Can You Give Money to Your Grandkids Tax-Free? Here’s What the IRS Says

The IRS allows grandparents to give up to $19,000 per grandchild in 2025 without filing a gift tax return, and up to $13.99 million over their lifetime before any tax applies. Gifts are rarely taxable for recipients — but understanding Form 709, 529 plan rules, and tuition exemptions can help families transfer wealth efficiently and avoid IRS issues.

Many grandparents want to help their grandchildren financially—whether it’s for education, a first home, or simply to transfer wealth during their lifetime. But the question often arises: will my grandkids owe taxes on those gifts? In most cases, the answer is no—the recipient of a gift doesn’t pay taxes. Instead, the giver may need to file a gift tax return if the gift exceeds the annual exclusion amount. Here’s how the IRS actually handles gifts to grandchildren, what forms apply, and how to avoid unnecessary taxes or filing headaches.

Who Pays the Tax on a Gift?

Under IRS rules, the person making the gift (the donor) is responsible for any gift tax—not the person receiving it. This means if a grandparent gives money, investments, or property to a grandchild, the child typically doesn’t report or owe anything.

However, there are thresholds to know:

Annual gift tax exclusion (2025): $19,000 per recipient

Lifetime gift and estate tax exemption (2025): $13.99 million per person

If a grandparent gives less than $19,000 to any one grandchild during the year, no filing or tax applies. Gifts above that limit simply require Form 709, but gift tax is only owed once total lifetime gifts exceed the $13.99 million exemption.

Studies show that fewer than 1% of Americans ever owe gift tax—most gifts fall well below these thresholds.

What Counts as a Gift

The IRS defines a gift as any transfer where full value isn’t received in return. Common examples include:

Cash gifts or checks

Paying a grandchild’s tuition or medical bills directly

Contributing to a 529 plan

Transferring stocks or real estate below market value

Tuition and Medical Exceptions

Certain payments don’t count toward the annual gift limit if you pay the institution directly:

Tuition paid straight to a college or private school

Medical expenses paid directly to a hospital or provider

These payments are excluded from both the annual and lifetime gift limits, making them powerful estate-planning tools for grandparents who want to help without triggering IRS reporting.

Gifting Through a 529 Plan

A popular way to help grandchildren is through 529 college savings plans. Contributions are treated as gifts for tax purposes, but there’s a special election that allows grandparents to “front-load” five years’ worth of annual exclusions.

In 2025, you can contribute up to $95,000 per grandchild ($19,000 × 5) without using any lifetime exemption.

Married couples can jointly contribute up to $190,000 per grandchild with the same rule.

This allows for significant education funding while keeping assets out of the grandparent’s taxable estate.

What the IRS Actually Looks At

When reviewing gifts, the IRS primarily focuses on:

Value and documentation – was the transfer properly valued and recorded?

Ownership control – did the grandparent truly give up control of the asset?

Direct vs. indirect payments – paying tuition directly to a school is excluded; writing a check to the grandchild is not.

Cumulative totals – large gifts across multiple years can push a donor closer to their lifetime exemption.

It’s rare for the IRS to flag or audit small gifts, but clear documentation and Form 709 filings for larger transfers help prevent confusion or estate complications later.

Tax-Free Ways to Support Grandkids

There are several strategies to help grandchildren financially without ever triggering gift tax concerns:

Pay tuition or medical bills directly to the provider

Make annual $19,000 gifts to as many recipients as desired

Fund 529 plans using the 5-year front-loading rule

Use custodial accounts (UGMA/UTMA) for small transfers

Contribute to Roth IRAs for working grandchildren (earned income required)

Each of these options lets you transfer wealth efficiently while minimizing tax reporting.

When a Gift Tax Return Is Required

A federal gift tax return (Form 709) is required when:

You give more than $19,000 to one individual in a single year (2025 limit)

You give property or assets that exceed the annual limit in fair market value

You elect to spread a 529 plan contribution over five years

Filing doesn’t mean you owe tax—it simply allows the IRS to track your lifetime exemption usage. Most taxpayers never actually pay gift tax; they only report it for record-keeping purposes.

FAQs: Gifting to Grandchildren

Q: Do my grandchildren have to report a cash gift on their tax return?

A: No. Gifts are not considered taxable income to the recipient and don’t need to be reported.

Q: How much can I give my grandchild without filing a gift tax return?

A: You can give up to $19,000 per grandchild in 2025 without any filing requirement.

Q: What happens if I exceed the $19,000 limit?

A: You’ll file Form 709, but you likely won’t owe any gift tax unless you’ve already used your $13.99 million lifetime exemption.

Q: Do 529 plan contributions count as gifts?

A: Yes, but you can elect to treat large contributions as if they were made evenly over five years to stay within the annual exclusion limits.

Q: Can I pay my grandchild’s college tuition tax-free?

