Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents opportunities to use retirement savings to pay off debt; but before doing so, it is important to consider the possible consequences.

Clients often come to us saying they have some amount left on a mortgage and they would feel great if they could just pay it off. Lower monthly bills and less debt when living on a fixed income is certainly good, both from a financial and psychological point of view, but taking large distributions from retirement accounts just to pay off debt may lead to tax consequences that can make you worse off financially.

Below are three items I typically consider before making a recommendation for clients. Every retiree is different so consulting with a professional such as a financial planner or accountant is recommended if you’d like further guidance.

Impact on State Income and Property Taxes

Depending on what state you are in, withdrawals from IRA’s could be taxed very differently. It is important to know how they are taxed in your state before making any big decision like this. For example, New York State allows for tax free withdrawals of IRA accounts up to a maximum of $20,000 per recipient receiving the funds. Once the $20,000 limit is met in a certain year, any distribution you take above that will be taxed.

If someone normally pulls $15,000 a year from a retirement account to meet expenses and then wanted to pull another $50,000 to pay off a mortgage, they have created $45,000 of additional taxable income to New York State. This is typically not a good thing, especially if in the future you never have to pull more than $20,000 in a year, as you would have never paid New York State taxes on the distributions.

Note: Another item to consider regarding states is the impact on property taxes. For example, New York State offers an “Enhanced STAR” credit if you are over the age of 65, but it is dependent on income. Here is an article that discusses this in more detail STAR Property Tax Credit: Make Sure You Know The New Income Limits.

What Tax Bracket Are You in at the Federal Level?

Federal income taxes are determined using a “Progressive Tax” calculation. For example, if you are filing single, the first $9,700 of taxable income you have is taxed at a lower rate than any income you earn above that. Below are charts of the 2019 tax tables so you can review the different tax rates at certain income levels for single and married filing joint ( Source: Nerd Wallet ).

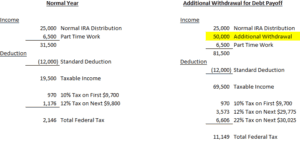

There isn’t much of a difference between the first two brackets of 10% and 12%, but the next jump is to 22%. This means that, if you are filing single, you are paying the government 10% more on any additional taxable income from $39,475 – $84,200. Below is a basic example of how taking a large distribution from the IRA could impact your federal tax liability.

How Will it Impact the Amount of Social Security You Pay Tax on?

This is usually the most complicated to calculate. Here is a link to the 2018 instructions and worksheets for calculating how much of your Social Security benefit will be taxed ( IRS Publication 915 ). Basically, by showing more income, you may have to pay tax on more of your Social Security benefit. Below is a chart put together with information from the IRS to show how much of your benefit may be taxed.

To calculate “Combined Income”, you take your Adjusted Gross Income + Nontaxable Interest + Half of your Social Security benefit. For the purpose of this discussion, remember that any amount you withdraw from your IRA is counted in your Combined Income and therefore could make more of your social security benefit subject to tax.

Peace of mind is key and usually having less bills or debt can provide that, but it is important to look at the cost you are paying for it. There are times that this strategy could make sense, but if you have questions about a personal situation please consult with a professional to put together the correct strategy.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

We Are Sleep Walking Into The Next Crisis

The U.S. economy is headed down a dangerous path. In our opinion it has nothing to do with the length of the current economic cycle, valuations, interest rates, or trade wars. Instead, it has everything to do with our mounting government deficits. We have been talking about the federal budget deficits for the past ten years but when does that

The U.S. economy is headed down a dangerous path. In our opinion it has nothing to do with the length of the current economic cycle, valuations, interest rates, or trade wars. Instead, it has everything to do with our mounting government deficits. We have been talking about the federal budget deficits for the past ten years but when does that problem really come home to roost?

A Crisis In Plain Sight

An economic crisis is often easier to spot than you think if you are looking in the right places. Most of the time it involves identifying a wide spread trend that has evolved in the financial markets and the economy, shutting out all of the noise, and then applying some common sense. Looking at the tech bubble, people were taking home equity loans to buy tech stocks that they themselves did not understand. During the housing bubble people that were making $40,000 per year were buying homes for $500,000 and banks were giving loans with no verification of income. Both of the last two recessions you could have spotted by paying attention to the trends and applying some common sense.

