Inheritance Planning (Receiving)

Thoughtful Guidance When Inheritance Changes Your Financial Picture

Receiving an inheritance can meaningfully alter your personal financial plan—sometimes overnight. Depending on the size and structure of the inheritance, there may also be significant tax planning and time-sensitive decisions that need to be addressed to ensure assets pass to you as efficiently as possible.

In many cases, individuals receiving an inheritance are also navigating grief, family responsibilities, and administrative tasks at the same time. Our role is to help bring clarity, structure, and confidence to a process that can otherwise feel overwhelming.

Why Inheritance Planning Matters

Inheritance is not simply about receiving assets. It often involves:

Tax filings and reporting

Required decisions around inherited retirement accounts

Trust distribution rules

Executor or trustee responsibilities

Long-term financial and investment planning implications

A thoughtful plan helps avoid unnecessary taxes, IRS penalties, and costly missteps.

Not All Inherited Assets Are Created Equal

One of the most important concepts to understand is that each type of inherited asset follows different rules and has different tax implications.

Individuals may inherit:

A primary residence or other real estate

Brokerage and investment accounts

Annuities

Traditional IRAs or 401(k)s

Roth IRAs

Life insurance

Assets held inside a trust

Each of these assets must be handled differently from both a tax and planning standpoint.

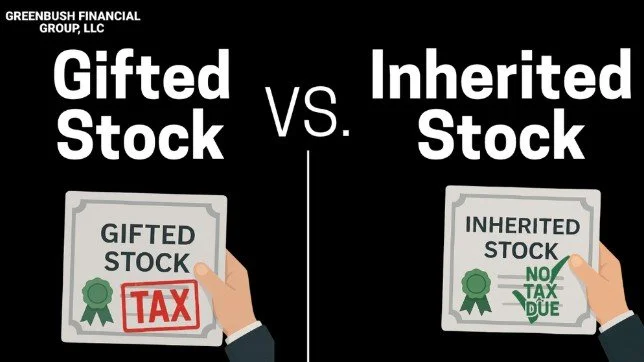

Step-Up in Cost Basis for Non-Retirement Assets

For many non-retirement assets, such as:

Real estate

Stocks and bonds

Brokerage accounts

A properly structured estate may provide a step-up in cost basis.

This means:

The asset’s cost basis is adjusted to its fair market value on the date of death

If the beneficiary sells the asset shortly thereafter, there may be little or no capital gains tax

This can create significant tax savings when handled correctly

Understanding whether assets receive a step-up is critical before making any sale decisions.

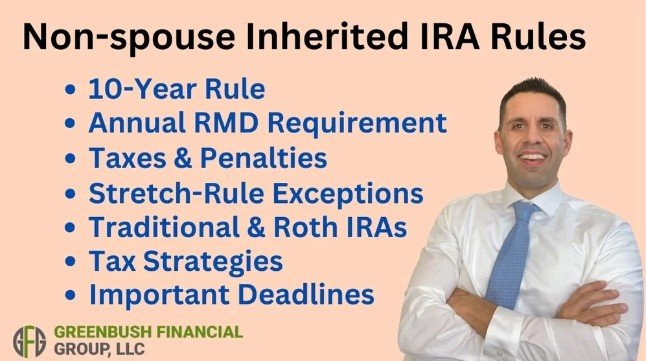

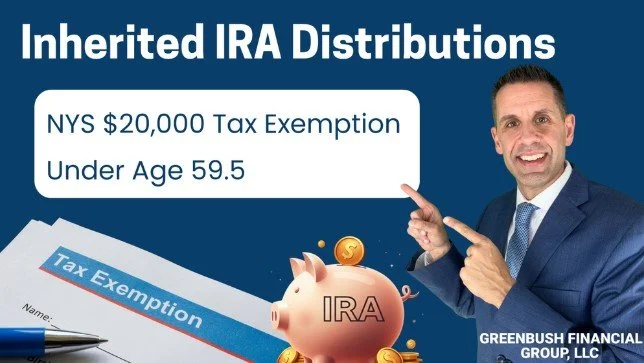

Inherited Retirement Accounts and the 10-Year Rule

Inherited retirement accounts require particularly careful planning.

For individuals who pass away after December 31, 2019, most non-spouse beneficiaries are subject to the IRS 10-year rule, which requires inherited retirement accounts to be fully depleted within 10 years.

Key questions beneficiaries must address include:

Was the decedent already taking Required Minimum Distributions (RMDs)?

Does the beneficiary need to complete the decedent’s final RMD?

Is the beneficiary subject to annual RMDs during the 10-year period?

Does the beneficiary qualify for an exception to the 10-year rule?

How should distributions be timed to minimize income taxes?

Because distributions from pre-tax retirement accounts are taxed as ordinary income, we often need to plan out a 10-year tax strategy to determine the most efficient withdrawal schedule.

Advanced Tax Strategies for Inherited Accounts

Inherited retirement planning often requires advanced tax coordination, including:

Managing tax brackets over multiple years

Coordinating distributions with other income sources

Avoiding IRMAA Medicare premium increases

Impact of inheritance on other financial goals: college planning, second house, etc.