A: Yes, as long as the payment goes directly to the educational institution, it doesn’t count toward the annual exclusion.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

New Ways to Plan for Long-Term Care Costs: Self-Insure & Medicaid Trusts

Planning for long-term care is harder than ever as insurance premiums rise and availability shrinks. In 2025, families are turning to two main strategies: self-insuring with dedicated assets or using Medicaid trusts for protection and eligibility. This article breaks down how each option works, their pros and cons, and which approach fits your financial situation. Proactive planning today can help you protect assets, reduce risks, and secure peace of mind for retirement.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Planning for long-term care has always been one of the most challenging aspects of a retirement plan. For decades, the go-to solution was purchasing long-term care insurance. But as we move into 2025, this option is becoming less viable for many families due to skyrocketing premiums and shrinking availability associated with long-term care insurance. For example, in New York, there is now only one insurance company still offering new long-term care insurance policies. Carriers are exiting the market because the probability of policies paying out is high, and the dollar amounts associated with these claims can easily be in excess of $100,000 per year.

So where does that leave retirees and their families? Fortunately, there are two primary strategies that have emerged as alternatives:

Self-insuring by setting aside a dedicated pool of assets for potential care.

Using Irrevocable or Medicaid trusts to protect assets and plan for Medicaid eligibility.

In this article, we’ll break down each approach, their pros and cons, and what you should consider when deciding which path makes sense for you.

The Self-Insurance Strategy

Self-insuring means you create a separate “bucket” of assets earmarked specifically for long-term care needs. Instead of paying tens or even hundreds of thousands of dollars in premiums over the years for the long-term insurance coverage, those funds stay in your name. If a long-term care event never occurs, those assets simply pass on to your beneficiaries.

The benefits:

Flexibility—you decide how, when, and where care is provided.

Assets remain under your control and stay in your estate.

Avoid the risk of paying for insurance you never use.

The challenges:

You need significant extra assets, beyond what you already need to meet your retirement income goals.

Costs can be substantial—long-term care can run $120,000 to $200,000 per year, depending on location and type of care.

Self-insuring works best for those who have enough wealth to comfortably dedicate a portion of their portfolio to this potential risk without jeopardizing their retirement lifestyle.

The Trust Approach

For individuals or couples without the level of assets needed to fully self-insure, the next common strategy is using Irrevocable trusts (often called Medicaid trusts). These trusts are designed to protect non-retirement assets so that if you need long-term care in the future, you may qualify for Medicaid without having to spend down all your savings.

How it works:

Assets placed into an irrevocable trust are no longer counted as yours for Medicaid eligibility purposes.

If structured properly and far enough in advance, this can preserve assets for heirs while ensuring that Medicaid can help cover long-term care.

Important considerations:

There is typically a five-year look-back period in most states. If assets aren’t in the trust at least five years before applying for Medicaid, the strategy can fail.

Medicaid doesn’t cover everything. For example, around-the-clock home health care often isn’t fully covered, which limits flexibility.

The trust strategy is most effective for individuals who wish to protect their assets but recognize that care options may be limited to facilities and providers that accept Medicaid.

Which Approach is Right for You?

Ultimately, the choice between self-insuring and using a trust comes down to your financial position and your preferences for future care.

If you value flexibility and have the assets, self-insuring is often the preferred option.

If resources are more limited, a trust strategy can provide asset protection and access to Medicaid, even though it may reduce your care options.

The Key Takeaway: Plan Ahead

Whether you choose to self-insure, set up a trust, or use a combination of both, the most important factor is timing. These strategies require proactive planning—often years in advance. With costs continuing to rise and traditional long-term care insurance becoming less accessible, exploring these new approaches early can help protect both your assets and your peace of mind.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

Why is traditional long-term care insurance becoming less viable?

Long-term care insurance has become less practical due to rising premiums, stricter underwriting, and fewer insurers offering new policies. Many carriers have exited the market because claim payouts are large and frequent, making policies increasingly expensive for consumers.

What does it mean to self-insure for long-term care?

Self-insuring means setting aside a dedicated portion of your assets to cover potential long-term care expenses instead of paying insurance premiums. This approach offers flexibility and keeps assets under your control but requires sufficient wealth to handle potentially high annual costs.

Who is best suited for a self-insurance strategy?

Self-insuring typically works best for individuals or couples with substantial savings beyond what’s needed for retirement income. Those with enough assets can earmark funds for potential care without endangering their financial security or lifestyle.

What is a Medicaid or irrevocable trust, and how does it help with long-term care planning?

An irrevocable or Medicaid trust allows individuals to transfer assets out of their name, potentially helping them qualify for Medicaid coverage without depleting all their savings. If created properly and early enough, it can preserve wealth for heirs while enabling access to Medicaid-funded care.

What are the limitations of using a trust for long-term care planning?

Medicaid trusts must be established at least five years before applying for benefits to meet look-back rules. Additionally, Medicaid may not cover all types of care, such as full-time home assistance, which can limit personal choice and flexibility.

When should you start planning for long-term care needs?

It’s best to plan well in advance—ideally several years before care is needed. Early planning allows time to build assets for self-insuring or to structure a trust properly for Medicaid eligibility, reducing financial and emotional stress later.

