Retirement Tax Traps and Penalties: 5 Gotchas That Catch People Off Guard

Even the most disciplined retirees can be caught off guard by hidden tax traps and penalties. Our analysis highlights five of the biggest “retirement gotchas” — including Social Security taxes, Medicare IRMAA surcharges, RMD penalties, the widow’s penalty, and state-level tax surprises. Learn how to anticipate these costs and plan smarter to preserve more of your retirement income.

Even the most disciplined savers can be blindsided in retirement by unexpected taxes, penalties, and benefit reductions that derail a carefully built plan. These “retirement gotchas” often appear subtle during your working years but can cost tens of thousands once you stop earning a paycheck.

Here are five of the biggest surprises retirees face—and how to avoid them before it’s too late.

1. The Tax Torpedo from Social Security

Many retirees are surprised to learn that Social Security isn’t always tax-free. Depending on your income, up to 85% of your benefit can be taxed.

The IRS uses something called “provisional income,” which includes half your Social Security benefit plus all other taxable income and tax-free municipal bond interest.

For individuals, taxes begin when provisional income exceeds $25,000.

For married couples, it starts at $32,000.

A well-intentioned IRA withdrawal or capital gain can push you over these thresholds—causing a sudden jump in taxes. Strategic Roth conversions and careful withdrawal sequencing can help smooth this out over time.

2. Higher Medicare Premiums (IRMAA)

The Income-Related Monthly Adjustment Amount (IRMAA) is one of the most overlooked retirement costs. Once your modified adjusted gross income (MAGI) exceeds certain limits, your Medicare Part B and D premiums increase—often by thousands of dollars per year.

For 2025, IRMAA surcharges begin when MAGI exceeds roughly $103,000 for single filers or $206,000 for married couples. The catch? Medicare looks back two years at your income. A Roth conversion, property sale, or large one-time distribution can unexpectedly trigger higher premiums two years later.

Proactive tax planning can prevent crossing these thresholds unintentionally.

3. Required Minimum Distributions (RMDs)

Once you reach age 73, the IRS requires you to start withdrawing from pre-tax retirement accounts each year—whether you need the money or not. These RMDs are taxed as ordinary income and can increase your tax bracket, raise Medicare premiums, and reduce your eligibility for certain deductions.

The biggest mistake is waiting until your 70s to plan for them. Roth conversions in your 60s can reduce future RMDs, and charitable giving through Qualified Charitable Distributions (QCDs) can offset the tax impact once they begin.

4. The Widow’s Penalty

When one spouse passes away, the surviving spouse’s tax brackets and standard deduction are cut in half—but income sources often don’t decrease proportionally. Social Security may drop by one benefit, but RMDs, pensions, and investment income remain largely the same.

The result is a higher effective tax rate for the survivor. This “widow’s penalty” can last for years, especially when combined with RMDs and Medicare surcharges. Couples can reduce the long-term impact through lifetime Roth conversions, strategic asset titling, and beneficiary planning.

5. State Taxes and Hidden Relocation Costs

Many retirees move to lower-tax states hoping to stretch their income, but state-level taxes can be tricky. Some states tax pension and IRA withdrawals, others tax Social Security, and a few impose taxes on out-of-state income or estates.

Additionally, higher property taxes, insurance premiums, and healthcare costs can offset income tax savings. A comprehensive cost-of-living comparison is essential before relocating.

Our analysis at Greenbush Financial Group often reveals that the “best” retirement state depends more on quality of life, healthcare access and total cost of living than on income tax rates alone.

How to Avoid These Retirement Surprises

Most retirement gotchas come down to timing and coordination—especially between taxes, Social Security, and healthcare. A few key steps can make a major difference:

Run retirement income projections that include taxes and IRMAA thresholds.

Consider partial Roth conversions before RMD age.

Sequence withdrawals intentionally between taxable, tax-deferred, and Roth accounts.

