What’s a Target Date Fund and Should I Invest in It?

Target date funds adjust automatically as you approach retirement, offering a simple “set it and forget it” investment strategy. They can be a smart option for early savers, but investors with complex financial situations may need more customized solutions.

If you've logged into your 401(k) or IRA recently, there's a good chance you've seen investment options labeled something like “2050 Target Date Fund” or “2065 Retirement Fund.” But what exactly is a target date fund, and is it the right choice for your retirement savings?

This article breaks down how target date funds work, their pros and cons, and when they make sense within a broader financial plan.

What Is a Target Date Fund?

A target date fund is a type of investment fund that automatically adjusts its asset allocation based on your expected retirement year—your target date.

For example, a “2060 Target Date Fund” is designed for someone retiring around the year 2060. The fund starts out heavily invested in stocks to maximize growth. Over time, it gradually becomes more conservative, shifting toward bonds and cash equivalents as the retirement year approaches. This automatic reallocation is called the glide path.

Target date funds are often considered a “set-it-and-forget-it” option for retirement investors but understanding how they work may help determine whether they are a suitable option for your savings.

How the Glide Path Works

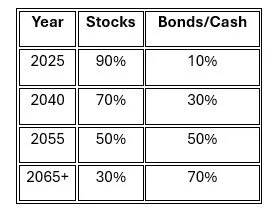

The glide path is the fund’s built-in schedule for reducing investment risk over time. Here's a simplified example of how the asset allocation might shift as retirement nears:

This gradual transition helps reduce the impact of market volatility as you get closer to drawing income from the portfolio. The example above may be a glide path associated with a “2065 Target Date Fund”.

Benefits of Target Date Funds

Simplicity: Target date funds are professionally managed, removing the need to select and monitor individual investments.

Diversification: These funds typically include a mix of U.S. and international stocks, bonds, and sometimes alternative investments, offering broad market exposure.

Automatic rebalancing: The fund rebalances its portfolio over time, keeping it aligned with its risk-reduction strategy without requiring action from the investor.

Good default option: Many 401(k) plans use target date funds as the default investment for participants who don’t actively choose their own allocation.

Potential Drawbacks to Consider

One-size-fits-all: These funds assume that all investors retiring in the same year have similar goals and risk tolerances, which isn’t always the case.

Higher fees: Some target date funds—especially those with actively managed components—can carry higher expense ratios compared to index-based options.

Misaligned risk profile: Some glide paths become too conservative too early, while others remain aggressive longer than ideal. The right fit depends on your personal retirement income plan.

Tax inefficiency in taxable accounts: Frequent rebalancing may create taxable events when held in non-retirement accounts. They are generally best suited for IRAs or 401(k)s.

When Target Date Funds Make Sense

Target date funds can be a solid choice if you:

Are early in your career and want a simple, broadly diversified investment

Don’t want to actively manage your retirement portfolio

Prefer to avoid emotional or reactive investment decisions

Are not yet working with a financial advisor

They are especially useful as a default option when you’re getting started or want to automate long-term investing with minimal oversight.

When to Consider Alternatives

You may want to explore other investment options if you:

Have substantial assets and want a more customized portfolio

Are implementing tax planning strategies like Roth conversions or asset location

Have other income sources in retirement that affect your risk tolerance

Want more control over your asset mix and withdrawal strategy

Have a lower risk tolerance than where the target date fund would allocate your investments

In these cases, building a personalized portfolio may better align with your goals and offer more flexibility.

Final Thoughts

Target date funds can offer convenience, professional management, and a clear path toward a retirement-ready portfolio. For many investors—especially those early in their careers—they can be a smart, efficient way to begin building long-term wealth.

However, as your financial picture grows more complex, it may be worth reevaluating whether a one-size-fits-all fund still fits your personal strategy. A custom portfolio tailored to your income needs, tax situation, and risk tolerance may offer more precise control over your retirement outcome.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Frequently Asked Questions (FAQs)

What is a target date fund?

A target date fund is a diversified investment designed to automatically adjust its mix of stocks, bonds, and other assets as you approach a specific retirement year. It aims to provide growth in the early years and gradually reduce risk as the target date gets closer.

How does a target date fund’s glide path work?

The glide path is the fund’s schedule for shifting from aggressive investments, like stocks, to more conservative holdings, such as bonds and cash equivalents. This gradual transition helps reduce volatility as you near retirement while still pursuing growth early on.

How do I choose the right target date fund?

Most investors select the fund closest to their expected retirement year. However, personal factors such as risk tolerance, savings rate, and income goals should also be considered when choosing a fund.

What are the main benefits of target date funds?

Target date funds offer automatic diversification and rebalancing, making them a convenient “set-it-and-forget-it” option. They can simplify retirement investing for those who prefer not to manage asset allocation themselves.

What are the potential drawbacks of target date funds?

One downside is that investors have little control over the fund’s specific holdings or risk adjustments. Glide paths also vary by provider, meaning some funds may remain more aggressive or conservative than expected.

Are target date funds a good choice for everyone?

They can be a strong fit for investors who want a hands-off approach, but those with complex financial goals or multiple investment accounts may benefit from a more customized strategy. Reviewing the fund’s allocation and costs before investing is essential.