College Students: The Top 2 Action Items To Get Ahead

The job market for college students is more competitive than it has ever been in the past. Why? Because companies continue to leverage technology to do more with less people. So what separates the college students that have multiple job offers prior to graduation from the college grads that struggle to find their first career?As an investment advisor,

The job market for college students is more competitive than it has ever been in the past. Why? Because companies continue to leverage technology to do more with less people. So what separates the college students that have multiple job offers prior to graduation from the college grads that struggle to find their first career?As an investment advisor, most of our clients are business owners or executives. They are the folks that hold the keys to the positions that are available at their respective companies. Throughout our daily interaction with these clients we receive continuous feedback about:

Their young rockstar employee that is rising quickly through the ranks

The troubles that they are having finding the right people

The skills and personality traits that they are looking for in their next round of hires

If your child is either in college or about to enter college, what advice can you give them to put them at the top of the most wanted list of these high growth companies?

Intern, Intern, Intern

The college degree gets you the interview. Your work experience is what lands you the job. If it comes down to two candidates for a position, both interview well, both have the right personality for the job, good GPA’s, etc, if one candidate has completed an internship and other has not, the candidate with the work experience is going to be highly favored. There are a number of reasons for this.

First, the goal of the company is to get you up and running as soon as possible. If you have real life work experience, the employer will most likely assume that you will be up and running more quickly than a new employee that has no work experience. You probably already know the lingo of the industry, you may be familiar with the software that the company uses, you know who the competitors are in the industry, etc.

Second, there is more to talk about in the interview. While it’s pleasant to talk about your personal interests, the research that you have completed on the company, general knowledge of the industry, and your college experience. Instead, if you are able to talk about a project that you worked on during a college internship that is relevant to the positon that you are applying for, the conversation and the lasting impression that you will have during your interview will be elevated to a level that is head and shoulders above most of the other job candidates that will follow the typically question and answer session.

College students should get involved with as many internships and work studies as they can while they are attending college. Also, don’t’ wait until your senior year in college to obtain an internship. Internships serve another purpose besides giving you the advantage in a job interview. They can also tell you what you don’t want to do. You put yourself in a tough spot if you spend four years in college to obtain an accounting degree, only to find out after obtaining your first job that you don’t like being an accountant. It happens more often than you would think. We all have to do all we can in order to reach our career goal. It’s better to find that out in your freshman or sophomore year of college so you have the opportunity to change majors if needed.

Internships also help to narrow down your options. You may be interested in obtaining a degree in business but business is a very broad industry with a lot of different paths. Are you interested in marketing, finance, sales, accounting, management, operations, data analytics, manufacturing, or investment banking? Even if you are not 100% certain which path is the right one for you, make a choice. It will either reinforce your decision or it will allow you to scratch it off the list. Both are equally important.

Read These Books

There is common trait among business owners and executives. They typically have a thirst for knowledge which usually means that they are avid readers. One of the greatest challenges that young employees have is being able to relate to how the owner of the business thinks, what motivates them, and how they view the world. In general, business owners tend to admire or at least acknowledge the risk taking behaviors and achievements of some of the standout CEO’s of their time. Steve Jobs, Elon Musk, Bill Gates, Warren Buffet, Jeff Bezos, and the list goes on.

It’s not uncommon for a business owner to borrow personality traits or business strategies from some of these highly regarded CEO’s and incorporated them into their own business. If during an interview you happen to bring up that you admire how Elon Musk has the ability to identify solutions to problems in industries where it was previously deemed impossible like PayPal and SpaceX. There is a good chance that the business owner or executive that is interviewing you has either read Elon’s book or is aware of his achievements and it brings that conversation to next level.

In addition, the person interviewing you will most likely assume that if you are interested in reading those types of books than you probably have that entrepreneur mindset which is rare and valuable. It’s very difficult to teach someone how to think like an entrepreneur. Showing that you possess that trait can easily excite a potential employer.

