New York State Secure Choice Law — Companies Are Now Required to Sponsor Retirement Plans for Employees

New York’s SECURE Choice program is changing how many employers must handle retirement benefits. If your business doesn’t currently offer a qualified retirement plan, you may be required to either register for SECURE Choice or implement an alternative plan option. In this article, we break down who must comply, key deadlines, and what employers should do now to avoid penalties and ensure employees have a retirement savings solution.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The New York State Secure Choice Savings Program requires most companies and not-for-profit organization in New York to either:

Sponsor a qualified employer-sponsored retirement plan, or

Register for the state-run Roth IRA program and remit employee contributions.

This law affects businesses based on size and existing retirement plan offerings. In this article, we’ll explain:

Who is covered under the law

Important effective dates by company size

What qualifies as an exempt employer-sponsored retirement plan

How to certify exemptions

Employer responsibilities in remitting contributions

How employees interact with their state-run IRAs

Penalties for non-compliance

Practical tips for employers to prepare

What Is the NY Secure Choice Savings Program?

The Secure Choice program is a state-sponsored retirement savings program that allows participating employees to save for retirement through automatic payroll deductions into a Roth IRA. Employers who do not already offer a qualified plan are required to facilitate the program.

The program is overseen by the New York Secure Choice Savings Program Board and is designed to expand retirement savings access to private-sector workers across the state.

Who Must Comply?

An employer must either offer a employer-sponsored retirement plan or participate in the Secure Choice program if all of the following are true:

The employer has 10 or more employees in New York during the prior calendar year;

The employer has been in business for at least two years;

The employer does not already offer an employer-sponsored retirement plan to employees.

Employers with fewer than 10 employees are generally not required to participate in the state program, though they must still register and certify exemption if applicable.

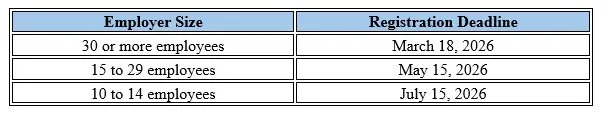

Effective Dates Based on Employer Size

Secure Choice implementation in 2026 is staggered based on the number of New York employees:

These are the dates by which employers must either:

Register for the Secure Choice program, or

Certify exemption via the official state portal.

Exemptions: Qualifying Employer-Sponsored Retirement Plans

However, even if an employer meets the employee-size threshold above, it is exempt from the Secure Choice program if it already sponsors an employer-sponsored retirement plan. Employers must still certify their exemption through the Secure Choice portal.

Qualifying employer-sponsored plans include:

401(k) plans

403(a) qualified annuity plans

403(b) tax-sheltered annuity plans

SEP IRAs

SIMPLE IRA plans

457(b) plans

If you offer one of the above, your business can avoid participation in the state program — but you must still submit an exemption through the official portal.

How to Certify an Exemption

Employers seeking exemption need to log in to the Secure Choice employer portal and submit documentation of their qualified plan. Details include:

Federal Employer Identification Number (EIN)

Access Code (typically sent to employers by mail or email)

Plan documentation showing current retirement plan offerings

Official website for registration and exemptions: www.NewYorkSecureChoice.com

Employer Responsibilities if Participating in Secure Choice

If your business does not qualify for an exemption, you must:

Register for Secure Choice by the deadline assigned to your employer size.

Automatically enroll eligible employees into the program. (Eligibility is all employee age 18 or older with earned taxable wages)

Set up payroll deductions and begin subtracting employee contributions.

Remit contributions to the state-administered Roth IRAs.

Upload employee data and maintain records via the program portal.

Employers do not contribute to the accounts, and they cannot offer matching contributions under the Secure Choice IRA program.

How Contributions Work

Remitting Employee Payroll Contributions

Contributions are deducted from employee paychecks via automatic payroll withholding.

Employers are responsible for timely remittance of these contributions to the state program’s recordkeeper (program administrators).

Employers do not make employer contributions.

Default Contribution and Adjustments

Employees are typically auto-enrolled at a default 3% contribution rate of gross pay.

Employees may adjust the contribution amount or opt out entirely within the enrollment period or later open enrollment windows.

Employee Experience With Secure Choice

Account Setup and Features

Each participating employee gets a Roth IRA account through the Secure Choice program.

Contributions are after-tax, meaning withdrawals in retirement are generally tax-free (subject to Roth IRA rules).

Accounts are portable — employees keep them even if they change jobs.

Investing, Contribution Limits, and Withdrawals

Employees can choose investment options provided by the program or stay with the default investment.

They can change contribution rates or opt out after the initial enrollment period.

Roth IRA contribution limits apply (e.g., the standard IRA annual limits — $7,500 for 2026 before catch-up, potentially higher with catch-up contributions for those 50+, etc.).

Distributions follow general Roth IRA rules (qualified distributions tax-free and penalty-free after meeting age/service requirements).

How Employees Are Enrolled in the NY Secure Choice Roth IRA Program

A common question from employers is whether they are responsible for enrolling employees, or whether employees must sign themselves up. Under the New York State Secure Choice Savings Program, the process works as follows:

Employers Facilitate Enrollment — Employees Do Not Self-Enroll

Employers do not actively “sign up” employees, and employees do not enroll themselves directly. Instead, enrollment happens through automatic payroll facilitation by the employer.

Here’s how the process works step-by-step:

Step 1: Employer Registers and Uploads Employee Information

Once an employer registers for Secure Choice (or confirms participation is required), the employer must:

Upload required employee data into the Secure Choice employer portal, including:

Employee name

Social Security number or Tax ID

Date of hire

Contact information

Identify eligible employees who meet program requirements

For newly hired employees, the employer needs to enroll them in the Secure Choice Program within 30 days of their hire date

This step triggers the enrollment process, but it does not immediately deduct contributions.

Step 2: Employees Receive Enrollment Notice From the State Program

After the employer uploads employee information:

The Secure Choice program (or its appointed program administrator) sends official enrollment notices directly to employees

The notice explains:

That the employee will be automatically enrolled

The default contribution rate

How to opt out or change contribution levels

Where to access their account online

This communication comes from the state program, not the employer.

Step 3: Automatic Enrollment Occurs Unless the Employee Opts Out

If the employee takes no action during the notice period:

The employee is automatically enrolled in a state-sponsored Roth IRA

Payroll deductions begin at the default contribution rate (generally 3% of gross pay, unless adjusted by the employee)

If the employee chooses to opt out:

No deductions are taken

The employer must maintain records showing the opt-out election

Step 4: Employer Begins Payroll Withholding and Remittance

Once enrollment is active:

The employer withholds the elected contribution amount from each paycheck

Contributions are remitted to the Secure Choice program on a recurring basis, aligned with payroll schedules

The employer’s role is limited to withholding and remitting contributions — similar to payroll taxes

Importantly:

Employers do not select investments

Employers do not manage accounts

Employers do not provide investment advice

Employers do not contribute employer funds

Step 5: Ongoing Employee Control

After enrollment:

Employees manage their own accounts directly through the Secure Choice program

Employees can:

Change contribution percentages

Opt out or opt back in later

Select or change investment options

Request distributions (subject to Roth IRA rules)

The account belongs to the employee and is fully portable if they change jobs.

Penalties for Non-Compliance

While specific penalties in the Secure Choice law are still being formalized, failure to register or certify your exemption by the applicable deadline can subject employers to:

Administrative penalties and fines

Potential liability for missed remittance obligations

Ongoing penalties until compliance is achieved

For example, programs in other states have assessed penalties like $250 per employee per month for non-compliance, escalating over time. While New York’s specific fines may vary, the risk of enforcement is real and growing as the program rolls out statewide. However, as of February 2026, New York has yet to communicate when penalities will begin and what the amounts will be.

