What Happened The Last Time The Dow Dropped By More Than 4% In A Day?

Yesterday was an “ouch”. The Dow Jones Industrial average dropped by more than 1000 points resulting in a 4.60% drop in the value of the index. While yesterday marked the largest “point” decline in the history of the Dow Jones Index, it was not anywhere near the largest percentage decline which is the metric that we care about.

Yesterday was an “ouch”. The Dow Jones Industrial average dropped by more than 1000 points resulting in a 4.60% drop in the value of the index. While yesterday marked the largest “point” decline in the history of the Dow Jones Index, it was not anywhere near the largest percentage decline which is the metric that we care about.

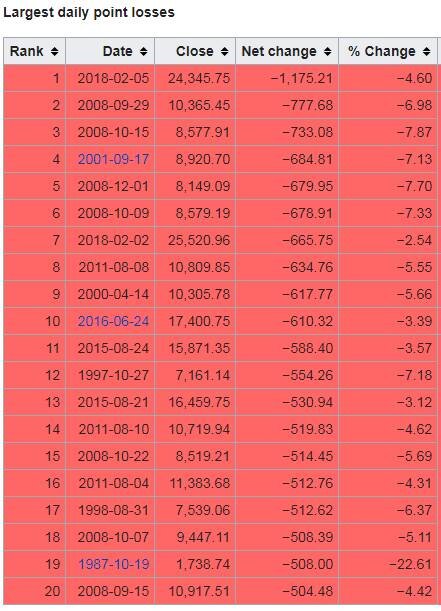

Below is a chart that shows the largest daily “point” losses in the history of the Dow Jones Industrial Index:

You will find yesterday at the top of the chart. Now look at the column all the way to the right labelled “% change”. You will notice that while yesterday topped the chart from a point decline, it does not come anywhere near the largest percentage decline that we have seen. In fact, it does not even make it in the top 20 worse days for the Dow. See the chart below that shows the largest daily percentage declines in the Dow’s history:

What Happened Last Time?

Whenever there is a big drop in the stock market, I immediately start looking back in history to find market events that are similar to the current one. So when was the last time the market dropped by more than 4% in a single day?

The answer: August 8, 2011

If you remember, 2011 was the start of the European Sovereign Debt Crisis. That was when Greece, Portugal, Spain, and Ireland announced that they were unable to repay their government debt and needed a bailout package from the European Union to survive. There were two single day declines in the month of August that rivaled what we saw yesterday.

How Long Did It Take The Market To Come Back?

If we are looking to history as a guide, how long did it take for the market to recoup the losses after these large single day declines? On July 31, 2011 the Dow Jones Industrial closed at 11,444, the Europe debt crisis hit, and the market experienced those two 4%+ decline days on August 4th and August 8th. By September 11, 2011, the Dow Jones closed at 11,509, recouping all of its losses from the beginning of August. Thus making the answer to the question: 38 days. The market took 38 days to recoup all of the losses from not one but two 4%+ decline days in 2011.

We Don’t Have A Crisis

The main difference between 2011 and now is we don’t have a global economic crisis. In my opinion, the market correction in 2011 was warranted. There was a real problem in Europe. We were not sure how and if those struggling Eurozone countries could be saved so the market dropped.

The only trigger that I hear analysts pointing to in an effort to explain the selloff yesterday is the 2.9% wage growth number that we got on Friday. This in turn has sparked inflation fears and in reaction, the Fed may decide to hike rates four times this year instead of three. Hardly a “crisis”. Outside of that nothing else meaningful has happened to trigger the volatility that we are seeing in the stock market. OK……so what should you do in reaction to this? Sometimes the right answer is “nothing”. It’s difficult to hear that because emotionally you want to pull money out of the market and run to cash or bonds but absent a sound economic reason for making that move, at this point, the best investment decision may be to just stay the course.