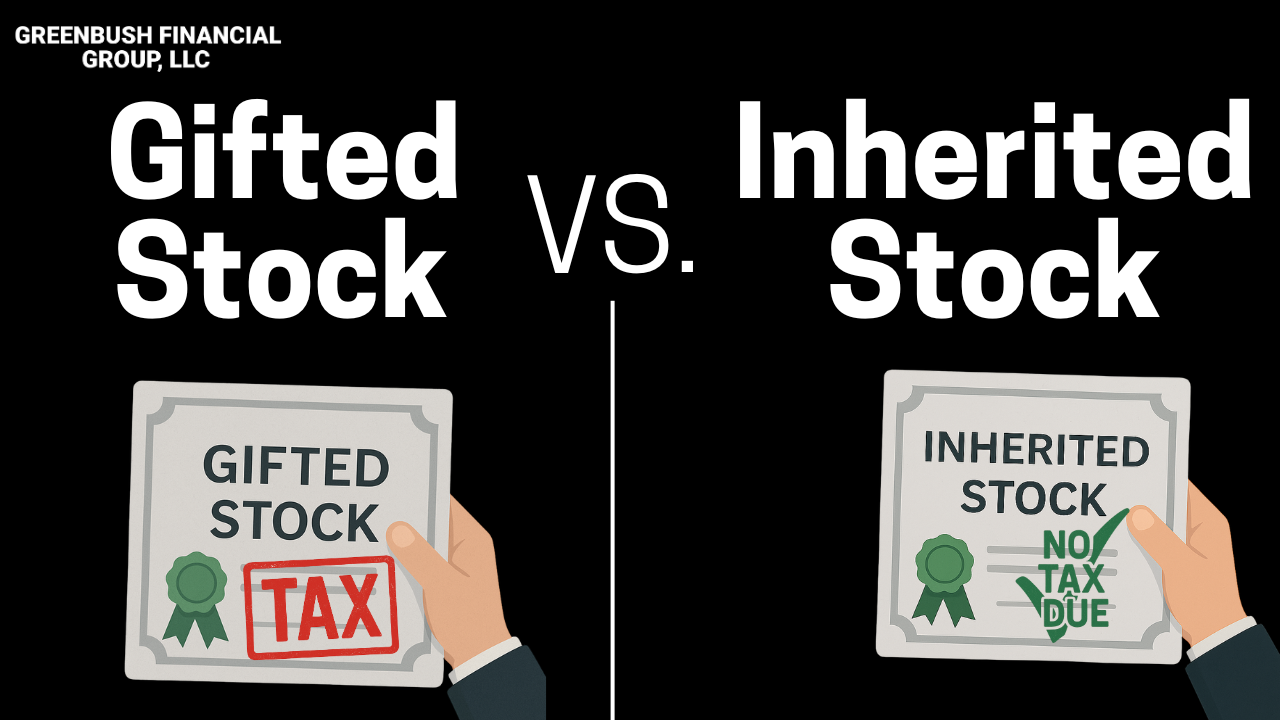

Don’t Gift That Stock Yet – Why Inheriting Might Be Better

Thinking about gifting your stocks to your kids or loved ones? You might want to hit pause. In this video, we break down why inheriting appreciated stock is often a far smarter move from a tax perspective.

When it comes to passing wealth to the next generation, many investors consider gifting appreciated stock during their lifetime. While the intention is generous, gifting stock prematurely can create unexpected tax consequences. In many cases, allowing your heirs to inherit the stock instead can lead to a significantly better outcome — especially from a tax perspective.

Here’s what you need to know before transferring shares.

The Key Difference: Gifting vs. Inheriting Stock

The tax treatment of appreciated stock hinges on the concept of cost basis — the original value of the stock when you acquired it.

Gifted stock: The recipient takes on your original cost basis. If they sell, they may owe capital gains tax on the full appreciation.

Inherited stock: The recipient receives a “step-up” in basis to the fair market value on the date of your death. If they sell shortly after, there may be little or no capital gain.

This example illustrates why timing matters when transferring highly appreciated assets.

When Gifting Might Still Make Sense

There are scenarios where gifting appreciated stock can be a smart move:

Low-Income Beneficiaries: If the person receiving the stock is in the 0% long-term capital gains tax bracket, they might sell the stock with no federal tax owed.

In 2025, this includes:

Single filers with taxable income under $47,025

Married couples filing jointly with taxable income under $94,050

Charitable Giving: Donating appreciated stock to a qualified charity allows you to avoid capital gains tax altogether and potentially deduct the fair market value of the donation.

Other Considerations

Timing of Sale: If your child or heir plans to sell the shares quickly, gifting may trigger a large capital gain — something they might not be prepared for.

Holding Period Requirements: Gifting doesn’t reset the holding period. If owner of the stock purchase the stock more than 12 months ago, if it’s gift to someone else and they sell it immediate, they receive long-term capital gain treatment since they get credit for the time the original owner held the securities.

State Taxes: Even if there's no federal capital gain, some states still impose capital gains taxes.

Final Checklist: Before You Gift Stock, Ask:

Has the stock appreciated significantly since I bought it?

Would the recipient likely sell the stock soon after receiving it?

Are they in a low-income tax bracket or facing large expenses?

Am I trying to reduce my estate or make a charitable contribution?

Final Thoughts

Gifting stock during your lifetime can be useful in the right situations — particularly for charitable intent or strategic gifting. But in many cases, letting your heirs inherit appreciated stock allows them to avoid a sizable capital gains tax bill.