Tips for Employers

Start Early — Don’t Wait

Act well in advance of your registration deadline. If your company currently sponsors an employer-sponsored retirement plan, it’s making sure someone on your team will be logging into the NYS portal to file the exemption. For companies that plan to implement an employer-sponsored retirement plan prior to their deadline, there is extreme urgency to start evaluating as soon as possible both the type of plan that is best for the company and the platform for their plan. Establishing an employer-sponsored plan often involves:

Plan design and adoption

Document creation and compliance testing

Employee communications and elections

Payroll integration

If it’s the intent of your company / organization not establish a retirement plan and enroll employees in the state-mandated Roth IRAs, advanced action is still required. Companies will be required to gather the employee data and upload it to the NYS Secure Choice website, confirm how payroll will handle the automatic Roth deductions from payroll, who will be responsible for remitting the contributions to the NYS platform each pay period, and communication to the employees in advance of the payroll deduction is highly recommended.

Many businesses will be acting on these requirements in 2026 — waiting until the last minute can create unnecessary compliance risk.

Evaluate Whether to Offer Your Own Plan

Offering a 401(k) or other qualified plan may be more attractive for recruiting and retention, may allow employer matching, and could provide tax incentives not available under the state program. Also, there are a number of tax credits currently available to help offset some or all of the plan fees associated with establishing an employer-sponsored retirement plan for the first time. See our article below for detail on the start-up plan tax credits available:

GFG Article: 3 New Start-up 401(k) Tax Credits

How Many Other States Have Similar Mandated Retirement Programs?

New York is not alone in adopting a mandatory retirement savings program for private-sector employees. In fact, Secure Choice builds on a growing national trend aimed at addressing the retirement savings gap for workers who do not have access to an employer-sponsored plan.

As of today:

More than a dozen states (15+) have enacted legislation requiring certain employers to either:

Offer a qualified employer-sponsored retirement plan, or

Participate in a state-facilitated IRA program funded through payroll deductions.

Several of these programs are fully operational, while others are in various stages of implementation or phased rollout.

States that were early adopters (such as California, Oregon, and Illinois) now have millions of workers enrolled and billions of dollars in assets within their state-facilitated retirement programs.

New York Has Selected Vestwell

New York has selected a company by the name of Vestwell to serve as the program administrator for the state-mandated Roth IRA accounts.

Choosing a Startup Retirement Plan Provider: What Employers Should Know

For many employers, the Secure Choice law will prompt a first-time decision about whether to start an employer-sponsored retirement plan instead of participating in the state-run IRA program. While this can be a positive move for employee recruitment and retention, it’s important to understand that not all startup plan providers — or pricing models — are the same.

There Are Many Choices — and Fees Vary Widely

Employers exploring startup plans will quickly find a wide range of providers, including bundled platforms, payroll-integrated solutions, and self-directed providers. Costs can differ significantly depending on:

Plan administration fees

Investment platform and fund expenses

Recordkeeping and compliance costs

Per-participant charges

Advisor or fiduciary service fees (if applicable)

Some providers advertise low headline pricing but layer on additional costs elsewhere. Others charge flat fees that may be economical at certain asset levels but expensive for smaller plans. Understanding how fees are structured — and how they may grow over time — is critical when selecting a provider.

Start-up 401(k) Provider

In the past, we have worked with companies that successfully used Employee Fiduciary as a start-up 401(k) solution. Employee Fiduciary is a national-level 401(k) provider that offers flexibility with plan design, Vanguard index funds for investment options, and fee transparency.

Disclosure: This statement is not an endorsement of Employee Fiduciary or their 401(k) solution. Our firm has had experience in working with Employee Fiduciary in the past, and since we do not offer investment services to start-up plans, we want to be able to connect readers with what I, as the author of this article, deem to be a high-quality start-up 401(k) plan solution. Our firm does not receive any form of compensation for referring clients to Employee Fiduciary.

Conclusion

The New York Secure Choice Savings Program represents a significant change for private employers in the state. Whether you must register for the state-run IRA program or certify exemption with your existing retirement plan, compliance is mandatory and deadlines are coming fast in 2026.

By planning ahead — and consulting legal, tax, or benefits professionals if needed — employers can meet these requirements smoothly while ensuring their employees have access to valuable retirement savings opportunities.

A Note on Our Firm’s Focus

Our firm does not offer solutions for brand-new startup plans. We specialize in working with established retirement plans that already have at least $250,000 in plan assets, for which we provide investment management and plan consulting services.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Executive Non-Qualified Deferred Compensation Plans Work?

If you're a high-income executive, you’ve likely hit the contribution ceiling on your 401(k) or other qualified plans. So what’s next?

Enter the non-qualified deferred compensation (NQDC) plan—a tax deferral strategy designed for executives who want to save more for retirement beyond traditional limits.

For highly compensated employees, saving for retirement isn’t always as simple as maxing out a 401(k). When income exceeds traditional plan limits, non-qualified deferred compensation (NQDC) plans—often offered to executives—can provide a powerful way to defer taxes and accumulate wealth beyond standard retirement vehicles.

But how do these plans actually work? And what should executives know before deferring compensation?

Let’s break it down.

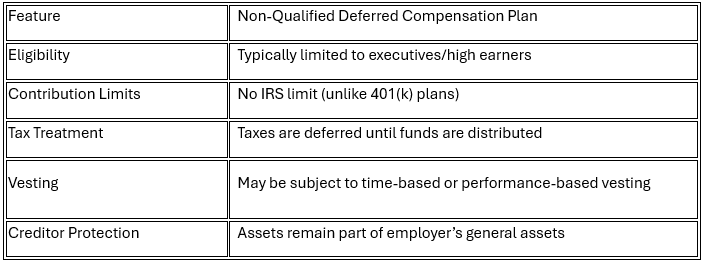

What Is a Non-Qualified Deferred Compensation Plan?

An NQDC plan is an employer-sponsored agreement that allows certain employees—typically executives or other key personnel—to defer a portion of their income to a future date, such as retirement or separation from service.

Unlike qualified plans (such as a 401(k)), these plans do not fall under ERISA coverage and do not have contribution limits set by the IRS. This makes them attractive for those whose income exceeds the maximum deferral limits in traditional plans.

Key Features

How Deferrals Work

An executive elects—in advance of the year earned—to defer a portion of salary, bonus, or other compensation. This election is typically irrevocable for that year and must comply with IRC Section 409A.

For example:

Jane, a CFO earning $600,000, defers $100,000 of her 2025 compensation into her company’s NQDC plan. She’ll pay no income tax on that $100,000 in 2025—it'll be taxed when she receives the funds in retirement or at a future distribution date.

Distribution Options

The executive can usually choose from a menu of payout options, such as:

Lump sum at retirement

Installments over 5–10 years

Specific distribution events (e.g., separation from service, death, disability)

Important: Once the distribution schedule is set, changing it often requires a five-year delay and must follow 409A regulations to avoid penalties.

Tax Considerations

Deferred income is not taxed until it’s actually received.

Funds may grow tax-deferred in an investment vehicle selected by the participant or the employer.

Unlike a 401(k), contributions are not protected from creditors—they remain employer assets until distributed.

Distributions are taxed as ordinary income, not capital gains.

What Are the Risks?

NQDC plans can be valuable, but they come with risks not present in qualified plans:

Employer Solvency: Since funds remain part of the employer’s general assets, they could be lost in bankruptcy.

Limited Access: You cannot take early withdrawals without triggering taxes and penalties under 409A.

Inflexibility: Election and distribution decisions are difficult to change once made.

Unfunded plan: NQDC plans are not required to be “funded” by the employer like a 401(k) plan so it may just be a future promise of the employer to pay those amounts out to the employee when the benefit vests. This adds additional risk for the executive.

