“Sell in May and Go Away” is Dead

“Sell in May and Go Away” sounds clever, but the data tells a different story. Since 2020, investors who followed this rule would have missed out on strong summer gains. We break down why discipline and staying invested consistently beat market timing.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

One of the most well-known Wall Street adages is the “Sell in May and go away” strategy. The idea is simple: sell your stock holdings in May, avoid the typically slower summer months, and then re-enter the market in the fall when trading activity and returns supposedly pick back up. On the surface, this strategy sounds appealing—who wouldn’t want to avoid risk and still capture the best gains of the year?

But here’s the problem: if you had followed this strategy over the past six years, you would have missed out on some very strong returns. In fact, staying on the sidelines from June through August would have cost you real money.

In this article, we’ll cover:

A look at the actual S&P 500 returns from June–August over the past few years

Why investors would have been “right” only 1 out of 6 times

The real risk of following catchy headlines instead of hard data.

Why discipline through volatility has historically paid off.

What the Data Really Says

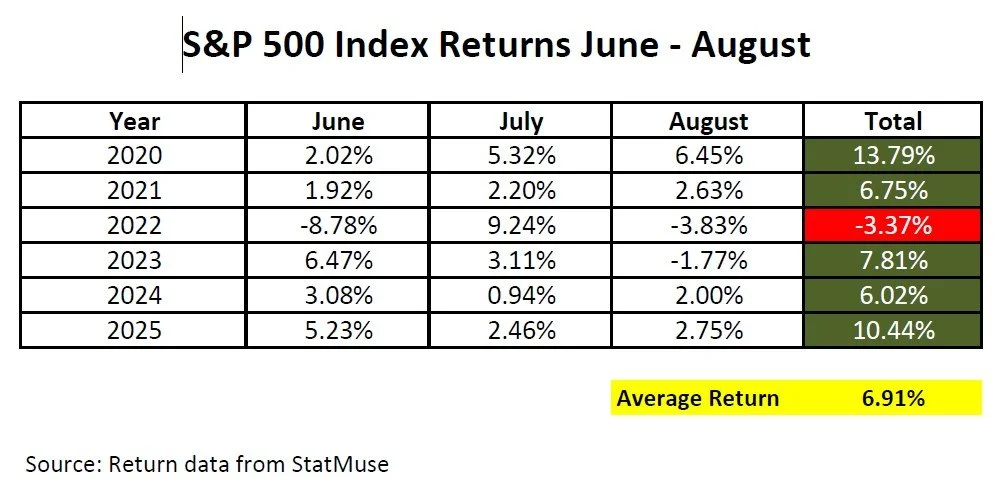

Below is a breakdown of the S&P 500 Index returns from June through August for each year since 2020.

When we look at the data:

Five out of six years, the June – August months produced positive returns.

The average return over this period was 6.91%.

Investors would have only been correct in sitting out one year (2022), when the S&P fell by –3.37%.

Put simply, investors who followed the Sell In May and Go Away strategy for the past 6 years cost themselves about 7% PER YEAR in investment returns.

Why the Temptation is Strong

It’s easy to see how investors get drawn into these types of strategies. A headline or article points out that summer months are historically weaker, or that volatility spikes during this period. On paper, it can sound logical: avoid risk, re-enter later, and come out ahead.

But as the table shows, the reality doesn’t line up with the theory. By relying on the “Sell in May” strategy, investors risk leaving money on the table. That’s the danger of market timing—you need to be right not once, but twice (when to sell, and when to buy back in).

Volatility vs. Discipline

There’s no denying that the summer months often bring more volatility to the stock market. Thinner trading volumes and seasonal economic patterns can cause choppier price action. But investors who have had the discipline to ride through those bumps have been rewarded.

The past six years make this clear: while the S&P 500 had its ups and downs from June to August, the overall trend was solidly positive. That’s why sticking to a long-term investment plan often beats trying to time the market.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What does “Sell in May and go away” mean in investing?

“Sell in May and go away” is a market adage suggesting that investors should sell their stock holdings in May, avoid the summer months when returns are thought to be weaker, and reinvest in the fall. The strategy is based on historical seasonal trends but often oversimplifies how markets actually perform.

Has the “Sell in May” strategy worked in recent years?

Recent data shows that this strategy has largely underperformed. Over the past several years, the S&P 500 has delivered positive returns during the summer months more often than not, meaning investors who exited in May would have missed out on gains.

Why can following seasonal market sayings be risky?

Relying on old adages or headlines instead of data can lead to missed opportunities or poorly timed decisions. Markets are influenced by a range of factors—economic trends, interest rates, and company performance—not just the calendar.

What’s the downside of sitting out of the market during the summer?

Missing even a few strong market days can significantly reduce long-term investment returns. Staying invested allows you to participate in rebounds and compounding growth that can happen unexpectedly throughout the year.

Why is discipline so important for investors?

A disciplined, long-term investment approach helps smooth out volatility and avoid emotional decision-making. Sticking with a consistent strategy based on goals and time horizon has historically produced better outcomes than trying to time the market.

What’s a more effective alternative to timing seasonal trends?

Instead of trying to predict short-term market movements, investors can focus on maintaining a diversified portfolio aligned with their risk tolerance and financial objectives. This approach emphasizes consistency and adaptability rather than reacting to temporary patterns.

What’s a Target Date Fund and Should I Invest in It?

Target date funds adjust automatically as you approach retirement, offering a simple “set it and forget it” investment strategy. They can be a smart option for early savers, but investors with complex financial situations may need more customized solutions.

If you've logged into your 401(k) or IRA recently, there's a good chance you've seen investment options labeled something like “2050 Target Date Fund” or “2065 Retirement Fund.” But what exactly is a target date fund, and is it the right choice for your retirement savings?

This article breaks down how target date funds work, their pros and cons, and when they make sense within a broader financial plan.

What Is a Target Date Fund?

A target date fund is a type of investment fund that automatically adjusts its asset allocation based on your expected retirement year—your target date.

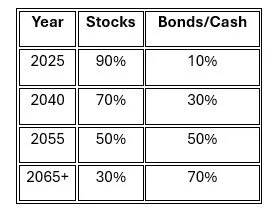

For example, a “2060 Target Date Fund” is designed for someone retiring around the year 2060. The fund starts out heavily invested in stocks to maximize growth. Over time, it gradually becomes more conservative, shifting toward bonds and cash equivalents as the retirement year approaches. This automatic reallocation is called the glide path.

