Coronavirus vs. SARS: Buying Opportunity?

As fears of the Coronavirus continue to spread, this week was the largest drop in the stock market since the 2008 / 2009 financial crisis. On Thursday, February 27, 2020, the Dow Jones Index dropped by 1,191 points, making it the largest single day point drop in the history of the index. As the selling has intensified into the week, clients are asking us what we expect in the upcoming weeks. Should they be buying the dip? Do we expect a further selloff from here?

Like most major market events, we have to look back in history to find similar events that allow us to model how the markets might behave from here. This week, we have conducted extensive research into virus outbreaks that have happened in the past such as SARS, MERS, Zika, and Swine Flu, in an effort to better understand possible outcomes to the Coronavirus epidemic. In this article, I’m going to share with you:

Coronavirus vs SARS / Zika / other epidemics

What makes the Coronavirus different than other epidemics in the past

Why has this selloff been so fast & fierce

Disruptions to the global supply chain

Performance of the stock market following the end of epidemics in the past

Will the Fed lower rates to help the market

When does this become a buying opportunity for investors

Coronavirus vs SARS

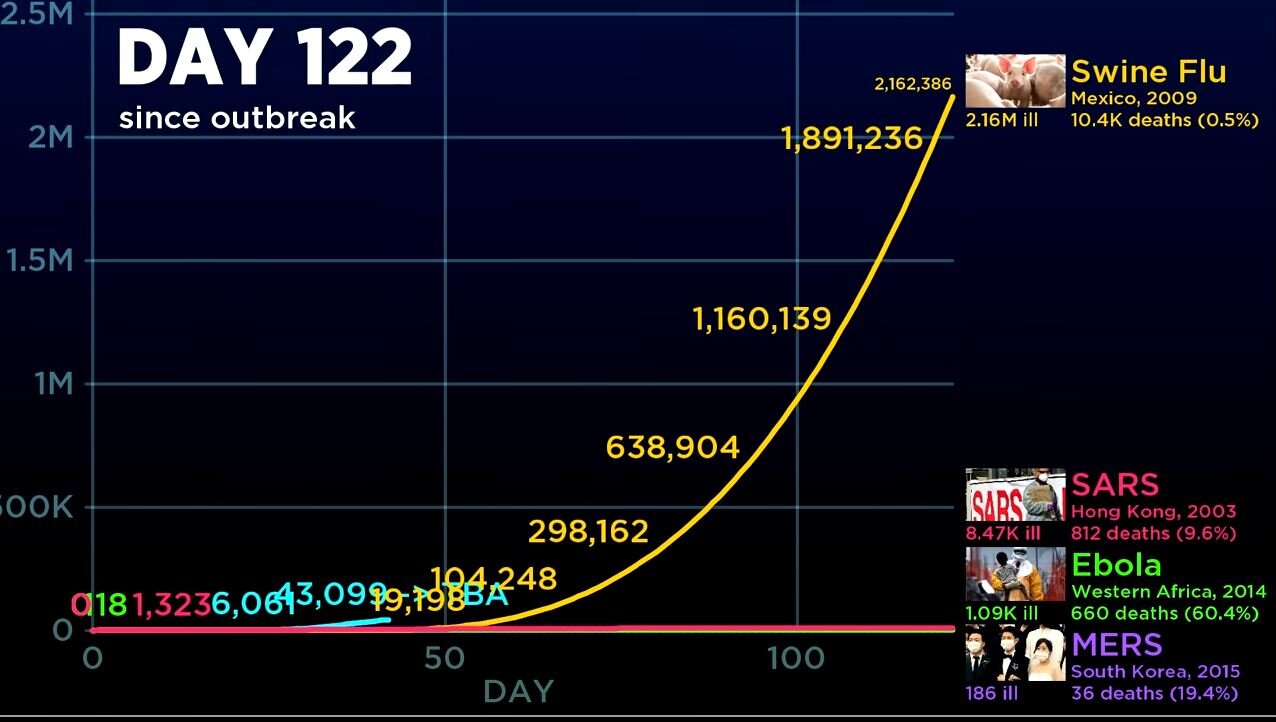

We spent an extensive amount of time comparing Coronvavirus to SARS, and other epidemics in the past. Without a doubt, the Coronavirus is very different than many of the epidemics that we have seen in the past which is making financial modeling very difficult. When we compare the Coronavirus to SARS and other outbreaks, the rate at which the Coronavirus has spread in the first 30 days is unprecedented. Here are a few time lapse charts that compares the infection rate of the Coronavirus to SARS, Ebola, MERS, and Swine Flu.

When you compare SARS to the Coronavirus at Day 19, SARS was much worse out of the gates. By Day 19, SARS had infected 1,490 people and 53 people had died, making the death rate 3.6%. By comparison, at Day 19, Coronavirus had only infected 123 people in China, and resulted in 2 deaths. Making the death rate 1.6%.

However, only 7 days later, at Day 26, the story completely changed:

By Day 26, the number of confirmed cases of Coronavirus rocketed higher, outpacing that of SARS in the early 2000’s. In addition, the death toll for the Coronavirus jumped to 79 people.

But then it continued to get worse. By Day 43, the chart says it all:

By day 43, the number of confirmed cases of the Coronavirus jumped to 43,099 compared to just 3,860 confirmed cases of the SARS virus during that same time period. The death toll for the Coronavirus had risen to over 1,000 people compared to 217 from SARS during that same time period. This chart highlights the main issue with the Coronavirus. It’s spreading faster than government’s are able to control compared to most epidemics in the past.