When Does an NQDC Plan Make Sense?

An NQDC plan can be a smart tool for:

High W2 earners who max out traditional retirement plans and want to save more

Executives with predictable income and long-term tenure at the company

Those expecting to be in a lower tax bracket in retirement

Executives who are employed by a financially strong company

However, it may not be suitable for someone with:

Uncertainty around staying with the employer long-term

Concerns about the company’s financial health

A need for liquidity or access to funds before retirement

Final Thought

Non-qualified deferred compensation plans can be a powerful tax deferral and wealth-building tool for high-income executives, but they require careful planning. Because these plans carry unique risks and limited flexibility, it’s important to review your full financial picture, long-term goals, and employer stability before making a deferral election.

If you're considering participating in your company’s NQDC plan, talk to a financial planner who understands executive compensation and tax strategy. The right guidance can help you avoid missteps and make the most of what these plans have to offer.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is a Non-Qualified Deferred Compensation (NQDC) plan?

A Non-Qualified Deferred Compensation (NQDC) plan is an employer-sponsored arrangement that allows select employees—typically executives or highly compensated individuals—to defer a portion of their income to a future date, such as retirement or separation from service. These plans are not subject to the same IRS limits as 401(k)s, allowing for greater savings potential.

How does an NQDC plan work?

Participants elect in advance to defer a portion of their salary, bonuses, or other compensation before it is earned. The deferred income grows tax-deferred until distributed, usually at retirement or another specified event. Because the funds technically remain part of the employer’s assets, they are not taxed until paid out to the employee.

When do I have to make my deferral election?

Under IRS Section 409A, deferral elections must be made before the start of the year in which the income is earned. These elections are generally irrevocable for that year and must follow strict timing and compliance rules to avoid penalties.

How are NQDC distributions paid?

Participants usually choose a distribution schedule when enrolling in the plan. Common options include a lump sum at retirement or installment payments over 5–10 years. Once the schedule is selected, it’s difficult to change without a five-year delay and compliance with Section 409A regulations.

How is deferred compensation taxed?

Deferred income and its growth are not taxed until distributed. When payouts occur, the amounts are taxed as ordinary income—not capital gains. However, if the plan violates 409A rules, deferred amounts could become immediately taxable with additional penalties.

Are NQDC plans protected from creditors?

No. Unlike 401(k)s, NQDC plan assets remain part of the employer’s general assets until distributed. This means that if the company faces bankruptcy or insolvency, participants may lose their deferred compensation.

What are the main risks of participating in an NQDC plan?

The key risks include employer insolvency, lack of liquidity, and limited flexibility. Because plans are often unfunded and cannot be accessed early without tax penalties, participants rely on their employer’s financial strength and long-term stability.

Who should consider using an NQDC plan?

These plans are best suited for high earners who have already maxed out qualified retirement plans, expect to stay with their employer long-term, and anticipate being in a lower tax bracket in retirement. They may also be attractive for executives at financially stable companies.

Who might want to avoid an NQDC plan?

NQDC plans may not be appropriate for individuals who expect to leave their employer soon, need short-term access to funds, or are concerned about the company’s financial health. Those uncertain about their future tax situation should also evaluate carefully before deferring large amounts.

What’s the difference between an NQDC plan and a 401(k)?

A 401(k) is a qualified, ERISA-protected plan with contribution limits and creditor protection. An NQDC plan is non-qualified, has no IRS contribution limits, offers greater flexibility in savings amounts, but lacks creditor protection and carries employer solvency risk.

Can I change my payout schedule after enrolling?

Generally no—changes to distribution timing or method require at least a five-year deferral from the original payout date and must follow strict Section 409A rules to avoid penalties.

Should I consult a financial planner before enrolling in an NQDC plan?

Yes. Because NQDC plans involve complex tax, investment, and timing decisions, working with a financial planner or tax advisor experienced in executive compensation can help you optimize your deferral strategy and manage potential risks.

Mandatory 401(k) Roth Catch-up Details Confirmed by IRS January 2025

IRS Issues Guidance on Mandatory 401(k) Roth Catch-up Starting in 2026

Starting January 1, 2026, high-income earners will face a significant shift in retirement savings rules due to the new Mandatory Roth Catch-Up Contribution requirement. If you earn more than $145,000 annually (indexed for inflation), your catch-up contributions to 401(k), 403(b), or 457 plans will now go directly to Roth, rather than pre-tax.

The IRS just released guidance in January 2025 regarding how the new mandatory Roth catch-up provisions will work for high-income earners. This article dives into everything you need to know!

On January 10, 2025, the IRS issued proposed regulations that provided much-needed clarification on the details associated with the Mandatory Roth Catch-up Contribution rule for high-income earners that are set to take effect on January 1, 2026. Employers, payroll companies, and 401(k) providers alike will undoubtedly be scrambling for the remainder of 2025 to get their systems ready for this restriction that will be placed on 401(k) plans starting in 2026.

This is a major change within 401(k) plans, and it is not a welcome change for high-income earners, since individuals in high tax brackets typically like to defer as much as they can pre-tax into 401(k), 403(b), and 457 plans to reduce their current tax liability. Here’s a quick list of the items that will be covered in this article:

General overview of new mandatory 401(k) Roth Catch-up Requirement

Income threshold for employees that will be impacted by the new rule

Definition of “wages” for purposes of the income threshold

Will it apply to Simple IRA plans as well?

“First year of employment” exception for the new Roth rule

Will a 401(k) plan be required to adopt Roth deferrals prior to 1/1/26?

401(k) Mandatory Roth Catch-up Contributions

When an employee reaches age 50, they can make an additional employee deferral called a catch-up contribution. Prior to 2026, all employees were allowed to select whether they wanted to make their catch-up contributions in pre-tax, Roth, or a combination of both. Starting in 2026, the freedom of choice will be taken away from W-2 employees that have more than $145,000 in wages in the prior calendar year (indexed for inflation).

Employees that are above the $145,000 threshold for the previous calendar year, are with the SAME employer, and are age 50 or older, will not be given the option to make their catch-up in pre-tax dollars. If an employee over this wage threshold wishes to make a catch-up contribution to their qualified retirement plan (401K, 403b, 457b), they will only be given the Roth deferral option.

Definition of Wages

One of the big questions that surfaced when the Secure Act 2.0 regulations were first released regarding the mandatory Roth catch-up contribution was the definition of “wages” for the purpose of the $145,000 income threshold. The IRS confirmed in their new regulation that only wages subject to FICA tax would count towards the $145,000 threshold. This is good news for self-employed individuals such as sole proprietors and partnerships that have earnings that are more than the $145,000 threshold, but do not receive W-2 wage, allowing them to continue to make their catch-up contributions all pre-tax for years 2026+.

So essentially, you could have partners of a law firm making $500,000+, and they would be able to continue to make catch-up contributions all pre-tax, but the firm could have a W-2 attorney on their staff that makes $180,000 in wages, and that individual would be forced to make their catch-up contributions all in Roth dollars and pay income tax on those amounts.

Will Mandatory Roth Catch-up Apply to Simple IRA Plans?

Many small employers sponsor Simple IRA plans, which also allow employees aged 50 or older to make pre-tax catch-up contributions, but at lower dollar limits. Fortunately, Simple IRA plans have been granted a pass by the IRS when it comes to the new mandatory Roth catch-up contributions. All employees that are covered by a Simple IRA plan, regardless of their wages, will be allowed to continue to make their catch-up contributions, all pre-tax, for tax years 2026+.