We Have Forgotten What Volatility Feels Like

When you are in a market environment like 2017, you very quickly forget what normal market volatility feels like. In 2017, the stock market just gradually climbed throughout the year without any hiccups. That’s not normal. Below is a chart that shows the magnitude of market corrections each year going back to 1990. As you will see, on average, when the economy is not in a recession, the market averages an 11.56% correction at some point during the year. In 2017, we only experienced a 3% correction.

Now the next chart shows you the big picture. Not only does it illustrate the amount of the largest market correction during the year but it also shows the return of the S&P 500 for the year.

Look at 2016. In 2016, at some point in the year the S&P 500 Index dropped by 11%. If you just held through it, the S&P 500 returned 10% for the year.

In 2011, the S&P 500 dropped by 19% during the year!! If you didn’t sell and just held through the volatility, you would have had a breakeven year.

Easier Said Than Done

Every big market correction feels like a new world ending crisis. It’s not. We have been fortunate enough to have a nice easy ride for the past 12 months but it seems like we are returning to more historical levels of volatility. Days like February 5, 2018 will test your patience and make you feel compelled to react. It’s easy to look back and confess that “yes, I should have just held through it” but it’s easier said than done.

It’s important to understand the catalysts that are driving the volatility in the markets. Sometimes the markets are dropping for a good reason and other times it’s just plain old fashion volatility. Based on what we have seen over the past few days and absent the emergence of a new economic, political, or global crisis, we expect it to be the later of the two.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Government Is Shut Down. Should You Be Worried?

The senate was not able to pass a temporary spending bill in the late hours of the night so as of Saturday, January 20th the government is officially shut down. But what does that mean? How will it impact you? What will be the impact on the stock market?

The senate was not able to pass a temporary spending bill in the late hours of the night so as of Saturday, January 20th the government is officially shut down. But what does that mean? How will it impact you? What will be the impact on the stock market?

Don’t Let The Media Scare You

The media loves big disruptive events. Why? The news is a "for profit" business. The more viewers they have, the more profits they make. What makes you watch more news? Fear. If the weather forecasts is 80 degrees and sunny, you just go on with your day. Instead, if the weather is predicting “The Largest Winter Blizzard Of The Century”, my guess is you will be glued to the weather channel most of the day trying to figure out when the storm will hit, how many feet of snow is expected to fall, and are schools closing, etc.

You will undoubtedly wake up this morning to headlines about “The Government Shutdown” and all of the horrible things that could happen as a result. In the short term a government shutdown or a “funding gap” is not incredibly disruptive. Many government agencies have residual funding to keep operations going for a period of time. Only portions of the government really “shut down”. The “essential” government services continue to function such as national security and law enforcement. The risk lies in the duration of the government shutdown. If Congress does not pass either a temporary extension or reach a final agreement within a reasonable period of time, some of these government agencies will run out of residual funding and will be forced to halt operations.

The news will target the “what if’s” of the current government shutdown. What if the government stays shut down and social security checks stop? What if the U.S. cannot fund defense spending and we are left defenseless? All of these scenarios would require a very prolonged government shutdown which is unlikely to happen.

How Often Does This Happen?

When I woke up this morning, my first questions was “how often do government shutdowns happen?” Is this an anomaly that I should be worried about or is it a frequent occurrence? The last government shutdown took place on September 30, 2013 and the government stayed shut down for 16 days. Prior to the 2013 shutdown, you have to go back to December 15, 1995. The duration of the 1995 shutdown was 21 days. Making the current government shutdown only the third shutdown between December 15, 1995 – January 20, 2018. Not an anomaly but also not a frequent event.

But let’s look further back. How many times did the U.S. government experience a shutdown between 1976 – 2018? In the past 42 years, the U.S. government has experienced a shutdown 18 times. On average the government shutdowns lasted for about 7 days. This makes me less worried about the current government shutdown given the number of shutdowns that we have overcome in the past.