Now, I say “most” because when we started gathering the data, there is a chart that looks similar to the Coronravirus outbreak. If I move these charts forward to Day 122, this is what happened with the Swine Flu in Mexico in 2009.

The Swine Flu was relatively mute for the first 50 days, but after day 50, the chart looks very similar to the fast spread of the Coronavirus. By Day 122, 2.1M people had been infected with the Swine Flu and over 10,000 people had died.

So why didn’t you hear more about the Swine flu when it was happening? The death rate of the Swing Flu was only 0.5%. Compare this to the current 2.1% estimated death rate of the Coronavirus, which is not as high as the SARS death rate of 4.9%, but it is significantly higher than the Swine Flu. Here is a chart comparing the death rate of SARS, Coronavirus, and MERS:

Another important note, the Swine Flu was fairly wide spread as well. See the chart below from the World Health Organization on the Swine Flu:

However, given how fast the Coronavirus is spreading in it’s early stage, it could end up having a larger global footprint than the Swine Flu if they are unable to contain it soon.

Key Takeaway From The Comparison

Our key takeaway from this comparison is that Coronavirus has spread more quickly in the early stages compared to past epidemics which represents a larger risk to the markets than in the past. Due to the pace of the spread, it’s difficult to put an estimated timeline together for containment. When we look at the comparison of Coronavirus to the Swine Flu, it shows that there could be further downside risks to the markets if the spread of the virus follows a similar glide path.

Coronavirus Disruption To The Market

We issued an article earlier this week explaining the business impact of the Coronavirus.

Article: Coronavirus & The Market Selloff

I just want to quickly summarize again what’s causing the market selloff from a business standpoint. As the Coronavirus continues to spread to other regions, it forces governments to restrict the movements of its people in an effort to contain the spread of the virus. This means transportation is shut down, events are canceled where there would have been large gatherings of people, and employees are not going to work. Also, when people are afraid, they don’t go out to eat, and they don’t go shopping. All of these things have a direct impact on the revenue of the companies that make up the stock market. When these companies entered 2020, there was no expectation that their manufacturing operations could be completely shut down due to a global health epidemic. The stock market right now is trying to determine how much it needs to discount the prices of these companies based on the revenue that’s being lost.

The longer the epidemic continues, the longer it takes people to get back to work, the longer it takes people to resume their normal spending habits, and the more damage it does to the markets.

