Don’t Gift That Stock Yet – Why Inheriting Might Be Better

When it comes to passing wealth to the next generation, many investors consider gifting appreciated stock during their lifetime. While the intention is generous, gifting stock prematurely can create unexpected tax consequences. In many cases, allowing your heirs to inherit the stock instead can lead to a significantly better outcome — especially from a tax perspective.

Here’s what you need to know before transferring shares.

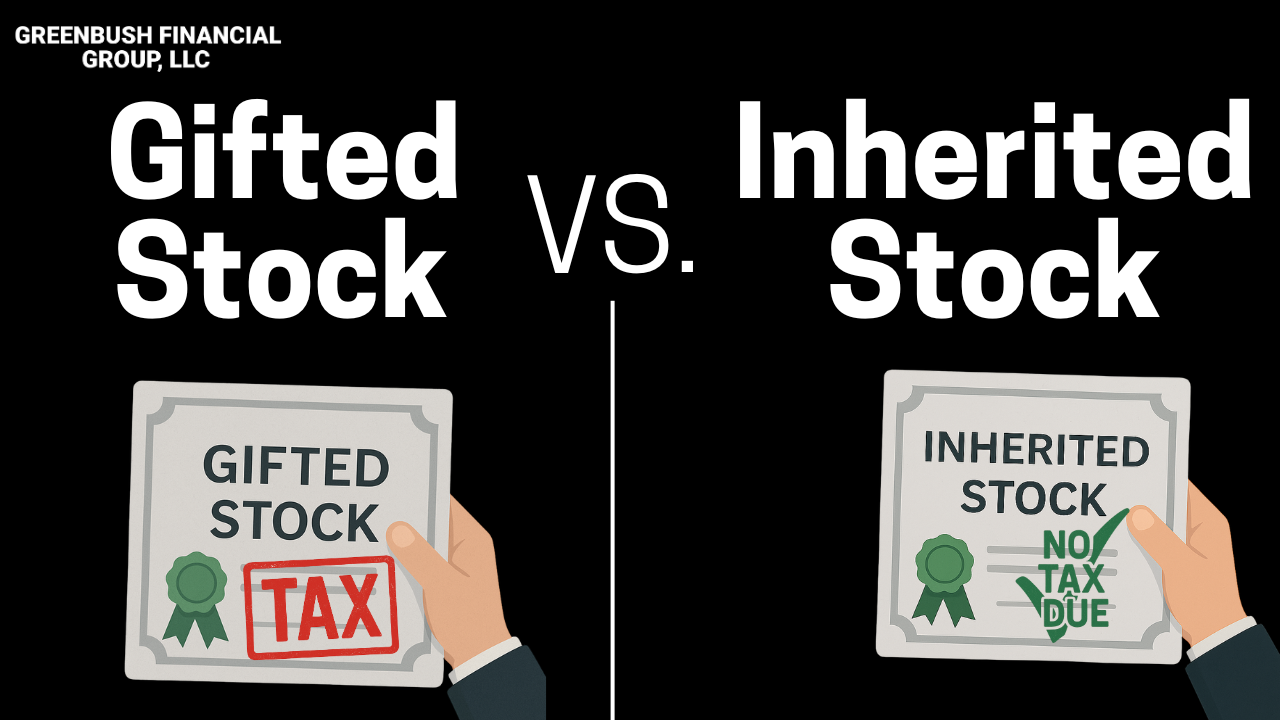

The Key Difference: Gifting vs. Inheriting Stock

The tax treatment of appreciated stock hinges on the concept of cost basis — the original value of the stock when you acquired it.

Gifted stock: The recipient takes on your original cost basis. If they sell, they may owe capital gains tax on the full appreciation.

Inherited stock: The recipient receives a “step-up” in basis to the fair market value on the date of your death. If they sell shortly after, there may be little or no capital gain.

This example illustrates why timing matters when transferring highly appreciated assets.

When Gifting Might Still Make Sense

There are scenarios where gifting appreciated stock can be a smart move:

Low-Income Beneficiaries: If the person receiving the stock is in the 0% long-term capital gains tax bracket, they might sell the stock with no federal tax owed.

In 2025, this includes:

Single filers with taxable income under $47,025

Married couples filing jointly with taxable income under $94,050

Charitable Giving: Donating appreciated stock to a qualified charity allows you to avoid capital gains tax altogether and potentially deduct the fair market value of the donation.

Other Considerations

Timing of Sale: If your child or heir plans to sell the shares quickly, gifting may trigger a large capital gain — something they might not be prepared for.

Holding Period Requirements: Gifting doesn’t reset the holding period. If owner of the stock purchase the stock more than 12 months ago, if it’s gift to someone else and they sell it immediate, they receive long-term capital gain treatment since they get credit for the time the original owner held the securities.

State Taxes: Even if there's no federal capital gain, some states still impose capital gains taxes.

Final Checklist: Before You Gift Stock, Ask:

Has the stock appreciated significantly since I bought it?

Would the recipient likely sell the stock soon after receiving it?

Are they in a low-income tax bracket or facing large expenses?

Am I trying to reduce my estate or make a charitable contribution?

Final Thoughts

Gifting stock during your lifetime can be useful in the right situations — particularly for charitable intent or strategic gifting. But in many cases, letting your heirs inherit appreciated stock allows them to avoid a sizable capital gains tax bill.

Before gifting, consider your own goals, the recipient’s financial position, and the long-term tax impact. The best outcomes often come from a well-timed, well-informed plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the main difference between gifting and inheriting stock?

When you gift appreciated stock, the recipient assumes your original cost basis, meaning they may owe capital gains tax on all prior appreciation when they sell. In contrast, inherited stock receives a “step-up” in basis to its fair market value at the time of your death, often eliminating or greatly reducing capital gains tax if sold soon after.

When does gifting appreciated stock make sense?

Gifting may be advantageous if the recipient is in the 0% long-term capital gains tax bracket or if the stock is being donated to a qualified charity. In those cases, little to no capital gains tax may apply, and charitable donors may be able to deduct the stock’s fair market value.

How does the cost basis affect capital gains taxes on gifted stock?

The cost basis determines how much of the stock’s value is subject to capital gains tax. When stock is gifted, the recipient keeps the giver’s original basis, so highly appreciated shares can result in significant taxes when sold. Inherited shares, however, get a new basis equal to their current market value.

Are there tax benefits to donating appreciated stock to charity?

Yes. Donating appreciated stock directly to a qualified charity allows you to avoid paying capital gains tax on the appreciation and may provide a charitable deduction equal to the stock’s fair market value. This can be more tax-efficient than selling the stock and donating cash.

Do gifted stocks qualify for long-term capital gains treatment?

Yes, the recipient inherits the donor’s holding period. If the donor owned the stock for more than one year, the recipient can sell immediately and still qualify for long-term capital gains rates.

What should I consider before gifting appreciated stock?

Before gifting, assess how much the stock has appreciated, the recipient’s income level and potential tax bracket, and whether they plan to sell soon. In many cases, allowing heirs to inherit appreciated stock can result in better long-term tax outcomes due to the step-up in basis.