NYS Retiree Medicare Part B and IRMAA Reimbursement Process Explained

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

For individuals who retire from New York State service, the retiree health benefits are among the most generous in the country. One of the most valuable — and often misunderstood — features is how Medicare Part B premiums and IRMAA surcharges are reimbursed after age 65.

This article explains, in plain language:

How New York State automatically reimburses retirees for Medicare Part B premiums

How IRMAA (Income-Related Monthly Adjustment Amount) works and why higher earners pay more

The manual process required to get reimbursed for IRMAA

How far back you can go to reclaim missed IRMAA reimbursements

What retirees (and spouses) need to do each year to stay reimbursed

How Does New York State Reimburse Retirees for Medicare Part B Premiums?

Once a New York State retiree reaches age 65 and enrolls in Medicare, the Medicare Part B premium reimbursement is automatic.

There is no form to file and no annual application required for the base Medicare Part B premium.

Here’s how it works:

When you turn 65 and enroll in Medicare Part B during your open enrollment window

New York State automatically increases your monthly pension by the amount of the standard Medicare Part B premium

This applies to:

The retiree

A spouse who is covered under the New York State retiree health plan

That automatic pension increase is why New York State retiree health benefits are considered so lucrative — the reimbursement applies to both the retiree and their spouse, which can amount to thousands of dollars per year.

2026 Medicare Part B Example

In 2026, the base Medicare Part B premium is $202.90 per month.

Example:

A New York State retiree is receiving a pension of $2,000 per month

Upon turning 65 and enrolling in Medicare Part B

Their pension automatically increases to $2,202.90 per month

That increase directly offsets the Medicare Part B premium that is being deducted from their Social Security check.

If you are only paying the standard Medicare Part B premium, no action is required beyond enrolling in Medicare on time.

Understanding IRMAA: Why Higher-Income Retirees Pay More for Medicare

Medicare premiums are income-based. As income rises, so does the Medicare Part B premium — this additional charge is known as IRMAA (Income-Related Monthly Adjustment Amount).

2026 IRMAA Income Thresholds

For 2026, IRMAA begins when income exceeds:

Single filers: $109,000

Married filing jointly: $218,000

Above those levels, Medicare Part B premiums increase in steps as income rises.

IRMAA Example for a NYS Retiree

Let’s say:

A single New York State retiree

With retiree health benefits

Earns $200,000 in 2026

Instead of paying the base $202.90 per month, their Medicare Part B premium increases to $527.50 per month due to IRMAA.

That’s an additional $324.60 per month, or nearly $3,900 per year, in extra Medicare costs.

How IRMAA Reimbursements Work for New York State Retirees

New York retirees are often pleasantly surprised to find out that the retiree health plan not only reimbursement them for the standard Medicare premium but also the IRMAA amount but the IRMAA reimbursement process is not automatic.

What Happens Automatically vs. Manually

✅ Base Medicare Part B premium

Reimbursed automatically through an increased pension payment

❌ IRMAA surcharge

Requires a physical application each year

To receive reimbursement for IRMAA, the retiree must:

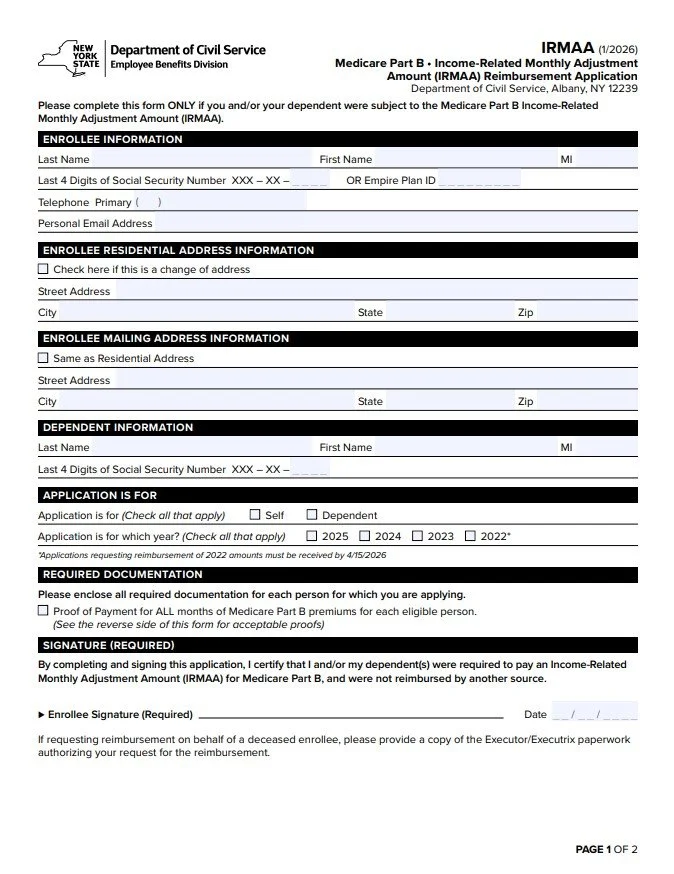

Complete the IRMAA reimbursement form from the New York State Department of Civil Service (below is a picture of the form)

Attach documentation from Social Security showing:

The Medicare Part B premiums paid for the year

Mail the form and documentation to New York State

Receive reimbursement by check

You Can Go Back Up to Four Years to Reclaim Missed IRMAA Reimbursements

If you’re reading this and realizing you’ve been paying IRMAA for years without reimbursement — there’s good news.

New York State allows retirees to go back up to four years to recoup IRMAA premiums already paid.

On the IRMAA reimbursement form, you can:

Check the boxes for each year you were subject to IRMAA

Submit the required Social Security tax documentation for each year

When approved, New York State will issue reimbursement checks for those prior years.

A Simple Annual Reminder Strategy

For our clients who we know will be subject to IRMAA every year, we recommend a very simple system:

Set a recurring reminder for January or February

When your Social Security tax form arrives showing Medicare premiums paid:

Complete the IRMAA reimbursement form

Attach the documentation

Mail it to New York State

That’s it.

New York State does not advertise this process — which is exactly why many retirees miss out on thousands of dollars they’re entitled to receive.

If you’re a New York State retiree — especially one with higher retirement income — understanding this process can mean thousands of dollars back in your pocket every year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.