Before gifting, consider your own goals, the recipient’s financial position, and the long-term tax impact. The best outcomes often come from a well-timed, well-informed plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the main difference between gifting and inheriting stock?

When you gift appreciated stock, the recipient assumes your original cost basis, meaning they may owe capital gains tax on all prior appreciation when they sell. In contrast, inherited stock receives a “step-up” in basis to its fair market value at the time of your death, often eliminating or greatly reducing capital gains tax if sold soon after.

When does gifting appreciated stock make sense?

Gifting may be advantageous if the recipient is in the 0% long-term capital gains tax bracket or if the stock is being donated to a qualified charity. In those cases, little to no capital gains tax may apply, and charitable donors may be able to deduct the stock’s fair market value.

How does the cost basis affect capital gains taxes on gifted stock?

The cost basis determines how much of the stock’s value is subject to capital gains tax. When stock is gifted, the recipient keeps the giver’s original basis, so highly appreciated shares can result in significant taxes when sold. Inherited shares, however, get a new basis equal to their current market value.

Are there tax benefits to donating appreciated stock to charity?

Yes. Donating appreciated stock directly to a qualified charity allows you to avoid paying capital gains tax on the appreciation and may provide a charitable deduction equal to the stock’s fair market value. This can be more tax-efficient than selling the stock and donating cash.

Do gifted stocks qualify for long-term capital gains treatment?

Yes, the recipient inherits the donor’s holding period. If the donor owned the stock for more than one year, the recipient can sell immediately and still qualify for long-term capital gains rates.

What should I consider before gifting appreciated stock?

Before gifting, assess how much the stock has appreciated, the recipient’s income level and potential tax bracket, and whether they plan to sell soon. In many cases, allowing heirs to inherit appreciated stock can result in better long-term tax outcomes due to the step-up in basis.

How to Title Your House To Avoid Probate

When we are working with clients on their estate plan, one of the primary objectives is to assist them with titling their assets so they avoid the probate process after they pass away. For anyone that has had to serve as the executor of an estate, you have probably had firsthand experience of how much of a headache the probate processes which is why it's typically a goal of an estate plan to avoid the probate process altogether.

When we are working with clients on their estate plan, one of the primary objectives is to assist them in titling their assets so they avoid the probate process after they pass away. For anyone that has had to serve as the executor of an estate, you have probably had firsthand experience with how much of a headache the probate process is. For that reason, it's typically a goal of an estate plan to avoid the probate process altogether.

While it’s fairly easy to protect an IRA, a brokerage account, bank accounts, and life insurance policies from the probate process, it has historically been more difficult to protect the primary residence from the probate process without setting up a trust to own the house.

But there is good news on this front, especially for residents of New York State. As of July 2024, New York allows residence to add a Transfer on Death (TOD) designation to their deed. Adding a TOD designation is like naming beneficiaries on an IRA account or brokerage account. Prior to July 2024, residents of New York State were not allowed to add a TOD designation to a deed for real estate, so their only ways to protect their house from the probate process was:

Gift the house to their child before they die (Not a good option)

Gift the house with a life estate (Ok….but not great)

Set up either a Revocable or Irrevocable Trust to own the house

Those three options are still available but now there is a fourth option which is simple and costs less money than setting up a trust. Change the deed on your house to a “TOD deed”.

32 States Now Allow TOD Deeds

While New York just made this option available in 2024, there were already 31 other states that already allowed residents to add a TOD designation to their deed. Depending on which state you live in, a simple Google search or contacting a local estate attorney, will help you determine if your state offers the TOD deed option.

What Is The Probate Process?

Why is it a common goal of an estate plan to have your assets avoid the probate process? The probate process can be expensive and time consuming depending on what state you live in. In New York, the state that we are located in, it’s a headache. Any asset that is not owned by a trust or does not have beneficiaries directly assigned to it, pass to your beneficiaries through your will. The process of moving assets from your name (the decedent) to the beneficiaries of your estate, it a formal legal process called the “probate process”.

It is not as easy as when someone passes away with a house, they just look at their will which list their children as beneficiaries of their estate, and then the ownership of the house is transferred to the kids the next day. The probate process is a formal legal process in which the court system is involved, an estate attorney may need to be hired to help the executor through the probate process, an accountant may need to be hired to file an estate tax return, an appraiser may need to be hired to value real estate holdings, and investment advisors may be involved to help retitle assets to the beneficiaries. All of this costs money and takes time to navigate the process. We have seen some estates take years to settle before the beneficiaries receive their inheritance.

How Assets Pass to Beneficiaries of an Estate

There are three ways that assets pass to a beneficiary of an estate:

Probate

By Contract

By Trust

Assets That Pass By Contract

Assets that pass “by contract” to beneficiaries of an estate avoid the probate process because there are beneficiaries contractually designated on those accounts. Examples of these types of assets are retirement accounts, IRAs, annuities, life insurance policies, and an asset with a TOD designation like a brokerage account, bank account, or a house with a TOD deed. For these types of assets, you simply look at the beneficiary form that was completed by the account owner, and that's who the account passes to immediately after the decedent passes away. It does NOT pass by the decedent’s will.

