This Market Rally Could Be A Bear Trap!! Here’s why……

The recent stock market rally could end up being a bear market trap for investors. If it is, this would be the 4th bear market trap of 2022.

After a really tough first 6 months of the year, the stock market has been in rally mode, rising over 9% within the last 30 days. It’s left investors anxious to participate in the rally to recapture the losses that were incurred in the first half of the year. Our guidance to clients, while there are plenty of bobbing heads on TV talking about “buying the dip” and trying to call the “bottom” in the market, this could very well be what we call a “bear trap”. A bear trap is a short-term rally that baits investors into thinking the market has bottomed only to find out that they fell for the trap, and experience big losses when the market retreats to new lows.

The 4th Bear Trap In 2022

If the current rally ends up being a bear trap, it would actually be the 4th bear trap so far in 2022.

The green boxes in the chart show when the rallies occurred and the magnitude. Notice how the market moved to a new lower level after each rally, this is a common pattern when you are in a prolonged bear market environment.

So how do you know when the bear market is over and the new sustainable bull market rally has begun? It’s actually pretty simple. Ask yourself, what were the issues that drove the market lower in the first place? Next question, “Is the economy making MEANINGFUL progress to resolve those issues?” If the answer is yes, you may in fact be at the beginning of the rally off of the bottom; if the answer is no, you should resist the temptation to begin loading up on risk assets.

It's Not A Secret

It’s not a secret to anyone that inflation is the main issue plaguing not just the U.S. economy but economies around the world. Everyone is trying to call the “peak” but we did a whole video on why the peak doesn’t matter.

The market cheered the July inflation report showing that headline year over year inflation dropped from 9.1% in June to 8.5% in July. While progress is always a good thing, if the inflation rate keeps dropping by only 0.60% per month, we are going to be in a lot of trouble heading into 2023. Why? As long as the inflation rate (the amount prices are going up) is higher than the wage growth rate (how much more people are making), it will continue to eat away at consumer spending which is the bedrock of the U.S. economy. As of July, wages are growing at only 6.2% year over year. That’s still a big gap until we get to that safety zone.

Understand The Math Behind The CPI Data

While it’s great that the CPI (Consumer Price Index) is dropping, the main CPI number that hits the headlines is the year-over-year change, comparing where prices were 12 months ago to the prices on those same goods today. Let me explain why that is an issue as we look at the CPI data going forward. If I told you I will sell you my coffee mug today for $100, you would say “No way, that’s too expensive.” But a year from now I try and sell you that same coffee mug for $102 and I tell you that the cost of this mug has only risen by 2% over the past year, does that make you more likely to buy it? No, it doesn’t because the price was already too high to begin with.

In August 2021, inflation was already heating up. The CPI headline number for August 2021 was 5.4%, already running above the Fed’s comfort level of 3%. Similar to the example I just gave you above with the coffee mug, if the price of everything was ALREADY at elevated levels a year ago, and it went up another 8.5% on top of that elevated level, why is the market celebrating?

Probability of A 2023 Recession

Even though no single source of data is an accurate predicator as to whether or not we will end up in a recession in 2023, the chart that I am about to show you is being weighted heavily in the investment decisions that we are making for our clients.

Historically an “inverted” yield curve has been a fairly accurate predicator of a coming recession. Without going into all of the details of what causes a yield curve inversion, in its simplest form, it’s the bond market basically telling the stock market that a recession could be on the horizon. The chart below shows all of the yield curve inversions going back to 1970. The red arrows are where the inversion happened and the gray shaded areas are where recession occurred.

Look at where we are right now on the far right-hand side of the chart. There is no question that the yield curve is currently inverted and not just by a little bit. There are two main takeaways from this chart, first, there has been a yield curve inversion prior to every recession going back to 1970, an accurate data point. Second, there is typically a 6 – 18 month delay between the time the yield curve inverts and when the recession actually begins.

Playing The Gap

I want to build off of that last point about the yield curve. Investors will sometimes ask, “if there is historically a 6 – 18 month delay between the inversion and the recession, why would you not take advantage of the market rally and then go to cash before the recession hits?” My answer, if someone could accurately do that on a consistent basis, I would be out of a job, because they would manage all of the money in the world.

Recession Lessons

I have been in the investment industry since 2002. I experienced the end of the tech bubble bust, the Great Recession of 2008/2009, Eurozone Crisis, and 2020 COVID recession. I have learned a number of valuable lessons with regard to managing money prior to and during those recessions that I’m going to share with you now:

It’s very very difficult to time the market. By the time most investors realize we are on the verge of a recession, the market losses have already piled up.

Something typically breaks during the recession that no one expects. For example, in the 2008 Housing Crisis, on the surface it was just an issue with inflated housing prices, but it manifested into a leverage issue that almost took down our entire financial system. The questions becomes if we end up in a recession in 2023, will something break that is not on the surface?

Do not underestimate the power of monetary and fiscal policy.

The Power of Monetary & Fiscal Policy

I want to spend some time elaborating on that third lesson. The Fed is in control of monetary policy which allows them to use interest rates and bond activity to either speed up or slow down the growth rate of the economy. The Fed’s primary tool is the Fed Funds Rate, when they want to stimulate the economy, they lower rates, and when they want to slow the economy down (like they are now), they raise rates.

Fiscal policy uses tax policy to either stimulate or slow down the economy. Similar to what happened during COVID, the government authorized stimulus payments, enhanced tax credits, and created new programs like the PPP to help the economy begin growing again.

Many investors severely underestimate the power of monetary and fiscal stimulus. COVID was a perfect example. The whole world economy came to a standstill for the first time in history, but the Fed stepped in, lowered rates to zero, injected liquidity into the system via bond purchases, and Congress injected close to $7 Trillion dollars in the U.S. economy via all of the stimulus policies. Even though the stock market dropped by 34% within two months at the onset of the COVID crisis in 2020, the S&P 500 ended up posting a return of 16% in 2020.

Now those same powerful forces that allowed the market to rally against unsurmountable odds are now working against the economy. The Fed is raising rates and decreasing liquidity assistance. Since the Fed has control over short term interest rates but not long-term rates, that is what causes the yield curve inversion. Every time the Fed hikes interest rates, it takes time for the impact of those rate hikes to make their way through the economy. Some economists estimate that the delay between the rate hike and the full impact on the economy is 6 – 12 months.

The Fed Is Raising More Aggressively

The Fed right now is not just raising interest rates but raising them at a pace and magnitude that is greater than anything we have seen since the 1970’s. A chart below shows historical data of the Fed Fund Rate going back to 2000.

