How To Pay 0% Tax On Capital Gains Income

When you sell a stock, mutual fund, investment property, or a business, if you have made money on that investment, the IRS is kindly waiting for a piece of that gain in the form of capital gains tax. Capital gains are taxed differently than the ordinary income that you received via your paycheck or pass-through income from your business. Unlike ordinary

When you sell a stock, mutual fund, investment property, or a business, if you have made money on that investment, the IRS is kindly waiting for a piece of that gain in the form of capital gains tax. Capital gains are taxed differently than the ordinary income that you received via your paycheck or pass-through income from your business. Unlike ordinary income, which has a series of tax brackets that range from 10% to 37% in 2025, capital gains income is taxed at a flat rate at the federal level. Most taxpayers are aware of the 15% long term capital gains tax rate but very few know about the 0% capital gains tax rate and how to properly time the sale of your invest to escape having to pay tax on the gain.

Short-term vs Long-Term Gains

Before I get into this tax strategy, you first have to understand the difference between “short-term” and “long-term” capital gains. Short-term capital gains apply to any investment that you bought and sold in less than a 12 month period. Example, if I buy a stock today for $1,000 and I sell it three months later for $3,000, I would have a $2,000 short-term capital gain. Short-term capital gains are taxed as ordinary income like your paycheck. There is no special tax treatment for short-term capital gains and the 0% tax strategy does not apply.

Long-term capital gains on the other hand are for investments that you bought and then sold more than 12 months later. When I say “investments” I’m using that in broad terms. It could be a business, investment property, stock, etc. When you sell these investments at a gain and you have satisfied the 1 year holding period, you receive the benefit of paying tax on the gain at the preferential “long-term capital gains rate”.

What Are The Long Term Capital Gains Rates?

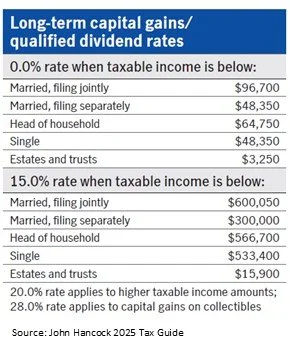

For federal tax purposes, there are 3 long term capital gains rates: 0%, 15%, and 20%. What rate you pay is determined by your filing status and your level of taxable income in the year that you sold the investment subject to the long term capital gains tax. For 2025, below are the capital gains brackets for single filers and joint filers.

As you will see on the chart, if you are a single filer and your taxable income is below $48,350 or a joint filer with taxable income below $96,700, all or a portion of your long term capital gains income may qualify for the federal 0% capital gains rate.

An important note about state taxes on capital gains income is that each state has a different way of handling capital gains income. New York state is a “no mercy state” meaning they do not offer a special tax rate for long term capital gains. For NYS income tax purposes, your long term capital gains are taxed as ordinary income. But let’s continue our story with the fed tax rules which are typically the lion share of the tax liability.

In a straight forward example, assume you live in New York, you are married, and your total taxable income for the year is $50,000. If you realize $25,000 in long term capital gains, you will not pay any federal tax on the $25,000 in capital gain income but you will have to pay NYS income tax on the $25,000.

Don’t Stop Reading This Article If Your Taxable Income Is Above The Thresholds

For many taxpayers, their income is well above these income thresholds. But I have good news, with some maneuvering, there are legit strategies that may allow you to take advantage of the 0% long term capital gains tax rate even if your taxable income is above the $48,350 single filer and $96,700 joint filer thresholds. I will include multiple examples below as to how our high net worth clients are able to access the 0% long term capital gains rate but I first have to build the foundation as to how it all works.

Using 401(k) Contributions To Lower Your Taxable Income

In years that you will have long term capital gains, there are strategies that you can use to reduce your taxable income to get under the 0% thresholds. Here is an example, I had a client sell a rental property this year and the sale triggered a long term capital gain for $40,000. They were married and had a combined income of $110,000. If they did nothing, at the federal level they would just have to pay the 15% long term capital gains tax which results in a $6,000 tax liability. Instead, we implemented the following strategy to move the $40,000 of capital gains into the 0% tax rate.

