Understanding FAFSA & How To Qualify For More College Financial Aid

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students to understand:

How is college financial aid calculated?

Are there ways to increase the amount of financial aid you can receive?

What are the income and asset thresholds where financial aid evaporates?

Understanding the FAFSA 2 Year Lookback Rule

The difference between financial aid at public colleges vs private colleges

In this article we will provide you with guidance on these topics as well as introduce strategies that we as financial planners use with our clients to help them qualify for more financial aid.

How is college financial aid calculated?

Too often we see families jump to the incorrect assumption that “I make too much to qualify for financial aid.” Depending on what your asset and income picture looks like there may be strategies that will allow you to shift assets around during the financial aid determination years to qualify for need based financial aid. But you first need to understand how need based financial aid is calculated.

The Department of Education has a formula to calculate your “Expected Family Contribution” (EFC). The Expected Family Contribution is the amount that a family is expected to pay out of pocket each year before financial aid is awarded. Here is the general formula for financial aid:

It’s pretty simple and straight forward. Cost of the college, minus the EFC, equals the amount of your financial aid award. Now let’s breakdown how the EFC is calculated

Expected Family Contribution (EFC) Calculation

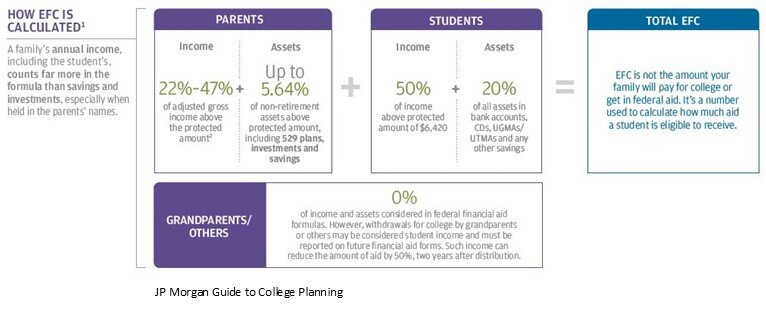

Both the parent’s income and assets, as well as the student’s income and assets come into play when calculating a family’s EFC. But they are weighted differently in the formula. Let’s look at the parent’s income and assets first.

Parent’s Income & Assets

Parents Income: The parent’s income is one of the largest factors in the EFC calculation. The percentage of the parents income that counts toward the EFC calculation is expressed as a range between 22% - 47% because it depends on a number of factors such as household size and the number of children that you have attending college at the same time.

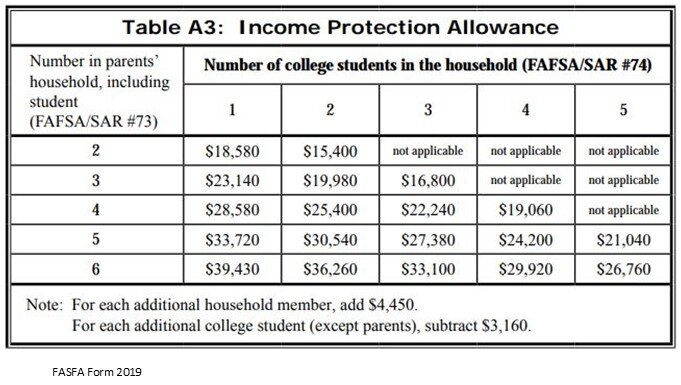

However, there is an “Income Protection Allowance” that allows parents to shelter a portion of their income from the formula based on the household size and the number of children attending college. See that chart below for the 2019-2020 FAFSA form:

Parents Assets: Any assets owned by the parents of the student are multiplied by 5.64% and that amount counts towards the EFC. Here are a few assets that are specifically EXCLUDED from this calculation:

Retirement Accounts: 401(k), 403(b), IRA’s, SEP, Simple

Pensions

Primary Residence

Family controlled business (less than 100 employees and 51%+ ownership by parents)

On the opposite side of that coin, here is a list of some assets that are specifically INCLUDED in the calculation:

Balance in 529 accounts

Real estate other than the primary residence

Even if held in an LLC – Reported separately from “business assets”

Non-retirement investment accounts, savings account, CD’s

Trusts where the student is a beneficiary of the trust (even if not entitled to distributions yet)

Business interest (less than 51% family owned by parents or more than 100 employees)

Similar to the Income Allowance Table, there is also a Parents’ Asset Protection Allowance Table that allows them to shelter a portion of their countable assets from the EFC formula. See the table below for the 2019-2020 school year.