Look at 2004 and 2016, it looks like a staircase. Historically the Fed has raised rates in small steps of 0.25% - 0.50%. This gives the economy the time that it needs to digest the rate hikes. If you look at where we are now in 2022, the line shoots up like a rocket because they have been raising rates in 0.75% increments and another hike of 0.50% - 0.75% is expected at the next Fed meeting in September. When the Fed hikes rates bigger and faster than it ever has in recent history, it increases the chances that something could “break” unexpectedly 6 to 12 months from now.

Don’t Fight The Fed

You will frequently hear the phrase “Don’t Fight The Fed”. When you look back at history, when the Fed is lowering interest rates in an effort to jump start the economy, it usually works. Conversely, when the Fed is raising rates to slow down the economy to fight inflation, it usually works but it’s a double edged sword. While they may successfully slow down inflation, to do so, they have to slow down the economy, which is traditionally not great news for the stock market.

I have to credit Rob Mangold in our office with this next data point that was eye opening to me, when you look back in history, the Fed has NEVER been able to reduce the inflation rate by more than 2% without causing a recession. Reminder, the inflation rate is at 8.5% right now and they are trying to get the year over year inflation rate back down to the 2% - 3% range. That’s a reduction of a lot more than 2%.

Stimulus Packages Don’t Work

In the 1970’s, when we had hyperinflation, the government made the error of issuing stimulus payments and subsidies to taxpayers to help them pay the higher prices. They discovered very quickly that it was a grave mistake. If there is inflation and the people have more money to spend, it allows them to keep paying those higher prices which creates MORE inflation. That is why in the late 70’s and early 80’s, interest rates rose well above 10%, and it was a horrible decade for the stock market.

In the U.S. we have become accustomed to recessions that are painful but short. The COVID Recession and 2008/2009 Housing Crisis were both painful but short because the government stepped in, lowered interest rates, printed a bunch of money, and got the economy growing again. However, when inflation is the root cause of our pain, unless the government repeats their mistakes from the 1970’s, there is very little the government can do to help until the economy has contracted by enough to curb inflation.

Is This The Anomaly?

Investors have to be very careful over the next 12 months. If by some chance, the economy is able to escape a recession in 2023, based on the historical data, that would be an “anomaly” as opposed to the rule. Over my 20 year career in the industry, I have heard the phrase “well this time it’s different because of X, Y, and Z” but I have found that it rarely is. Invest wisely.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Coronavirus Battle Will Be Won Or Lost By April 30th

These are unprecedented times. Over the past few weeks we have spent countless hours researching past epidemics, listening to medical experts, economists, market analysts, hedge fund managers, and local business owners. Of all the

These are unprecedented times. Over the past few weeks we have spent countless hours researching past epidemics, listening to medical experts, economists, market analysts, hedge fund managers, and local business owners. Of all the things we’ve learned up to this point, one thing seems very clear to us, we should know by April 30th whether the U.S. economy is setting itself up for a quick recovery or a prolonged recession.

Why April 30th? Confirmed cases of the Coronavirus are going to spike in the upcoming weeks as test results come back. As we charge toward the peak of the infection rate, we will begin to see whether the inflection rate is accelerating or leveling out. All of this is driven by the effectiveness of the containment efforts that are being put in place now. But will it be enough and when will investors know which path the economy is on?

In addition, we are beginning to see some abnormal behavior from certain asset classes within the financial markets as stimulus packages and rate cuts are put to work by countries around the globe. In this article, we will present those trends and help investors prepare for what could be next for the financial markets.

A Race Against Time

The US economy is in a race against time. While every day the headlines are filled with breaking news about bailout packages, interest rate cuts, infection rates, and the stock market dropping by over 1000 points a day, at the risk of over oversimplifying it, there are really only 3 things that matter:

Containing the virus as soon as possible

Keeping businesses solvent during the shutdown

Providing individuals with financial assistance to pay their bills

These items are listed in the order of priority and I'm going to explain why.

#1: Containment

If the US government is not able to slow the infection rate by the end of April, it’s going to be difficult for many businesses to sustain operations without layoffs. While layoffs have already begun in industries directly impacted by the Coronavirus containment efforts such as restaurants, airlines, and hotels, this trend would most likely spread into the broader economy and make a quick recovery less likely.

The ideal scenario is the containment efforts prove effective and by the end of April the rate of infection decreases or levels out, fear subsides in the market knowing that progress is being made, and people resume travelling, restaurants reopen, and global spending and trade return to “pre-Corona” levels. In this scenario, the losses that we have seen in the U.S. stock market could rebound quickly in the second half of the year.

In addition, if there is swift recovery, the U.S. consumer and businesses now have access to lower interest rates, oil prices not seen since 2002, and an economy that would most likely resume it’s steady growth trend.

Error On The Side Of More

As we have seen in prior economic crises, problems become much larger when the government does not act fast enough or with enough firepower to manage the threat; that is especially true of the current situation. Understanding that time is everything in this situation, the government should be erroring on the side of more swift and restrictive measures to contain the virus. Rolling out containment efforts in pieces as we have seen over the past two weeks, in my opinion, creates more risk to achieving a positive outcome and from speaking with business owners over the past few days, it creates more disruption. If you are a business that is still allowed to operate in this environment but every day new restrictions are passed down in pieces, valuable time has to be taken to digest those rules, determine how it impacts the business, and then communicate the new restrictions to the employees. I have heard some business owners say “it would actually be better for us if they just shut everything down for two weeks”.

Erroring on the side of “more” will hurt the stock market and the economy in the short term but I think it will give us a better chance of avoiding a prolonged recession. But we will just have to wait to see how effective the current containment efforts are over the course of the next few weeks.

#2: Keeping Businesses Solvent

The second priority is keeping businesses solvent during the economic slowdown. Most businesses can survive disruptions that last 30 to 60 days if they are given access to cheap capital. It's for this reason that the Fed has rapidly dropped interest rates to almost zero and has pumped billions of dollars of liquidity into the system to encourage banks to lend. The U.S. government is also working on stimulus packages that would provide direct capital injection for industries most adversely effected by the containment efforts. What we are experiencing now is the first “all stop” global economic shutdown that we have ever seen. The government is trying to minimize the number of companies that go insolvent between now in the containment of the virus. At this point, it seems like the U.S. is doing an adequate job of opening up the cash floodgates for the companies here in the U.S.

#3: Financial Assistance For Individuals

The third priority is providing financial assistance for individuals that have been laid off so they can continue meet their basic needs while this containment process runs its course. There are discussions happening right now about the U.S. government sending everyone a check for $1,000, programs for deferring student loan payments, and encouraging financial institutions to create special programs for individuals that have been negatively impacted by the economic slowdown. But I placed this lower on the priority list than business solvency because most people can survive being laid off for a month or two with some financial assistance from the government, but if the current environment turns into a prolonged recession, they lose their job, and are unable to find work over the next 6 to 12 months, that it a much dire situation. It’s vitally important for the U.S. to preserve jobs during this containment period.

