If You Retire With $1 Million, How Long Will It Last?

Is $1 million enough to retire? The answer depends on withdrawal rates, inflation, investment returns, and taxes. This article walks through different scenarios to show how long $1 million can last and what retirees should consider in their planning.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

Retirement planning often circles around one big question: If I save $1 million, how long will it last once I stop working? The answer isn’t one-size-fits-all. It depends on a handful of key factors, including:

Your annual withdrawal rate

Inflation (the rising cost of goods and services over time)

Your assumed investment rate of return

Taxes (especially if most of your money is in pre-tax retirement accounts)

In this article, we’ll walk through each of these factors and then run the numbers on a few different scenarios. By the end, you’ll have a much clearer idea of how far $1 million can take you in retirement.

Step 1: Determining Your Withdrawal Rate

Your withdrawal rate is simply the amount of money you’ll need to take from your retirement accounts each year to cover living expenses. Everyone’s number looks different:

Some retirees might only need $60,000 per year after tax.

Others might need $90,000 per year after tax.

The key is to determine your annual expenses first. Then consider:

Other income sources (Social Security, pensions, part-time work, rental income, etc.)

Tax impact (if pulling from pre-tax accounts, you’ll need to withdraw more than your net spending need to cover taxes).

For example, if you need $70,000 in after-tax spending money, you might need to withdraw closer to $75,000–$90,000 per year from your 401(k) or IRA to account for taxes.

Step 2: Don’t Forget About Inflation

Inflation is the silent eroder of retirement plans. Even if you’re comfortable living on $70,000 today, that number won’t stay static. If we assume a 3% inflation rate, here’s how that changes over time:

At age 65: $70,000

At age 80: $109,000

At age 90: $147,000

Expenses like healthcare, insurance, and groceries tend to rise faster than other categories, so it’s critical to build inflation adjustments into your plan.

Step 3: The Assumed Rate of Return

Once you retire, you move from accumulation mode (saving and investing) to distribution mode (spending down your assets). This shift raises important questions about asset allocation.

During accumulation years, you weren’t withdrawing, so market dips didn’t permanently hurt your portfolio.

In retirement, selling investments during downturns locks in losses, making it harder for your account to recover.

That’s why most retirees take at least one or two “step-downs” in portfolio risk when they stop working.

For most clients, a reasonable retirement assumption is 4%–6% annual returns, depending on risk tolerance.

Step 4: The Impact of Taxes

Taxes can make a significant difference in how long your retirement savings last.

If most of your money is in pre-tax accounts (401k, traditional IRA), you’ll need to gross up withdrawals to cover taxes.

Example: If you need $80,000 after tax, and your tax bill is $10,000, you’ll really need to withdraw $90,000 from your retirement accounts.

Now, if you have Social Security income or other sources, that reduces how much you need to pull from your investments.

Example:

Annual after-tax expenses: $80,000

Grossed-up for taxes: $90,000

Social Security provides: $30,000

Net needed from retirement accounts: $60,000 (indexed annually for inflation)

Scenarios: How Long Does $1 Million Last?

Now let’s put the numbers into action. Below are four scenarios that show how long a $1 million retirement portfolio lasts under different withdrawal rates. Each assumes:

Retirement age: 65

Beginning balance: $1,000,000

Inflation: 3% annually

Investment return: 5% annually

Scenario 1: Withdrawal Rate $40,000 Per Year

Assumptions:

Annual withdrawal: $40,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 36 years (until age 100).

Why not forever? Because inflation steadily raises the withdrawal amount. At age 80, withdrawals rise to $62,000/year. By age 90, they reach $83,000/year.

Math Note: For the duration math, while age 90 minus age 65 would be 35 years. We are also counting the first year age 65 all the way through age 90, which is technically 36 years. (Same for all scenarios below)

Scenario 2: Withdrawal Rate $50,000 Per Year

Assumptions:

Annual withdrawal: $50,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 26 years (until age 90).

By age 80, withdrawals grow to $77,000/year. By age 90, they reach $104,000/year.