Student’s Income & Assets

Now let’s switch gears over to the student side of the EFC formula. The income and the assets of the student are weighted differently than the parent’s income and assets. Here is the student side of the EFC formula:

As you can clearly see, income and assets in the student’s name compared to the parent name will dramatically increase the Expected Family Contribution and in turn decrease the amount of financial aid awarded. It is because of this, that as a general rule, if you think your asset and income picture may qualify you for financial aid, do not put assets in the name of your child. The most common error that we see people make are assets in an UGMA or UTMA account. Even though parents control those accounts, they are technically considered an asset of the child. If there is $30,000 sitting in an UTMA account for the student, they are automatically losing around $6,000 EACH YEAR in financial aid. Multiply that by 4 years of college, it ends up costing the family $24,000 out of pocket that otherwise could have been covered by financial aid.

EFC Formula Illustration

If we put all of the pieces together, here is an illustration of the full EFC Formula:

Grandparent Owned 529 Plans For The Student

As you will see in the EFC formula above, assets owned by the grandparents with the student listed as the beneficiary, like 529 accounts, are not counted at all toward the EFC calculation. This can be a very valuable college savings strategy for families since the parent owned 529 accounts count toward the Expected Family Contribution. However, there are some pitfalls and common mistakes that we have seen people make with regard to grandparent owned 529 accounts. See the article below for more information specific to this topic:

Article: Common Mistakes With Grandparent Owned 529 Accounts

Financial Aid Chart

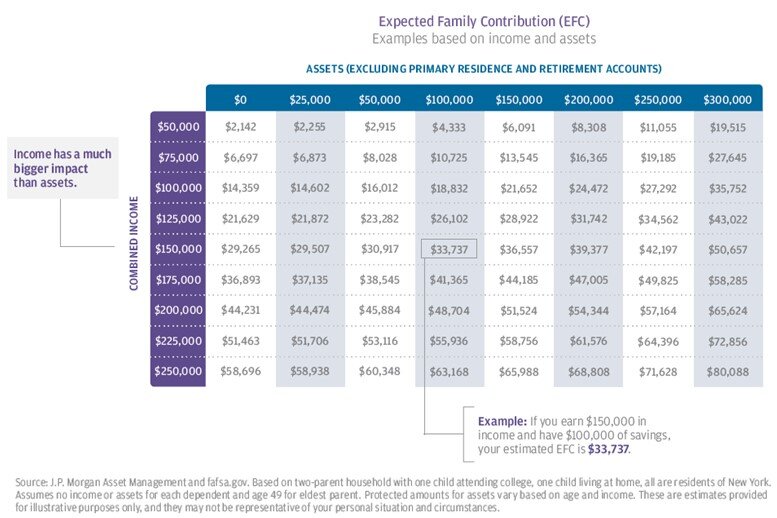

Our friends over at JP Morgan were kind enough to put a summary chart together for this EFC calculation which allows families to get a ballpark idea of what their Expected Family Contribution might be without getting out a calculator. The chart below is based on the following assumptions:

Two parent household

2 Children: One attending college and the other still at home

The child attending college has no assets or income

The oldest parent is age 49

Using the chart above, if the parents combined income is $150,000 and they have $100,000 in countable assets, the Expected Family Contribution would be $33,737 for that school year. What does that mean? If the student is attending a state college and the tuition with room and board is $26,000, since the EFC is greater than the total cost of college for that year, that family would receive no financial aid. However, if that student applies to a private school and the CSS Profile form results in approximately that same EFC of $33,737 but the private school costs $60,000 per year, then the family may receive need based financial aid or a grant from the private school equaling $26,263 per year.

Public Colleges vs. Private Colleges

It’s important to point out that FAFSA and the EFC calculation primarily applies to students that plan on attending a Community College, State College, or certain Private Colleges. Since Private Colleges do not receive federal financial aid they do not have to adhere to the EFC calculation that is used by FAFSA. Private college can choose to use to FAFSA criteria but many of the private colleges will require students to complete both the FAFSA form and the CSS Profile Form.

Here are a few examples of how the financial reporting deviates:

If the parents have a 100% family owned business, they would not have to list that as an asset on the FAFSA application but they would have to list the business as an assets on the CSS Profile form.

The equity in your primary residence is not counted as an asset for FAFSA but it is listed as an asset on the CSS Profile Form.

For parents that are divorced. FAFSA only looks at the assets and income of the custodial parent. The CSS Profile Form captures the assets and income of both the custodial and non-custodial parent.

Because of the deviations between the FAFSA application and the CSS Profile Form, we have seen situations where a student received no need based financial aid when applying to a $50,000 per year private school but they received financial aid for attending a state school even though the annual cost to attend the state school was half the cost of the private school.

Top 10 Ways To Increase College Financial Aid

Here is a quick list of the top strategies that we use to help families to qualify for more financial aid.