Evaluate the long-term impact of home state taxes before moving.

Review beneficiary and trust structures regularly.

The earlier you identify potential traps, the easier they are to fix while you still control your income and withdrawals.

The Bottom Line

Retirement is more complex than simply replacing a paycheck. The interplay between taxes, healthcare, and income sources can turn small decisions into costly mistakes. By spotting these gotchas early, you can preserve more of your wealth and enjoy a smoother, more predictable retirement.

Our advisors at Greenbush Financial Group can help you identify your biggest risk areas and design a plan to minimize the tax and income surprises most retirees never see coming.

FAQs: Retirement Planning Surprises

Q: Are Social Security benefits always taxed?

A: No. But depending on your income, up to 85% of your benefits may be taxable.

Q: How can I avoid higher Medicare premiums?

A: Manage your income below IRMAA thresholds through strategic Roth conversions and tax-efficient withdrawals.

Q: What happens if I miss an RMD?

A: You could face a 25% penalty on the amount not withdrawn, reduced to 10% if corrected quickly.

Q: Why do widows and widowers pay more in taxes?

A: Filing status changes from joint to single, cutting brackets and deductions in half while much of the income remains.

Q: Are all retirement states tax-friendly?

A: No. Some states tax retirement income or have higher overall costs despite no income tax.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Social Security Cost of Living Increase Only 2.8% for 2026

The Social Security Administration announced a 2.8% cost-of-living adjustment (COLA) for 2026, slightly higher than 2025’s 2.5% increase but still below the long-term average. This modest rise may not keep pace with the real cost of living, as retirees continue to face rising prices for essentials like food, utilities, and healthcare. Learn how this affects your benefits, why COLA timing matters, and strategies to help offset inflation in retirement.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

The Social Security Administration (SSA) has announced that the annual Cost-of-Living Adjustment (COLA) for 2026 will be 2.8%, up slightly from 2.5% in 2025, but still below the ten-year average of about 3.1%. While any increase in Social Security benefits is welcome news for retirees, many experts and retirees alike worry that this modest adjustment may not be enough to keep pace with rising living costs.

In this article, we’ll cover:

How the 2026 COLA compares to previous years

Why this year’s increase may not keep up with inflation

The lag retirees face when inflation heats up

Possible strategies to help offset higher costs

The 2026 COLA: Modest in Historical Context

While the 2.8% increase may seem like a fair bump, it’s actually on the lower end of recent COLA adjustments. Here’s a look at the last five years of Social Security COLAs:

As the table shows, retirees experienced significant boosts during the high-inflation years of 2022 and 2023, but those increases have tapered off as inflation cooled — at least according to official data. However, many households continue to feel that everyday prices for groceries, utilities, and especially healthcare haven’t truly come back down.

Why the 2026 COLA May Not Be Enough

Although the 2.8% COLA aims to help beneficiaries keep up with inflation, many retirees report that their actual cost of living has increased by well over 3%. Everyday expenses — particularly healthcare premiums, prescription drugs, and food — have outpaced average inflation in recent years.

For retirees living on a fixed income, this can feel like a slow squeeze. Even small differences between the COLA and real inflation can add up to a meaningful loss in purchasing power over time.

The Timing Problem: If Inflation Heats Up, Help May Be a Year Away

One major challenge with the COLA system is timing. Adjustments are made once per year, based on inflation readings from the third quarter of the previous year.

That means if inflation begins to surge again in mid-2026 — say, to 4% or higher — retirees won’t see an increase in their Social Security benefits until January 2027. By then, a full year of higher prices could have eroded much of their financial cushion.

For retirees already struggling to cover basic costs, that lag can create a serious hardship.

What Can Retirees Do?

If the COLA isn’t keeping up with rising expenses, retirees may need to take proactive steps to protect their financial well-being. A few options to consider:

Reevaluate annual spending. Look for non-essential expenses that can be trimmed or delayed.

