Planning for Healthcare Costs in Retirement: Why Medicare Isn’t Enough

Healthcare often becomes one of the largest and most underestimated retirement expenses. From Medicare premiums to prescription drugs and long-term care, this article from Greenbush Financial Group explains why healthcare planning is critical—and how to prepare before and after age 65.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When most people picture retirement, they imagine travel, hobbies, and more free time—not skyrocketing healthcare bills. Yet, one of the biggest financial surprises retirees face is how much they’ll actually spend on medical expenses.

Many retirees dramatically underestimate their healthcare costs in retirement, even though this is the stage of life when most people access the healthcare system the most. While it’s common to pay off your mortgage leading up to retirement, it’s not uncommon for healthcare costs to replace your mortgage payment in retirement.

In this article, we’ll cover:

Why Medicare isn’t free—and what parts you’ll still need to pay for.

What to consider if you retire before age 65 and don’t yet qualify for Medicare.

The difference between Medicare Advantage and Medicare Supplement plans.

How prescription drug costs can take retirees by surprise.

The reality of long-term care expenses and how to plan for them.

Planning for Healthcare Before Age 65

For those who plan to retire before age 65, healthcare planning becomes significantly more complicated—and expensive. Since Medicare doesn’t begin until age 65, retirees need to bridge the coverage gap between when they stop working and when Medicare starts.

If your former employer offers retiree health coverage, that’s a tremendous benefit. However, it’s critical to understand exactly what that coverage includes:

Does it cover just the employee, or both the employee and their spouse?

What portion of the premium does the employer pay, and how much is the retiree responsible for?

What out-of-pocket costs (deductibles, copays, coinsurance) remain?

If you don’t have retiree health coverage, you’ll need to explore other options:

COBRA coverage through your former employer can extend your workplace insurance for up to 18 months, but it’s often very expensive since you’re paying the full premium plus administrative fees.

ACA marketplace plans (available through your state’s health insurance exchange) may be an alternative, but premiums and deductibles can vary widely depending on your age, income, and coverage level.

In many cases, healthcare costs for retirees under 65 can be substantially higher than both Medicare premiums and the coverage they had while working. This makes it especially important to build early healthcare costs into your retirement budget if you plan to leave the workforce before age 65.

Medicare Is Not Free

At age 65, most retirees become eligible for Medicare, which provides a valuable foundation of healthcare coverage. But it’s a common misconception that Medicare is free—it’s not.

Here’s how it breaks down:

Part A (Hospital Insurance): Usually free if you’ve paid into Social Security for at least 10 years.

Part B (Medical Insurance): Covers doctor visits, outpatient care, and other services—but it has a monthly premium based on your income.

Part D (Prescription Drug Coverage): Also carries a monthly premium that varies by plan and income level.

Example:

Let’s say you and your spouse both enroll in Medicare at 65 and each qualify for the base Part B and Part D premiums.

In 2025, the standard Part B premium is approximately $185 per month per person.

A basic Part D plan might average around $36 per month per person.

Together, that’s about $220 per person, or $440 per month for a couple—just for basic Medicare coverage. And this doesn’t include supplemental or out-of-pocket costs for things Medicare doesn’t cover.

NOTE: Some public sector or state plans even provide Medicare Part B premium reimbursement once you reach 65—a feature that can be extremely valuable in retirement.

Medicare Advantage and Medicare Supplement Plans

While Medicare provides essential coverage, it doesn’t cover everything. Most retirees need to choose between two main options to fill in the gaps:

Medicare Advantage (Part C) plans, offered by private insurers, bundle Parts A, B, and often D into one plan. These plans usually have lower premiums but can come with higher out-of-pocket costs and limited provider networks.

Medicare Supplement (Medigap) plans, which work alongside traditional Medicare, help pay for deductibles, copayments, and coinsurance.

It’s important not to simply choose the lowest-cost plan. A retiree’s prescription needs, frequency of care, and preferred doctors should all factor into the decision. Choosing the cheapest plan could lead to much higher out-of-pocket expenses in the long run if the plan doesn’t align with your actual healthcare needs.

Prescription Drug Costs: A Hidden Retirement Expense

Prescription drug coverage is one of the biggest cost surprises for retirees. Even with Medicare Part D, out-of-pocket expenses can add up quickly depending on the medications you need.

Medicare Part D plans categorize drugs into tiers:

Tier 1: Generic drugs (lowest cost)

Tier 2: Preferred brand-name drugs (moderate cost)

Tier 3: Specialty drugs (highest cost, often with no generic alternatives)

If you’re prescribed specialty or non-generic medications, you could spend hundreds—or even thousands—per month despite having coverage.

To help, some states offer programs to reduce these costs. For example, New York’s EPIC program helps qualifying seniors pay for prescription drugs by supplementing their Medicare Part D coverage. It’s worth checking if your state offers a similar benefit.

Planning for Long-Term Care

One of the most misunderstood aspects of Medicare is long-term care coverage—or rather, the lack of it.

Medicare only covers a limited number of days in a skilled nursing facility following a hospital stay. Beyond that, the costs become the retiree’s responsibility. Considering that long-term care can easily exceed $120,000 per year, this can be a major financial burden.

Planning ahead is essential. Options include:

Purchasing a long-term care insurance policy to offset future costs.

Self-insuring, by setting aside savings or investments for potential care needs.

Planning to qualify for Medicaid through strategic trust planning

Whichever route you choose, addressing long-term care early is key to protecting both your assets and your peace of mind.

Final Thoughts

Healthcare is one of the largest—and most underestimated—expenses in retirement. While Medicare provides a foundation, retirees need to plan for premiums, prescription costs, supplemental coverage, and potential long-term care needs.

If you plan to retire before 65, early planning becomes even more critical to bridge the gap until Medicare begins. By taking the time to understand your options and budget accordingly, you can enter retirement with confidence—knowing that your healthcare needs and your financial future are both protected.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQ)

Why isn’t Medicare enough to cover all healthcare costs in retirement?

While Medicare provides a solid foundation of coverage starting at age 65, it doesn’t pay for everything. Retirees are still responsible for premiums, deductibles, copays, prescription drugs, and long-term care—expenses that can add up significantly over time.

What should I do for healthcare coverage if I retire before age 65?

If you retire before Medicare eligibility, you’ll need to bridge the gap with options like COBRA, ACA marketplace plans, or employer-sponsored retiree coverage. These plans can be costly, so it’s important to factor early healthcare premiums and out-of-pocket expenses into your retirement budget.

What are the key differences between Medicare Advantage and Medicare Supplement plans?

Medicare Advantage (Part C) plans combine Parts A, B, and often D, offering convenience but limited provider networks. Medicare Supplement (Medigap) plans work alongside traditional Medicare to reduce out-of-pocket costs. The right choice depends on your budget, health needs, and preferred doctors.

How much should retirees expect to pay for Medicare premiums?