Government Debt

Looking at the data, we think there is a good chance that the next economic crisis may stem from reaching unsustainable levels of government debt. Up until now we have just been talking about it but my goal with this article is to put where we are now in perspective and why this "talking point" may soon become a reality.

Debt vs GDP

The primary measuring stick that we use to measure the sustainability of the U.S. debt level is the Debt vs GDP ratio. This ratio compares the total debt of the U.S. versus how much the U.S. economy produces in one year. Think of it as an individual. If I told you that someone has $100,000 in credit card debt, your initial reaction may be “wow, that’s a lot of debt”. But then what if I told you that an individual makes $1,000,000 per year in income? That level of debt is probably sustainable for that person since it’s only 10% of their gross earnings, whereas that amount of credit card debt would render someone who makes $50,000 per year bankrupt.

Our total gross federal deficit just eclipsed $21 trillion dollars. That’s Trillion with a “T”. From January through March 2018, GDP in the U.S. was running at an annual rate of $19.965 trillion dollars (Source: The Balance). Based on the 2018 Q1 data our debt vs GDP ratio is approximately 105%. That’s big number.

The Safe Zone

Before I start throwing more percentages at you let's first establish a baseline for what's sustainable and not sustainable from a debt standpoint. Two Harvard professors, Reinhart and Rogoff, conducted a massive study on this exact topic and wrote a whitepaper titled "Growth in a Time of Debt". Their study aimed to answer the question "how much debt is too much for a government to sustain?" They looked at historic data, not just for the U.S. but also for other countries around the world, to determine the correlation between various levels of Debt vs GDP and the corresponding growth or contraction rate of that economy. What they found was that in many cases, once a government's Debt vs GDP ratio exceeded 90%, it was frequently followed by a period of either muted growth or economic contraction. It makes sense. Even though the economy may still be growing, if you are paying more in interest on your debt then you are making, it puts you in a bad place.

Only One Time In History

There has only been one other time in U.S. history that the Debt vs GDP ratio has been as high as it is now and that was during World War II. Back in 1946, the Debt vs GDP ratio hit 119%. The difference between now and then is we are not currently funding a world war. I make that point because wars end and when they end the spending drops off dramatically. Between 1946 and 1952, the Debt vs GDP ratio dropped from 119% to 72%. Our Debt vs GDP ratio bottomed in 1981 at 31%. Since then it has been a straight march up to the levels that were are at now. We are not currently financing a world war and there is not a single expenditure that we can point to that will all of a sudden drop off to help us reduce our debt level.

Spending Too Much

So what is the United States spending the money on? Below is a snapshot of the 2018 federal budget which answers that question. As illustrated by the spending bar on the left, we are estimated to spend $4.1 trillion dollars in 2018. The largest pieces coming from Social Security, Medicare, and Medicaid.

The bar on the right illustrates how the U.S. intends to pay for that $4.1 trillion in spending. At the top of that bar you will see “Borrowing $804 Bn”. That means the Congressional Budget Office estimates that the U.S. will have to borrow an additional $804 billion dollars just to meet the planned spending for 2018. With the introduction of tax reform and the infrastructure spending, the annual spending amount is expected to increase over the next ten years.

Whether you are for or against tax reform, it’s difficult to make the argument that it’s going to “pay for itself in the form of more tax as a result of greater economic growth.” Just run the numbers. If our annual GDP is $19.9 Trillion per year, our 3% GDP growth rate I already factored into the budget numbers, to bridge the $804B shortfall, our GDP growth rate would have to be around 7% per year to prevent further additions to the total government debt. Good luck with that. A 7% GDP growth rate is a generous rate at the beginning of an economic expansion. Given that we are currently in the second longest economic expansion of all time, it’s difficult to make the argument that we are going to see GDP growth rates that are typically associated with the beginning of an expansion period.

