.0, starting in 2024, owners of 529 accounts will now have the ability to transfer up to $35,000 from their 529 college savings account directly to a Roth IRA for the beneficiary of the account. While on the surface, this would just seem like a fantastic new option for parents that have money leftover in 529 accounts for their children, it is potentially much more than that. In creating this new rule, the IRS may have inadvertently opened up a new way for high-income earners to move up to $35,000 into a Roth IRA, creating a new “backdoor Roth IRA contribution” strategy for high-income earners and their family members.

With the passing of the Secure Act 2.0, starting in 2024, owners of 529 accounts will now have the ability to transfer up to $35,000 from their 529 college savings account directly to a Roth IRA for the beneficiary of the account. While on the surface, this would just seem like a fantastic new option for parents that have money leftover in 529 accounts for their children, it is potentially much more than that. In creating this new rule, the IRS may have inadvertently opened up a new way for high-income earners to move up to $35,000 into a Roth IRA, creating a new “backdoor Roth IRA contribution” strategy for high-income earners and their family members.

Money Remaining In the 529 Account for Your Children

I will start by explaining this new 529 to Roth IRA transfer provision using the scenario that it was probably intended for; a parent that owns a 529 account for their children, the kids are done with college, and there is still a balance remaining in the 529 account.

The ability to shift money from a 529 account directly to a Roth IRA for your child is a fantastic new distribution option for balances that may be leftover in these accounts after your child or grandchild has completed college. Prior to the passage of the Secure Act 2.0, there were only two options for balances remaining in 529 accounts:

Change the beneficiary on the account to someone else

Process a non-qualified distribution from the account

Both options created potential challenges for the owners of 529 accounts. For the “change the beneficiary option”, what if you only have one child, or what if the remaining balance is in the youngest child’s account? There may not be anyone else to change the beneficiary to.

The second option, processing a “non-qualified distribution” from the 529 account, if there were investment earnings in the account, those investment earnings are subject to taxes and a 10% penalty because they were not used to pay a qualified education expense.

The “Roth Transfer Option” not only gives account owners a third attractive option, but it’s so attractive that planners may begin advising clients to purposefully overfund these 529 accounts with the intention of processing these Roth transfers after the child has completed college.

Requirements for 529 to Roth IRA Transfers

Before I get into explaining the advanced tax and wealth accumulation strategies associated with this new 529 distribution option, like any new tax law, there is a list of rules that you have to follow to be eligible to process these 529 to Roth IRA transfers.

The 15 Year Rule

The first requirement is the 529 account must have been in existence for at least 15 years to be eligible to execute a Roth transfer from the account. The clock starts when you deposit the first dollar into that 529 account. The planning tip here is to fund the 529 as soon as you can after the child is born, if you do, the 529 account will be eligible for Roth IRA transfers by their 15th or 16th birthday.

There is an unanswered question surrounding rollovers between state plans and this 15-year rule. Right now, you are allowed to rollover let’s say a Virginia 529 account into a New York 529 account. The question becomes, since the New York 529 account is a new account, would that end up re-setting the 15-year inception clock?

Contributions Within The Last 5 Years Are Not Eligible

When you go to process a Roth transfer from a 529 account, contributions made to the 529 account within the previous 5 years are not eligible for Roth transfers.

The Beneficiary of the 529 Account and the Owners of the Roth IRA Must Be The Same Person

A third requirement is the beneficiary listed on the 529 account and the owner of the Roth IRA account must be the same person. If your daughter is the beneficiary of the 529 account, she would also need to be the owner of the Roth IRA that is receiving the transfer directly from the 529 account. There is a big question surrounding this requirement that we still need clarification on from the IRS. The question is this: Is the account owner allowed to change the beneficiary on the 529 account without having to re-satisfy a new 15-year account inception requirement?

If they allow beneficiary changes without a new 15-year inception period, with 529 accounts, the account owner can change the beneficiary on these accounts to whomever they want……..including themselves. This would allow a parent to change the beneficiary to themselves on the 529 account and then transfer the balance to their own Roth IRA, which may not be the intent of the new law. We will have to wait for guidance on this.

No Roth IRA Income Limitations

As many people are aware, if you make too much, you are not allowed to contribute to a Roth IRA. For 2023, the ability to make Roth IRA contributions begins to phase out at the following income levels:

Single Filer: $138,000

Married Filer: $218,000

These transfers directly from 529 accounts to the beneficiary’s Roth IRA do not carry the income limitation, so regardless of the income level of the 529 account owner or the beneficiary, there a no maximum income limit that would preclude these 529 to Roth IRA transfers from taking place.