Abnormal Activity

When there are unprecedented events that occur in the markets, they bring with them abnormal behaviors within financial markets that tend to surprise investors. During the recent market selloff there are two unexpected events that have occurred:

The pace of the market selloff

Recent losses in the bond market

During the recent selloff, the U.S. stock market set a record when it lost over 20% if its value in just 16 days. By comparison, below is a chart of the other 20% declines in the stock market and the number of days it took for the 20% drop to happen.

To us, this speaks to the fear and uncertainty surrounding the events that are currently unfolding in the markets. In addition, the average daily price movement of the S&P 500 Index over the past 2 weeks has been 5% per day. That’s a crazy amount of volatility.

Turning to the bond market, a surprising trend has unfolded over the past week. Typically, when the stock market is selling off, interest rates go down, and bond prices go up. This allows bonds to appreciate in value and offset some of the losses from the stock side of the portfolio. While this was the trend for the first two weeks of the sell off, that trend recently reversed. The stock market was selling off and interest rates where rising. This created an environment where both stocks and bonds were losing value at the same time. Not an ideal market environment for a diversified portfolio. On March 17th, the yield on the 10 year treasury bond went from 0.72% to 1.08% which is a big move for a bond yield in a single day, especially considering that the stock market was down that day.

Why did that happen? We can point to a few reasons. First, the bond market is anticipating a $1 trillion dollar stimulus package to be released by Congress. When the government wants to spend $1 trillion dollars, it does so by issuing bonds which is debt. The demand for bonds, especially of this magnitude, are not in high demand because governments around the world are also spending money to stimulate their own economy. To entice people to buy our bonds, they have to offer them at a higher interest rate.

Along those same lines, countries that hold our bonds have been selling them to raise cash to fund their own stimulus packages. As demand for U.S. bonds decreases, the interest rate goes up and the price of the bonds goes down. Will this trend continue? Interest rates could move slightly higher in the short-term but the Fed has the ability to step in and start buying U.S. bonds if it wants to lower interest rates. In addition, the flight to safety trade will most likely continue in upcoming weeks as the uncertainty surrounding the containment efforts persists which will also create additional demand for U.S. Treasuries.

What To Expect

As we sit here on March 19th, it’s tough to handicap which outcome is more likely: a quick bounce back or a prolonged recession. However, the upcoming few weeks are going to be key at providing us with evidence on the success or failure of the containment efforts. Investors need to be ready to make changes to their investment portfolios over the upcoming months as the likely outcome begins to surface. The current market environment has the makings to either be one of the greatest investment opportunities of all time or just the beginning of a prolonged slowdown in the U.S. economy. Emotions will temp investors to make irrational investment decisions but it’s important to keep the relevant economic and financial market data in focus. Stay safe, stay healthy, and we welcome any questions that you have regarding the current market environment.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Market Selloff: Time To Buy, Sell, or Hold?

Over the past month, the stock market has dropped by 20%. Largely due to the economic impact of the Coronavirus. As the feeling of panic continues to increase here in the U.S., our clients are asking:

Over the past month, the stock market has dropped by 20%. Largely due to the economic impact of the Coronavirus. As the feeling of panic continues to increase here in the U.S., our clients are asking:

Should we be buying stocks at these lower levels?

Is it going to get worse before it gets better?

How quickly do you think the market will bounce back after the virus is contained?

Having managed money for clients through the Tech Bubble, The Great Recession of 2008/2009, and countless market selloffs, while the circumstances are always different from crisis to crisis, there are patterns that seem to be consistent within each market selloff. Being able to identify those patterns is key in determining what the next move should be within your investment portfolio and I’m going to share those with you today.

DISCLOSURE: Throughout this article I will be using examples of industries and companies. These are not recommendations to buy or sell a particular stock. Please consult your investment professional for advice.

Is The Market Oversold?

When there is a market selloff, one of the key questions we’re trying to answer is: “Has the stock market overreacted to the risks that are being presented?” In answering this question, I think the key thing that investors forget is that a company’s stock price represents more than just one year of its earnings. When investors buy a stock it’s typically because they expect that company to grow over the course of multiple years and yield a generous return. Unexpected events like the Coronavirus without question impact those projections but it’s not uncommon for the market to overreact because it’s focused on what’s going to happen to that company’s revenue in the short term.

A good example of this are the airlines in the United States. Due to the Coronavirus companies have canceled conferences, people have canceled vacations, and sporting events have been postponed or are now being played without spectators. That is a direct hit to the airlines in the U.S. because prior to the Coronavirus they had projected a specific amount of revenue to be generated during 2020 based on all that activity. But here comes the key question. Many of the airline stocks in the U.S. have dropped by more than 50% in the past 60 days. If investors believe that the Coronavirus will eventually be contained in the coming months, are those airlines really only worth half of what they were 60 days ago?

Buffett’s Words of Wisdom

I hesitate to use Warren Buffett’s famous quote because it’s used with such frequency but it’s proven to be a valuable investment practice during times of uncertainty: “Be fearful when others are greedy and greedy when others are fearful.” While it’s easy to say, it’s very difficult to execute effectively. Buying low and selling high goes against every human emotion. It often means stepping into the most unloved names, at what would seem to be the worst time, and owning that decision. Right now those investments seem to be the airlines, hotels, cruiselines, oil companies, and other industries directly tied to travel and tourism.

This same concept also applies to the decision to “hold” or not sell your equity holdings when the market is in a panic. Even though no one likes to see their investment accounts lose value, if you were positioned appropriately prior to the start the Coronavirus pandemic, in my professional opinion, you should not be making any adjustments to your portfolio given the recent market events. If however, you were allocated too aggressively based on your own personal risk tolerance or time horizon, you have a much more difficult decision to make.

Short Term vs Long Term Risks

Market selloffs are typically triggered by two types of risks: short term risks and long term risks. Being able to identify which risk the market is facing should greatly influence the decisions that you are making within your investment portfolio.

I’m going to use the airlines again as an example. In my personal option, the Coronavirus represents a short-term risk to the airline industry. In an effort to contain the virus, conferences have been cancelled, companies have told their employees not to travel, people have canceled vacations, etc. But you have to ask yourself this question: “what’s likely to happen once the virus is contained?” Conferences may be rescheduled, business travel resumes, and people map out a new plan for their vacation. There is arguably pent up demand being created right now that the airlines will benefit from once the virus is contained.