In 2025, the standard Medicare Part B premium is around $185 per month, while a basic Part D plan averages about $36 monthly. For a married couple, that’s roughly $440 per month for both—before adding supplemental coverage or out-of-pocket expenses. These costs should be built into your retirement spending plan.

Why are prescription drugs such a major expense in retirement?

Even with Medicare Part D, out-of-pocket drug costs can vary widely based on your prescriptions. Specialty and brand-name medications often carry high copays. Programs like New York’s EPIC can help eligible seniors manage these costs by supplementing Medicare coverage.

Does Medicare cover long-term care expenses?

Medicare only covers limited skilled nursing care following a hospital stay and does not pay for most long-term care needs. Since extended care can exceed $120,000 per year, retirees should explore options like long-term care insurance, Medicaid planning, or setting aside savings to self-insure.

How can a financial advisor help plan for healthcare costs in retirement?

A financial advisor can estimate future healthcare expenses, evaluate Medicare and supplemental plan options, and build these costs into your retirement income plan. At Greenbush Financial Group, we help retirees design strategies that balance healthcare needs with long-term financial goals.

Special Tax Considerations in Retirement

Retirement doesn’t always simplify your taxes. With multiple income sources—Social Security, pensions, IRAs, brokerage accounts—comes added complexity and opportunity. This guide from Greenbush Financial Group explains how to manage taxes strategically and preserve more of your retirement income.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

You might think that once you stop working, your tax situation becomes simpler — after all, no more paychecks! But for many retirees, taxes actually become more complex. That’s because retirement often comes with multiple income sources — Social Security, pensions, pre-tax retirement accounts, brokerage accounts, cash, and more.

At the same time, retirement can present unique tax-planning opportunities. Once the paychecks stop, retirees often have more control over which tax bracket they fall into by strategically deciding which accounts to pull income from.

In this article, we’ll cover:

How Social Security benefits are taxed

Pension income rules (and how they vary by state)

Taxation of pre-tax retirement accounts like IRAs and 401(k)s

Developing an efficient distribution strategy

Special tax deductions and tax credits for retirees

Required Minimum Distribution (RMD) planning

Charitable giving strategies, including QCDs and donor-advised funds

How Social Security Is Taxed

Social Security benefits may be tax-free, partially taxed, or mostly taxed — depending on your provisional income. Provisional income is calculated as:

Adjusted Gross Income (AGI) + Nontaxable Interest + ½ of Your Social Security Benefits.

Here’s a quick summary of how benefits are taxed at the federal level:

While Social Security is taxed at the federal level, most states do not tax these benefits. However, a handful of states — including Colorado, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, and Vermont — do impose some form of state tax on Social Security income.

Pension Income

If you’re fortunate to receive a state pension, your state of residence plays a big role in determining how that income is taxed.

If you have a state pension and continue living in the same state where you earned the pension, many states exclude that income from state tax.

However, with state pensions, if you move to another state, and that state has income taxation at the stateve level, your pension may become taxable in your new state of domicile.

If you have a pension with a private sector employer, often times those pension payment are full taxable at both the federal and state level.

Some states also provide preferential treatment for private pensions or IRA income. For example, New York excludes up to $20,000 per person in pension or IRA distributions from state income tax each year — a significant benefit for retirees managing taxable income.

Taxation of Pre-Tax Retirement Accounts

Pre-tax retirement accounts — including Traditional IRAs, 401(k)s, 403(b)s, and inherited IRAs — are typically taxed as ordinary income when distributions are made.

However, the tax treatment at the state level varies:

Some states (like New York) exclude a set amount – for example New York excludes the first $20,000 per person per year — from state taxation.

Others tax all pre-tax distributions in full.

A few states offer income-based exemptions or reduced rates for lower-income retirees.

Because these rules differ so widely, it’s important to research your state’s tax laws.

Developing a Tax-Efficient Distribution Strategy

A well-designed distribution strategy can make a big difference in how much tax you pay throughout retirement.

Many retirees have income spread across:

Pre-tax accounts (401(k), IRA)

After-tax brokerage accounts

Roth IRAs

Social Security

Let’s say you need $70,000 per year to maintain your lifestyle. Some of that may come from Social Security, but you’ll need to decide where to withdraw the rest.

With smart planning, you can blend withdrawals from different accounts to minimize your overall tax liability and control your tax bracket year by year. The goal isn’t just to reduce taxes today — it’s to manage them over your lifetime.

Special Deductions and Credits in Retirement

Your Adjusted Gross Income (AGI) or Modified AGI doesn’t just determine your tax bracket — it also affects which deductions and credits you can claim.

A few important highlights:

The Big Beautiful Tax Bill that just passed in 2025 introduces a new Age 65+ tax deduction of $6,000 per person over and above the existing standard deduction.

Certain deductions and credits, however, phase out once income exceeds specific thresholds.

Your income level also affects Medicare premiums for Parts B and D, which increase if your income surpasses the IRMAA thresholds (Income-Related Monthly Adjustment Amount).

Managing your taxable income through careful distribution planning can therefore help preserve deductions and keep Medicare premiums lower.

Required Minimum Distribution (RMD) Planning

Once you reach age 73 or 75 (depending on your birth year), you must begin taking Required Minimum Distributions (RMDs) from your pre-tax retirement accounts — even if you don’t need the money.

These RMDs can significantly increase your taxable income, especially when stacked on top of Social Security and other income sources.

A proactive strategy is to take controlled distributions or perform Roth conversions before RMD age. Doing so can reduce the size of your future RMDs and potentially lower your lifetime tax bill by spreading taxable income across more favorable tax years.

Charitable Giving Strategies

Many retirees are charitably inclined, but since most take the standard deduction, they don’t receive an additional tax benefit for their donations.

There are two primary strategies to consider:

Donor-Advised Funds (DAFs) – You can “bunch” several years’ worth of charitable giving into one tax year to exceed the standard deduction, then direct the funds to charities over time.

Qualified Charitable Distributions (QCDs) – Once you reach age 70½, you can donate directly from your IRA to a qualified charity. These QCDs are excluded from taxable income and count toward your RMD once those begin.

Final Thoughts

Retirement opens up new opportunities — and new complexities — when it comes to managing taxes. Understanding how your various income sources interact and planning your distributions strategically can help you:

Reduce taxes over your lifetime

Preserve more of your retirement income

Maintain flexibility and control over your financial future

As always, it’s wise to coordinate with a financial advisor and tax professional to ensure your retirement tax strategy aligns with your goals, income sources, and state tax rules.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQ)

How are Social Security benefits taxed in retirement?

Depending on your provisional income, up to 85% of your Social Security benefits may be subject to federal income tax. Most states don’t tax these benefits, though a few—including Colorado, Minnesota, and Utah—do.

How is pension income taxed, and does it vary by state?

Pension income is typically taxable at the federal level, but state rules differ. Some states exclude public pensions from taxation or offer partial exemptions—like New York’s $20,000 per person exclusion for pension or IRA income. If you move to another state in retirement, your pension’s tax treatment could change.

What taxes apply to withdrawals from pre-tax retirement accounts?