The IRA Owner Must Have Earned Income

With exception of the Roth IRA income phaseout rules, the rest of the Roth RIA rules still apply when determining whether or not a 529 to Roth IRA transfer is allowed in a given tax year. First, the beneficiary of the 529 (also the owner of the Roth IRA) needs to have earned income in the year that the transfer takes place to be eligible to process a transfer from the 529 to their Roth IRA.

Annual 529 to Roth IRA Transfer Limits

The amount that can be transferred from the 529 to the Roth IRA is also limited each year by the regular Roth IRA annual contribution limits. For 2023, an individual under the age of 50, is allowed to make a Roth IRA contribution of up to $6,500. That is the most that can be moved from the 529 account to Roth IRA in a single tax year. But in addition to this hard dollar limit, you have to also take into account any other Roth IRA contributions that were made to the IRA owner’s account and the IRA owners earned income for that tax year.

The annual contribution limit to a Roth IRA for 2023 is actually the LESSER of:

$6,500; or

100% of the earned income of the account owner

Assuming the IRA contribution limits stay the same in 2024, if a child only has $3,000 in income, the maximum amount that could be transferred from the 529 to the Roth IRA in 2024 is $3,000.

If the child made a contribution of their own to the Roth IRA, that would also count against the amount that is available for the 529 to Roth IRA transfer. For example, the child makes $10,000 in earned income, making them eligible for the full $6,500 Roth IRA contribution, but if the child contributes $2,000 to their Roth IRA throughout the year, the maximum 529 to Roth IRA transfer would be $4,500 ($6,500 - $2,000 = $4,500)

The IRA limits could be the same or potentially higher in 2024 when this 529 to Roth IRA transfer option goes into effect.

$35,000 Limiting Maximum Per Beneficiary

The maximum lifetime amount that can be transferred from a 529 to a Roth IRA is $35,000 for each beneficiary. Given the annual contribution limits that we just covered, you would not be allowed to just transfer $35,000 from the 529 to the Roth IRA all in one shot. The $35,000 lifetime limit would be reached after making multiple years of transfers from the 529 to the Roth IRA over a number of tax years.

Advanced 529 Planning Strategies Using Roth Transfers

Now I’m going to cover some of the advanced tax and wealth accumulation strategies that may be able to be executed under this 529 Roth Transfer provision. Disclosure, writing this in February 2023, we are still waiting on guidance from the IRS on what they may or may not have intended with this new 529 to Roth transfer option that becomes available starting in 2024, so their guidance could either reinforce that these strategies can be used or limit the use of these advanced strategies. Time will tell.

Super Funding A Roth IRA For Your Child

While 529 accounts have traditionally been used to save exclusively for future college expenses for your children or grandchild, they just become much more than that. Parents and grandparents can now fund these accounts when a child is young with the pure intention of NOT using the funds for college but rather creating a supercharged Roth IRA as soon as that child begins earning income in their teenage years and into their 20s.

This is best illustrated in an example. You have a granddaughter that is born in 2023, you open a 529 account for her and fund it with $15,000. By the time your granddaughter has reached age 18, let’s assume through wise investment decisions, the account has tripled to $45,000. Between ages 18 and 21, she works a summer job making $8,000 in earned income each year and then gets a job after graduating college making $80,000 per year. Assuming she made no contributions to a Roth IRA over the years, you would be able to make transfers between her 529 account and her Roth IRA up to the annual contribution limit until the total transfers reached the $35,000 lifetime maximum.

If that $35,000 lifetime maximum is reached when she turns age 24, assuming she also makes wise investment decisions and earns 8% per year on her Roth IRA until she reaches age 60, at age 60 she would have $620,000 in that Roth IRA account that could be withdrawal ALL TAX-FREE.

Now multiply that $620,000 across EACH of your children or grandchildren, and it becomes a truly fantastic way to build tax-free wealth for the next generation.

529 Backdoor Roth Contribution Strategy

A fun fact, there are no age limits on either the owner or beneficiary of a 529 account. At the age of 40, I could open a 529 account, be the owner and the beneficiary of the account, fund the account with $15,000, wait the 15 years, and then when I turn age 55, begin processing transfers directly from the 529 to my Roth IRA up to the maximum annual IRA limit each year until I reach my $35,000 lifetime limit.