Disclosure: There are details associated with each strategy listed below that need to be executed correctly in order for the strategy to have a positive impact on the EFC calculation. Not all strategies will work depending on the financial circumstances of each household and where the child plans to attend college. Contact us for details.

Get assets out of the name of the student

Grandparent owned 529 accounts

Use countable assets of the parents to pay down debt

Move UTGMA & UGMA accounts to 529 UGMA or 529 UTMA accounts

Increase contributions to retirement accounts

Minimize distributions from retirement accounts

Minimize capital gain and dividend income

Accelerate necessary expenses

Use home equity line of credit instead of home equity loan

Families that own small businesses have a lot of advanced planning options

FAFSA – 2 Year Lookback

It’s important to understand the FAFSA application process because you have know when they take the snapshot of your income and assets for the EFC calculation in order to have a shot at increasing the financial aid that you may be able to qualify for.

FAFSA looks back 2 years to determine what your income will be for the upcoming school year. For example, if your child is going to be a freshman in college in the fall of 2020, you will report your 2018 income on the FAFSA application. This is important because you have to start putting some of these strategies into place in the spring of your child’s sophomore year in high school otherwise you could miss out on planning opportunities for their freshman year in college.

If your child is already a junior or senior in high school and you are just reading this article now, there is still an opportunity to implement some of the strategies listed above. Income has a 2 year lookback but assets are reported as of the day of the application. Also the FAFSA application is completed each year that your child is attending college, so even though you may have missed income reduction strategies for their freshman year, at some point the 2 year lookback will influence the financial aid picture during the four years of their undergraduate degree.

IMPORTANT NOTE: Income has a 2-year lookback

Asset balances are determined on the day that you submit the FAFSA Application

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Prepare Financially For A Divorce

Divorce can stain finances as well as emotions. Both parties are trying to determine financially what life is going to look like after the divorce is finalized. It is also more common than not that in a marriage one of the spouses assumes the role of paying the bills and managing the family's finances. In this arrangement the "non-financial spouse" is now

Divorce can stain finances as well as emotions. Both parties are trying to determine financially what life is going to look like after the divorce is finalized. It is also more common than not that in a marriage one of the spouses assumes the role of paying the bills and managing the family's finances. In this arrangement the "non-financial spouse" is now forced very quickly into the role of understanding their total financial picture.

How much income do they need to meet their living expenses?

Where are all of the marital assets located?

How much debt do they have?

How much should they expect to receive or pay in child support / alimony?

Who is responsible for paying the bills while the divorce process is ongoing?

Step 1: Establish a team of professionals........

Since so many important financial decisions are being made in such a short window of time, we strongly recommend that each spouse surround themselves with a team of professionals that they like and trust. That team of professionals usually consists of an attorney /mediator, accountant, therapist, and a financial planner. Even though the divorce process can be stressful and sometimes scary, surrounding yourself with a knowledgeable team of advisors will help you to better understand your current situation, the options available to you, and to help you better prepare for life after the divorce is final.

Step 2: Identify your assets and debts.............

You need to fully understand your current financial situation before you can begin to plan for your income and expenses going forward. First, make a list of all of your assets, their values, where they are located, and how they are owned (jointly or separately). This can usually be accomplished by gathering statements on all of your accounts.

You will also need a list of all of your debts, the name of each creditor, outstanding balances, monthly payments, interest rates, and how each debt is owned (jointly or separately). This information can typically be obtained by requesting a credit report for both you and your spouse.

Step 3: Create a new budget...............

Before you can figure out how much income/support you will need going forward you need to know what your estimated monthly expenses are going to be once the divorce is finalized. We recommend listing all of your monthly expenses and list separately large one-time expenses that are expected to be incurred in the future such as college expense for the kids or a down payment on a house. Once you know your estimated monthly expenses you can work with your financial professionals to determine how much income/support you will need each month to meet those expenses taking into account taxes, inflation, and an assumed rate of return on your assets. Please feel free to utilize our GFG Expense Planner which is located in the Resource section of our newsroom.

Step 4: Develop financial projections............

Remember, the financial decisions that you are making now during the divorce process will most likely have a dramatic impact on what your financial future will look like. Not all assets are treated equally. Some assets are taxable while others are not. Likewise, you may have access to certain assets now to meet current expense while others assets may not be available until retirement.

The goal of these financial projections is to determine what your financial future may look like next year, 3 years, 10 years, and 20 years from now given the financial decisions that are being made today. There are a lot of variables that need to be considered when creating these projections such as assumed rates of return on current assets, annual contribution amounts, taxes, social security, inflation, and debt. We strongly recommend that individuals work with financial planners that specialize in divorce planning to develop these projections.

