Backdoor Roth IRA Contributions

An Advanced Strategy for High-Income Earners to Build Tax-Free Wealth

For many high-income and high-net-worth individuals, contributing directly to a Roth IRA is not permitted due to income limitations imposed by the IRS. However, the Backdoor Roth IRA Contribution Strategy provides a legitimate way for these individuals to allocate money into Roth IRAs using a carefully structured tax strategy.

At Greenbush Financial Group, we help clients evaluate whether the backdoor Roth strategy is appropriate, structure it correctly, and avoid common (and costly) mistakes that can cause unintended tax consequences.

Why Backdoor Roth IRA Contributions Exist

Many taxpayers are surprised to learn that:

There are income limits on Roth IRA contributions

But…..there are no income limits on Roth conversions

This distinction is what makes the backdoor Roth IRA contribution strategy possible.

For individuals who have already:

Maximized employer-sponsored retirement plans (401(k), 403(b), etc.)

Reached income levels that phase them out of direct Roth IRA contributions

The backdoor Roth IRA becomes a powerful way to continue building tax-free retirement assets instead of placing additional savings into taxable brokerage accounts.

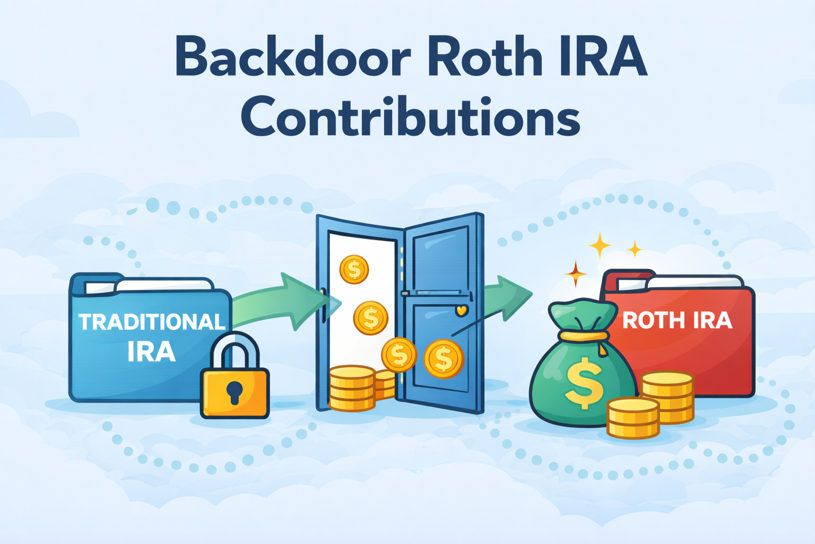

How the Backdoor Roth IRA Contribution Strategy Works

The strategy generally follows two steps:

Make a non-deductible contribution to a Traditional IRA

Because income limits apply only to deductions, not contributions, high-income earners can still fund a Traditional IRA on an after-tax basis.Convert the Traditional IRA to a Roth IRA

The contributed funds are then converted to a Roth IRA. Since Roth conversions have no income limits, the money can move into a Roth account where future growth and qualified withdrawals are tax-free.

When executed correctly, this strategy allows after-tax dollars to grow in a Roth IRA rather than in a taxable account.

Why Backdoor Roth IRAs Are Attractive for High-Net-Worth Individuals

For many clients, the backdoor Roth strategy comes into play after all pre-tax retirement options have been exhausted.

Instead of directing excess savings into a taxable brokerage account—where dividends, interest, and capital gains may be taxed—this strategy allows:

Tax-free accumulation inside a Roth IRA

Tax-free withdrawals after age 59½ (subject to Roth rules)

No Required Minimum Distributions (RMDs) during the owner’s lifetime

Greater flexibility and tax efficiency in retirement

More favorable assets to pass on to heirs

Beware of the IRS Step Transaction Rule

One of the most common mistakes we see with backdoor Roth IRA contributions involves the IRS step transaction rule.

Some taxpayers contribute to a Traditional IRA and then convert the funds to a Roth IRA immediately or the next day, without understanding how the IRS may interpret the intent of the transaction.

If the IRS determines that:

The contribution and conversion were pre-planned as a single transaction

The steps were merely a formality to bypass contribution limits

The conversion may be disallowed, potentially triggering taxes and penalties.

How We Help Manage the Step Transaction Rule

We work with clients to structure timing and documentation appropriately so that backdoor Roth contributions are:

Executed correctly

Defensible under IRS scrutiny

Allowed to remain in the Roth IRA

This is a critical planning detail that is often overlooked.