Once they received the sale proceeds from the house, we had them deposit that money to their checking account, and then go to their employer and instruct them to max out their 401(k) pre-tax contributions for the remainder of the year. Since they were both over 50, they were each able to defer $31,000 (total of $62,000). They used the proceeds from the house sale to supplement the income that they were losing in their paychecks due to the higher pre-tax 401(k) deferrals. Not only did they reduce their taxable income for the year by $62,000, saving a bunch in taxes, but they also were able to move the full $40,000 in long term capital gain income into the 0% tax bracket. Here’s how the numbers work:

Adjusted Gross Income (AGI): $110,000

Pre-tax 401(k) Contributions: ($62,000)

Less Standard Deduction: ($30,000)

Total Taxable Income: $30,100

In their case, they would be able to realize $66,600 in long term capital gains before they would have to start paying the 15% fed tax on that income ($96,700 – $30,100 = $66,600). Since they were below that threshold, they paid no federal income tax on the $40,000 saving them $6,000 in fed taxes.

“Filling The Bracket”

The strategy that I just described is called “filling the bracket”. We find ways to reduce an individuals taxable income in the year that long term capital gains are realized to “fill up” as much of that 0% long-term capital gains tax rate that we can before it spills over into the 15% long-term capital gains rate.

More good news, it’s not an “all or none” calculation. If you are married, have $60,000 in taxable income, and $100,000 in long term capital gains, a portion of your $100,000 in capital gains will be taxed at the 0% rate with the majority taxed at the 15% tax rate. As you might have guessed the IRS is not going to let you get away with paying 0% on a $100,000 in long term capital gains because you maneuvered your taxable income into the 0% cap gain range. But in this case, $36,700 would be taxed at the 0% long term cap gain rate, and the reminder would be taxed at the 15% long term cap gain rate.

Do Capital Gains Bump Your Ordinary Income Into A Higher Bracket?

When explaining this “filling up the bracket” strategy to clients, the most common question I get is: “If long term capital gains count as taxable income, does that push my ordinary income into a higher tax bracket?” The answer is “no”. In the eyes of the IRS, capital gains income is determined to be earned “after” all of your other income sources.

In an extreme example, let’s say you have $70,000 in ordinary income and $200,000 in capital gains. If your total ordinary income was $70,000 and you file a joint tax return, your top fed tax bracket in 2025 would be 12%. However, if the IRS decided to look at the $200,000 in capital gain income first and then put your ordinary income on top of that, your top federal tax bracket would now be 24%. That would hurt tax wise. Luckily, it does not work that way. Even if you realized $1M in long term capital gains, the $70,000 in ordinary income would be taxed at the same lower tax brackets since it was earned first in the eyes of the IRS.

Work With Your Accountant

Before I get into the more advanced strategies for how this filling up the brackets strategy is used, I cannot stress enough the importance of working with your tax advisor when executing these more complex tax strategies. The tax system is complex and making a shift in one area could hurt you in another area.

Even though these strategies may lower the federal tax rate on your long-term capital gain income, capital gains will increase your AGI (adjusted gross income) for the year which could phase you out of certain deductions, tax credits, increase your Medicare premiums, reduce college financial aid, etc. Your accountant should be able to run tax projections for you in their software to play with the numbers to determine the ideal amount of long-term capital gains that can be realized in a given year without hurting the other aspects of your financial picture.

Strategy #1: I’m Retiring

When people retire, in many cases, their taxable income drops because they no longer have their paycheck and they are typically supplementing their income with social security and distributions from their investment accounts. This creates a tax planning opportunity because these taxpayers sometimes find themselves in the lowest tax bracket that they have been in over the past 30+ years. Here are some of the common examples.

Example 1: The First Year Of Retirement

If you retire at the beginning of the calendar year, you may only have had a few months of paychecks, so your income may be lower in that year. If you have built up cash in your savings account or if you have an after tax investment account that you can use to supplement your income for the remainder of the year to meet your expenses, this may create the opportunity to “fill up the bracket” and realize some long-term capital gains at a 0% federal tax rate in that year.

