2026 New York State Mandatory IRA Rules: What Employers Must Do to Stay Compliant

New York State’s Secure Choice IRA program is creating new compliance requirements for many employers beginning in 2026. Businesses with 10 or more employees that do not already offer a qualified retirement plan may be required to enroll workers in this state-facilitated Roth IRA program. Our analysis at Greenbush Financial Group explains who must comply, employer responsibilities, potential penalties, and why alternative retirement plans like SIMPLE IRAs or 401(k)s may offer greater long-term value.

New York State now requires many employers to offer a retirement savings option through the state-mandated Secure Choice IRA program. If your business has at least 10 employees and does not already offer a qualified retirement plan, participation is mandatory. Our analysis at Greenbush Financial Group shows that understanding who must comply, how the program works, and what alternatives exist can help business owners avoid penalties while improving employee retention. This article explains New York’s mandatory IRA rules and outlines smarter planning options for employers.

What Is the New York State Mandatory IRA Program?

The New York State mandatory IRA requirement applies through the New York State Secure Choice Savings Program, a state-facilitated retirement savings option for private-sector employees.

Secure Choice is designed for workers who do not have access to an employer-sponsored retirement plan. Employers act as facilitators, while the state oversees the program’s administration.

Key characteristics:

Roth IRA structure for employees

Automatic payroll deductions

No employer contributions required

State-administered investment options

Which New York Employers Are Required to Offer a Mandatory IRA?

Under New York law, participation is mandatory if all of the following apply:

You have 10 or more employees

You have been in business for at least two years

You do not currently offer a qualified retirement plan such as a 401(k), SIMPLE IRA, or SEP IRA

At Greenbush Financial Group, we commonly see confusion around part-time and seasonal employees. For Secure Choice purposes, employees are generally counted if they are on payroll, regardless of hours worked.

Which Businesses Are Exempt From the Requirement?

You are exempt from the New York mandatory IRA requirement if your business already offers:

A 401(k) or Safe Harbor 401(k)

A SIMPLE IRA

A SEP IRA

A defined benefit or cash balance pension plan

Offering any qualified retirement plan removes the obligation to participate in Secure Choice. This exemption often creates an opportunity for employers to choose a more flexible and customizable plan instead.

How the Secure Choice IRA Works for Employees

Eligible employees are automatically enrolled unless they opt out.

Default program features include:

Automatic enrollment at a preset contribution rate

Contributions made on a Roth (after-tax) basis

Employee-owned accounts that move with them if they change jobs

Limited investment menu selected by the state

Employees can:

Change contribution amounts

Opt out at any time

Withdraw funds subject to Roth IRA rules and penalties

Employer Responsibilities Under the Mandatory IRA Law

Although employers do not contribute financially, they still carry administrative responsibilities.

Employer duties include:

Registering with the Secure Choice program

Providing employee information

Processing payroll deductions

Submitting contributions on schedule

Distributing required employee notices

Failure to comply may result in state enforcement actions once deadlines are fully phased in.

Deadlines and Penalties for Non-Compliance

New York’s rollout is being phased in by employer size, with enforcement expected to increase through 2026.

Potential consequences of non-compliance include:

Monetary penalties

State enforcement notices

Increased scrutiny for repeat violations

Our analysis at Greenbush Financial Group suggests that many business owners delay action simply because they are unaware the rule applies to them.

Is Secure Choice the Best Option for Employers?

For some businesses, Secure Choice meets the minimum requirement. However, it may not be the best long-term solution.

Limitations of the mandatory IRA include:

No employer contribution flexibility

Roth-only structure

Limited investment choices

Reduced perceived benefit compared to a 401(k)

In contrast, alternatives such as SIMPLE IRAs or 401(k) plans can:

Increase tax deductions for employers

Improve employee recruitment and retention

Offer higher contribution limits

Allow customized plan design

At Greenbush Financial Group, we often help employers compare Secure Choice with private retirement plans to determine the most cost-effective and strategic solution.

Planning Considerations for Business Owners

When deciding how to comply, consider:

Your employee demographics and turnover

Tax deductions available to the business

Administrative complexity

Long-term growth and scalability

Choosing the right retirement plan is not just about compliance; it is a strategic business decision.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Frequently Asked Questions About New York State Mandatory IRAs

-

Is the New York State Secure Choice IRA mandatory for all businesses?No. It is only mandatory for businesses with 10 or more employees that do not already offer a qualified retirement plan.

