What is the Value of My Pension?

In our latest article, we break down how to calculate the present value of your pension—a powerful way to compare your pension to your other retirement assets and make better long-term decisions.

Whether you’re 5 years from retirement or already collecting, this article will help you see your pension in a new light.

For many Americans approaching retirement, a pension represents one of the most valuable pieces of their financial picture. But while pensions may promise reliable income in the future, they can be hard to evaluate in present terms—especially if you’re trying to compare your pension to a 401(k), IRA, or a lump-sum offer from your employer. That’s where calculating the present value of your pension becomes useful.

In this article, we’ll break down what present value means, how to calculate it, and why it’s essential for retirement planning.

What Is Present Value and Why Does It Matter?

The present value (PV) of your pension tells you how much the future stream of income payments is worth in today’s dollars. It answers this question:

“If I had to replace my pension with a lump sum today, how much money would I need?”

This is especially important when:

You're offered a lump-sum payout option instead of monthly payments

You're comparing your pension to your other investments

You're trying to understand your net worth or financial independence readiness

Step 1: Gather the Details of Your Pension

To begin, you’ll need the following information, which you should be able to request from your employer or pension administrator:

Annual or monthly payment amount

Start date of pension payouts

Expected length of payments (based on life expectancy or plan rules)

Discount rate (assumed rate of return—typically between 4%–6%)

Let’s look at an example:

You’re eligible to receive $30,000 per year

Payments start at age 65

You expect payments to last for 20 years (Age 85 Life Expectancy)

You use a 5% discount rate

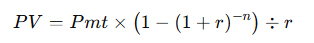

Step 2: Use the Present Value of an Annuity Formula

Most pensions pay a fixed amount each year. This makes them resemble a type of annuity. To calculate the present value of that annuity, use the formula:

Where:

PV = present value

Pmt = annual pension payment

r = discount rate (as a decimal)

n = number of years of payment

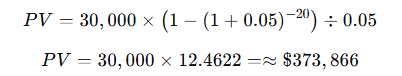

In our example:

So the present value of this pension is about $373,866.

Step 3: Adjust for the Time Until Retirement

If you're not retiring immediately, you’ll need to discount the result back to today’s dollars.

Let’s say you're 55 now, and payments begin at 65. That’s a 10-year delay. The formula becomes:

This means the value of your pension—in today’s dollars—is roughly $229,625.

How Should You Choose a Discount Rate?

The discount rate reflects your assumed rate of return if you invested that money yourself. When we create financial plans for individuals, we typically assume a rate of return of 6-7% before retirement and 4% in retirement for investments. Unlike a 401(k) or other investment account where the account owner assumes the investment risk, a pension is more of a “promise to pay” and the investment risk is assumed by the organization paying the benefit. When estimating the present value of a pension, we typically recommend using a more conservative rate of 4-5%. If you believe your rate of return would be higher if you invested the money yourself, that would increase the discount rate used in the calculation above and reduce the estimated present value of your pension.

Other Factors to Consider

Cost of Living Adjustments (COLAs)

If your pension increases each year to keep up with inflation, it’s worth more than a flat pension and requires a different calculation.Joint Life Payouts

If your pension pays for your spouse’s lifetime too, you’ll need to factor in their life expectancy as well.Taxes

Pension payments are typically taxed as ordinary income. This doesn’t change the present value math, but it matters when comparing to Roth accounts or after-tax investments.

When Calculating Present Value Can Help

Here’s when you might want to calculate your pension’s present value:

Deciding between a monthly pension or lump sum

Coordinating pension income with Social Security and investment withdrawals

Evaluating your retirement readiness

Planning how to split retirement assets in a divorce

It gives you a common-dollar framework for comparison—turning an income stream into a lump sum you can benchmark and plan around.