Here are the top three books that I would recommend reading:

Delivering Happiness by Tony Hsieh (CEO of Zappos)

Elon Musk by Ashlee Vance (CEO of Tesla)

The Virgin Way by Richard Branson (CEO of Virgin Group)

Each of these CEO's have different leadership styles, come from different industries, have different backgrounds, and provide different takeaways for the reader. There is a tremendous amount of knowledge to be gain from reading these books and all of these books are written in a way that makes it difficult to put them down once you have started reading them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Attention Middle Class: The End Is Near

I'm not a fan of conspiracy theories and I'm not a fan of "doom and gloom" articles. However, I feel compelled to write this article because I want people to be aware of a trend that is unfolding right now in our economy. This trend will strengthen over time, we will cheer for it as it's happening, but like many great things in history, it may have an

I'm not a fan of conspiracy theories and I'm not a fan of "doom and gloom" articles. However, I feel compelled to write this article because I want people to be aware of a trend that is unfolding right now in our economy. This trend will strengthen over time, we will cheer for it as it's happening, but like many great things in history, it may have an unintended consequence. I fear that the unintended consequence of this new trend will be the elimination of the U.S. middle class.

More Profits

I’m an investment advisor so I naturally love a strong bull market that results in large investment gains for our clients. The stock market generally goes up when companies are more profitable than the consensus expects. Higher profits equal higher stock prices which equal more wealth for investors. Corporations have become laser-focused on findings new ways to increase profits. This is important because businesses that struggle to make profits and have constant losses are not so successful and will probably end up shutting down in the near future, according to websites like https://www.laraedo.com/signs-that-my-business-is-ripe-for-a-shutdown/. The equation for net profit is easy:

Revenue – Expenses = Net Profit

Let me ask you this question: What is typically a company’s largest expense?

Answer: Payroll. Said another way, the employees. Salaries, benefits, the building to house the employees, training, workers comp, payroll taxes, and the list goes on and on. If you are the owner of a company that makes cell phones and I told you that I have a way that you can make TWICE as many cell phones with HALF the number of employees, what do you think is going to happen to profits? Up!!! In a big way.

The scenario that I just described is not something that might happen in the future, it’s something that is happening right now. Here is the data to support it.

The chart below compares the 10 largest companies in the S&P 500 Index in 1990 to the 10 largest companies in the S&P 500 in 2016. First, you may notice that none of the companies that were the largest in 1990 remained on the list in 2016. But here is the trend that I want to point out. When you look at the 10 largest companies in 1990, they produced $368 Billion dollars of revenue and employed 1.4 Million workers. Fast forward to 2016, the top 10 largest companies produced $1.2 Trillion dollars in revenue and employed about 1.6 Million workers. Now let’s do some quick math, between 1990 and 2016 the gross revenue of the largest 10 companies in the S&P 500 increased by 239% but the number of workers employed by those companies only increased by 14%. Companies are already doing more with less people.

Just when you thought things were going good for the company, I now come to you, the owner of the company, and tell you I have a way to make profits double within the next 3 years. Are you interested? Of course you are. All we have to do is buy these three machines that will replace another 50% of the employees. These machines work 24 hours a day, don’t need health insurance, don’t get sick, and we can move to a smaller building which will reduce rent by 60%. How is that possible? Welcome to the party…..artificial intelligence.

Not A Terminator Movie

What do we think of when we hear the words “artificial intelligence”? Terminators!! Fortunately for us that’s not the artificial intelligence that I’m referring too. But a machine that thinks and learns from its mistakes? The human mind is not as unique as we would like to think it is. Just take a Myers Briggs personality test. You answer 100 questions and then it tells you how you react to things, what annoys you, what your strengths are, how you communicate, and what you have difficulties with. It’s kind of scary as you read the results and realize “Yup. That’s me”

Think about it. Google may know more about you than your spouse. What do you want for Christmas? Your spouse may not know but Google knows all of the items that you looked at over the past 3 months, what items you spent the most time looking at, did you click on the description to read more, and what other items did you look at after you click on the initial item. It tells Google how you search for information. Also Google acknowledges that we all search for things differently and what we are searching for tells Google more about us. Essentially Google learns at little bit more about you every time you search for something via their website.