-

Do employers have to contribute to the Secure Choice IRA?No. Employers are not allowed or required to make contributions; only employee payroll deductions are permitted.

-

What happens if my business ignores the mandatory IRA requirement?Non-compliance may result in penalties and enforcement actions as the state increases oversight.

-

Can employees opt out of the New York mandatory IRA?Yes. Employees are automatically enrolled but may opt out or change contributions at any time.

-

Does offering a SIMPLE IRA exempt my business from Secure Choice?Yes. Offering a SIMPLE IRA, 401(k), or SEP IRA fully satisfies the requirement.

-

Is Secure Choice better than a 401(k) for small businesses?Not always. While Secure Choice is simple, many businesses benefit more from private plans with higher limits and tax advantages.

New York State Secure Choice Law — Companies Are Now Required to Sponsor Retirement Plans for Employees

New York’s SECURE Choice program is changing how many employers must handle retirement benefits. If your business doesn’t currently offer a qualified retirement plan, you may be required to either register for SECURE Choice or implement an alternative plan option. In this article, we break down who must comply, key deadlines, and what employers should do now to avoid penalties and ensure employees have a retirement savings solution.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The New York State Secure Choice Savings Program requires most companies and not-for-profit organization in New York to either:

Sponsor a qualified employer-sponsored retirement plan, or

Register for the state-run Roth IRA program and remit employee contributions.

This law affects businesses based on size and existing retirement plan offerings. In this article, we’ll explain:

Who is covered under the law

Important effective dates by company size

What qualifies as an exempt employer-sponsored retirement plan

How to certify exemptions

Employer responsibilities in remitting contributions

How employees interact with their state-run IRAs

Penalties for non-compliance

Practical tips for employers to prepare

What Is the NY Secure Choice Savings Program?

The Secure Choice program is a state-sponsored retirement savings program that allows participating employees to save for retirement through automatic payroll deductions into a Roth IRA. Employers who do not already offer a qualified plan are required to facilitate the program.

The program is overseen by the New York Secure Choice Savings Program Board and is designed to expand retirement savings access to private-sector workers across the state.

Who Must Comply?

An employer must either offer a employer-sponsored retirement plan or participate in the Secure Choice program if all of the following are true:

The employer has 10 or more employees in New York during the prior calendar year;

The employer has been in business for at least two years;

The employer does not already offer an employer-sponsored retirement plan to employees.

Employers with fewer than 10 employees are generally not required to participate in the state program, though they must still register and certify exemption if applicable.

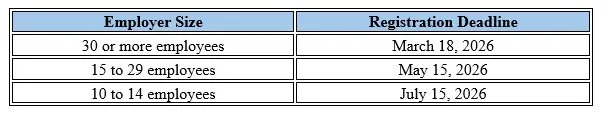

Effective Dates Based on Employer Size

Secure Choice implementation in 2026 is staggered based on the number of New York employees:

These are the dates by which employers must either:

Register for the Secure Choice program, or

Certify exemption via the official state portal.

Exemptions: Qualifying Employer-Sponsored Retirement Plans

However, even if an employer meets the employee-size threshold above, it is exempt from the Secure Choice program if it already sponsors an employer-sponsored retirement plan. Employers must still certify their exemption through the Secure Choice portal.

Qualifying employer-sponsored plans include:

401(k) plans

403(a) qualified annuity plans

403(b) tax-sheltered annuity plans

SEP IRAs

SIMPLE IRA plans

457(b) plans

If you offer one of the above, your business can avoid participation in the state program — but you must still submit an exemption through the official portal.

How to Certify an Exemption

Employers seeking exemption need to log in to the Secure Choice employer portal and submit documentation of their qualified plan. Details include:

Federal Employer Identification Number (EIN)

Access Code (typically sent to employers by mail or email)

Plan documentation showing current retirement plan offerings

Official website for registration and exemptions: www.NewYorkSecureChoice.com

Employer Responsibilities if Participating in Secure Choice

If your business does not qualify for an exemption, you must:

Register for Secure Choice by the deadline assigned to your employer size.

Automatically enroll eligible employees into the program. (Eligibility is all employee age 18 or older with earned taxable wages)

Set up payroll deductions and begin subtracting employee contributions.

Remit contributions to the state-administered Roth IRAs.

Upload employee data and maintain records via the program portal.