Final Thoughts

Your pension may be one of the most stable sources of income in retirement, but stability doesn’t always equal clarity. By calculating its present value, you equip yourself with a concrete number you can use in your overall retirement strategy. Whether you’re weighing a lump sum, planning for early retirement, or just seeking a clearer financial picture, this number helps turn your pension into a more actionable asset.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Selecting The Best Pension Payout Option

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

Lump sum

Single Life Benefit

100% Survivor Benefit

50% Survivor Benefit

Survivor Benefit Plus Pop-up Election

The right option varies person by person but some of the primary considerations are:

Marital status

Your age

Your spouse’s age

Income needed in retirement

Retirement assets that you have outside of the pension

Health considerations

Life expectancy

Financial stability of the company sponsoring the plan

Tax Strategy

Risk Tolerance

There are a lot of factors because the decision is not an easy one. In this article, I’m going to walk you through how we evaluate these options for our clients so you can make an educated decision when selecting your pension payout option.

Understanding The Options

To give you a better understanding of the various payout options, I’m going to walk you through how each type of benefit works. Not all pension plans are the same, some plans may only offer some of these options, others after all of these options, and some plans have additional payout options available.

Lump Sum: Some pension plans will give you the option of receiving a lump sum dollar amount instead of receiving monthly payment for the rest of your life. Retirees will typically rollover these lump sum amounts into their IRA’s, which is a non-taxable event, and then take distributions as needed from their IRA.

Single Life Benefit: This is also referred to as the “straight life benefit”. This option usually offers the highest monthly pension payments because there are no survivor benefits attached to it. You receive a monthly payment for the rest of your life but when you pass away, all pension payments stop.

Survivor Benefits: There are usually multiple survivor benefit payout options. They are typically listed as:

100% Survivor Benefit

75% Survivor Benefit

50% Survivor Benefit

25% Survivor Benefit

The percentages represent the amount of the benefit that will continue to your spouse should you pass away first. The higher the survivor benefit, typically the lower your monthly pension payment will be because the pension plans realize they may have to make payments for longer because it’s based on two lives instead of one.

Example: If the Single Life pension payment is $3,000, if instead you elect a 50% survivor benefit, your pension payment may only be $2,800, but if you elect the 100% survivor benefit it may only be $2,700. The monthly pension payments go down as the survivor benefits go up.

Here is an example of the survivor benefit, let’s say you elect the $2,800 pension payment with a 50% survivor benefit. Your pension will pay you $2,800 per month when you retire but if you were to pass away, the pension plan will continue to pay your spouse $1,400 per month (50% of the benefit) for the rest of their life.

Pop-Up Elections: Some pension plans, like the New York State Pension Plan, provide retirees with a “Pop-Up Election”. With the pop-up, if you select a survivor benefit which provides you with a lower monthly pension payment amount but your spouse passes away first, thus eliminating the need for a survivor benefit, your monthly pension payment “pops-up” to the amount that you would have received if you elected the Single Life Benefit.

Example: You are married, getting ready to retire, and you have the following pension payout options:

Single Life: $3,000 per month

50% Survivor Benefit: $2,800 per month

50% Survivor Benefit with Pop-Up: $2,700 per month

If you elect the Single Life option, you would receive $3,000 per month, but when you pass away the pension payments stop.

If you elect the 50% Survivor Benefit, you would receive $2,800 per month, but if you pass away before your spouse, they will continue to receive $1,400 for the rest of their life.

If you elect the 50% Survivor Benefit WITH the Pop-Up, you would receive $2,700 per month, if you were to pass away before your spouse, your spouse would continue to receive $1,350 per month. But if your spouse passes away before you, your pension payment pops-up to the $3,000 Single Life amount for the rest of your life.

Why do people select the pop-up? It’s more related to what happens to the social security benefits when a spouse passes away. If your spouse were to pass away, one of the social security benefits is going to stop, and you receive the higher of the two but some of that lost social security income could be made up by the higher pop-up pension amount.