Back when 9/11 happened, I viewed that risk as a longer term risk for the airlines because people could choose to permanently change their behavior and choose not to fly for a very long time based on that event. In the 2008 financial crisis, the banks had a long road ahead of them as they executed plans to dig out of their leveraged positions. Problems of this nature usually require more time to fix which is why these longer term risks can justify a move from stocks into bonds.

Winners and Losers

Even with short term risk diversification is key. Just because a risk is a short term risk does not necessarily mean all companies are going to survive it. There is a risk to all companies that are impacted by market events that they run out of cash before the tide turns back to the upside. If you are an investor looking to buy into airlines at these lower levels, it's typically prudent to buy multiple companies in smaller increments, as opposed to establishing a large position in a single airline. Again, just an example, if you decide to buy stock in American Airlines, Delta, Southwest, and United Airlines, the risk of buying low is one of the four may run out of money before the virus is contained and they are forced with filing bankruptcy without a bailout from the government. If you put all of your money into one airline, you are taking on a lot more risk.

Buyer’s Remorse

One of the lessons I’ve learned from buying during a market selloff is you need to keep your long-term perspective. Meaning when you purchase a stock that has dropped significantly, there are forces acting on that company that could cause it to drop by more. You have to be comfortable with that reality and you have to possess the time horizon to weather the storm in the likely case that it could get worse before it gets better.

It’s all too common that investors purchase a stock thinking that since it’s already dropped 30%+ that it can’t possibly go any lower, only to watch it drop by another 30% and then feel pressured to sell it thinking they made a mistake. I call this “buyer’s remorse”. When you play the role of an opportunistic investor, it may take months or years for the benefit to be realized. Investing for a “quick pop” is a fool’s game, especially with the Coronavirus situation. No one knows how long it’s going to take to contain the virus, how badly Q1 and Q2 revenue will be hurt for companies, or will it end up causing a recession. Making the decision to buy stock at lower levels is usually based on the investment thesis that the stock market is overreacting to a relatively short term event and those companies getting hit the hardest will recover over time.

How Much Time Will It Take For the Market To Recover?

No one knows the answer to this question because we have never really been in this situation before. We have been through other epidemics in the past such as SARS, MERS, Swine Flu, and Ebola, but nothing that spread as quickly or as broadly around the globe as the Coronavirus. Since China was ground zero for the virus, the good news is we are already seeing significant progress being made at containing the virus.

As you can see via the blue line in the chart, at the beginning of February China was reporting thousands of new cases every day, but since the beginning of March the line flattens out, meaning the number new people getting infected is tapering off. If the United States follows a similar trajectory, we may see the rate of infection rise significantly in the upcoming days only to see the numbers taper off a month or two from now.

I would argue that we have an added advantage over China and Europe in that we had more time to prepare, we know more about the spread of the virus, and how to contain it. I think the lesson that we learned from Europe was you have to be aggressive in your containment efforts which is why you are seeing the extreme measures that the U.S. is taking to contain the spread of the virus. Those extreme containment efforts hurt the market more in the short term but will hopefully result in less damage to the economy over the longer term.

It’s really a race against time. The longer it takes to contain the virus, the longer it takes for people to get back to work, the longer it takes for people to feel safe traveling again, which results in more companies being put at risk of running out of capital waiting for the recovery to arrive. This is the reason why the Fed is aggressively dropping interest rates right now. Dropping interest rates does absolutely nothing to contain the virus or make people feel safe about traveling but it provides companies that are struggling due to the loss of revenue with access to low interest rate debt to bridge the gap.

A Recession Is Very Possible

A recession is defined as two consecutive quarters of negative GDP growth. With the global slowdown that has taken place in 2020, the U.S. economy may post a negative GDP number for the first quarter. Since it takes a while to bring global supply chains back online and for consumers to return to their normal spending behaviors, it's possible that the U.S. economy could also post a negative GDP number for the second quarter as well. By definition, that puts the U.S. economy in a recession. But it may end up being a very brief recession as the Coronavirus reaches containment, global supply chains come back online, pent up demand for goods and services is fulfilled, and U.S. households and businesses have the dual benefit of having access to lower oil prices and lower interest rates.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

We Are Sleep Walking Into The Next Crisis

The U.S. economy is headed down a dangerous path. In our opinion it has nothing to do with the length of the current economic cycle, valuations, interest rates, or trade wars. Instead, it has everything to do with our mounting government deficits. We have been talking about the federal budget deficits for the past ten years but when does that

The U.S. economy is headed down a dangerous path. In our opinion it has nothing to do with the length of the current economic cycle, valuations, interest rates, or trade wars. Instead, it has everything to do with our mounting government deficits. We have been talking about the federal budget deficits for the past ten years but when does that problem really come home to roost?

A Crisis In Plain Sight

An economic crisis is often easier to spot than you think if you are looking in the right places. Most of the time it involves identifying a wide spread trend that has evolved in the financial markets and the economy, shutting out all of the noise, and then applying some common sense. Looking at the tech bubble, people were taking home equity loans to buy tech stocks that they themselves did not understand. During the housing bubble people that were making $40,000 per year were buying homes for $500,000 and banks were giving loans with no verification of income. Both of the last two recessions you could have spotted by paying attention to the trends and applying some common sense.

Government Debt

Looking at the data, we think there is a good chance that the next economic crisis may stem from reaching unsustainable levels of government debt. Up until now we have just been talking about it but my goal with this article is to put where we are now in perspective and why this "talking point" may soon become a reality.

Debt vs GDP

The primary measuring stick that we use to measure the sustainability of the U.S. debt level is the Debt vs GDP ratio. This ratio compares the total debt of the U.S. versus how much the U.S. economy produces in one year. Think of it as an individual. If I told you that someone has $100,000 in credit card debt, your initial reaction may be “wow, that’s a lot of debt”. But then what if I told you that an individual makes $1,000,000 per year in income? That level of debt is probably sustainable for that person since it’s only 10% of their gross earnings, whereas that amount of credit card debt would render someone who makes $50,000 per year bankrupt.

Our total gross federal deficit just eclipsed $21 trillion dollars. That’s Trillion with a “T”. From January through March 2018, GDP in the U.S. was running at an annual rate of $19.965 trillion dollars (Source: The Balance). Based on the 2018 Q1 data our debt vs GDP ratio is approximately 105%. That’s big number.