First Year of Employment Exception

Since the $145,000 wage threshold is based on an employee’s “prior year” wages, the IRS confirmed in the new regulations that an employer is allowed to give employees a pass on making pre-tax catch-up contributions during the first calendar year that the company employs them. Meaning, if Sue is hired by Company ABC in February of 2025 and makes $250,000 from February – December in 2025, she would be allowed to contribute her 401(k) catch-up contributions all pre-tax if she is over 50 years old, since Sue doesn’t have wages with Company ABC in 2024, even though her wages for the 2025 were over the $145,000 threshold.

Some High-Income Employees Will Get A 2-Year Pass

There are also situations where new employees with wages over $145,000 will get a 2-year pass on the application of the mandatory Roth catch-up rule. Let’s say Tim is hired by a law firm as a W-2 employee on July 1, 2025, at an annual salary of $200,000. Tim automatically gets a pass for 2025 for the mandatory Roth catch-up, because he did not have wages in 2024 with that company. However, between July 1, 2025 – December 31, 2025, he will only earn half his salary ($100,000), so when they look at Tim’s W-2 wages for purposes of the mandatory Roth catch-up in 2026, his 2025 W-2 will only be showing $100,000, allowing him to make his catch-up contribution all pre-tax in both 2025 and 2026.

Will 401(k) Plans Be Forced to Adopt Roth Deferrals

Not all 401(k) or 403(b) plans allow employees to make Roth employee deferrals. Roth deferrals have historically been an optional provision within an employer-sponsored retirement plan that a company had to voluntarily adopt. When the regulations for the new mandatory Roth catch-up were first released, the regulations seemed to state that if a plan did not allow Roth deferrals, NO EMPLOYEES, regardless of their wage level, were allowed to make catch-up contributions to the plan.

In the proposed regulations that the IRS just released, the IRS clarified that if a retirement plan does not allow Roth deferrals, only the employees above the $145,000 wage threshold would be precluded from making contributions. Employees below the $145,000 wage threshold would still be able to make catch-up contributions pre-tax, even without the Roth deferral feature in the plan.

Due to this restriction, it is expected that if a plan did not previously allow Roth deferrals, many plans will elect to adopt a Roth deferral option by January 1, 2026, to avoid this restriction on their employees with wages in excess of $145,000 (indexed for inflation).

For more information on this new Mandatory Roth Catch-Up Contribution effective 2026, please see our article: https://www.greenbushfinancial.com/all-blogs/roth-catch-up-contributions-high-wage-earners-secure-act-2

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new Mandatory Roth Catch-Up Contribution rule?

Beginning January 1, 2026, employees age 50 and older who earned more than $145,000 in wages (indexed for inflation) from their employer in the previous calendar year must make all catch-up contributions to their 401(k), 403(b), or 457(b) plan as Roth (after-tax) contributions. High-income employees will no longer have the option to make pre-tax catch-up contributions.

Who is affected by the new Roth catch-up rule?

Only W-2 employees with wages over $145,000 in the previous calendar year from the same employer are affected. Employees earning $145,000 or less may continue to choose between pre-tax and Roth catch-up contributions.

How does the IRS define “wages” for this rule?

The IRS clarified that “wages” refer to compensation subject to FICA tax (i.e., W-2 wages). This means self-employed individuals, partners, or sole proprietors whose income is not reported as W-2 wages are not subject to the mandatory Roth catch-up requirement and can continue making pre-tax catch-up contributions after 2026.

Do Simple IRA or SEP IRA plans have to comply with this rule?

No. The Mandatory Roth Catch-Up rule applies only to qualified employer-sponsored plans such as 401(k), 403(b), and 457(b) plans. Simple IRAs and SEP IRAs are exempt, allowing all employees to continue making pre-tax catch-up contributions regardless of income.

What is the “first year of employment” exception?

The IRS confirmed that the $145,000 wage limit applies only to wages from the prior calendar year with the same employer. Therefore, employees in their first year with a new employer are not subject to the Roth catch-up rule, even if their current-year wages exceed $145,000.

Can new high-income employees get a two-year pass?

Yes, in some cases. For example, if an employee joins a company midyear (e.g., July 2025) and earns less than $145,000 that year, they will be exempt in both 2025 and 2026 because their prior-year wages were below the threshold.

What if my 401(k) plan doesn’t currently allow Roth deferrals?

If a plan does not offer a Roth option, the IRS clarified that only high-income employees (earning over $145,000) will be barred from making catch-up contributions starting in 2026. Employees earning below the threshold can continue making pre-tax catch-ups even if the plan lacks a Roth feature.

Will employers be required to add Roth deferral options to their 401(k) plans?

While not legally required, most employers are expected to add Roth deferral options by January 1, 2026, to prevent their high-income employees from losing the ability to make catch-up contributions altogether.

Why are these changes being implemented?

The new Roth catch-up rule was introduced under the SECURE Act 2.0 to increase tax revenue in the short term by requiring high-income employees to pay income tax on their catch-up contributions now rather than deferring taxation until retirement withdrawals.

A Complex Mess: Simple IRA Maximum Contributions 2025 and Beyond

Prior to 2025, it was very easy to explain to an employee what the maximum Simple IRA contribution was for that tax year. Starting in 2025, it will be anything but “Simple”. Thanks to the graduation implementation of the Secure Act 2.0, there are 4 different limits for Simple IRA employee deferrals that both employees and companies will need to be aware of.

Prior to 2025, it was very easy to explain to an employee what the maximum Simple IRA contribution was for that tax year. Starting in 2025, it will be anything but “Simple”. Thanks to the gradual implementation of the Secure Act 2.0, there are 4 different limits for Simple IRA employee deferrals that both employees and companies will need to be aware of.

2025 Normal Simple IRA Deferral Limit

Like past years, there is a normal employee deferral limit of $16,500 in 2025.

NEW: Roth Simple IRA Deferrals

When Secure Act 2.0 passed, for the first time ever, it allowed Roth Deferrals to Simple IRA plans. However, due to the lack of guidance from the IRS, we are still not aware of any investment platforms that are currently accepting Roth deferrals into their Simple IRA platforms. So, for now, most employees are still limited to making pre-tax deferrals to their Simple IRA plan, but at some point, this will be another layer of complexity, whether or not an employee wants to make pre-tax or Roth Simple IRA deferrals.

2025 Age 50+ Catch-up Contribution

Like in past years, any employee aged 50+ is also allowed to make a catch-up contribution to their Simple IRA over and above the regular $16,500 deferral limit. In 2025, the age 50+ catch-up is $3,500, for a total of $20,000 for the year.

Under the old rules, this would have been it, plain and simple, but here are the new more complex Simple IRA employee deferral maximum contribution rules for 2025+.

NEW: Age 60 to 63 Additional Catch-up Contribution

Secure Act 2.0 introduced a new enhanced catch-up contribution starting in 2025, but it is only available to employees that are age 60 – 63. Employees ages 60 – 63 are now able to contribute the regular deferral limit ($16,500) PLUS the age 50 catch-up ($3,500) PLUS the new age 60 – 63 catch-up ($1,750).

The calculation for the new age 60 – 63 catch-up is an additional 50% above the current catch-up limit. So for 2025 it would be $3,500 x 50% = $1,750. For employees ages 60 – 63 in 2025, their deferral limit would be as follows:

Regular Deferral: $16,500

Regular Age 50+ Catch-up: $3,500

New Age 60 – 63 Catch-up: $1,750

Total: $21,750

But, the additional age 60 – 63 catch-up contribution is lost in the year that the employee turns age 64. When they turn 64, they revert back to the regular catch-up limit of $3,500

NEW: Additional 10% EE Deferral for ALL Employees

I wish I could say the complexity stops there, but it doesn’t. Introduced in 2024 was a new additional 10% employee deferral contribution that is available to ALL employees regardless of age, but automatic adoption of this additional 10% contribution depends on the size of the employer sponsoring the Simple IRA plan.

