NYS Retiree Medicare Part B and IRMAA Reimbursement Process Explained

New York State retiree health benefits include a powerful perk: reimbursement for Medicare Part B premiums after age 65. But many retirees don’t realize that IRMAA surcharges can also be reimbursed — and that process is manual. This guide explains how NYS Part B reimbursement works automatically through pension increases, how IRMAA (Income-Related Monthly Adjustment Amount) raises Medicare premiums for higher earners, what form you must file to get IRMAA money back, and how to claim up to four years of missed reimbursements.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

For individuals who retire from New York State service, the retiree health benefits are among the most generous in the country. One of the most valuable — and often misunderstood — features is how Medicare Part B premiums and IRMAA surcharges are reimbursed after age 65.

This article explains, in plain language:

How New York State automatically reimburses retirees for Medicare Part B premiums

How IRMAA (Income-Related Monthly Adjustment Amount) works and why higher earners pay more

The manual process required to get reimbursed for IRMAA

How far back you can go to reclaim missed IRMAA reimbursements

What retirees (and spouses) need to do each year to stay reimbursed

How Does New York State Reimburse Retirees for Medicare Part B Premiums?

Once a New York State retiree reaches age 65 and enrolls in Medicare, the Medicare Part B premium reimbursement is automatic.

There is no form to file and no annual application required for the base Medicare Part B premium.

Here’s how it works:

When you turn 65 and enroll in Medicare Part B during your open enrollment window

New York State automatically increases your monthly pension by the amount of the standard Medicare Part B premium

This applies to:

The retiree

A spouse who is covered under the New York State retiree health plan

That automatic pension increase is why New York State retiree health benefits are considered so lucrative — the reimbursement applies to both the retiree and their spouse, which can amount to thousands of dollars per year.

2026 Medicare Part B Example

In 2026, the base Medicare Part B premium is $202.90 per month.

Example:

A New York State retiree is receiving a pension of $2,000 per month

Upon turning 65 and enrolling in Medicare Part B

Their pension automatically increases to $2,202.90 per month

That increase directly offsets the Medicare Part B premium that is being deducted from their Social Security check.

If you are only paying the standard Medicare Part B premium, no action is required beyond enrolling in Medicare on time.

Understanding IRMAA: Why Higher-Income Retirees Pay More for Medicare

Medicare premiums are income-based. As income rises, so does the Medicare Part B premium — this additional charge is known as IRMAA (Income-Related Monthly Adjustment Amount).

2026 IRMAA Income Thresholds

For 2026, IRMAA begins when income exceeds:

Single filers: $109,000

Married filing jointly: $218,000

Above those levels, Medicare Part B premiums increase in steps as income rises.

IRMAA Example for a NYS Retiree

Let’s say:

A single New York State retiree

With retiree health benefits

Earns $200,000 in 2026

Instead of paying the base $202.90 per month, their Medicare Part B premium increases to $527.50 per month due to IRMAA.

That’s an additional $324.60 per month, or nearly $3,900 per year, in extra Medicare costs.

How IRMAA Reimbursements Work for New York State Retirees

New York retirees are often pleasantly surprised to find out that the retiree health plan not only reimbursement them for the standard Medicare premium but also the IRMAA amount but the IRMAA reimbursement process is not automatic.

What Happens Automatically vs. Manually

✅ Base Medicare Part B premium

Reimbursed automatically through an increased pension payment

❌ IRMAA surcharge

Requires a physical application each year

To receive reimbursement for IRMAA, the retiree must:

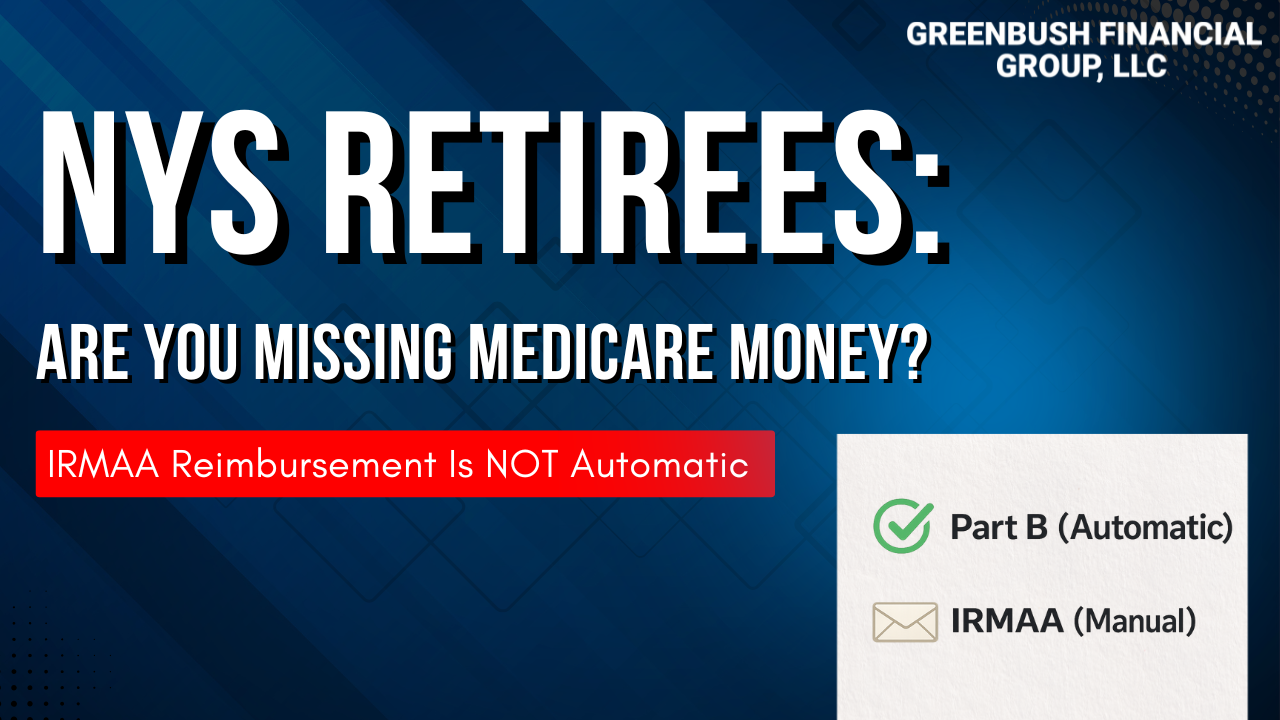

Complete the IRMAA reimbursement form from the New York State Department of Civil Service (below is a picture of the form)

Attach documentation from Social Security showing:

The Medicare Part B premiums paid for the year

Mail the form and documentation to New York State

Receive reimbursement by check

You Can Go Back Up to Four Years to Reclaim Missed IRMAA Reimbursements

If you’re reading this and realizing you’ve been paying IRMAA for years without reimbursement — there’s good news.

New York State allows retirees to go back up to four years to recoup IRMAA premiums already paid.

On the IRMAA reimbursement form, you can:

Check the boxes for each year you were subject to IRMAA

Submit the required Social Security tax documentation for each year

When approved, New York State will issue reimbursement checks for those prior years.

A Simple Annual Reminder Strategy

For our clients who we know will be subject to IRMAA every year, we recommend a very simple system:

Set a recurring reminder for January or February

When your Social Security tax form arrives showing Medicare premiums paid:

Complete the IRMAA reimbursement form

Attach the documentation

Mail it to New York State

That’s it.