Scenario 3: Withdrawal Rate $60,000 Per Year

Assumptions:

Annual withdrawal: $60,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 21 years (until age 85).

Scenario 4: Withdrawal Rate $80,000 Per Year

Assumptions:

Annual withdrawal: $80,000 (indexed for 3% inflation)

Rate of return: 5%

Result: Portfolio lasts 15 years (until age 79).

Even if you bump the return to 6%, it only extends one more year to age 80. Higher withdrawals create a significant risk of outliving your money.

Final Thoughts

If you retire with $1 million, the answer to “How long will it last?” depends heavily on your withdrawal rate, inflation, taxes, and investment returns. A $40,000 withdrawal rate can potentially last through age 100, while a more aggressive $80,000 withdrawal rate may deplete funds before age 80.

The bottom line: Everyone’s situation is unique. Your lifestyle, income sources, tax situation, and risk tolerance will shape your plan. This is why working with a financial advisor is so important — to stress-test your retirement under different scenarios and give you peace of mind that your money will last as long as you do.

For more information on our fee based financial planning services to run your custom retirement projections, please visit our website.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is a safe withdrawal rate in retirement?

A commonly used guideline is the 4% rule, meaning you withdraw 4% of your starting balance each year, adjusted for inflation. However, personal factors—such as market performance, expenses, and longevity—should guide your specific rate.

How does inflation affect retirement spending?

Inflation steadily increases the cost of living, which raises how much you need to withdraw each year. At a 3% inflation rate, an annual $70,000 expense today could grow to over $100,000 within 15 years, reducing how long savings can last.

Why do investment returns matter so much in retirement?

Once you start taking withdrawals, poor market performance can have a lasting impact because you’re selling investments during downturns.

How do taxes impact retirement withdrawals?

Withdrawals from pre-tax accounts like traditional IRAs and 401(k)s are taxable, so you may need to take out more than your net spending needs. For instance, needing $80,000 after tax could require withdrawing around $90,000 or more before tax.

What can help make retirement savings last longer?

Strategies like moderating withdrawal rates, maintaining some stock exposure for growth, and factoring in Social Security or pension income can extend portfolio longevity. Regularly reviewing your plan helps ensure it stays aligned with your goals and spending needs.

The Risk of Outliving Your Retirement Savings

Living longer is a blessing, but it also means your savings must stretch further. Rising costs, inflation, and healthcare expenses can quietly erode your nest egg. This article explains how to stress-test your retirement plan to ensure your money lasts as long as you do.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When you imagine retirement, perhaps you see time with family, travel, golf, and more time for your hobbies. What many don’t realize is how two forces—longer lifespans and rising costs—can quietly erode your nest egg while you're still enjoying those moments. Living longer is a blessing, but it means your savings must stretch further. And inflation, especially for healthcare and long-term care, can quietly chip away at your financial comfort over the years. Let’s explore how these factors shape your retirement picture—and what you can do about it.

What you’ll learn in this article:

How life expectancy is evolving, and how it’s increasing the need for more retirement savings

The impact of inflation on a retiree's expenses over the long term

How inflation on specific items like healthcare and long-term care are running at much higher rates than the general rate of inflation

How retirees can test their retirement projections to ensure that they are properly accounting for inflation and life expectancy

How pensions can be both a blessing and a curse

1. Living Longer: A Good But Bad Thing

The Social Security life tables estimate that a 65-year-old male in 2025 is expected to live another 21.6 years (reaching about age 86.6), while a 65-year-old female can expect about 24.1 more years, extending to around 89.1 (ssa.gov).

That has consequences:

If a retiree spends $60,000 per year, a male might need 21.6 × $60,000 = $1,296,000 in total

A female might need 24.1 × $60,000 = $1,446,000

These totals—before considering inflation—highlight how long-term retirement can quickly become a multi-million-dollar endeavor.