What about a machine that can respond to questions and it sounds just like a person when it speaks? Oh and it speaks perfect English. No more overseas call centers with people you can’t understand. With most call centers, there are probably 20 questions that represent 80% of all the questions asked. If the machine is unable to answer the question, it automatically routes that call to a living, breathing person. The programmers of the machines are notified when a question triggers a transfer to a live person, they listen to the call, and then update the software to be able to answer the question the next time it is asked. The easy math, this could reduce the number of customer service representatives that the company needs to employ by 80%. Oh and the number of employees will continue to decrease as the machines learn to answer more questions and the software gets more sophisticated.

While a company may go this direction to reduce expenses, we as the consumer will also champion this change. Think about how painful it is to call the cable company. What if I told you that when you call you won’t have to wait on hold, the “person” that you are speaking to will know how to resolve your problem, and you will be off the phone in less than 2 minutes. Time is a valuable commodity to us. Fix my problem and fix it quickly. If a machine can do that better than a real person, be my guest. If companies want it and we as the consumer want it, how fast do you think it’s going to happen?

I Can't Be Replaced By A Machine.....Wrong

While we will cheer how the new A.I. technology saves us time and makes life easier, many of us will have the hubris that “a machine can’t do what I do?”. While a machine may not be able to replace 100% of what you do, could it replace 50%? It’s going to be presented like this, “you know all of those daily tasks that you don’t like to do: paperwork, scanning forms, payroll, and preparing financial reports for the weekly managers meeting. Well you don’t have to do those anymore.” Yes!!!! Oh and more good news you don’t have to train a new employee to complete those tasks and wonder if they are going to leave a year from now and have to train someone else.

Programming a machine to complete a task is not too different from training a new employee. When you hire a new employee many of them may know very little about your industry, they have no idea how your company operates, how to answer tough questions from prospects, etc. You have to train them or “program” them. Then they learn on the job from there. The value of having 20 years of experience is you have seen many difficult situations throughout your career and you learned from your past experiences. The next time the same or similar problem surfaces you know how to react. Normally what you do is you teach those lessons to each new manager and employee over and over again. That takes time. What if you only had to teach that lesson one more time and every new employee already knew how to react in the same tough situation? That’s artificial intelligence.

My point, this trend will not be limited to just manufacturing or customer services. This new technology will eventually impact each of our careers in some way, shape, or form.

3 Stages

I expect this to happen in three stages.

Stage 1: Companies do MORE with only a FEW MORE employees

Stage 2: Companies do MORE with the SAME number of employees

Stage 3: Companies do MORE with LESS employees

We are already through Stage 1 and we are entering Stage 2. How long will it be before we reach stage 3? That’s anyone’s guess. But with most evolution, Stage 1 takes the longest and the following stages evolve more rapidly. If Stage 1 took 16 years, my guess would be that stage 3 will be here a lot sooner than we think.

So What Happens To All Of The Employees?

The million dollar question and I don't know the answer. If I had to guess, the current middle class is going to be divided into two. Half of the middle class is going move up into the "upper class" and the other half will be "unemployed". The level of education will be the dividing line. Companies will continue to do more with less people. The only way to stop it is to tell companies that need to stop trying to be more profitable. Good luck. Our entire economy is built on the premise that you should accumulate as much as you can as fast as you can.

War and Conflict

When I look back in history, major conflicts arise when there is a large deviation between the “Have’s” and the “Have Not’s”. The fancy name that is used today is “income inequality”. When you have a robust middle class, everyone has something to lose if a conflict arises because that conflict generally disrupts the current system, uncertainty prevails, the economy goes into a recession, people lose their job, and they in turn cannot make their mortgage payment.