Employers do not contribute to the accounts, and they cannot offer matching contributions under the Secure Choice IRA program.

How Contributions Work

Remitting Employee Payroll Contributions

Contributions are deducted from employee paychecks via automatic payroll withholding.

Employers are responsible for timely remittance of these contributions to the state program’s recordkeeper (program administrators).

Employers do not make employer contributions.

Default Contribution and Adjustments

Employees are typically auto-enrolled at a default 3% contribution rate of gross pay.

Employees may adjust the contribution amount or opt out entirely within the enrollment period or later open enrollment windows.

Employee Experience With Secure Choice

Account Setup and Features

Each participating employee gets a Roth IRA account through the Secure Choice program.

Contributions are after-tax, meaning withdrawals in retirement are generally tax-free (subject to Roth IRA rules).

Accounts are portable — employees keep them even if they change jobs.

Investing, Contribution Limits, and Withdrawals

Employees can choose investment options provided by the program or stay with the default investment.

They can change contribution rates or opt out after the initial enrollment period.

Roth IRA contribution limits apply (e.g., the standard IRA annual limits — $7,500 for 2026 before catch-up, potentially higher with catch-up contributions for those 50+, etc.).

Distributions follow general Roth IRA rules (qualified distributions tax-free and penalty-free after meeting age/service requirements).

How Employees Are Enrolled in the NY Secure Choice Roth IRA Program

A common question from employers is whether they are responsible for enrolling employees, or whether employees must sign themselves up. Under the New York State Secure Choice Savings Program, the process works as follows:

Employers Facilitate Enrollment — Employees Do Not Self-Enroll

Employers do not actively “sign up” employees, and employees do not enroll themselves directly. Instead, enrollment happens through automatic payroll facilitation by the employer.

Here’s how the process works step-by-step:

Step 1: Employer Registers and Uploads Employee Information

Once an employer registers for Secure Choice (or confirms participation is required), the employer must:

Upload required employee data into the Secure Choice employer portal, including:

Employee name

Social Security number or Tax ID

Date of hire

Contact information

Identify eligible employees who meet program requirements

For newly hired employees, the employer needs to enroll them in the Secure Choice Program within 30 days of their hire date

This step triggers the enrollment process, but it does not immediately deduct contributions.

Step 2: Employees Receive Enrollment Notice From the State Program

After the employer uploads employee information:

The Secure Choice program (or its appointed program administrator) sends official enrollment notices directly to employees

The notice explains:

That the employee will be automatically enrolled

The default contribution rate

How to opt out or change contribution levels

Where to access their account online

This communication comes from the state program, not the employer.

Step 3: Automatic Enrollment Occurs Unless the Employee Opts Out

If the employee takes no action during the notice period:

The employee is automatically enrolled in a state-sponsored Roth IRA

Payroll deductions begin at the default contribution rate (generally 3% of gross pay, unless adjusted by the employee)

If the employee chooses to opt out:

No deductions are taken

The employer must maintain records showing the opt-out election

Step 4: Employer Begins Payroll Withholding and Remittance

Once enrollment is active:

The employer withholds the elected contribution amount from each paycheck

Contributions are remitted to the Secure Choice program on a recurring basis, aligned with payroll schedules

The employer’s role is limited to withholding and remitting contributions — similar to payroll taxes

Importantly:

Employers do not select investments

Employers do not manage accounts

Employers do not provide investment advice

Employers do not contribute employer funds

Step 5: Ongoing Employee Control

After enrollment:

Employees manage their own accounts directly through the Secure Choice program

Employees can:

Change contribution percentages

Opt out or opt back in later

Select or change investment options

Request distributions (subject to Roth IRA rules)

The account belongs to the employee and is fully portable if they change jobs.

Penalties for Non-Compliance

While specific penalties in the Secure Choice law are still being formalized, failure to register or certify your exemption by the applicable deadline can subject employers to:

Administrative penalties and fines

Potential liability for missed remittance obligations

Ongoing penalties until compliance is achieved

For example, programs in other states have assessed penalties like $250 per employee per month for non-compliance, escalating over time. While New York’s specific fines may vary, the risk of enforcement is real and growing as the program rolls out statewide. However, as of February 2026, New York has yet to communicate when penalities will begin and what the amounts will be.