The goal is not just compliance—but optimization.

Special Considerations for Annuities and Trust Assets

Certain assets require additional analysis:

Non-qualified annuities often do not receive a step-up in cost basis, meaning taxes may be due on previously untaxed gains

Trust assets may be subject to:

Distribution restrictions

Trustee discretion

Timeline separate from other estate assets

Tax decision by beneficiaries prior to receipt of trust assets

Transfer instructions

Understanding the governing documents is essential before taking action.

Incorporating Inheritance Into Your Financial Plan

Once inheritance is received, it must be integrated into your own financial plan.

Key planning questions often include:

Does this inheritance allow for earlier retirement?

Should distribution strategies change?

Does this create a need for your own trust or estate planning updates?

Will this increase future tax exposure?

How should these assets be invested based on your age and goals?

Assets that were appropriate for the decedent may not be appropriate for you.

Investment Planning After an Inheritance

Inheritance often requires:

Opening new investment or custodial accounts

Retitling assets properly

Rebalancing inherited portfolios

Selling assets that no longer fit your risk profile

Creating a tax-efficient investment strategy going forward

Investment decisions should be made deliberately—not reactively.

Our Role in Inheritance Planning

At Greenbush Financial Group, we help clients:

Navigate inheritance-related tax rules

Avoid IRS penalties and missed deadlines

Understand distribution options and obligations

Integrate inherited assets into their financial plan

Coordinate with CPAs, estate attorneys, executors, and trustees

Create confidence during a complex transition

While receiving an inheritance is a positive event, it can also be complicated. Having professional guidance helps ensure that the opportunity strengthens—not disrupts—your financial future.

Our Inheritance Planning Articles

“I had a question about inheritance of my ROTH IRA account. I reached out to Greenbush Financial Group. Rob Mangold from Greenbush Financial Group promptly responded with clear explanation. I am very pleased with their professionalism and will be glad to work with them in future. ⭐⭐⭐⭐⭐”

This endorsement provided for Greenbush Financial Group, LLC on Google Review was made by a non-client, and it was a non-paid review. This non-client was solicited by Greenbush Financial Group, LLC to provide the endorsement.

“ Michael Ruger, and later with a follow up question Brad Harkness, were immeasurably generous and helpful with their time and advice. I had a question about joint beneficiaries of an inherited IRA that I could not find an answer to anywhere. I had contacted both law firms and accounting firms locally and across the country that advertised on the internet that they were experts in estate taxation and was told that they did not do what I was asking about or they did not return my calls or emails. Eventually, I found Mr. Ruger’s videos and in them he got very close to what I was inquiring about but not completely. So I called Greenbush Financial Group and was able to speak in person with Mr. Ruger. He was very personable and helpful and seemed to take an actual interest in helping me. The next day I called the financial company that had the IRA with and was told something that sounded odd. I again called Greenbush Financial and asked to speak with Mr. Ruger, but he was out of the office and a very nice gentleman (Brad Harkness) said maybe he could help me. So, I told him the situation, and he too thought that what I was told seemed strange and he said that he would research the matter and get back with me the next day. He called me back the next day and told me the conclusion he had come to. Both of these gentlemen were very helpful, friendly, insightful and knowledgeable. They obviously have a wonderful company culture at Greenbush Financial. ⭐⭐⭐⭐⭐”

This endorsement provided for Greenbush Financial Group, LLC on Google Review was made by a non-client, and it was a non-paid review. This non-client was solicited by Greenbush Financial Group, LLC to provide the endorsement.

Frequently Asked Questions About Inheritance Planning (Receiving)

-

Do I have to pay taxes on an inheritance?It depends on the type of asset. Some assets are tax-free, while others—like pre-tax retirement accounts—are taxable when distributed.

-

What is a step-up in cost basis?A step-up in cost basis resets the value of certain assets to their fair market value at death, potentially eliminating capital gains taxes.

-

How does the 10-year rule for inherited IRAs work?Most non-spouse beneficiaries must fully withdraw inherited retirement accounts within 10 years, following specific IRS rules.

-

Do I have to take RMDs from an inherited IRA every year?It depends on the account type, beneficiary status, and whether the decedent was already taking RMDs.

-

What happens if I inherit assets from a trust?Trust distributions depend on the trust’s terms, trustee discretion, and tax rules applicable to the trust.

-

Can inheritance affect my tax bracket?Yes. Distributions from inherited retirement accounts may increase taxable income and affect tax brackets and Medicare premiums.

-

Should I keep or sell inherited investments?That depends on tax implications, cost basis, and whether the investments align with your financial goals.

-

Should I work with a financial planner after receiving an inheritance?It’s strongly recommended. Inheritance planning involves tax, investment, and long-term planning considerations that benefit from professional guidance.

Contact Us . . . .

All of our services start with a complimentary consult. No high pressure sales tactics. We are financial planners, not salesmen.

About Our Firm: Greenbush Financial Group is an independent registered investment advisory firm based in Albany, New York, that provides four main services to clients: fee-based financial planning services, investment management, employer-sponsored retirement plans, and retirement planning services. The firm serves clients locally in the Albany region and virtually across the United States.