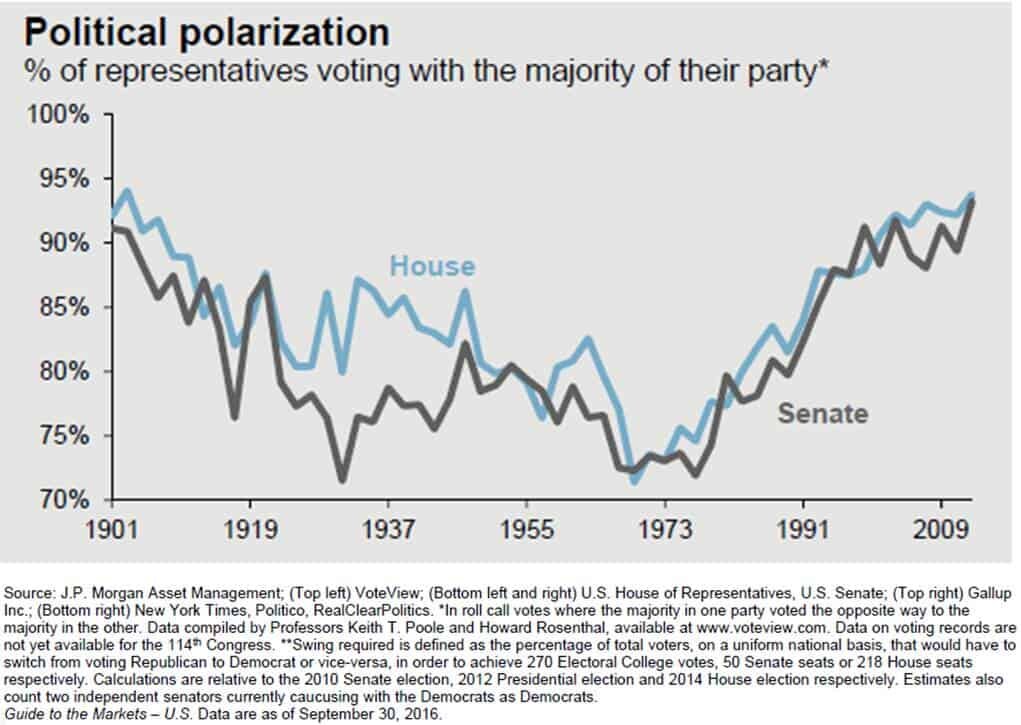

This Shutdown Could Be Longer

The only thing that worries me a little is the potential duration of the current government shutdown. I would not consider two data points to be a new “trend” but it is hard to ignore that the last two government shutdowns that occurred in 1995 and 2013 were much longer than the 7 day historical average. However, this could be the start of a new trend given how polarized Congress has become. It’s a clear trend that over the past 40 years fewer members of the Senate and House are willing to cross party lines during a vote. See the chart below: Back in 1973, only 73% of the members of Congress voted with the majority of their political party. It would seem rational to assume that during that time period members of Congress were more willing to step across the aisle for the greater good of the American people. Now, approximately 95% of the members of both the House and Senate vote with their own camp. This creates deadlock situations that take longer to resolve as the “blame game” takes center stage.

Impact On The Stock Market

In most cases, injecting uncertainty in our economy is never good for the stock market. However, given the fact that U.S. corporations are still riding the high of tax reform, if the government shutdown is resolved within the next two weeks it may have little or no impact on the markets.

If it were not for the recent passage of tax reform, my guess is this government shutdown may have been completely avoided. Not choosing a side here but just acknowledging the Democratic Party was delivered a blow with passage of tax reform in December. Since the spending bill requires 60 votes to pass in the Senate, it will require support from the Democrats. This situation provides the Democratic party with a golden opportunity to negotiate terms to help make up for some the lost ground from the passage of the Republican led tax bill. This challenging political environment could lengthen the duration of the government shutdown. However, it’s also important to remember that neither party benefits from a government shutdown, especially in a midterm election year.