If the employer that sponsors the Simple IRA plan has no more than 25 employees who received $5,000 or more in compensation on the preceding calendar year, adoption of this new additional 10% deferral limit is MANDATORY, even though no changes have been made to the 5304 and 5305 Simple Forms by the IRS.

What that means is for 2025 is if an employer had 25 or fewer employees that made $5,000 in the previous year, the regular employee deferral limit AND the regular catch-up contribution limit will automatically be increased by 10% of the 2024 limit. Something odd to note here: The additional 10% is based just on the 2024 contribution limits, even though there are new increased limits for 2025. (This has been the most common interpretation of the new rules that we have seen to date)

Employee Deferral Limit: $16,500

Employee Deferral with Additional 10%: $17,600 ($16,000 2024 limit x 110%)

Employee 50+ Catch-up Limit: $3,500

Employee 50+ Catch-up Limit with Additional 10%: $3,850 ($3,500 2024 limit x 110%)

What this means is if an employee is covered by a Simple IRA plan in 2025 and that employer had less than 26 employees in 2024, for an employee under the age of 50, the Simple IRA employee deferral limit is not $16,500 it’s $17,600. For employees ages 50 – 59 or 64+, the employee deferral limit with the catch-up is not $20,000, it’s $21,450.

For employers that have 26 – 100 employees who, in the previous year, made at least $5,000 in compensation, in order for the employees to gain access to the additional 10% employee deferral, the company has to sponsor either a 4% matching contribution or 3% non-elective which is higher than the current standard 3% match and 2% non-elective.

NOTE: The special age 60 – 63 catch-up contribution is not increased by this 10% additional contribution because it was not in existence in 2024, and this 10% additional contribution is based on 2024 limits. The age 60 – 63 special catch-up contribution remains at $5,250, regardless of the size of the employer sponsoring the Simple IRA plan.

Summary of Simple IRA Employee Deferral Limits for 2025

Bringing all of these things together, here is a quick chart to illustrate the Simple IRA employee deferral limits for 2025:

EMPLOYER UNDER 26 EMPLOYEES

Employee Deferral Limit: $17,600

Employees Ages 50 – 59: $21,450

Employees Ages 60 – 63: $22,850

Employees Age 64+: $21,450

EMPLOYERS 26 EMPLOYEES or MORE

(Assuming they do not sponsor the enhanced 4% match or 3% non-elective ER contribution)

Employee Deferral Limit: $16,500

Employees Ages 50 – 59: $20,000

Employees Ages 60 – 63: $21,750

Employees Age 64+: $20,000

However, if the employer with 26+ employees sponsors the enhanced employer contribution amounts, the employee deferral contribution limits would be the same as the Under 26 Employees grid.

What a wonderful mess……

Voluntary Additional Simple IRA Non-Elective Contribution

Everything we have addressed up to this point focuses solely on the employee deferral limits to Simple IRA plans. Secure Act 2.0 also introduced a voluntary non-elective contribution that employers can make to their employees in Simple IRA plans. Prior to Secure Act 2.0, the only EMPLOYER contributions allowed to Simple IRA plans was either the 3% matching contribution or the 2% non-elective contribution.

Starting in 2024, employers that sponsor Simple IRA plans are now allowed to voluntarily make an additional non-elective employer contribution to all of the eligible employees based on the LESSER of 10% of compensation or $5,000. This additional employer contribution can be made any time prior to the company’s tax filing, plus extensions.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the Simple IRA contribution limit for 2025?

For 2025, the standard Simple IRA employee deferral limit is $16,500 for employers with more than 25 employees. For employers with 25 or fewer employees, the 2025 employee deferral limit is $17,600. Employees aged 50 or older can make an additional $3,500 catch-up contribution for employer with 25 or more employees and the a catch-up contribution of $3,850 for employers with 25 or less employees, bringing their total allowable deferral to $20,000 or $21,450, depending on the size of the employer.

What new changes apply to Simple IRA plans in 2025?

Beginning in 2025, several new rules from the SECURE Act 2.0 will apply to Simple IRA plans. There are now four potential contribution limits depending on an employee’s age and employer size. These include new Roth deferrals, a special age 60–63 catch-up contribution, and an additional 10% deferral increase for smaller employers.

Can employees make Roth contributions to a Simple IRA in 2025?

Yes, the SECURE Act 2.0 allows Roth deferrals to Simple IRA plans. However, as of early 2025, most custodians and investment platforms have not yet implemented this option, so most employees are still limited to pre-tax contributions.

What is the age 50+ catch-up contribution limit for 2025?

It depends on the size of your employer. As mentioned above, employees aged 50 or older can make an additional $3,500 catch-up contribution for employers with 25 or more employees and the a catch-up contribution of $3,850 for employers with 25 or less employees, bringing their total allowable deferral to $20,000 or $21,450, depending on the size of the employer.

What is the new age 60–63 catch-up contribution?

Starting in 2025, employees aged 60 through 63 can make an additional catch-up contribution equal to 50% of the standard catch-up limit. For 2025, this adds $1,750, to the maximum limits listed above. Once an employee turns 64, this enhanced catch-up no longer applies.

How does the new 10% additional employee deferral rule work?

Employers with 25 or fewer employees who earned $5,000 or more in the previous year must automatically offer a 10% higher employee deferral limit. This raises the standard limit from $16,500 to $17,600 and the age 50+ catch-up from $3,500 to $3,850.

Do larger employers also have access to the 10% deferral increase?

Employers with 26 to 100 employees can offer the additional 10% deferral if they increase their matching contribution to 4% or provide a 3% non-elective contribution.

Does the 10% increase apply to the new age 60–63 catch-up contribution?

No. The 10% deferral increase is based on 2024 contribution limits, and since the age 60–63 catch-up did not exist in 2024, it remains at $1,750 for 2025 regardless of employer size.

What are the 2025 Simple IRA limits for small employers (25 or fewer employees)?

Under age 50: $17,600

Ages 50–59: $21,450

Ages 60–63: $22,850

Age 64 and older: $21,450

What are the 2025 limits for larger employers (26 or more employees)?

If the employer does not offer the enhanced match or non-elective contribution:

Under age 50: $16,500

Ages 50–59: $20,000

Ages 60–63: $21,750

Age 64 and older: $20,000

If the employer does offer the enhanced contribution, the higher limits for small employers apply.

What is the new voluntary employer non-elective contribution option?

Starting in 2024, employers may make an additional non-elective contribution equal to the lesser of 10% of employee compensation or $5,000. This contribution is optional and can be made in addition to the standard employer match or non-elective contribution before the company’s tax filing deadline, including extensions.

New Age 60 – 63 401(k) Enhanced Catch-up Contribution Starting in 2025

Good news for 401(k) and 403(b) plan participants turning age 60 – 63 starting in 2025: there is now an enhanced employee catch-up contribution thanks to Secure Act 2.0 that passed back in 2022. For 2025, the employee contributions limits are as follows: Employee Deferral Limit $23,500, Age 50+ Catch-up Limit $7,500, and the New Age 60 – 63 Catch-up: $3,750.

Good news for 401(k) and 403(b) plan participants turning age 60 – 63 starting in 2025: there is now an enhanced employee catch-up contribution thanks to Secure Act 2.0 that passed back in 2022. For 2025, the employee contributions limits are as follows:

Employee Deferral Limit: $23,500

Age 50+ Catch-up: $7,500

New Age 60 – 63 Catch-up: $3,750

401K Age 60 – 63 Catch-up Contribution

Under the old rules, in 2025, a 401(k) plan participant age 60 – 63 would have been limited to the employee deferral limit of $23,500 plus the age 50+ catch-up of $7,500 for a total employee contribution of $31,000.