Target date funds are often considered a “set-it-and-forget-it” option for retirement investors but understanding how they work may help determine whether they are a suitable option for your savings.

How the Glide Path Works

The glide path is the fund’s built-in schedule for reducing investment risk over time. Here's a simplified example of how the asset allocation might shift as retirement nears:

This gradual transition helps reduce the impact of market volatility as you get closer to drawing income from the portfolio. The example above may be a glide path associated with a “2065 Target Date Fund”.

Benefits of Target Date Funds

Simplicity: Target date funds are professionally managed, removing the need to select and monitor individual investments.

Diversification: These funds typically include a mix of U.S. and international stocks, bonds, and sometimes alternative investments, offering broad market exposure.

Automatic rebalancing: The fund rebalances its portfolio over time, keeping it aligned with its risk-reduction strategy without requiring action from the investor.

Good default option: Many 401(k) plans use target date funds as the default investment for participants who don’t actively choose their own allocation.

Potential Drawbacks to Consider

One-size-fits-all: These funds assume that all investors retiring in the same year have similar goals and risk tolerances, which isn’t always the case.

Higher fees: Some target date funds—especially those with actively managed components—can carry higher expense ratios compared to index-based options.

Misaligned risk profile: Some glide paths become too conservative too early, while others remain aggressive longer than ideal. The right fit depends on your personal retirement income plan.

Tax inefficiency in taxable accounts: Frequent rebalancing may create taxable events when held in non-retirement accounts. They are generally best suited for IRAs or 401(k)s.

When Target Date Funds Make Sense

Target date funds can be a solid choice if you:

Are early in your career and want a simple, broadly diversified investment

Don’t want to actively manage your retirement portfolio

Prefer to avoid emotional or reactive investment decisions

Are not yet working with a financial advisor

They are especially useful as a default option when you’re getting started or want to automate long-term investing with minimal oversight.

When to Consider Alternatives

You may want to explore other investment options if you:

Have substantial assets and want a more customized portfolio

Are implementing tax planning strategies like Roth conversions or asset location

Have other income sources in retirement that affect your risk tolerance

Want more control over your asset mix and withdrawal strategy

Have a lower risk tolerance than where the target date fund would allocate your investments

In these cases, building a personalized portfolio may better align with your goals and offer more flexibility.

Final Thoughts

Target date funds can offer convenience, professional management, and a clear path toward a retirement-ready portfolio. For many investors—especially those early in their careers—they can be a smart, efficient way to begin building long-term wealth.

However, as your financial picture grows more complex, it may be worth reevaluating whether a one-size-fits-all fund still fits your personal strategy. A custom portfolio tailored to your income needs, tax situation, and risk tolerance may offer more precise control over your retirement outcome.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Frequently Asked Questions (FAQs)

What is a target date fund?

A target date fund is a diversified investment designed to automatically adjust its mix of stocks, bonds, and other assets as you approach a specific retirement year. It aims to provide growth in the early years and gradually reduce risk as the target date gets closer.

How does a target date fund’s glide path work?

The glide path is the fund’s schedule for shifting from aggressive investments, like stocks, to more conservative holdings, such as bonds and cash equivalents. This gradual transition helps reduce volatility as you near retirement while still pursuing growth early on.

How do I choose the right target date fund?

Most investors select the fund closest to their expected retirement year. However, personal factors such as risk tolerance, savings rate, and income goals should also be considered when choosing a fund.

What are the main benefits of target date funds?

Target date funds offer automatic diversification and rebalancing, making them a convenient “set-it-and-forget-it” option. They can simplify retirement investing for those who prefer not to manage asset allocation themselves.

What are the potential drawbacks of target date funds?

One downside is that investors have little control over the fund’s specific holdings or risk adjustments. Glide paths also vary by provider, meaning some funds may remain more aggressive or conservative than expected.

Are target date funds a good choice for everyone?

They can be a strong fit for investors who want a hands-off approach, but those with complex financial goals or multiple investment accounts may benefit from a more customized strategy. Reviewing the fund’s allocation and costs before investing is essential.

Advantages of Using A Bond Ladder Instead of ETFs or Mutual Funds

Bond ladders can provide investors with predictable income, interest rate protection, and more control compared to bond ETFs or mutual funds. Greenbush Financial Group breaks down how they work, the different ladder strategies, and why some investors prefer this approach.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When it comes to investing, one of the biggest challenges is dealing with interest rate uncertainty. Rates go up, rates go down, and bond prices fluctuate with those changes. For investors who want predictable income and a way to smooth out the risks of rising and falling interest rates, a bond ladder can be a powerful strategy.

In this article, we’ll walk through:

What a bond ladder is and how it works

How a bond ladder helps hedge against interest rate fluctuations

The different types of bond ladders (equal-weighted, barbell, middle-loaded)

Why some investors prefer an individual bond ladder over bond mutual funds or ETFs

What Is a Bond Ladder?

A bond ladder is a portfolio of individual bonds with staggered maturity dates. For example, you might buy bonds maturing in 1 year, 2 years, 3 years, 4 years, and 5 years. When the 1-year bond matures, you reinvest the proceeds into a new 5-year bond, keeping the “ladder” in place.

This structure offers two key benefits:

Hedging Interest Rate Risk: Since a portion of your ladder matures every year (or at regular intervals), you always have an opportunity to reinvest at the prevailing interest rate—whether rates go up or down.

Consistent Income and Liquidity: The maturing bonds provide cash flow that can be reinvested or used for spending needs.

In short, a bond ladder helps smooth out the effects of interest rate fluctuations while still generating steady income.

Types of Bond Ladders and How They Work

There isn’t just one way to build a bond ladder. The structure you choose depends on your investment goals, risk tolerance, and views on interest rates. Here are three common approaches:

1. Equal-Weighted Bond Ladder

How it works: Bonds are spread evenly across maturity dates (e.g., equal amounts in 1, 2, 3, 4, and 5-year maturities).

Why use it: This is the most straightforward approach. It balances risk and return by spreading exposure across time horizons, making it a good fit for investors who want predictability.

2. Barbell Strategy

How it works: Bonds are concentrated at the short and long ends of the maturity spectrum, with little or nothing in the middle. For example, you might own 1-year and 10-year bonds, but nothing in between.