Distributions from Traditional IRAs, 401(k)s, and similar pre-tax accounts are taxed as ordinary income. Some states offer exclusions or partial deductions, while others tax these withdrawals in full. Understanding your state’s rules is essential for accurate tax planning.

What is a tax-efficient withdrawal strategy in retirement?

A tax-efficient strategy blends withdrawals from different account types—pre-tax, Roth, and after-tax—to control your annual tax bracket. The goal is not just to lower taxes today but to reduce lifetime taxes by managing income across multiple years and minimizing required minimum distributions later.

What new tax deductions or credits are available for retirees?

The 2025 tax law introduced an additional $6,000 deduction per person age 65 and older, in addition to the standard deduction. Keeping taxable income lower through smart planning can also help retirees preserve deductions and avoid higher Medicare IRMAA surcharges.

How do Required Minimum Distributions (RMDs) impact taxes?

Starting at age 73 or 75 (depending on birth year), retirees must withdraw minimum amounts from pre-tax retirement accounts, which increases taxable income. Performing partial Roth conversions or strategic withdrawals before RMD age can help reduce future tax exposure.

What are Qualified Charitable Distributions (QCDs) and how do they work?

QCDs allow individuals age 70½ or older to donate directly from an IRA to a qualified charity, satisfying all or part of their RMD while excluding the amount from taxable income. This strategy helps maximize charitable impact while reducing taxes in retirement.

How to Maximize Social Security Benefits with Smart Claiming and Income Planning

Social Security is a cornerstone of retirement income—but when and how you claim can have a major impact on lifetime benefits. This article from Greenbush Financial Group explains 2025 thresholds, how benefits are calculated, and smart strategies for delaying, coordinating with taxes, and managing Medicare costs. Learn how to maximize your Social Security benefits and plan your income efficiently in retirement.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

For many retirees, Social Security is a cornerstone of their retirement income. But when and how you claim your benefits—and how you plan your income around them—can have a major impact on the total amount you receive over your lifetime. With updated Social Security thresholds, limits, and rules, there are new opportunities to optimize your claiming strategy and coordinate Social Security with your broader financial plan.

In this article, we’ll cover:

How Social Security benefits are calculated and funded

Four ways to increase your Social Security benefit amount

How income and taxes affect your benefits

The impact of Medicare premiums and income planning

How delaying Social Security can create opportunities for Roth conversions

What to know about the earned income penalty if you claim early

Answers to common Social Security claiming questions

Maximizing Social Security During the Working Years

The foundation for a strong Social Security benefit starts during your working years. Understanding how the system works helps you make informed decisions about your career, income, and retirement planning.

How Social Security Is Funded and Calculated

Social Security is primarily funded through payroll taxes under the Federal Insurance Contributions Act (FICA). In 2025, workers and employers each pay 6.2% of wages (for a total of 12.4%) up to the taxable wage base, which is $176,000 in 2025. Any earnings above that amount are not subject to Social Security tax and do not increase your benefit.

Your benefit is based on your highest 35 years of indexed earnings—meaning each year’s income is adjusted for inflation to reflect its value in today’s dollars. If you worked fewer than 35 years, zeros are included in the calculation, which can significantly reduce your average and therefore your monthly benefit.

Key takeaway: Once your annual income exceeds the taxable wage base, additional earnings don’t raise your future Social Security benefit. However, working longer can still increase your benefit if you replace lower-earning years or zeros in your 35-year average.

Four Ways to Increase Your Social Security Benefits

1. Fill in or Replace Zero Years

If you have fewer than 35 years of work history, each missing year is counted as zero. Even one extra year of income can replace a zero and raise your benefit.

Example: If you worked 32 years and earned $80,000 annually in your final three years, adding those years could significantly boost your benefit calculation.

2. Delay Claiming to Earn Higher Benefits

You can claim Social Security as early as age 62, but doing so permanently reduces your benefit—up to 30% less than your full retirement age (FRA) amount. For those born in 1960 or later, FRA is 67.

If you wait past FRA, your benefit grows by 8% per year up to age 70, plus annual cost-of-living adjustments (COLAs).

Example:

Claiming at 62: $1,400/month

Claiming at 67: $2,000/month

Claiming at 70: $2,480/month

That’s a $1,080 per month difference for waiting between the ages of 62 and 70.

3. Maximize Spousal and Dependent Benefits

Spousal and dependent benefits can be valuable for married couples or retirees with young children.

Spousal Benefit: A spouse can claim up to 50% of the higher earner’s FRA benefit, provided the higher earner has already filed.

Divorced Spouse Benefit: You may qualify if the marriage lasted 10 years or longer, and you haven’t remarried prior to age 60.

Dependent Benefit: Retirees age 62+ with children under 18 may receive additional benefits for dependents.

Planning tip: For individuals who plan to utilize the 50% spousal benefit and/or the dependent benefit, the path to the optimal filing strategy is more complex because the spouse and dependents cannot receive these benefits until that individual has actually turned on their social security benefit, which, in some cases, can favor not waiting until age 70 to file.

4. Understand Survivor Benefits

If one spouse passes away, the surviving spouse receives the higher of the two benefits. This makes it especially beneficial for the higher-earning spouse to delay claiming to age 70, maximizing the survivor benefit and providing long-term income protection.

How Social Security Benefits Are Taxed

Up to 85% of your Social Security benefits may be taxable, depending on your combined income (adjusted gross income + nontaxable interest + half of your Social Security benefits).

Single filers: Taxes begin at $25,000 of combined income

Married filing jointly: Taxes begin at $32,000 of combined income

If you don’t need Social Security to cover living expenses right away, delaying benefits can not only increase your future income but may also help manage taxes by controlling your income levels in early retirement.

Medicare Premiums and Income Planning

Once you reach age 65, you’ll typically enroll in Medicare Part B and D, and your premiums are based on your Modified Adjusted Gross Income (MAGI). Higher income means higher premiums under the Income-Related Monthly Adjustment Amount (IRMAA) rules.

Because Social Security benefits count as income for these purposes, timing your claiming strategy can help you manage Medicare costs.

Roth Conversions: Turning Delay into an Opportunity

Delaying Social Security creates a window for Roth conversions—moving money from a traditional IRA to a Roth IRA at potentially lower tax rates before Required Minimum Distributions (RMDs) begin at age 73 or 75.

Benefits of Roth conversions include:

Paying tax now at potentially lower rates

Reducing future RMDs

Potentially reduce future Medicare premiums

Creating a tax-free income source in retirement

Leaving tax-free assets to heirs

Coordinating your claiming strategy with Roth conversions can improve long-term tax efficiency and enhance your retirement flexibility.

Claiming Early? Know the Earned Income Penalty

If you claim Social Security before full retirement age and continue to work, your benefits may be temporarily reduced.

In 2025, the earnings limit is $23,400. For every $2 earned over the limit, $1 in benefits is withheld.

In the year you reach FRA, a higher limit applies: $62,160, and only $1 is withheld for every $3 earned above that.