Tips for Employers

Start Early — Don’t Wait

Act well in advance of your registration deadline. If your company currently sponsors an employer-sponsored retirement plan, it’s making sure someone on your team will be logging into the NYS portal to file the exemption. For companies that plan to implement an employer-sponsored retirement plan prior to their deadline, there is extreme urgency to start evaluating as soon as possible both the type of plan that is best for the company and the platform for their plan. Establishing an employer-sponsored plan often involves:

Plan design and adoption

Document creation and compliance testing

Employee communications and elections

Payroll integration

If it’s the intent of your company / organization not establish a retirement plan and enroll employees in the state-mandated Roth IRAs, advanced action is still required. Companies will be required to gather the employee data and upload it to the NYS Secure Choice website, confirm how payroll will handle the automatic Roth deductions from payroll, who will be responsible for remitting the contributions to the NYS platform each pay period, and communication to the employees in advance of the payroll deduction is highly recommended.

Many businesses will be acting on these requirements in 2026 — waiting until the last minute can create unnecessary compliance risk.

Evaluate Whether to Offer Your Own Plan

Offering a 401(k) or other qualified plan may be more attractive for recruiting and retention, may allow employer matching, and could provide tax incentives not available under the state program. Also, there are a number of tax credits currently available to help offset some or all of the plan fees associated with establishing an employer-sponsored retirement plan for the first time. See our article below for detail on the start-up plan tax credits available:

GFG Article: 3 New Start-up 401(k) Tax Credits

How Many Other States Have Similar Mandated Retirement Programs?

New York is not alone in adopting a mandatory retirement savings program for private-sector employees. In fact, Secure Choice builds on a growing national trend aimed at addressing the retirement savings gap for workers who do not have access to an employer-sponsored plan.

As of today:

More than a dozen states (15+) have enacted legislation requiring certain employers to either:

Offer a qualified employer-sponsored retirement plan, or

Participate in a state-facilitated IRA program funded through payroll deductions.

Several of these programs are fully operational, while others are in various stages of implementation or phased rollout.

States that were early adopters (such as California, Oregon, and Illinois) now have millions of workers enrolled and billions of dollars in assets within their state-facilitated retirement programs.

New York Has Selected Vestwell

New York has selected a company by the name of Vestwell to serve as the program administrator for the state-mandated Roth IRA accounts.

Choosing a Startup Retirement Plan Provider: What Employers Should Know

For many employers, the Secure Choice law will prompt a first-time decision about whether to start an employer-sponsored retirement plan instead of participating in the state-run IRA program. While this can be a positive move for employee recruitment and retention, it’s important to understand that not all startup plan providers — or pricing models — are the same.

There Are Many Choices — and Fees Vary Widely

Employers exploring startup plans will quickly find a wide range of providers, including bundled platforms, payroll-integrated solutions, and self-directed providers. Costs can differ significantly depending on:

Plan administration fees

Investment platform and fund expenses

Recordkeeping and compliance costs

Per-participant charges

Advisor or fiduciary service fees (if applicable)

Some providers advertise low headline pricing but layer on additional costs elsewhere. Others charge flat fees that may be economical at certain asset levels but expensive for smaller plans. Understanding how fees are structured — and how they may grow over time — is critical when selecting a provider.

Start-up 401(k) Provider

In the past, we have worked with companies that successfully used Employee Fiduciary as a start-up 401(k) solution. Employee Fiduciary is a national-level 401(k) provider that offers flexibility with plan design, Vanguard index funds for investment options, and fee transparency.

Disclosure: This statement is not an endorsement of Employee Fiduciary or their 401(k) solution. Our firm has had experience in working with Employee Fiduciary in the past, and since we do not offer investment services to start-up plans, we want to be able to connect readers with what I, as the author of this article, deem to be a high-quality start-up 401(k) plan solution. Our firm does not receive any form of compensation for referring clients to Employee Fiduciary.

Conclusion

The New York Secure Choice Savings Program represents a significant change for private employers in the state. Whether you must register for the state-run IRA program or certify exemption with your existing retirement plan, compliance is mandatory and deadlines are coming fast in 2026.

By planning ahead — and consulting legal, tax, or benefits professionals if needed — employers can meet these requirements smoothly while ensuring their employees have access to valuable retirement savings opportunities.

A Note on Our Firm’s Focus

Our firm does not offer solutions for brand-new startup plans. We specialize in working with established retirement plans that already have at least $250,000 in plan assets, for which we provide investment management and plan consulting services.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.