Still Working at 65? Here’s What to Do About Medicare and Social Security

Turning 65 is a major milestone — but if you're still working, it can also bring confusion around Medicare and Social Security. Do you need to enroll in Medicare? Will claiming Social Security now trigger an earnings penalty? The answers depend on your specific situation.

Turning 65 is a milestone that often raises questions about Medicare and Social Security. But if you’re still working — and especially if you have employer-sponsored health insurance — your decisions may not follow the traditional retirement playbook.

This guide outlines what you need to know about how continued employment affects Medicare enrollment and Social Security strategy.

Medicare: Do You Need to Enroll at 65?

You become eligible for Medicare at age 65, but whether you need to enroll right away depends on your health insurance situation.

If You Have Employer Coverage Through a Company with 20 or More Employees

You can delay Medicare Part B (medical insurance) and Part D (prescription drug coverage) without penalty.

Many people still choose to enroll in Part A (hospital insurance), which is typically premium-free, while keeping their employer plan as primary coverage.

However, if you're still contributing to a Health Savings Account (HSA), be careful — enrolling in Medicare Part A makes you ineligible to continue making HSA contributions.

Once you leave your job or lose coverage, you’ll qualify for a Special Enrollment Period and have eight months to sign up for Medicare Part B without facing late penalties.

If Your Employer Has Fewer Than 20 Employees

You generally need to enroll in Medicare Parts A and B at age 65. Medicare becomes your primary payer, and your employer plan pays secondary.

Failing to enroll can result in a gap in coverage and a permanent late enrollment penalty on your Medicare premiums.

We strongly recommend reaching out to the HR contact at your employer well in advance of your 65th birthday to fully understand what actions you need to take with regard your Medicare enrollment for both you and your spouse if they are covered by your plan as well.

Don’t Overlook Part D Requirements

If you delay enrolling in Medicare Part D, you must have “creditable” prescription drug coverage through your employer — meaning coverage that is expected to pay, on average, as much as Medicare’s standard prescription drug plan.

Be sure to confirm with your employer that your current plan meets Medicare’s creditable coverage standard to avoid future penalties.

How Social Security Fits Into the Picture

While you can claim Social Security as early as age 62, most people don’t reach their full retirement age (FRA) until age 67. While you are eligible to begin collecting your social security benefit while you are still working and prior to recaching age 67, it may make sense to delay receiving your social security benefits to avoid the earned income penalty.

If you claim before your full retirement age and your earnings exceed the annual limit ($23,400 in 2025), an earned income penalty is assessed against your benefit. For every $2 earned over the limit, $1 in benefits is withheld. These withheld benefits are not lost — your benefit is recalculated at FRA to account for months when payments were withheld.

Example:

If you earn $30,000 in 2025 before reaching FRA, you are $6,600 over the earnings limit. This would result in $3,300 of your Social Security benefits being withheld that year.

After you reach FRA, there is no reduction in benefits, no matter how much you earn.

Also by delay the receipt of your social security benefits, your benefit increase by about 6% per year between the ages of 62 and 67, and then increase by 8% per year between ages 67 and 70.

Key Action Steps at 65 If You're Still Working

Review your employer health plan: Determine whether it’s considered creditable coverage and how it coordinates with Medicare.

Decide on Medicare Part A: Enrolling may make sense, but if you're still contributing to an HSA, delay enrollment to remain eligible.

Verify Part D creditable coverage: Confirm with your employer that your prescription plan meets Medicare’s standards.

Review your Social Security strategy: Consider whether it makes sense to delay benefits to avoid earnings penalties and increase your monthly payout.

Final Thoughts

Working past age 65 can offer financial flexibility and allow you to delay drawing on Social Security, but it also comes with specific rules around Medicare and benefit eligibility. Taking the time to coordinate your health coverage, HSA contributions, and income planning now can help you avoid unnecessary penalties and make more informed decisions later.

Once you are within 5 year to retirement, it can be beneficial to work with a Certified Financial Planner to create a formal retirement plan which include reviewing what your expenses will be in retirement, social security filing strategy, Medicare coverage, distribution planning, and tax strategies leading up to your retirement date.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Do I need to sign up for Medicare when I turn 65 if I’m still working?

If your employer has 20 or more employees and provides group health coverage, you can delay Medicare Part B and Part D without penalty. However, if your employer has fewer than 20 employees, you generally need to enroll in Medicare Parts A and B at 65, as Medicare becomes your primary insurance.

Can I keep contributing to my Health Savings Account (HSA) after enrolling in Medicare?

No. Once you enroll in any part of Medicare, including Part A, you can no longer make HSA contributions. To continue contributing, you must delay all parts of Medicare enrollment until after you stop HSA-eligible coverage.

What happens if I delay Medicare Part B & D while keeping employer coverage?

You can delay Part B & D of Medicare if your employer’s health plan is considered “creditable coverage,” meaning it’s as good as or better than Medicare’s standard plan. If your coverage isn’t creditable, you may face a permanent late enrollment penalty when you eventually sign up for Medicare Part B & D.

How does working past 65 affect Social Security benefits?

You can begin Social Security as early as age 62, but if you earn more than the annual limit before reaching full retirement age (FRA), your benefits may be temporarily reduced. After FRA, your earnings no longer affect your Social Security payments, and delayed benefits increase your monthly amount by up to 8% per year until age 70.

Should I enroll in Medicare Part A at 65 even if I’m still covered by my employer?

Many people enroll in premium-free Part A at 65 while keeping their employer plan as primary coverage. However, if you’re still contributing to an HSA, you should delay Part A enrollment to avoid losing HSA contribution eligibility.

What steps should I take as I approach age 65 while still working?

Confirm whether your employer plan is creditable coverage, decide whether to enroll in Medicare Part A, and review how your plan coordinates with Medicare. Also, evaluate your Social Security filing strategy to balance income needs, taxes, and future benefit growth.

Understanding the Order of Withdrawals In Retirement

The order in which you withdraw money in retirement can make a huge difference in how long your savings last—and how much tax you pay. In this article, we break down a smart withdrawal strategy to help retirees and pre-retirees keep more of their hard-earned money.

When entering retirement, one of the most important financial questions you’ll face is: What’s the smartest order to pull funds from my various retirement accounts? Getting this order wrong can lead to unnecessary taxes, reduced portfolio longevity, and even higher Medicare premiums.

