If You Retire With $1 Million, How Long Will It Last?

Is $1 million enough to retire? The answer depends on withdrawal rates, inflation, investment returns, and taxes. This article walks through different scenarios to show how long $1 million can last and what retirees should consider in their planning.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Retirement planning often circles around one big question: If I save $1 million, how long will it last once I stop working? The answer isn’t one-size-fits-all. It depends on a handful of key factors, including:

Your annual withdrawal rate

Inflation (the rising cost of goods and services over time)

Your assumed investment rate of return

Taxes (especially if most of your money is in pre-tax retirement accounts)

In this article, we’ll walk through each of these factors and then run the numbers on a few different scenarios. By the end, you’ll have a much clearer idea of how far $1 million can take you in retirement.

Step 1: Determining Your Withdrawal Rate

Your withdrawal rate is simply the amount of money you’ll need to take from your retirement accounts each year to cover living expenses. Everyone’s number looks different:

Some retirees might only need $60,000 per year after tax.

Others might need $90,000 per year after tax.

The key is to determine your annual expenses first. Then consider:

Other income sources (Social Security, pensions, part-time work, rental income, etc.)

Tax impact (if pulling from pre-tax accounts, you’ll need to withdraw more than your net spending need to cover taxes).

For example, if you need $70,000 in after-tax spending money, you might need to withdraw closer to $75,000–$90,000 per year from your 401(k) or IRA to account for taxes.

Step 2: Don’t Forget About Inflation

Inflation is the silent eroder of retirement plans. Even if you’re comfortable living on $70,000 today, that number won’t stay static. If we assume a 3% inflation rate, here’s how that changes over time:

At age 65: $70,000

At age 80: $109,000

At age 90: $147,000

Expenses like healthcare, insurance, and groceries tend to rise faster than other categories, so it’s critical to build inflation adjustments into your plan.

Step 3: The Assumed Rate of Return

Once you retire, you move from accumulation mode (saving and investing) to distribution mode (spending down your assets). This shift raises important questions about asset allocation.

During accumulation years, you weren’t withdrawing, so market dips didn’t permanently hurt your portfolio.

In retirement, selling investments during downturns locks in losses, making it harder for your account to recover.

That’s why most retirees take at least one or two “step-downs” in portfolio risk when they stop working.

For most clients, a reasonable retirement assumption is 4%–6% annual returns, depending on risk tolerance.

Step 4: The Impact of Taxes

Taxes can make a significant difference in how long your retirement savings last.

If most of your money is in pre-tax accounts (401k, traditional IRA), you’ll need to gross up withdrawals to cover taxes.

Example: If you need $80,000 after tax, and your tax bill is $10,000, you’ll really need to withdraw $90,000 from your retirement accounts.

Now, if you have Social Security income or other sources, that reduces how much you need to pull from your investments.

Example:

Annual after-tax expenses: $80,000

Grossed-up for taxes: $90,000

Social Security provides: $30,000

Net needed from retirement accounts: $60,000 (indexed annually for inflation)

Scenarios: How Long Does $1 Million Last?

Now let’s put the numbers into action. Below are four scenarios that show how long a $1 million retirement portfolio lasts under different withdrawal rates. Each assumes:

Retirement age: 65

Beginning balance: $1,000,000

Inflation: 3% annually

Investment return: 5% annually

Scenario 1: Withdrawal Rate $40,000 Per Year

Assumptions:

Annual withdrawal: $40,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 36 years (until age 100).

Why not forever? Because inflation steadily raises the withdrawal amount. At age 80, withdrawals rise to $62,000/year. By age 90, they reach $83,000/year.

Math Note: For the duration math, while age 90 minus age 65 would be 35 years. We are also counting the first year age 65 all the way through age 90, which is technically 36 years. (Same for all scenarios below)

Scenario 2: Withdrawal Rate $50,000 Per Year

Assumptions:

Annual withdrawal: $50,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 26 years (until age 90).

By age 80, withdrawals grow to $77,000/year. By age 90, they reach $104,000/year.

Scenario 3: Withdrawal Rate $60,000 Per Year

Assumptions:

Annual withdrawal: $60,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 21 years (until age 85).

Scenario 4: Withdrawal Rate $80,000 Per Year

Assumptions:

Annual withdrawal: $80,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 15 years (until age 79).