New York State does not advertise this process — which is exactly why many retirees miss out on thousands of dollars they’re entitled to receive.

If you’re a New York State retiree — especially one with higher retirement income — understanding this process can mean thousands of dollars back in your pocket every year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Planning for Healthcare Costs in Retirement: Why Medicare Isn’t Enough

Healthcare often becomes one of the largest and most underestimated retirement expenses. From Medicare premiums to prescription drugs and long-term care, this article from Greenbush Financial Group explains why healthcare planning is critical—and how to prepare before and after age 65.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When most people picture retirement, they imagine travel, hobbies, and more free time—not skyrocketing healthcare bills. Yet, one of the biggest financial surprises retirees face is how much they’ll actually spend on medical expenses.

Many retirees dramatically underestimate their healthcare costs in retirement, even though this is the stage of life when most people access the healthcare system the most. While it’s common to pay off your mortgage leading up to retirement, it’s not uncommon for healthcare costs to replace your mortgage payment in retirement.

In this article, we’ll cover:

Why Medicare isn’t free—and what parts you’ll still need to pay for.

What to consider if you retire before age 65 and don’t yet qualify for Medicare.

The difference between Medicare Advantage and Medicare Supplement plans.

How prescription drug costs can take retirees by surprise.

The reality of long-term care expenses and how to plan for them.

Planning for Healthcare Before Age 65

For those who plan to retire before age 65, healthcare planning becomes significantly more complicated—and expensive. Since Medicare doesn’t begin until age 65, retirees need to bridge the coverage gap between when they stop working and when Medicare starts.

If your former employer offers retiree health coverage, that’s a tremendous benefit. However, it’s critical to understand exactly what that coverage includes:

Does it cover just the employee, or both the employee and their spouse?

What portion of the premium does the employer pay, and how much is the retiree responsible for?

What out-of-pocket costs (deductibles, copays, coinsurance) remain?

If you don’t have retiree health coverage, you’ll need to explore other options:

COBRA coverage through your former employer can extend your workplace insurance for up to 18 months, but it’s often very expensive since you’re paying the full premium plus administrative fees.

ACA marketplace plans (available through your state’s health insurance exchange) may be an alternative, but premiums and deductibles can vary widely depending on your age, income, and coverage level.

In many cases, healthcare costs for retirees under 65 can be substantially higher than both Medicare premiums and the coverage they had while working. This makes it especially important to build early healthcare costs into your retirement budget if you plan to leave the workforce before age 65.

Medicare Is Not Free

At age 65, most retirees become eligible for Medicare, which provides a valuable foundation of healthcare coverage. But it’s a common misconception that Medicare is free—it’s not.

Here’s how it breaks down:

Part A (Hospital Insurance): Usually free if you’ve paid into Social Security for at least 10 years.

Part B (Medical Insurance): Covers doctor visits, outpatient care, and other services—but it has a monthly premium based on your income.

Part D (Prescription Drug Coverage): Also carries a monthly premium that varies by plan and income level.

Example:

Let’s say you and your spouse both enroll in Medicare at 65 and each qualify for the base Part B and Part D premiums.

In 2025, the standard Part B premium is approximately $185 per month per person.

A basic Part D plan might average around $36 per month per person.

Together, that’s about $220 per person, or $440 per month for a couple—just for basic Medicare coverage. And this doesn’t include supplemental or out-of-pocket costs for things Medicare doesn’t cover.

NOTE: Some public sector or state plans even provide Medicare Part B premium reimbursement once you reach 65—a feature that can be extremely valuable in retirement.

Medicare Advantage and Medicare Supplement Plans

While Medicare provides essential coverage, it doesn’t cover everything. Most retirees need to choose between two main options to fill in the gaps:

Medicare Advantage (Part C) plans, offered by private insurers, bundle Parts A, B, and often D into one plan. These plans usually have lower premiums but can come with higher out-of-pocket costs and limited provider networks.

Medicare Supplement (Medigap) plans, which work alongside traditional Medicare, help pay for deductibles, copayments, and coinsurance.

It’s important not to simply choose the lowest-cost plan. A retiree’s prescription needs, frequency of care, and preferred doctors should all factor into the decision. Choosing the cheapest plan could lead to much higher out-of-pocket expenses in the long run if the plan doesn’t align with your actual healthcare needs.

Prescription Drug Costs: A Hidden Retirement Expense

Prescription drug coverage is one of the biggest cost surprises for retirees. Even with Medicare Part D, out-of-pocket expenses can add up quickly depending on the medications you need.

Medicare Part D plans categorize drugs into tiers:

Tier 1: Generic drugs (lowest cost)

Tier 2: Preferred brand-name drugs (moderate cost)

Tier 3: Specialty drugs (highest cost, often with no generic alternatives)

If you’re prescribed specialty or non-generic medications, you could spend hundreds—or even thousands—per month despite having coverage.

To help, some states offer programs to reduce these costs. For example, New York’s EPIC program helps qualifying seniors pay for prescription drugs by supplementing their Medicare Part D coverage. It’s worth checking if your state offers a similar benefit.

Planning for Long-Term Care

One of the most misunderstood aspects of Medicare is long-term care coverage—or rather, the lack of it.

Medicare only covers a limited number of days in a skilled nursing facility following a hospital stay. Beyond that, the costs become the retiree’s responsibility. Considering that long-term care can easily exceed $120,000 per year, this can be a major financial burden.

Planning ahead is essential. Options include:

Purchasing a long-term care insurance policy to offset future costs.

Self-insuring, by setting aside savings or investments for potential care needs.

Planning to qualify for Medicaid through strategic trust planning

Whichever route you choose, addressing long-term care early is key to protecting both your assets and your peace of mind.

Final Thoughts

Healthcare is one of the largest—and most underestimated—expenses in retirement. While Medicare provides a foundation, retirees need to plan for premiums, prescription costs, supplemental coverage, and potential long-term care needs.

If you plan to retire before 65, early planning becomes even more critical to bridge the gap until Medicare begins. By taking the time to understand your options and budget accordingly, you can enter retirement with confidence—knowing that your healthcare needs and your financial future are both protected.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQ)

Why isn’t Medicare enough to cover all healthcare costs in retirement?

While Medicare provides a solid foundation of coverage starting at age 65, it doesn’t pay for everything. Retirees are still responsible for premiums, deductibles, copays, prescription drugs, and long-term care—expenses that can add up significantly over time.

What should I do for healthcare coverage if I retire before age 65?

If you retire before Medicare eligibility, you’ll need to bridge the gap with options like COBRA, ACA marketplace plans, or employer-sponsored retiree coverage. These plans can be costly, so it’s important to factor early healthcare premiums and out-of-pocket expenses into your retirement budget.

What are the key differences between Medicare Advantage and Medicare Supplement plans?

Medicare Advantage (Part C) plans combine Parts A, B, and often D, offering convenience but limited provider networks. Medicare Supplement (Medigap) plans work alongside traditional Medicare to reduce out-of-pocket costs. The right choice depends on your budget, health needs, and preferred doctors.

How much should retirees expect to pay for Medicare premiums?

In 2025, the standard Medicare Part B premium is around $185 per month, while a basic Part D plan averages about $36 monthly. For a married couple, that’s roughly $440 per month for both—before adding supplemental coverage or out-of-pocket expenses. These costs should be built into your retirement spending plan.

Why are prescription drugs such a major expense in retirement?

