Stock Options 101: ISO, NQSO, and Restricted Stock

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

Stock options give you the right to purchase a specific number of shares of the company’s stock at a fixed price. There is typically a vesting schedule attached to option grants that specify when you have the right to exercise your stock options. Companies can offer employees:

Incentive Stock Options (“ISO”)

Nonqualified Stock Options (“NQSO”)

Restricted Stock

It is very important to understand how these different types of options and grants are taxed otherwise it could lead to unfortunate tax surprises down the road.

Non-Qualified Stock Options (NQSO)

A non-qualified stock option (NQSO) is a type of stock option that does not qualify for special favorable tax treatment under the US Internal Revenue Code. Thus the word nonqualified applies to the tax treatment (not to eligibility or any other consideration). NQSOs are the most common form of stock option and may be granted to employees, officers, directors, contractors, and consultants.

You pay taxes on these options at the time of exercise. For tax purposes, the exercise spread is compensation income and is therefore reported on your IRS Form W-2 for the calendar year of exercise.

Example: Your stock options have an exercise price of $30 per share. You exercise them when the price of your company stock is $100 per share. You have a $70 spread ($100 – 30) and thus $70 per share is included in your W2 as ordinary income.

Your company will withhold taxes—income tax, Social Security, and Medicare—when you exercise the options.

When you sell the shares, whether immediately or after a holding period, your proceeds are taxed under the rules for capital gains and losses. You report the stock sale on Form 8949 and Schedule D of your IRS Form 1040 tax return.

Incentive Stock Options (ISO)………..

Incentive stock options (ISOs) qualify for special tax treatment under the Internal Revenue Code and are not subject to Social Security, Medicare, or withholding taxes. However, to qualify they must meet rigid criteria under the tax code. ISOs can be granted only to employees, not to consultants or contractors. There is a $100,000 limit on the aggregate grant value of ISOs that may first become exercisable (i.e. vest) in any calendar year. Also, for an employee to retain the special ISO tax benefits after leaving the company, the ISOs must be exercised within three months after the date of termination.

After you exercise these options, if you hold the acquired shares for at least two years from the date of grant and one year from the date of exercise, you incur favorable long-term capital gains tax (rather than ordinary income tax) on all appreciation over the exercise price. However, the paper gains on shares acquired from ISOs and held beyond the calendar year of exercise can subject you to the alternative minimum tax (AMT). This can be problematic if you are hit with the AMT on theoretical gains but the company's stock price then plummets, leaving you with a big tax bill on income that has evaporated.

Very Important: If you have been granted ISOs, it’s important to understand how the alternative minimum tax can affect you prior to exercising your stock options.

Restricted Stock……………….

Your company may no longer be granting you stock options, or may be granting fewer than before. Instead, you may be receiving restricted stock. While these grants don't give you the same potentially life-altering, wealth-building upside as stock options, they do have additional benefits compared to ISO’s and NQSO’s.

The value of stock options, such as ISO’s and NQSO’s, depend on how much (or whether) your company's stock price rises above the price on the grant date. By contrast, restricted stock has value at vesting even if the stock price has not moved or even dropped since grant.

Depending on your attitude toward risk and your experience with swings in your company's stock price, the certainty of your restricted stock's value can be appealing. By contrast, stock options (ISO & NQSO) have great upside potential but can be "underwater" (i.e. having a market price lower than the exercise price). This is why restricted stock is often granted to a newly hired executive. It may be awarded as a hiring bonus or to make up for compensation and benefits, including in-the-money options and nonqualified retirement benefits, forfeited by leaving a prior employer.

Of course, the very essence of restricted stock is that you must remain employed until the shares vest to receive its value. While you may have between 30 and 90 days to exercise stock options after voluntary termination, unvested grants of restricted stock are often forfeited immediately. Thus, it is an extremely effective “golden handcuff” to keep you at your company.

Fewer Decisions

Unlike a stock option, which requires you to decide when to exercise and what exercise method to use, restricted stock involves fewer decisions. When you receive the shares at vesting—which can be based simply on the passage of time or the achievement of performance goals—you may have a choice of tax-withholding methods (e.g. cash, sell shares for taxes), or your company may automatically withhold enough vested shares to cover the tax withholding. Restricted stock is considered "supplemental" wages, following the same tax rules and W-2 reporting that apply to grants of nonqualified stock options.

Tax Decisions

The most meaningful decision with restricted stock grants is whether to make a Section 83(b) election to be taxed on the value of the shares at grant instead of at vesting. Whether to make this election, named after the section of the Internal Revenue Code that authorizes it, is up to you. (It is not available for Restricted Stock Units (RSUs), which are not "property" within the meaning of Internal Revenue Code Section 83)

If a valid 83(b) election is made within 30 days from the date of grant, you will recognize as of that date ordinary income based on the value of the stock at grant instead of recognizing income at vesting. As a result, any appreciation in the stock price above the grant date value is taxed at capital gains rates when you sell the stock after vesting.

While this can appear to provide an advantage, you face significant disadvantages should the stock never vest and you forfeit it because of job loss or other reasons. You cannot recover the taxes you paid on the forfeited stock. For this reason, and the earlier payment date of required taxes on the grant date value, you usually do better by not making the election. However, this election does provide one of the few opportunities for compensation to be taxed at capital gains rates. In addition, if you work for a startup pre-IPO company, it can be very attractive for stock received as compensation when the stock has a very small current value and is subject to a substantial risk of forfeiture. Here, the downside risk is relatively small.

Dividends

Unlike stock options, which rarely carry dividend equivalent rights, restricted stock typically entitles you to receive dividends when they are paid to shareholders.

However, unlike actual dividends, the dividends on restricted stock are reported on your W-2 as wages (unless you made a Section 83(b) election at grant) and are not eligible for the lower tax rate on qualified dividends until after vesting.

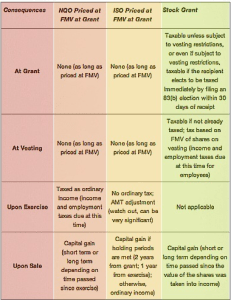

Comparison Chart

Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide tax advice. For tax advice, please consult your accountant.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.