While there’s no universal rule that fits everyone, there are strategic guidelines that can help most retirees withdraw more efficiently and keep more of what they’ve saved.

1. Use Tax-Deferred Accounts (Traditional IRA / 401(k))

For clients who have both after-tax brokerage accounts or cash reserves as well as pre-tax retirement accounts, they are often surprised to find out that there are large tax advantages to taking distributions from pre-tax retirement accounts in the early years of retirement. Since all Traditional IRA and 401(k) distributions are taxed, retirees unknowingly will fully deplete their after-tax sources before turning to their pre-tax retirement accounts.

I’ll explain why this is a mistake.

When most individuals retire, their paychecks stop, and they may, tax-wise, find themselves in low to medium tax brackets. Knowing they are in low to medium tax brackets, by not taking distributions from pre-tax retirement accounts, a retiree could be wasting those low-bracket years.

For example, Scott and Kelly just retired. Prior to retirement their combine income was $300,000. Scott and Kelly have a cash reserve of $100,000, an after tax brokerage account with $250,000, and Traditional IRA’s totaling $800,000. Since their only fixed income source in retirement is their social security benefits totaling $60,000, if they need an additional $20,000 per year to meet their annual expenses, it may make sense for them to withdrawal that money from their Traditional IRAs as opposed to their cash reserve or brokerage account.

Reason 1: For a married couple filing a joint tax return, the 12% Federal tax bracket caps out at $96,000, that is relatively low tax rate. If they need $20,000 after tax to meet their expenses, they could gross up their IRA distribution to cover the 12% Fed Tax and withdrawal $22,727 from their IRA’s and still be in the 12% Fed bracket.

Reason 2: If they don't take withdrawals from their pretax retirement accounts, those account balances will keep growing, and at age 75, Scott and Kelly will be required to take RMD’s from their pre-tax retirement account, and those RMDs could be very large pushing them into the 22% Fed tax bracket.

Reason 3: For states like New York that have state income tax, depending on the state you live in, they may provide an annual state tax exemption for a certain amount of distributions from pre-tax retirement accounts each year. In New York, the state does not tax the first $20,000 EACH YEAR withdrawn from pre-tax retirement accounts. By not taking distributions in their early years and retirement, a retiree may be wasting that annual $20,000 New York state exemption, making a larger portion of their IRA distribution subject to state tax in the future.

For client who have both pre-tax retirement accounts and after-tax brokerage accounts, it can sometimes be a blend of the two, depending on how much money they need to meet their expenses. It could be that the first $20,000 comes from their Traditional IRA to keep them in the low tax bracket, but the remainder comes from their brokerage account. It varies on a case-by-case basis.

2. After-Tax Brokerage Accounts and Cash Reserve (Brokerage)

For individuals who retire after age 59 ½, the distribution strategy usually involves a blend of pre-tax retirement account distributions and distributions from after-tax brokerage accounts. When selling holdings in a brokerage account to raise cash for distributions, retirees have to be selective as to which holdings they sell. Selling holdings that have appreciated significantly in value could trigger large capital gains, adding to their taxable income in the retirement years. But there are typically holdings that may either have minimal gains that could be sold with very little tax impact or holding that have long-term capital gains treatment taxed at a flat 15% federal rate. Since every dollar is taxed coming out of a pre-tax retirement account, having after-tax cash or a brokerage account can sometimes allow a retiree to pick their tax bracket from year to year.

There is often an exception for individuals that retire prior to age 59½ or in some cases prior to age 65. In these cases, taking withdrawals from after-tax sources may be the primary objective. For individual under the age of 59 1/2 , if distributions are taken from a Traditional IRA prior to age 59 1/2, the individual faced taxation and a 10% early withdrawal penalty.

Note: There are some exceptions for 401(k) distributions after age 55 but prior to age 59 1/2.

For individuals who retire prior to age 65 and do not have access to retiree health benefits, they frequently have to obtain their insurance coverage through the state exchange, which has income subsidies available. Meaning the less income an individual shows, the less they have to pay out of pocket for their health insurance coverage. Taking taxable distributions from pre-tax retirement accounts could potentially raise their income, forcing them to pay more for their health insurance coverage. If instead they take distributions from after-tax sources, they could potentially receive very good health insurance coverage for little to no cost.

3. Save Roth IRA Funds for Last

Roth IRAs grow tax-free and offer tax-free withdrawals in retirement. Because they don’t have RMDs and don’t increase your taxable income, Roth IRAs are ideal for later in retirement, or even as a legacy asset to pass on to heirs. To learn more about creating generational wealth with Roth Conversions, watch this video.

Keeping your Roth untouched early in retirement also gives you flexibility in higher-income years. Need to take a larger withdrawal to fund a home project or major expense? Roth distributions won’t impact your tax bracket or Medicare premiums.

4. Special Considerations

Health Savings Accounts (HSAs):

If you have a balance in an HSA, use it for qualified medical expenses tax-free. These can be especially valuable in later years as healthcare costs increase.

Social Security Timing:

Delaying Social Security can reduce taxable income in early retirement, opening the door for Roth conversions and other tax strategies.

Sequence of Return Risk:

Withdrawing from the wrong accounts during a market downturn can permanently damage your portfolio. Diversifying your income sources can reduce that risk.

5. Avoid These Common Withdrawal Mistakes

Triggering higher Medicare premiums (IRMAA): Large withdrawals can push your income over thresholds that increase Medicare Part B and D premiums.

Missing Roth Conversion Opportunities: Processing Roth conversions to take advantage of low tax brackets and reduce future RMDs.

Tapping after-tax accounts too early: Maintaining a balance in a brokerage account can provide more tax flexibility in future years, and when it comes to estate planning these asset receive a step-up in cost basis before passing to your beneficiaries.

Final Thoughts

The order you withdraw your funds in retirement can significantly affect your taxes, benefits, and long-term financial security. A smart strategy blends tax awareness, income needs, and market conditions.

Every retiree’s situation is unique and working with a financial planner who understands the coordination of retirement income can help you keep more of your wealth and make it last longer.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the best order to withdraw funds from retirement accounts?

The “best” withdrawal strategy truly varies from person to person. A common mistake retirees make is fully retiring and withdrawing money first from after-tax sources, then, once depleted, from pre-tax sources. Depending on the types of investment accounts someone has and their income needs, a blended approach can often be ideal.