Over the next two weeks, I would recommend that investors take all the media hype with a grain of salt. However, if a permanent or temporary spending bill is not passed within the next two weeks, it could result in increased volatility and downward pressure on the stock market as government agencies run out of cash reserves and begin to put workers on furlough. At this point, we are really in a “wait and see” environment.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can I Use My 401K or IRA To Buy A House?

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down payment given all of the taxes and penalties that I would have to pay?" This article aims to answer both of those questions and provide you with withdrawal strategies to help you avoid big tax consequences and early withdrawal penalties.

401(k) Withdrawal Options Are Not The Same As IRA's

First you have to acknowledge that different types of retirement accounts have different withdrawal options available. The withdrawal options for a down payment on a house from a 401(k) plan are not the same a the withdrawal options from a Traditional IRA. There is also a difference between Traditional IRA's and Roth IRA's.

401(k) Withdrawal Options

There may be loan or withdrawal options available through your employer sponsored retirement plan. I specifically say "may" because each company's retirement plan is different. You may have all or none of the options available to you that will be presented in this article. It all depends on how your company's 401(k) plan is designed. You can obtain information on your withdrawal options from the plan's Summary Plan Description also referred to as the "SPD".

Taking a 401(k) loan.............

The first option is a 401(k) loan. Some plans allow you to borrow 50% of your vested balance in the plan up to a maximum of $50,000 in a 12 month period. Taking a loan from your 401(k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of 59.5. 401(k) loans, like other loans, change interest but you are paying that interest to your own account so it is essentially an interest free loan. Typically 401(k) loans have a maximum duration of 5 years but if the loan is being used toward the purchase of a primary residence, the duration of the loan amortization schedule can be extended beyond 5 years if the plan's loan specifications allow this feature.

Note of caution, when you take a 401(k) loan, loan payments begin immediately after the loan check is received. As a result, your take home pay will be reduced by the amount of the loan payments. Make sure you are able to afford both the 401(k) loan payment and the new mortgage payment before considering this option.

The other withdrawal option within a 401(k) plan, if the plan allows, is a hardship distribution. As financial planners, we strongly recommend against hardship distributions for purposes of accumulating the cash needed for a down payment on your new house. Even though a hardship distribution gives you access to your 401(k) balance while you are still working, you will get hit with taxes and penalties on the amount withdrawn from the plan. Unlike IRA's which waive the 10% early withdrawal penalty for first time homebuyers, this exception is not available in 401(k) plans. When you total up the tax bill and the 10% early withdrawal penalty, the cost of this withdrawal option far outweighs the benefits.

If You Have A Roth IRA.......Read This.....

Roth IRA's can be one of the most advantageous retirement accounts to access for the down payment on a new house. With Roth IRA's, you make after tax contributions to the account, and as long as the account has been in existence for 5 years and you are over the age of 59� all of the earnings are withdrawn from the account 100% tax free. If you withdraw the investment earnings out of the Roth IRA before meeting this criteria, the earnings are taxed as ordinary income and a 10% early withdrawal penalty is assessed on the earnings portion of the account.

What very few people know is if you are under the age of 59� you have the option to withdraw just your after-tax contributions and leave the earnings in your Roth IRA. By doing so, you are able to access cash without taxation or penalty and the earnings portion of your Roth IRA will continue to grow and can be distributed tax free in retirement.

The $10,000 Exclusion From Traditional IRA's.......

Typically if you withdraw money out of your Traditional IRA prior to age 59� you have to pay ordinary income tax and a 10% early withdrawal penalty on the distribution. There are a few exceptions and one of them is the "first time homebuyer" exception. If you are purchasing your first house, you are allowed to withdrawal up to $10,000 from your Traditional IRA and avoid the 10% early withdrawal penalty. You will still have to pay ordinary income tax on the withdrawal but you will avoid the early withdrawal penalty. The $10,000 limit is an individual limit so if you and your spouse both have a traditional IRA, you could potentially withdrawal up to $20,000 penalty free.