Marital Status

The easiest variable to address is marital status. If you are not married or there are no domestic partners that depend on your pension payments to meet their expenses, then typically it makes sense to elect either the Lump Sum or Straight Life payment option. Whether or not the lump sum or straight life benefit makes sense will depend on your age, tax strategy, income need, if you want to preserve assets for your children, and other factors.

Income Need

If you are married or have someone that depends on your pension income, by far, the number one factors becomes your income need in retirement when making your pension election. If the primary source of your retirement income is your pension and you were to pass away, your spouse would need to continue to receive all or a portion of those pension payments to meet their expenses, you have to weigh very heavily the survivor benefit options. We have seen people make the mistake of electing the Single Life Option because it was the highest monthly payout and then the spouse with the pension unexpectedly passes away at an earlier age. It’s a devastating financial event for the surviving spouse because the pension payments just stop. If someone were to pass away 5 years after leaving their company, they worked all of those year to receive 5 years worth of pension payments, and then they just stopped.

We usually have to run projections for clients to answer this question, if the spouse with the pension passes away will their surviving spouse need 50%, 75%, or 100% of the pension payments to meet their income needs? In most cases it’s worth accepting a slightly lower monthly pension payment to reduce this survivor risk.

Retirement Assets Outside Of The Pension

If you have substantial retirement savings outside of your pension like 401(k) accounts, investment accounts, 457, IRA’s, 403(b) plans, this may give you more flexibility with your pension options. Having those outside assets almost creates a survivor benefit for your spouse that if the pension payments were to stop or be reduced, there are other retirement assets to draw from to meet their income needs.

Example: You have a retired couple, both have pensions, and they have also accumulated $1M in retirement accounts outside the pension, if one spouse were to pass away, even though the pension payments may stop or be reduced, there may be enough assets to draw from the outside retirement accounts to make up for that lost pension income. This may allow a couple to elect a 50% survivor benefit and receive a higher monthly pension payment compared to electing the 100% survivor benefit with the lower monthly pension payment.

Risk Management

This last example usually leads us into another discussion about long-term risk. Even though you may have the outside assets to accept a higher monthly pension payment with a lower survivor benefit, should you? When we create retirement plans for clients we have to make a lot of assumptions about assumed rates of return, life expectancy, expenses, etc. But what if your investment accounts take a big hit during the next recession or a spouse passes away much sooner than expected, accepting a lower survivor benefit may increase the impact of those risks on your plan. If you and your spouse are both able to elect the 100% survivor benefit on your pensions, you then know, that no matter what happens in the future, that pension income will always be there, so it’s one less variable in your long-term financial plan.

While this could be looked at as a less risky path, there is also the flip side to that. If you lock up the 100% survivor benefit on the pension, that may allow you to take more risk in your outside retirement accounts, because you are not as dependent on those accounts to supplement a survivor benefit depending on which spouse passes away first.

Age

The age of you and your spouse can also be a factor. If the spouse with the pension is quite a bit older than the spouse without pension, it may make sense for normal life expectancy reasons, to elect a larger survivor benefit. Visa versa, if the spouse with then pension is much younger, it may warrant a lower survivor benefit elect. But in the end, it all goes full circle back to the income need if the pension payments were to stop, are there enough other assets to supplement income for the surviving spouse?

Health Considerations / Life Expectancy

When conducting a pension analysis, we will typically use age 90 as a life expectancy for most clients. But there are factors that can alter the use of age 90 such as special health considerations and longevity. If the spouse that has the pension is forced to retire for health reasons, it gives greater weight to electing a pension benefit with a higher survivor benefit. When a client tells us that their father, mother, and grandmother, all lived past age 93, that can impact the pension decision. Since people are living longer, it increases the risk of spending through their traditional retirement savings, whereas the pension payments will be there for as long as they live.

