How to Correct Missed Required Minimum Distributions (RMDs)

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Missing a Required Minimum Distribution (RMD) can cause a lot of stress, especially when you hear the words IRS excise tax. Fortunately, the rules around missed RMDs were updated under the SECURE Act 2.0, which provides some relief compared to the old law. In this article, we’ll break down:

What happens if you miss an RMD and how to correct it

The updated excise tax penalties under SECURE Act 2.0

The “first year” April 1st rule and why you may need to take two RMDs in one year

The new IRS guidance for beneficiaries who inherit retirement accounts

What tax forms need to be filed if you miss an RMD

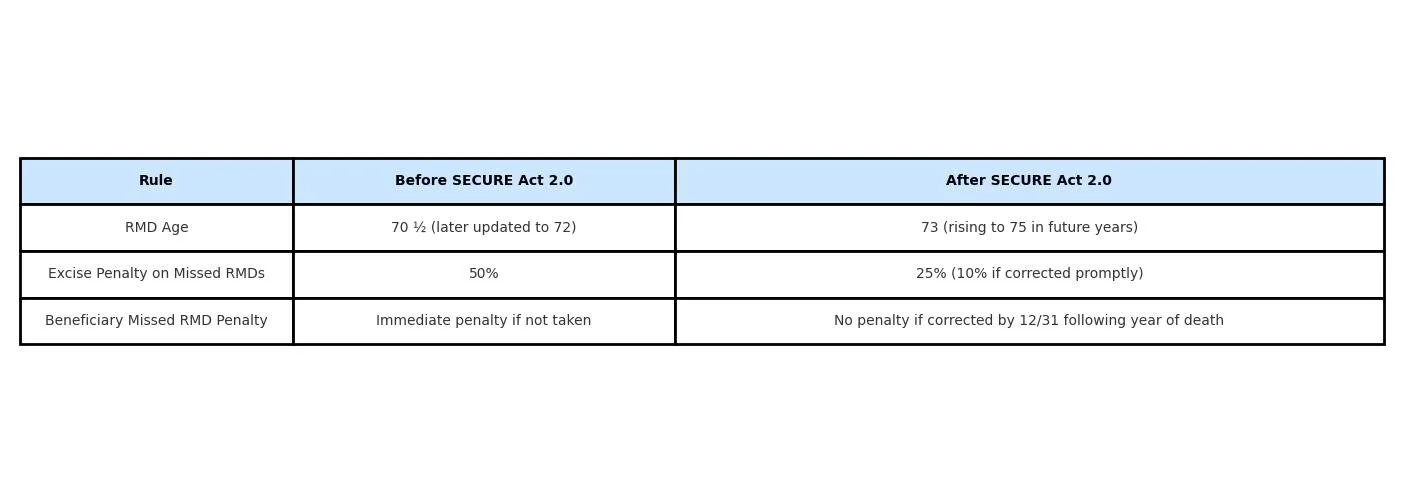

A quick before-and-after look at the old rules versus SECURE Act 2.0

What Happens if You Miss an RMD?

If you forget to take an RMD, the IRS assesses an excise tax penalty on the amount you should have withdrawn. Under the old law, that penalty was steep—50% of the missed RMD.

Under SECURE Act 2.0, the penalty was reduced to a much more manageable amount:

25% penalty on the missed distribution.

If corrected quickly (by taking the missed RMD and filing the proper paperwork), the penalty may be further reduced to 10%.

Example: If you missed a $10,000 RMD:

Old rule: You owed $5,000 in penalties.

New rule: You may owe only $1,000 (if corrected promptly).

The First-Year April 1st Rule

When you reach RMD age (currently age 73 under SECURE Act 2.0), your very first required distribution doesn’t have to be taken in that calendar year. Instead, you can delay it until April 1st of the following year.

But here’s the catch: if you delay your first RMD, you’ll still need to take two RMDs in that next year—the delayed one (by April 1st) plus the regular one (by December 31st).

Example:

Jane turns 73 in 2025.

She can delay her first RMD until April 1, 2026.

If she does, she must also take her 2026 RMD by December 31, 2026—meaning two taxable distributions in one year.

IRS Relief for Inherited Accounts (New Guidance)

For beneficiaries of inherited IRAs or retirement accounts, the IRS just issued new guidance under SECURE Act 2.0.

If a decedent had an RMD due in the year of their death and it wasn’t taken, the beneficiary must still withdraw it. However, the IRS has clarified that as long as the missed RMD is taken by December 31st of the year following the decedent’s death, no excise penalty will be assessed.

This is a significant update and provides more flexibility for beneficiaries who may be navigating a difficult time.

Before SECURE Act 2.0 vs. After

Filing Tax Forms for Missed RMDs

If you missed an RMD, you need to do two things:

Take the missed distribution as soon as possible.

File Form 5329 with your federal tax return to report the missed RMD and calculate the excise penalty.

If you qualify for the reduced 10% penalty, you’ll indicate this on Form 5329.

The actual RMD amount you withdraw will be reported on your Form 1099-R and included in your taxable income for the year you take it.

In some cases, the IRS has historically waived penalties if you can show “reasonable cause” for missing the RMD and that you’ve corrected the mistake. While SECURE Act 2.0 made the penalties less severe, requesting a waiver may still be an option worth considering with your tax professional.

Key Takeaways

SECURE Act 2.0 lowered the penalty for missed RMDs from 50% down to 25% (or 10% if fixed promptly).

The first-year April 1st rule gives you some flexibility but may cause two RMDs in one year.

Beneficiaries now have until December 31st of the year following the decedent’s death to take missed RMDs without penalty.

File Form 5329 to report missed RMDs and claim reduced penalties.

Missing an RMD isn’t ideal, but it’s not the end of the world—especially under the updated SECURE Act 2.0 rules. The most important step is to correct it quickly and make sure you file the proper paperwork with your tax return.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What happens if you miss a Required Minimum Distribution (RMD)?

If you miss an RMD, the IRS may assess an excise tax penalty on the amount that should have been withdrawn. Under SECURE Act 2.0, the penalty is now 25% of the missed amount, reduced to 10% if you correct the mistake promptly by taking the distribution and filing the appropriate tax form.

How did SECURE Act 2.0 change the penalties for missed RMDs?

Previously, missing an RMD triggered a 50% penalty on the shortfall. SECURE Act 2.0 lowered this to 25%, with a further reduction to 10% if the missed distribution is corrected in a timely manner. This change provides much-needed relief for retirees who make honest errors.

What is the April 1st rule for first-year RMDs?

When you first reach RMD age (currently 73), you can delay your initial withdrawal until April 1st of the following year. However, doing so means you must take two RMDs that year—the delayed one and the new year’s required amount—potentially increasing your taxable income.

What are the new IRS rules for inherited IRAs and missed RMDs?

If a deceased account owner had an RMD due in the year of death, the beneficiary must still take that distribution. Under new guidance, if the missed RMD is taken by December 31st of the year following the death, no excise penalty will apply.

What should you do if you missed an RMD?

Take the missed distribution as soon as possible and file IRS Form 5329 with your tax return to report the oversight and calculate any applicable penalty. Your financial or tax advisor can help determine if you qualify for the reduced 10% penalty or a possible waiver.

Can the IRS waive the RMD penalty entirely?

Yes. The IRS may waive the penalty if you can demonstrate reasonable cause for missing the RMD and show that you corrected the issue promptly. While SECURE Act 2.0 reduced the penalties, requesting a waiver may still be worthwhile in some cases.