The Safe Zone

Before I start throwing more percentages at you let's first establish a baseline for what's sustainable and not sustainable from a debt standpoint. Two Harvard professors, Reinhart and Rogoff, conducted a massive study on this exact topic and wrote a whitepaper titled "Growth in a Time of Debt". Their study aimed to answer the question "how much debt is too much for a government to sustain?" They looked at historic data, not just for the U.S. but also for other countries around the world, to determine the correlation between various levels of Debt vs GDP and the corresponding growth or contraction rate of that economy. What they found was that in many cases, once a government's Debt vs GDP ratio exceeded 90%, it was frequently followed by a period of either muted growth or economic contraction. It makes sense. Even though the economy may still be growing, if you are paying more in interest on your debt then you are making, it puts you in a bad place.

Only One Time In History

There has only been one other time in U.S. history that the Debt vs GDP ratio has been as high as it is now and that was during World War II. Back in 1946, the Debt vs GDP ratio hit 119%. The difference between now and then is we are not currently funding a world war. I make that point because wars end and when they end the spending drops off dramatically. Between 1946 and 1952, the Debt vs GDP ratio dropped from 119% to 72%. Our Debt vs GDP ratio bottomed in 1981 at 31%. Since then it has been a straight march up to the levels that were are at now. We are not currently financing a world war and there is not a single expenditure that we can point to that will all of a sudden drop off to help us reduce our debt level.

Spending Too Much

So what is the United States spending the money on? Below is a snapshot of the 2018 federal budget which answers that question. As illustrated by the spending bar on the left, we are estimated to spend $4.1 trillion dollars in 2018. The largest pieces coming from Social Security, Medicare, and Medicaid.

The bar on the right illustrates how the U.S. intends to pay for that $4.1 trillion in spending. At the top of that bar you will see “Borrowing $804 Bn”. That means the Congressional Budget Office estimates that the U.S. will have to borrow an additional $804 billion dollars just to meet the planned spending for 2018. With the introduction of tax reform and the infrastructure spending, the annual spending amount is expected to increase over the next ten years.

Whether you are for or against tax reform, it’s difficult to make the argument that it’s going to “pay for itself in the form of more tax as a result of greater economic growth.” Just run the numbers. If our annual GDP is $19.9 Trillion per year, our 3% GDP growth rate I already factored into the budget numbers, to bridge the $804B shortfall, our GDP growth rate would have to be around 7% per year to prevent further additions to the total government debt. Good luck with that. A 7% GDP growth rate is a generous rate at the beginning of an economic expansion. Given that we are currently in the second longest economic expansion of all time, it’s difficult to make the argument that we are going to see GDP growth rates that are typically associated with the beginning of an expansion period.

Apply Common Sense

Here’s where we apply common sense to the debt situation. Excluding the financing of a world war, the United State is currently at a level of debt that has never been obtained in history. Like running a business, there are only two ways to dig yourself out of debt. Cut spending or increase revenue. While tax reform may increase revenue in the form of economic growth, it does not seem likely that the U.S. economy is at this stage in the economic cycle and be able to obtain the GDP growth rate needed to prevent a further increase in the government deficits.

A cut in spending, in its simplest form, means that something has to be taken away. No one wants to hear that. The Republican and Democratic parties seem so deeply entrenched in their own camps that it will make it difficult, if not impossible, for any type of spending reform to take place before we are on the eve of what would seem to be a collision course with the debt wall. Over the past two decades, the easy solution has been to “just borrow more” which makes the landing even harder when we get there.

Answering the “when” question is probably the most difficult. We are clearly beyond what history has revered as the “comfort zone” when to comes to our Debt vs GDP ratio. However, the combination of the economic boost from tax reform and infrastructure spending in the U.S., the accelerating economic expansion that is happening outside of the U.S., and the low global interest rate environment, could continue to support growth rates even at these elevated levels of government debt.

Debt is tricky. There are times when it can be smart accept the debt, and times where it isn’t helpful. As we know from the not too distant past, it has the ability to sustain growth for an unnaturally long period of time but when the music stops it gets ugly very quickly. I’m not yelling that the sky is falling and everyone needs to go to cash tomorrow. But now is a good time to evaluate where you are risk wise within your portfolio and begin having the discussion with your investment advisor as to what an exit plan may look like if the U.S. debt levels become unsustainable and it triggers a recession within the next five years.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Are The New Trade Tariffs Good Or Bad For The Stock Market?

US businesses often imports their manufactured goods from China. This is because the cost of manufacturing products is much lower than in other places so they want to take advantage of this. The government makes money off this relationship by imposing tariffs on certain products coming into the US. President Trump announced on March 8, 2018

US businesses often imports their manufactured goods from China. This is because the cost of manufacturing products is much lower than in other places so they want to take advantage of this. The government makes money off this relationship by imposing tariffs on certain products coming into the US. President Trump announced on March 8, 2018 that the United States will begin imposing a tariff on steel and aluminum imported into the U.S. from countries other than Mexico and Canada. The tariff on steel will be 25% and 10% on aluminum. There are two main questions that we will seek to answer in this article:

What happened the last time the U.S. implemented trade tariffs?

How will the stock market react to the new trade barriers?

What Is A Tariff?

First, let's do a quick recap on what a tariff is. A tariff is a special tax on goods that come into the United States. Tariffs are imposed to make select foreign goods more expensive in an effort to encourage the U.S. consumer to buy more American made goods. For example, if the government puts a 25% tariff on cars that are imported into the U.S., that BMW that was manufactured in Germany and shipped over to the U.S. and sold to you for $70,000 will now cost $87,500 for that same exact car due to the 25% tariff. As a consumer this may cause you not to buy that BMW and instead buy a Corvette that was manufactured in the U.S. and carries a lower price tag.

What Does History Tell Us?

It’s very clear from this chart that the U.S. has not imposed meaningful tariffs since the early 1900’s. Conclusion, it’s going to be very difficult to predict how these tariffs are going to impact the U.S. economy and global trade. Even though we have some historical references, the world is very different today compared to 1930. The “global economy” did not even really exist back then.

As you can see in the chart, the average import trade tariff in 1930 was about 20%. Since 1975, the average trade tariff on imports has been below 5%. More recently, between 2000 and 2016 the average tariff on imports was below 2%.

History Will Not Be A Useful Guide

As an investment manager, when a big financial event takes place, we start to scour through historical data to determine what happened in the past when a similar event took place. While we have had tariffs implemented in the past, many of those tariffs were implemented for reasons other than the ones that are driving the U.S. trade policy today.

Prior to 1914, tariffs were used primarily to generate revenue for the U.S. government. In 1850, tariffs represented 91% of the government’s total revenue mainly because there was no income tax back then. By 1900 that percentage had dropped to 41%. As many of us are well aware, over time, the main source of revenue for the government has shifted to the receipt of income and payroll taxes with tariff revenue only representing about 2% of the government’s total receipts.