However, thanks to the passing of the Secure Act in 2022, an additional catch-up contribution will be introduced to employer-sponsored qualified retirement plans, only available to employees age 60 – 63, equal to “50% of the regular catch-up contribution for that plan year”. In 2025, the catch-up contribution is $7,500, making the additional catch-up contribution for employees age 60 – 63 $3,750 ($7,500 x 50%). Thus, a plan participant age 60 – 63 would be able to contribute the regular employee deferral limit of $23,500, plus the normal age 50+ catch-up of $7,500, PLUS the new age 60 – 63 catch-up contribution of $3,750, for a total employee contribution of $34,750 in 2025.

Age 64 – Revert Back To Normal 401(k) Catch-up Limit

This is a very odd way to assess a special catch-up contribution because it is ONLY available to employees between the ages of 60 and 63. In the year the 401(k) plan participant obtains age 64, the new additional age 60 – 63 contribution is completely eliminated. Here is a quick list of the contribution limits for 2025 based on an employee’s age:

Under Age 50: $23,500

Age 50 – 59: $31,000

Age 60 – 63: $34,750

Age 64+: $31,000

The Year The Employee OBTAINS Age 60 – 63

The employee just has to OBTAIN age 60 – 63 during that year to be eligible for the enhanced catch-up contribution. The enhanced catch-up contribution is not pro-rated based on WHEN the employee turns age 60. For example, if an employee turns 60 on December 31st, they are eligible to make the full $3,750 additional catch-up contribution for the year.

By that same token, if the employee turns age 64 by December 31st, they are no longer allowed to make the new enhanced catch-up contribution for that year.

Optional Provision At The Plan Level

The new 60 – 63 enhanced catch-up contribution is an OPTIONAL provision for qualified retirement plans, meaning some employers may allow this new enhanced catch-up contribution while others may not. If no action is taken by the employer sponsoring the plan, be default, the new age 60 – 63 catch-up contributions starting in 2025 will be allowed.

If an employer prefers to opt out of allowing employees ages 60 – 63 from making this new enhanced catch-up contribution, they will need to contact their TPA firm (third-party administrator) as soon as possible to amend their plan to disallow this new type of employee contributions starting in 2025.

Contact Payroll Company

Since this a brand new 401(k) employee contribution starting in 2025, we strongly recommend that plan sponsors reach out to their payroll company to make sure they are aware that your plan will either ALLOW or NOT ALLOW this new age 60 – 63 catch-up contribution, so the payroll system doesn’t incorrectly cap employees age 60 – 63 from making the additional catch-up contribution.

Formula: 50% of Normal Catch-up Contribution

For future years, the formula for this age 60 – 63 enhanced catch-up contribution is 50% of the regular catch-up contribution limit. The IRS usually announces the updated 401(k) contribution limits in either October or November of each year for the following calendar year. For example, if the IRS announces that the new catch-up limit in 2026 is $8,000, the enhanced age 60 – 63 catch-up contribution would be $4,000 over the regular $8,000 catch-up limit.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new 401(k) and 403(b) age 60–63 catch-up contribution for 2025?

Starting in 2025, employees aged 60–63 can contribute an extra “enhanced” catch-up contribution to their 401(k) or 403(b) plan. This new contribution equals 50% of the standard catch-up contribution for that year. For 2025, that means an additional $3,750 on top of the normal catch-up limit.

How much can employees aged 60–63 contribute to a 401(k) in 2025?

For 2025, employees aged 60–63 can contribute:

Regular employee deferral: $23,500

Standard age 50+ catch-up: $7,500

New age 60–63 catch-up: $3,750

Total: $34,750

What happens when an employee turns 64?

The new enhanced catch-up contribution is only available through age 63. In the year an employee turns 64, they revert back to the standard catch-up limit of $7,500, for a total maximum contribution of $31,000 in 2025.

Do employees need to be 60 for the full year to qualify?

No. The employee only needs to obtain age 60–63 during the tax year to be eligible. Even if they turn 60 on December 31, they qualify for the full additional $3,750 catch-up contribution for that year.

Is the new 60–63 catch-up contribution mandatory for employers?

No. The provision is optional. Employers must decide whether to allow the new enhanced catch-up contribution in their retirement plan. If an employer takes no action, the new contribution will automatically be allowed starting in 2025.

Should employers notify their payroll company?

Yes. Plan sponsors should confirm with their payroll provider whether their plan will allow the new 60–63 catch-up contributions. Payroll systems will need to be updated to ensure eligible employees can contribute correctly.

How will future enhanced catch-up amounts be calculated?

Each year, the enhanced age 60–63 catch-up limit will equal 50% of that year’s regular catch-up contribution. For example, if the standard catch-up limit rises to $8,000 in 2026, the new enhanced catch-up would be $4,000.

Leaving Your Job? What Should You Do With Your 401(k)?

When you separate service from an employer, you have to make decisions with regard to your 401K plan. It’s important to understand the pros and cons of each option while also understanding that the optimal solution often varies from person to person based on their financial situation and objectives. The four primary options are:

1) Leave it in the existing 401(k) plan

2) Rollover to an IRA

3) Rollover to your new employer’s 401(k) plan

4) Cash Distribution

When you separate from an employer, there are important decisions to make regarding your 401(k) plan. It’s crucial to understand the pros and cons of each option, as the optimal solution often varies depending on individual financial situations and objectives. The four primary options are:

Leave it in the existing 401(k) plan

Rollover to an IRA

Rollover to your new employer’s 401(k) plan

Cash Distribution

Option 1:Leave It In The Existing 401(k) Plan

If your 401(k) balance exceeds $7,000, your employer is legally prohibited from forcing you to take a distribution or roll over the funds. You can keep your balance invested in the plan. While no new contributions are allowed since you’re no longer employed, you can still change your investment options, receive statements, and maintain online access to the account.

PROS to Leaving Your Money In The Existing 401(k) Plan

#1: No Urgent Deadline to Move

Leaving a job often coincides with major life changes—whether retiring, job hunting, or starting a new position. It’s reassuring to know that you don't need to make an immediate decision regarding your 401(k), allowing time to evaluate options and choose the best one.

#2: You May Not Be Eligible Yet For Your New Employer’s 401(k) Plan

One of the distribution options that we will address later in this article is rolling over your balance from your former employer's 401(k) plan into your new employer’s 401(k) plan. However, it's not uncommon for companies to have a waiting period for new employees before they're eligible to participate and the new company’s 401(k) plan. If you must wait a year before you have the option to roll over your balance into your new employer's plan, the prudent solution may be just to leave the balance in your former employer’s 401(k) plan, and just roll it over once you become eligible for the new 401(k) plan.

#3: Fees May Be Lower

It's also prudent to do a fee assessment before you move your balance out of your former employer’s 401(k) plan. If you work for a large employer, it's not uncommon for there to be significant assets within that company’s 401(k) plan, which can result in lower overall fees to any plan participants that maintain a balance within that plan. For example, if you work for Company ABC, which is a big publicly traded company, they may have $500 million in their 401(k) plan when you total up all the employee's balances. That may result in total annual fees of under 0.50% depending on the platform. If your balance in the plan is $100,000, and you roll over your balance to either an IRA or a smaller employer’s 401(k) plan, the total fees could be higher because you are no longer part of a $500 million pool of assets. You may end up paying 1% or more in fees each year, depending on where you roll over your balance.

#4: Age 55 Rule

401(k) plans have a special distribution option that if you separate from service with the employer after reaching age 55, you are allowed to request cash distributions directly from that 401(k) plan, but you avoid the 10% early withdrawal penalty that normally exists in IRA accounts for taking distributions under the age of 59 ½. For individuals that retire after age 55, not before age 59 ½, this is one of the primary reasons why we advise some clients to maintain their balance in the former employer’s 401(k) plan and take distributions from that account to avoid the 10% penalty. If they were to inadvertently roll over the entire balance to an IRA, that 10% early withdrawal penalty exception would be lost.