Why use it: Short-term bonds provide liquidity and flexibility, while long-term bonds lock in higher yields. This strategy can be appealing when you expect interest rates to change significantly in the future.

3. Middle-Loaded Ladder

How it works: Bonds are concentrated in intermediate maturities (e.g., 3–7 years).

Why use it: Provides a balance between short-term reinvestment risk and long-term interest rate exposure. This can be attractive if you think the current yield curve makes mid-range maturities the “sweet spot” for returns.

Bond ladders can also vary by duration. Some investors create 5-year ladders, 10-year ladders, or 20-year ladders.

Why Build a Bond Ladder Instead of Using a Mutual Fund or ETF?

You might wonder: why not just buy a bond fund and let the professionals handle it? There are several reasons why individual investors prefer building their own bond ladders:

Predictable Cash Flow: With a ladder, you know exactly when each bond will mature and what it will pay. Bond funds and ETFs fluctuate daily, and there are no set maturity dates.

Control Over Holdings: You decide the maturity schedule, the credit quality, and the exact bonds in your ladder. In a fund, you’re subject to the manager’s decisions.

Reduced Interest Rate Risk: In a bond ladder, if you hold bonds to maturity, you get your principal back regardless of market fluctuations. Bond funds never truly “mature,” so you’re always exposed to price swings.

Potentially Lower Costs: By buying individual bonds and holding them, you avoid ongoing expense ratios charged by mutual funds and ETFs.

In short, a bond ladder offers clarity, predictability, and control that pooled investment vehicles can’t always match.

Why You Need Significant Capital for a Bond Ladder

While bond ladders offer many advantages, they aren’t practical for every investor. Building a well-diversified ladder requires a substantial amount of money for a few reasons:

Minimum Purchase Amounts: Many individual bonds trade in $1,000 or $5,000 increments. To build a ladder with multiple rungs across different maturities, you need enough capital to meet those minimums. When investing in short-term U.S. treasuries, sometimes the purchase minimum is $250,000.

Diversification Needs: A proper ladder spreads risk across multiple issuers and maturities. Doing this with small amounts of money is difficult, leaving you concentrated in just a few bonds.

Transaction Costs: Buying and selling individual bonds often involves markups or commissions, which can eat into returns if the investment amount is too small.

Income Needs: If you’re using the ladder to generate income, small investments may not produce meaningful cash flow compared to what’s achievable with funds or ETFs.

For these reasons, investors with smaller portfolios often turn to bond mutual funds or ETFs. These vehicles pool money from many investors, allowing even modest contributions to achieve diversification, professional management, and steady income without the large upfront commitment required by a ladder

Final Thoughts

A bond ladder can be an excellent strategy for investors looking to hedge interest rate risk, generate predictable income, and maintain flexibility. Whether you choose an equal-weighted ladder for balance, a barbell strategy for flexibility and yield, or a middle-loaded approach to target the sweet spot of the curve, the right structure depends on your unique goals.

And while bond mutual funds and ETFs may be convenient, an individual bond ladder provides unmatched control, transparency, and reliability.

If you’re considering adding a bond ladder to your portfolio, the key is aligning it with your financial objectives, income needs, and risk tolerance. Done correctly, it’s a time-tested way to bring stability and consistency to your investment plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is a bond ladder and how does it work?

A bond ladder is a portfolio of individual bonds with staggered maturity dates, such as 1-, 2-, 3-, 4-, and 5-year terms. As each bond matures, the proceeds are reinvested into a new long-term bond, creating a cycle that provides steady income and helps manage interest rate risk.

How does a bond ladder help protect against interest rate changes?

Because bonds mature at regular intervals, you continually reinvest at current market rates. This means when interest rates rise, maturing bonds can be rolled into higher-yielding ones; when rates fall, the longer-term bonds in the ladder continue to earn higher fixed rates.

What are the different types of bond ladders?

Common structures include equal-weighted ladders (evenly spread maturities), barbell strategies (short- and long-term maturities), and middle-loaded ladders (focused on intermediate terms). Each structure balances risk, return, and flexibility differently.

Why might investors choose a bond ladder over a bond mutual fund or ETF?

An individual bond ladder offers predictable maturity dates, control over holdings, and stable cash flow if bonds are held to maturity. In contrast, bond funds and ETFs fluctuate in value and have no set maturity, which can expose investors to ongoing price volatility.

Who is a bond ladder best suited for?

Bond ladders typically work best for investors with larger portfolios who want predictable income and can meet minimum bond purchase requirements. Smaller investors may prefer bond funds or ETFs for diversification and lower entry costs. We advise consulting with your personal investment advisor.

What are the key advantages of using a bond ladder in a portfolio?

A bond ladder provides consistent income, reduces interest rate risk, and enhances liquidity through regular maturities. It also allows investors to match cash flow needs with future expenses while maintaining control over credit quality and investment duration.

Should Your Investment Strategy Change when You Retire

Should your investment strategy change when you retire? Most people don’t realize how much the answer impacts taxes, income, and long-term security. Retirement isn’t the end of your financial planning—it’s the start of a new phase. Your goals shift from growth to income, and your investment strategy should evolve with them.

Retirement marks a major shift in your financial life: you move from saving and accumulating wealth to spending it. But does that mean your investment strategy should change the moment you stop working?

The answer isn’t a simple yes or no—it depends on your goals, income needs, and risk tolerance. Let’s explore what changes may be necessary, what can stay the same, and how to align your investment approach with the realities of retirement.

1. Accumulation vs. Distribution: A New Financial Phase

During your working years, your investment strategy likely focused on growth—maximizing returns over the long term. For most, in retirement, the focus shifts to income and moderate growth. Your portfolio now needs to:

Support monthly withdrawals

Last for 20–30+ years

Withstand market volatility without derailing your lifestyle

This shift doesn't mean abandoning growth altogether, but it does mean adjusting how you balance risk and reward.

2. Reassess Your Asset Allocation

One of the first things to review in retirement is your asset allocation—how your investments are divided among stocks, bonds, and cash.

A typical pre-retirement portfolio may be 70–100% in equities. But in retirement, many advisors recommend dialing that back to reduce risk.

Example:

If you have a $1 million portfolio:

A 60/40 allocation would mean $600,000 in diversified stock funds and $400,000 in bonds or other fixed-income assets.