Apply Common Sense

Here’s where we apply common sense to the debt situation. Excluding the financing of a world war, the United State is currently at a level of debt that has never been obtained in history. Like running a business, there are only two ways to dig yourself out of debt. Cut spending or increase revenue. While tax reform may increase revenue in the form of economic growth, it does not seem likely that the U.S. economy is at this stage in the economic cycle and be able to obtain the GDP growth rate needed to prevent a further increase in the government deficits.

A cut in spending, in its simplest form, means that something has to be taken away. No one wants to hear that. The Republican and Democratic parties seem so deeply entrenched in their own camps that it will make it difficult, if not impossible, for any type of spending reform to take place before we are on the eve of what would seem to be a collision course with the debt wall. Over the past two decades, the easy solution has been to “just borrow more” which makes the landing even harder when we get there.

Answering the “when” question is probably the most difficult. We are clearly beyond what history has revered as the “comfort zone” when to comes to our Debt vs GDP ratio. However, the combination of the economic boost from tax reform and infrastructure spending in the U.S., the accelerating economic expansion that is happening outside of the U.S., and the low global interest rate environment, could continue to support growth rates even at these elevated levels of government debt.

Debt is tricky. There are times when it can be smart accept the debt, and times where it isn’t helpful. As we know from the not too distant past, it has the ability to sustain growth for an unnaturally long period of time but when the music stops it gets ugly very quickly. I’m not yelling that the sky is falling and everyone needs to go to cash tomorrow. But now is a good time to evaluate where you are risk wise within your portfolio and begin having the discussion with your investment advisor as to what an exit plan may look like if the U.S. debt levels become unsustainable and it triggers a recession within the next five years.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Top 2 Strategies For Paying Off Student Loan Debt

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. There has been a lot of speculation between president obama and student loans, but student loan debt is still piling up. The amount of student loan debt is piling up and it's putting the next generation of

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. There has been a lot of speculation between president obama and student loans, but student loan debt is still piling up. The amount of student loan debt is piling up and it's putting the next generation of our work force at a big disadvantage. While you yourself may not have student loan debt, at some point you may have to counsel a child, grandchild, friend, neighbor, or a co-worker that just can't seem to get ahead because of the financial restrains of their student loan payments. After all, for a child born today, it's projected that the cost for a 4 year degree including room and board will be $215,000 for a State College and $487,000 for a private college. Half a million dollars for a 4 year degree!!

The most common reaction to this is: "There is no way that this can happen. Something will have to change." The reality is, as financial planners, we were saying that exact same thing 10 years ago but we don't say that anymore. Despite the general disbelief that this will happen, the cost of college has continued to rise at a rate of 6% per year over the past 10 years. It's good old supply and demand. If there is a limited supply of colleges and the demand for a college degree keeps going up, the price will continue to go up. As many of us know, a college degree is not necessarily an advantage anymore, it's the baseline. You need it just to get the job interview and that will be even more true for types of jobs that will be available in future years.

No Professional Help

Making matters worse, most individuals that have large student loan debt don't have access to high quality financial planners because they do not have any investible assets since everything is going toward paying down their student loan debt. I wrote this article to give our readers a look into how we as Certified Financial Planners® help our clients to dig out of student loan debt. Unfortunately a lot of the advice that you will find by searching online is either incomplete or wrong. The solution for digging out of student loan debt is not a one size fits all solution and there are trap doors along the way.

Loan Inventory

The first step in the process is to the collect and organize all of the information pertaining to your student loan debt. Create a spreadsheet that lists the following information:

Name of Lender

Type of Loan (Federal or Private)

Name of Loan Servicer

Total Outstanding Loan Balance

Interest Rate

Fixed or Variable Interest Rate

Minimum Monthly Payment

Current Monthly Payment

Estimated Payoff Date

Now, below this information I want you to list January 1 of the current year and the next 10 years. It will look like this:

Total Balance

January 1, 2018

January 1, 2019

January 1, 2020

Each year you will record your total student loan debt below your itemized student loan information. Why? In most cases you are not going to be able to payoff your student loans overnight. It’s going to be a multi-year process. But having this running total will allow you to track your progress. You can even add another column to the right of the “Total Balance” column labelled “Goal”. If your goal is to payoff your student loan debt in five years, set some preliminary balance goals for yourself. When you receive a raise or a bonus at work, a tax refund, or a cash gift from a family member, this will encourage you to apply some or all of those cash windfalls toward your student loan balance to stay on track.