Even if you bump the return to 6%, it only extends one more year to age 80. Higher withdrawals create a significant risk of outliving your money.

Final Thoughts

If you retire with $1 million, the answer to “How long will it last?” depends heavily on your withdrawal rate, inflation, taxes, and investment returns. A $40,000 withdrawal rate can potentially last through age 100, while a more aggressive $80,000 withdrawal rate may deplete funds before age 80.

The bottom line: Everyone’s situation is unique. Your lifestyle, income sources, tax situation, and risk tolerance will shape your plan. This is why working with a financial advisor is so important — to stress-test your retirement under different scenarios and give you peace of mind that your money will last as long as you do.

For more information on our fee based financial planning services to run your custom retirement projections, please visit our website.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is a safe withdrawal rate in retirement?

A commonly used guideline is the 4% rule, meaning you withdraw 4% of your starting balance each year, adjusted for inflation. However, personal factors—such as market performance, expenses, and longevity—should guide your specific rate.

How does inflation affect retirement spending?

Inflation steadily increases the cost of living, which raises how much you need to withdraw each year. At a 3% inflation rate, an annual $70,000 expense today could grow to over $100,000 within 15 years, reducing how long savings can last.

Why do investment returns matter so much in retirement?

Once you start taking withdrawals, poor market performance can have a lasting impact because you’re selling investments during downturns.

How do taxes impact retirement withdrawals?

Withdrawals from pre-tax accounts like traditional IRAs and 401(k)s are taxable, so you may need to take out more than your net spending needs. For instance, needing $80,000 after tax could require withdrawing around $90,000 or more before tax.

What can help make retirement savings last longer?

Strategies like moderating withdrawal rates, maintaining some stock exposure for growth, and factoring in Social Security or pension income can extend portfolio longevity. Regularly reviewing your plan helps ensure it stays aligned with your goals and spending needs.

The Risk of Outliving Your Retirement Savings

Living longer is a blessing, but it also means your savings must stretch further. Rising costs, inflation, and healthcare expenses can quietly erode your nest egg. This article explains how to stress-test your retirement plan to ensure your money lasts as long as you do.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When you imagine retirement, perhaps you see time with family, travel, golf, and more time for your hobbies. What many don’t realize is how two forces—longer lifespans and rising costs—can quietly erode your nest egg while you're still enjoying those moments. Living longer is a blessing, but it means your savings must stretch further. And inflation, especially for healthcare and long-term care, can quietly chip away at your financial comfort over the years. Let’s explore how these factors shape your retirement picture—and what you can do about it.

What you’ll learn in this article:

How life expectancy is evolving, and how it’s increasing the need for more retirement savings

The impact of inflation on a retiree's expenses over the long term

How inflation on specific items like healthcare and long-term care are running at much higher rates than the general rate of inflation

How retirees can test their retirement projections to ensure that they are properly accounting for inflation and life expectancy

How pensions can be both a blessing and a curse

1. Living Longer: A Good But Bad Thing

The Social Security life tables estimate that a 65-year-old male in 2025 is expected to live another 21.6 years (reaching about age 86.6), while a 65-year-old female can expect about 24.1 more years, extending to around 89.1 (ssa.gov).

That has consequences:

If a retiree spends $60,000 per year, a male might need 21.6 × $60,000 = $1,296,000 in total

A female might need 24.1 × $60,000 = $1,446,000

These totals—before considering inflation—highlight how long-term retirement can quickly become a multi-million-dollar endeavor.