Example: Someone could list their two children as 50/50 beneficiaries of their estate in their will but if they list their cousin as their 100% primary beneficiary on their IRA, when they pass away, that IRA balance will go 100% to their cousin because IRA assets transfer by contract and not through the probate process. Any assets that go through the probate process are distributed in accordance with a person’s will.

Asset That Pass By Trust

One of the primary reasons for an individual to set up either a revocable trust or irrevocable trust to own their house or other assets is to avoid the probate process, because assets that are owned by a trust pass directly to the beneficiaries listed in the trust document outside of the will. Example: your brokerage account is owned by your Revocable Trust, when you pass away, the assets can be immediately distributed to the beneficiaries listed in the trust document without going through the probate process. The beneficiaries listed in your trust document may or may not be different than the beneficiaries listed in your will.

House With A Transfer of Death Deed

Prior to New York allowing residents to attach a TOD designation to the deed on their house, the only options for titling the house to avoid the probate process were to:

Gift the house to the kids before they pass (not a good option)

Gifting the house with a life estate

Setting up a trust to own the house

The most common solution was setting up a trust to own the house which costs money because you typically have to engage an estate attorney to draft the trust document. If the ONLY objective of establishing the trust was for the house to avoid probate, the new TOD deed option could replace that option and be an easier, more cost-effective option going forward.

How To Change The Deed to a TOD Deed

Changing the deed on your house to a TOD deed is very simple. You just need to file the appropriate form at your County Clerk’s Office. The TOD designation on your house does not become official until it has been formally filed with the County Clerk’s Office.

What If You Still Have A Mortgage?

Having a mortgage against your primary residence should not preclude you from changing your current deed to a TOD deed. Even after you file the TOD deed, you still own the house, the bank still maintains a lien against your house for the outstanding amount, and even if you pass and the house transfers to the kids via the TOD designation, it does not remove the lien that the bank has against the property. If the kids tried to sell the house after you pass, they would first need to satisfy the outstanding mortgage, potentially with proceeds from the sale of the house.

The TOD Deed Does Not Protect The House From Medicaid

While changing the deed on your house to a TOD deed will successfully help the house to avoid the probate process, it does not protect the house from a future long-term care event. While the primary residence is not a countable asset for Medicaid, Medicaid, depending on the county that you live in, could put a lien against your house for the amount that they paid to the nursing home for your long-term care. Individuals that want to fully protect their house from a future long-term care event will often set up an Irrevocable Trust, otherwise known as a Medicaid Trust, to own their house to avoid these Medicaid liens. That is an entirely different but important topic that we have a separate article on. If you are looking for more information on how to protect your house from probate AND a long-term care event, here are our articles on those topics:

Article: Gifting Your House with a Life Estate vs Medicaid Trust

Article: Don’t Gift Your House To Your Children!!

Article: How to Protect Assets From A Nursing Home

Changing the House TOD Beneficiaries

The question frequently comes up during our estate planning meetings, “What if I change my mind on who I want listed as the beneficiary of my house?” With a TOD Deed, it’s an easy change. You just go back to the County Clerks Office and file a new TOD Deed with your updated beneficiary designations. Remember, once you Change the deed to a TOD deed, the house no longer passes in accordance with your will, it passes by contract to the beneficiaries list on that TOD designation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is a Transfer on Death (TOD) deed?

A Transfer on Death (TOD) deed allows you to name beneficiaries who will automatically inherit your home when you pass away—without having to go through probate. It works similarly to naming beneficiaries on an IRA, bank, or brokerage account.

Does New York State allow TOD deeds?

Yes. As of July 2024, New York residents can add a TOD designation to their property deed. Before this change, homeowners in New York had to use trusts or life estates to avoid probate. New York now joins 31 other states that already allow TOD deeds.

Why should I want to avoid probate?

The probate process can be costly and time-consuming. It often requires attorneys, accountants, and court filings before beneficiaries can receive their inheritance. In some cases, estates can take years to settle. A TOD deed allows real estate to transfer immediately to beneficiaries, avoiding this process entirely.

How do assets pass to beneficiaries?

Assets can pass three ways: through probate (by will), by contract (through named beneficiaries), or by trust. TOD deeds fall under the “by contract” category, which means the property goes directly to the listed beneficiaries without court involvement.

How is a TOD deed different from a trust?

A TOD deed is simpler and less expensive to set up than a trust. It only applies to real estate, while a trust can manage multiple types of assets. For homeowners who only want to avoid probate on their house, a TOD deed may be an easier solution than creating a trust.

How do you file a TOD deed in New York?

You must complete and file the appropriate form with your County Clerk’s Office. The TOD designation is not valid until it has been officially recorded by the county. Once filed, your home will automatically transfer to the listed beneficiaries when you pass away.

Can you still file a TOD deed if you have a mortgage?

Yes. Having a mortgage doesn’t prevent you from using a TOD deed. The bank’s lien on the property remains in place, and your beneficiaries will need to pay off or refinance the loan if they sell or keep the property after your death.

Does a TOD deed protect your home from Medicaid?

No. A TOD deed only avoids probate—it does not protect the property from potential Medicaid liens for long-term care expenses. Homeowners concerned about Medicaid recovery typically use an Irrevocable (Medicaid) Trust instead.

Can you change TOD deed beneficiaries later?

