How Do Executive Non-Qualified Deferred Compensation Plans Work?

If you're a high-income executive, you’ve likely hit the contribution ceiling on your 401(k) or other qualified plans. So what’s next?

Enter the non-qualified deferred compensation (NQDC) plan—a tax deferral strategy designed for executives who want to save more for retirement beyond traditional limits.

For highly compensated employees, saving for retirement isn’t always as simple as maxing out a 401(k). When income exceeds traditional plan limits, non-qualified deferred compensation (NQDC) plans—often offered to executives—can provide a powerful way to defer taxes and accumulate wealth beyond standard retirement vehicles.

But how do these plans actually work? And what should executives know before deferring compensation?

Let’s break it down.

What Is a Non-Qualified Deferred Compensation Plan?

An NQDC plan is an employer-sponsored agreement that allows certain employees—typically executives or other key personnel—to defer a portion of their income to a future date, such as retirement or separation from service.

Unlike qualified plans (such as a 401(k)), these plans do not fall under ERISA coverage and do not have contribution limits set by the IRS. This makes them attractive for those whose income exceeds the maximum deferral limits in traditional plans.

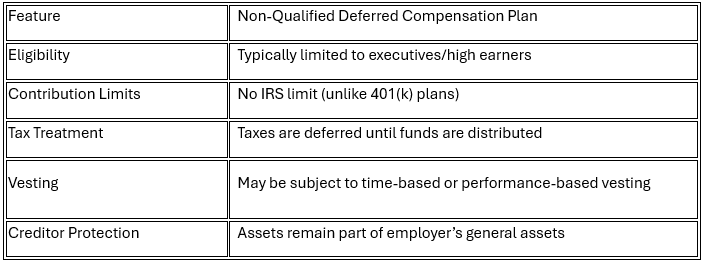

Key Features

How Deferrals Work

An executive elects—in advance of the year earned—to defer a portion of salary, bonus, or other compensation. This election is typically irrevocable for that year and must comply with IRC Section 409A.

For example:

Jane, a CFO earning $600,000, defers $100,000 of her 2025 compensation into her company’s NQDC plan. She’ll pay no income tax on that $100,000 in 2025—it'll be taxed when she receives the funds in retirement or at a future distribution date.

Distribution Options

The executive can usually choose from a menu of payout options, such as:

Lump sum at retirement

Installments over 5–10 years

Specific distribution events (e.g., separation from service, death, disability)

Important: Once the distribution schedule is set, changing it often requires a five-year delay and must follow 409A regulations to avoid penalties.

Tax Considerations

Deferred income is not taxed until it’s actually received.

Funds may grow tax-deferred in an investment vehicle selected by the participant or the employer.

Unlike a 401(k), contributions are not protected from creditors—they remain employer assets until distributed.

Distributions are taxed as ordinary income, not capital gains.

What Are the Risks?

NQDC plans can be valuable, but they come with risks not present in qualified plans:

Employer Solvency: Since funds remain part of the employer’s general assets, they could be lost in bankruptcy.

Limited Access: You cannot take early withdrawals without triggering taxes and penalties under 409A.

Inflexibility: Election and distribution decisions are difficult to change once made.

Unfunded plan: NQDC plans are not required to be “funded” by the employer like a 401(k) plan so it may just be a future promise of the employer to pay those amounts out to the employee when the benefit vests. This adds additional risk for the executive.

When Does an NQDC Plan Make Sense?

An NQDC plan can be a smart tool for:

High W2 earners who max out traditional retirement plans and want to save more

Executives with predictable income and long-term tenure at the company

Those expecting to be in a lower tax bracket in retirement

Executives who are employed by a financially strong company

However, it may not be suitable for someone with:

Uncertainty around staying with the employer long-term

Concerns about the company’s financial health

A need for liquidity or access to funds before retirement

Final Thought

Non-qualified deferred compensation plans can be a powerful tax deferral and wealth-building tool for high-income executives, but they require careful planning. Because these plans carry unique risks and limited flexibility, it’s important to review your full financial picture, long-term goals, and employer stability before making a deferral election.

If you're considering participating in your company’s NQDC plan, talk to a financial planner who understands executive compensation and tax strategy. The right guidance can help you avoid missteps and make the most of what these plans have to offer.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is a Non-Qualified Deferred Compensation (NQDC) plan?

A Non-Qualified Deferred Compensation (NQDC) plan is an employer-sponsored arrangement that allows select employees—typically executives or highly compensated individuals—to defer a portion of their income to a future date, such as retirement or separation from service. These plans are not subject to the same IRS limits as 401(k)s, allowing for greater savings potential.

How does an NQDC plan work?

Participants elect in advance to defer a portion of their salary, bonuses, or other compensation before it is earned. The deferred income grows tax-deferred until distributed, usually at retirement or another specified event. Because the funds technically remain part of the employer’s assets, they are not taxed until paid out to the employee.

When do I have to make my deferral election?

Under IRS Section 409A, deferral elections must be made before the start of the year in which the income is earned. These elections are generally irrevocable for that year and must follow strict timing and compliance rules to avoid penalties.

How are NQDC distributions paid?

Participants usually choose a distribution schedule when enrolling in the plan. Common options include a lump sum at retirement or installment payments over 5–10 years. Once the schedule is selected, it’s difficult to change without a five-year delay and compliance with Section 409A regulations.

How is deferred compensation taxed?

Deferred income and its growth are not taxed until distributed. When payouts occur, the amounts are taxed as ordinary income—not capital gains. However, if the plan violates 409A rules, deferred amounts could become immediately taxable with additional penalties.

Are NQDC plans protected from creditors?

No. Unlike 401(k)s, NQDC plan assets remain part of the employer’s general assets until distributed. This means that if the company faces bankruptcy or insolvency, participants may lose their deferred compensation.

What are the main risks of participating in an NQDC plan?

The key risks include employer insolvency, lack of liquidity, and limited flexibility. Because plans are often unfunded and cannot be accessed early without tax penalties, participants rely on their employer’s financial strength and long-term stability.

Who should consider using an NQDC plan?

These plans are best suited for high earners who have already maxed out qualified retirement plans, expect to stay with their employer long-term, and anticipate being in a lower tax bracket in retirement. They may also be attractive for executives at financially stable companies.

Who might want to avoid an NQDC plan?

NQDC plans may not be appropriate for individuals who expect to leave their employer soon, need short-term access to funds, or are concerned about the company’s financial health. Those uncertain about their future tax situation should also evaluate carefully before deferring large amounts.

What’s the difference between an NQDC plan and a 401(k)?

A 401(k) is a qualified, ERISA-protected plan with contribution limits and creditor protection. An NQDC plan is non-qualified, has no IRS contribution limits, offers greater flexibility in savings amounts, but lacks creditor protection and carries employer solvency risk.

Can I change my payout schedule after enrolling?

Generally no—changes to distribution timing or method require at least a five-year deferral from the original payout date and must follow strict Section 409A rules to avoid penalties.

Should I consult a financial planner before enrolling in an NQDC plan?

Yes. Because NQDC plans involve complex tax, investment, and timing decisions, working with a financial planner or tax advisor experienced in executive compensation can help you optimize your deferral strategy and manage potential risks.