2. Inflation: The Silent Retirement Thief

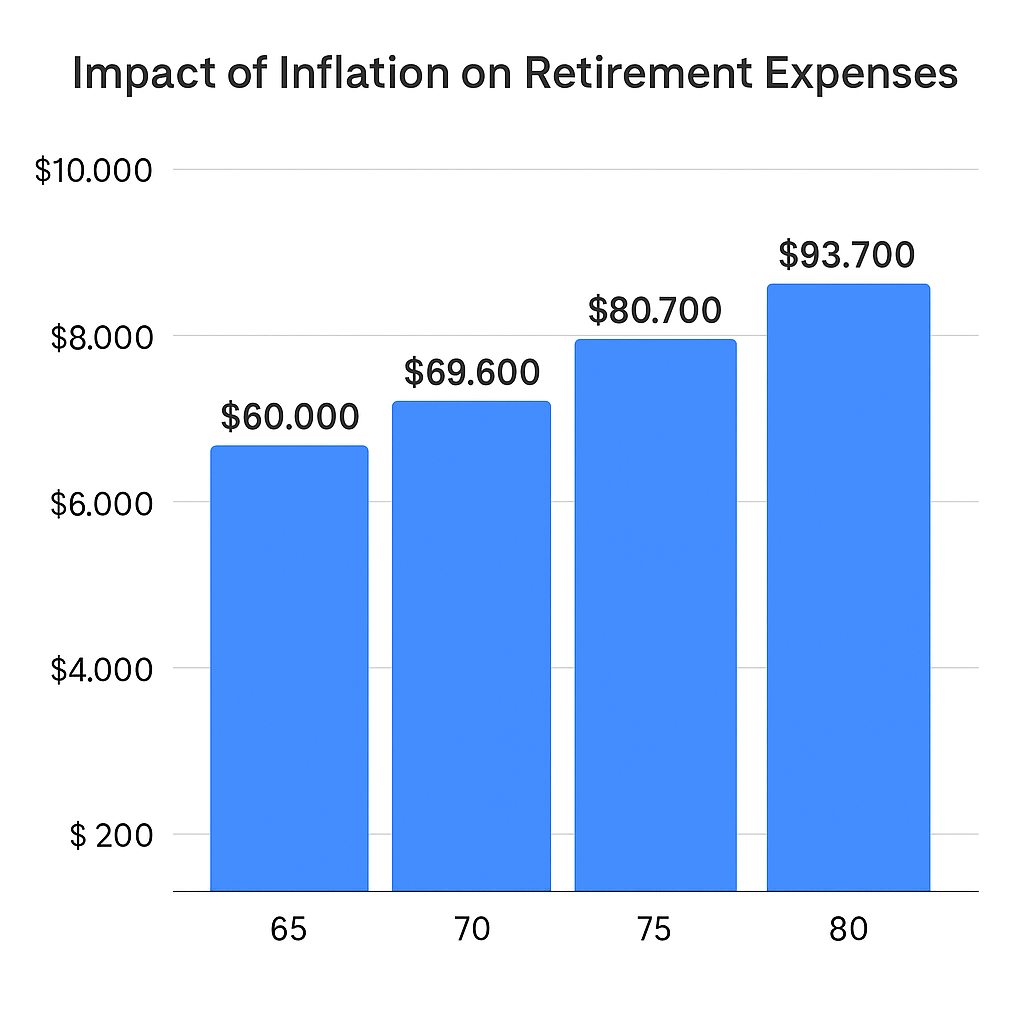

Inflation steadily erodes the real value of money. Over the past 20 years, average annual inflation has held near 3%. Let’s model how inflation reshapes $60,000 in annual after-tax expenses for a 65 year-old retiree over time with a 3% annual increase:

At age 80 (15 years after retirement):

$60,000 × (1.03)^15 ≈ $93,068 per yearAt age 90 (25 years after retirement):

$60,000 × (1.03)^25 ≈ $127,278 per year

In just the first 15 years, this retiree’s annual expenses increased by $33,068 per year, a 55% increase.

3. The Hidden Risk of Relying Too Much on Pensions

One of the most common places retirees feel this pinch is with pensions. Most pensions provide a fixed monthly amount that does not rise meaningfully with inflation. That can create a false sense of security in the early years of retirement.

Example:

A married couple has after-tax expenses of 70,000 per year.

They receive $50,000 from pensions and $30,000 from Social Security.

At retirement, their $80,000 of income in enough to meet their $70,000 in after-tax annual expenses.

Here’s the problem:

The $50,000 pension payment will not increase.

Their expenses, however, will rise with inflation. After 15 years at 3% inflation, those same expenses could total about $109,000 per year.

By then, their combined pension and Social Security will fall well short, forcing them to dip heavily into savings—or cut back their lifestyle.

This illustrates why failing to account for inflation often means retirees “feel fine” at first, only to face an unexpected shortfall 10–15 years later.

4. Healthcare & Long-term Care Expenses

While the general rise in expenses by 3% per year would seem challenging enough, there are two categories of expenses that have been rising by much more than 3% per year for the past decade: healthcare and long-term care. Since healthcare often becomes a large expense for individuals 65 year of age and older, it’s created additional pressure on the retirement funding gap.