I really don’t care that the money has to sit in the 529 for 15 years because 529 accumulate tax deferred anyways, and by the time I hit age 59.5, making me eligible for tax-free withdrawal of the earnings, I will have already moved most of the balance over to my Roth IRA. Oh and remember, even if you make too much to contribute directly to a Roth IRA, the income limits do not apply to these 529 to Roth IRA direct transfers.

The IRS may have inadvertently created a new “Backdoor Roth IRA Contribution” strategy for high-income earners.

Now there may be some limitations that can come into play with the age of the individual executing this strategy, it’s really less about their age, and more about whether or not they will have earned income 15 years from now when the 529 to Roth IRA transfer window opens. If you are 65, fund a 529, and then at age 80 want to begin these 529 to Roth IRA transfers, if you have no earned income, you can process these 529 to Roth IRA transfers because you are limited by the regular IRA annual contribution limits that require you to have earned income to process the transfers.

Advantage Over Traditional Backdoor Roth Conversions

For individuals that have a solid understanding of how the traditional “Backdoor Roth IRA Contribution” strategy works, the new 529 to Roth IRA transfer strategy potentially contains additional advantages over and above the traditional backdoor Roth strategy. These movements from the 529 to Roth IRA are not considered “conversions”, they are considered direct transfers. Why is that important? Under the traditional Backdoor Roth Contribution strategy the taxpayer is making a non-deductible contribution to a traditional IRA and then processes a conversion to a Roth IRA.

One of the IRS rules during this conversion process is the “aggregation rule”. When a Roth conversion is processed, the taxpayer has to aggregate all of their pre-tax IRA balance together in determining how much of the conversion is taxable, so if the taxpayer has other pre-tax IRAs, it came sometimes derail the backdoor Roth contribution strategy. If they instead use the 529 to Roth IRA direct transfer processes, since as of right now it is not technically a “conversion”, the aggregate rule is avoided.

The second big advantage is with the 529 to Roth IRA transfer strategy, the Roth IRA is potentially being funded with “untaxed earnings” as opposed to after-tax dollar. Again, in the traditional Backdoor Roth Strategy, the taxpayer is using after-tax money to make a nondeductible contribution to a Traditional IRA and then converting those dollars to a Roth IRA. If instead the taxpayer funds a 529 with $15,000 in after-tax dollars, but during the 15-year holding, The account grows the $35,000, they are then able to begin direct transfers from the 529 to the Roth IRA when $20,000 of that account balance represents earnings that were never taxed. Pretty cool!!

State Tax Deduction Clawbacks?

There are some states, like New York, that offer tax deductions for contributions to 529 accounts up to annual limits. When the federal government changes the rules for 529 accounts, the states do not always follow suit. For example, when the federal government changed the tax laws allowing account owners to distribute up to $10,000 per year for K – 12 qualified expenses from 529 accounts, some states, like New York, did not follow suit, and did not recognize the new “qualified expenses”. Thus, if someone in New York distributed $10,000 from a 529 for K – 12 expenses, while they would not have to pay federal tax on the distribution, New York viewed it as a “non-qualified distribution”, not only making the earnings subject to state taxes but also requiring a clawback of any state tax deduction that was taken on the contribution amounts.

The question becomes will the states recognize these 529 to Roth IRA transfers as “qualified distributions,” or will they be subject to taxes and deduction clawbacks at the state level? Time will tell.

Waiting for Guidance From The IRS

This new 529 to Roth IRA transfer option that starts in 2024 has the potential to be a tremendous tax-free wealth accumulation strategy for not just children but for individuals of all ages. However, as I mentioned multiple times in the article, we have to wait for formal guidance from the IRS to determine which of these advanced wealth accumulation strategies will be allowed from tax years 2024 and beyond.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Top 10 Things To Know About Filing A Tax Extension

Are you considering filing for a tax extension? It can be a great way to give yourself more time to organize your financial documents and ensure that the information on your return is accurate. But before you file the extension, here are a few things you should know.

There are a number of myths out there about filing a tax extension beyond the April 15th deadline. Many taxpayers incorrectly assume that there are penalties involved or it increases their chances of being audited by the IRS. In reality, filing for an extension can be a great way to give yourself more time to organize your financial documents, identify tax strategies to implement, and ensure that the information on your return is accurate. But before you file the extension, here are a few things you should know.......

1: You must file your extension by April 15th

To apply for an extension, you must file the appropriate paperwork by the April 15th filing deadline. However, filing for an extension does not extend the due date for payment of any taxes owed.

2: What is the extension deadline?