Example 2: Lower Expenses In Retirement

We have had clients that were making $150,000 per year and then when they retire they only need $40,000 per year to live off of. When you retire, the kids are typically through college, the mortgage is paid off, and your expenses drop so you need less income to supplement those expenses. A portion of your social security will most likely be counted as taxable income but if you do not have a pension, you may have some wiggle room to realize a portion of your long-term capital gains as a 0% rate each year.

Assume this is a single filer. Here is how the numbers would work:

Social Security & IRA Taxable Income: $40,000

Less Standard Deduction: ($15,000)

Total Taxable Income: $28,000

This individual would be able to realize $20,350 in long term capital gains each year at the 0% fed tax because the threshold is $48,350 and they are only showing $28,000 in taxable income. Saving $3,053 in fed taxes.

Strategy #2: Business Owner Experiences A Low Income Year

If you have been running a business for 5+ years, you have probably been through those one or two tough years where either revenue drops dramatically or the business incurs a lot of expenses in a single year, lowering your net profits. Do not let these low taxable income years go to waste. If you typically make $250,000+ per year and you have one of these low income years, start planning as soon as possible because once you cross that December 31st threshold, you have wasted a tax planning opportunity. If you are showing no income for that year, you may want to talk to your accountant about realizing some long term capital gains in your brokerage account to realize those gains at a 0% tax rate. Or you may want to consider processing a Roth conversion in that low tax year. There are a number of tax strategies that will allow you to make the most of that “bad year” income wise.

Strategy #3: Leverage Cash Reserves and Brokerage Accounts

If you have been building up cash reserves or you have a brokerage account that you could sell some holdings without incurring big taxable gains, you may be able to use that as your income source for the year which could result in little to no taxable income showing for that tax year. We have seen both retirees and business owners use this strategy.

Business owners have control over when expenses will be realized which influences how much taxable income is being passed through to the business owner. If you can overload expenses into a single tax year instead of splitting it evenly between two separate tax years, that could create some tax planning opportunities.

Strategy #4: Moving To Another State

It’s common for individuals to move to more tax friendly states in retirement. If you live in a state now, like New York, that makes you pay tax on long term capital gain income, and you plan to move to Florida next year and change your state of domicile, you may want to wait to realize your capital gains until you are resident of Florida to avoid having to pay state tax on that income. This has nothing to do with the 0% Fed tax strategy but it might reduce your state income tax bill on those capital gains.

Bottom Line

There are few strategies that allow you to pay 0% in federal taxes on any type of gain. If you are a high income earner, this strategy may not work for you every year but there may be opportunities to use them at some point if income drops or when you enter the retirement years. Again, don’t let those lower income years go to waste. Work with your accountant and determine if “filling the bracket” is the right move for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the difference between short-term and long-term capital gains?

Short-term capital gains apply to investments held for less than one year and are taxed as ordinary income. Long-term capital gains apply to investments held for more than 12 months and receive preferential tax treatment at 0%, 15%, or 20% depending on your taxable income and filing status.

Who qualifies for the 0% long-term capital gains tax rate?

For 2025, single filers with taxable income below $48,350 and married couples filing jointly with income below $96,700 may qualify for the 0% federal capital gains rate. Taxpayers within these thresholds can sell long-term investments and pay no federal tax on the gain.

Can higher-income taxpayers still benefit from the 0% capital gains rate?

Yes. By lowering taxable income through pre-tax 401(k) contributions, charitable deductions, or strategic timing of income, higher earners can “fill the bracket” and move some or all of their capital gains into the 0% range. This is often most effective during years of reduced income, such as early retirement or a slow business year.

What does it mean to ‘fill the bracket’?

Filling the bracket involves realizing just enough long-term capital gains to stay within the 0% or 15% tax thresholds. By managing income levels—through retirement contributions or expense timing—you can take advantage of lower tax rates on your gains without triggering higher brackets.

Do capital gains push your ordinary income into a higher tax bracket?

No. The IRS calculates tax on ordinary income first, and capital gains are layered on top. Your wages or other ordinary income remain taxed at their respective brackets, and capital gains receive their separate preferential rates.

When is the best time to realize long-term capital gains?