Even with Medicare Part D, out-of-pocket drug costs can vary widely based on your prescriptions. Specialty and brand-name medications often carry high copays. Programs like New York’s EPIC can help eligible seniors manage these costs by supplementing Medicare coverage.

Does Medicare cover long-term care expenses?

Medicare only covers limited skilled nursing care following a hospital stay and does not pay for most long-term care needs. Since extended care can exceed $120,000 per year, retirees should explore options like long-term care insurance, Medicaid planning, or setting aside savings to self-insure.

How can a financial advisor help plan for healthcare costs in retirement?

A financial advisor can estimate future healthcare expenses, evaluate Medicare and supplemental plan options, and build these costs into your retirement income plan. At Greenbush Financial Group, we help retirees design strategies that balance healthcare needs with long-term financial goals.

Retiring Before 65? How to Bridge the Health Insurance Gap Until Medicare

Retiring before age 65 creates a major challenge: how to pay for health insurance until Medicare begins. Greenbush Financial Group outlines options including ACA exchange subsidies, COBRA, spouse employer plans, and HSAs—plus key planning steps to manage income, reduce costs, and avoid gaps in coverage.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

One of the biggest challenges for individuals planning to retire before age 65 is how to pay for health insurance until Medicare kicks in. Unlike employer coverage, which often subsidizes a large portion of the premium, individual coverage can be expensive—and health care costs are a major factor in determining if early retirement is financially feasible.

In this article, we’ll explore:

Health insurance through the Affordable Care Act (ACA) exchange and how subsidies work

COBRA coverage as a temporary option and how rules vary by state

Coverage through a spouse’s employer and how to coordinate benefits when one spouse retires

Using a Health Savings Account (HSA) to fund health care expenses before Medicare

Why income planning is critical when considering exchange subsidies

How “Navigators” can help retirees select the right plan

The importance of planning ahead before you retire

Exchange Policies: Income-Based Subsidies

The ACA exchange (also known as the marketplace) provides health insurance options that may be more affordable than people realize—thanks to premium tax credits and cost-sharing subsidies.

Here’s the key: Subsidies are based on income, not assets.

This means someone could have $1 million in investment / retirement accounts but report relatively low taxable income and still qualify for significant subsidies. For example, if you live primarily off savings or manage withdrawals from retirement accounts strategically, you may qualify for much lower premiums.

Planning Tip: Since subsidies are income-driven, managing taxable income (through Roth conversions, tax-efficient withdrawals, or capital gains planning) is a crucial part of retirement planning before age 65.

COBRA Coverage

Another option to bridge the gap is COBRA coverage from your former employer. COBRA allows you to continue your existing employer plan, typically for 18 months, but in some cases longer depending on state laws.

The downside? Cost. Under COBRA, you generally pay the full premium plus a 2% administrative fee, which can be much higher than what you were used to as an active employee.

Coverage Through a Spouse’s Employer

If your spouse is still working, you may be able to join their employer-sponsored health plan. This option is often less expensive than COBRA or the exchange, and employers usually subsidize a portion of the premium for dependents.

When one spouse retires, it’s important to notify the employer and coordinate the change in coverage. Many plans allow special enrollment when a spouse loses employer-sponsored insurance, so timing the switch correctly is key.

Using a Health Savings Account (HSA)

If you’ve been contributing to an HSA during your working years, this account can be a valuable bridge for health care costs before Medicare.

HSAs allow you to withdraw funds tax-free for qualified medical expenses, including insurance premiums for COBRA or Medicare.

Unlike Flexible Spending Accounts (FSAs), unused HSA funds carry over year to year, making them an effective tool for pre-retirement savings.

By banking HSA contributions in your working years, you give yourself more flexibility to cover early-retirement health care costs.

The Financial Planning Perspective

Health care is often the largest expense for retirees before Medicare eligibility. When building your retirement income plan, ask:

How much will insurance cost under COBRA, a spouse’s plan, or the exchange?

How much taxable income do you plan to show in early retirement, and will it affect exchange subsidies?

Do you have HSA funds available to offset these costs?

How long will you need coverage before Medicare (just a few years or more than a decade)?

The answers to these questions directly impact whether early retirement is financially realistic.

Exchange Navigators: Help at No Cost

Not everyone feels comfortable navigating the ACA exchange on their own. Fortunately, each state has navigators—trained professionals who help individuals understand their health coverage options and available subsidies.

These navigators are state-funded, so their services come at no additional cost to you. If you’re considering exchange coverage, speaking with a navigator can help ensure you’re getting the right plan and maximizing subsidies.

Planning Ahead Is Critical

One of the biggest mistakes we see is individuals retiring without a plan for health insurance. Waiting too long to assess the various options can lead to gaps in insurance, higher premiums, or missed opportunities for subsidies.

Planning ahead allows you to:

Time your retirement date with coverage options

Estimate premiums under different income scenarios

Decide between COBRA, a spouse’s plan, or the exchange

Maximize tax strategies to reduce costs

Key Takeaways

Retiring before 65 requires a clear plan for health insurance until Medicare.

The ACA exchange offers income-based subsidies, making taxable income planning essential.

COBRA coverage can provide continuity but is usually expensive

If your spouse is still working, joining their plan may be the most cost-effective bridge.

HSAs are a powerful tool to fund health insurance and medical costs pre-Medicare.

Use navigators for guidance on exchange policies and subsidies.

Start planning health coverage well before your retirement date to avoid costly surprises.

Health care is one of the biggest financial considerations for early retirees. By planning ahead, you can bridge the gap to Medicare while keeping costs manageable—and retire with peace of mind.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What are the main health insurance options for early retirees before Medicare?

Common options include coverage through the Affordable Care Act (ACA) exchange, COBRA from a former employer, or joining a spouse’s employer-sponsored plan. Each option varies in cost, duration, and flexibility, depending on your income and household situation.

How do ACA exchange subsidies work for retirees?

Premium subsidies under the ACA are based on taxable income, not total assets. Retirees who manage withdrawals from retirement accounts strategically can often qualify for significant premium reductions, even with substantial savings.

Is COBRA a good option for early retirees?

COBRA allows you to stay on your former employer’s plan for up to 18 months (depending on state law), maintaining the same coverage. However, you must pay the full premium plus a small administrative fee, which can make it one of the more expensive options.

Can I use my spouse’s health insurance if I retire early?

Yes. If your spouse continues to work, you may be eligible to join their employer-sponsored plan. This is often more affordable than COBRA or an ACA plan, especially since many employers subsidize dependent coverage.

How can a Health Savings Account (HSA) help cover pre-Medicare costs?

Funds in an HSA can be withdrawn tax-free for qualified medical expenses, including COBRA and Medicare premiums. Building up HSA savings before retirement can provide a valuable source of tax-efficient funds to cover healthcare costs.

Why is income planning so important for ACA subsidies?

Since exchange subsidies are income-based, managing distributions from taxable retirement accounts, or capital gains planning, can dramatically lower your health insurance premiums in early retirement.

What are ACA “navigators,” and how can they help?

Navigators are trained, state-funded professionals who help individuals compare ACA plans and determine eligibility for subsidies. Their services are free and can simplify selecting the most cost-effective coverage for your situation.

Filing a Medicare Income Appeal Form: What You Need to Know

Paying higher Medicare premiums than you should? If your income has dropped, you may qualify to file Form SSA-44 and appeal your IRMAA surcharge. Our guide explains how Medicare’s income-based premiums work, which life events allow an appeal, and how to lower your Part B and Part D costs.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner®, one question I consistently encounter from retirees is how Medicare premiums relate to income—and what to do if those premiums no longer reflect your current financial reality. If your income has dropped but you're still paying higher Medicare Part B and Part D premiums, you may qualify to file a Medicare income appeal. Here's how to navigate that process.