2. Inflation: The Silent Retirement Thief

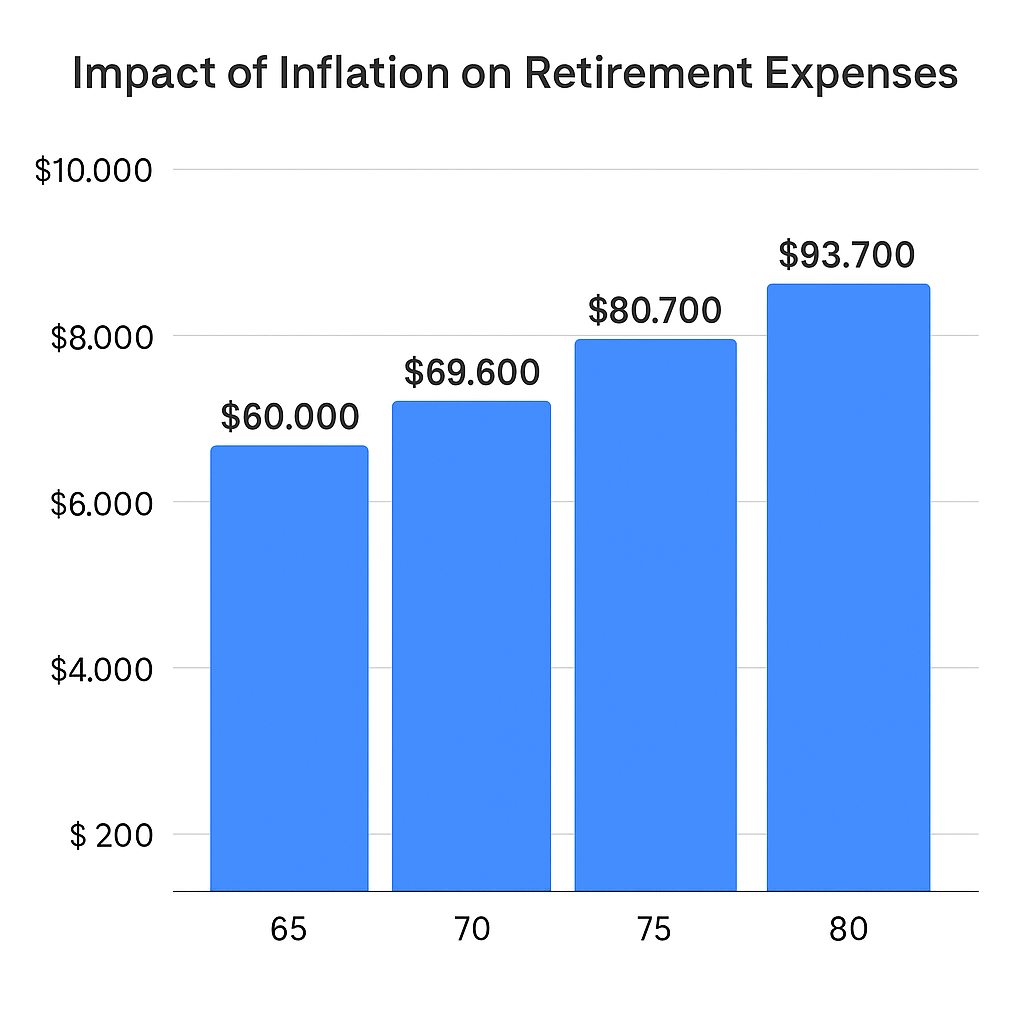

Inflation steadily erodes the real value of money. Over the past 20 years, average annual inflation has held near 3%. Let’s model how inflation reshapes $60,000 in annual after-tax expenses for a 65 year-old retiree over time with a 3% annual increase:

At age 80 (15 years after retirement):

$60,000 × (1.03)^15 ≈ $93,068 per yearAt age 90 (25 years after retirement):

$60,000 × (1.03)^25 ≈ $127,278 per year

In just the first 15 years, this retiree’s annual expenses increased by $33,068 per year, a 55% increase.

3. The Hidden Risk of Relying Too Much on Pensions

One of the most common places retirees feel this pinch is with pensions. Most pensions provide a fixed monthly amount that does not rise meaningfully with inflation. That can create a false sense of security in the early years of retirement.