Financial Stability Of The Company / Organization

You are seeing more and more stories about workers that were promised a pension but then their company, union, or not-for-profit goes bankrupt. This is a real risk that should factor into your pension decision. While there are government agencies like the PBGC that are there to help backstop these failed pension plans, there have been so many bankrupt pensions over the past two decades that the PBGC fund itself is at risk of running out of assets. If a retiree is worried about the financial solvency of their employer, it may give greater weight to electing the “Lump Sum Option”, taking your money out of the plan, getting it over to your IRA, and then taking monthly payments from the IRA. Since this is becoming a greater risk to employees, we created a video dedicated to this topic: What Happens To Your Pension If The Company Goes Bankrupt?

Tax Strategy

Tax strategy also comes into play when electing your pension benefit. If we have retirees that have both a pension and retirement accounts outside the pension plan, we have to map out the distribution / tax strategy for the next 10 to 20 years. Depending on who you worked for and what state you live in, the monthly pension payments may be taxed at the federal level, state level, or both. Also, many retirees don’t realize that social security will also be considered taxable income in retirement. Then, if you have pre-tax retirement accounts, at age 72, you have to begin taking Required Minimum Distributions which are taxable.

There are situations where we will have a retiree forego the monthly pension payment from the pension plan and elect the Lump Sum Benefit option, so they can rollover the full balance to an IRA, and then we have more flexibility as to what their taxable income will be each year to execute a long term tax strategy that can save them thousands and thousands of dollars in taxes over their lifetime. We may have them process Roth conversions, or realize long term capital gains at a 0% tax rate, neither of which may be available if the pension income is pushing them up into the higher tax brackets.

There are so many other tax strategies, long term care strategies, and wealth accumulation strategies that come into the mix when deciding whether to take the monthly pension payments or the lump sum payment of your pension benefit.

Pension Option Analysis

These pension decisions are very important because you only get one shot at them. Once the decision is made you are not allowed to go back and change your mind to a different option. We run this pension analysis for clients all of the time, so before you make the decision, feel free to reach out to us and we can help you to determine which pension benefit is the right one for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are the main pension payout options available at retirement?

Most pension plans offer several payout choices, including a lump sum, single life benefit, and various survivor benefit options such as 50%, 75%, or 100% survivor benefits. Some plans also include a pop-up feature, which increases your payment to the single life amount if your spouse passes away first.

How does the lump sum option work?

The lump sum option provides a one-time payout that retirees often roll over into an IRA to avoid immediate taxes. This choice offers more flexibility and control over investments but transfers market and longevity risk to the retiree.

What is the difference between single life and survivor benefit options?

A single life pension pays the highest monthly amount but ends when the retiree dies. A survivor benefit option pays a reduced monthly amount during the retiree’s life, but continues payments—often 50%, 75%, or 100%—to the surviving spouse after death.

What is a pop-up survivor benefit?

A pop-up election reduces your monthly pension slightly compared to a standard survivor benefit but increases (“pops up”) your payment to the full single life amount if your spouse passes away first. This feature can help offset lost Social Security income when one spouse dies.

How does marital status influence your pension decision?

Married retirees or those with financial dependents often need to prioritize survivor benefits to ensure continued income for a spouse. Single retirees, by contrast, may benefit more from the lump sum or single life option since there are no survivor needs to plan for.

How do other retirement assets impact pension elections?

If you have substantial savings in 401(k)s, IRAs, or investment accounts, you may be able to take on more risk with your pension option by selecting a smaller survivor benefit or a lump sum. These outside assets can act as a backup income source for your spouse or emergencies.

What role does health and life expectancy play in choosing a pension option?

Shorter expected life spans or significant health issues may make a lump sum or 100% survivor benefit more appealing.

How does company stability affect pension decisions?

If the employer’s financial health or pension funding is uncertain, a lump sum rollover may provide greater security. While the PBGC insures many pensions, its coverage limits may not fully protect large benefits if a plan fails.

Can taxes influence which pension option you choose?

Yes. Pension income is generally taxable at both federal and state levels. Rolling a lump sum into an IRA provides more control over withdrawals and potential tax strategies, such as Roth conversions or managing tax brackets in retirement.