Do You Have To Pay Tax On Your Social Security Benefits?

I have some unfortunate news. If you look at your most recent paycheck, you are going to see a guy by the name of “FICA” subtracting money from your take-home pay. Part of that FICA tax is sent to the Social Security system, which entitles you to receive Social Security payments when you retire. The unfortunate news is that, even though it was a tax that you paid while you were working, when you go to receive your payments from Social Security, most retirees will have to pay some form of Income Tax on it. So, it’s a tax you pay on a tax? Pretty much!

In this article, I will be covering:

· The percent of your Social Security benefit that will be taxable

· The tax rate that you pay on your Social Security benefits

· The Social Security earned income penalty

· State income tax exceptions

· Withholding taxes from your Social Security payments

What percent of your Social Security benefit is taxable?

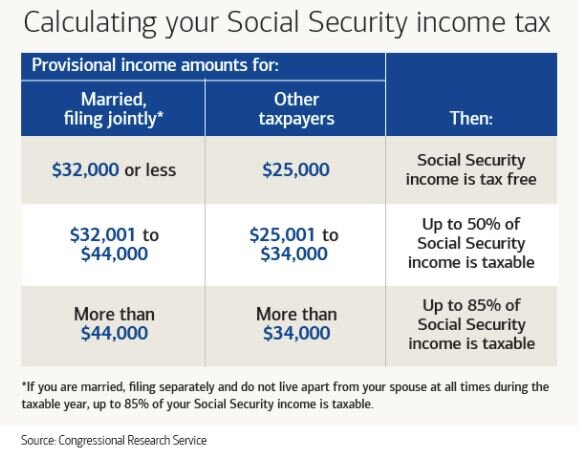

First, let’s start off with how much of your Social Security will be considered taxable income. It ranges from 0% to 85% of the amount received. Where you fall in that range will depend on the amount of income that you have each year. Here is the table for 2025:

But, here’s the kicker. 50% of your Social Security benefit that you receive counts towards the income numbers that are listed in the table above to arrive at your “combined Income” amount. Here is the formula:

Adjusted Gross Income (AGI) + nontaxable interest + 50% of your SS Benefit = Combined Income

If you are a single tax filer, and you are receiving $30,000 in Social Security benefits, you are already starting at a combined income level of $15,000 before you add in any of your other income from employment, pensions, pre-tax distributions from retirement accounts, investment income, or rental income.

As you will see in the table, if your combined income for a single filer is below $25,000, or a joint filer below $32,000, you will not have to pay any tax on your Social Security benefit. Taxpayers above those thresholds will have to pay some form of tax on their Social Security benefits. But, I have a small amount of good news: no one has to pay tax on 100% of their benefit, because the highest percentage is 85%. Therefore, everyone at a minimum receives 15% of their benefit tax free.

NOTE: The IRS does not index the combined income amounts in the table above for inflation, meaning that even though an individual’s Social Security and wages tends to increase over time, the dollar amounts listed in the table stay the same from year to year. This has caused more and more taxpayers to have to pay tax on a larger portion of their Social Security benefit over time.

Tax Rate on Social Security Benefits

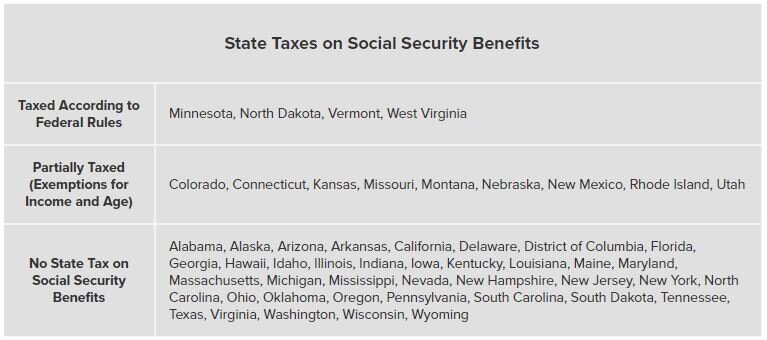

Your Social Security benefits are taxed as ordinary income. There are no special tax rates for Social Security like capital gains rates for investment income. Social Security is taxed at the federal level but may or may not be taxed at the state level. Currently there are 37 states in the U.S. that do not tax Social Security benefits. There are 4 states that tax it at the same level as the federal government and there are 13 states that partially tax the benefit. Here is table:

Withholding Taxes From Your Social Security Benefit

For taxpayers that know that will have to pay tax on their Social Security benefit, it is usually a good idea to have Social Security withholding taxes taken directly from your Social Security payments. Otherwise, you will have to issue checks for estimated tax payments throughout the year which can be a headache. They only provide you with four federal tax withholding options:

7%

0%

12%

22%

These percentages are applied to the full amount of your Social Security benefit, not to just the 50% or 85% that is taxable. Just something to consider when selecting your withholding elections.

To make a withholding election, you have to complete Form W-4V (Voluntary Withholding Request). Once you have completed the form, which only has 7 lines, you can mail it or drop it off at the closest Social Security Administration office.

Social Security Earned Income Penalty

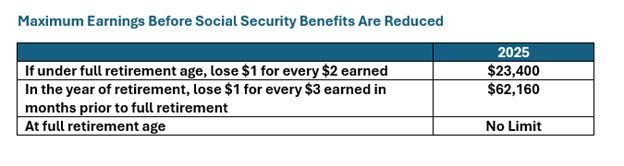

If you elect to turn on your Social Security benefit prior to your Normal Retirement Age (NRA) AND you plan to keep working, you have to be aware of the Social Security earned income penalty. Your Normal Retirement Age is the age that you are entitled to receive your full Social Security benefit, and it’s based on your date of birth.

The earned income penalty ONLY applies to taxpayers that turn on their Social Security prior to their normal retirement age. Once you have reached your normal retirement age, this penalty does not apply.

Basically, the IRS limits how much you are allowed to make each year if you elect to turn on your Social Security early. If you earn over those amounts, you may have to pay all or a portion of the Social Security benefit back to the government. Note that for married couples, the earned income numbers below apply to your personal earnings, and do not take into consideration your spouse’s income.

INCOME UNDER $23,400: If you earned income is below $23,400, no penalty, you get to keep your full social security benefit

INCOME OVER $23,400: You lose $1 of your social security benefit for every $2 you earn over the threshold. Example:

You turn on your social security at age 63

Your social security benefit is $20,000 per year

You make $40,000 per year in wages

Since you made $40,000 in wages, you are $16,600 over the $23,400 limit:

$16,600 x 50% ($1 reduction for every $2 earned) = $8,300 penalty.

The following year, your $20,000 Social Security benefit would be reduced by $8,300 for the assessment of the earned income penalty. Ouch!!

As a general rule of thumb, if you plan on working prior to your Social Security normal retirement age, and your wages will be in excess of the $23,400 limit, it usually makes sense to wait to turn on your Social Security benefit until your wages are below the threshold or you reach normal retirement age.

NOTE: You will see in the second row of the table “In the year of retirement”. In the year that you reach your full retirement age for social security the wage threshold is higher and the penalty is lower (a $1 penalty for every $3 over the threshold).

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.