Example:

A married couple has after-tax expenses of 70,000 per year.

They receive $50,000 from pensions and $30,000 from Social Security.

At retirement, their $80,000 of income in enough to meet their $70,000 in after-tax annual expenses.

Here’s the problem:

The $50,000 pension payment will not increase.

Their expenses, however, will rise with inflation. After 15 years at 3% inflation, those same expenses could total about $109,000 per year.

By then, their combined pension and Social Security will fall well short, forcing them to dip heavily into savings—or cut back their lifestyle.

This illustrates why failing to account for inflation often means retirees “feel fine” at first, only to face an unexpected shortfall 10–15 years later.

4. Healthcare & Long-term Care Expenses

While the general rise in expenses by 3% per year would seem challenging enough, there are two categories of expenses that have been rising by much more than 3% per year for the past decade: healthcare and long-term care. Since healthcare often becomes a large expense for individuals 65 year of age and older, it’s created additional pressure on the retirement funding gap.

Prescription drugs shot up nearly 40% over the past decade, outpacing overall inflation (~32.5%) (nypost.com).

Overall healthcare spending jumped 7.5% from 2022 to 2023, reaching $4.9 trillion—well above historical averages (healthsystemtracker.org).

In-home long-term care is also hefty—median rates for a home health aide have skyrocketed, with 24-hour care nearing $290,000 annually in some cases (wsj.com).

5. The Solution: Projections That Embrace Uncertainty

When retirement may stretch 20+ years, and inflation isn’t uniform across expense categories, guessing leads to risk. A projection-driven strategy helps you:

Model life expectancy: living until age 85 – 95 (depending on family longevity)

Incorporate general inflation (3%) on your expenses within your retirement projections

Determine if you have enough assets to retire comfortably

Whether your plan shows a wide cushion or flags a potential shortfall, you’ll make confident decisions—about savings, investments, expense reduction, or part-time work—instead of crossing your fingers.

6. Working with a Fee-Based Financial Planner Can Help

Here’s the bottom line: Living longer is wonderful, but it demands more planning in the retirement years as inflation, taxes, life expectancy, and long-term care risks continue to create larger funding gaps for retirees.

A fee-based financial planner can help you run personalized retirement projections, taking these variables into account—so you retire with confidence. And if the real world turns out kinder than your model, that's a bonus. If you would like to learn more about our fee-based retirement planning services, please feel free to visit our website at: Greenbush Financial Group – Financial Planning.

Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How does longer life expectancy affect retirement planning?

People are living well into their 80s and 90s, meaning retirement savings must cover 20–30 years or more. The longer you live, the more years your portfolio must fund, increasing the importance of conservative withdrawal rates and sustainable planning.

Why is inflation such a big risk for retirees?

Inflation steadily raises the cost of living, reducing the purchasing power of fixed income sources like pensions. Even at a modest 3% inflation rate, living expenses can rise more than 50% over 15 years, requiring larger withdrawals from savings.

How does inflation impact pensions and fixed income sources?

Most pensions don’t increase with inflation, so their purchasing power declines over time. A pension that comfortably covers expenses at retirement may fall short within 10–15 years as costs rise, forcing retirees to draw more from savings.

Why are healthcare and long-term care costs such a concern in retirement?

Healthcare and long-term care expenses have been increasing faster than general inflation. Costs for prescriptions, medical services, and in-home care can grow at 5–7% annually, putting additional strain on retirement savings.

How can retirees plan for inflation and longevity risk?

Running detailed retirement projections that factor in inflation, longer life expectancy, and varying rates of return helps reveal whether savings are sufficient. This approach allows retirees to make informed decisions about spending, investing, and lifestyle adjustments.

When should retirees work with a financial planner?

Consulting a fee-based financial planner early in the retirement planning process can help test different inflation and longevity scenarios. A planner can build customized projections and ensure your plan remains flexible as costs and life circumstances evolve.

How Much Money Will You Need to Retire Comfortably?