Helping your child to buy a house..........

Here is a little known fact. You do not have to be the homebuyer. You can qualify for the early withdrawal exemption if you are helping your spouse, child, grandchild, or parent to buy their first house.

Be careful of the timing rules..........

There is a very important timing rule associated with this exception. The closing must take place within 120 day of the date that the withdrawal is taken from the IRA. If the closing happens after that 120 day window, the full 10% early withdrawal penalty will be assessed. There is also a special rollover rule for the first time homebuyer exemption which provides you with additional time to undo the withdrawal if need be. Typically with IRA's you are only allowed 60 days to put the money back into the IRA to avoid taxation and penalty on the IRA withdrawal. This is called a "60 Day Rollover". However, if you can prove that the money was distributed from the IRA with the intent to be used for a first time home purchase but a delay or cancellation of the closing brought you beyond the 60 day rollover window, the IRS provides first time homebuyers with a 120 window to complete the rollover to avoid tax and penalties on the withdrawal.

Don't Forget About The 60 Day Rollover Option

Another IRA withdrawal strategy that is used as a “bridge solution” is a “60 Day Rollover”. The 60 Day Rollover option is available to anyone with an IRA that has not completed a 60 day rollover within the past 12 months. If you are under the age of 59.5 and take a withdrawal from your IRA but you put the money back into the IRA within 60 days, it’s like the withdrawal never happened. We call it a “bridge solution” because you have to have the cash to put the money back into your IRA within 60 days to avoid the taxes and penalty. We frequently see this solution used when a client is simultaneously buying and selling a house. It’s often the intent that the seller plans to use the proceeds from the sale of their current house for the down payment on their new house. Unfortunately due to the complexity of the closing process, sometimes the closing on the new house will happen prior to the closing on the current house. This puts the homeowner in a cash strapped position because they don’t have the cash to close on the new house.

As long as the closing date on the house that you are selling happens within the 60 day window, you would be able to take a withdrawal from your IRA, use the cash from the IRA withdrawal for the closing on their new house, and then return the money to your IRA within the 60 day period from the house you sold. Unlike the “first time homebuyer” exemption which carries a $10,000 limit, the 60 day rollover does not have a dollar limit.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Buy Or Lease A Car?

This is one of the most common questions asked by our clients when they are looking for a new car. The answer depends on a number of factors:

How long do you typically keep your cars?

How many miles do you typically drive each year?

What do you want your down payment and monthly payment to be?

This is one of the most common questions asked by our clients when they are looking for a new car. The answer depends on a number of factors:

How long do you typically keep your cars?

How many miles do you typically drive each year?

What do you want your down payment and monthly payment to be?

We typically start off by asking how long clients usually keep their cars. If you are the type of person that trades in their car every 2 or 3 year for the new model, leasing a car is probably a better fit. If you typically keep your cars for 5 plus years, then buying a car outright is most likely the better option.

“How many miles do you drive each year?”

This is often times the trump card for deciding to buy instead of lease. Most leases allow you to drive about 12,000 miles per year but this varies from dealer to dealer. If you go over the mileage allowance there are typically sever penalties and it becomes very costly when you go to trade in the car at the end of the lease. We see younger individuals get caught in this trap because they tend to change jobs more frequently. They lease a car when they live 10 miles away from work but then they get a job offer from an employer that is 40 miles away from their house and the extra miles start piling on. When they go to trade in the car at the end of the lease they owe thousands of dollars due to the excess mileage.

We also ask clients how much they plan to put down on the car and what they want their monthly payments to be. If you think you can stay within the mileage allowance, a lease will more often require a lower down payment and have a lower monthly payment. Why? Because you are not “buying” the car. You are simply “borrowing” it from the dealership and your payments are based on the amount that the dealership expects the car to depreciate in value during the duration of the lease. When you buy a car……you own it……and at the end of the car loan you can sell it or continue to drive the car with no car payments.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.