Prescription drugs shot up nearly 40% over the past decade, outpacing overall inflation (~32.5%) (nypost.com).

Overall healthcare spending jumped 7.5% from 2022 to 2023, reaching $4.9 trillion—well above historical averages (healthsystemtracker.org).

In-home long-term care is also hefty—median rates for a home health aide have skyrocketed, with 24-hour care nearing $290,000 annually in some cases (wsj.com).

5. The Solution: Projections That Embrace Uncertainty

When retirement may stretch 20+ years, and inflation isn’t uniform across expense categories, guessing leads to risk. A projection-driven strategy helps you:

Model life expectancy: living until age 85 – 95 (depending on family longevity)

Incorporate general inflation (3%) on your expenses within your retirement projections

Determine if you have enough assets to retire comfortably

Whether your plan shows a wide cushion or flags a potential shortfall, you’ll make confident decisions—about savings, investments, expense reduction, or part-time work—instead of crossing your fingers.

6. Working with a Fee-Based Financial Planner Can Help

Here’s the bottom line: Living longer is wonderful, but it demands more planning in the retirement years as inflation, taxes, life expectancy, and long-term care risks continue to create larger funding gaps for retirees.

A fee-based financial planner can help you run personalized retirement projections, taking these variables into account—so you retire with confidence. And if the real world turns out kinder than your model, that's a bonus. If you would like to learn more about our fee-based retirement planning services, please feel free to visit our website at: Greenbush Financial Group – Financial Planning.

Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How does longer life expectancy affect retirement planning?

People are living well into their 80s and 90s, meaning retirement savings must cover 20–30 years or more. The longer you live, the more years your portfolio must fund, increasing the importance of conservative withdrawal rates and sustainable planning.

Why is inflation such a big risk for retirees?

Inflation steadily raises the cost of living, reducing the purchasing power of fixed income sources like pensions. Even at a modest 3% inflation rate, living expenses can rise more than 50% over 15 years, requiring larger withdrawals from savings.

How does inflation impact pensions and fixed income sources?

Most pensions don’t increase with inflation, so their purchasing power declines over time. A pension that comfortably covers expenses at retirement may fall short within 10–15 years as costs rise, forcing retirees to draw more from savings.

Why are healthcare and long-term care costs such a concern in retirement?

Healthcare and long-term care expenses have been increasing faster than general inflation. Costs for prescriptions, medical services, and in-home care can grow at 5–7% annually, putting additional strain on retirement savings.

How can retirees plan for inflation and longevity risk?

Running detailed retirement projections that factor in inflation, longer life expectancy, and varying rates of return helps reveal whether savings are sufficient. This approach allows retirees to make informed decisions about spending, investing, and lifestyle adjustments.

When should retirees work with a financial planner?

Consulting a fee-based financial planner early in the retirement planning process can help test different inflation and longevity scenarios. A planner can build customized projections and ensure your plan remains flexible as costs and life circumstances evolve.

How Much Money Will You Need to Retire Comfortably?

Retirement planning isn’t just about hitting a number. From withdrawal rates and inflation to taxes and investment returns, several factors determine if your savings will truly last. This article explores how to test your retirement projections and build a plan for financial security.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner who runs retirement projections on a daily basis, one of the most common questions I get is: “How much money do I need to retire?”

The answer may surprise you—because there’s no universal number. The amount you’ll need depends largely on one thing: your expenses.

In this article, we’ll walk through:

Why expenses are the biggest driver of how much you need to retire

How inflation impacts retirement spending

Why the type of account you own matters

The importance of factoring in all your income sources

A quick 60-second way to test your own retirement readiness

Expenses: The Biggest Driver

When you ask, “Can I retire comfortably?”, the first question to answer is: How much do you spend each year?

For example:

If your expenses are $40,000 per year, then $500,000 in retirement savings could potentially be enough—especially if you’re supplementing withdrawals with Social Security or a pension.

But if your expenses are $90,000 per year, that same $500,000 likely won’t stretch nearly as far.

Your retirement lifestyle drives your retirement savings need. Someone with modest expenses may not need millions to retire, while someone with higher spending will require significantly more.