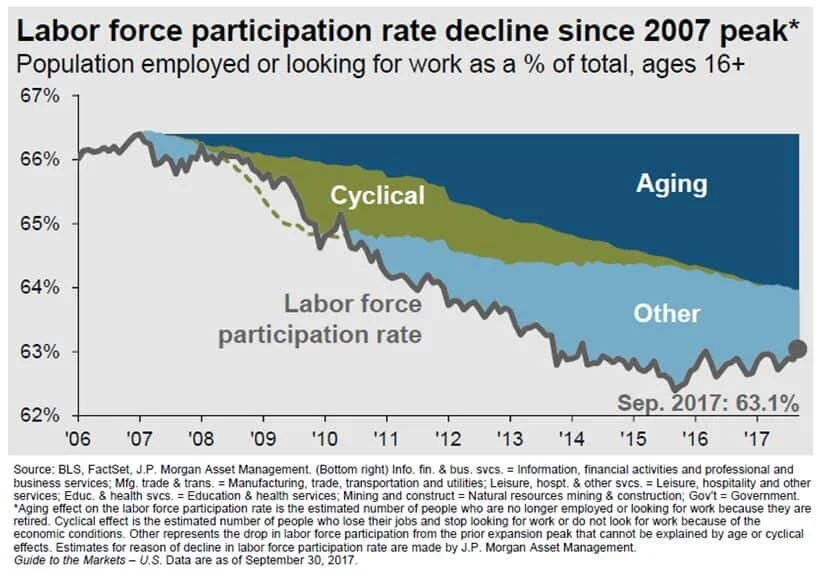

If instead, a majority of the population is unemployed and they can’t find a job because the jobs don’t exist anymore, that group of individuals has nothing to lose by burning the current system to the ground and rebuilding a new one from the ashes. I know that sounds dark but there is no arguing the gap between the Have’s and the Have Not’s is getting larger. Just look at the labor participation rate:

The Labor Participation Rate answers the question, how many people in the U.S. that could be working either are working or are looking for work? If there are individuals who could work, don’t have a job, and stop looking for work, they drop out of the labor force which decrease the labor participation rate because there are less citizens participating on the work force. As you can see in the chart above, in 2006 the labor participation rate was around 66%, and while we continue to experience one of the longest economic expansions of all time, the labor participation rate is still lower now than it was prior to the beginning of the economic recovery. Remember we are in an expansion and it has dropped by about 3%. What do you think will happen when we hit the next recession? While the baby boomer generation has had an impact on these numbers as you can see based on the large percentage of that decrease attributed to an “aging population”. Traditionally when someone retires, the company will promote the person below them and then hire another person to fill there spot. As many of us know, that’s not how it works anymore. Now that key employee retires, the company promotes one person into their role, but instead of hiring a new employee they just redistribute the work to the current staff. If anything, the baby boomer generation moving into retirement has made this transition to “do more with less people” easier on companies because they don’t have to fire anyone.

Tax Reform Will Accelerate The Trend

If you combine tax reform with the current 4.1% employment rate, I would expect this to accelerate the development of artificial intelligence. Companies are going to have cash from the tax savings to reinvest into new technologies which includes artificial intelligence. If the economy continues to grow at its current 2% pace or accelerates, one would expect consumption to increase which increases the demand for products and services. With the unemployment rate at 4.1%, we are already at "full employment". There are not enough qualified workers for companies to hire to meet the increase in demand for their product or service. The answer, let's accelerate the development of artificial intelligence that will allow the company to enter Phase 2 which is "Do MORE with the SAME number of workers".

People Will Cheer

These advances in technology are potentially setting the stage for levels of profitability that companies have only dreamed of. Higher profits traditionally equal higher stock prices. Investors will cheer this!! It may even lead us to the longest economic expansion of all time. In the short term, investors may have a lot to be excited about but we may look back years from now and realize that we were unintentionally cheering for the end of the middle class as we know it.

Again, this article is not meant to be a “dark cloud” or a new conspiracy theory but rather to keep our readers aware of the world that is changing rapidly around us. Like many of the economic challenges that the U.S. economy has experienced in the past, the hazard was in plain view, but investors failed to see it because they got caught up in the moment. When investing, it’s ok to take advantage of short term gains but never lose sight of the big picture.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.