Retirement planning isn’t just about hitting a number. From withdrawal rates and inflation to taxes and investment returns, several factors determine if your savings will truly last. This article explores how to test your retirement projections and build a plan for financial security.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

As a Certified Financial Planner who runs retirement projections on a daily basis, one of the most common questions I get is: “How much money do I need to retire?”

The answer may surprise you—because there’s no universal number. The amount you’ll need depends largely on one thing: your expenses.

In this article, we’ll walk through:

Why expenses are the biggest driver of how much you need to retire

How inflation impacts retirement spending

Why the type of account you own matters

The importance of factoring in all your income sources

A quick 60-second way to test your own retirement readiness

Expenses: The Biggest Driver

When you ask, “Can I retire comfortably?”, the first question to answer is: How much do you spend each year?

For example:

If your expenses are $40,000 per year, then $500,000 in retirement savings could potentially be enough—especially if you’re supplementing withdrawals with Social Security or a pension.

But if your expenses are $90,000 per year, that same $500,000 likely won’t stretch nearly as far.

Your retirement lifestyle drives your retirement savings need. Someone with modest expenses may not need millions to retire, while someone with higher spending will require significantly more.

Don’t Forget About Inflation

It’s not just today’s expenses you need to plan for—it’s tomorrow’s too. Inflation quietly eats away at your purchasing power, making your cost of living higher every single year.

Here’s an example:

At age 65, your expenses are $60,000 per year.

If expenses rise at 3% annually, by age 80 they’ll be roughly $93,700 per year.

That’s a 50% increase in just 15 years—and you’ll need your retirement assets to keep up.

This is one of the hardest factors for individuals to quantify without financial planning software. Inflation not only increases expenses, but it changes your withdrawal rate from investments, which can impact how long your money lasts.

The Type of Account Matters

Not all retirement accounts are created equal. The type of retirement/investment accounts you own has a big impact on whether you can retire comfortably.

Pre-tax accounts (401k, traditional IRA): Every dollar withdrawn is taxed as ordinary income. A $1,000,000 account might really be worth closer to $700,000 after taxes.

Roth accounts: Withdrawals are tax-free, making these extremely valuable in retirement.

After-tax brokerage accounts: Withdrawals often receive more favorable capital gains treatment, so the tax drag can be lighter compared to pre-tax accounts.

Cash: Offers liquidity but typically earns little return, making it best for short-term expenses.

In short: Roth and after-tax brokerage accounts often provide more after-tax value compared to pre-tax accounts.

Factor in All Your Income Sources

Getting a general idea of your retirement income picture is key. This means adding up:

Social Security benefits

Pensions

Investment income (dividends, interest, etc.)

Part-time income in retirement

Withdrawals from retirement accounts

Once you total these income sources, you’ll need to apply the tax impact. Only then can you compare your after-tax income against your after-tax expenses (adjusted for inflation each year) to see if there’s a gap.

This is exactly how financial planners build retirement projections to determine sustainability.

Find Out If You Can Retire in 60 Seconds

Curious if you’re on track? We’ve built a 60-second retirement check-up that can help you quickly see if you have enough to retire.

Bottom line: There’s no magic retirement number. The amount you need depends on your expenses, inflation, account types, and income sources. By running the numbers—and stress-testing them with a financial planner—you can gain the confidence to know whether you’re truly ready to retire comfortably.

Partner with a Fee-Based Financial Planner to Build Your Retirement Plan

While rules of thumb and calculators can provide a helpful starting point, everyone’s retirement picture looks different. Your income needs, lifestyle goals, and unique financial situation will ultimately determine how much you need to retire comfortably.

Working with a fee-based financial planner can help take the guesswork out of retirement planning. A planner will create a customized strategy that factors in your retirement expenses, investments, Social Security, healthcare, and tax planning—so you know exactly where you stand and what adjustments to make.

If you’d like to explore your own numbers and build a retirement roadmap, we’d love to help. Learn more about our financial planning services here.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

How much money do I need to retire?