Don’t Forget About Inflation

It’s not just today’s expenses you need to plan for—it’s tomorrow’s too. Inflation quietly eats away at your purchasing power, making your cost of living higher every single year.

Here’s an example:

At age 65, your expenses are $60,000 per year.

If expenses rise at 3% annually, by age 80 they’ll be roughly $93,700 per year.

That’s a 50% increase in just 15 years—and you’ll need your retirement assets to keep up.

This is one of the hardest factors for individuals to quantify without financial planning software. Inflation not only increases expenses, but it changes your withdrawal rate from investments, which can impact how long your money lasts.

The Type of Account Matters

Not all retirement accounts are created equal. The type of retirement/investment accounts you own has a big impact on whether you can retire comfortably.

Pre-tax accounts (401k, traditional IRA): Every dollar withdrawn is taxed as ordinary income. A $1,000,000 account might really be worth closer to $700,000 after taxes.

Roth accounts: Withdrawals are tax-free, making these extremely valuable in retirement.

After-tax brokerage accounts: Withdrawals often receive more favorable capital gains treatment, so the tax drag can be lighter compared to pre-tax accounts.

Cash: Offers liquidity but typically earns little return, making it best for short-term expenses.

In short: Roth and after-tax brokerage accounts often provide more after-tax value compared to pre-tax accounts.

Factor in All Your Income Sources

Getting a general idea of your retirement income picture is key. This means adding up:

Social Security benefits

Pensions

Investment income (dividends, interest, etc.)

Part-time income in retirement

Withdrawals from retirement accounts

Once you total these income sources, you’ll need to apply the tax impact. Only then can you compare your after-tax income against your after-tax expenses (adjusted for inflation each year) to see if there’s a gap.

This is exactly how financial planners build retirement projections to determine sustainability.

Find Out If You Can Retire in 60 Seconds

Curious if you’re on track? We’ve built a 60-second retirement check-up that can help you quickly see if you have enough to retire.

Bottom line: There’s no magic retirement number. The amount you need depends on your expenses, inflation, account types, and income sources. By running the numbers—and stress-testing them with a financial planner—you can gain the confidence to know whether you’re truly ready to retire comfortably.

Partner with a Fee-Based Financial Planner to Build Your Retirement Plan

While rules of thumb and calculators can provide a helpful starting point, everyone’s retirement picture looks different. Your income needs, lifestyle goals, and unique financial situation will ultimately determine how much you need to retire comfortably.

Working with a fee-based financial planner can help take the guesswork out of retirement planning. A planner will create a customized strategy that factors in your retirement expenses, investments, Social Security, healthcare, and tax planning—so you know exactly where you stand and what adjustments to make.

If you’d like to explore your own numbers and build a retirement roadmap, we’d love to help. Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How much money do I need to retire?

There’s no single number that fits everyone—the right amount depends primarily on your annual expenses, lifestyle, and income sources. A retiree spending $40,000 per year will need far less savings than someone spending $90,000.

Why are expenses the most important factor in retirement planning?

Your spending habits determine how much income your portfolio must generate. Knowing your annual expenses helps estimate your withdrawal needs, which directly drives how large your retirement savings must be.

How does inflation affect retirement spending?

Inflation gradually increases the cost of living, reducing the purchasing power of your money. At a 3% inflation rate, $60,000 in annual expenses today could rise to about $94,000 in 15 years, meaning your savings must grow to keep pace.

How does the type of retirement account impact how much you need to save?

Withdrawals from pre-tax accounts like 401(k)s and traditional IRAs are taxable, so you may need to save more to cover taxes. Roth IRAs and brokerage accounts often provide more after-tax value, since withdrawals may be tax-free or taxed at lower rates.

What income sources should I include when estimating retirement readiness?

Include all sources such as Social Security, pensions, dividends, part-time income, and withdrawals from savings. Comparing your total after-tax income against your inflation-adjusted expenses helps reveal whether you’re financially ready to retire.

How can I quickly estimate if I’m on track for retirement?

A simple way is to compare your projected annual expenses (adjusted for inflation) with your expected retirement income. Working with a fee-based financial planner can oftern provide a more comprehensive approach to answering the question “Do I have enough to retire?”

401(k) Catch-Up Contribution FAQs: Your Top Questions Answered (2025 Rules)

Got questions about 401(k) catch-up contributions? You’re not alone. With updated 2025 limits and new Roth rules on the horizon, this article answers the most common questions about who qualifies, how much you can contribute, and what strategic moves to consider in your 50s and early 60s.