Once you reach full retirement age, the penalty disappears, and your benefit is recalculated to credit any withheld amounts.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQ)

How are Social Security benefits calculated?

Social Security benefits are based on your highest 35 years of indexed earnings, adjusted for inflation. If you worked fewer than 35 years, zeros are included in your calculation, which can reduce your benefit.

What are the main ways to increase your Social Security benefits?

You can boost your benefit by replacing “zero” earning years, delaying your claim up to age 70 for an 8% annual increase past full retirement age, and coordinating spousal or survivor benefits strategically. Working longer and earning more during high-income years can also improve your benefit calculation.

How does delaying Social Security affect taxes and Medicare premiums?

Delaying benefits can help you manage taxable income in early retirement and avoid higher Medicare premiums triggered by the IRMAA income thresholds. This window can also allow for Roth conversions, which reduce future Required Minimum Distributions (RMDs) and create tax-free income in later years.

How are Social Security benefits taxed?

Up to 85% of your benefits may be taxable depending on your combined income (adjusted gross income + nontaxable interest + half of your benefits). Taxes begin at $25,000 for single filers and $32,000 for married couples filing jointly. Managing income sources can help minimize these taxes.

What is the earned income penalty for claiming Social Security early?

If you claim before full retirement age and continue working, benefits are reduced by $1 for every $2 earned above $23,400 in 2025. In the year you reach full retirement age, the limit increases to $62,160, and only $1 is withheld for every $3 earned over that amount. The penalty ends at full retirement age, when your benefit is recalculated.

What are spousal and survivor Social Security benefits?

A spouse can claim up to 50% of the higher earner’s full retirement benefit once that person has filed. If one spouse passes away, the survivor receives the higher of the two benefits. This makes it especially advantageous for the higher earner to delay claiming to age 70 to maximize long-term income protection.

How can Roth conversions complement Social Security planning?

Performing Roth conversions in the years before claiming Social Security or reaching RMD age allows retirees to shift pre-tax funds into tax-free accounts at potentially lower tax rates. This strategy can reduce future taxable income, manage Medicare premiums, and increase retirement flexibility.

“Sell in May and Go Away” is Dead

“Sell in May and Go Away” sounds clever, but the data tells a different story. Since 2020, investors who followed this rule would have missed out on strong summer gains. We break down why discipline and staying invested consistently beat market timing.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

One of the most well-known Wall Street adages is the “Sell in May and go away” strategy. The idea is simple: sell your stock holdings in May, avoid the typically slower summer months, and then re-enter the market in the fall when trading activity and returns supposedly pick back up. On the surface, this strategy sounds appealing—who wouldn’t want to avoid risk and still capture the best gains of the year?

But here’s the problem: if you had followed this strategy over the past six years, you would have missed out on some very strong returns. In fact, staying on the sidelines from June through August would have cost you real money.

In this article, we’ll cover:

A look at the actual S&P 500 returns from June–August over the past few years

Why investors would have been “right” only 1 out of 6 times

The real risk of following catchy headlines instead of hard data.

Why discipline through volatility has historically paid off.

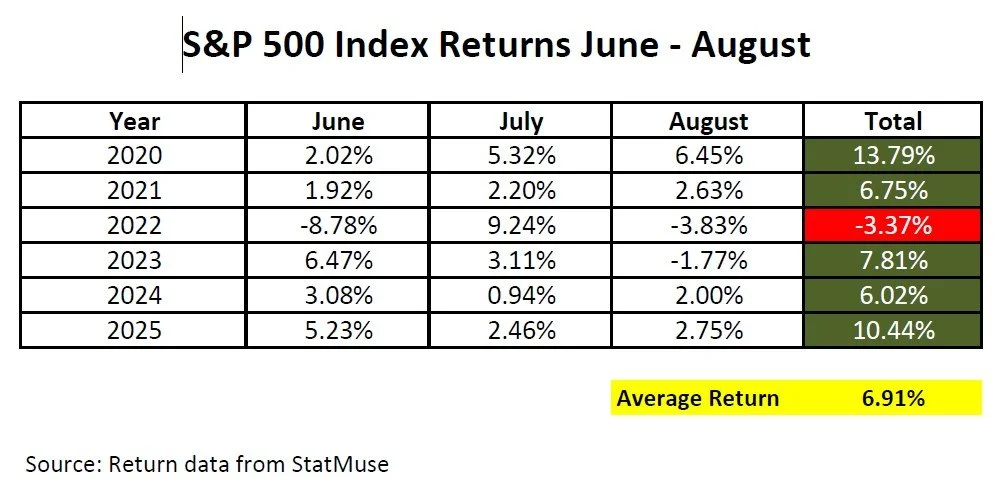

What the Data Really Says

Below is a breakdown of the S&P 500 Index returns from June through August for each year since 2020.

When we look at the data:

Five out of six years, the June – August months produced positive returns.

The average return over this period was 6.91%.

Investors would have only been correct in sitting out one year (2022), when the S&P fell by –3.37%.

Put simply, investors who followed the Sell In May and Go Away strategy for the past 6 years cost themselves about 7% PER YEAR in investment returns.

Why the Temptation is Strong

It’s easy to see how investors get drawn into these types of strategies. A headline or article points out that summer months are historically weaker, or that volatility spikes during this period. On paper, it can sound logical: avoid risk, re-enter later, and come out ahead.

But as the table shows, the reality doesn’t line up with the theory. By relying on the “Sell in May” strategy, investors risk leaving money on the table. That’s the danger of market timing—you need to be right not once, but twice (when to sell, and when to buy back in).

Volatility vs. Discipline

There’s no denying that the summer months often bring more volatility to the stock market. Thinner trading volumes and seasonal economic patterns can cause choppier price action. But investors who have had the discipline to ride through those bumps have been rewarded.

The past six years make this clear: while the S&P 500 had its ups and downs from June to August, the overall trend was solidly positive. That’s why sticking to a long-term investment plan often beats trying to time the market.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What does “Sell in May and go away” mean in investing?

“Sell in May and go away” is a market adage suggesting that investors should sell their stock holdings in May, avoid the summer months when returns are thought to be weaker, and reinvest in the fall. The strategy is based on historical seasonal trends but often oversimplifies how markets actually perform.

Has the “Sell in May” strategy worked in recent years?

Recent data shows that this strategy has largely underperformed. Over the past several years, the S&P 500 has delivered positive returns during the summer months more often than not, meaning investors who exited in May would have missed out on gains.

Why can following seasonal market sayings be risky?

Relying on old adages or headlines instead of data can lead to missed opportunities or poorly timed decisions. Markets are influenced by a range of factors—economic trends, interest rates, and company performance—not just the calendar.

What’s the downside of sitting out of the market during the summer?

Missing even a few strong market days can significantly reduce long-term investment returns. Staying invested allows you to participate in rebounds and compounding growth that can happen unexpectedly throughout the year.

Why is discipline so important for investors?