A 40/60 allocation might suit someone who is more risk-averse or heavily reliant on portfolio withdrawals.

Mistake Alert:

Some retirees swing too far into conservative territory. While that may feel safe, inflation can quietly erode your purchasing power—especially over a 25- to 30-year retirement.

3. Add an Income Strategy

Now that you’re drawing from your investments, it’s essential to have a plan for generating reliable income and decreasing the level of volatility with your portfolio. This may include:

Dividend-paying stocks or ETFs

Bond holdings or short-term fixed income

The goal is to create stable cash flow while giving your growth assets time to recover from market dips.

4. Be Strategic With Withdrawals

Your withdrawal strategy has a major impact on taxes and portfolio longevity. The order you pull from different account types matters.

Example:

Let’s say you need $80,000/year from your portfolio. You might:

Take $40,000 from a taxable account (capital gains taxed at lower rates)

Pull $20,000 from a Traditional IRA (fully taxable as income)

Social Security $20,000 (up to 85% taxable)

This balanced approach spreads the tax burden, avoids pushing you into a higher bracket, and gives your Roth assets (if you have them) more time to grow.

Common Misstep:

Many retirees default to depleting all of their after-tax assets first, but by not taking withdrawals from their tax-deferred accounts, like Traditional IRAs and 401(k) accounts, they potentially miss out on realizing those taxable distributions at very low tax rates. Having a withdrawal plan that coordinates your social security, Medicare premiums, after-tax accounts, pre-tax accounts, and Roth accounts is key.

5. Stay Diversified—Reduce Volatility In Portfolio

Diversification and reducing volatility are key considerations when entering retirement years. When you take withdrawals from your retirement accounts, the investment returns can vary significantly from those of the accumulation years. Why is that?

When you were working and contributing to your retirement accounts, and the economy hit a recession, since you were not withdrawing any money from your accounts when the market rebounded, you likely regained those losses fairly quickly. But in retirement, when you are taking distributions from the account as the market is moving lower, there is less money in the account when the market begins to rally. As such, your rate of return is more significantly impacted by market volatility when you enter distribution mode.

To reduce volatility in your portfolio, you may need to:

Increase your level of diversification across various asset classes

Keep a large cash reserve on hand to avoid selling stocks in a downturn

Be more proactive about adjusting your investment allocation in response to changing market conditions

6. Don’t Forget About Growth

Retirement could last 30 years or more. That means your portfolio needs to outpace inflation, especially with rising healthcare and long-term care costs.

Even if you’re taking distributions, keeping 30–60% in equities may help ensure your money grows enough to support you in later decades.

Final Thoughts: Don’t “Set It and Forget It”

Your investment strategy should evolve with you. Retirement isn’t a one-time financial event—it’s a new chapter that requires ongoing planning and regular reviews.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Should your investment strategy change when you retire?

While the focus shifts from accumulation to income and preservation, your investment approach should evolve based on your goals, risk tolerance, and income needs. Many retirees move toward a more balanced portfolio that supports sustainable withdrawals while still allowing for growth.

What’s the difference between the accumulation and distribution phases?

During the accumulation phase (your working years), the goal is to grow wealth through regular contributions and long-term compounding. In the distribution phase (retirement), you rely on your savings for income, so the emphasis shifts to generating steady cash flow and managing risk.

How should retirees adjust their asset allocation?

Many retirees move from aggressive stock-heavy portfolios to more balanced allocations—like 60/40 (stocks/bonds) or 40/60—depending on their comfort with risk. However, being too conservative can expose you to inflation risk, which can erode purchasing power over time.

How can you generate income from your investments in retirement?

Common income strategies include using dividend-paying stocks, bonds, or fixed-income funds to provide a steady cash flow. A well-structured income plan helps cover expenses while allowing growth-oriented investments to recover from market downturns.

What’s the best order to withdraw funds from retirement accounts?

Strategic withdrawals can help minimize taxes and extend portfolio longevity. The right order depends on your income, Social Security, and Medicare situation.

Why is diversification so important in retirement?

Diversification can reduce portfolio volatility—critical during retirement, when you’re withdrawing funds. Selling assets during a market downturn can permanently harm portfolio growth. Diversifying across asset classes and maintaining a cash buffer may help reduce the impact of market volatility.

Should retirees still invest in stocks?

In most cases, yes. Even in retirement, equities are important for long-term growth and inflation protection. With retirees living longer, it’s not uncommon for retirees to maintain investment accounts for 15+ years into retirement.

How often should retirees review their investment strategy?

At least once a year—or after major life or market changes. Retirement isn’t static, and your investment strategy should adjust to reflect evolving income needs, health costs, tax law updates, and market conditions.

What’s the most common mistake retirees make?

Becoming too conservative too soon. Avoiding market exposure entirely can limit growth and increase the risk of outliving your savings. A balanced approach that manages volatility while maintaining some growth potential is ideal in most situations.

Understanding the $3,000 Investment Loss Annual Tax Deduction

Each year, the IRS allows a tax deduction for investment losses that can be used to offset earned income. However, it’s a use-it-or-lose-it tax deduction, meaning if you fail to realize losses in your investment accounts by December 31st, you could forfeit a valuable tax deduction.

Each year, the IRS allows a tax deduction for investment losses that can be used to offset earned income. However, it’s a use-it-or-lose-it tax deduction, meaning if you fail to realize losses in your investment accounts by December 31st, you could forfeit a valuable tax deduction. In this article, we are going to cover:

Investment loss deduction limit

Single filer versus Joint filer

Short-term vs Long-term losses offset

Carryforward loss rules

Wash sale rules

$3,000 Investment Loss Deduction

Each year, the IRS allows both single filers and joint filers to deduct $3,000 worth of investment losses against their ordinary income. Usually, this is not allowed because investment gains and losses are considered “passive income”, while W-2 income or self-employment income is considered “earned income.” In most cases, gains and losses on the passive side of the fence do not normally offset income on the earned side of the fence. This $3,000 annual deduction for investment losses is the exception to the rule.

Realized Losses In Investment Accounts

To capture the tax deduction for the investment losses, the losses have to be “realized losses,” meaning you actually sold the investment at a loss, which turned the loss from an “unrealized” loss into a “realized loss” by December 31st. In addition, the realized loss has to take place in a taxable investment account like an individual account, a joint account, or a revocable trust account. Accounts such as an IRA, 401(k), or SEP IRA are tax-deferred accounts, so they do not generate realized gains or losses.