Why might it make sense to take IRA withdrawals early in retirement?

Early retirement years often come with lower taxable income, allowing retirees to withdraw from pre-tax accounts at favorable tax rates. Doing so can reduce the size of future RMDs and help avoid being pushed into higher tax brackets later in life.

How do after-tax brokerage accounts fit into a retirement income strategy?

After-tax brokerage accounts offer flexibility since withdrawals are not fully taxable—only gains are. They can help retirees manage their tax brackets from year to year, especially when balancing withdrawals from pre-tax and Roth accounts.

When should retirees use Roth IRA funds?

Roth IRAs are typically best reserved for later in retirement because withdrawals are tax-free and don’t affect Medicare premiums or tax brackets. They also have no required minimum distributions, making them valuable for legacy or estate planning.

How can withdrawal timing affect Medicare premiums?

Large distributions from pre-tax accounts can raise your income and trigger higher Medicare Part B and D premiums through the Income-Related Monthly Adjustment Amount (IRMAA). Spreading withdrawals over multiple years or using Roth funds strategically can help avoid these surcharges.

What are common mistakes to avoid when withdrawing retirement funds?

Common pitfalls include depleting after-tax accounts too early, missing Roth conversion opportunities, or taking large taxable withdrawals that increase Medicare costs. Coordinating withdrawals with tax brackets and healthcare needs can help prevent these costly errors.

How does delaying Social Security affect retirement withdrawal strategy?

Delaying Social Security reduces taxable income in early retirement, which can open opportunities for Roth conversions or strategic IRA withdrawals. Once benefits begin, managing income sources carefully helps minimize taxes and maximize long-term income.

Don’t Gift That Stock Yet – Why Inheriting Might Be Better

Thinking about gifting your stocks to your kids or loved ones? You might want to hit pause. In this video, we break down why inheriting appreciated stock is often a far smarter move from a tax perspective.

When it comes to passing wealth to the next generation, many investors consider gifting appreciated stock during their lifetime. While the intention is generous, gifting stock prematurely can create unexpected tax consequences. In many cases, allowing your heirs to inherit the stock instead can lead to a significantly better outcome — especially from a tax perspective.

Here’s what you need to know before transferring shares.

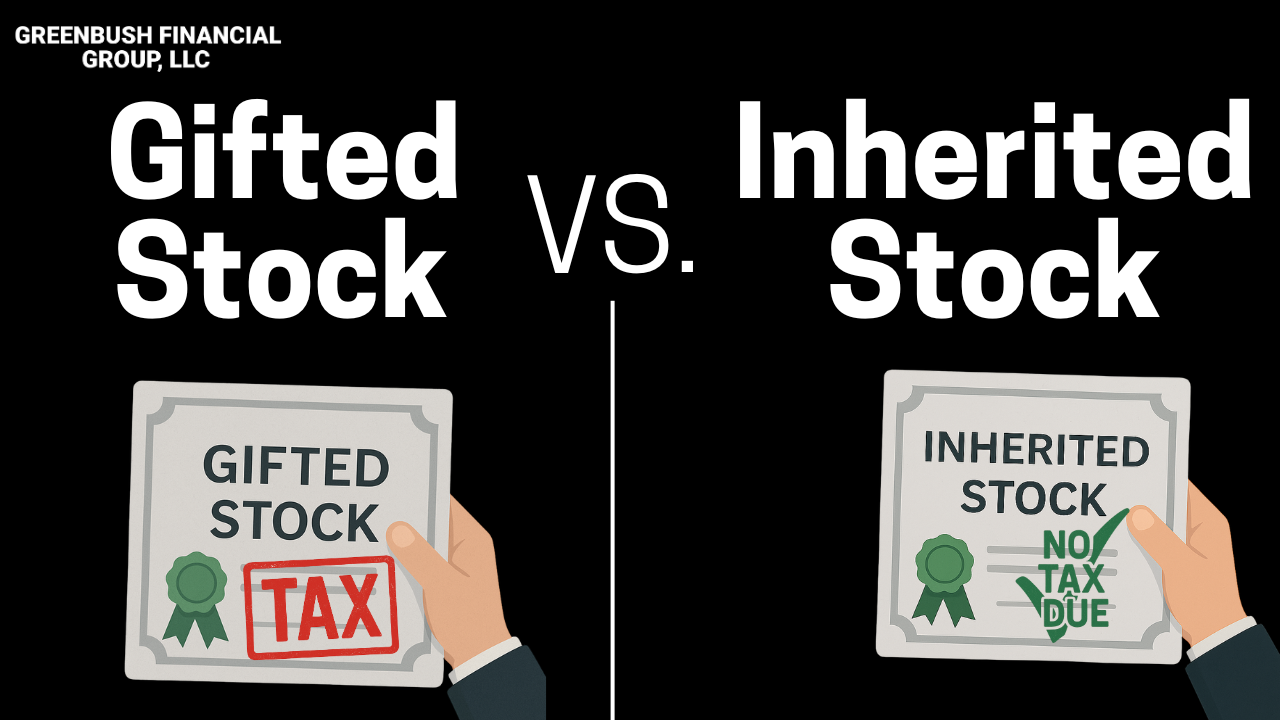

The Key Difference: Gifting vs. Inheriting Stock

The tax treatment of appreciated stock hinges on the concept of cost basis — the original value of the stock when you acquired it.

Gifted stock: The recipient takes on your original cost basis. If they sell, they may owe capital gains tax on the full appreciation.

Inherited stock: The recipient receives a “step-up” in basis to the fair market value on the date of your death. If they sell shortly after, there may be little or no capital gain.

This example illustrates why timing matters when transferring highly appreciated assets.

When Gifting Might Still Make Sense

There are scenarios where gifting appreciated stock can be a smart move:

Low-Income Beneficiaries: If the person receiving the stock is in the 0% long-term capital gains tax bracket, they might sell the stock with no federal tax owed.

In 2025, this includes:

Single filers with taxable income under $47,025

Married couples filing jointly with taxable income under $94,050

Charitable Giving: Donating appreciated stock to a qualified charity allows you to avoid capital gains tax altogether and potentially deduct the fair market value of the donation.