Order of Payoff

The most common advice you will find when researching this topic is “make minimum payments on all of the student loans with the exception of your student loan with the highest interest rate and apply the largest payment you can against that loan”. Mathematically this is the right strategy but we do not necessary recommend this strategy for all of our clients. Here’s why……..

There are two situations that we typically run into with clients:

Situation 1: “I’m drowning in student loan debt and need a lifeline”

Situation 2: “I’m starting to make more money at my job. Should I use some of that extra income to pay down my student loan debt or should I be applying it toward my retirement plan or saving for a house?”

Situation 1: I'm Drowning

As financial planners we are unfortunately running into Situation 1 more frequently. You have young professionals that are graduating from college with a 4 year degree, making $50,000 per year in their first job, but they have $150,000 of student loan debt. So they basically have a mortgage that starts 6 months after they graduate but that mortgage payment comes without a house. For the first few years of their career they are feeling good about their new job, they receive some raises and bonuses here and there, but they still feel like they are struggling every month to meet their expenses. The realization starts to set in the “I’m never going to get ahead because these student loan payments are killing me. I have to do something.”

If you or someone you know is in this category remember these words: “Cash is king”. You will hear this in the business world and it’s true for personal finances as well. As mentioned earlier, from a pure math standpoint, they fastest way to get out of debt is to target the debt with the highest interest rate and go from there. While mathematically that may work, we have found that it is not the best strategy for individuals in this category. If you are in the middle of the ocean, treading water, with the closest island a mile away, why are we having a debate about how fast you can swim to that island? You will never make it. Instead you just need someone to throw you a life preserver.

Life Preserver Strategy

If you are just barely meeting your monthly expense or find yourself falling short each month, you have to stop the bleeding. In these situations, you should be 100% focus on improving your current cash flow not whether you are going to be able to payoff your student loans in 8 years instead of 10 years. In the spreadsheet that you created, organize all of your student loan debt from the largest outstanding loan balance to the smallest. Ignore the interest rate column for the time being. Next, begin making the minimum payments on all of your student loans except for the one with the SMALLEST BALANCE. We need to improve your cash flow which means reducing the number of monthly payments that you have each month. Once the month to month cash flow is no longer an issue then you can graduate to Situation 2 and revisit the debt payoff strategy.

This strategy also builds confidence. If you have a $50,000 loan with a 7% interest rate and two other student loans for $5,000 with an interest rate of 4% while applying more money toward the largest loan balance will save you the most interest long term, it’s going to feel like your climbing Mt. Everest. “Why put an extra $200 toward that $50,000 loan? I’m going to be paying it until I’m 50.” There is no sense of accomplishment. We find that individuals that choose this path will frequently abandon the journey. Instead, if you focus your efforts on the loans with the smaller balances and you are able to pay them off in a year, it feels good. Getting that taste of real progress is powerful. This strategy comes from the book written by Dave Ramsey called the Total Money Makeover. If you have not read the book, read it. If you have a child or grandchild graduating from college, if you were going to give them a check for graduation, buy the book for them and put the check in the book. Tell them that “this check will help you to get a start in your new career but this book is worth the amount of the check multiplied by a thousand”.

Situation 2: Paying Off Your Student Loans Faster

If you are in Situation 2, you are no longer treading water in the middle of the ocean and you made it to the island. The name of this island is “Risk Free Rate Of Return”. Let me explain.