CONS to Leaving Your Money In The Existing 401(k) Plan

#1: Scattered 401(k) Balance

I have met with individuals who have three 401(k) plans, all with former employers. When I start asking questions about the balance in each account, how each 401(k) account is invested, and who the providers are, most individuals with more than one 401(k) account have trouble answering those questions. From both a planning and investment strategy standpoint, it's often more efficient to have all your retirement dollars in one place so you can very easily assess your total retirement nest egg, how that nest egg is invested, and you can easily make investment changes or updates to your personal information.

#2: Forgetting to Update Addresses

It's not uncommon for individuals to move after they've left employment with a company, and over the course of the next 10 years, it's not uncommon for someone to move multiple times. Oftentimes, plan participants forget to go back to all their scattered 401K plans and update their mailing addresses, so they are no longer receiving statements on many of those accounts which makes it very difficult to keep track of what they have and what it's invested in.

#3: Limited Investment Options

401(k) plans typically limit plan participants to a set menu of investments which the plan participant has no control over. Rolling your balance into a new employer’s plan or an IRA could provide a broader range of investment options.

OPTION 2: Rollover to an IRA

The second option for plan participants is to roll over their 401(k) balance to an IRA(s). The primary advantage of the IRA rollover is that it allows employees to remove their balance from their former employers' 401(k) plan, but it does not generate tax liability. The pre-tax dollars within the 401(k) plan can be rolled directly to a Traditional IRA, and any Roth dollars in the 401(k) plan can be rolled over into a Roth IRA.

PROS of 401K Rollover to IRAs

#1: Full Control of Investment Options

As I just mentioned in the previous section, 401(k)’s typically have a set menu of investments available to plan participants by rolling over their balance to an IRA. The plan participant can choose to invest their IRA balance in whatever they would like - individual stocks, bonds, mutual funds, CD, etc.

#2: Consolidating Retirement Accounts

Since it's not uncommon for employees to have multiple employers over their career, as they leave employment with each company, if the employee has an IRA in their own name, they can keep rolling over the balances into that central IRA account to consolidate all their retirement accounts into a single account.

#3: Ease of Distributions in Retirement

It is sometimes easier to take distributions from an IRA than it is from a 401(k) plan. When you request a distribution from a 401(k) plan, you typically have to work through the plan’s administrator. The plan trustee may need to approve each distribution, and some plans are “lump-sum only,” which means you can’t take partial distributions from the 401(k) account. With those lump-sum-only plans, when you request your first distribution from the account, you have to remove your entire balance. When you roll over the balance to an IRA, you can often set up monthly reoccurring distributions, or you can request one-time distributions at your discretion.

#4: Avoid the 401(k) 20% Mandatory Fed Tax Withholding

When you request Distributions from a 401(k) plan, by law, they are required to withhold 20% for Federal Taxes from each distribution (unless it’s an RMD or hardship). But what if you don’t want them to withhold 20% for Fed taxes? With 401(k) plans, you don’t have a choice. By rolling over your balance to an IRA, you have the option to not withhold any taxes or electing a Fed amount less than 20% - it’s completely up to you.

#5: Discretionary Management

Most 401(k) investment platforms are set up as participant-directed platforms which means the plan participant has to make investment decisions with regard to their accounts without an investment advisor overseeing the account and trading it actively on their behalf. Some individuals like the idea of having an investment professional involved to actively manage their retirement accounts on their behalf, and rolling over the balance from 401(k) to an IRA can open up that option after the employee has separated from service.

CONS of 401(k) Rollover to IRAs

Here is a consolidated list based on some of the pros and cons already mentioned:

Fees could be higher in an IRA compared to the existing 401(k)

The Age 55 10% early withdrawal exception could be lost

No point in rolling to an IRA if the plan is just to roll over to the new employer’s plan once you have met the plan’s eligibility requirements

OPTION 3: Rollover to New Employer’s 401(k) Plan

To avoid repeating many of the pros and cons already mentioned here is a quick hit list of the pros and cons

PROS:

Keep retirement accounts consolidated in new employer plan

No tax liability incurred for rollover

Potentially lower fees compared to rolling over to an IRA

If the new plan allows 401(k) loans, rollover balances are typically eligible toward the max loan amount

Full balance eligible for age 55 10% early withdrawal penalty exception

A new advantage that I would add to this list is for employees over the age of 73 who are still working; if you keep your pre-tax retirement account balance within your current employer’s 401(k) plan, you can avoid the annual RMD requirement. When you turn certain ages, currently 73 but soon to be 75, the IRS forces you to start taking taxable distributions out of your pre-tax retirement accounts. However, there is an exception to that rule for any pretax balances maintained in a 401(k) plan with your current employer. The balance in your 401(k) plan with your CURRENT employer is not subject to annual RMDs so you avoid the tax hit associated with taking distributions from a pre-tax retirement account.

I put CURRENT in all caps because this 401(k) RMD exception does not apply to balances in former employer 401(k) plans. You must be employed by that company for the entire year to avoid the RMD requirement. Balances in former employer 401(k) plans are still subject to the RMD requirement.

CONS:

Potentially limited to investment options offered via the 401(k) investment menu

You may not be allowed to take distribution at any time from your 401(k) account after the rollover, whereas a rollover IRA would allow you to keep that option open.

Your personal investment advisor cannot manage those assets within the 401(k) plan

Possible distribution and tax withholding restrictions depend on the plan design

OPTION 4: Cash Distributions

I purposely saved cash distributions for last because it is rarely the optimal distribution option. When you request a cash distribution from a 401(k) plan and you are under the age of 59 ½, you will incur fed taxes, potentially state taxes depending on what state you reside in, and a 10% early withdrawal penalty. When you begin to total up the taxes and penalties, sometimes you’re losing 30% - 50% of your balance in the plan to taxes and penalties.

When you lose 30 to 50% of your retirement account balance in one shot, it can set you back years in the future when it comes to trying to figure out what date you can retire. While, it's not uncommon for a 25-year-old to not be overly concerned with their retirement date; making the decision to withdraw their entire account balance can end up being a huge regret when they are 75 and still working while all their friends retired 10 years before them.

However, as financial planners, we do acknowledge that someone losing their job can create financial disruption, and sometimes a balance needs to be reached between a cash distribution to help them bridge the financial gap to their next career while maintaining as much of their retirement account as possible. The good news is it's not an all-or-nothing decision. For clients that have a high degree of uncertainty, it can sometimes be prudent to roll over the balance from the 401(k) to an IRA which gives them maximum flexibility as to how much they can take from that IRA account for distributions, but usually reserves the right to allow them to roll over that IRA balance into a future employer’s 401(k) plan at their discretion.

Example: Samantha Was just laid off by Company XYZ; she has a $50,000 balance in their 401(k) plan and she is worried that she's not going to be able to pay her bills for the next few months while she's looking for her next job. She may want to roll over that $50,000 balance to an IRA so she can distribute $10,000 from the IRA, pay the taxes and the penalties, but continue to maintain the remaining $40,000 in the IRA untaxed. But if she struggles to continue to find her next career, she can always go back to the IRA and take additional distributions. Samantha then gets hired by Company ABC and is eligible to participate in that company's 401(k) plan after three months. At that time, she can make the decision to either roll over the IRA balance to her new 401(k) plan or just keep the IRA where it is.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are my options for my 401(k) after leaving an employer?

You have four main options:

Leave the balance in your existing 401(k) plan

Roll it over to an IRA

Roll it into your new employer’s 401(k) plan

Take a cash distribution

Each option has pros and cons depending on your age, employment status, investment goals, and tax situation.

When does it make sense to leave my 401(k) with my former employer?