Long-term versus Short-term Losses

The realized losses can be either short-term or long-term, or a combination of both, leading up to the $3,000 annual loss limit. But if you have the option, it’s often more beneficial from a pure tax standpoint to realize a long-term loss, and I’ll explain why.

In the investment world, short-term gains are taxed as ordinary income and long-term gains are taxed at preferential long-term capital gains rates that range from 0% - 23.8% (including the Medicare surcharge). But when you realize investment losses, long-term losses cannot offset short-term gains. Only short-term losses can offset short-term gains.

By realizing $3,000 in long-term capital losses, you can use that amount to offset $3,000 of earned income—taxed at higher ordinary income rates—rather than just offsetting long-term capital gains, which are already taxed at lower preferential rates. Potentially saving you more tax dollars.

Loss Carryforward Rules

But what if your realized losses are more than $3,000 for the year? No worries, both short-term and long-term losses are eligible for “carryforward” which means you can keep carrying forward those losses into future tax years until you have additional realized investment gains to eat up the loss, or you can continue to take the $3,000 per year investment loss deduction until your carryforward loss has been used up.

Single Filer versus Joint Filer

Whether you are a single filer or a joint filer, the total annual investment losses deduction is $3,000. It does not double because you file married filing jointly - even though technically each spouse could have their own individual brokerage account with $3,000 in realized losses. However, if you file “married filing separately,” the annual deduction is limited to $1,500.

Wash Sale Rule

When you intentionally sell investments for purposes of capturing this $3,000 annual loss deduction, you have to be careful of the 30-Day Wash Sale Rule, which states that if you sell an investment at a loss and then buy that same investment or a “substantially identical security” back within 30 days of the sale, it prevents the investor from taking deduction for the realized loss.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the IRS investment loss deduction limit?

The IRS allows taxpayers to deduct up to $3,000 of realized investment losses ($1,500 if married filing separately) against ordinary income each year. This deduction applies only to losses in taxable investment accounts and must be realized by December 31st to count for that tax year.

What counts as a “realized” investment loss?

A loss is realized when you sell an investment for less than its purchase price. Unrealized losses—investments that have declined in value but haven’t been sold—do not qualify for the deduction. Losses must occur in taxable accounts, not tax-deferred ones like IRAs or 401(k)s.

How do short-term and long-term losses differ for tax purposes?

Short-term losses offset short-term gains, while long-term losses offset long-term gains. However, up to $3,000 of net long-term losses can also offset ordinary income, which is taxed at higher rates. This can provide a greater tax benefit than simply offsetting lower-taxed long-term gains.

What happens if I have more than $3,000 in investment losses?

Losses that exceed the $3,000 annual limit can be carried forward indefinitely to future tax years. These carryforward losses can offset future investment gains or continue to reduce ordinary income by up to $3,000 each year until they are fully used.

Does the $3,000 investment loss deduction double for married couples?

No. The deduction limit is $3,000 per tax return, whether you file as single or married filing jointly. For those filing separately, the limit is reduced to $1,500 per person.

What is the wash sale rule and how does it affect loss deductions?

The IRS wash sale rule disallows a deduction if you sell an investment at a loss and repurchase the same or a substantially identical security within 30 days before or after the sale. To preserve the deduction, you must wait at least 31 days before buying the same investment again.

Why is it important to realize losses before year-end?

The investment loss deduction follows a “use it or lose it” rule — losses must be realized before December 31st to count for that year’s tax filing. Missing the deadline means forfeiting the potential $3,000 deduction for that tax year.

Trump Tariffs 2025 versus Trump Tariffs 2017 to 2020: The Stock Market Reaction

President Trump just announced tariffs against Canada, Mexico, and China that will go into effect this week, which has sent the stock market sharply lower. I have received multiple emails from clients over the past 24 hours, all asking the same question:

“With the Trump tariffs that were just announced, should we be going to cash?”

President Trump just announced tariffs against Canada, Mexico, and China that will go into effect this week, which has sent the stock market sharply lower. I have received multiple emails from clients over the past 24 hours, many asking the same question:

“With the Trump tariffs that were just announced, should we be going to cash?”

Investors have to remember that we have seen Trump’s tariff playbook during his first term as president between 2017 and 2020, but investors' memories are short, and they forget how the stock market reacted to tariffs during his first term. While history does not always repeat itself, today we are going to look back on how the stock market reacted to the Trump tariffs during his first term, how those tariffs compare in magnitude to new tariffs that were just announced, and what changes investors should be making to their investment portfolio.

Trump Tariffs 2017 – 2020

During Trump’s first term as president, he introduced multiple rounds of tariffs, including the tariffs in 2018 on solar panels, washing machines, steel, and aluminum. The tariffs were levied against Canada, Mexico, and the European Union. Throughout his first term, he also escalated tariffs against China, which led to the news headlines of the trade war during his first four years in office.

How did the U.S. stock market react to these tariff announcements? Similar to today, not good. There were sharp selloffs in the stock market in the days following each tariff announcement, but here were the returns for the S&P 500 Index during Trump’s first term in office:

2017: 21.9%

2018: -4.41%

2019: 31.74%

2020: 18.38%

If we are looking to history as a guide, the first round of Trump tariffs created heightened levels of volatility in the markets, financially harmed specific industries in the U.S., and raised prices on various goods and services throughout the US economy. In the end, despite all of the negative press about the tariffs and trade wars, the U.S. stock market posted solid gains in 3 of the 4 years during Trumps first term as president.

The Trump Tariffs Are Larger This Time

However, we also have to acknowledge the difference between the tariffs that were announced in Trump’s first term and the tariffs that were just announced on February 2, 2025. The tariffs that Trump just announced are dramatically larger than the tariffs that we imposed during his first term, which could translate to a larger impact on the U.S. economy and higher prices. During his first term, Trump was very strategic as to which types of goods would be hit with the tariffs, but the latest round of tariffs is a 25% tariff on ALL goods from Canada and Mexico (with the exception of oil) and a 10% tariff on goods coming from China.

