Target Date Funds: A Public Service Announcement

Target Date Funds: A Public Service Announcement

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement or to start withdrawing assets. For this article, I will refer to the target date as the “retirement date” because that is how Target Date Funds are typically used.

Target Date Funds are continuing to grow in popularity as Defined Contribution Plans (i.e. 401(k)’s) become the primary savings vehicle for retirement. Per the Investment Company Institute, as of March 31, 2018, there was $1.1 trillion invested in Target Date Mutual Funds. Defined Contribution Plans made up 67 percent of that total.

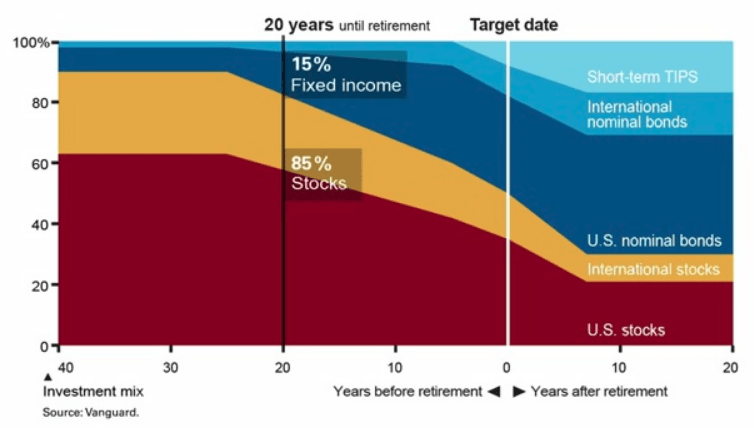

Target Date Funds are often coined as the “set it and forget it” of investments for participants in retirement plans. Target Date Funds that are farther from the retirement date will be invested more aggressively than target date funds closer to the retirement date. Below is a chart showing the “Glide Path” of the Vanguard Target Date Funds. The horizontal access shows how far someone is from retirement and the vertical access shows the percentage of stocks in the investment. In general, more stock means more aggressive. The “40” in the bottom left indicates someone that is 40 years from their retirement date. A common investment strategy in retirement accounts is to be more aggressive when you’re younger and become more conservative as you approach your retirement age. Following this strategy, someone with 40 years until retirement is more aggressive which is why at this point the Glide Path shows an allocation of approximately 90% stocks and 10% fixed income. When the fund is at “0”, this is the retirement date and the fund is more conservative with an allocation of approximately 50% stocks and 50% fixed income. Using a Target Date Fund, a person can become more conservative over time without manually making any changes.

Note: Not every fund family (i.e. Vanguard, American Funds, T. Rowe Price, etc.) has the same strategy on how they manage the investments inside the Target Date Funds, but each of them follows a Glide Path like the one shown below.

The Public Service Announcement

The public service announcement is to remind investors they should take both time horizon and risk tolerance into consideration when creating a portfolio for themselves. The Target Date Fund solution focuses on time horizon but how does it factor in risk tolerance?Target Date Funds combine time horizon and risk tolerance as if they are the same for each investor with the same amount of time before retirement. In other words, each person 30 years from retirement that is using the Target Date strategy as it was intended will have the same stock to bond allocation.This is one of the ways the Target Date Fund solution can fall short as it is likely not possible to truly know somebody’s risk tolerance without knowing them. In my experience, not every investor 30 years from retirement is comfortable with their biggest retirement asset being allocated to 90% stock. For various reasons, some people are more conservative, and the Target Date Fund solution may not be appropriate for their risk tolerance.The “set it and forget it” phrase is often used because Target Date Funds automatically become more conservative for investors as they approach their Target Date. This is a strategy that does work and is appropriate for a lot of investors which is why the strategy is continuing to increase in popularity. The takeaway from this article is to think about your risk tolerance and to be educated on the way Target Date Funds work as it is important to make sure both are in line with each other.For a more information on Target Date Funds please visit https://www.greenbushfinancial.com/target-date-funds-and-their-role-in-the-401k-space/

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

New York’s SECURE Choice program is changing how many employers must handle retirement benefits. If your business doesn’t currently offer a qualified retirement plan, you may be required to either register for SECURE Choice or implement an alternative plan option. In this article, we break down who must comply, key deadlines, and what employers should do now to avoid penalties and ensure employees have a retirement savings solution.

If you're a high-income executive, you’ve likely hit the contribution ceiling on your 401(k) or other qualified plans. So what’s next?

Enter the non-qualified deferred compensation (NQDC) plan—a tax deferral strategy designed for executives who want to save more for retirement beyond traditional limits.

IRS Issues Guidance on Mandatory 401(k) Roth Catch-up Starting in 2026

Starting January 1, 2026, high-income earners will face a significant shift in retirement savings rules due to the new Mandatory Roth Catch-Up Contribution requirement. If you earn more than $145,000 annually (indexed for inflation), your catch-up contributions to 401(k), 403(b), or 457 plans will now go directly to Roth, rather than pre-tax.

The IRS just released guidance in January 2025 regarding how the new mandatory Roth catch-up provisions will work for high-income earners. This article dives into everything you need to know!