Other Considerations

Timing of Sale: If your child or heir plans to sell the shares quickly, gifting may trigger a large capital gain — something they might not be prepared for.

Holding Period Requirements: Gifting doesn’t reset the holding period. If owner of the stock purchase the stock more than 12 months ago, if it’s gift to someone else and they sell it immediate, they receive long-term capital gain treatment since they get credit for the time the original owner held the securities.

State Taxes: Even if there's no federal capital gain, some states still impose capital gains taxes.

Final Checklist: Before You Gift Stock, Ask:

Has the stock appreciated significantly since I bought it?

Would the recipient likely sell the stock soon after receiving it?

Are they in a low-income tax bracket or facing large expenses?

Am I trying to reduce my estate or make a charitable contribution?

Final Thoughts

Gifting stock during your lifetime can be useful in the right situations — particularly for charitable intent or strategic gifting. But in many cases, letting your heirs inherit appreciated stock allows them to avoid a sizable capital gains tax bill.

Before gifting, consider your own goals, the recipient’s financial position, and the long-term tax impact. The best outcomes often come from a well-timed, well-informed plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the main difference between gifting and inheriting stock?

When you gift appreciated stock, the recipient assumes your original cost basis, meaning they may owe capital gains tax on all prior appreciation when they sell. In contrast, inherited stock receives a “step-up” in basis to its fair market value at the time of your death, often eliminating or greatly reducing capital gains tax if sold soon after.

When does gifting appreciated stock make sense?

Gifting may be advantageous if the recipient is in the 0% long-term capital gains tax bracket or if the stock is being donated to a qualified charity. In those cases, little to no capital gains tax may apply, and charitable donors may be able to deduct the stock’s fair market value.

How does the cost basis affect capital gains taxes on gifted stock?

The cost basis determines how much of the stock’s value is subject to capital gains tax. When stock is gifted, the recipient keeps the giver’s original basis, so highly appreciated shares can result in significant taxes when sold. Inherited shares, however, get a new basis equal to their current market value.

Are there tax benefits to donating appreciated stock to charity?

Yes. Donating appreciated stock directly to a qualified charity allows you to avoid paying capital gains tax on the appreciation and may provide a charitable deduction equal to the stock’s fair market value. This can be more tax-efficient than selling the stock and donating cash.

Do gifted stocks qualify for long-term capital gains treatment?

Yes, the recipient inherits the donor’s holding period. If the donor owned the stock for more than one year, the recipient can sell immediately and still qualify for long-term capital gains rates.

What should I consider before gifting appreciated stock?

Before gifting, assess how much the stock has appreciated, the recipient’s income level and potential tax bracket, and whether they plan to sell soon. In many cases, allowing heirs to inherit appreciated stock can result in better long-term tax outcomes due to the step-up in basis.

Non-Taxable Income in Retirement: 5 Sources You Should Know About

When it comes to retirement income, not all dollars are created equal. Some income sources are fully taxable, others partially — but a select few can be completely tax-free. And understanding the difference could mean thousands of dollars in savings each year.

When it comes to retirement income, not all dollars are treated equally. Some are fully taxable, others partially taxable, and a select few are entirely tax-free. Understanding the difference is critical to building a retirement income plan that protects your nest egg from unnecessary taxation, especially in a high-inflation, high-cost-of-living environment.

In this article, we break down five sources of non-taxable income in retirement, how they work, and how to strategically use them to lower your tax bill and preserve long-term wealth.

1. Roth IRA Withdrawals

A Roth IRA offers one of the most powerful tax benefits available to retirees — tax-free growth and qualified tax-free withdrawals.

To qualify, withdrawals must occur after age 59½ and at least five years after your first contribution or Roth conversion. If both conditions are met, all distributions (contributions and growth) are 100% tax-free.

Why it matters:

Withdrawals from pre-tax retirement accounts like Traditional IRAs and 401(k)s are taxed as ordinary income, which can push you into a higher tax bracket, increase Medicare premiums, and reduce the portion of your Social Security benefits that are tax-free. With Roth IRAs, none of those problems exist.

Planning strategy:

Many retirees choose to complete Roth conversions during low-income years (such as early retirement) to move pre-tax funds into a Roth IRA while controlling their tax rate. This allows them to create a future pool of tax-free income while reducing Required Minimum Distributions (RMDs) down the line.

2. Health Savings Account (HSA) Distributions for Medical Expenses

HSAs are the only account type that offers triple tax advantages:

Contributions are tax-deductible

Growth is tax-deferred

Withdrawals are tax-free if used for qualified medical expenses

Qualified expenses include Medicare premiums, prescriptions, dental and vision care, long-term care insurance premiums (subject to limits), and more.

Why it matters:

Healthcare is often one of the largest expenses in retirement, and using HSA funds tax-free for these costs allows retirees to preserve their other taxable accounts.

Planning strategy:

For clients who are still working and enrolled in a high-deductible health plan, the strategy may be to contribute the maximum amount to an HSA and pay current medical expenses out-of-pocket. This allows the HSA to grow and be used as a supplemental retirement account for tax-free medical reimbursements later in life.

3. Social Security (Partially Non-Taxable)

Up to 85% of Social Security benefits can be taxable at the federal level, depending on your provisional income (which includes half of your Social Security benefits, taxable income, and tax-exempt interest).

However, if a retiree has very little income other than their social security, it’s possible that they may not pay any tax on their social security benefits.

Why it matters:

Retirees who rely heavily on Roth IRA withdrawals or return of principal from brokerage accounts may be able to keep their provisional income low enough to shield some or all of their Social Security benefits from taxation.

Planning strategy:

By building a tax-efficient distribution plan in retirement, retirees can often reduce the amount of tax paid on their Social Security benefits and improve net income in retirement.

4. Municipal Bond Interest

Interest from municipal bonds is generally exempt from federal income tax. If you reside in the state where the bond was issued, that interest may also be exempt from state and local taxes.

Why it matters:

For retirees in high tax brackets, municipal bonds can provide steady, tax-advantaged income without adding to provisional income or triggering taxes on Social Security.

Planning strategy:

Retirees in high-income tax brackets may hold municipal bonds in taxable brokerage accounts, while keeping higher-yield taxable bonds inside IRAs or 401(k)s where the interest won’t be taxed annually.