Yes. You can change beneficiaries at any time by filing a new TOD deed with your County Clerk’s Office. The most recently filed TOD deed overrides all prior versions.

A CFP® Explains: Wills, Health Proxy, Power of Attorney, & Trusts

When we are constructing financial plans for clients, we inevitably get to the estate planning portion of the plan, and ask them “Do you have updated wills, a health proxy, and a power of attorney in place?

When we are constructing financial plans for clients, we inevitably get to the estate planning portion of the plan, and ask them “Do you have updated wills, a health proxy, and a power of attorney in place?” The most common responses that we receive are:

“I know we should have but we never did”

“I did but it was over 10 years ago”

“I have a will but not a health proxy or a power of attorney”

“I have heard about trusts, should I have one?”

The Will, Health Proxy, and Power of Attorney are the three main estate documents that most people should have. In this article I will review:

How Wills work and items that you should include in your Will

Why you should have a Health Proxy and how they work

Power of Attorney

The probate process

Considering a testamentary trust

Assets that pass outside of the Will

Revocable Trusts & Irrevocable Trusts

Estate planning tips

How much does it cost to establish a will, health proxy, and a power of attorney

Establishing A Will

The most basic estate document that most people are aware of is a written Will. The Will provides specific guidance as to who will receive your assets after you have passed away. The Will also establishes who would be the guardian of your minor children should you pass away prior to your children reaching the age of majority. Without a Will, state laws and the court system that know nothing about you, will decide who receives your assets and who will be the guardian of your minor children; not a situation that most people want.

The Will can be a very simple document. If you are married and have children, the Will may state that if you pass away everything goes to your spouse but if both you and your spouse were to pass away simultaneously, the assets go to the children. For individuals or married couples without children, or for married couples that have been divorced, it’s also critical to have a Will to provide direction as to what will happen to your assets if you were to pass away.

You can engage an estate attorney to complete a simple Will or if your Will is very simple and straightforward, you may elect to use a do-it-yourself option through a platform like Legal Zoom. We typically encourage clients to meet with an estate attorney because when it comes to estate planning many people don’t know what questions to ask to get the right documents and plan in place. If you are married with minor children, and you and your spouse were to pass away leaving all the assets to the kids, with a simple Will, they would have access to their full inheritance at age 18. An 18 year old having access to large sums of money may not be an optimal situation. In those cases, you may want to include a testamentary trust or revocable trust in your estate plan to put some restrictions in place as to how and when your children will have access to their inheritance.

Probate

I'm going pause here for a moment and explain what probate is and the probate process. When someone passes away, all of the assets included in their estate go through what's called a “probate process”. The probate process is a legal process of accounting for all of your assets, debts, and transferring your assets to the beneficiaries of your estate. The person listed in your will as the “executor” is responsible for coordinating the probate process. Depending on the size of the estate, your executor will usually work with an attorney, an accountant, and possibly appraiser, to:

Value the assets in your estate

Work with the courts to process your estate

Pay outstanding expenses or debts

Coordinate the transfer of assets to your beneficiaries

Since the probate process is a legal process involving the courts, the process often takes longer than beneficiaries expect. Individuals will make the incorrect assumption that when you pass away, they just read the will, and your beneficiaries receive the assets within a few days or weeks; unfortunately that's not that case. It’s not uncommon for the probate process to take 6 to 12 months and there are expenses involved with probating an estate. If it’s a complex estate, it could take over a year to complete the probate process.

For these reasons, it’s a common goal with estate planning to find ways to avoid the probate process and pass you assets directly to your beneficiaries. I will explain more about these strategies later on. But circling back to our discussion about the Will, if all you have is a Will, when you pass away, the assets in your estate will pass through this probate process.

Testamentary Trusts

There are a lot of different types of trusts within in estate planning world. One of the most basic and common trusts, especially for individuals with children under that age of 25, is a testamentary trust. A testamentary trust is a trust that is built into your will. With at testamentary trust, you are not establishing a trust today , but rather, if you pass away, a trust is established during the probate process and you can direct assets to the trust. Building a testamentary trust into your Will gives you some control over how the assets are distributed to the beneficiaries after you have passed away.

It's common for individuals or married couples with children under that age of 25, to build these testamentary trusts into their Wills. I will illustrate how these trusts work in the example below.

Example: Jim and Sarah have two children, Rob age 14 and Wendy age 8. Between the value of their house, life insurance policies, and other assets, their estate would total $1.5M. Jim & Sarah realize that if something were to happen to them tomorrow, they would not want their kids to inherit $1.5M when they turn age 18 because they might not go to college, they may try to start a business that fails, buy a Corvette, etc. In their Will they establish a Testamentary Trust that states that if both parents pass away prior to the children turning age 25, all of their assets will flow into a trust, and that Sarah’s brother Harold will serve as the trustee. Harold as the trustee is able to distribute cash from the trust for living expenses, education, health expenses, and other expenses deemed necessary for the well being of the children. The children will receive 1/3 of their inheritance at age 25, 30, and 35.

You can design these testamentary trusts however you would like. In the Will you would designate who will be the trustee of your trust and the terms of the trust.

