What is the Value of My Pension?

In our latest article, we break down how to calculate the present value of your pension—a powerful way to compare your pension to your other retirement assets and make better long-term decisions.

Whether you’re 5 years from retirement or already collecting, this article will help you see your pension in a new light.

For many Americans approaching retirement, a pension represents one of the most valuable pieces of their financial picture. But while pensions may promise reliable income in the future, they can be hard to evaluate in present terms—especially if you’re trying to compare your pension to a 401(k), IRA, or a lump-sum offer from your employer. That’s where calculating the present value of your pension becomes useful.

In this article, we’ll break down what present value means, how to calculate it, and why it’s essential for retirement planning.

What Is Present Value and Why Does It Matter?

The present value (PV) of your pension tells you how much the future stream of income payments is worth in today’s dollars. It answers this question:

“If I had to replace my pension with a lump sum today, how much money would I need?”

This is especially important when:

You're offered a lump-sum payout option instead of monthly payments

You're comparing your pension to your other investments

You're trying to understand your net worth or financial independence readiness

Step 1: Gather the Details of Your Pension

To begin, you’ll need the following information, which you should be able to request from your employer or pension administrator:

Annual or monthly payment amount

Start date of pension payouts

Expected length of payments (based on life expectancy or plan rules)

Discount rate (assumed rate of return—typically between 4%–6%)

Let’s look at an example:

You’re eligible to receive $30,000 per year

Payments start at age 65

You expect payments to last for 20 years (Age 85 Life Expectancy)

You use a 5% discount rate

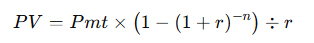

Step 2: Use the Present Value of an Annuity Formula

Most pensions pay a fixed amount each year. This makes them resemble a type of annuity. To calculate the present value of that annuity, use the formula:

Where:

PV = present value

Pmt = annual pension payment

r = discount rate (as a decimal)

n = number of years of payment

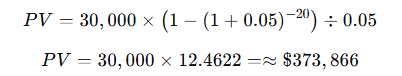

In our example:

So the present value of this pension is about $373,866.

Step 3: Adjust for the Time Until Retirement

If you're not retiring immediately, you’ll need to discount the result back to today’s dollars.

Let’s say you're 55 now, and payments begin at 65. That’s a 10-year delay. The formula becomes:

This means the value of your pension—in today’s dollars—is roughly $229,625.

How Should You Choose a Discount Rate?

The discount rate reflects your assumed rate of return if you invested that money yourself. When we create financial plans for individuals, we typically assume a rate of return of 6-7% before retirement and 4% in retirement for investments. Unlike a 401(k) or other investment account where the account owner assumes the investment risk, a pension is more of a “promise to pay” and the investment risk is assumed by the organization paying the benefit. When estimating the present value of a pension, we typically recommend using a more conservative rate of 4-5%. If you believe your rate of return would be higher if you invested the money yourself, that would increase the discount rate used in the calculation above and reduce the estimated present value of your pension.

Other Factors to Consider

Cost of Living Adjustments (COLAs)

If your pension increases each year to keep up with inflation, it’s worth more than a flat pension and requires a different calculation.Joint Life Payouts

If your pension pays for your spouse’s lifetime too, you’ll need to factor in their life expectancy as well.Taxes

Pension payments are typically taxed as ordinary income. This doesn’t change the present value math, but it matters when comparing to Roth accounts or after-tax investments.

When Calculating Present Value Can Help

Here’s when you might want to calculate your pension’s present value:

Deciding between a monthly pension or lump sum

Coordinating pension income with Social Security and investment withdrawals

Evaluating your retirement readiness

Planning how to split retirement assets in a divorce

It gives you a common-dollar framework for comparison—turning an income stream into a lump sum you can benchmark and plan around.

Final Thoughts

Your pension may be one of the most stable sources of income in retirement, but stability doesn’t always equal clarity. By calculating its present value, you equip yourself with a concrete number you can use in your overall retirement strategy. Whether you’re weighing a lump sum, planning for early retirement, or just seeking a clearer financial picture, this number helps turn your pension into a more actionable asset.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.