How Much Money Will You Need to Retire Comfortably?

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner who runs retirement projections on a daily basis, one of the most common questions I get is: “How much money do I need to retire?”

The answer may surprise you—because there’s no universal number. The amount you’ll need depends largely on one thing: your expenses.

In this article, we’ll walk through:

Why expenses are the biggest driver of how much you need to retire

How inflation impacts retirement spending

Why the type of account you own matters

The importance of factoring in all your income sources

A quick 60-second way to test your own retirement readiness

Expenses: The Biggest Driver

When you ask, “Can I retire comfortably?”, the first question to answer is: How much do you spend each year?

For example:

If your expenses are $40,000 per year, then $500,000 in retirement savings could potentially be enough—especially if you’re supplementing withdrawals with Social Security or a pension.

But if your expenses are $90,000 per year, that same $500,000 likely won’t stretch nearly as far.

Your retirement lifestyle drives your retirement savings need. Someone with modest expenses may not need millions to retire, while someone with higher spending will require significantly more.

Don’t Forget About Inflation

It’s not just today’s expenses you need to plan for—it’s tomorrow’s too. Inflation quietly eats away at your purchasing power, making your cost of living higher every single year.

Here’s an example:

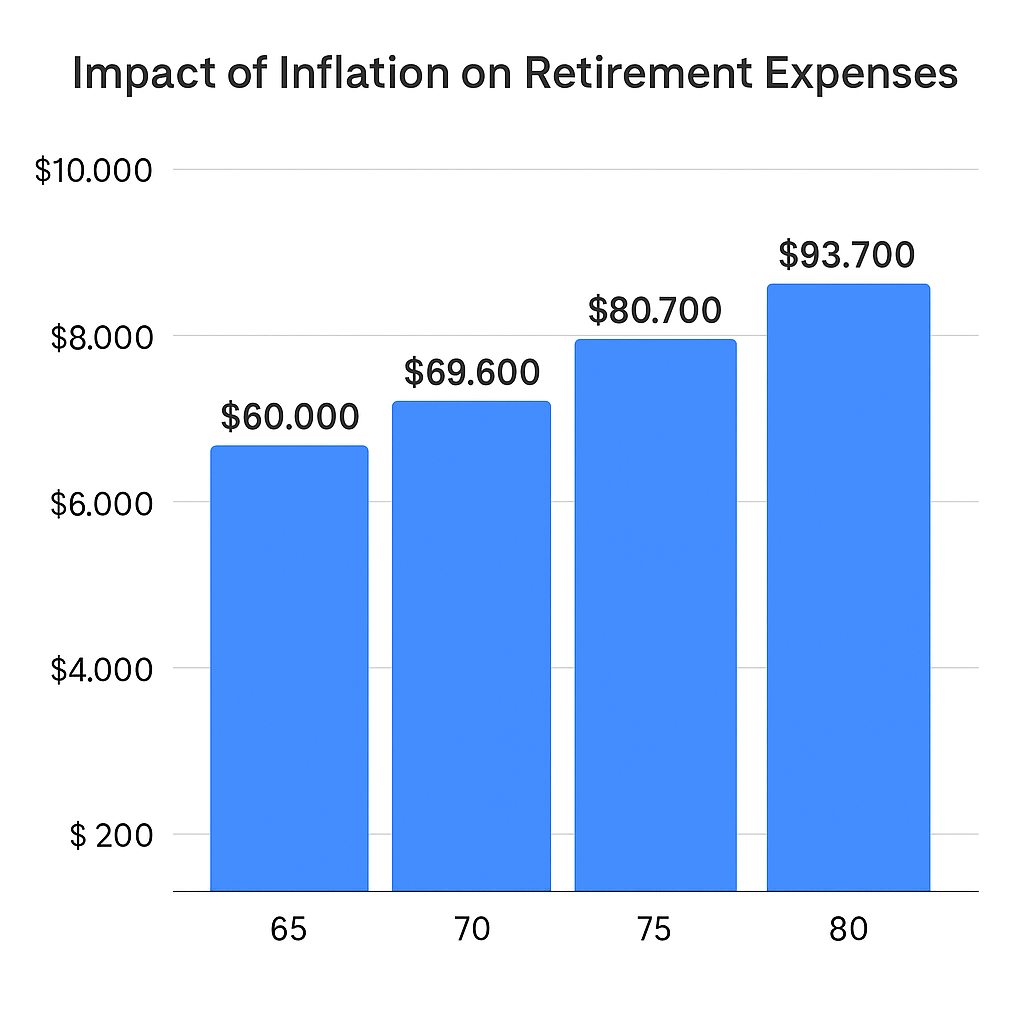

At age 65, your expenses are $60,000 per year.