During the Industrial Revolution (1760 – 1840), tariffs were used to protect the new U.S. industries that were in their infancy. Without tariffs it would have been very difficult for these new industries that were just starting in the U.S. colonies to compete with the price of goods coming from Europe. Tariffs were used to boost the domestic demand for steel, wool, and other goods that were being produced in the U.S. colonies. These trade policies helped the new industries get off the ground, expand the workforce, and led to a prosperous century of economic growth.

Today, tariffs are being used for a different reason. To protect our mature industries from the risk of extinction as a result of foreign competition. Since the 1950’s, the global economy has evolved and the trade policies of the U.S. have been largely in support of free trade. While this sounds like a positive approach, free trade policies have taken their toll on a number of industries here in the U.S. such as steel, automobiles, and electronics. Foreign countries like China have access to cheap labor and they are able to produce select goods and services at a much lower cost than here in the United States.

While this a good thing for the U.S. consumer because you can purchase a big screen TV made in China for a lot less than that same TV made in the U.S., there are negative side effects. First and foremost are the U.S. jobs that are lost when a company decides that it can produce the same product for a lot less over in China. We have seen this trend play out over the past 20 or 30 years. Tariffs can help protect some of those U.S. jobs because it makes products purchased from foreign manufactures more expensive and it increases the demand for U.S. goods. The downside to that is the consumer may be asked to pay more for those same products since at the end of the day it costs more to produce those products in the U.S.

In the announcement of the steel and aluminum tariffs yesterday, the White House also acknowledged the national security risk of certain industries facing extinction in the United States. Below is a chart of production of steel in the U.S. from 1970 – 2016.

As you can see in the chart, our economy has grown dramatically over this time period but we are producing half the amount of steel in the U.S. that we were 47 years ago. If everything stayed the same, this reduction in the U.S. production of steel would probably continue. It begs the question, what happens 50 years from now if there is a global conflict and we are unable to build tanks, jets, and ships because we import 100% of our steel from China and they decide to shut off the supply? There are definitely certain industries that we will always need to protect here in the U.S. even though they may be “cheaper” to buy somewhere else.

There is also monopoly risk. Once we have to import 100% of a particular good or service, those producers have 100% pricing power over us. While I would be less concerned over TV’s and electronics, I would be more concerned over items like cars, foods, building materials, and other items that many of us consider a necessity to our everyday lives.

Free or Fair?

While we have had “free” trade policies over the past few decades, have they been “fair”? Elon Musk, the CEO of Tesla, recently highlighted that “China isn’t playing fair in the car trade with the U.S.” He goes on to point out that China puts a 25% import tariff on American cars sold to China but the U.S. only has a 2.5% import tariff on cars that are manufactured in China and sold in the U.S.

In response to this, Trump mentioned in his speech that the U.S. will be pursuing “reciprocal” or “mirror” trade policies. Meaning, if a country puts a 25% tariff on U.S. goods imported into their country, the U.S. would put a 25% tariff on those same goods that are imported from their country into the U.S.

Trade Wars

While the reciprocal trade policies seem fair on the surface and it also makes sense to protect industries that are vital to our national security, the greatest risk of transitioning from a “free trade” policy to “protectionism” policy is trade wars. We just put a 25% tariff on all of the steel that is imported from China, how is China going to respond to that? Remember, the U.S. is part of a global economy and trade is important. How important? When you look at the gross revenue of all of the companies that make up the S&P 500 Index, over 50% of their revenue now comes from outside the U.S. If all of a sudden, foreign countries start putting tariffs on U.S. goods sold aboard, that could have a big negative impact on the corporate earnings of our big multinational corporations in the United States. In addition, when you listen to the quarterly earnings calls from companies like Apple, Nike, Pepsi, and Ford, the future growth of those companies are relying heavily on their ability to sell their products to the growing consumer base in the emerging market. Countries like China, India, Russia, and Brazil.

I go back to my initial point, that history will not be a great guide for us here. We have not used tariffs in a very long period of time and the reason why we are using tariffs now is different than it was in the past. Plus the world has changed. There is no clear way to know at this point if these new tariffs are going to help or hurt the U.S. economy over the next year because a lot depends on how these foreign countries respond to the United States moving away from the long standing era of free trade.

Canada & Mexico Exempt

The White House announced yesterday that Canada and Mexico would be exempt from the new tariffs. Why? This is my guess and it's only guess, the U.S. is currently in the process of negotiating the NAFTA terms with Canada and Mexico. NAFTA stands for the North American Free Trade Agreement. Trump has made it clear that if we cannot obtain favorable trade terms, the U.S. will exit the NAFTA agreement. The U.S. may use the recent tariff announcement as a negotiation tool in the talks with Canada and Mexico on NAFTA. "Listen, we gave you an exemption but if you don't give us favorable trade terms, all deals are off."

Coin Flip

While tax reform seems like a clear win for U.S. corporations, only history will tell us whether or not these new trade policies will help or harm the U.S. economy. If we are able to protect more U.S. jobs, protect industries vital to the growth and protection of the U.S., and negotiate better trade deals with our trading partners, we may look back and realize this was the right move at the right time.On the flip side of the coin, if trade wars break out that could lead to a decrease in the demand for U.S. goods around the globe that may cause the U.S. to lose more jobs than it is trying to protect. As a result, that could put downward pressure on corporate earnings and in turn send stock prices lower in the U.S. Only time will tell.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

When Do Higher Interest Rates Become Harmful To The Stock Market?

On Friday, the jobs report came out and it was a strong report. The consensus was expecting 180,000 new jobs in January and the actual number released on Friday ended up being 200,000. So why did the markets drop? The answer: wage growth. The jobs report not only contains how many new employees were hired but it also includes the amount

On Friday, the jobs report came out and it was a strong report. The consensus was expecting 180,000 new jobs in January and the actual number released on Friday ended up being 200,000. So why did the markets drop? The answer: wage growth. The jobs report not only contains how many new employees were hired but it also includes the amount that wages for the current workforce either increased or decreased on a year over year basis. The report on Friday indicated that wages went up by 2.9% year over year. That is the strongest wage growth number since 2009.