A disciplined, long-term investment approach helps smooth out volatility and avoid emotional decision-making. Sticking with a consistent strategy based on goals and time horizon has historically produced better outcomes than trying to time the market.

What’s a more effective alternative to timing seasonal trends?

Instead of trying to predict short-term market movements, investors can focus on maintaining a diversified portfolio aligned with their risk tolerance and financial objectives. This approach emphasizes consistency and adaptability rather than reacting to temporary patterns.

If You Retire With $1 Million, How Long Will It Last?

Is $1 million enough to retire? The answer depends on withdrawal rates, inflation, investment returns, and taxes. This article walks through different scenarios to show how long $1 million can last and what retirees should consider in their planning.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Retirement planning often circles around one big question: If I save $1 million, how long will it last once I stop working? The answer isn’t one-size-fits-all. It depends on a handful of key factors, including:

Your annual withdrawal rate

Inflation (the rising cost of goods and services over time)

Your assumed investment rate of return

Taxes (especially if most of your money is in pre-tax retirement accounts)

In this article, we’ll walk through each of these factors and then run the numbers on a few different scenarios. By the end, you’ll have a much clearer idea of how far $1 million can take you in retirement.

Step 1: Determining Your Withdrawal Rate

Your withdrawal rate is simply the amount of money you’ll need to take from your retirement accounts each year to cover living expenses. Everyone’s number looks different:

Some retirees might only need $60,000 per year after tax.

Others might need $90,000 per year after tax.

The key is to determine your annual expenses first. Then consider:

Other income sources (Social Security, pensions, part-time work, rental income, etc.)

Tax impact (if pulling from pre-tax accounts, you’ll need to withdraw more than your net spending need to cover taxes).

For example, if you need $70,000 in after-tax spending money, you might need to withdraw closer to $75,000–$90,000 per year from your 401(k) or IRA to account for taxes.

Step 2: Don’t Forget About Inflation

Inflation is the silent eroder of retirement plans. Even if you’re comfortable living on $70,000 today, that number won’t stay static. If we assume a 3% inflation rate, here’s how that changes over time:

At age 65: $70,000

At age 80: $109,000

At age 90: $147,000

Expenses like healthcare, insurance, and groceries tend to rise faster than other categories, so it’s critical to build inflation adjustments into your plan.

Step 3: The Assumed Rate of Return

Once you retire, you move from accumulation mode (saving and investing) to distribution mode (spending down your assets). This shift raises important questions about asset allocation.

During accumulation years, you weren’t withdrawing, so market dips didn’t permanently hurt your portfolio.

In retirement, selling investments during downturns locks in losses, making it harder for your account to recover.

That’s why most retirees take at least one or two “step-downs” in portfolio risk when they stop working.

For most clients, a reasonable retirement assumption is 4%–6% annual returns, depending on risk tolerance.

Step 4: The Impact of Taxes

Taxes can make a significant difference in how long your retirement savings last.

If most of your money is in pre-tax accounts (401k, traditional IRA), you’ll need to gross up withdrawals to cover taxes.

Example: If you need $80,000 after tax, and your tax bill is $10,000, you’ll really need to withdraw $90,000 from your retirement accounts.

Now, if you have Social Security income or other sources, that reduces how much you need to pull from your investments.

Example:

Annual after-tax expenses: $80,000

Grossed-up for taxes: $90,000

Social Security provides: $30,000

Net needed from retirement accounts: $60,000 (indexed annually for inflation)

Scenarios: How Long Does $1 Million Last?

Now let’s put the numbers into action. Below are four scenarios that show how long a $1 million retirement portfolio lasts under different withdrawal rates. Each assumes:

Retirement age: 65

Beginning balance: $1,000,000

Inflation: 3% annually

Investment return: 5% annually

Scenario 1: Withdrawal Rate $40,000 Per Year

Assumptions:

Annual withdrawal: $40,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 36 years (until age 100).

Why not forever? Because inflation steadily raises the withdrawal amount. At age 80, withdrawals rise to $62,000/year. By age 90, they reach $83,000/year.

Math Note: For the duration math, while age 90 minus age 65 would be 35 years. We are also counting the first year age 65 all the way through age 90, which is technically 36 years. (Same for all scenarios below)

Scenario 2: Withdrawal Rate $50,000 Per Year

Assumptions:

Annual withdrawal: $50,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 26 years (until age 90).

By age 80, withdrawals grow to $77,000/year. By age 90, they reach $104,000/year.

Scenario 3: Withdrawal Rate $60,000 Per Year

Assumptions:

Annual withdrawal: $60,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 21 years (until age 85).

Scenario 4: Withdrawal Rate $80,000 Per Year

Assumptions:

Annual withdrawal: $80,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 15 years (until age 79).

Even if you bump the return to 6%, it only extends one more year to age 80. Higher withdrawals create a significant risk of outliving your money.

Final Thoughts

If you retire with $1 million, the answer to “How long will it last?” depends heavily on your withdrawal rate, inflation, taxes, and investment returns. A $40,000 withdrawal rate can potentially last through age 100, while a more aggressive $80,000 withdrawal rate may deplete funds before age 80.

The bottom line: Everyone’s situation is unique. Your lifestyle, income sources, tax situation, and risk tolerance will shape your plan. This is why working with a financial advisor is so important — to stress-test your retirement under different scenarios and give you peace of mind that your money will last as long as you do.

For more information on our fee based financial planning services to run your custom retirement projections, please visit our website.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is a safe withdrawal rate in retirement?

A commonly used guideline is the 4% rule, meaning you withdraw 4% of your starting balance each year, adjusted for inflation. However, personal factors—such as market performance, expenses, and longevity—should guide your specific rate.

How does inflation affect retirement spending?

Inflation steadily increases the cost of living, which raises how much you need to withdraw each year. At a 3% inflation rate, an annual $70,000 expense today could grow to over $100,000 within 15 years, reducing how long savings can last.

Why do investment returns matter so much in retirement?

Once you start taking withdrawals, poor market performance can have a lasting impact because you’re selling investments during downturns.

How do taxes impact retirement withdrawals?

Withdrawals from pre-tax accounts like traditional IRAs and 401(k)s are taxable, so you may need to take out more than your net spending needs. For instance, needing $80,000 after tax could require withdrawing around $90,000 or more before tax.

What can help make retirement savings last longer?

Strategies like moderating withdrawal rates, maintaining some stock exposure for growth, and factoring in Social Security or pension income can extend portfolio longevity. Regularly reviewing your plan helps ensure it stays aligned with your goals and spending needs.

The Risk of Outliving Your Retirement Savings

Living longer is a blessing, but it also means your savings must stretch further. Rising costs, inflation, and healthcare expenses can quietly erode your nest egg. This article explains how to stress-test your retirement plan to ensure your money lasts as long as you do.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When you imagine retirement, perhaps you see time with family, travel, golf, and more time for your hobbies. What many don’t realize is how two forces—longer lifespans and rising costs—can quietly erode your nest egg while you're still enjoying those moments. Living longer is a blessing, but it means your savings must stretch further. And inflation, especially for healthcare and long-term care, can quietly chip away at your financial comfort over the years. Let’s explore how these factors shape your retirement picture—and what you can do about it.