Years with lower taxable income—such as the first year of retirement, a down year in business profits, or after a move to a tax-friendly state—are ideal times to realize gains. These windows can allow you to sell appreciated assets while minimizing or eliminating capital gains taxes.

How can retirees use this strategy?

Retirees often find themselves in lower income brackets, especially before required minimum distributions begin. By realizing capital gains strategically during these years, they can capture gains at the 0% rate and reduce future tax exposure on their investments.

Should you consult a professional before implementing this strategy?

Yes. Realizing capital gains affects your adjusted gross income, which can impact Medicare premiums, financial aid, and eligibility for tax credits. A tax advisor can model your situation to determine the optimal amount of capital gains to realize without creating unintended consequences.

Don't Let Taxes Dictate Your Investment Decisions

Everyone hates to pay more in taxes. But this is something that has to be done. Sometimes taxes can often lead investors to make foolish investment decisions. The stock market bottomed in March 2009 and since then we have experienced the second-longest bull market rally of all time. This type of market environment typically creates a

Everyone hates to pay more in taxes. But this is something that has to be done. Sometimes taxes can often lead investors to make foolish investment decisions. The stock market bottomed in March 2009, and since then, we have experienced the second-longest bull market rally of all time. This type of market environment typically creates a stockpile of unrealized gains in the equity portion of your portfolio. When you go to sell one of your investment holdings that has appreciated in value over the past few years, there may be a big tax bill waiting for you. But when is it the right time to ignore the tax hit and execute the trade?

Do The Math

What sounds worse? Writing a check to the government for $10,000 in taxes or experiencing a 3% loss in your investment accounts? Most people would answer paying taxes. After all, who wants to write a check to the government for $10,000 after you have already paid your fair share of taxes throughout the year. It’s this exact situation that gets investors in a lot of trouble when the stock market turns or when that concentrated stock position takes a nosedive.

Before making this decision make sure you do the math. If you have $500,000 in your taxable investment account and the account value drops by 3%, your account just lost $15,000. It would have been better to sell the holding, pay the $10,000 in taxes, and you would still be ahead by $5,000. Before making the decision not to sell for tax reasons, make sure you run this calculation.

Gains Are Good

While most of us run from paying taxes like the plague, remember that gains are good. It means that you made money on the investment. At some point, you are going to have to pay tax on that gain unless you are purposefully waiting for the investment to lose value or if you plan to die with that holding in your estate.

If you put $100,000 in an aggressive investment a year ago and it’s now worth $200,000, if you sell it all today, you will have to pay long-term cap gains tax and possibly state tax on the $100,000 realized gain. However, remember that what goes up by 100% can also go down by 100%. To avoid the tax bill, you make the decision to just sit on the investment, and 3 months from now, the economy goes into a recession. The value of that investment drops to $125,000 and you sell it before things get worse. While you successfully decreased your tax liability, the tax hit would have been a lot better than saying goodbye to $75,000.

As financial planners, we are always looking for ways to reduce the tax bill for our clients, but sometimes paying taxes is unavoidable. The more you make, the more you pay in taxes. In most tax years, investors try to use investment losses to help offset some of the realized taxable gains. However, since most assets classes have appreciated in value over the last few years, investors may be challenges to find investment losses in their accounts.

Capital Gains Tax

A quick recap of capital gains tax rates. There are long-term and short-term capital gains. They apply to investments that are held in non-retirement account. IRA’s, 401(k), and 403(b) plans are all tax deferred vehicles so you do not have worry about realizing capital gains tax when you sell a holding within those types of accounts.

In a taxable brokerage account, if you buy an investment and sell it in less than 12 months, if it made money, you realize a short-term capital gain. Short-term gains do not receive preferential tax treatment. You pay tax at the ordinary income tax rates.

However, if you buy an investment and hold it for more than a year before selling it, the gain is taxed at the preferential long-term capital gain rates. At the federal level, there are three flat rates: 0%, 15%, and 20%. At the state level, it varies based on what state you live in. If you live in New York, where we are headquartered, long-term capital gains do not have preferential tax treatment for state income tax purposes. They are taxed as ordinary income. While other states like Alaska, Florida, and Texas assess no taxes at the state level on capital gains.