Double Edged Sword

Wage growth is a double edged sword. On the positive side, when wages are going up, people have more money in their paychecks which allows them to spend more and consumer spending makes up 70% of our GDP in the United States. I'm actually surprised the market did not see this coming. The whole premise behind tax reform was "if we give U.S. corporations a tax break, they will use that money to hire more employees and increase wages." The big question people had with the tax reform was "would the trickle down of the dollars saved by the corporations eventually make it to the employees pockets?" Many corporations in January, as a result of tax reform, announced employee bonuses and increases to the minimum wage paid within their organizations. The wage growth number on Friday would seem to imply that this is happening. So again, I'm actually surprised that the market was not ready for this and while the market reacted negatively I see this more as a positive long term trend, instead of a negative one. If instead the U.S. corporations decided not to give the bonuses or increase wages for employees and just use the money from the tax reform savings to increase dividends or share buybacks, then you probably would have seen only a moderate increase in the wage growth number. But that also would imply that there would be no "trickle down" effect to the middle class.

The Downside

This all sounds really positive but what is the downside to wage growth? While wage growth is good for employees, it's bad for corporate earnings. If I was paying Employee A $50,000 in 2017 but now I'm paying them $55,000 per year in 2018, assuming the output of that employee did not change, the expenses to the company just went up by $5,000 per year. Now multiply that over thousands of employees. It's a simple fact that higher expenses without higher output equals lower profits.

Wage Growth = Inflation

There is another downside to wage growth. Wage growth is the single largest contributor to inflation. Inflation is what we use to measure the increase in the price of goods and services in the U.S.. Why are these two measurements so closely related? If your salary just increased by $300 per month, when you go to the grocery store to buy milk, you may not notice that the price of milk went up by $0.15 over last week because you are making more in your paycheck. That is inflation. The price of everything starts going up because, in general, consumers have more take home pay and it gives the sellers of goods and services more pricing power. Visa versa, when the economy is in a recession, people are losing their jobs, and wages are decreasing. If you sell cars and you decided to raise the price of the cars that you sell, that may cause the consumer to not buy from you and look for a lower priced alternative. Companies have less pricing power when the economy is contracting and you typically have "deflation" not inflation.

When Does Inflation Become Harmful?

Some inflation is good. It means the economy is doing well. A rapid increase in inflation is bad because it forces the Fed to use monetary policy to slow down the economy so it does not over heat. The Fed uses the Federal Funds Rate as their primary tool to keep inflation in check. When inflation starts heating up, the Fed will often raise the Fed Funds Rate to increase the cost of lending which in turn reduces the demand for lending. It’s like tapping the brakes in your car to make sure you do not accelerate too quickly and then go flying off the road.

If some inflation is good but too much inflation is bad, the question is at what point do higher interest rates really jeopardize economic growth? The chart below provides us with guidance as to what has happened in the past when interest rates were on the rise.

The chart compares every 2 year period in the stock market versus the level of the 10-Year Treasury yield between 1963 – 2017. For example, one dot would represent the time period 1963 – 1964. Another dot would represent 1964 – 1965 and so on. If the dot is above the “0.0” line, that means that there was a “positive correlation” between stock prices going up and the interest rate on the 10-Year Treasury yield going up during that same time period. Worded another way, when the dot is above the line that means the stock market was going up while interest rates were also increasing. In general, the dots above the line are good, when they are below the line, that’s bad.

Right now the 10-Year Treasury Bond is at 2.85% which is the red line on the chart. What we can conclude from this is going all the way back to 1963, at this data point, there has never been a two year period where interest rates were rising and stock prices were falling. Could it be different this time? It could, but it’s a low probability if we use historical data as our guide. History would suggest that we do not run into trouble until the yield on the 10-Year Treasury Bond gets above 4%. Once the yield on our 10-Year Treasury Bond reaches that level and interest rates are rising, historically the correlation between rising interest rates and stock prices turns negative. Meaning interest rates are going up but stock prices are going down.

It makes sense. Even though interest rates are moving up right now, they are still at historically low levels. So lending is still “cheap” by historical standards which will continue to fuel growth in the economy.

A Gradual Rise In Interest Rates

Most fixed income managers that we speak with are expecting a gradual rise in interest rates throughout 2018. While we expect interest rates to move higher throughout the year due to an increase in wage growth as a result of a tighter labor market, in our opinion, it’s a stretch to make the case that the yield on the 10-year Treasury will be at 4% by the end of the year.

If the U.S. was the only country in the world, I would feel differently. Our economy is continuing to grow, wages are increasing, the labor markets are tight which requires companies to pay more for good employees, and all of these factors would warrant a dramatic increase in the rate of inflation. But we are not the only country in the world and the interest rate environment in the U.S. is impacted by global rates.

The chart below illustrates the yield on a 10 year government bonds for the U.S., Japan, Germany, UK, Italy, Spain, and total “Global Ex-U.S.”.

On December 31, 2017 the yield on a 10-Year Government Bond in the U.S. was 2.71%. The yield on a 10-Year government bond in Germany was only 0.46%. So, if you bought a 10-Year Government Bond from Germany, they are going to hand you back a measly 0.46% in interest each year for the next 10 years.

Why is this important? The argument can be made that while the changes in the Fed Funds Rate may have a meaningful impact on short-term rates, it may have less of an impact on intermediate to longer term interest rates. When the U.S. government needs more money to spend they conduct “treasury auctions”. The government announces that on a specified date that they are going to be selling “30 million worth of 10-year treasury bonds at a 2.8% rate”. As long as there is enough demand to sell all of the bonds at the 2.8% rate, the auction is a success. If there is not enough demand, then they may have to increase the interest rate from 2.8% to 3% to sell all $30 million worth of the bonds. While the U.S. 10-Year Treasury Bond only had a yield of 2.71%, it’s a lot higher than the other trusted government lenders around the world. As you can see in the chart above, the average 10-year government bond yield excluding the U.S. is 1.03%. This keeps the demand for U.S. debt high without the need to dramatically increase the interest rate on new government debt issuance to attract buyers of the debt.

As for the trend in global interest rates, you will see in the chart that from September 30, 2017 to December 31, 2017, global 10-year government bond yields ex-U.S. decreased from 1.05% to 1.03%. While we are in the monetary tightening cycle in the U.S., there is still monetary easing happening around the world as a whole which should prevent our 10-year treasury yields from spiking over the next 12 months.

Impact on Investment Portfolios

The media will continue to pounce on this story about “the risk of rising interest rates and inflation” throughout 2018 but it’s important to keep it in context. If tax reform works the way that it’s supposed to, wage growth should continue but we may not see the positive impact of increased consumer spending due to the wage growth until corporate earnings are released for the first and second quarter of 2018. We just have to wait to see how the strength of consumer spending nets out against the pressure on corporate earnings from higher wages.

However, investors should be looking at the fixed income portion of their portfolio to make sure there is the right mix of bonds if inflation is expected to rise throughout the year. Bond duration and credit quality will play an important role in your fixed income portfolio in 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Government Is Shut Down. Should You Be Worried?