Negotiating Tool

Trump historically has used tariffs as a negotiating tool. During his first term, there were multiple rounds of delays in the tariffs being implemented as trade terms were negotiated; that could happen again. Even if the tariff is implemented this week, it’s tough to estimate how long those tariffs will stay in place, if they will be reduced or increased in coming months, and since they are so widespread this time, which industries in the US will get hit the hardest in this new round of tariffs.

U.S. Unfair Advantage in the Tariff Game

While the trade war / tariff game hurts all countries involved because it ultimately drives prices higher on specific goods and services, investors have to acknowledge the advantage that the United States has over other countries when tariffs are imposed. The U.S……by FAR…..is the largest consumer economy in the WORLD, so when we put tariffs on goods coming into our country, the US consumer historically will begin to shift their buying habits to lower-cost goods or buy less of those higher-cost items.

While the US consumer feels some pain from the impact of higher costs on the imported goods being tariffed, the pain is 3x or 5x for the country that tariffs are being imposed on because it’s immediately impacting their sales in the largest consumer economy in the world. This is why Trump has identified tariffs as such a powerful negotiating tool, even if the action that the president is trying to resolve has nothing to do with trade.

Investor Action

While the knee-jerk reaction to the tariff announcement may be to run for the hills, in our opinion, it’s too soon to make a dramatic shift in investment strategy given the opposing forces of the possible outcomes to the stock market beyond the initial reaction from the stock market. On the positive side of the argument, the stock market reacted similarly to the tariff announcements during his first term but still produced sizable gains throughout that four-year period. We don’t know how long these tariffs may be in place, they may not be permanent, or they may be reduced as negotiations progress. Third, the U.S. economy is healthy right now and may be able to absorb some of the negative impact of short-term price increases from the tariffs.

On the other side of the argument, the tariffs are much larger this time compared to Trump’s first term so it could have a larger negative impact. Also, the tariffs this round are broader versus the more surgical approach that he took during his first term, which could negatively impact more businesses in the US than it did the first time. Third, the retaliatory tariffs by Canada, Mexico, and China could be larger this time, which again, could have a larger negative impact on the U.S. economy compared to the 2017 – 2020 time frame.

The word “could” is used a lot in this article because the tariffs were just announced, and there are so many outcomes that could unfold in the coming months. When counseling clients on asset allocation, we find it prudent to hold off on making dramatic changes to the investment strategy until the path forward becomes clearer, even though it’s very tempting to want to react immediately to the events that trigger market sell-offs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What tariffs did President Trump announce in February 2025?

On February 2, 2025, President Trump announced new tariffs against Canada, Mexico, and China that will take effect immediately. The tariffs include a 25% tariff on all goods from Canada and Mexico (except oil) and a 10% tariff on goods from China.

Why did the stock market drop after the tariff announcement?

Markets sold off sharply following the announcement because tariffs generally increase costs for businesses and consumers, which can lead to lower corporate profits and slower economic growth. Historically, markets have reacted negatively in the short term to new tariffs or trade restrictions.

Should investors move to cash because of the new tariffs?

It may be too soon to make drastic portfolio changes. During Trump’s first term (2017–2020), similar tariff announcements caused short-term volatility, but the S&P 500 still gained strongly in three of those four years. Investors should remain focused on data, diversification, and long-term objectives rather than reacting immediately to headlines.

How do these new tariffs compare to the tariffs from Trump’s first term?

The 2025 tariffs are much broader and larger than those imposed during Trump’s first term. The earlier tariffs targeted specific products such as steel, aluminum, and solar panels, while the new tariffs apply across nearly all imports from Canada and Mexico, and all goods from China.

What is Trump’s strategy behind using tariffs?

President Trump often uses tariffs as a negotiating tool to pressure trading partners into reaching more favorable agreements with the United States. In the past, tariffs were sometimes delayed, reduced, or eliminated as trade deals were negotiated.

Why does the U.S. have an advantage in trade disputes?

The U.S. is the largest consumer economy in the world, meaning other countries rely heavily on selling goods to American consumers. While tariffs can raise prices in the U.S., they often cause much greater economic pain for the exporting countries whose access to the U.S. market is restricted.

What should investors expect in the short term?

Short-term volatility is likely as markets adjust to the uncertainty surrounding the tariffs and potential retaliatory actions from other countries. Investors should monitor updates on trade negotiations and watch key indicators such as inflation, consumer spending, and corporate earnings.

Could the tariffs eventually be rolled back or delayed?

Yes. In the past, Trump has used tariff announcements as leverage in negotiations and has paused or reduced tariffs once trade agreements were reached. The duration and scope of the current tariffs may change depending on how trade discussions progress in the coming weeks.

What actions should investors consider now?

For most investors, the best course of action is to stay disciplined and avoid emotional reactions. Broad diversification, periodic rebalancing, and patience often outperform attempts to time the market during politically driven volatility. It may be wise to reassess portfolio exposure once more clarity emerges on how long the tariffs will remain in place.

Surrendering an Annuity: Beware of Taxes and Surrender Fees

There are many reasons why individuals decide to surrender their annuities. Unfortunately, one of the most common reasons that we see is when individuals realize that they were sold the annuity by a broker and that annuity investment was either not in their best interest or they discover that there are other investment solutions that will better meet the investment objectives. This situation can often lead to individuals making the tough decision to cut their losses and surrender the annuity. But before surrendering their annuity, it’s important for investors to understand the questions to ask the annuity company about the surrender fees and potential tax liability before making e the final decision to end their annuity contract.

There are many reasons why individuals decide to surrender their annuities. Unfortunately, one of the most common reasons that we see is that individuals realize they were sold the annuity by a broker that was either not in their best interest, or they discover that there are other investment solutions that will better meet their investment objectives. This situation can often lead to individuals making the tough decision to cut their losses and surrender the annuity. But before surrendering their annuity, it’s important for investors to understand the questions to ask the annuity company about the surrender fees and potential tax liability before making the final decision to end their annuity contract.

Surrender Fee Schedule

Most annuities have what are called “surrender fees,” which are fees that are charged against the account balance in the annuity if the contract is terminated within a specific number of years. The surrender fee schedule varies greatly from annuity to annuity. Some have a 5-year surrender schedule, others have a 7-year surrender schedule, and some have 8+ year surrender fees. Typically, the amount of the surrender fees decreases over time, but the fees can be very high within the first few years of obtaining the annuity contract.