IMPORTANT NOTE: Testamentary trusts do not avoid probate like other trusts do. The trust is established as part of the probate process.

Revocable Trusts & Irrevocable Trusts

It's also common for individuals and married couples to consider establishing either a Revocable Trust or Irrevocable Trust as part of their estate planning. These are separate from Testamentary Trusts. Revocable Trusts and Irrevocable Trusts are being established today and assets owned by the trust pass in accordance with the terms set forth in the trust document. There are material differences between these two types of trusts but some primary reasons why people establish these types of trust are to:

Avoid probate

Protecting assets from a long term event

Control how and when assets are distributed beyond the date of death

Reducing the size of the estate

Advanced tax strategies

Assets That Pass Outside of The Will

There are certain assets that pass outside of the Will. Many of these “other assets” pass by “contract”, meaning there are beneficiaries designated on those accounts. A common example of assets that pass by contract are 401(k) accounts, IRA’s, annuities, and life insurance. When you set up those accounts you typically designate beneficiaries for each account and your Will could say something completely different. The assets that pass by contract do not have to go through the probate process unless the beneficiary listed on the account is your estate which is usually not an advantageous election for most individuals.

Transfer On Death Accounts (TOD)

One of the estate planning strategies that we use with clients is instead of holding an individual investment account in the name of the individual, we will register the account as a “transfer on death” (TOD) account. If you have an individual brokerage account and you pass away, the value of that account will have to go through probate. By simply adding the TOD feature to an existing individual brokerage account which lists beneficiaries similar to a 401(K) or IRA account, that account now avoids probate, and passes by contract directly to the beneficiaries.

Depending on the assets that make up your estate, you may be able to setup TOD accounts as opposed to going through the process of setting up trusts but it varies from person to person.

Power of Attorney

Let’s shift gears now over to the Power of Attorney document. A Power of Attorney document is important because it allows someone to step into your shoes and handle your financial affairs, should you become incapacitated. Some common examples are:

Example 1: If you're in a car accident and end up in a coma, for accounts that are held only in your name, such as a checking account, investment account, or credit card, they will only speak to you. Being married does not give your spouse access financially to those accounts while you are still alive but your spouse may need access to them to continue to pay your bills or get access to cash to pay expenses while you're incapacitated. Having a power of attorney document would allow your spouse or trusted individual named as your “agent” to act financially on your behalf.

Example 2: Having a power of attorney in place is key for Long Term Care events. If you have a spouse or parent and they have a stroke, develop dementia, or another health event that renders them unable to handle their personal finances, you could step in as their agent and handle their personal finances. In long term care situations that can often mean paying a nursing home, applying for Medicaid, paying medical bills, or shifting the ownership of assets to protect from a Medicaid spend down.

The Power of Attorney can also be built so your agent is not given that power today but rather it would only be given if a triggering event happened sometime in the future. With this document you really have to name someone you 100% trust. As financial planners, we have seen cases where there is abuse of the Power of Attorney powers and it’s never pretty. It's not uncommon for a power of attorney to allow the agent to make gifts as a planning tool, but that might also include gifts to themselves, so you have to fully trust your agent and the powers that you provide to them.

Health Proxy

The health proxy is usually the least fun estate document to complete but is equally important. In this document you are naming the individual that has the right to make your health decisions for you if you are incapacitated. This document spells out what you want and don’t want to have happen if certain health events occur. While it's not uncommon for individuals to be a little uncomfortable completing this document due to the nature of the questions, it's a lot better to complete it now, versus your family members trying to determine what your wishes would be when a severe health event has already occurred.

The health proxy will list items like:

Would you be willing to be put on life support?

If you could not eat, would you allow them to use a feeding tub

Resuscitation preferences

Willingness to accept blood transfusions

Again, not fun things to think about but by you making these decisions while you are of sound body and mind, it takes away the difficult situation where your family members have to decide in the heat of the moment what you would have wanted. That situation can sometimes tear families apart.

Keep Your Estate Plan Up To Date

All too often, we run into this situation where a client will acknowledge that they have estate documents, but they were established 20 years ago, and they never made any changes. It makes sense to meet with your estate attorney and revisit your estate plan:

Every five years

If you move to a different state

When Congress makes major changes to the estate tax rules

The estate laws vary state by state. If we have clients that are planning to move and they plan to change their state of domicile to another state, we will often encourage them to meet with an estate attorney within that state once the move is complete. Congress has also made a number of changes to the federal estate tax laws over the past few years, with potentially more in the works, and not revisiting the estate plan could end up costing your beneficiaries tens of thousands of dollars in estate taxes that could have been avoided with some advanced planning.

Cost of Estate Documents

The cost of establishing a Will, Health Proxy, Power of Attorney, and Trusts, often varies based on the complexity of your estate plan. A simple Will may cost less than $1,000 to establish through an estate attorney. Establishing all three documents: Will, Health Proxy, and Power of Attorney may cost somewhere between $1,000 - $3,000. While it's not uncommon for individuals to be surprised by the cost of setting up these estate documents, I always urge people to think about the cost of not having those documents in place. The probate process with professionals involved could cost thousands of dollar, your beneficiaries could lose thousands of dollars in taxes that could have been avoided, not to mention the emotional toll on your family trying to figure out what you would have wanted without clear guidance from your estate documents. Revocable Trusts and Irrevocable Trust

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Have To Pay Tax On A House That I Inherited?