Here are the updated thresholds for 2025:

2025 Long-Term Capital Gains Tax Brackets:

Single Filers:

- 0%: $0 to $48,350

- 15%: $48,351 to $533,400

- 20%: Over $533,400

Married Filing Jointly:

- 0%: $0 to $96,700

- 15%: $96,701 to $600,050

- 20%: Over $600,050

Head of Household:

- 0%: $0 to $64,750

- 15%: $64,751 to $566,700

- 20%: Over $566,700

Long term cap gains rates

A special note for investors that fall in the 20% category, in addition to being taxed at the higher rate, there is also a 3.8% Medicare surtax that is tacked onto the 20% rate. So the top long-term capital gains rate for high-income earners is really 23.8%, not 20%.

Don't Forget About The Flat Rate

Investors forget that long-term capital gains are taxed, for the most part, at a flat rate. If your AGI is $200,000 and you are considering selling an investment that would cause you to incur a $100,000 long-term capital gain, it may not matter from a tax standpoint whether you sell it all this year or if you split the gain between two different tax years. You are still taxed at that flat 15% federal tax rate on the full amount of the gain, regardless of when you sell it. There are, of course, exceptions to this rule. Here is a list of some of the exceptions that you need to be aware of:

Your AGI limit for the year

The impact of the long-term capital gain on your AGI

College financial aid

Social security taxation

Health insurance through the exchange

First exception is the one-time income event that pushes your income dramatically higher for the year. This could be a big bonus, a good year for the company that you own, or you sell an investment property. In these cases you have to mindful of the federal capital gains tax thresholds. If it’s toward the end of the year and you are thinking about selling an investment that has a good size unrealized gain built up into it, it may be prudent to sell enough to keep yourself out of the top long-term capital gains bracket and then sell the rest in January when you enter the new tax year. That move could save you 8.8% in taxes on the realized gains. The 23.8% to tax rate minus the 15% median rate. If you are at the beginning or in the middle of a tax year trying to make this decision, the decision is more difficult. You will have to weigh the risk of the investment losing value before you flip into a new tax year versus paying a slightly higher tax rate on the gain.

To piggyback on the first exception, you have to remember that long-term capital gains increase your AGI. If you make $300,000 and you realize a $200,000 long-term capital gain on an investment, it’s going to bump you up into the highest federal long-term capital gains tax rate.

College financial aid can be a big exception. If you have a child in college or a child who will be going to college within the next two years, and you expect to receive some type of financial aid based on income, be very careful about when you realize capital gains in your investment portfolio. The parents’ investment income can count against a student’s financial aid package. Also, FASFA looks back two years for purposes of determining your financial aid package, so conducting this tax versus risk analysis requires some advanced planning.

For those receiving social security benefits, capital gains can impact how much of your social security benefit is subject to taxation.

For individuals that receive their health insurance through a state exchange platform (Obamacare) and qualify for income subsidies, the capital gains income could decrease the amount of the subsidy that you receive for that year. Be careful.

Don't Make This Mistake

Bottom line, nothing is ever simple. I wish I could say that in all instances, you should completely ignore the tax ramifications and make the right investment decision. In the real world, it’s about determining the balance between the two. It’s about doing the math to better under the tax hit versus the downside risk of continuing to hold a security to avoid paying taxes.

While the current economic expansion may still have further to go, we are probably closer to the end than we are to the beginning of the current economic expansion. When the expansion ends, investors are going to be tempted to hold onto certain investments within their portfolio longer than they should because they don’t want to take the tax hit. Don’t make this mistake. If you have a stock holding within your portfolio and it drops significantly in value, you may not have the time horizon needed to wait for that investment to bounce back. Or you may have the opportunity to preserve principal during the next market downturn and buy back that same investment at a lower level.

In general, it’s a good time for investors to revisit their investment portfolios from a risk standpoint. You may be faced with some difficult investment decisions within the next few years. Remember, selling an investment that has lost money is ten times easier than selling one of your “big winners”. Do the math, don’t get emotionally attached to any particular investment, and be prepared to make investment changes to your investment portfolios as we enter the later stages of this economic cycle.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.