5. Return of Principal from Non-Retirement Accounts

Withdrawals from taxable brokerage accounts can be structured to return your cost basis first, which is not subject to tax. Only the gains portion of a sale is subject to capital gains tax — and long-term capital gains may be taxed at 0% if your taxable income is below certain thresholds.

Why it matters:

This allows retirees to tap into their investments in a low-tax or no-tax manner — especially when drawing from principal rather than interest, dividends, or gains.

Planning strategy:

Coordinate asset sales to manage taxable gains, and consider drawing from principal early in retirement to reduce future RMDs or pay the tax liability generated by Roth conversions in lower-income years.

Final Thoughts: Build a Tax-Efficient Retirement Income Plan

Most retirees understand the importance of investment performance, but few give the same attention to tax efficiency, even though taxes can quietly erode thousands of dollars in retirement income each year.

By blending these non-taxable income sources into your withdrawal strategy, you can:

Reduce your tax liability

Lower Medicare surcharges

Improve portfolio longevity

Increase the amount of inheritance passed to the next generation

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What types of retirement income are tax-free?

Common sources of tax-free retirement income include qualified Roth IRA withdrawals, Health Savings Account (HSA) distributions for medical expenses, a portion of Social Security benefits, municipal bond interest, and the return of principal from non-retirement investments. These sources can help retirees reduce overall taxable income and extend portfolio longevity.

Why are Roth IRA withdrawals tax-free in retirement?

Roth IRA withdrawals are tax-free if you’re over age 59½ and the account has been open for at least five years. Because Roth withdrawals don’t count toward taxable income, they won’t increase your tax bracket, affect Medicare premiums, or reduce the tax-free portion of your Social Security benefits.

How can a Health Savings Account (HSA) provide tax-free income in retirement?

HSAs offer triple tax advantages: contributions are tax-deductible, growth is tax-deferred, and withdrawals are tax-free for qualified medical expenses. Retirees can use HSA funds to pay for Medicare premiums, prescriptions, and other healthcare costs without generating taxable income.

Are Social Security benefits always taxable?

No. Depending on your provisional income, up to 85% of Social Security benefits may be taxable, but some retirees owe no tax on their benefits. Keeping taxable income low through Roth withdrawals or return of principal from brokerage accounts can help reduce or eliminate Social Security taxation.

How are municipal bond earnings taxed?

Interest earned from municipal bonds is typically exempt from federal income tax and, if the bonds are issued by your home state, may also be exempt from state and local taxes. This makes municipal bonds a valuable source of tax-advantaged income for retirees in higher tax brackets.

What does “return of principal” mean for taxable accounts?

When you sell investments in a taxable brokerage account, the portion representing your original cost basis is considered a return of principal and isn’t taxed. Only the gains portion is subject to capital gains tax, which may be as low as 0% for retirees in lower income brackets.

How can retirees use non-taxable income to improve their financial plan?

Strategically blending tax-free and taxable income sources can lower your overall tax burden, reduce Medicare surcharges, and improve long-term portfolio sustainability. This approach helps preserve wealth and increase the amount that can ultimately be passed to heirs.

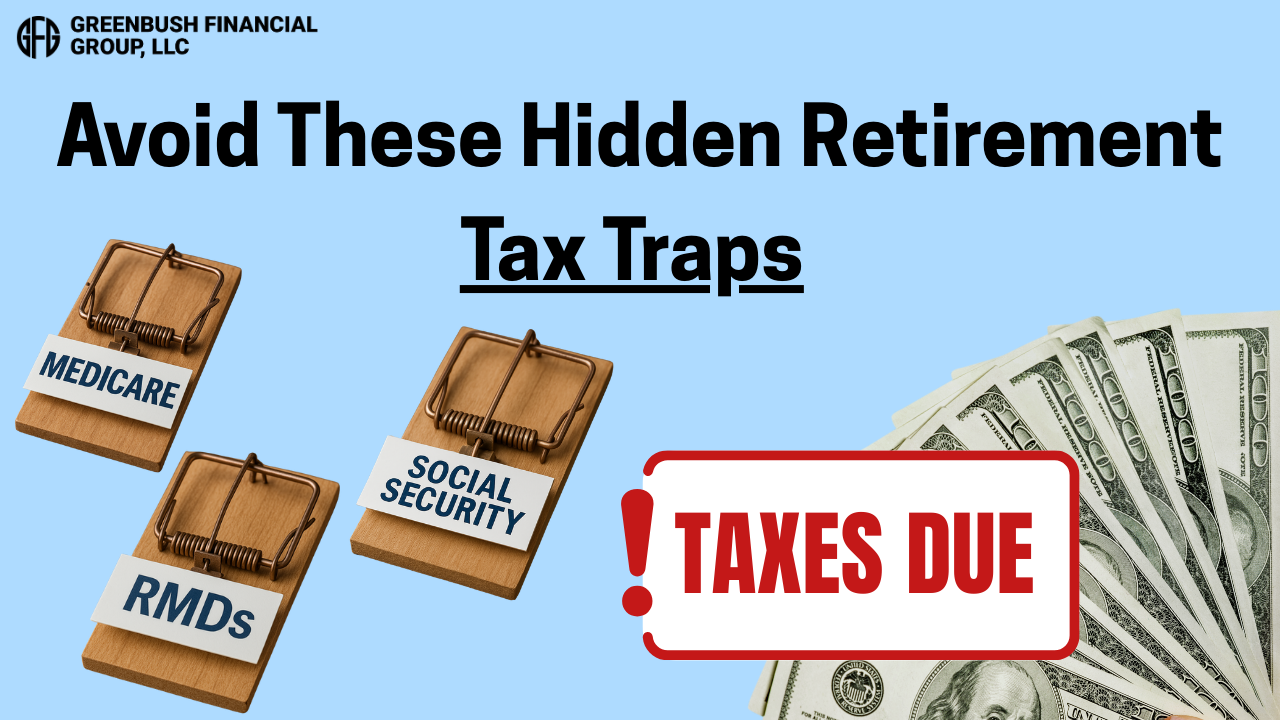

The Hidden Tax Traps in Retirement Most People Miss

Many retirees are caught off guard by unexpected tax hits from required minimum distributions (RMDs), Social Security, and even Medicare premiums. In this article, we break down the most common retirement tax traps — and how smart planning can help you avoid them.