The tax extension filing due date for individual returns is October 15th in most years, but this can vary by a day or two each year, depending on what day of the week the tax deadline or extension deadline falls on. If they fall on a Saturday, Sunday, or Holiday, the IRS will typically move the date to the next business date.

3: How do you file an extension?

You or your accountant can file your extension electronically. This is the quickest and easiest way to file an extension. If you prefer to file your extension by mail, you can do so by filling out Form 4868 and sending it to the IRS.

4: What if you owe taxes?

If you owe taxes, it’s important to remember that filing for an extension does not extend the due date for payment. At least 90% of the tax owed for the year must be paid with the extension. Any remaining balance can be paid by the extended due date, although it will be subject to interest (not penalties). If you do not pay at least 90% of the balance owed, then you will be subject to interest and late payment penalties until the tax is paid.

If you pay your taxes after April 15th but before October 15th, you may be subject to a "failure to pay" penalty. This penalty is typically 0.5% of the tax owed for each month that the taxes remain unpaid, up to a maximum of 25%.

If you pay your taxes after October 15th, the “failure to pay” penalty increases to 1% per month, up to a maximum of 25%. In addition, you may also be subject to a "failure to file" penalty of 5% per month, up to a maximum of 25%.

If you can't pay the taxes due by the April 15th deadline and don't file an extension, you may be subject to both the “failure to pay” and “failure to file” penalties. This can add up to a substantial amount, so it's important to file an extension if you can't pay your taxes by the April 15th due date.

5: What if you are due a refund?

It will not take longer for the IRS to process your refund, however since your return will be submitted at a later date, your refund will be received later than if the return was submitted by April 15th.

6: Are You More Likely To Get Audited By The IRS?

No, there is absolutely no correlation between the filing of an extension and audit risk. However, filing an incomplete or incorrect tax return which necessitates the filing of an amended tax return, can increase your audit risk.

7: Do You Have To Give A Reason To File An Extension?

When you file for an extension, you don’t have to give a reason for why you need the extra time. The IRS will accept your extension request without question.

8: Do You Still Have To Make Estimated Tax Payments?

If you make estimated tax payments each year, filing an extension for the previous tax year, does not extend the due date of making your estimated tax payment for the current tax year on April 15th, June 15th, September 15th, and January 15th.

The penalty for not making estimated tax payments is 4.5% of the unpaid taxes for each quarter that the taxes remain unpaid.

9: IRA Contribution Deadline

Even if you file an extension, IRA contributions must still be made by the April 15th tax deadline.

10: Extra Time To Make Contributions to Employer-Sponsored Retirement Plans

While putting your tax return on extension does not extend the IRA contribution deadline, it does extend the deadline for self-employed individuals making contributions to their employer-sponsored retirement plans, which are not due until a tax filing deadline plus extension. This would include contributions to Simple IRAs, SEP IRAs, Solo(k), Cash Balance Plans, and employer contributions to 401(K) plans.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Mandatory Roth Catch-up Contributions for High Wage Earners - Secure Act 2.0

Starting in 2026, individuals that make over $145,000 in wages will no longer be able to make pre-tax catch-up contributions to their employer-sponsored retirement plan. Instead, they will be forced to make catch-up contributions in Roth dollars which means that they will no longer receive a tax deduction for those contributions.

Starting in 2026, individuals that make over $145,000 in wages will no longer be able to make pre-tax catch-up contributions to their employer-sponsored retirement plan. Instead, they will be forced to make catch-up contributions in Roth dollars which means that they will no longer receive a tax deduction for those contributions.

This, unfortunately, was not the only change that the IRS made to the catch-up contribution rules with the passing of the Secure Act 2.0 on December 23, 2022. Other changes will take effect in 2025 to further complicate what historically has been a very simple and straightforward component of saving for retirement.

Even though this change will not take effect until 2026, your wage for 2025 may determine whether or not you will qualify to make pre-tax catch-up contributions in the 2026 tax year. In addition, high wage earners may implement tax strategies in 2025, knowing that they are going to lose this sizable tax deduction in the 2024 tax year.

Effective Date Delayed Until 2026

Originally when the Secure Act 2.0 was passed, the Mandatory 401(K) Roth Catch-up was schedule to become effective in 2024. However, in August 2023, the IRS released a formal notice delaying the effective date until 2026. This was most likely a result of 401(k) service providers reaching out to the IRS requesting for the delay so the IRS has more time to provide much need additional guidance on this new rule as well as time for the 401(k) service providers to update their systems to comply with the new rules.

Before Secure Act 2.0