What you’ll learn in this article:

How life expectancy is evolving, and how it’s increasing the need for more retirement savings

The impact of inflation on a retiree's expenses over the long term

How inflation on specific items like healthcare and long-term care are running at much higher rates than the general rate of inflation

How retirees can test their retirement projections to ensure that they are properly accounting for inflation and life expectancy

How pensions can be both a blessing and a curse

1. Living Longer: A Good But Bad Thing

The Social Security life tables estimate that a 65-year-old male in 2025 is expected to live another 21.6 years (reaching about age 86.6), while a 65-year-old female can expect about 24.1 more years, extending to around 89.1 (ssa.gov).

That has consequences:

If a retiree spends $60,000 per year, a male might need 21.6 × $60,000 = $1,296,000 in total

A female might need 24.1 × $60,000 = $1,446,000

These totals—before considering inflation—highlight how long-term retirement can quickly become a multi-million-dollar endeavor.

2. Inflation: The Silent Retirement Thief

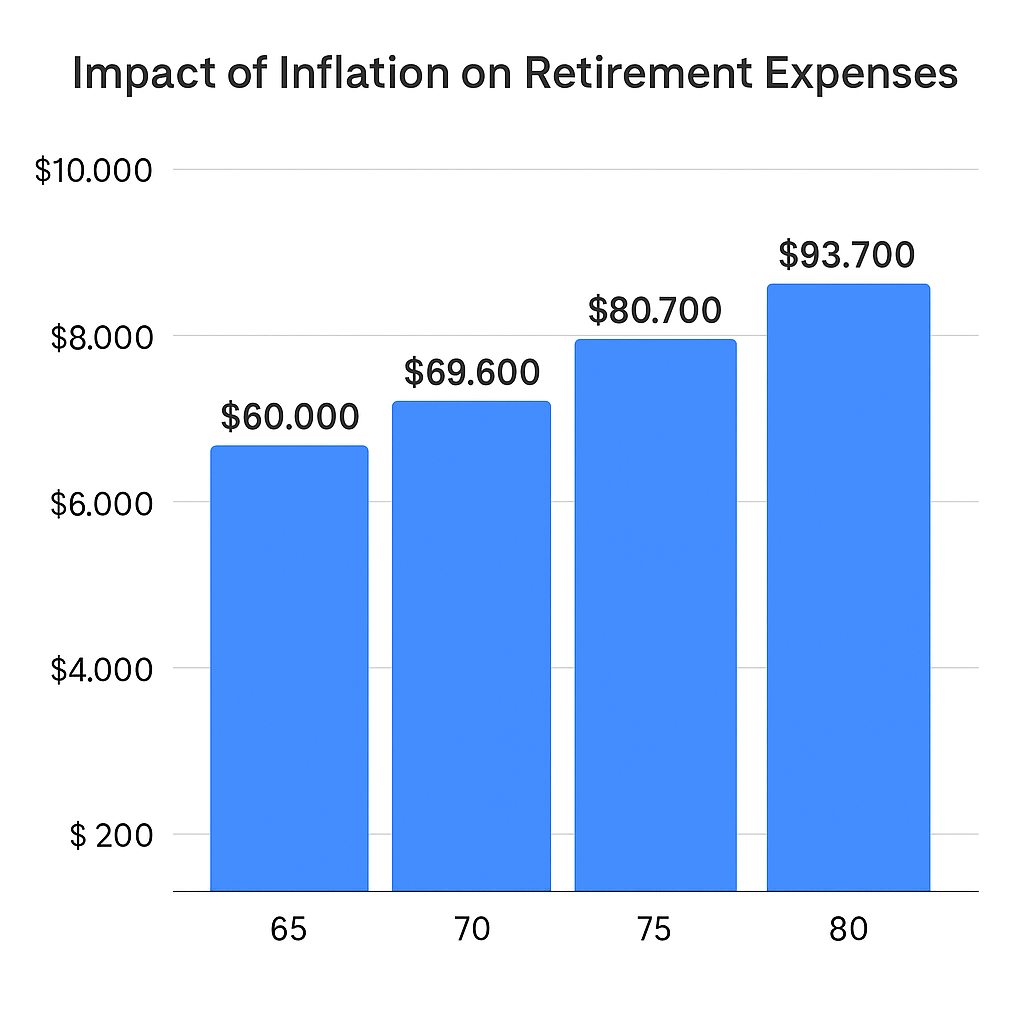

Inflation steadily erodes the real value of money. Over the past 20 years, average annual inflation has held near 3%. Let’s model how inflation reshapes $60,000 in annual after-tax expenses for a 65 year-old retiree over time with a 3% annual increase:

At age 80 (15 years after retirement):

$60,000 × (1.03)^15 ≈ $93,068 per yearAt age 90 (25 years after retirement):

$60,000 × (1.03)^25 ≈ $127,278 per year

In just the first 15 years, this retiree’s annual expenses increased by $33,068 per year, a 55% increase.

3. The Hidden Risk of Relying Too Much on Pensions

One of the most common places retirees feel this pinch is with pensions. Most pensions provide a fixed monthly amount that does not rise meaningfully with inflation. That can create a false sense of security in the early years of retirement.

Example:

A married couple has after-tax expenses of 70,000 per year.

They receive $50,000 from pensions and $30,000 from Social Security.

At retirement, their $80,000 of income in enough to meet their $70,000 in after-tax annual expenses.

Here’s the problem:

The $50,000 pension payment will not increase.

Their expenses, however, will rise with inflation. After 15 years at 3% inflation, those same expenses could total about $109,000 per year.

By then, their combined pension and Social Security will fall well short, forcing them to dip heavily into savings—or cut back their lifestyle.

This illustrates why failing to account for inflation often means retirees “feel fine” at first, only to face an unexpected shortfall 10–15 years later.

4. Healthcare & Long-term Care Expenses

While the general rise in expenses by 3% per year would seem challenging enough, there are two categories of expenses that have been rising by much more than 3% per year for the past decade: healthcare and long-term care. Since healthcare often becomes a large expense for individuals 65 year of age and older, it’s created additional pressure on the retirement funding gap.

Prescription drugs shot up nearly 40% over the past decade, outpacing overall inflation (~32.5%) (nypost.com).

Overall healthcare spending jumped 7.5% from 2022 to 2023, reaching $4.9 trillion—well above historical averages (healthsystemtracker.org).

In-home long-term care is also hefty—median rates for a home health aide have skyrocketed, with 24-hour care nearing $290,000 annually in some cases (wsj.com).

5. The Solution: Projections That Embrace Uncertainty

When retirement may stretch 20+ years, and inflation isn’t uniform across expense categories, guessing leads to risk. A projection-driven strategy helps you:

Model life expectancy: living until age 85 – 95 (depending on family longevity)

Incorporate general inflation (3%) on your expenses within your retirement projections

Determine if you have enough assets to retire comfortably

Whether your plan shows a wide cushion or flags a potential shortfall, you’ll make confident decisions—about savings, investments, expense reduction, or part-time work—instead of crossing your fingers.