Medicare Premiums Are Income-Based (IRMAA)

Medicare Part B (covering medical services, outpatient care, durable medical equipment, and more) and Part D (prescription drug coverage) premiums are adjusted based on your Modified Adjusted Gross Income (MAGI) from two years prior. This is known as the Income‑Related Monthly Adjustment Amount (IRMAA).

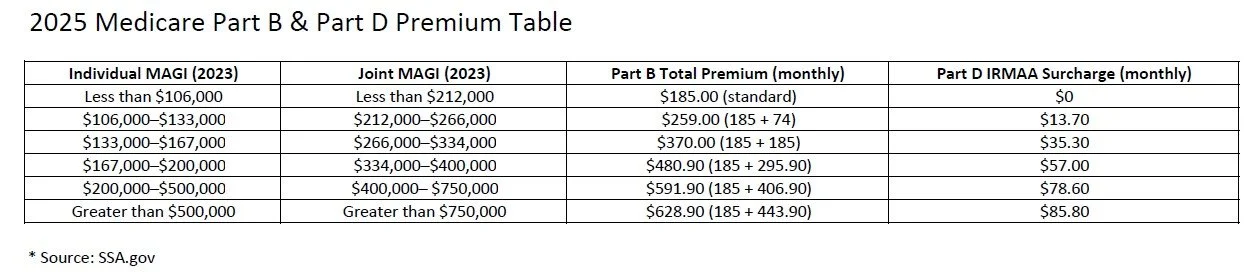

For 2025, premiums are determined using your 2023 MAGI.

Here’s a summarized 2025 IRMAA table for Part B and Part D:

Appealing IRMAA Premiums

If your income has changed significantly due to a qualifying event (and yet Medicare is still charging higher premiums based on your 2023 income), you can appeal using Form SSA‑44, titled “Medicare Income‑Related Monthly Adjustment Amount – Life‑Changing Event.”

The Appeal Form You Must Submit

To initiate the process, you'll complete Form SSA‑44 and submit it to the Social Security Administration (SSA). On the form, you’ll:

Indicate your qualifying life-changing event.

Provide documentation to support your reduced income.

Request recalculation of your Medicare premiums based on your new financial situation.

Qualifying Life-Changing Events

Appeal eligibility hinges on experiencing specific life-changing events, such as:

Retirement (work stoppage or reduction)

Death of a spouse

Divorce or annulment

Loss of income-producing property (beyond your control)

Loss or reduction of pension income

Certain employer settlement payouts

Common Scenarios That Do Not Qualify

Not all income changes are appealable. Examples that typically do not qualify include:

One-time sale of investment / real estate resulting in a capital gain

Large distributions from IRAs

Severance payments

Inheritance distributions

Roth IRA conversions

These changes don’t typically meet SSA’s definition of life-changing events.

The Two-Year Look-Back Period

Remember: Medicare bases IRMAA on your MAGI from two years ago.

2025 premiums rely on your 2023 income

2026 premiums will use your 2024 income, and so forth

How Reimbursement Works After an Approved Appeal

Once your appeal is approved:

SSA will recalculate your premiums based on your current income.

Any excess premiums you've already paid will be reimbursed—typically via direct deposit (if your Social Security benefit is direct-deposited) or a mailed check.

Future premiums will reflect the lower, recalculated amount automatically—so you pay less going forward.

Final Thoughts

This is a proactive process that requires the income appeal form to be submitted; without it, retirees could end up paying thousands of dollars in higher Medicare premiums that could otherwise have been avoided.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is IRMAA, and how does it affect Medicare premiums?

IRMAA stands for Income-Related Monthly Adjustment Amount. It’s an additional charge added to Medicare Part B and Part D premiums for higher-income individuals. The Social Security Administration bases IRMAA on your Modified Adjusted Gross Income (MAGI) from two years prior.

How does income determine Medicare premiums?

Medicare uses your MAGI reported on your tax return from two years ago to set your current premiums. For example, your 2025 premiums are based on your 2023 income. As income rises, IRMAA surcharges are added in tiers to standard Medicare costs.

Can you appeal your Medicare premiums if your income has dropped?

Yes. If your income has fallen due to a life-changing event—such as retirement, marriage, divorce, or the loss of a spouse—you can request a reduction in your IRMAA charges by filing an appeal with the Social Security Administration.

How do you file a Medicare income appeal?

You can submit Form SSA-44, “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event,” along with documentation supporting your income reduction. The SSA reviews your request and may adjust your premiums based on your current financial situation.

What qualifies as a life-changing event for an IRMAA appeal?

Common qualifying events include retirement, loss of employment or income, marriage, divorce, or the death of a spouse. The event must have significantly reduced your income compared to the amount used to calculate your current premiums.

How long does it take for an IRMAA adjustment to take effect?

If your appeal is approved, the adjustment typically applies to future premiums within one to two billing cycles. You may also receive a refund if you’ve already overpaid based on outdated income information.

Why is it important to review your Medicare premiums each year?

Since IRMAA is based on prior-year tax data, your premiums may not always reflect your current income level. Reviewing your Medicare costs annually ensures you’re not overpaying and helps identify whether you qualify for an appeal.

The HSA 6-Month Rule: What Happens When You Enroll in Medicare at Age 65

If you’re approaching age 65 and contributing to a Health Savings Account (HSA), there’s a little-known Medicare rule that could quietly cost you.

Many people know that Health Savings Accounts (HSAs) offer triple tax benefits: tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses. But what’s less commonly understood is the 6-month rule tied to Medicare Part A enrollment—and how it can affect your HSA eligibility.

If you’re turning 65 and planning to sign up for Medicare, this rule could impact when you must stop HSA contributions and potentially trigger a tax penalty if not handled properly.

Let’s walk through what the 6-month rule is, when it applies, and how to avoid costly mistakes.

What Is the HSA 6-Month Rule?

The 6-month rule refers to a Medicare regulation stating that when you apply for Medicare Part A after age 65, your coverage may retroactively begin up to six months prior to your application date—but no earlier than your 65th birthday.

Why does this matter for HSAs?

Because you cannot contribute to an HSA once you are enrolled in any part of Medicare. If your Medicare Part A enrollment is retroactive, and you weren’t aware, you could accidentally contribute to your HSA while you were technically ineligible—and face a tax penalty.

When Does the 6-Month Rule Apply?

This rule only comes into play if:

You are 65 or older, and

You delay enrolling in Medicare Part A, and

You later apply for Medicare Part A (for example, when retiring at 67 or 68)

At that point, the Social Security Administration may retroactively activate your Part A coverage up to 6 months prior to your application date.

Important: If you enroll in Medicare at age 65 or earlier, this rule does not apply. Your Part A coverage starts based on your enrollment date.

Timeline Example

Turns 65: July 2023

Continues working and delays Medicare

Applies for Medicare: October 2025 (at age 67)

Medicare Part A effective date: April 1, 2025

Last eligible month to contribute to an HSA: March 2025

Why You Must Stop HSA Contributions Before Medicare Coverage Starts

HSA rules state that:

You must stop making contributions to your HSA the month before your Medicare coverage begins.

Medicare coverage always begins on the first day of the month—so plan your final HSA contribution accordingly.