As retirement gets closer, many individuals start to wonder how they can supercharge their savings and make up for lost time. For those age 50 and older, catch-up contributions offer a powerful opportunity to contribute more to retirement accounts beyond the standard annual limits. Below, I’ve addressed some of the most common questions I get from clients about catch-up contributions, especially with the updated 2025 rules in play.

Can I make catch-up contributions if I’m working part-time in retirement?

Yes, as long as you have earned income from a job, and you have met the plan’s eligibility requirements. So, even if you’ve scaled back your hours or semi-retired, you may still be eligible to make additional contributions.

For example, if you're age 65 and working part-time and eligible for your company’s 401(k) plan, you can contribute up to $23,500, plus an extra $7,500 in catch-up contributions for a total of $31,000 in 2025, assuming you have at least $31,000 in W2 compensation.

If you have less than $31,000 in W2 comp, you will be capped by the lesser of the annual contribution limit or 100% of your W2 compensation.

Are Roth catch-up contributions allowed?

Yes. If your employer plan offers a Roth option, you can choose to make your catch-up contributions as Roth dollars. This means you contribute after-tax money now and take qualified distributions tax-free in retirement.

This option is popular for individuals who are in the same tax bracket now as they plan to be in retirement. The Roth source also avoids required minimum distributions (RMDs) starting at age 73 or 75.

How do catch-up contributions impact required minimum distributions (RMDs)?

Catch-up contributions themselves don’t change the timing or calculation of RMDs. However, where you put the catch-up dollars can affect your future RMDs. If you contribute catch-up dollars to a Roth 401(k) and then roll over the balance to a Roth IRA prior to the RMD start age, RMDs are not required.

Adding more to the pre-tax employee deferral source within the plan may increase your future RMD requirement since pre-tax retirement accounts are subject to the annual RMD requirement once you reach age 73 (for those born 1951–1959) or 75 (for those born 1960 or later).

Should I prioritize catch-up contributions or pay down my mortgage?

This depends on your interest rate, your retirement timeline, tax bracket, and your overall financial goals. Generally, if your mortgage interest rate is below 4% and you’re behind on retirement savings, catch-up contributions may be a better use of your idle cash, especially if your investments are growing tax-deferred (pre-tax) or tax-free (roth).

However, if you’re already on track for retirement and the psychological benefit of being debt-free is important to you, putting extra cash toward your mortgage can make sense. It’s all about balancing the right financial decision with your personal preferences.

What happens if I forget to update my payroll deferrals after turning 50?

Unfortunately, you won’t automatically get the benefit since your employer’s payroll system won’t adjust your contributions just because you had a birthday. You need to take action and manually increase your deferrals to take advantage of the higher limits.

For example, if you turn 50 this year and forget to bump your 401(k) deferrals, you may miss out on contributing an additional $7,500. Worse yet, once the calendar year closes, you can't go back and make up for it.

Are there additional tax benefits associated with making catch-up contributions?

It’s common that the years leading up to retirement are often the highest income years for an individual. The additional pre-tax contributions associated with the catch-up contribution allow employees to take more of their income off the table during the peak income years and shift it into the retirement years, when ideally they are in a lower tax bracket.

What is the new age 60 – 63 catch-up contribution?

Starting in 2025, there is a new enhanced catch-up contribution available to employees covered by 401(k) and 403(b) plans who are aged 60 to 63. Instead of being limited to just the regular $7,500 catch-up contribution, in 2025, employees age 60 – 63 will be allowed to make a catch-up contribution equal to $11,250.

What is the Mandatory Roth catch-up for high income earners?

Starting in 2026, and for the following years, if an employee makes more than $145,000 in W2 compensation (indexed for inflation) with the same employer in the previous year, that employee will no longer be allowed to make pre-tax catch-up contributions. If they make a catch-up contribution, it will be required to be a Roth catch-up contribution.

Final Thoughts…

Whether you’re still decades from retirement or just a few years away, catch-up contributions are a crucial part of retirement planning for those age 50 and older. With the 2025 limits now in place and Roth rules continuing to evolve, understanding how these contributions fit into your broader plan can help you save smarter — and avoid costly mistakes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are catch-up contributions and who qualifies for them?

