Attention Non-Spouse 10-Year Beneficiaries: 2030 Is Rapidly Approaching

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

If you inherited an IRA or other retirement account from a non-spouse after December 31, 2019, the clock is ticking—and for many families, the tax consequences are coming into sharper focus.

The SECURE Act, which went into effect in 2020, dramatically changed how non-spouse beneficiaries must handle inherited retirement accounts. While these rules may have seemed far off at the time, 2030 is now just around the corner for those who inherited accounts in the first year of the new law.

In this article, we’ll cover:

How the SECURE Act’s 10-year rule works

Why 2030 could trigger significant tax liabilities

How market growth has quietly made the problem bigger

Practical tax-planning strategies to consider now

Why waiting until the last year can be costly

A Quick Refresher: What Changed Under the SECURE Act?

Prior to 2020, most non-spouse beneficiaries could “stretch” distributions from an inherited IRA over their lifetime. This allowed smaller required distributions and, in many cases, never required the account to be fully depleted.

That all changed with the SECURE Act.

For most non-spouse beneficiaries:

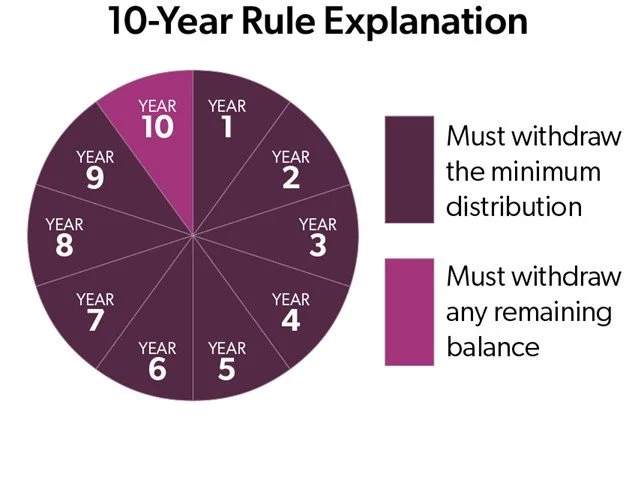

The inherited retirement account must be fully depleted within 10 years

The rule applies to anyone who passed away after December 31, 2019

All pre-tax dollars distributed during that period are taxable income

From the IRS’s perspective, this rule change was a revenue raiser—it ensures that inherited retirement assets become taxable within a defined window.

Why 2030 Is Such a Big Deal

For individuals who inherited a retirement account from someone who passed away in 2020, the 10-year clock runs out at the end of 2030.

That means:

Only five tax years remain (2026–2030) before the final distribution year

Any remaining balance must be distributed—and taxed—by the end of year 10

Large balances could result in substantial one-year tax spikes

Many beneficiaries have only been taking small distributions or the minimum required amounts. While that may have felt prudent at the time, it can create a tax bombshell in the final year if the account balance is still large.

RMD Rules Add Another Layer of Complexity

Required Minimum Distribution (RMD) rules under the SECURE Act depend on whether the original account owner was already taking RMDs when they passed away.

Some beneficiaries were required to take annual RMDs

Others were not required to take annual distributions—but still must empty the account by year 10

Regardless of which category you fall into, the key issue remains the same:

Waiting too long often concentrates taxable income into fewer years.

Market Growth Has Made the Problem Bigger

Ironically, strong market performance over the past several years has amplified the issue.

For individual that have a large allocation to stocks within their inherited IRA, since the market returns have been so strong over the past few years, they may have seen the balance in their inherited IRA increase despite taking RMDs from the account each year.

This is great from a wealth-building perspective, but it also means:

Larger balances remain late in the 10-year window

Larger forced distributions

Larger tax bills await

In short, investment success can unintentionally worsen the tax outcome if distributions aren’t coordinated with a broader tax plan.

Why Smoothing Income Often Makes Sense

For many non-spouse beneficiaries, the goal should be tax smoothing—intentionally spreading distributions over the remaining years to avoid one massive taxable event in year 10.

This often means:

Taking more than the minimum each year

Coordinating distributions with your current income level

Evaluating how many years remain in your 10-year window

The sooner this planning happens, the more flexibility you typically have.

One Common Strategy: Offset Taxes With 401(K) Contributions

One tax-planning strategy we often explore with clients involves maximizing employer-sponsored retirement plan contributions.

Here’s a simplified example:

A 50-year-old employee is contributing $15,000 to their 401(k)

In 2026, they may be eligible to contribute up to $32,500

That’s an additional $17,500 of potential pre-tax deferrals

A possible strategy:

Take a $17,500 distribution from the inherited IRA (taxable)

Increase payroll deferrals so more income flows into the 401(k) pre-tax

Use the inherited IRA distribution to supplement take-home pay

Result:

Taxable income from the inherited IRA distribution is fully offset by pre-tax retirement contributions, while also shifting assets into the inherited IRA owner's personal 401(k) account, which does not have a 10-year distribution restriction.

A Critical Caveat for 2026

High-income earners should be aware that starting in 2026, certain catch-up contributions for those over age 50 may be required to be made as Roth contributions. Roth deferrals do not provide an immediate tax deduction, which could limit the effectiveness of this strategy.

When Waiting Can Make Sense

Not every situation calls for accelerating distributions.

For individuals who plan to retire before the 10-year period ends, delaying distributions may be intentional and strategic. Once paychecks stop:

Ordinary income may drop significantly

Larger inherited IRA distributions could fall into lower tax brackets

This can be a very effective approach—but only when planned in advance.

The Real Warning Sign to Watch For

This article isn’t about fear—it’s about awareness.

If you:

Inherited a retirement account after 2019

Have only been taking small distributions or RMDs

Haven’t mapped out the remaining years of your 10-year window

There’s a real risk that a large, avoidable tax liability is waiting at the end of the road.

Final Thoughts

The SECURE Act permanently changed the landscape for non-spouse beneficiaries, and 2030 is approaching faster than many realize. Thoughtful, proactive tax planning—especially in the final years of the 10-year period—can make a meaningful difference in outcomes.

Now is the time to:

Count the remaining years

Project future tax exposure

Coordinate investment, distribution, Medicare premium, and tax strategies

Advanced planning today can help turn a looming tax problem into a manageable—and sometimes even strategic—opportunity.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.