Prior to 2025, it was very easy to explain to an employee what the maximum Simple IRA contribution was for that tax year. Starting in 2025, it will be anything but “Simple”. Thanks to the graduation implementation of the Secure Act 2.0, there are 4 different limits for Simple IRA employee deferrals that both employees and companies will need to be aware of.

Good news for 401(k) and 403(b) plan participants turning age 60 – 63 starting in 2025: there is now an enhanced employee catch-up contribution thanks to Secure Act 2.0 that passed back in 2022. For 2025, the employee contributions limits are as follows: Employee Deferral Limit $23,500, Age 50+ Catch-up Limit $7,500, and the New Age 60 – 63 Catch-up: $3,750.

When you separate service from an employer, you have to make decisions with regard to your 401K plan. It’s important to understand the pros and cons of each option while also understanding that the optimal solution often varies from person to person based on their financial situation and objectives. The four primary options are:

1) Leave it in the existing 401(k) plan

2) Rollover to an IRA

3) Rollover to your new employer’s 401(k) plan

4) Cash Distribution

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

In the past, companies have been allowed to limit access to their 401(k) plan to just full-time employees but that is about to change starting in 2024. With the passing of the Secure Act, beginning in 2024, companies that sponsor 401(K) plans will be required to allow part-time employees to participate in their qualified retirement plans.

401(K) plans with over 100 eligible plan participants are considered “large plans” in the eyes of DOL and require an audit to be completed each year with the filing of their 5500. These audits can be costly, often ranging from $8,000 - $30,000 per year.

Starting in 2023, there is very good news for an estimated 20,000 401(k) plans that were previously subject to the 5500 audit requirement. Due to a recent change in the way that the DOL counts the number of plan participants for purposes of assessing a large plan filer status, many plans that were previously subject to a 401(k) audit, will no longer require a 5500 audit for plan year 2023 and beyond.

When Congress passed the Secure Act 2.0 in December 2022, they introduced new tax credits and enhanced old tax credits for startup 401(k) plans for plan years 2023 and beyond. There are now 3 different tax credits that are available, all in the same year, for startup 401(k) plans that now only help companies to subsidize the cost of sponsoring a retirement plan but also to offset employer contributions made to the employee to enhance a company’s overall benefits package.

Starting in 2026, individuals that make over $145,000 in wages will no longer be able to make pre-tax catch-up contributions to their employer-sponsored retirement plan. Instead, they will be forced to make catch-up contributions in Roth dollars which means that they will no longer receive a tax deduction for those contributions.

With the passage of the Secure Act 2.0, for the first time ever, starting in 2023, taxpayers will be allowed to make ROTH contributions to Simple IRAs. Prior to 2023, only pre-tax contributions were allowed to be made to Simple IRA plans.

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy

When an employee unexpectedly loses their job and needs access to cash to continue to pay their bills, it’s not uncommon for them to elect a cash distribution from their 401(K) account. Still, they may regret that decision when the tax bill shows up the following year and then they owe thousands of dollars to the IRS in taxes and penalties that they don’t have.

There are a number of pros and cons associated with taking a loan from your 401K plan. There are definitely situations where taking a 401(k) loan makes sense but there are also number of situations where it should be avoided.

There are income limits that can prevent you from taking a tax deduction for contributions to a Traditional IRA if you or your spouse are covered by a 401(k) but even if you can’t deduct the contribution to the IRA, there are tax strategies that you should consider

When you become eligible to participate in your employer’s 401(k), 403(b), or 457 plan, you will have to decide what type of contributions that you want to make to the plan.

DB/DC combo plans can allow business owners to contribute $100,000 to $300,000 pre-tax EACH YEAR which can save them tens of thousands of dollars in taxes.

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans.

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child

Enrolling in a company retirement plan is usually the first step employees take to join the plan and it is important that the enrollment process be straight forward. There should also be a contact, i.e. an advisor (wink wink), who can guide the employees through the process if needed. Even with the most efficient enrollment process, there is a lot of

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should

For many savers, the objective of a retirement account is to accumulate assets while you are working and use those assets to pay for your expenses during retirement. While you are in the accumulation phase, assets are usually invested and hopefully earn a sufficient rate of return to meet your retirement goal. For the majority,

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement

While it probably seems odd that there is a connection between the government passing a budget and your 401(k) plan, this year there was. On February 9, 2018, the Bipartisan Budget Act of 2018 was passed into law which ended the government shutdown by raising the debt ceiling for the next two years. However, also buried in the new law were

In the last 3 years, the number of lawsuits filed against colleges for excessive fees and compliance issues related to their 403(b) plans has increased exponentially. Here is a list of just some of the colleges that have had lawsuit brought against them by their 403(b) plan participants:

Not every company with employees should have a 401(k) plan. In many cases, a Simple IRA plan may be the best fit for a small business. These plans carry the following benefits

SEP stands for “Simplified Employee Pension”. The SEP IRA is one of the most common employer sponsored retirement plans used by sole proprietors and small businesses.