Most people think retirement is the end of tax planning. But nothing could be further from the truth. There are several tax traps that retirees encounter, which range from:

How RMDs create tax surprises

How Social Security is taxed

How Medicare Premiums (IRMAA) are affected by income

A lack of tax-specific distribution planning

We will be covering each of these tax traps in this article to assist retirees in avoiding these costly mistakes in the retirement years.

RMD Tax Surprises

Once you reach a specific age, the IRS requires individuals to begin taking mandatory distributions from their pre-tax retirement accounts, called RMDs (required minimum distributions). Distributions from pre-tax retirement accounts represent taxable income to the retiree, which requires advanced planning to ensure that that income is not realized at an unnecessarily high tax rate.

All too often, Retirees will make the mistake of putting off distributions from their pre-tax retirement accounts until RMDs are required to begin, which allows the pretax accounts to accumulate and become larger during retirement, which in turn requires larger distributions once the RMD start age is reached.

Here is a common example: Tim and Sue retire from New York State at age 55 and both have pensions that are more than enough to meet their current expenses. Both of them also have retirement accounts through NYS, totaling $500,000. Assuming Tim and Sue start taking their required minimum distributions (RMDs) at age 75, and since Tim and Sue do not need to take withdrawals from their retirement account to supplement their income, those retirement accounts could grow to over $1,000,000. This sounds like a good thing, but it creates a potential tax problem. By age 75, they’ll both be receiving their pensions and have turned on Social Security, which under current tax law is 85% taxable at the federal level. On top of that, they’ll need to take a required minimum distribution of $37,735 which stacks up on top of all their other income sources.

This additional income from age 75 and beyond could:

Be subject to higher tax rates

Trigger higher Medicare Premiums

Cause them to phase out of certain tax deductions or credits

In hindsight, it may have been more prudent for Tim & Sue to begin taking distributions from their retirement accounts each year beginning the year after they retired, to avoid many of these unforeseen tax consequences 20 years after they retired.

How Is Social Security Taxed?

I start this section by saying, based on current law, because the Trump administration has on its agenda to make social security tax-free at the Federal level. At the time of this article, social security is potentially subject to taxation at the federal level for individuals based on their income. A handful of states also tax social security benefits.

Here is a quick summary of the proportion of social security benefits subject to taxation at the Federal level in 2025:

0% Taxable: Combined income for single filers below $25,000 and joint filers below $32,000.

50% Taxable: Combined income for single filers between $25,000 - $34,000 and joint filers between $32,000 - $44,000

85% Taxable: Combined income for single filers above $34,000 and joint filers above $44,000.

One-time events that occur in retirement could dramatically impact the amount of a retiree's social security benefit, subject to taxation. For example, a retiree might sell a stock at a gain in a brokerage account, surrender an insurance policy, earn part-time income, or take a distribution from a pre-tax retirement account. Any one of these events could inadvertently trigger a larger tax liability associated with the amount of an individual’s social security that is subject to taxation at the Federal level.

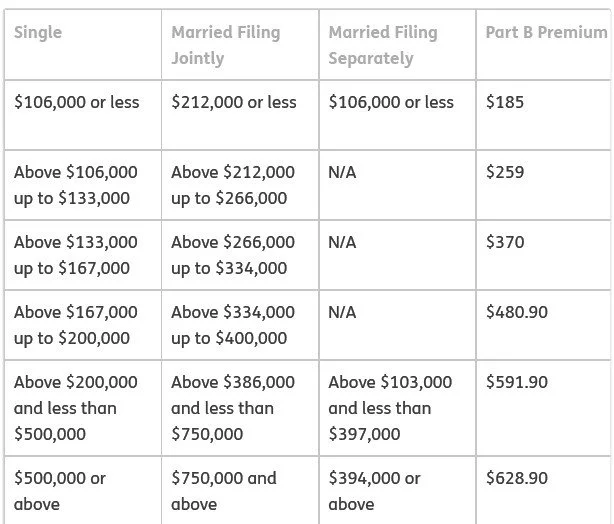

Medicare Premiums Are Income-Based

When you turn age 65, many retirees discover for the first time that there is a cost associated with enrolling in Medicare, primarily in the form of the Medicare Part B premiums that are deducted directly from a retiree's monthly social security benefit. The tax trap is that if a retiree shows too much income in a given year, it can cause their Medicare premium to increase for 2 years in the future.

Medicare looks back at your income from two years prior to determine the amount of your Medicare Part B premium in the current year. Here is the Medicare Part B premium table for 2025:

As you can see from the table, as income rises, so does the monthly premium charged by Medicare. There are no additional benefits, the retiree just has to pay more for their Medicare coverage.

This is where those higher RMDs can come back to haunt retirees once they reach the RMD start age. They might be ok between ages 65 – 75, but once they hit age 75 and must start taking RMDs from their pre-tax retirement accounts, those pre-tax RMD’s can sometimes push retirees over the Medicare based premium income threshold, and then they end up paying higher premiums to Medicare for the rest of their lives that could have been avoided.

Lack of Retirement Distribution Planning

All these tax traps surface due to a lack of proper distribution planning as an individual enters retirement. It’s incredibly important for retirees to look at their entire asset picture leading up to retirement, determine the income level that is needed to cover expenses in their retirement year, and then construct a long-term distribution plan that allows them to minimize their tax liability over the remainder of their life expectancy. This may include:

Processing sizable distributions from pre-tax accounts early in the retirement years

Processing Roth conversions

Delaying to file for social security

Developing a tax plan for surrendering permanent life insurance policies

Evaluating pension and annuity elections

A tax plan for realizing gains in taxable investment accounts

Forecasting RMDs at age 73 or 75

Developing a robust distribution plan leading up to retirement can potentially save retirees thousands of dollars in taxes over the long run and avoid many of the pitfalls and tax traps that we reviewed in the article today.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why is tax planning still important in retirement?

Many retirees assume that once they stop working, tax planning ends. In reality, retirement can bring new tax challenges — including required minimum distributions (RMDs), Social Security taxation, and income-based Medicare premium increases — that require proactive management to avoid costly surprises.

How do required minimum distributions (RMDs) create tax surprises?