If you accidentally contribute while enrolled in Medicare—even retroactively—you may owe a 6% excise tax on those excess contributions.

How to Plan Around the 6-Month Rule

To avoid penalties and protect your tax savings:

1. Stop HSA Contributions at Least 6 Months Before Applying for Medicare

If you plan to delay Medicare past age 65, stop HSA contributions at least 6 months before you submit your Medicare application. This helps avoid retroactive coverage overlapping with HSA eligibility.

2. Calculate and Remove Excess Contributions Promptly

If you do contribute after your Medicare Part A effective date, you must remove the excess to avoid penalties.

How to calculate excess: Total the amount contributed after your Medicare coverage began. This includes both your own and any employer contributions during that ineligible period.

Penalty timeline: You must remove the excess contributions (plus any earnings) by your tax filing deadline—typically April 15 of the following year—to avoid the 6% excise tax.

If you miss that deadline, the 6% penalty applies for each year the excess amount remains in the account.

3. Use a Mid-Year Retirement Strategy

If retiring mid-year, prorate your annual HSA contribution based on the number of months you were eligible. Contributions made after Medicare enrollment—even by your employer—count toward your annual limit and must be removed if you were ineligible.

Final Thought:

The HSA 6-month rule is easy to overlook—but understanding how it works can help you avoid costly mistakes as you transition to Medicare. Whether you’re retiring soon or planning ahead, coordinating your HSA contributions with Medicare enrollment is an essential part of a tax-efficient retirement strategy.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the HSA 6-month rule?

The HSA 6-month rule refers to a Medicare regulation stating that when you apply for Medicare Part A after age 65, your coverage can be retroactive for up to six months—but no earlier than your 65th birthday. Since you cannot contribute to a Health Savings Account (HSA) while enrolled in any part of Medicare, this retroactive coverage can make you ineligible to contribute for that six-month period.

Why does the 6-month rule matter for HSA contributions?

Because Medicare Part A coverage may be applied retroactively, you could unknowingly contribute to your HSA during months when you were technically covered by Medicare. Those contributions would be considered “excess contributions” and subject to a 6% excise tax if not corrected.

When does the 6-month rule apply?

The rule applies only if you delay enrolling in Medicare Part A beyond age 65 and later apply. At that point, the Social Security Administration may backdate your Medicare Part A coverage up to six months. If you enroll at or before age 65, the rule does not apply.

How does retroactive Medicare coverage affect my HSA?

Once your Medicare Part A coverage begins—whether retroactively or not—you lose HSA eligibility from that start date. You must stop making contributions the month before your Medicare coverage begins to avoid excess contributions.

Can you give an example of the 6-month rule?

Yes. Suppose you turn 65 in July 2023 and continue working with an HSA-eligible plan. You apply for Medicare in October 2025 (at age 67). Your Medicare Part A effective date will be April 1, 2025—six months retroactive. Therefore, your last eligible HSA contribution month is March 2025.

When should I stop contributing to my HSA?

You should stop contributing at least six months before applying for Medicare Part A to ensure your contributions don’t overlap with retroactive coverage. This applies to both your own and any employer contributions.

What happens if I accidentally contribute while covered by Medicare?

Any contributions made after your Medicare Part A effective date are considered excess. You must withdraw those excess contributions (plus earnings) by your tax filing deadline—typically April 15 of the following year—to avoid a 6% penalty.

How do I calculate my excess contributions?

Add up all contributions (including employer contributions) made after your Medicare Part A effective date. That total must be withdrawn from your HSA. If not removed by your tax deadline, a 6% penalty applies each year the excess remains.

How should I handle HSA contributions if I retire mid-year?

If you retire partway through the year, prorate your HSA contribution limit based on the number of months you were eligible before Medicare enrollment. Contributions made after that date—even by your employer—count toward your annual limit and may need to be withdrawn.

What’s the best way to avoid penalties from the 6-month rule?

Plan ahead. Stop HSA contributions at least six months before applying for Medicare, coordinate with your HR or benefits department, and track contributions closely to prevent ineligible deposits.

Self-employed Individuals Are Allowed To Take A Tax Deduction For Their Medicare Premiums

If you are age 65 or older and self-employed, I have great news, you may be able to take a tax deduction for your Medicare Part A, B, C, and D premiums as well as the premiums that you pay for your Medicare Advantage or Medicare Supplemental coverage.

Self-employed Individuals Are Allowed To Take A Tax Deduction For Their Medicare Premiums

If you are age 65 or older and self-employed, I have great news, you may be able to take a tax deduction for your Medicare Part A, B, C, and D premiums as well as the premiums that you pay for your Medicare Advantage or Medicare Supplemental coverage. This is a huge tax benefit for business owners age 65 and older because most individuals without businesses are not able to deduct their Medicare premiums, so they have to be paid with after-tax dollars.

Individuals Without Businesses

If you do not own a business, you are age 65 or older, and on Medicare, you are only allowed to deduct “medical expenses” that exceed 7.5% of your adjusted gross income (AGI) for that tax year. Medical expenses can include Medicare premiums, deductibles, copays, coinsurance, and other noncovered services that you have to pay out of pocket. For example, if your AGI is $80,000, your total medical expenses would have to be over $6,000 ($80,000 x 7.5%) for the year before you would be eligible to start taking a tax deduction for those expenses.

But it gets worse, medical expenses are an itemized deduction which means you must forgo the standard deduction to claim a tax deduction for those expenses. For 2022, the standard deduction is $12,950 for single filers and $25,900 for married filing joint. Let’s look at another example, you are a married filer, $70,000 in AGI, and your Medicare premiums plus other medical expenses total $12,000 for the year since the 7.5% threshold is $5,250 ($70,000 x 7.5%), you would be eligible to deduct the additional $6,750 ($12,000 - $5,250) in medical expenses if you itemize. However, you would need another $13,600 in tax deductions just to get you up to the standard deduction limit of $25,900 before it would even make sense to itemize.

Self-Employed Medicare Tax Deduction

Self-employed individuals do not have that 7.5% of AGI threshold, they are able to deduct the Medicare premiums against the income generated by the business. A special note in that sentence, “against the income generated by the business”, in other words, the business has to generate a profit in order to take a deduction for the Medicare premiums, so you can’t just create a business, that has no income, for the sole purpose of taking a tax deduction for your Medicare premiums. Also, the IRS does not allow you to use the Medicare expenses to generate a loss.

For business owners, it gets even better, not only can the business owner deduct the Medicare premiums for themselves but they can also deduct the Medicare premiums for their spouse. The standard Medicare Part B premium for 2022 is $170.10 per month for EACH spouse, now let’s assume that they both also have a Medigap policy that costs $200 per month EACH, here’s how the annual deduction would work:

Business Owner Medicare Part B: $2,040 ($170 x 12 months)

Business Owner Medigap Policy: $2,400

Spouse Medicare Part B: $2,040

Spouse Medigap Policy: $2,400

Total Premiums: $8,880

If the business produces $10,000 in net profit for the year, they would be able to deduct the $8,880 against the business income, which allows the business owner to pay the Medicare premiums with pre-tax dollars. No 7.5% AGI threshold to hurdle. The full amount is deductible from dollar one and the business owner could still elect the standard deduction on their personal tax return.

