Filing a Medicare Income Appeal Form: What You Need to Know

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner®, one question I consistently encounter from retirees is how Medicare premiums relate to income—and what to do if those premiums no longer reflect your current financial reality. If your income has dropped but you're still paying higher Medicare Part B and Part D premiums, you may qualify to file a Medicare income appeal. Here's how to navigate that process.

Medicare Premiums Are Income-Based (IRMAA)

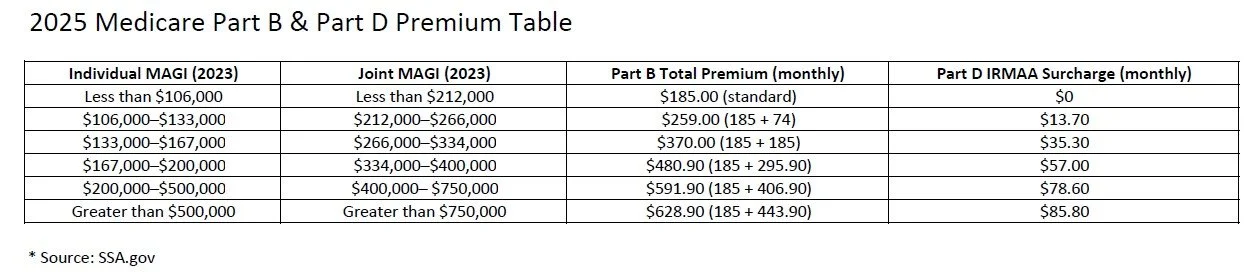

Medicare Part B (covering medical services, outpatient care, durable medical equipment, and more) and Part D (prescription drug coverage) premiums are adjusted based on your Modified Adjusted Gross Income (MAGI) from two years prior. This is known as the Income‑Related Monthly Adjustment Amount (IRMAA).

For 2025, premiums are determined using your 2023 MAGI.

Here’s a summarized 2025 IRMAA table for Part B and Part D:

Appealing IRMAA Premiums

If your income has changed significantly due to a qualifying event (and yet Medicare is still charging higher premiums based on your 2023 income), you can appeal using Form SSA‑44, titled “Medicare Income‑Related Monthly Adjustment Amount – Life‑Changing Event.”

The Appeal Form You Must Submit

To initiate the process, you'll complete Form SSA‑44 and submit it to the Social Security Administration (SSA). On the form, you’ll:

Indicate your qualifying life-changing event.

Provide documentation to support your reduced income.

Request recalculation of your Medicare premiums based on your new financial situation.

Qualifying Life-Changing Events

Appeal eligibility hinges on experiencing specific life-changing events, such as:

Retirement (work stoppage or reduction)

Death of a spouse

Divorce or annulment

Loss of income-producing property (beyond your control)

Loss or reduction of pension income

Certain employer settlement payouts

Common Scenarios That Do Not Qualify

Not all income changes are appealable. Examples that typically do not qualify include:

One-time sale of investment / real estate resulting in a capital gain

Large distributions from IRAs

Severance payments

Inheritance distributions

Roth IRA conversions

These changes don’t typically meet SSA’s definition of life-changing events.

The Two-Year Look-Back Period

Remember: Medicare bases IRMAA on your MAGI from two years ago.

2025 premiums rely on your 2023 income

2026 premiums will use your 2024 income, and so forth

How Reimbursement Works After an Approved Appeal

Once your appeal is approved:

SSA will recalculate your premiums based on your current income.

Any excess premiums you've already paid will be reimbursed—typically via direct deposit (if your Social Security benefit is direct-deposited) or a mailed check.

Future premiums will reflect the lower, recalculated amount automatically—so you pay less going forward.

Final Thoughts

This is a proactive process that requires the income appeal form to be submitted; without it, retirees could end up paying thousands of dollars in higher Medicare premiums that could otherwise have been avoided.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is IRMAA, and how does it affect Medicare premiums?

IRMAA stands for Income-Related Monthly Adjustment Amount. It’s an additional charge added to Medicare Part B and Part D premiums for higher-income individuals. The Social Security Administration bases IRMAA on your Modified Adjusted Gross Income (MAGI) from two years prior.

How does income determine Medicare premiums?

Medicare uses your MAGI reported on your tax return from two years ago to set your current premiums. For example, your 2025 premiums are based on your 2023 income. As income rises, IRMAA surcharges are added in tiers to standard Medicare costs.

Can you appeal your Medicare premiums if your income has dropped?

Yes. If your income has fallen due to a life-changing event—such as retirement, marriage, divorce, or the loss of a spouse—you can request a reduction in your IRMAA charges by filing an appeal with the Social Security Administration.

How do you file a Medicare income appeal?

You can submit Form SSA-44, “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event,” along with documentation supporting your income reduction. The SSA reviews your request and may adjust your premiums based on your current financial situation.

What qualifies as a life-changing event for an IRMAA appeal?

Common qualifying events include retirement, loss of employment or income, marriage, divorce, or the death of a spouse. The event must have significantly reduced your income compared to the amount used to calculate your current premiums.

How long does it take for an IRMAA adjustment to take effect?

If your appeal is approved, the adjustment typically applies to future premiums within one to two billing cycles. You may also receive a refund if you’ve already overpaid based on outdated income information.

Why is it important to review your Medicare premiums each year?

Since IRMAA is based on prior-year tax data, your premiums may not always reflect your current income level. Reviewing your Medicare costs annually ensures you’re not overpaying and helps identify whether you qualify for an appeal.