Catch-up contributions allow individuals age 50 and older to contribute additional funds to retirement accounts beyond the standard annual limits. For 2025, employees can contribute up to $23,500 to a 401(k) plus an extra $7,500 in catch-up contributions, for a total of $31,000 — provided they have sufficient earned income.

Can part-time workers make catch-up contributions?

Yes. As long as you have earned income and meet your employer plan’s eligibility requirements, you can make catch-up contributions even if you’re working part-time. The total contribution amount cannot exceed 100% of your W-2 compensation.

Are Roth catch-up contributions available?

If your employer plan offers a Roth option, you can make your catch-up contributions as Roth dollars. Roth contributions are made after tax, grow tax-free, and qualified withdrawals are also tax-free, offering flexibility for future tax planning.

How do catch-up contributions affect required minimum distributions (RMDs)?

Catch-up contributions do not change when RMDs begin, but the type of account matters. Pre-tax catch-up dollars increase your future RMDs, while Roth 401(k) contributions can be rolled into a Roth IRA before RMD age to avoid mandatory withdrawals altogether.

Should I prioritize catch-up contributions or pay down my mortgage?

It depends on your financial situation. If your mortgage rate is low (under 4%) and you’re behind on retirement savings, maximizing catch-up contributions may be beneficial. However, paying down your mortgage may make sense if you’re already on track for retirement and value being debt-free or if you have a higher interest rate on your mortgage.

What happens if I forget to increase my deferrals after turning 50?

Your employer’s payroll system won’t automatically adjust contributions, so you must update them manually. Missing the adjustment means forfeiting that year’s extra contribution opportunity — once the year ends, you can’t retroactively make up the difference.

What is the new enhanced age 60–63 catch-up contribution for 2025?

Starting in 2025, employees aged 60 to 63 can make a larger catch-up contribution of up to $11,250 to 401(k) and 403(b) plans, providing an additional savings boost in the final years before retirement.

What is the new rule for high-income earners and Roth catch-ups?

Beginning in 2026, employees earning more than $145,000 (indexed for inflation) in W-2 income with the same employer will be required to make catch-up contributions as Roth contributions — pre-tax catch-ups will no longer be allowed for this group.

401(k) Catch-Up Contributions Explained: Maximize Your Retirement Savings in 2025

Turning 50? It’s time to boost your retirement savings.

This article breaks down the updated 2025 401(k) catch-up contribution limits, new rules for ages 60–63, and whether pre-tax or Roth contributions make the most sense for your situation.

For individuals aged 50 or older, catch-up contributions allow for additional retirement savings during what are often their highest earning years. With updated limits and new provisions taking effect in 2025, this strategy can be especially valuable for those looking to strengthen their financial position ahead of retirement and maximize tax efficiency in what are typically their highest income years leading up to retirement.

Below, I break down the 2025 catch-up contribution limits, rules, and strategic considerations to help you make informed decisions.

What Are Catch-Up Contributions?

Catch-up contributions allow individuals aged 50 or older to contribute above the standard annual limits to retirement accounts. You’re eligible to make catch-up contributions starting in the calendar year you turn 50.

2025 Contribution Limits

Here are the updated 2025 401(k) contribution limits for each plan type:

401(k), 403(b), 457(b):

Standard limit: $23,500

Age 50 – 59 & Age 64+ catch-up: $7,500

Age 60 – 63 catch-up: $11,250

New 401(k) Age 60–63 Catch-Up Limits

Beginning in 2025, a new tier of higher catch-up limits will apply to individuals between ages 60 and 63. Under the SECURE 2.0 Act, these individuals can contribute an additional amount equal to 50% of the regular catch-up contribution for that plan year. For 2025, this equates to an extra $3,750, bringing the total possible contribution to $34,750 for 401(k), 403(b), and 457(b) plans. This enhanced catch-up contribution is optional for employers, so it's important to confirm with your plan sponsor whether this provision is available in your plan.

To learn more, read our article: New Age 60 – 63 401(k) Enhanced Catch-up Contribution Starting in 2025

Pre-Tax vs. Roth Catch-Up Contributions

Employer-sponsored retirement plans often allow participants to choose whether their catch-up contributions are made on a pre-tax or Roth (after-tax) basis. The best approach depends on income levels, expected tax rates in retirement, and broader financial planning goals.