Individuals in this scenario have a good handle on their monthly expenses and they are finding that they now have extra discretionary income. So what’s the best use of that extra income? When you are younger there are probably a number items on your wish list, some of which you may debate looking into title loans near me to obtain. Here are the top four that we see:

Retirement savings

Saving for a house

Paying off student loan debt

Buying a new car

Don't Leave Free Money On The Table

Before applying all of your extra income toward your student loan payments, we ask our clients “what is the employer contribution formula for your employer’s retirement plan?” If it’s a match formula, meaning you have to put money in the plan to get the employer contribution, we will typically recommend that our clients contribute the amount needed to receive the full employer match. Otherwise you are leaving free money on the table.

The amount of that employer contribution represents a risk free rate of return. Meaning, unlike the investing in the stock market, you do not have to take any risk to receive that return on your money. If your company guarantees a 100% match on the first 5% of pay contribution out of your paycheck into the plan, your money is guaranteed to double up to 5% of your pay. Where else are you going to get a 100% risk free rate of return on your money?

Start With The Highest Interest Rate

Now that you have extra income each month you can begin to pick and choose how you apply it. You should list all of you student loans from the highest interest rate to the lowest. If it’s close between two interest rates but one is a fixed interest rate and the other is a variable interest rate, it’s typically better to pay down the variable interest rate loan first if interest rates are expected to move higher. Apply the minimum payment amount to all of your student loan payments and apply as much as you can toward the loan with the HIGHEST INTEREST RATE. Once the loan with the highest interest rate is paid off, you will move on to the next one.

Again, by applying more money toward your student loans, those additional payments represent a risk free rate of return equal to the interest rate that is being charges on each loan. For example, if the highest interest rate on one of your student loans is 7%, every additional dollar that you are apply toward paying off that loan you are receiving a 7% rate of return on because you are not paying that amount to the lender.

Here is a rebuttal question that we sometimes get: “But wouldn’t it be better to put it in the stock market and earn a higher rate of return?” However, that’s not an apple to apples comparison. The 7% rate of return that you are receiving by paying down that student loan balance is guaranteed because it represents interest that would have been paid to the lender that you are now keeping. By contrast, even though the stock market may average an 8% annualized rate of return over a 10 year period, you have to take risk to obtain that 8% rate of return. A 7% risk free rate of return is the equivalent of being able to buy a CD at a bank with a 7% interest rate guaranteed by the FDIC which does not exist right now.

But Can't I Deduct The Interest On My Student Loans?

It depends on how much you make. In 2018, if you are single, the deduction for student loan interest begins to phaseout at $70,000 of AGI and you completely lose the deduction once your AGI is above $85,000. If you are married filing a joint tax return, the deduction begins to phaseout at $140,000 of AGI and it’s completely gone once your AGI hits $170,000.

Also the deduction is limited to $2,500.

However, even if you can deduct the interest on your student loan, the tax benefit is probably not as big as you think. Let me explain via an example. Take the following fact set:

Tax Filing Status: Single

Adjusted Gross Income (AGI): $50,000

Outstanding Student Loan Balance: $60,000

Interest Rate: 7% ($4,200 Per Year)

First, you are limited to deducting $2,500 of the $4,200 in student loan interest that you paid to the lender. At $50,000 of AGI your top federal tax bracket in 2018 is 22%. So that $2,500 equals $550 in actual tax savings ($2,500 x 22% = $550). If you want to get technical, taking the tax deduction into account, your after tax interest rate on your student loan debt is really 6.08% instead of 7%. Can you get a CD from a bank right now with a 6% interest rate? No. From both a debt reduction standpoint and a rate of return standpoint, it probably makes sense to pay down that loan more aggressively.

Striking A Balance

When you are younger, you typically have a lot of financial goals such as saving for retirement, paying off debt, saving for the down payment on your first house, starting a family, college savings for you kids, etc. While I'm sure you would like to take all of your extra income and really start aggressively reducing your student loans you have to determine what the right balance is between all of your financial goals. If you receive a $5,000 bonus from work, you may allocate $3,000 of that toward your student loan debt and deposit $2,000 in your savings account for the eventual down payment on your first house. We also recommend speaking a loan authority company to see what can be done to help you reach your goal. One example being to create that "goal" column in your student loan spreadsheet will help you to keep that balance and eventually lead to the payoff of all of your student loans.