Having formal income and expense projections in place will also allow you determine how changes to what is being offered during the negotiation process will impact your financial future.

Step 5: Crossing emotional and financial decisions

It is not uncommon for individuals to have an emotional attachment to a specific marital asset. The two most commons assets that we see that fall into this category are the primary residence and pensions.

We see many situations where one spouse has a strong emotional attachment to the house and they become completely focused on doing whatever it takes to "keep the house". But there are certain circumstances where from a financial standpoint that keeping the house is just not a viable financial option. Couples can underestimate the financial impact of divorce. While married, a couple's total income was being used to maintain a single household. Now that same level of income will need to be used to maintain two separate households which usually comes at a greater overall cost. If projections can be produced early on in the divorce process showing that keeping the current house is just not a viable option, it may remove that addition stress of fighting over an asset that cannot be financially maintain by either spouse.

Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide legal advice. For legal advice, please consult your attorney.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Need to Know College Savings Strategies

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control.

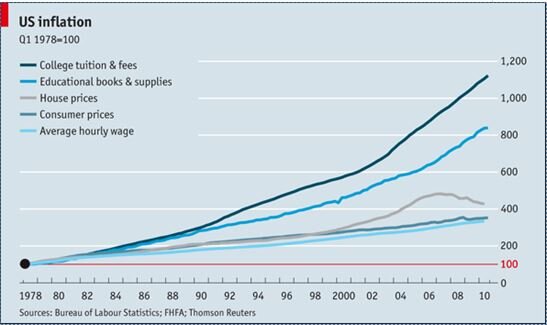

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control. The year over year increase in the cost of tuition and fees since 1978 to date has far outpaced any reasonable rate of inflation, and demands a new look at college savings strategies. In the chart below, you will see the increase in the price of college tuition and fee versus other comparable expenses over the past 30 years. Its mind blowing!!

Fund A 529 Account*

As far as college savings strategies go, there are very few options that beat 529 accounts as a savings vehicle for college. In these accounts you make after tax contribution to the account and when the amounts are withdrawn, as long as those withdrawals are attributed to a qualified college expenses, the earnings generated by the account are tax free. Depending on the state you live in you may be eligible to receive a state tax deduction for contribution up to specified dollar amount. In New York, single filers receive a NYS tax deduction up to $5,000 and married filing joint $10,000.

Also for financial aid purposes these account are looked at very favorably in the EFC (Expected Family Contribution) calculation. They are looked at by FASFA as an asset of the "parent" not the asset of the "child". There are many contribution and withdrawal strategies associated with these accounts that can produce big tax benefits for individuals accumulating savings for themselves or their children.

Roth IRAs Are Not Just For Retirement

When clients have the dual goal of saving for retirement and saving for college, the Roth IRA is often times a great option. Even if you make too much to contribute directly to a Roth, you can implement a "non-deductible IRA to Roth IRA conversion strategy" that will allow you to still get money into a Roth IRA.

Contributions to Roth IRAs are made with after tax dollars but unlike a traditional IRA if you hold a Roth IRA for at least 5 years and make withdrawals after age 59 1/2 you pay no tax on the earnings.

Here is one college savings strategy technique: You are allowed at any time and at any age to withdrawal the contribution portion of your account balance from a Roth IRA tax and penalty free. For example, if I contribute $5,000 to a Roth IRA and 5 years later it is worth $10,000, I can contact my IRA provider and request that they distribute just my basis ($5,000) and leave the earnings in the account to continue to accumulate tax free. You can then use that basis distribution to fund college expenses but the earnings in the Roth IRA continue to accumulate tax free.

Maximize Your Financial Aid

There are strategies that can be implemented leading up to the filing of the FASFA form that can increase that amount of financial aid that you receive. When you apply for financial aid, FASFA has a complex EFC calculation that takes a snapshot of your assets and income to determine how much financial aid you will qualify for. There are ways to shift assets and shelter income from this calculation that can save individuals and families thousands of dollars when it come to paying for college. Here are a few of the strategies that can help to improve a EFC calculation:

Save money in the parents or grandparents name, not the childs name

Pay off consumer debt, such as credit cards and auto loans

Spend down the students asset and income first

Accelerate necessary expenses (such as computer purchase) to reduce cash

Minimize capital gains

Maximize your contributions to a retirement plan

Do not withdrawal money from a retirement plan to pay for college

Ask grandparents to wait to give grandchildren money until after college

Trust funds are generally ineffective at sheltering money from EFC

Prepay your mortgage

Contribute to 529 plans owned by the parent or grandparent

Choose the date to submit the FASFA carefully

About Michael...

Hi, Im Michael Ruger. Im the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.