6. Working with a Fee-Based Financial Planner Can Help

Here’s the bottom line: Living longer is wonderful, but it demands more planning in the retirement years as inflation, taxes, life expectancy, and long-term care risks continue to create larger funding gaps for retirees.

A fee-based financial planner can help you run personalized retirement projections, taking these variables into account—so you retire with confidence. And if the real world turns out kinder than your model, that's a bonus. If you would like to learn more about our fee-based retirement planning services, please feel free to visit our website at: Greenbush Financial Group – Financial Planning.

Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How does longer life expectancy affect retirement planning?

People are living well into their 80s and 90s, meaning retirement savings must cover 20–30 years or more. The longer you live, the more years your portfolio must fund, increasing the importance of conservative withdrawal rates and sustainable planning.

Why is inflation such a big risk for retirees?

Inflation steadily raises the cost of living, reducing the purchasing power of fixed income sources like pensions. Even at a modest 3% inflation rate, living expenses can rise more than 50% over 15 years, requiring larger withdrawals from savings.

How does inflation impact pensions and fixed income sources?

Most pensions don’t increase with inflation, so their purchasing power declines over time. A pension that comfortably covers expenses at retirement may fall short within 10–15 years as costs rise, forcing retirees to draw more from savings.

Why are healthcare and long-term care costs such a concern in retirement?

Healthcare and long-term care expenses have been increasing faster than general inflation. Costs for prescriptions, medical services, and in-home care can grow at 5–7% annually, putting additional strain on retirement savings.

How can retirees plan for inflation and longevity risk?

Running detailed retirement projections that factor in inflation, longer life expectancy, and varying rates of return helps reveal whether savings are sufficient. This approach allows retirees to make informed decisions about spending, investing, and lifestyle adjustments.

When should retirees work with a financial planner?

Consulting a fee-based financial planner early in the retirement planning process can help test different inflation and longevity scenarios. A planner can build customized projections and ensure your plan remains flexible as costs and life circumstances evolve.

How Much Money Will You Need to Retire Comfortably?

Retirement planning isn’t just about hitting a number. From withdrawal rates and inflation to taxes and investment returns, several factors determine if your savings will truly last. This article explores how to test your retirement projections and build a plan for financial security.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner who runs retirement projections on a daily basis, one of the most common questions I get is: “How much money do I need to retire?”

The answer may surprise you—because there’s no universal number. The amount you’ll need depends largely on one thing: your expenses.

In this article, we’ll walk through:

Why expenses are the biggest driver of how much you need to retire

How inflation impacts retirement spending

Why the type of account you own matters

The importance of factoring in all your income sources

A quick 60-second way to test your own retirement readiness

Expenses: The Biggest Driver

When you ask, “Can I retire comfortably?”, the first question to answer is: How much do you spend each year?

For example:

If your expenses are $40,000 per year, then $500,000 in retirement savings could potentially be enough—especially if you’re supplementing withdrawals with Social Security or a pension.

But if your expenses are $90,000 per year, that same $500,000 likely won’t stretch nearly as far.

Your retirement lifestyle drives your retirement savings need. Someone with modest expenses may not need millions to retire, while someone with higher spending will require significantly more.

Don’t Forget About Inflation

It’s not just today’s expenses you need to plan for—it’s tomorrow’s too. Inflation quietly eats away at your purchasing power, making your cost of living higher every single year.

Here’s an example:

At age 65, your expenses are $60,000 per year.

If expenses rise at 3% annually, by age 80 they’ll be roughly $93,700 per year.

That’s a 50% increase in just 15 years—and you’ll need your retirement assets to keep up.

This is one of the hardest factors for individuals to quantify without financial planning software. Inflation not only increases expenses, but it changes your withdrawal rate from investments, which can impact how long your money lasts.

The Type of Account Matters

Not all retirement accounts are created equal. The type of retirement/investment accounts you own has a big impact on whether you can retire comfortably.

Pre-tax accounts (401k, traditional IRA): Every dollar withdrawn is taxed as ordinary income. A $1,000,000 account might really be worth closer to $700,000 after taxes.

Roth accounts: Withdrawals are tax-free, making these extremely valuable in retirement.

After-tax brokerage accounts: Withdrawals often receive more favorable capital gains treatment, so the tax drag can be lighter compared to pre-tax accounts.

Cash: Offers liquidity but typically earns little return, making it best for short-term expenses.

In short: Roth and after-tax brokerage accounts often provide more after-tax value compared to pre-tax accounts.

Factor in All Your Income Sources

Getting a general idea of your retirement income picture is key. This means adding up:

Social Security benefits

Pensions

Investment income (dividends, interest, etc.)

Part-time income in retirement

Withdrawals from retirement accounts

Once you total these income sources, you’ll need to apply the tax impact. Only then can you compare your after-tax income against your after-tax expenses (adjusted for inflation each year) to see if there’s a gap.

This is exactly how financial planners build retirement projections to determine sustainability.

Find Out If You Can Retire in 60 Seconds

Curious if you’re on track? We’ve built a 60-second retirement check-up that can help you quickly see if you have enough to retire.

Bottom line: There’s no magic retirement number. The amount you need depends on your expenses, inflation, account types, and income sources. By running the numbers—and stress-testing them with a financial planner—you can gain the confidence to know whether you’re truly ready to retire comfortably.

Partner with a Fee-Based Financial Planner to Build Your Retirement Plan

While rules of thumb and calculators can provide a helpful starting point, everyone’s retirement picture looks different. Your income needs, lifestyle goals, and unique financial situation will ultimately determine how much you need to retire comfortably.

Working with a fee-based financial planner can help take the guesswork out of retirement planning. A planner will create a customized strategy that factors in your retirement expenses, investments, Social Security, healthcare, and tax planning—so you know exactly where you stand and what adjustments to make.

If you’d like to explore your own numbers and build a retirement roadmap, we’d love to help. Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How much money do I need to retire?

There’s no single number that fits everyone—the right amount depends primarily on your annual expenses, lifestyle, and income sources. A retiree spending $40,000 per year will need far less savings than someone spending $90,000.

Why are expenses the most important factor in retirement planning?

Your spending habits determine how much income your portfolio must generate. Knowing your annual expenses helps estimate your withdrawal needs, which directly drives how large your retirement savings must be.

How does inflation affect retirement spending?

Inflation gradually increases the cost of living, reducing the purchasing power of your money. At a 3% inflation rate, $60,000 in annual expenses today could rise to about $94,000 in 15 years, meaning your savings must grow to keep pace.

How does the type of retirement account impact how much you need to save?

Withdrawals from pre-tax accounts like 401(k)s and traditional IRAs are taxable, so you may need to save more to cover taxes. Roth IRAs and brokerage accounts often provide more after-tax value, since withdrawals may be tax-free or taxed at lower rates.