There’s no single number that fits everyone—the right amount depends primarily on your annual expenses, lifestyle, and income sources. A retiree spending $40,000 per year will need far less savings than someone spending $90,000.

Why are expenses the most important factor in retirement planning?

Your spending habits determine how much income your portfolio must generate. Knowing your annual expenses helps estimate your withdrawal needs, which directly drives how large your retirement savings must be.

How does inflation affect retirement spending?

Inflation gradually increases the cost of living, reducing the purchasing power of your money. At a 3% inflation rate, $60,000 in annual expenses today could rise to about $94,000 in 15 years, meaning your savings must grow to keep pace.

How does the type of retirement account impact how much you need to save?

Withdrawals from pre-tax accounts like 401(k)s and traditional IRAs are taxable, so you may need to save more to cover taxes. Roth IRAs and brokerage accounts often provide more after-tax value, since withdrawals may be tax-free or taxed at lower rates.

What income sources should I include when estimating retirement readiness?

Include all sources such as Social Security, pensions, dividends, part-time income, and withdrawals from savings. Comparing your total after-tax income against your inflation-adjusted expenses helps reveal whether you’re financially ready to retire.

How can I quickly estimate if I’m on track for retirement?

A simple way is to compare your projected annual expenses (adjusted for inflation) with your expected retirement income. Working with a fee-based financial planner can oftern provide a more comprehensive approach to answering the question “Do I have enough to retire?”

Non-Taxable Income in Retirement: 5 Sources You Should Know About

When it comes to retirement income, not all dollars are created equal. Some income sources are fully taxable, others partially — but a select few can be completely tax-free. And understanding the difference could mean thousands of dollars in savings each year.

When it comes to retirement income, not all dollars are treated equally. Some are fully taxable, others partially taxable, and a select few are entirely tax-free. Understanding the difference is critical to building a retirement income plan that protects your nest egg from unnecessary taxation, especially in a high-inflation, high-cost-of-living environment.

In this article, we break down five sources of non-taxable income in retirement, how they work, and how to strategically use them to lower your tax bill and preserve long-term wealth.

1. Roth IRA Withdrawals

A Roth IRA offers one of the most powerful tax benefits available to retirees — tax-free growth and qualified tax-free withdrawals.

To qualify, withdrawals must occur after age 59½ and at least five years after your first contribution or Roth conversion. If both conditions are met, all distributions (contributions and growth) are 100% tax-free.

Why it matters:

Withdrawals from pre-tax retirement accounts like Traditional IRAs and 401(k)s are taxed as ordinary income, which can push you into a higher tax bracket, increase Medicare premiums, and reduce the portion of your Social Security benefits that are tax-free. With Roth IRAs, none of those problems exist.

Planning strategy:

Many retirees choose to complete Roth conversions during low-income years (such as early retirement) to move pre-tax funds into a Roth IRA while controlling their tax rate. This allows them to create a future pool of tax-free income while reducing Required Minimum Distributions (RMDs) down the line.

2. Health Savings Account (HSA) Distributions for Medical Expenses

HSAs are the only account type that offers triple tax advantages:

Contributions are tax-deductible

Growth is tax-deferred

Withdrawals are tax-free if used for qualified medical expenses

Qualified expenses include Medicare premiums, prescriptions, dental and vision care, long-term care insurance premiums (subject to limits), and more.

Why it matters:

Healthcare is often one of the largest expenses in retirement, and using HSA funds tax-free for these costs allows retirees to preserve their other taxable accounts.

Planning strategy:

For clients who are still working and enrolled in a high-deductible health plan, the strategy may be to contribute the maximum amount to an HSA and pay current medical expenses out-of-pocket. This allows the HSA to grow and be used as a supplemental retirement account for tax-free medical reimbursements later in life.

3. Social Security (Partially Non-Taxable)

Up to 85% of Social Security benefits can be taxable at the federal level, depending on your provisional income (which includes half of your Social Security benefits, taxable income, and tax-exempt interest).

However, if a retiree has very little income other than their social security, it’s possible that they may not pay any tax on their social security benefits.