The Tax Deduction Is Limited Only To Medicare Premiums

When we compare the “medical expense” deduction for individual taxpayers that carries the 7.5% AGI threshold and the deduction that business owners can take for Medicare premiums, it’s important to understand that for business owners the deduction only applies to Medicare premiums NOT their total “medical expenses” for the year which include co-pays, coinsurance, and other out of pocket costs. If a business owner has large medical expenses outside of the Medicare premiums that they deducted against the business income, they would still be eligible to itemize on their personal tax return, but the 7.5% AGI threshold for those deductions comes back into play.

What Type of Self-Employed Entities Qualify?

To be eligible to deduct the Medicare premiums as an expense against your business income your business could be set up as a sole proprietor, independent contractor, partnership, LLC, or an S-corp shareholder with at least 2% of the common stock.

The Medicare Premium Deduction Lowers Your AGI

The tax deduction for Medicare Premiums for self-employed individuals is considered an “above the line” deduction, which lowers their AGI, an added benefit that could make that taxpayer eligible for other tax credits and deductions that are income based. If your company is an S-corp, the S-corp can either pay your Medicare Premiums on your behalf as a business expense or the S-corp can reimburse you for the premiums that you paid, report those amounts on your W2, and you can then deduct it on Schedule 1 of your 1040.

Employer-Subsidized Health Plan Limitation

One limitation to be aware of, is if either the business owner or their spouse is eligible to enroll in an employer-subsidized health plan through their employer, you are no longer allowed to deduct the Medicare Premiums against your business income. For example, if you and your spouse are both age 66, and you are self-employed, but your spouse has a W2 job that offers health benefits to cover both them and their spouse, you would not be eligible to deduct the Medicare Premiums against your business income. This is true even if you voluntarily decline the coverage. If you or your spouse is eligible to participate, you cannot take a deduction for their Medicare premiums.

I receive the question, “What if they are only employed for part of the year with health coverage available?” For the month that they were eligible for employer-subsidized health plan, a deduction would not be able to be taken during those months for the Medicare premiums.

On the flip side, if the health plan through their employer is considered “credible coverage” by Medicare, you may not have to worry about Medicare premiums anyways.

Multiple Businesses

If you have multiple businesses, you will have to select a single business to be the “sponsor” of your health plan for the purpose of deducting your Medicare premiums. It’s usually wise to select the business that produces a consistent net profit because net profits are required to deduct all or a portion of the Medicare premium expense.

Forms for Tax Reporting

You will have to keep accurate records to claim this deduction. If you collect Social Security, the Medicare premiums are deducted directly from the social security benefit, but they issue you a SSA-1099 Form at the end of the year which summarized the Medicare Premiums that you paid for Part A and Part B.

If you have a Medigap Policy (Supplemental) with a Part D plan or a Medicare Advantage Plan, you normally make premium payments directly to the insurance company that you have selected to sponsor your plan. You will have to keep records of those premium payments.

No Deduction For Self-Employment Taxes

As a self-employed individual, the Medicare premiums are eligible for a federal, state, and local tax deduction but they do not impact your self-employment taxes which are the taxes that you pay to fund Medicare and Social Security.

Amending Your Tax Returns

If you have been self-employed for a few years, paying Medicare premiums, and are just finding out now about this tax deduction, the IRS allows you to amend your tax returns up to three years from the filing date. But again, the business had to produce a profit during those tax years to be eligible to take the deduction for those Medicare premiums.

DISCLOSURE: This information is for educational purposes only. For tax advice, please consult a tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Can self-employed individuals deduct their Medicare premiums?

Yes. Self-employed individuals age 65 and older can deduct Medicare Part A, B, C, and D premiums, as well as premiums for Medicare Advantage and Medigap policies, against their business income. This deduction allows them to pay Medicare premiums with pre-tax dollars rather than after-tax dollars.

How is the Medicare premium deduction different for individuals who are not self-employed?

Individuals who are not self-employed may only deduct medical expenses, including Medicare premiums, that exceed 7.5% of their adjusted gross income (AGI). These deductions must also be itemized, meaning taxpayers must forgo the standard deduction to claim them.

What requirements must be met to take the self-employed Medicare deduction?

The business must generate a net profit for the year, and the deduction cannot create or increase a business loss. The deduction is only available for the taxpayer and their spouse if neither is eligible for an employer-subsidized health plan.

Which types of business entities qualify for the Medicare premium deduction?

Eligible entities include sole proprietorships, independent contractors, partnerships, LLCs taxed as partnerships, and S corporation shareholders owning at least 2% of company stock. C corporations are not eligible for this specific deduction.

Does the Medicare premium deduction reduce adjusted gross income (AGI)?

Yes. The deduction is considered “above the line,” meaning it lowers AGI directly. This can help taxpayers qualify for other income-based credits or deductions.

What happens if a business owner or spouse has access to employer health coverage?

If either spouse is eligible for an employer-subsidized health plan, the Medicare premiums cannot be deducted against business income for those months. This rule applies even if the employer coverage is declined.

Can self-employed individuals amend past tax returns to claim this deduction?

Yes. The IRS allows taxpayers to amend returns for up to three years from the original filing date to claim missed Medicare premium deductions, provided the business generated a profit during those tax years.

Medicare Is Projected To Be Insolvent In 2028

The trustees of the Medicare program just released their 2022 annual report and it came with some really bad news. The Medicare Part A Hospital Insurance (HI) Trust is expected to be insolvent in 2028 which currently provides health benefits to over 63 million Americans. We have been kicking the can down the road for the past 40 years and we have finally run out of road.

The trustees of the Medicare program just released their 2022 annual report and it came with some really bad news. The Medicare Part A Hospital Insurance (HI) Trust is expected to be insolvent in 2028 which currently provides health benefits to over 63 million Americans. The U.S. has been kicking the can down the road for the past 40 years and we have finally run out of road. In this article I will be covering:

What benefits Medicare Part A provides that are at risk

The difference between the Medicare HI Trust & Medicare SMI Trust

If Medicare does become insolvent in 2028, what happens?

Changes that Congress could make to prevent insolvency

Actions that retirees can take to manage the risk of a Medicare insolvency

Medicare HI Trust vs. Medicare SMI Trust

The Medicare program provides health insurance benefits to U.S. citizens once they have reached age 65, or if they become disabled. Medicare is made up of a few parts: Part A, Part B, Part C, and Part D.

Part A covers services such as hospitalization, hospice care, skilled nursing facilities, and some home health service. Medicare is made up of two trusts, the Hospital Insurance (HI) Trust and the Supplemental Medical Insurance (SMI) Trust. The HI Trust supports the Medicare Part A benefits and that is the trust that is in jeopardy of becoming insolvent in 2028. This trust is funded primarily through the 2.9% payroll tax that is split between employees and employers.

Medicare Part B, C, and D cover the following:

Part B: Physician visits, outpatient services, and preventative services

Part C: Medicare Advantage Programs

Part D: Prescription drug coverage

Part B and Part D are funded through a combination of general tax revenues and premiums paid by U.S. citizens that are deducted from their social security benefits. Most of the funding though comes from the tax revenue portion, in 2021, about 73% of Part B and 74% of Part D were funded through income taxes (CNBC). Even though they are supported by the SMI Trust, it would be very difficult for these sections of Medicare to go insolvent because they can always raise the premiums charged to retirees, which they did in 2022 by 14%, or increase taxes.

Part C is Medicare Advantage plans which are partially supported by both the HI and SMI Trust, and depending on the plan selected, premiums from the policyholder.

What Happens If Medicare Part A Becomes Insolvent in 2028?