Forgiveness Scheme

Although they are not very common and only a few people can qualify for one of these schemes, they will provide great help. A student loan forgiveness scheme can help a student pay off their loan over an extended period of time, a shorter period of time, reduce the amount they owe, or entirely pay off the loan for them. However, like I have already mentioned, this is based upon whether they qualify or not.I hope this has been of some assistance and i have provided you with some helpful advice on how to prepare for and manage your student loan.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Life Insurance Do I Need?

Do you even need life insurance? If you have dependants to protect and you do not have enough savings, you will most likely need life insurance. But the question is how much should I have? Well, your home will be one of your biggest assets, and in some cases the money that it makes from its sale when you have passed away is a significant inheritance

Do you even need life insurance? If you have dependants to protect and you do not have enough savings, you will most likely need life insurance. But the question is how much should I have? Well, your home will be one of your biggest assets, and in some cases the money that it makes from its sale when you have passed away is a significant inheritance for your children.

If you do not have dependents or you have enough savings to cover the current and future expenses for your dependents there really is no need for life insurance. Life insurance sales professional can be very aggressive with their sales tactics and sometime they mask their services as "financial planning" but all of their solutions lead to you buying an expensive whole life insurance policy.

Remember, life insurance is simply a transfer of risk. When you are younger, have a family, a mortgage, and are just starting to accumulate assets, the amount of life insurance coverage is usually at its greatest. But as your children grow up, they finish college, you pay your mortgage, you have no debt, and you have accumulated a good amount in retirement savings, your need to transfer that risk diminishes because you have essentially become self-insured. Just because you had a $1M dollar life insurance policy issued 10 years ago does not mean that is the amount you need now.

Which kind of insurance should you get?

It's our opinion that for most individuals term insurance makes the most sense. Insurance agents are always very eager to sell whole life, variable life, and universal life policies. Why? They pay big commissions!! When you compare a $1M 30 year term policy and a $1M Whole Life policy side by side, often times the annual premium for whole life insurance is 10 times that amount of the term insurance policy. Insurance agents will tout that the whole life policy has cash value, you can take loans, and that it's a tax deferred savings vehicle. But often time when you compare that to: "If I just bought the cheaper term insurance and did something else with the money I would have spent on the more expensive whole life policy such as additional pre-tax retirement savings, college savings for the kids, paying down the mortgage, or setting up an investment management account, at the end of the day I'm in a much better spot financially."

How much life insurance do you need?

The most common rule of thumb that I hear is "10 times my annual salary". Please throw that out the window. The amount of insurance you need varies greatly from individual to individual. The calculation to reach the answer is fairly straight forward. Below is the approach we take with our clients:

How much debt do you have? This includes mortgages, car loans, personal loans, credit cards, etc. Your total debt amount is your starting point.

What are your annual expenses? Just create a quick list of your monthly expenses, they do not have to be exact, and our recommendation is to estimate on the high side just to be safe. Then multiply your monthly expense by 12 months to reach your "annual after tax expenses".

How much monthly income do you have to replace? If you are married, we have to look at the income of each spouse. If your monthly expenses are $50,000 per year and the husband earns $30,000 and the wife earns $80,000, we are going to need more insurance on the wife because we have to replace $80,000 per year in income if she were to pass away unexpectedly. Married couples make the mistake of getting the same face value of insurance just because. Look at it from an income replacement standpoint. If you are a single parent or provider, you will just look at the amount of income that is needed to meet the anticipated monthly expenses for your dependents.

Factor in long term savings goals and expenses. Examples of this are the college cost for your children and the annual retirement savings for the surviving spouse.