Starting at age 73 or 75 (depending on birth year), retirees must begin taking taxable withdrawals from pre-tax retirement accounts. These RMDs can push retirees into higher tax brackets, increase Medicare premiums, and cause more of their Social Security benefits to become taxable if withdrawals aren’t planned carefully in advance.

Can delaying IRA withdrawals until RMD age cause higher taxes later?

Yes. Deferring all withdrawals until RMDs begin can cause retirement accounts to grow substantially, leading to larger mandatory distributions later in life. Spreading withdrawals earlier in retirement can help manage tax brackets, reduce future RMDs, and potentially lower long-term taxes.

How is Social Security taxed at the federal level?

In 2025, up to 85% of Social Security benefits may be taxable depending on your combined income (adjusted gross income + tax-exempt interest + 50% of benefits). For joint filers, benefits become partially taxable above $32,000 and up to 85% taxable above $44,000.

What income sources can increase the taxation of Social Security?

Capital gains, part-time wages, insurance policy surrenders, or withdrawals from pre-tax retirement accounts can all raise taxable income and cause a greater portion of Social Security benefits to become taxable.

How do Medicare premiums (IRMAA) depend on income?

Medicare Part B and Part D premiums increase for retirees with higher incomes, based on a two-year income lookback. For example, your 2025 premiums are based on your 2023 tax return. Large one-time income events — such as Roth conversions or asset sales — can trigger higher Medicare premiums for two years.

What strategies can help retirees reduce tax traps?

Effective planning may include drawing down pre-tax accounts earlier, using Roth conversions in low-income years, managing capital gains, and coordinating income sources to control how much is exposed to higher taxes or Medicare surcharges.

Do You Have Enough To Retire? The 60 Second Calculation

Do you have enough to retire? Believe it or not, as financial planners, we can often answer that question in LESS THAN 60 SECONDS just by asking a handful of questions. In this video, I’m going to walk you through the 60-second calculation.

Do you have enough to retire? Believe it or not, as financial planners, we can often answer that question in LESS THAN 60 SECONDS just by asking a handful of questions. In this video, I’m going to walk you through the 60-second calculation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the 60-second retirement readiness calculation?

The 60-second retirement readiness calculation is a quick method we use to estimate whether someone has saved enough to retire comfortably. It relies on a few key data points — typically your total retirement savings, desired annual income in retirement, and expected Social Security or pension benefits.

What information do you need for the 60-second retirement check?

To make the quick calculation, you’ll need:

Your total retirement savings (IRAs, 401(k)s, brokerage accounts, etc.)

The annual income you want in retirement

Your estimated Social Security or pension income

Your age and desired retirement age

How accurate is the 60-second retirement calculation?

This calculation is a fast way to estimate retirement readiness, but it’s not a substitute for a full financial plan. It doesn’t account for taxes, inflation, healthcare costs, market performance, or other personal factors. It’s best used as a starting point for more detailed retirement planning.

What’s the next step after doing the quick calculation?

If your savings fall short, the next step is to build a customized retirement plan that incorporates your income sources, spending goals, and tax strategy.

Should You Surrender Your Life Insurance Policies When You Retire?

Squarespace Excerpt: As individuals approach retirement, they often begin reviewing their annual expenses, looking for ways to trim unnecessary expenses so their retirement savings last as long as possible now that their paychecks are about to stop for their working years. A common question that comes up during these client meetings is “Should I get rid of my life insurance policy now that I will be retiring?”

As individuals approach retirement, they often begin reviewing their annual expenses, looking for ways to trim unnecessary expenses so their retirement savings last as long as possible now that their paychecks are about to stop for their working years. A common question that comes up during these client meetings is “Should I get rid of my life insurance policy now that I will be retiring?”

Very often, the answer is “Yes, you should surrender your life insurance policy”, because by the time individuals reach retirement, their mortgage is paid off, kids are through college and out of the house, they have no debt outside of maybe a car loan, and they have accumulated large sums in their retirement accounts. So, what is the need for life insurance?

However, for some individuals, the answer is “No, you should keep your life insurance policies in force,” and we will review several of those scenarios in this article as well.

Retirees That Should Surrender Their Life Insurance Policies

Since this is the more common scenario, we will start with the situations where it may make sense to surrender your life insurance policies when you retire.

Remember Why You Have Life Insurance In The First Place

Let’s start off with the most basic reason why individuals have life insurance to begin with. Life insurance is a financial safety net that protects you and your family against the risk if you unexpectedly pass away before you're able to accumulate enough assets to support you and your family for the rest of their lives, there is a big insurance policy that pays out to provide your family with the financial support that they need to sustain their standard of living.

Once you have paid off mortgages, the kids are out of the house, and you have accumulated enough wealth in investment accounts to support you, your spouse, and any dependents for the rest of their lives, there is very little need for life insurance.

For example, if we have a married couple, both age 67, who want to retire this year and they have accumulated $800,000 in their 401(K) accounts, we can show them via retirement projections that, based on their estimated expenses in retirement, the $800,000 in their 401(K) accounts in addition to their social security benefits is more than enough to sustain their expenses until age 95. So, why would they need to keep paying into their life insurance policies when they are essentially self-insured. If something happens to one of the spouses, there may be enough assets to provide support for the surviving spouse for the rest of their life. So again, instead of paying $3,000 per year for a life insurance policy that they no longer need, why not surrender the policy, and spend the money on more travel, gifts for the kids, or just maintain a larger retirement nest egg to better hedge against inflation over time?

It's simple. If there is no longer a financial need for life insurance protection, why are you continuing to pay for financial protection that you don’t need? There are a lot of retirees that fall into this category.

Individuals That Should KEEP Their Life Insurance Policies in Retirement

So, who are the individuals who should keep their life insurance policies after they retire? They fall into a few categories.

#1: Still Have A Mortgage or Debt

If a married couple is about to retire and they still have a mortgage or debt, it may make sense to continue to sustain their life insurance policies until the mortgage and/or debt have been satisfied, because if something happens to one of the spouses and they lose one of the social security benefits or part-time retirement income, it could put the surviving spouse in a difficult financial situation without a life insurance policy to pay off the mortgage.

#2: Single Life Pension Election

If an individual has a pension, when they retire, they have to elect a survivor benefit for their pension. If they elect a single life with no survivor benefit and that pension is a large portion of the household income and that spouse passes away, that pension would just stop, so a life insurance policy may be needed to protect against that pension spouse passing away unexpectedly.