The trustees of the Medicare trusts issue a report every year providing the public the funding status of the HI and SMI trusts. Based on the 2022 report, if no changes are made, there would not be enough money in the HI trust that supports all of the Part A health benefits to U.S. citizen. The system does not completely implode but there would only be enough money in the trust to pay about 90% of the promised benefits starting in 2029.

This mean that Medicare would not have the funds needed to fully pay hospitals and skilled nursing facilities for the services covered by Medicare. It could force these hospital and healthcare providers to accept a lower reimbursement from the service provider or it could delay when the reimbursement payments are received. In response, hospitals may have to cut cost, layoff workers, stop providing certain services, and certain practices may choose not to accept patients with Medicare coverage, limiting access to certain doctors.

Possible Solutions To Avoid Medicare Insolvency

The natural question is: If this is expected to happen in 2028, shouldn’t they make changes now to prevent the insolvency from taking place 6 years from now?” The definitely should but Medicare is a political football. When you have a government program that is at risk of going insolvent, there are really only three solutions:

Raise taxes

Cut Benefits

Restructure the Medicare Program

As a politician, whatever weapon you choose to combat the issue, you are going to tick off a large portion of the voting population which is why there probably have been no changes even though the warning bells has been ringing for years. The reality is that the longer they wait to implement changes, the larger, and more painful those changes need to be.

Some relatively small changes could go a long way if they act now. It’s estimated that if Congress raises the payroll tax that funds the HI Trust from 2.9% to 3.6% that would bump out the insolvency date of the HI Trust by about 75 years. If you go to the spending side, it’s estimated that if Part A were to cut its annual expenses by about 15% per year starting in 2022, it would have a similar positive impact (Source: Senate RPC).

Another possible fix, they could restructure the Medicare system, and move some of the Part A services to Part B. But this is not a great solution because even though it helps the Part A Trust insolvency issue, it pushes more of the cost to Part B which is funded be general tax revenues and premiums charged to retirees.

A third solution, Medicare could more aggressively negotiate the reimbursement rates paid to healthcare providers but that would of course have the adverse effect of putting revenue pressure on the hospitals and potentially jeopardize the quality of care provided.

The fourth, and in my opinion, the most likely outcome, no changes will be made between now and 2028, we will be on the doorstep of insolvency, and then Congress will pass legislation for an emergency bailout out package for the Medicare Part A HI Trust. This may buy them more time but it doesn’t solve the problem, and it will add a sizable amount to debt to the U.S. deficit.

What Should Retirees Do To Prepare For This?

Even though the government may try to issue more debt to bailout the Medicare Part A trust, as a retiree, you have to ask yourself the question, what if by the time we reach 2028, the U.S. can’t finance the amount a debt needed to stave off the insolvency? The Medicare Part A HI Trust is not the only government program facing insolvency over the next 15 years. One of the PBGC trusts that provides pension payments to workers that were once covered by a bankrupt pension plan is expected to be insolvent within the next 10 years. Social Security is expected to be insolvent in 2035 (2022 Trustees Report).

The solution may be to build a large expense cushion within your annual retirement budget so if the cost for your healthcare increases substantially in future years, you will already have a plan to handle those large expenses. This may mean paying down debt, not taking on new debt, cutting back on expenses, taking on some part-time income to build a large nest egg, or some combination of these planning strategies.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the Medicare Part A Hospital Insurance (HI) Trust and why is it at risk?

The Medicare Part A HI Trust funds hospital-related services such as inpatient care, hospice, and skilled nursing facilities. It is primarily funded through payroll taxes, but rising healthcare costs and an aging population are depleting the trust faster than it’s being replenished, putting it on track for insolvency by 2028.

What’s the difference between the Medicare HI Trust and the SMI Trust?

The HI Trust supports Medicare Part A, which covers hospital and inpatient services, while the Supplemental Medical Insurance (SMI) Trust funds Part B (doctor visits and outpatient care) and Part D (prescription drug coverage). The SMI Trust is less vulnerable to insolvency because it is financed by general tax revenues and premiums that can be adjusted as needed.

What happens if the Medicare Part A trust becomes insolvent?

If no changes are made, the HI Trust will only have enough funds to pay about 90% of promised Part A benefits beginning in 2029. Hospitals and healthcare providers could face lower reimbursements or payment delays, which might reduce access to certain services for retirees.

What options does Congress have to prevent Medicare insolvency?

Lawmakers could raise payroll taxes, cut benefits, or restructure the program. For example, increasing the Medicare payroll tax rate from 2.9% to 3.6% could extend the HI Trust’s solvency by decades. Delaying reforms, however, would require more drastic and painful adjustments later.

Could Medicare be bailed out if insolvency occurs?

A short-term bailout is possible, as Congress could allocate emergency funding to keep the HI Trust solvent temporarily. However, this would increase the national debt and delay rather than solve the underlying structural funding problem.

How can retirees prepare for potential Medicare funding issues?

Retirees can build financial resilience by paying down debt, reducing expenses, and saving more to cover potential increases in out-of-pocket healthcare costs. Establishing an emergency savings buffer or maintaining part-time income may also help offset rising healthcare expenses if Medicare benefits are reduced.

When To Enroll In Medicare

Medicare has important deadlines that you need to be aware of during your initial enrollment period. Missing those deadlines could mean gaps in coverage, penalties, and limited options when it comes to selecting a Medicare

Medicare has important deadlines that you need to be aware of during your initial enrollment period. Missing those deadlines could mean gaps in coverage, penalties, and limited options when it comes to selecting a Medicare Supplemental Plan.

Many people are aware of the age 65 start date for Medicare, however, it’s not uncommon for individuals to work past age 65 and have health insurance coverage through their employer or through their spouse’s employer. For many of these individuals working past age 65, they are often surprised to find out that even though they are still covered by an employer sponsored health plan, depending on the size of the employer, and the insurance carrier, they may still be required to enroll in Medicare at age 65.

In this article we will cover:

Enrollment deadlines for Medicare

When to start the enrollment process

Effective dates of coverage

Special rules for individuals working past age 65

Medicare vs. employer health coverage

Initial Enrollment Period

For many individuals, when they turn age 65, they are required to enroll in Medicare Part A and Part B which becomes their primary health insurance provider. The Medicare initial enrollment period lasts for seven months. This period begins 3 months prior to the month of your 65th birthday and ends 3 months after that month.

Example: If you turn age 65 on June 10th, your initial enrollment period begins on March 1 and ends on September 30.

Retired and Collecting Social Security

If you are retired and you are already receiving Social Security benefits prior to your 65th birthday, no action is needed to enroll in Medicare Part A & B. Your Medicare card should arrive in the mail one or two months prior to your 65th birthday.

However, even though you are automatically enrolled in Medicare Part A and Part B, if you are not covered by a retiree health plan through your former employer, you should begin the process of enrolling in either a Medicare Supplemental Plan or Medicare Advantage Plan at least two months prior to your 65th birthday. Medicare Part A and Part B by itself, does not cover all of your health costs which is why most retirees obtain a Supplemental Plan. If you wait until your 65th birthday, the effective date of that Supplemental coverage may not begin until the following month which creates a gap in coverage.

As soon as you receive your Medicare card, you can enroll in a Medicare Supplemental Plan or Medicare Advantage Plan to ensure that both your Medicare coverage and Supplemental Coverage will begin as soon as your employer health coverage ends.