The China Impact

When comparing SARS to the Coronavirus it’s also important to acknowledge the growth in the size of China’s economy between 2003 and 2020. When the SARS outbreak happened in 2003, China’s economy only represented 8.7% of global GDP. As of 2019, China’s economy now equals 19% of total global GDP. Since the Coronavirus has been the most wide spread in China, It will have a much larger impact on the markets around the globe compared to the SARS outbreak when China was a much smaller player in the global economy.

Valuations in the U.S. Stock Market

In our opinion, one of the other big factors that has fueled the magnitude of the selloff here in the U.S., is the simple fact that going into 2020, the stock market was overvalued already by historic terms. As of December 31, 2019, the P/E ratio of the S&P 500 was 18. The 25 year historical average P/E for the S&P 500 Index is 16. This essentially means that stocks were expensive going into the beginning of the year. When stocks are already arguably overvalued, and a negative event happens, the prices have to drop by more realizing that those companies are not going to produce the earnings growth for the upcoming year that was already baked into the stock price.

Fed Lowering Rates

There is talk now of the Fed coming to the markets aid and lowering interest rates throughout the year. Going into 2020, it was the market’s expectation that the Fed was going to remain on hold for 2020. In my opinion, the rate cuts are probably warranted at this point, given the unexpected slowdown to the global economy as a result of the Coronavirus. But I would also warn that the Fed lowering interest rates is not in itself going to heal the markets. Giving companies access to cheaper capital is not going to make people feel safer about traveling around the globe and it’s not going to help manufacturers resume operations if their employees can’t get to the factory due to travel restrictions.

However, giving companies access to cheaper capital will allow them to better weather the storm while the governments around the world work on a containment plan. Without that access to cheap capital, you could see companies going under because it took revenue too long to ramp back up.

Global Supply Chain

Investors should not underestimate the damage that has been done to the global supply change and how long it takes to get the supply chain back up and running again. A good example are car manufacturers. They do not typically keep large inventories of parts, and if those parts are not being made, they’re not being shipped, meaning they can’t build the cars, so they can’t sell the cars, and revenue drops.

Within the electronics industry, a lot of the products are made up of hundreds if not thousands of components, and the product does not work without all of those components. If there is one computer chip that is made in Korea, and the manufacturing of those chips has been halted, then the end product cannot be built and shipped. The examples go on and on but when you think of manufacturing around the globe being brought offline, it’s not like a light switch where you can go and simply turn it back on. It takes a while for it to get back up and running again. So while investors might think the Coronavirus could just impact Q1 revenue, it’s more likely that it will impact revenue beyond just the first quarter.

When Do You Buy The Dip?

I have received a lot of calls from clients asking if they should begin buying stocks at these lower levels with the anticipation of a bounce back. When we look at other epidemics in the past, there has been a sizable rally in the stock market 6 to 12 months after the epidemic has ended. The chart below shows each epidemic and the subsequent 6 month and 12 month return of the S&P 500 after the epidemic ended. On average, the stock market rose 20% a year following the end of the epidemic which is why investors are eager to buy into the selloff.

In my personal opinion, at some point, the Coronavirus will be contained and it will create an opportunity for investors. There is pent up demand being accumulated now that will need to be filled after the virus is contained. Individuals will most likely reschedule vacations and travel plans once they feel it’s safe to travel around the globe, and the Fed, via lower rates, will have given companies access to even cheaper capital to grow. But as I write this article on February 28th, I caution investors. When you look at the data that we’ve collected, there could definitely be more downside to the selloff if they are unable to contain the spread of the Coronavirus within the next few weeks. The market right now is just trying to guess how much damage has been done with no real solid guidance as to whether it’s guessing right or wrong.

It may be prudent to wait for evidence that progress is being made on the containment efforts of the virus before buying back into the market. For long term investors, it’s important to understand that while the Coronavirus will undoubtedly have an impact on the revenue of companies in 2020, in the past, epidemics have rarely changed the fate of solid companies over the long term.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.