#3: Estate Tax Liability

Uber wealthy individuals who pass away with over $13,990,000 in assets may have to pay estate tax at the federal level. Knowing they are going to have an estate tax liability, oftentimes these individuals will purchase a whole life insurance policy and place it in an ILIT (Irrevocable Life Insurance Trust) to remove it from their estate, but the policy will pay the estate tax liability on behalf of the beneficiaries of the estate.

#4: Tax-Free Inheritance

Some individuals will buy a whole life insurance policy so they have an inheritance asset earmarked for their children or heirs. The plan is to maintain that policy forever, and after the second spouse passes, the kids receive their inheritance in the form of a tax-free life insurance payout. This one can be a wishy-washy reason to maintain an insurance policy in retirement, because you have to pay into the insurance policy for a long time, and if you run an apple-to-apple comparison of accumulating the inheritance in a life insurance policy versus accumulating all of the life insurance premium dollars in another type of account, like a brokerage account, sometimes the latter is the more advantageous way to go.

#5: Illiquid Asset Within the Estate

An individual may have ownership in a privately held business or investment real estate which, if they were to pass away, the estate may have expenses that need to be paid. Or, if a business owner has two kids, and one child inherits the business, they may want a life insurance policy to be the inheritance asset for the child not receiving ownership in the family business. In these illiquid estate situations, the individual may maintain a life insurance policy to provide liquidity to the estate for any number of reasons.

#6: Poor Health Status

The final reason to potentially keep your life insurance in retirement is for individuals who are in poor health. Sometimes an individual is forced into retirement due to a health issue. Until that health issue is resolved, it probably makes sense to keep the life insurance policy in force. Even though they may no longer “need” that insurance policy to support a spouse or dependents, it may be a prudent investment decision to keep that policy in force if the individual has a shortened life expectancy and the policy may pay out within the next 10 years.

While “keeping” the life insurance policy in retirement is less commonly the optimal solution, there are situations like the ones listed above, where keeping the policy makes sense.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Should you keep or surrender your life insurance policy when you retire?

The answer depends on your financial situation. Most retirees who have paid off their mortgage, have no debt, and have sufficient assets to support themselves and their spouse no longer need life insurance for protection. In those cases, surrendering the policy can free up cash for travel, family, or other retirement goals.

When does it make sense to surrender life insurance in retirement?

If your financial plan shows that your retirement savings, pensions, and Social Security benefits are enough to meet your lifetime expenses, you’re effectively “self-insured.” Continuing to pay premiums on a policy you no longer need may not make financial sense. The savings from surrendering the policy can help stretch your retirement dollars.

Who should keep life insurance after retirement?

Some retirees should maintain coverage, including those who still have a mortgage or debt, those who elected a single-life pension with no survivor benefit, and individuals with high net worth who expect to owe estate taxes.

How can life insurance help if you have a pension?

If your pension ends when you pass away and your spouse depends on that income, life insurance can replace the lost income. This is especially important if you chose a “single life” pension option without survivor benefits.

Can life insurance be used for estate planning?

Yes. Wealthy individuals may use life insurance inside an irrevocable life insurance trust (ILIT) to pay future estate tax liabilities, ensuring heirs receive their inheritance without having to sell estate assets.

Is life insurance useful for leaving an inheritance?

Some retirees keep a whole life policy as a tax-free inheritance for their children. However, it’s wise to compare the long-term return of keeping the policy versus investing those premiums in a brokerage account, as alternative strategies may provide greater value.

What if your estate includes a business or real estate?

If your estate includes illiquid assets—like a business or property—life insurance can provide cash to cover estate expenses, taxes, or to equalize inheritance among heirs (for instance, when one child inherits a business and another does not).

Should retirees in poor health keep their life insurance?

Yes, possibly. If a retiree is in poor health and expects a shorter life expectancy, maintaining an existing policy can make sense. The death benefit could pay out soon, offering a strong return on the premiums.

Should You Lease or Buy A Car: Interview with a CFP® and Owner of a Car Dealership

When clients are looking to purchase a new car one of the most common questions that we receive is “Should I Buy or Lease?” To get the answer, we interviewed a Certified Financial Planner and the owner of Rensselaer Honda to educate our audience on the pros and cons of buying vs leasing.

When clients are looking to purchase a new car one of the most common questions that we receive is “Should I Buy or Lease?” To get the answer, we interviewed a Certified Financial Planner and the owner of Rensselaer Honda to educate our audience on the pros and cons of buying vs leasing.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Should I buy or lease my next car?

Whether you should buy or lease depends on your financial goals, driving habits, and how long you plan to keep the vehicle. Buying is generally better for long-term ownership, while leasing can make sense if you prefer lower monthly payments and like driving a new car every few years.

What are the advantages of buying a car?

Buying a car allows you to build equity and eventually drive payment-free once the loan is paid off. You have no mileage restrictions, can customize the vehicle, and can sell or trade it whenever you choose. Over time, purchasing is typically more cost-effective than leasing.

What are the downsides of buying?

The main drawback is higher upfront costs and larger monthly payments compared to leasing. You’re also responsible for the car’s depreciation, which can reduce resale value if you trade it in after only a few years.

What are the benefits of leasing a car?

Leasing generally provides lower monthly payments, minimal upfront costs, and the ability to drive a new car every two to three years. Lease agreements often include warranty coverage, which reduces maintenance costs during the lease term.

What are the disadvantages of leasing?

Leasing comes with mileage limits—usually 10,000 to 15,000 miles per year—and penalties for excess wear and tear. You don’t build equity in the vehicle, and at the end of the lease, you must either return it or start a new lease. Over many years, leasing repeatedly can cost more than buying.

Who should consider leasing?

Leasing may be ideal for individuals who prefer driving newer cars with the latest features, don’t drive long distances, and want predictable monthly costs without worrying about long-term maintenance.

Who should consider buying?

Buying is best for people who plan to keep their vehicles for many years, drive more than the average mileage, or want to eventually own a car outright without ongoing payments.

What financial factors should I consider before deciding?

Compare the total cost of ownership over the time you expect to use the car, including monthly payments, insurance, maintenance, taxes, and resale or lease-end fees. A financial planner or dealership finance manager can help run the numbers based on your budget and driving habits.