Pre-tax contributions reduce your taxable income today but are taxed when withdrawn in retirement.

Roth contributions provide no current tax deduction but grow and distribute tax-free in retirement.

When Pre-Tax May Make Sense:

You're in a high tax bracket today (e.g., 24%+)

You expect to be a lower tax bracket during the retirement years

Example:

Tom is age 60, married, and earns $400,000 annually, placing him in the 32% federal tax bracket. In the next 5 years, Tom expects to retire and be in a lower federal tax bracket. By making pre-tax catch-up contributions now, it will allow him to reduce his current taxable income, while potentially taking distributions in a lower tax bracket later.

When Roth May Make Sense:

You expect your current tax rate to be roughly the same in retirement

You already have substantial pre-tax retirement account balances

You expect tax rates to rising in the future

Example:

Susan is age 52, single filer, earns $125,000 per year, and is in the 22% tax bracket. She expects her income to remain steady over time. By choosing Roth catch-up contributions, she pays tax now at a relatively low rate and avoids taxation on future withdrawals.

Mandatory Roth Catch-Up Contributions for High Earners (Effective 2026)

Starting in 2026, individuals earning $145,000 or more (adjusted for inflation) in wages from the same employer in the previous year will be required to make catch-up contributions to their workplace plan on a Roth basis. This rule applies only to employer-sponsored plans (like 401(k)s) and does not impact Simple IRA plans. For 2025, these Roth rules have been delayed, giving high-income earners time to prepare.

To learn about the rules and exceptions for high earners, read our article: Mandatory 401(k) Roth Catch-up Details Confirmed by IRS January 2025

The Big Picture: Why This Strategy Matters Near Retirement

For individuals within five to ten years of retirement, catch-up contributions provide an opportunity to meaningfully increase retirement savings without relying on higher investment returns or making dramatic lifestyle changes. The added contributions also support strategic tax planning by allowing savers to choose between pre-tax and Roth treatment based on their broader income picture.

Catch-up contributions can help:

Maximize tax-advantaged savings when your income is typically at its highest

Take advantage of compound growth on a larger balance

Strategically shift assets into Roth accounts for future tax-free income

Consider the numbers:

A 60-year-old contributing the full $34,750 annual catch-up amount for three consecutive years could accumulate over $111,000 in additional retirement savings, assuming a 7% annual return. If contributed to a Roth 401(k), those funds would grow and be distributed tax-free, offering valuable flexibility in retirement.

Even if retirement is only a few years away, catch-up contributions can play a significant role in improving retirement readiness and reducing future tax burdens.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are catch-up contributions and who qualifies for them?

Catch-up contributions allow individuals aged 50 or older to contribute more to retirement accounts than the standard annual limit. Eligibility begins in the calendar year you turn 50, regardless of your income level or how close you are to retirement.

What are the 2025 catch-up contribution limits?

In 2025, employees can contribute up to $23,500 to a 401(k), 403(b), or 457(b) plan. Those aged 50–59 and 64 or older can contribute an additional $7,500, while individuals aged 60–63 can make an enhanced catch-up contribution of $11,250, for a total of $34,750 if allowed by their employer’s plan.

How does the new age 60–63 catch-up rule work?

Starting in 2025, individuals between ages 60 and 63 can make a higher catch-up contribution equal to 150% of the standard catch-up limit. This provision under the SECURE 2.0 Act lets older workers maximize savings during their final working years, but availability depends on whether an employer adopts the rule.

Should I make my catch-up contributions pre-tax or Roth?

The best option depends on your tax situation. Pre-tax contributions reduce taxable income now and are ideal if you expect to be in a lower tax bracket in retirement. Roth contributions are made after-tax but grow tax-free and are advantageous if you expect future tax rates to rise or your income to remain steady.

What is the mandatory Roth catch-up rule for high-income earners?

Beginning in 2026, employees earning $145,000 or more (adjusted for inflation) from the same employer in the previous year must make catch-up contributions on a Roth basis. This means contributions will be made after tax, and future withdrawals will be tax-free.

Why are catch-up contributions especially important near retirement?

Catch-up contributions help individuals nearing retirement boost savings during peak earning years without depending solely on market growth. They also provide tax planning flexibility by letting savers choose between pre-tax and Roth options based on their expected future income and tax rates.