What income sources should I include when estimating retirement readiness?

Include all sources such as Social Security, pensions, dividends, part-time income, and withdrawals from savings. Comparing your total after-tax income against your inflation-adjusted expenses helps reveal whether you’re financially ready to retire.

How can I quickly estimate if I’m on track for retirement?

A simple way is to compare your projected annual expenses (adjusted for inflation) with your expected retirement income. Working with a fee-based financial planner can oftern provide a more comprehensive approach to answering the question “Do I have enough to retire?”

Understanding Self-Employment Tax: A Guide for the Newly Self-Employed

Self-employment taxes can catch new business owners off guard. Our step-by-step guide explains the 15.3% tax rate, quarterly deadlines, and strategies to avoid costly mistakes.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Becoming self-employed can be one of the most rewarding career moves you’ll ever make. It comes with flexibility, independence, and the ability to control your own destiny. But it also comes with new responsibilities—particularly when it comes to taxes. One of the first financial hurdles new business owners encounter is understanding self-employment tax and how to keep up with their tax obligations throughout the year.

For business owners learning these rules for the first time, here is the step-by-step breakdown of what you need to know.

What Is Self-Employment Tax?

When you work as an employee and receive a W-2, your employer withholds Social Security and Medicare taxes from your paycheck. What many don’t realize is that your employer is paying half of those taxes on your behalf.

When you’re self-employed, however, you are both the employer and the employee. That means you’re responsible for the full 15.3% self-employment tax (12.4% for Social Security and 2.9% for Medicare) on your net earnings. If your income is above certain thresholds, an additional 0.9% Medicare surtax may apply.

This tax is in addition to federal and state income taxes, which makes planning ahead critical.

Estimated Tax Payments and Deadlines

Unlike W-2 employees, there’s no paycheck system automatically sending taxes to the government for you. The IRS expects you to make quarterly estimated tax payments. These payments cover both your income tax liability and your self-employment tax.

The deadlines for estimated tax payments are:

April 15 – for income earned January 1 through March 31

June 15 – for income earned April 1 through May 31

September 15 – for income earned June 1 through August 31

January 15 (of the following year) – for income earned September 1 through December 31

If the due date falls on a weekend or holiday, the deadline shifts to the next business day.

How Are Estimated Taxes Calculated?

The IRS gives you two main methods for calculating estimated taxes, sometimes called the “safe harbor” rules:

Prior-Year Method (110% Rule)

If your adjusted gross income was more than $150,000 in the previous year (or $75,000 if single), you can avoid penalties by paying 110% of your prior year’s total tax liability in equal quarterly installments.

If your income was below those thresholds, the requirement is 100% of your prior year’s tax liability.

Current-Year Method

Alternatively, you can calculate your actual expected tax liability for the current year and make payments to cover 90% of that amount.

What Happens If You Don’t Pay Estimated Taxes?

Failing to make estimated tax payments can lead to IRS penalties. These are generally underpayment penalties, calculated based on the amount you should have paid each quarter compared to what you actually paid.

In addition to penalties, you’ll still owe the unpaid taxes at year-end. This often creates a cash flow crisis for new self-employed individuals who didn’t set money aside during the year.

The IRS does offer some relief if:

You owe less than $1,000 in tax after subtracting withholding and credits, or

You paid at least 90% of your current-year tax liability (or 100%/110% of your prior year’s tax liability, depending on income).

Still, the safest strategy is to set aside a portion of each payment you receive for taxes and make your estimated payments on time.

How IRS Penalties Are Calculated?

The IRS calculates underpayment penalties using two key components:

Amount of Underpayment – The penalty is based on how much you should have paid each quarter versus how much you actually paid.

Time Period of Underpayment – The penalty is essentially interest charged on the shortfall, starting from the due date of the missed payment until the date you make it.

The interest rate used is tied to the federal short-term interest rate plus 3%. This rate changes quarterly, so the penalty amount can vary depending on when the shortfall occurred.

For example:

If you owed $4,000 in estimated payments for a quarter but only paid $2,000, the IRS considers the $2,000 shortfall late.

Interest is charged daily on the unpaid portion until you make up the difference or file your return.

While penalties may seem small at first, they add up quickly—especially if you consistently underpay throughout the year.

Why Taxes Become More Complex When You’re Self-Employed

For most W-2 employees, tax filing is relatively straightforward—gather a W-2 or two, maybe add a few deductions, and you’re done. For the self-employed, the process quickly becomes more involved:

Tracking business expenses for deductions (supplies, mileage, home office, etc.).

Paying both sides of Social Security and Medicare taxes.

Dealing with quarterly estimated payments.

Understanding rules around depreciation, retirement plan contributions, and health insurance deductions.

Because of these added layers, we strongly recommend engaging an experienced accounting firm or tax professional, especially in your first few years. This not only ensures compliance but also frees up your time to focus on building your business instead of spending evenings trying to interpret the tax code.

Final Thoughts

Transitioning from employee to self-employed entrepreneur comes with an exciting new level of independence—but it also requires discipline. Understanding self-employment tax, staying on top of quarterly estimated payments, and planning ahead for income tax can help you avoid costly surprises at year-end.

Working with a qualified tax professional or financial planner can help you estimate payments accurately, maximize deductions, and keep your business finances running smoothly.

Remember: as a self-employed individual, you are your own payroll department. Treating taxes like a regular business expense is the best way to stay ahead and protect your financial success.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is self-employment tax, and who has to pay it?

Self-employment tax covers both the employee and employer portions of Social Security and Medicare taxes, totaling 15.3%. Anyone earning $400 or more in net self-employment income must generally pay this tax, in addition to regular income taxes.

How often do self-employed individuals have to pay taxes?

The IRS requires quarterly estimated tax payments to cover both income and self-employment taxes. Payments are typically due April 15, June 15, September 15, and January 15 of the following year.

How can I calculate my estimated tax payments?

You can use the “safe harbor” rules: pay 100% of your prior year’s tax liability (110% if your income was over $150,000) or 90% of your current year’s expected tax liability. These methods help avoid IRS underpayment penalties.

What happens if I don’t make estimated tax payments?

Missing payments or underpaying can result in IRS penalties and interest, calculated based on how much you underpaid and for how long. Even if penalties apply, you’ll still owe the unpaid taxes at year-end.

How are IRS penalties for underpayment calculated?

Penalties function like interest, accruing daily on any shortfall from the payment due date until it’s paid. The rate is the federal short-term interest rate plus 3%, adjusted quarterly.

Why is tax planning more complex for self-employed individuals?

Self-employed taxpayers must track deductible expenses, manage quarterly payments, pay both sides of payroll taxes, and navigate complex deductions like home office or retirement contributions. Professional guidance can simplify compliance and help maximize deductions.

What’s the best way to stay on top of taxes when self-employed?

Set aside a portion of every payment you receive for taxes, make quarterly estimated payments on time, and work with a tax professional to stay compliant. Treating taxes as a regular business expense helps prevent surprises at year-end.