For example, an annuity may have a 7-year surrender fee schedule that is as follows:

Year 1: 8%

Year 2: 7%

Year 3: 6%

Year 4: 5%

Year 5: 4%

Year 6: 3%

Year 7: 3%

Year 8+: 0%

If you purchased an annuity with this surrender fee schedule and two years after purchasing the annuity you realize it was not the optimal investment solution for you, you would incur a 7% surrender fee. If your annuity had a $100,000 value, the annuity company would assess a $7,000 surrender fee when you cancel your contract and move your account.

When It Makes Sense To Pay The Surrender Fee

In some cases, it may make financial sense to pay the surrender fee to get rid of the annuity and just move your money into a more optimal investment solution. If a client has had an annuity for 6 years and they would only incur a 3% surrender fee to cancel the annuity, it may make sense to pay the 3% surrender fee as opposed to waiting 2 more years to surrender the annuity contract without a surrender fee. For example, if the annuity contract is only expected to produce a 4% rate of return over the next year, but they have another investment solution that is expected to produce an 8%+ rate of return over that same one-year period, it may make sense to just surrender the annuity and pay the 3% surrender fee, so they can start earning those higher rates of return sooner, which essentially more than covers the surrender fee that they paid to the annuity company.

Potential Tax Liability Associated with Annuity Surrender

An investor may or may not incur a tax liability when they surrender their annuity contract. Assuming the annuity is a non-qualified annuity, if the cash surrender value is not more than an investor's original investment, then there would not be a tax liability associated with the surrender process because the annuity contract did not create any “gain” in value for the investor. However, if the cash surrender value is greater than the initial investment in the contract, then the investors would trigger a realized gain when they surrender the contract, which is taxed at an ordinary income tax rate. Annuity investments do not receive long-term capital gain preferential tax treatment for contacts held for more than 12 months like stocks and other investments held in brokerage accounts. The gains are always taxed as ordinary income rates because it’s technically an insurance contract.

Not all annuity companies list your total “cost basis” on your statement. Often, we advise clients to call the annuity company to obtain their cost basis in the policy and have the annuity company tell them whether or not there would be a tax liability if they surrendered the annuity contract. You can call the annuity company directly; you do not need to call the broker that sold you the annuity.

If there is no tax liability associated with surrendering the contract, surrendering the contract can be an easy decision for an investor. However, if there is a large tax liability associated with surrendering an annuity, some tax planning may be required. There are tax strategies associated with surrendering annuities that have unrealized gains, such as if you are close to retirement, you could wait to surrender the annuity until the year that you are fully retired, making the taxable gain potentially subject to a lower tax rate. We have had clients that have surrendered an annuity, incurred a $15,000 taxable gain, and then turned around and contributed up to $23,500 (or $31,000 if age 50+), pre-tax, to their 401(k) account at work, which offset the additional taxable income from the annuity surrender in that tax year.

Is Paying The Surrender Fee and Taxes Worth It?

For investors who face either a surrender fee, taxes, or both when surrendering an annuity contract, the decision of whether or not to surrender the annuity contract comes down to whether or not paying those taxes and/or penalties is worth it, just to get out of that annuity that was not the right fit in the first place. Or maybe it was the right investment when you first purchased it, but now your investment needs have changed, or there is a better investment opportunity elsewhere. If there are no surrender fees and minimal tax liability, the decision can be very easy, but when large surrender fees and/or tax liability exists, additional analysis is often required to determine if delaying the surrender of the annuity contract makes sense.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why do investors surrender their annuities?

Many investors choose to surrender an annuity when they realize it no longer fits their financial goals or when they discover better investment alternatives. In some cases, annuities are sold by brokers under less-than-ideal circumstances, prompting investors to cut their losses and move to more flexible investment options.

What are annuity surrender fees?

Surrender fees are charges imposed by the insurance company if you cancel (surrender) your annuity within a certain period—typically 5 to 8 years after purchase. These fees decline over time. For example, a 7-year surrender schedule might charge 8% in the first year, 7% in the second, and gradually drop to 0% after year seven.

When might it make sense to pay the surrender fee?

It can make sense to pay a surrender fee if switching to a new investment is expected to produce significantly higher returns. For example, if your annuity is projected to earn 4% annually but another investment could earn 8%, paying a small surrender fee (like 3%) could be worthwhile because the higher returns may quickly offset the cost of surrendering the contract.

What taxes apply when you surrender an annuity?

If your annuity’s cash value exceeds your original investment (cost basis), the gain is taxable as ordinary income in the year you surrender it. Unlike stocks or mutual funds, annuities do not qualify for long-term capital gains tax treatment. However, if your cash surrender value is less than or equal to your original investment, no tax will be due.

How can you find out your annuity’s cost basis?

Your annuity company can tell you your exact cost basis and whether surrendering the annuity would trigger taxable gains. You can contact the insurance company directly—there’s no need to go through the broker who sold you the annuity.

Are there tax strategies for surrendering an annuity with gains?

Yes. Timing matters. For instance, if you’re close to retirement, surrendering the annuity after you stop working could mean the taxable gain falls into a lower tax bracket. Another strategy is to offset taxable gains by making a pre-tax 401(k) or IRA contribution in the same year.

How do you decide if paying surrender fees or taxes is worth it?

The decision depends on your time horizon, expected investment returns, and tax impact. If surrender fees are low and tax exposure is minimal, surrendering may be the best move. If both are high, it might make sense to wait or consult a financial planner to explore tax-efficient options.

How Will The Fed’s 50bps Rate Cut Impact The Economy In Coming Months?