If your balance is over $7,000, you can keep it in the plan. This may make sense if:

The plan offers low fees or strong investment options

You’re not yet eligible for your new employer’s plan

You separated from service at age 55 or later and may want penalty-free withdrawals under the “Age 55 Rule”

What are the benefits of rolling my 401(k) to an IRA?

Rolling to an IRA offers full investment control, potential for professional management, and simplified account consolidation. It also avoids mandatory 20% federal tax withholding on withdrawals. However, you lose the age 55 penalty exception and may pay slightly higher fees depending on your IRA provider.

Why might I roll my old 401(k) into my new employer’s plan?

This option keeps your retirement accounts consolidated and allows you to continue deferring taxes. It can also be advantageous if you’re over age 73 and still working, since RMDs (required minimum distributions) don’t apply to your current employer’s 401(k). However, investment options may be limited, and you may lose access to flexible withdrawals.

What happens if I take a cash distribution from my 401(k)?

A cash-out triggers ordinary income taxes and, if you’re under 59½, a 10% early withdrawal penalty. Between taxes and penalties, you could lose 30–50% of your balance. In most cases, this option should be avoided unless absolutely necessary.

When Should High-Income Earners Max Out Their Roth 401(k) Instead of Pre-tax 401(k)?

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferral contributions all in Roth dollars and forgo the immediate tax deduction.

No Income Limits for Roth 401(k)

It’s common for high income earners to think they are not eligible to make Roth deferrals to their 401(k) because their income is too high. However, unlike Roth IRAs that have income limitations for making contributions, Roth 401(k) contributions have no income limitation.

401(k) Deferral Aggregation Limits

In 2025, the employee deferral limits are $23,500 for individuals under the age of 50, $31,000 for individuals aged 50-59 and 64 and older and $34,750 for individuals age 60-63. If your 401(k) plan allows Roth deferrals, the annual limit is the aggregate between both pre-tax and Roth deferrals, meaning you are not allowed to contribute $23,500 pre-tax and then turn around and contribute $23,500 Roth in the same year. It’s a combined limit between the pre-tax and Roth employee deferral sources in the plan.

Scenario 1: Business Owner Has Abnormally Low-Income Year

Business owners from time to time will have a tough year for their business. They may have been making $300,000 or more per year for the past year but then something unexpected happens or they make a big investment in their business that dramatically reduces their income from the business for the year. We counsel these clients to “never waste a bad year for the business”.

Normally, a business owner making over $300,000 per year would be trying to max out their pre-tax deferral to their 401(K) plans in an effort to reduce their tax liability. But, if they are only showing $80,000 this year, placing a married filing joint tax filer in the 12% federal tax bracket, I’ll ask, “When are you ever going to be in a tax bracket below 12%?”. If the answer is “probably never”, then it an opportunity to change the tax plan, max out their Roth deferrals to the 401(k) plan, and realize that income at their abnormally lower rate. Plus, as the Roth source grows, after age 59 ½ they will be able to withdrawal the Roth source ALL tax free including the earnings.

Scenario 2: Change In Employment Status

Whenever there is a change in employment status such as:

Retirement

High income spouse loses a job

Reduction from full-time to part-time employment

Leaving a high paying W2 job to start a business which shows very little income

All these events may present an abnormally low tax year, similar to the business owner that experienced a bad year for the business, that could justify the switch from pre-tax deferrals to Roth deferrals.

The Value of Roth Compounding

I’ll pause for a second to remind readers of the big value of Roth. With pre-tax deferrals, you realize a tax benefit now by avoiding paying federal or state income taxes on those employee deferrals made to your 401(k) plan. However, you must pay tax on those contributions AND the earnings when you take distributions from that account in retirement. The tax liability is not eliminated, just deferred.

Scenario 3: Too Much In Pre-Tax Retirement Accounts Already

When high income earners have been diligently saving in their 401(k) plan for 30 plus years, sometimes they amass huge pre-tax balances in their retirement plans. While that sounds like a good thing, sometimes it can come back to haunt high-income earnings in retirement when they hit their RMD start date. RMD stands for required minimum distribution, and when you reach a specific age, the IRS forces you to begin taking distributions from your pre-tax retirement account whether you need to our not. The IRS wants their income tax on that deferred tax asset.

The RMD start age varies depending on your date of birth but right now the RMD start age ranges from age 73 to age 75. If for example, you have $3,000,000 in a Traditional IRA or pre-tax 401(k) and you turn age 73 in 2025, your RMD for 2025 would be $113,207. That is the amount that you would be forced to withdrawal out of your pre-tax retirement account and pay tax on. In addition to that income, you may also be showing income from social security, investment income, pension, or rental income depending on your financial picture at age 73.

If you are making pre-tax contributions to your retirement now, normally the goal is to take that income off that table now and push it into retirement when you will hopefully be in a lower tax bracket. However, if your pre-tax balances become too large, you may not be in a lower tax bracket in retirement, and if you’re not going to be in a lower tax bracket in retirement, why not switch your contributions to Roth, pay tax on the contributions now, and then you will receive all of the earning tax free since you will now have money in a Roth source.

Scenario 4: Multi-generational Wealth

It’s not uncommon for individuals to engage a financial planner as they approach retirement to map out their distribution plan and verify that they do in fact have enough to retire. Sometimes when we conduct these meetings, the clients find out that not only do they have enough to retire, but they will not need a large portion of their retirement plan assets to live off and will most likely pass it to their kids as inheritance.

Due to the change in the inheritance rules for non-spouse beneficiaries that inherit a pre-tax retirement account, the non-spouse beneficiary now is forced to deplete the entire account balance 10 years after the decedent has passed AND potentially take RMDs during the 10- year period. Not a favorable tax situation for a child or grandchild inheriting a large pre-tax retirement account.

If instead of continuing to amass a larger pre-tax balance in the 401(k) plan, say that high income earner forgoes the tax deduction and begins maxing out their 401K contributions at $31,000 per year to the Roth source. If they retire at age 65, and their life expectancy is age 90, that Roth contribution could experience 25 years of compounding investment returns and when their child or grandchild inherits the account, because it’s a Roth IRA, they are still subject to the 10 year rule, but they can continue to accumulate returns in that Roth IRA for another 10 years after the decedent passes away and then distribute the full account balance ALL TAX FREE. That is super powerful from a tax free accumulate standpoint.

Very few strategies can come close to replicating the value of this multigenerational wealth accumulation strategy.

One more note about this strategy, Roth sources are not subject to RMDs. Unlike pre-tax retirement plans which force the account owner to begin taking distributions at a specific age, Roth accounts do not have an RMD requirement, so the money can stay in the Roth source and continue to compound investment returns.

Scenario 5: Tax Diversification Strategy

The pre-tax vs Roth deferrals strategy is not an all or nothing decision. You are allowed to allocate any combination of pre-tax and Roth deferrals up to the annual contribution limits each year. For example, a high-income earner under the age of 50 could contribute $13,000 pre-tax and $10,500 Roth in 2025 to reach the $23,500 deferral limit.

Remember, the pre-tax strategy assumes that you will be in lower tax bracket in retirement than you are now, but some individuals have the point of view that with the total U.S. government breaking new debt records every year, at some point they are probably going to have to raise the tax rates to begin to pay back our massive government deficit. If someone is making $300,000 and paying a top Fed tax rate of 24%, even if they expect their income to drop in retirement to $180,000, who’s to say the tax rate on $180,000 income in 20 years won’t be above the current 24% rate if the US government needs to generate more tax return to pay back our national debt?

To hedge against this risk, some high-income earnings will elect to make some Roth deferrals now and pay tax at the current tax rate, and if tax rates go up in the future, anything in that Roth source (unless the government changes the rules) will be all tax free.

About Michael……...