Understanding the Aggregation Rule

Another major issue that can derail a backdoor Roth IRA strategy is the IRA aggregation rule.

The IRS does not look at IRAs individually when determining the taxability of a Roth conversion. Instead, it aggregates all of a taxpayer’s pre-tax IRAs, including:

Traditional IRAs

SEP IRAs

SIMPLE IRAs

If a taxpayer has other pre-tax IRA balances, the conversion is treated as pro-rata, meaning a portion of the conversion will be taxable—even if the specific IRA being converted was funded with after-tax dollars.

Why This Matters

Many individuals assume their backdoor Roth conversion will be tax-free, only to discover later that:

A large portion of the conversion was taxable

The strategy did not work as intended

This is one of the most common and costly errors with backdoor Roth IRAs.

Our Role

We help clients:

Understand how the aggregation rule applies

Determine whether the backdoor Roth strategy is viable

Coordinate employer plans or other strategies to mitigate issues

Backdoor Roth IRAs as Part of a Broader Plan

Backdoor Roth IRA contributions are most effective when integrated into a broader financial plan that includes:

Employer retirement plans

Tax bracket management

Roth conversion strategies

Retirement income projections

Estate and legacy planning

When coordinated properly, this strategy can significantly improve tax efficiency over decades.

Our Backdoor Roth IRA Articles

“I had a question about inheritance of my ROTH IRA account. I reached out to Greenbush Financial Group. Rob Mangold from Greenbush Financial Group promptly responded with clear explanation. I am very pleased with their professionalism and will be glad to work with them in future. ⭐⭐⭐⭐⭐”

This endorsement provided for Greenbush Financial Group, LLC on Google Review was made by a non-client, and it was a non-paid review. This non-client was solicited by Greenbush Financial Group, LLC to provide the endorsement.

“If you need any type of financial advise, this is the place to go see. Michael at Greenbush Financial Group was able to provide me a wealth of information about specific Roth IRA questions I had. He was super friendly and you can tell, they are passionate about anything finance when it comes to preparing for retiring through your lifetime, and also in other areas. Go see them today! ⭐⭐⭐⭐⭐”

This endorsement provided for Greenbush Financial Group, LLC on Google Review was made by a non-client, and it was a non-paid review. This non-client was solicited by Greenbush Financial Group, LLC to provide the endorsement.

“Man out of all the internet videos out there about retirement/401k/roth/IRA/529/etc... yours are the most articulate and easy to understand !!”

This endorsement provided for Greenbush Financial Group, LLC on YouTube was a non-solicited and non-paid comment by a non-client.

Frequently Asked Questions About Backdoor Roth IRA Contributions

-

What is a backdoor Roth IRA contribution?It is a strategy where a high-income earner makes a non-deductible Traditional IRA contribution and then converts it to a Roth IRA.

-

Why can high-income earners do Roth conversions but not Roth contributions?The IRS imposes income limits on Roth contributions, but not on Roth conversions, which enables this strategy.

-

Are backdoor Roth IRA contributions legal?Yes, when structured correctly. However, they must comply with IRS rules such as the step transaction and aggregation rules.

-

What is the step transaction rule and why does it matter?The IRS may disallow a conversion if it views the contribution and conversion as a single pre-planned transaction. Proper planning helps manage this risk.

-

What is the aggregation rule?The IRS aggregates all pre-tax IRAs when determining the taxability of a Roth conversion, which can cause unexpected taxes.

-

Can backdoor Roth conversions trigger taxes?Yes. If you have other pre-tax IRAs, a portion of the conversion may be taxable due to the pro-rata rule.

-

Who is a good candidate for a backdoor Roth IRA?High-income individuals who have maxed out employer retirement plans and either have no pre-tax IRAs or can mitigate aggregation issues.

-

Should I work with a financial planner before doing a backdoor Roth IRA?Absolutely. This strategy has multiple technical pitfalls, and professional planning helps ensure it’s executed correctly and tax-efficiently.

Contact Us . . . .

All of our services start with a complimentary consult. No high pressure sales tactics. We are financial planners, not salesmen.

About Our Firm: Greenbush Financial Group is an independent registered investment advisory firm based in Albany, New York, that provides four main services to clients: fee-based financial planning services, investment management, employer-sponsored retirement plans, and retirement planning services. The firm serves clients locally in the Albany region and virtually across the United States.