If expenses rise at 3% annually, by age 80 they’ll be roughly $93,700 per year.

That’s a 50% increase in just 15 years—and you’ll need your retirement assets to keep up.

This is one of the hardest factors for individuals to quantify without financial planning software. Inflation not only increases expenses, but it changes your withdrawal rate from investments, which can impact how long your money lasts.

The Type of Account Matters

Not all retirement accounts are created equal. The type of retirement/investment accounts you own has a big impact on whether you can retire comfortably.

Pre-tax accounts (401k, traditional IRA): Every dollar withdrawn is taxed as ordinary income. A $1,000,000 account might really be worth closer to $700,000 after taxes.

Roth accounts: Withdrawals are tax-free, making these extremely valuable in retirement.

After-tax brokerage accounts: Withdrawals often receive more favorable capital gains treatment, so the tax drag can be lighter compared to pre-tax accounts.

Cash: Offers liquidity but typically earns little return, making it best for short-term expenses.

In short: Roth and after-tax brokerage accounts often provide more after-tax value compared to pre-tax accounts.

Factor in All Your Income Sources

Getting a general idea of your retirement income picture is key. This means adding up:

Social Security benefits

Pensions

Investment income (dividends, interest, etc.)

Part-time income in retirement

Withdrawals from retirement accounts

Once you total these income sources, you’ll need to apply the tax impact. Only then can you compare your after-tax income against your after-tax expenses (adjusted for inflation each year) to see if there’s a gap.

This is exactly how financial planners build retirement projections to determine sustainability.

Find Out If You Can Retire in 60 Seconds

Curious if you’re on track? We’ve built a 60-second retirement check-up that can help you quickly see if you have enough to retire.

Bottom line: There’s no magic retirement number. The amount you need depends on your expenses, inflation, account types, and income sources. By running the numbers—and stress-testing them with a financial planner—you can gain the confidence to know whether you’re truly ready to retire comfortably.

Partner with a Fee-Based Financial Planner to Build Your Retirement Plan

While rules of thumb and calculators can provide a helpful starting point, everyone’s retirement picture looks different. Your income needs, lifestyle goals, and unique financial situation will ultimately determine how much you need to retire comfortably.

Working with a fee-based financial planner can help take the guesswork out of retirement planning. A planner will create a customized strategy that factors in your retirement expenses, investments, Social Security, healthcare, and tax planning—so you know exactly where you stand and what adjustments to make.

If you’d like to explore your own numbers and build a retirement roadmap, we’d love to help. Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How much money do I need to retire?

There’s no single number that fits everyone—the right amount depends primarily on your annual expenses, lifestyle, and income sources. A retiree spending $40,000 per year will need far less savings than someone spending $90,000.

Why are expenses the most important factor in retirement planning?

Your spending habits determine how much income your portfolio must generate. Knowing your annual expenses helps estimate your withdrawal needs, which directly drives how large your retirement savings must be.

How does inflation affect retirement spending?

Inflation gradually increases the cost of living, reducing the purchasing power of your money. At a 3% inflation rate, $60,000 in annual expenses today could rise to about $94,000 in 15 years, meaning your savings must grow to keep pace.

How does the type of retirement account impact how much you need to save?

Withdrawals from pre-tax accounts like 401(k)s and traditional IRAs are taxable, so you may need to save more to cover taxes. Roth IRAs and brokerage accounts often provide more after-tax value, since withdrawals may be tax-free or taxed at lower rates.

What income sources should I include when estimating retirement readiness?

Include all sources such as Social Security, pensions, dividends, part-time income, and withdrawals from savings. Comparing your total after-tax income against your inflation-adjusted expenses helps reveal whether you’re financially ready to retire.

How can I quickly estimate if I’m on track for retirement?

A simple way is to compare your projected annual expenses (adjusted for inflation) with your expected retirement income. Working with a fee-based financial planner can oftern provide a more comprehensive approach to answering the question “Do I have enough to retire?”