Why it matters:

Retirees who rely heavily on Roth IRA withdrawals or return of principal from brokerage accounts may be able to keep their provisional income low enough to shield some or all of their Social Security benefits from taxation.

Planning strategy:

By building a tax-efficient distribution plan in retirement, retirees can often reduce the amount of tax paid on their Social Security benefits and improve net income in retirement.

4. Municipal Bond Interest

Interest from municipal bonds is generally exempt from federal income tax. If you reside in the state where the bond was issued, that interest may also be exempt from state and local taxes.

Why it matters:

For retirees in high tax brackets, municipal bonds can provide steady, tax-advantaged income without adding to provisional income or triggering taxes on Social Security.

Planning strategy:

Retirees in high-income tax brackets may hold municipal bonds in taxable brokerage accounts, while keeping higher-yield taxable bonds inside IRAs or 401(k)s where the interest won’t be taxed annually.

5. Return of Principal from Non-Retirement Accounts

Withdrawals from taxable brokerage accounts can be structured to return your cost basis first, which is not subject to tax. Only the gains portion of a sale is subject to capital gains tax — and long-term capital gains may be taxed at 0% if your taxable income is below certain thresholds.

Why it matters:

This allows retirees to tap into their investments in a low-tax or no-tax manner — especially when drawing from principal rather than interest, dividends, or gains.

Planning strategy:

Coordinate asset sales to manage taxable gains, and consider drawing from principal early in retirement to reduce future RMDs or pay the tax liability generated by Roth conversions in lower-income years.

Final Thoughts: Build a Tax-Efficient Retirement Income Plan

Most retirees understand the importance of investment performance, but few give the same attention to tax efficiency, even though taxes can quietly erode thousands of dollars in retirement income each year.

By blending these non-taxable income sources into your withdrawal strategy, you can:

Reduce your tax liability

Lower Medicare surcharges

Improve portfolio longevity

Increase the amount of inheritance passed to the next generation

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What types of retirement income are tax-free?

Common sources of tax-free retirement income include qualified Roth IRA withdrawals, Health Savings Account (HSA) distributions for medical expenses, a portion of Social Security benefits, municipal bond interest, and the return of principal from non-retirement investments. These sources can help retirees reduce overall taxable income and extend portfolio longevity.

Why are Roth IRA withdrawals tax-free in retirement?

Roth IRA withdrawals are tax-free if you’re over age 59½ and the account has been open for at least five years. Because Roth withdrawals don’t count toward taxable income, they won’t increase your tax bracket, affect Medicare premiums, or reduce the tax-free portion of your Social Security benefits.

How can a Health Savings Account (HSA) provide tax-free income in retirement?

HSAs offer triple tax advantages: contributions are tax-deductible, growth is tax-deferred, and withdrawals are tax-free for qualified medical expenses. Retirees can use HSA funds to pay for Medicare premiums, prescriptions, and other healthcare costs without generating taxable income.

Are Social Security benefits always taxable?

No. Depending on your provisional income, up to 85% of Social Security benefits may be taxable, but some retirees owe no tax on their benefits. Keeping taxable income low through Roth withdrawals or return of principal from brokerage accounts can help reduce or eliminate Social Security taxation.

How are municipal bond earnings taxed?

Interest earned from municipal bonds is typically exempt from federal income tax and, if the bonds are issued by your home state, may also be exempt from state and local taxes. This makes municipal bonds a valuable source of tax-advantaged income for retirees in higher tax brackets.

What does “return of principal” mean for taxable accounts?

When you sell investments in a taxable brokerage account, the portion representing your original cost basis is considered a return of principal and isn’t taxed. Only the gains portion is subject to capital gains tax, which may be as low as 0% for retirees in lower income brackets.

How can retirees use non-taxable income to improve their financial plan?

Strategically blending tax-free and taxable income sources can lower your overall tax burden, reduce Medicare surcharges, and improve long-term portfolio sustainability. This approach helps preserve wealth and increase the amount that can ultimately be passed to heirs.