The tax rules are different depending on the type of assets that you inherit. If you inherit a house, you may or may not have a tax liability when you go to sell it. This will largely depend on whose name was on the deed when the house was passed to you. There are also special exceptions that come into play if the house is owned by a trust, or if it was gifted

Do I Have To Pay Tax On A House That I Inherited?

The tax rules are different depending on the type of assets that you inherit. If you inherit a house, you may or may not have a tax liability when you go to sell it. This will largely depend on whose name was on the deed when the house was passed to you. There are also special exceptions that come into play if the house is owned by a trust, or if it was gifted with the kids prior to their parents passing away. On the bright side, with some advanced planning, heirs can often times avoid having to pay tax on real estate assets when they pass to them as an inheritance.

Step-up In Basis

Many assets that are included in the decedent’s estate receive what’s called a step-up in basis. As with any asset that is not held in a retirement account, you must be able to identify the “cost basis”, or in other words, what you originally paid for it. Then when you eventually sell that asset, you don’t pay tax on the cost basis, but you pay tax on the gain.

Example: You buy a rental property for $200,000 and 10 years later you sell that rental property for $300,000. When you sell it, $200,000 is returned to you tax free and you pay long-term capital gains tax on the $100,000 gain.

Inheritance Example: Now let’s look at how the step-up works. Your parents bought their house 30 years ago for $100,000 and the house is now worth $300,000. When your parents pass away and you inherit the house, the house receives a step-up in basis to the fair market value of the house as of the date of death. This means that when you inherit the house, your cost basis will be $300,000 and not the $100,000 that they paid for it. Therefore, if you sell the house the next day for $300,000, you receive that money 100% tax-free due to the step-up in basis.

Appreciation After Date of Death

Let’s build on the example above. There are additional tax considerations if you inherit a house and continue to hold it as an investment and then sell it at a later date. While you receive the step-up in basis as of the date of death, the appreciation that occurs on that asset between the date of death and when you sell it is going to be taxable to you.

Example: Your parents passed away June 2019 and at that time their house is worth $300,000. The house receives the step-up in basis to $300,000. However, lets say this time you rent the house or don’t sell it until September 2020. When you sell the house in September 2020 for $350,000, you will receive the $300,000 tax-free due to the step-up in basis, but you’ll have to pay capital gains tax on the $50,000 gain that occurred between date of death and when you sold house.

Caution: Gifting The House To The Kids

In an effort to protect the house from the risk of a long-term event, sometimes individuals will gift their house to their kids while they are still alive. Some see this as a way to remove themselves from the ownership of their house to start the five-year Medicaid look back period, however, there is a tax disaster waiting for you with the strategy.

When you gift an asset to someone, they inherit your cost basis in that asset, so when you pass away, that asset does not receive a step-up in basis because you don’t own it and it’s not part of your estate.

Example: Your parents change the deed on the house to you and your siblings while they’re still alive to protect assets from a possible nursing home event. They bought the house 30 years ago for $100,000, and when they pass away it’s worth $300,000. Since they gifted the assets to the kids while they were still alive, the house does not receive a step-up in basis when they pass away, and the cost basis on the house when the kids sell it is $100,000; in other words, the kids will have to pay tax on the $200,000 gain in the property. Based on the long-term capital gains rates and possible state income tax, when the children sell the house, they may have a tax bill of $44,000 or more which could have been completely avoided with better advanced planning.

How To Avoid Paying Capital Gains Tax On Inherited Property

There are ways to both protect the house from a long-term event and still receive the step-up in basis when the current owners pass away. This process involves setting up an irrevocable trust to own the house which then protects the house from a long-term event as long as it’s held in the trust for at least five years.

Now, we do have to get technical for a second. When an asset is owned by an irrevocable trust, it is technically removed from your estate. Most assets that are not included in your estate when you pass do not receive a step-up in basis; however, if the estate attorney that drafts the trust document puts the correct language within the trust, it allows you to protect the assets from a long-term event and receive a step-up in basis when the owners of the house pass away.

For this reason, it’s very important to work with an attorney that is experienced in handling trusts and estates, not a generalist. It only takes a few missing sentences from that document that can make the difference between getting that asset tax free or having a huge tax bill when you go to sell the house.

Establishing this trust can sometimes cost between $3,000 and $6,000. But by paying this amount upfront and doing the advance planning, you could save your heirs 10 times that amount by avoiding a big tax bill when they inherit the house.

Making The House Your Primary

In the case that the house is gifted to the children prior to the parents passing away and the house is not awarded the step-up in basis, there is an advance tax planning strategy if the conditions are right to avoid the big tax bill. If one of the children would be interested in making their parent’s house their primary residence for two years, then they are then eligible for either the $250,000 or $500,000 capital gains exclusion.

According to current tax law, if the house you live in has been your primary residence for two of the previous five years, when you go to sell the house you are allowed to exclude $250,000 worth of gain for single filers and $500,000 worth of gain for married filing joint. This advanced tax strategy is more easily executed when there is a single heir and can get a little more complex when there are multiple heirs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.