Example:

Husband: Age 40: Annual Income $70,000

Wife: Age 41: Annual Income $70,000

Children: Age 13 & 10

Total Outstanding Debt with Mortgage: $250,000

Total Annual After Tax Expenses: $90,000

Savings & Investment Accounts: $100,000

Remember there is not a single correct way to calculate your insurance need. This example is meant to help you through the thought process. Let's look at an insurance policy for the husband. We first look at what the duration of the term insurance policy should be. Our top two questions are "when will the mortgage be paid off?" and "when will the kids be done with college?" These are the two most common large expenses that we are insuring against. In this example let's assume they have 20 years left on their mortgage so at a minimum we will be looking at a 20 year term policy since the youngest child will done with their 4 year degree within the next 12 years. So a 20 year term covers both.

Here is how we would calculate the amount. Start with the total amount of debt: $250,000. That is our base amount. Then we need to look at college expense for the kids. Assume $20K per year for each child for a 4 year degree: $160,000. Next we look at how much annual income we need to replace on the husband's life to meet their monthly expense. In this example it will be close to all of it but let's reduce it to $60K per year. It is determined that they will need their current level of income until the mortgage is paid in full so $60,000 x 20 Years = $1,200,000. When you add all of these up they will need a 20 year term policy with a death benefit of $1,610,000. But we also have to take into account that they already have $100,000 in savings and their levels of debt should decrease with each year as time progresses. In this scenario we would most likely recommend a 20 Year Term Policy with a $1.5M death benefit on the husband's life.

The calculation for his wife in this scenario would be similar since they have the same level of income.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Paying Down Debt: What is the Best Strategy?

Living with debt is not easy. It can be a constant burden and easily disrupt day-to-day life. Having debt will also ruin your credit score too. The worse your credit score gets, the less likely you will be accepted for any type of loan. One of the fastest ways to get rid of your debt is to pay your debt off in the correct order.

Living with debt is not easy. It can be a constant burden and easily disrupt day-to-day life. Having debt will also ruin your credit score too. The worse your credit score gets, the less likely you will be accepted for any type of loan. One of the fastest ways to get rid of your debt is to pay your debt off in the correct order.

STEP 1: Create a list of all your current debts

The first step is understanding what you owe. To start, make a master list of all your monthly credit card and loan statements. For each bill, include:

The creditor's name

The total amount you owe on that bill

The minimum required monthly payment

The interest rate (also known as APR)

The payment due date

STEP 2: List all of your monthly expenses

Add up all your monthly expenses: rent, car, food, utilities, health insurance and the minimum payments on your debts; as well as regular spending on things such as entertainment and clothing. Subtract that figure from your monthly after-tax income. The remaining amount is what you could put toward debt repayment each month-though it may make sense for you to save some.

STEP 3: Call your lenders

Call your lenders and explain your situation. They may be willing to lower your interest rate temporarily or waive late fees. You may also be able to lower your interest rate by transferring some high-interest credit card debt onto a new credit card with a lower rate (though that's not a long-term solution).

STEP 4: Payoff high interest rate or small balances first

You can start with the bill carrying the highest interest, or the one with the smallest balance. Prioritizing the highest-rate debt can save you more money: You pay off your most expensive debt sooner. Paying off the smallest debt can eliminate a bill faster, providing a motivating boost. Whichever you choose, make sure to pay at least the minimum on all your debts.

Pay the monthly minimum on each debt. The exception: your target bill. Put more money toward this one to pay it down faster. Once you pay off that bill, choose another to pay down aggressively. Your monthly debt repayment total shouldn't change, even when you eliminate bills. This way you gain momentum as you go, putting more and more money toward each remaining bill.

STEP 5: Get creative

You can use your annual tax refund or holiday bonus to pay down debt. Look for small ways to save money every day, such as riding your bike to work, or eating in instead of dining out. Another way to make a dent quickly is to sell unused or unnecessary belongings-maybe downgrading your car to a more affordable model with lower monthly payments.

STEP 6: Break the cycle

As you start to escape debt, it can be tempting to reward yourself by splurging on a new smartphone or an expensive dinner but just a few purchases can erase all your hard work. Instead, buy things with cash or your debit card, and think long and hard before taking on any new debt.

Read this book

If you want to live a debt free life, I strongly recommend you read the book "Total Money Makeover" by Dave Ramsey. Ramsey's book really paves the way to get out of debt and stay out of debt.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.