Retired But Not Collecting Social Security Yet

If you are retired, about to turn age 65, but you have not turned on your Social Security benefits yet, action is required. Medicare is not going to proactively notify you that you need to enroll in Medicare Part A & B. The responsibility of enrolling at the right time within your initial enrollment period falls 100% on you.

Three months prior to your 65th birthday you can either enroll in Medicare online or schedule an appointment to enroll in Medicare at your local Social Security office.

Note: If you plan to enroll in Medicare via an in-person meeting at the Social Security office, it is strongly recommended that you call your local Social Security office two months prior to the beginning of your initial enrollment period because they may require you to make an appointment.

If you decide to enroll online, it’s a fairly easy process, and it should only take you 10 to 15 minutes. Here is the link to enroll online: https://www.ssa.gov/benefits/medicare/

If you are simultaneously applying for Medicare and Social Security to begin at age 65, there is a separate link where you can enroll in both online: https://www.ssa.gov/retire

Working Past Age 65

If you or your spouse plan to work past age 65 and will be covered by an employer sponsored health plan, you may or may not need to enroll in Medicare at age 65. Unfortunately, many people assume that because they are covered by a company health plan, they don’t have to do anything with Medicare until they officially retire. That assumption can lead to problems for many people when they go to enroll in Medicare after age 65.

The following factors need to be taken into consideration if you have employer sponsored health coverage past age 65:

How many employees work for the company

The insurance company providing the health benefit

Does the plan qualify as “credible coverage” in the eyes of Medicare

The terms of your company’s plan

At Age 64: TAKE ACTION

I’m going to review each of the variables listed above but before I do, I want to make a blanket recommendation. If you plan to work past age 65 and will be covered by your employer’s health insurance plan, right after your 64th birthday, go talk to the person at your company that handles the health insurance benefit and ask them how the company’s health plan coordinates with Medicare. Do not wait until a week before you turn 65 to ask questions. If you or your spouse are required to enroll in Medicare, the process takes time.

19 or Fewer Employees

Medicare has a general rule of thumb that if a company has 19 or fewer employees, at age 65, employees have to enroll in Medicare Part A and B. Medicare becomes your primary insurance coverage and the employer’s health plan becomes your secondary insurance coverage. Your open enrollment period is the same as if you were turning age 65 with no employer health coverage.

20 or More Employees

If your company has 20 or more employees and the health insurance plan is considered “credible coverage” in the eyes on Medicare, there may be no action needed at age 65. As mentioned above, you should go to your human resource representative at your company, after your 64th birthday, to verify that the health plan that they have is considered “credible coverage” for Medicare. If it is, then there is no need to sign up for Medicare at age 65, your employer health coverage will continue to serve as your primary coverage until you retire.

However, if your company’s health plan does not qualify as “creditable coverage” then you will have to enroll in Medicare Part A & B at age 65 to avoid having to pay a penalty and avoid gaps in coverage once you officially retire.

Action: 90 Days Before You Retire

If you work past age 65 and have credible employer health coverage, 90 days before you plan to retire, you will need to take action regarding your Medicare benefits. This will ensure that your Medicare Part A & B coverage as well as your Medicare Supplemental coverage will begin immediately after your employer health insurance coverage ends.

When you retire after age 65, Medicare provides you with a “Special Enrollment Period”. You have 8 months to enroll in Medicare Part A & B without a late penalty:

63 Day Enrollment Window: Medicare Supplemental, Advantage, & Part D Plans

Even though the Special Enrollment Period lasts for 8 months, you only have 63 days after your employer coverage ends to enroll in a Medicare Supplemental, Medicare Advantage Plan (Part C), or a Medicare Part D Prescription Drug Plan. But remember, you are not eligible to enroll in those plans until after you have already enrolled in Medicare Part A & B which is why you need to start the process 90 days in advance of your actual retirement date to make sure you meet the deadlines.

COBRA Coverage Does Not Count

Some individuals voluntarily elect COBRA coverage after they retire to extend the employer based health coverage. But be aware, COBRA coverage does not count as credible insurance coverage in the eyes of Medicare regardless of the plan that you are covered by. If you do not enroll in Medicare within the eight months after leaving employment, you may face gaps in coverage and permanent Medicare penalties once your COBRA coverage ends.

Spousal Coverage After Age 65

You have to be very careful if you plan to be covered by your spouse’s employer sponsored health insurance past age 65. Some plans with 20 or more employees will serve as primary insurance provider for the employee but not their spouse. In these plans, the non-working spouse is required to enroll in Medicare at age 65.

We have even seen plans where the health insurance for the non-working spouse ends on the first day of the calendar year that they are scheduled to turn age 65. This creates a whole other issue because there is a gap in coverage between January 1st and when the non-working spouse turns age 65. Again, as soon as you or your spouse turn age 64, you should start asking questions about your health coverage.

The Insurance Company Matters

There are a few insurance companies that voluntarily deviate from the 19 or less employees rule listed above. These insurance companies serve as the primary insurance coverage for employee that work past age 65 regardless of the size of the company. Medicare does not fight it because the government is more than happy to allow an insurance company to foot the bill for your health coverage. In these cases, even if your company employs less than 20 employees, you do not have to take any action with regard to Medicare at age 65.

You Cannot Enroll Online

If you work past age 65 and have employer based health coverage, you do not have the option to enroll in Medicare online. You have to prove to Medicare that you have maintained credible health insurance coverage through your employer since age 65, otherwise you face penalties and potential gaps in coverage. You will need to make an appointment at your local Social Security office to enroll. Your employer or the health insurance company will provide you with a letter which serves as your proof of insurance coverage.

Enrolling in Medicare Supplemental or Medicare Advantage Plans

Once enrolled in Medicare Part A and part B, individuals that do not have retiree health benefits, will enroll in either a Medicare Advantage Plan or Medicare Supplemental Plan. You have to be enrolled in Medicare Part A & B, before you can enroll in a Supplemental or Advantage Plan.

It’s extremely important to understand the differences between a Medicare Supplemental Plan and Medicare Advantage Plan which is why we dedicated an entire article to this topic:

Article: Medicare Supplemental Plan vs. Medicare Advantage Plan

Retiree Health Benefits Through Your Former Employer

For employees that have retiree health coverage, you still need to enroll in Medicare Part A & B which serves as the primary insurance coverage and the retiree health coverage serves as your secondary insurance coverage.

Some larger employers even give employees access to multiple retiree health plans. You have to do your homework because some of those plans are structured as Supplemental Plans while others are structured as Advantage Plans.

Medicare vs Employer Health Coverage

Once you turn age 65, if you plan to continue to work, and have access to an employer based health plan, you still need to evaluate your options. A lot of companies have high deductible plans where the employee is required to pay a lot of money out of pocket before the insurance coverage begins. In general, Medicare Part A & B, paired with a Supplemental Plan, can offer very comprehensive coverage at a reasonable cost to individuals 65 and old. You have to compare how much you are paying in your employer health plan and the benefits, versus if you decided to voluntarily enroll in Medicare and obtain a Supplemental policy.

The results vary on a case by case basis and each person’s health needs are different but it’s worth running a comparison. In some cases, it can save both the employer and the employee money while providing the employee with a higher level of health insurance coverage.

Contact Us For Help

If you have any questions about anything Medicare related, please feel free to contact us at 518-477-6686. We are independent Medicare brokers and we can make the Medicare enrollment process easy, help you select the right Medicare Supplemental or Advantage Plan, and provide you with ongoing support with your Medicare benefits in retirement.

Other Medicare Articles

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.