The senate was not able to pass a temporary spending bill in the late hours of the night so as of Saturday, January 20th the government is officially shut down. But what does that mean? How will it impact you? What will be the impact on the stock market?

The senate was not able to pass a temporary spending bill in the late hours of the night so as of Saturday, January 20th the government is officially shut down. But what does that mean? How will it impact you? What will be the impact on the stock market?

Don’t Let The Media Scare You

The media loves big disruptive events. Why? The news is a "for profit" business. The more viewers they have, the more profits they make. What makes you watch more news? Fear. If the weather forecasts is 80 degrees and sunny, you just go on with your day. Instead, if the weather is predicting “The Largest Winter Blizzard Of The Century”, my guess is you will be glued to the weather channel most of the day trying to figure out when the storm will hit, how many feet of snow is expected to fall, and are schools closing, etc.

You will undoubtedly wake up this morning to headlines about “The Government Shutdown” and all of the horrible things that could happen as a result. In the short term a government shutdown or a “funding gap” is not incredibly disruptive. Many government agencies have residual funding to keep operations going for a period of time. Only portions of the government really “shut down”. The “essential” government services continue to function such as national security and law enforcement. The risk lies in the duration of the government shutdown. If Congress does not pass either a temporary extension or reach a final agreement within a reasonable period of time, some of these government agencies will run out of residual funding and will be forced to halt operations.

The news will target the “what if’s” of the current government shutdown. What if the government stays shut down and social security checks stop? What if the U.S. cannot fund defense spending and we are left defenseless? All of these scenarios would require a very prolonged government shutdown which is unlikely to happen.

How Often Does This Happen?

When I woke up this morning, my first questions was “how often do government shutdowns happen?” Is this an anomaly that I should be worried about or is it a frequent occurrence? The last government shutdown took place on September 30, 2013 and the government stayed shut down for 16 days. Prior to the 2013 shutdown, you have to go back to December 15, 1995. The duration of the 1995 shutdown was 21 days. Making the current government shutdown only the third shutdown between December 15, 1995 – January 20, 2018. Not an anomaly but also not a frequent event.

But let’s look further back. How many times did the U.S. government experience a shutdown between 1976 – 2018? In the past 42 years, the U.S. government has experienced a shutdown 18 times. On average the government shutdowns lasted for about 7 days. This makes me less worried about the current government shutdown given the number of shutdowns that we have overcome in the past.

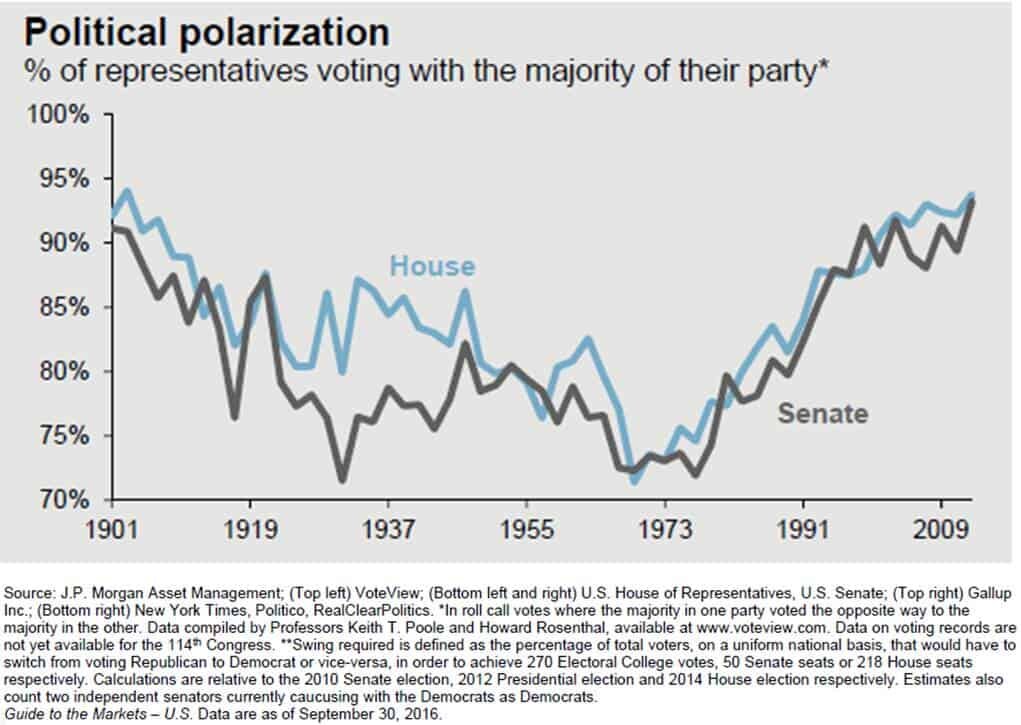

This Shutdown Could Be Longer

The only thing that worries me a little is the potential duration of the current government shutdown. I would not consider two data points to be a new “trend” but it is hard to ignore that the last two government shutdowns that occurred in 1995 and 2013 were much longer than the 7 day historical average. However, this could be the start of a new trend given how polarized Congress has become. It’s a clear trend that over the past 40 years fewer members of the Senate and House are willing to cross party lines during a vote. See the chart below: Back in 1973, only 73% of the members of Congress voted with the majority of their political party. It would seem rational to assume that during that time period members of Congress were more willing to step across the aisle for the greater good of the American people. Now, approximately 95% of the members of both the House and Senate vote with their own camp. This creates deadlock situations that take longer to resolve as the “blame game” takes center stage.

Impact On The Stock Market

In most cases, injecting uncertainty in our economy is never good for the stock market. However, given the fact that U.S. corporations are still riding the high of tax reform, if the government shutdown is resolved within the next two weeks it may have little or no impact on the markets.

If it were not for the recent passage of tax reform, my guess is this government shutdown may have been completely avoided. Not choosing a side here but just acknowledging the Democratic Party was delivered a blow with passage of tax reform in December. Since the spending bill requires 60 votes to pass in the Senate, it will require support from the Democrats. This situation provides the Democratic party with a golden opportunity to negotiate terms to help make up for some the lost ground from the passage of the Republican led tax bill. This challenging political environment could lengthen the duration of the government shutdown. However, it’s also important to remember that neither party benefits from a government shutdown, especially in a midterm election year.

Over the next two weeks, I would recommend that investors take all the media hype with a grain of salt. However, if a permanent or temporary spending bill is not passed within the next two weeks, it could result in increased volatility and downward pressure on the stock market as government agencies run out of cash reserves and begin to put workers on furlough. At this point, we are really in a “wait and see” environment.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.