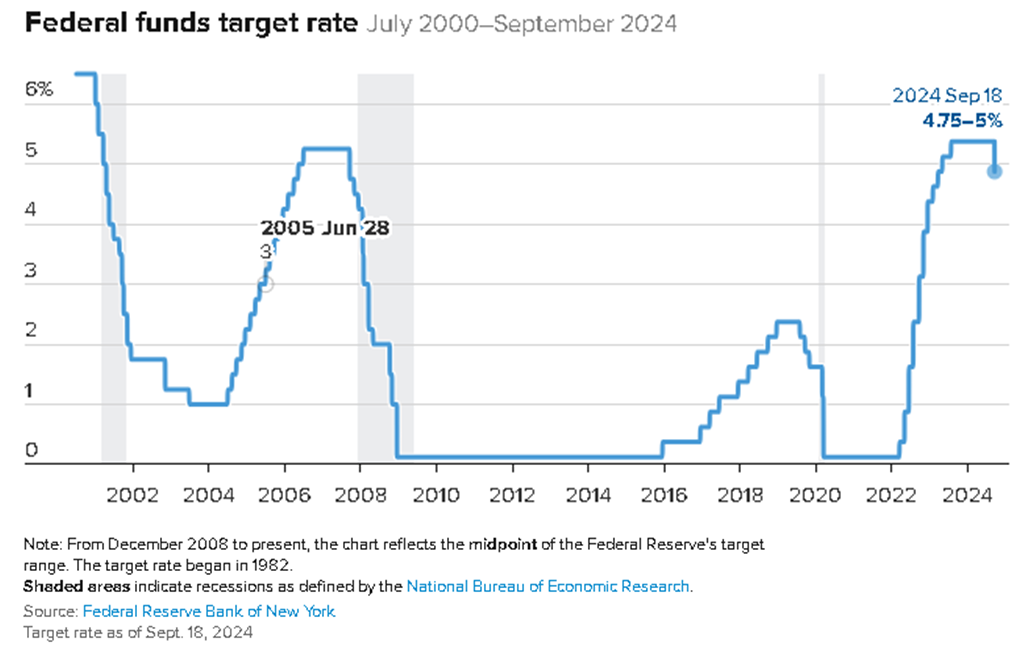

The Fed cut the Federal Funds Rate by 0.50% on September 18, 2024 which is not only the first rate cut since the Fed started raising rates in March 2022 but it was also a larger rate cut than the census expected. The consensus going into the Fed meeting was the Fed would cut rates by 0.25% and they doubled it. This is what the bigger Fed rate cut historically means for the economy

The Fed cut the Federal Funds Rate by 0.50% on September 18, 2024, which is not only the first rate cut since the Fed started raising rates in March 2022, but it’s also a larger rate cut than most economists predicted. The consensus going into the Fed meeting was that the Fed would cut rates by 0.25%, and they doubled it. In this article, we will cover:

How is the stock market likely to respond to this larger than anticipated rate cut?

How is this rate cut expected to impact the economy in the coming months?

Do we expect this rate cut trend to continue in the coming months?

Recession trends when the Fed begins cutting rates.

How Rate Cuts Impact The Economy

When the Fed decreases the Federal Funds Rate, it is essentially breathing oxygen back into the economy. Even the anticipation of the Fed lowering rates has an impact on the interest rate on car loans, mortgages, and commercial lending. As interest rates move lower, it usually stimulates the economy by making financing more attractive to the U.S. consumer. For example, a new homebuyer may not be able to afford a new house if it’s financed with a 30-year mortgage with a 7.5% interest rate, but as interest rates move lower, to say 6%, it lowers the monthly mortgage payments, putting the house in reach for that new homebuyer.

6 Month Delay

The reason why we support the Fed making a bigger rate cut now is the inflation rate has moved into the Feds 2% to 3% range, the job market has been cooling over the past few months, evident in the unemployment rate rising, and when the Fed cuts rates, it takes 6 to 9 months before that rate cut translates to more economic activity because it takes time for the impact of those lower interest rates to work their way through the economy.

Historically, The Fed Waits Too Long To Cut Rates

It’s reassuring to see the Fed cutting rates before we see significant pain in the U.S. economy because that is not the typical Fed pattern. Historically, the Fed waits too long to begin cutting rates, and only after a recession has arrived from rates being held high for too long does the Fed begin cutting rates. However, then there is a 6-month lag before the economy feels the benefits of those rate cuts and it’s usually an ugly 6 months for the equity market. The fact that the Fed is cutting rates now and by a larger amount than the consensus expects increases the chances that a soft landing will be delivered to the economy coming out of this rate hike cycle.

Not Out of The Woods Yet

While the Fed proactively cutting rates is a positive sign in the short term, if we look at a historic chart of the Fed Funds Rate going back to 2000, you will see a pattern from past cycles that only AFTER the Fed begins cutting rates does the economy enter a recession. So, while we applaud the Fed for being proactive with these bigger rate cuts, it still echoes the warning, “Will this rate cut and the future rate cuts be enough to avoid a recession?”. Only time will tell.

Do We Expect Additional Fed Rate Cuts

We do expect the Fed to implement additional rate cuts before the end of 2024, which if the economy hits a rough patch within the next few months, will hopefully provide some optimism that help is already on the way as these rates cuts that have already been made work their way through the economy.

The good news is they have room to cut rates by more. We were concerned at the beginning of the rate hike cycle that if they were not able to raise rates by enough, they would not have enough room to cut rates if the economy ran into a soft patch; but given the magnitude of the rate hikes between March 2022 and now, there is plenty of room to cut and restore confidence if it is needed in coming months.

COVID Stimulus Money Still In The Economy

In general, I think individuals underestimate the power of the amount of cash that was pumped into the system during COVID that was never taken out. In the 2008/2009 recession, the Federal Reserve expanded its balance sheet by about $1 trillion. During COVID they expanded the Fed balance sheet by about $4.5 Trillion, and to date they have only taken back about $1T of the initial $4.5T, so the U.S. economy has an additional $3.5T in liquidity that was not in the economy before 2020. That’s a lot of money to build a bridge to a possible soft-landing scenario.

Multiple Forces Acting On The Markets

We do expect escalated levels of volatility in the stock market in the fourth quarter. Not only do we have the market volatility surrounding the change in Fed policy, but we also have the elections in November that will inevitably inject additional volatility into the markets. As we get past the elections and enter 2025, we may return to more normal levels of volatility, because at that point the economy will know the political agenda for the next 4 years and some of the Fed rate cuts will have worked their way into the economy, potentially leading to stronger economic data in Q1 and Q2 of 2025.

All eyes will be on the race between the Fed rate cuts and the health of the economy.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why did the Federal Reserve cut rates by 0.50% in September 2024?

The Fed cut the Federal Funds Rate by 0.50% to support a slowing economy as inflation returned to its target range and the job market began to cool. The larger-than-expected cut was intended to provide earlier stimulus rather than waiting until the economy weakens further.

How do Fed rate cuts typically affect the economy?

Lowering interest rates makes borrowing cheaper for consumers and businesses, which can boost spending on homes, cars, and investments. However, it typically takes six to nine months for the effects of a rate cut to fully work through the economy.