New Auto Loan Interest Deduction Under the Big Beautiful Tax Bill: What You Need to Know

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The recently passed Big Beautiful Tax Bill introduced a series of attention-grabbing tax changes but one provision could directly benefit millions of Americans is the creation of a new tax deduction for auto loan interest.

For the first time in decades, personal auto loan interest is partially deductible—but it’s not as simple as deducting any old car payment. This provision comes with strict qualifications for both the vehicle and the borrower, and the clock is already ticking, as it’s only available from 2025 through 2028.

In this article, we’ll walk through the key features of the deduction, qualification criteria, and how to plan for this new benefit.

Qualified Passenger Vehicle Loan Interest Deduction

Starting January 1, 2025, taxpayers can deduct interest on certain qualified auto loans—but only if the vehicle and loan meet specific federal criteria.

Here’s what qualifies:

Up to $10,000 per year of interest on a qualifying auto loan can be deducted from your federal income.

Vehicle must be assembled in the United States; final assembly must occur within the U.S.

Only new vehicles—used vehicles do not qualify.

The loan must be secured by a first lien on the vehicle (i.e., the lender has the primary claim if you default).

The vehicle must be for personal use only; commercial use or fleet vehicles are excluded.

A valid Vehicle Identification Number (VIN) must be reported on your tax return.

This is an above-the-line deduction, meaning you don’t need to itemize to claim it—an important feature for the many taxpayers who now take the standard deduction.

What Passenger Vehicles Qualify?

Not all vehicles are eligible for the deduction. The IRS has laid out clear requirements for what constitutes a qualified passenger vehicle under this provision.

Eligible vehicles include:

Cars, minivans, SUVs, pickup trucks, vans, and motorcycles

Must have a gross vehicle weight rating (GVWR) under 14,000 pounds

Must be treated as a “motor vehicle” under Title II of the Clean Air Act

Final assembly must occur in the United States

Commercial or fleet sales do not qualify—the deduction is strictly for personal-use vehicles

If you're purchasing a vehicle in 2025 or beyond, be sure to check the window sticker or manufacturer's certification to ensure your vehicle meets the final assembly and GVWR requirements.

Income Phase-Outs for High Earners

As with many provisions in the Big Beautiful Tax Bill, the new auto loan interest deduction phases out for higher-income earners based on modified adjusted gross income (MAGI).

Here’s how the phase-out works:

Example:

A single taxpayer with $110,000 in MAGI is $10,000 over the phase-out threshold.

$10,000 ÷ $1,000 = 10 increments

10 × $200 = $2,000 deduction reduction

Since the max deduction is $10,000, that taxpayer would only be able to deduct $8,000 in auto loan interest.

The deduction completely phases out once your MAGI exceeds the threshold by $50,000, meaning:

Single filers earning $150,000 or more

Married couples filing jointly earning $250,000 or more

will not be eligible for this deduction.

Why It Matters

With auto loan rates hovering between 6–9% in today’s environment, the ability to deduct interest—especially up to $10,000 per year—can provide meaningful tax relief for car buyers. For example, if you finance a $50,000 vehicle at 7% interest, you could pay $3,000–$4,000 in interest annually. Deducting that amount directly reduces your taxable income and could save hundreds or even thousands in federal taxes depending on your tax bracket.

Planning Considerations

With interest rates still elevated and vehicle prices remaining high, this new deduction could result in meaningful savings—but only if your loan and income qualify.

Buy New and Verify Final Assembly Location

Used vehicles don’t qualify. You must be the first owner, and the vehicle must be assembled in the U.S.

Structure the Loan Properly

Make sure your loan is a secured first lien—most auto loans are, but personal loans and some alternative financing options might not qualify.

Mind Your Income

If you’re near the income phaseout thresholds, consider strategies to reduce your MAGI—like maxing out traditional retirement accounts or HSA contributions—to stay within range.

Track Interest Separately

Keep detailed records of interest paid. Many lenders provide this info via a year-end statement or IRS Form 1098.

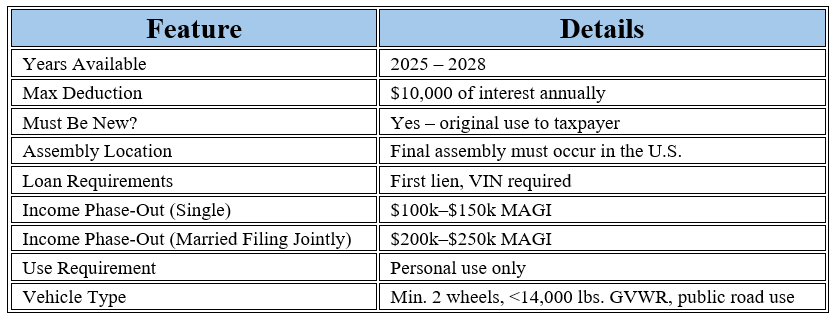

Key Dates and Summary Table

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new auto loan interest deduction under the Big Beautiful Tax Bill?

Beginning January 1, 2025, taxpayers can deduct up to $10,000 per year in interest paid on qualifying personal auto loans. The deduction is available for new, U.S.-assembled vehicles financed with a first-lien loan and remains in effect through 2028.

Do I need to itemize deductions to claim this benefit?

No. The deduction is classified as an above-the-line deduction, meaning you can claim it even if you take the standard deduction.

Which vehicles qualify for the deduction?

Eligible vehicles must be newly purchased (not used), assembled in the United States, and have a gross vehicle weight rating under 14,000 pounds. Cars, SUVs, pickup trucks, vans, and motorcycles may qualify, provided they are for personal—not commercial—use.

Are used or leased vehicles eligible?

No. Used vehicles, leased vehicles, and vehicles financed through unsecured personal loans do not qualify for the deduction.

What are the income limits for the auto loan interest deduction?

The deduction begins to phase out at modified adjusted gross income (MAGI) of $100,000 for single filers and $200,000 for married couples filing jointly. It is reduced by $200 for every $1,000 of income above these thresholds and fully phases out at $150,000 (single) and $250,000 (joint).

Why does the vehicle’s assembly location matter?

Only vehicles with final assembly in the United States qualify for the deduction. Buyers should confirm the assembly location using the manufacturer’s certification label or the vehicle’s window sticker.

How much can this deduction save the average car buyer?

The potential savings depend on your tax bracket and total interest paid. For example, if you pay $4,000 in interest at a 24% tax rate, the deduction could reduce your federal taxes by roughly $960.

When does the new deduction expire?

The provision is temporary and applies to tax years 2025 through 2028. Unless renewed by Congress, it will expire after December 31, 2028.

What documentation should I keep for my taxes?

Keep your loan agreement showing it is a first-lien secured loan, your lender’s year-end statement or Form 1098 showing total interest paid, and documentation verifying the vehicle’s final assembly location and VIN.