Explore part-time or flexible income. Even modest earnings can help bridge the gap during higher-inflation periods.

Lean on family support if necessary. Having an honest discussion about temporary help from family members can make a meaningful difference.

Revisit your financial plan. This is a good time to review your withdrawal strategy, investment income, and emergency savings to make sure your plan can weather inflation surprises.

The Importance of Adjusting Retirement Projections for Inflation

When planning for retirement, it’s critical to adjust annual expenses for inflation in your projections. Even modest inflation can dramatically change your future spending needs.

Let’s look at an example:

A 65-year-old retiree today has annual living expenses of $60,000.

If inflation averages 3% per year, by age 75, those same expenses would grow to roughly $80,600.

That’s over $20,000 more per year — just to maintain the same standard of living.

Failing to account for inflation in your retirement projections can lead to underestimating how much income you’ll truly need down the road. Whether you’re living off investment withdrawals, pensions, or Social Security, it’s essential to plan for rising costs and ensure your income sources can keep pace.

Final Thoughts

Now more than ever, staying proactive about budgeting, income planning, and inflation protection strategies is essential. Social Security was never meant to cover all retirement expenses — and in today’s environment, it’s important to ensure your broader financial plan can pick up where the COLA falls short.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQ)

How much will Social Security benefits increase in 2026?

The Social Security Administration announced a 2.8% Cost-of-Living Adjustment (COLA) for 2026, a modest rise from 2.5% in 2025. This increase remains below the ten-year average of roughly 3.1%.

Why is the 2026 COLA increase considered modest?

While the 2.8% adjustment helps offset inflation, it’s smaller than the larger increases retirees saw in 2022 and 2023 during periods of high inflation. Many retirees feel everyday costs, especially for healthcare and essentials, continue to rise faster than official inflation measures suggest.

How does the timing of COLA adjustments affect retirees?

COLA calculations are based on inflation data from the third quarter of the previous year, meaning there’s often a delay in responding to rising prices. If inflation increases during 2026, beneficiaries won’t see higher payments until 2027, leaving a potential gap between expenses and income.

What can retirees do if their Social Security increase isn’t keeping up with inflation?

Retirees can review spending habits, trim non-essential costs, explore part-time income opportunities, and update financial plans to better manage inflation risks. Maintaining flexibility and preparing for price changes can help preserve purchasing power.

How can inflation impact long-term retirement planning?

Even moderate inflation significantly raises living costs over time. For example, a retiree spending $60,000 annually could need over $80,000 within ten years if inflation averages 3%, underscoring the importance of including inflation adjustments in retirement projections.

Why is it important to revisit a financial plan regularly during retirement?

Regularly reviewing your financial plan helps ensure that income sources, such as investments or pensions, continue to meet rising expenses. Adjusting for inflation, healthcare costs, and market changes can help retirees maintain their desired standard of living.

Advantages of Using A Bond Ladder Instead of ETFs or Mutual Funds

Bond ladders can provide investors with predictable income, interest rate protection, and more control compared to bond ETFs or mutual funds. Greenbush Financial Group breaks down how they work, the different ladder strategies, and why some investors prefer this approach.

By Michael Ruger, CFP®

Partner and Chief Investment Officer at Greenbush Financial Group

When it comes to investing, one of the biggest challenges is dealing with interest rate uncertainty. Rates go up, rates go down, and bond prices fluctuate with those changes. For investors who want predictable income and a way to smooth out the risks of rising and falling interest rates, a bond ladder can be a powerful strategy.

In this article, we’ll walk through:

What a bond ladder is and how it works

How a bond ladder helps hedge against interest rate fluctuations

The different types of bond ladders (equal-weighted, barbell, middle-loaded)

Why some investors prefer an individual bond ladder over bond mutual funds or ETFs

What Is a Bond Ladder?

A bond ladder is a portfolio of individual bonds with staggered maturity dates. For example, you might buy bonds maturing in 1 year, 2 years, 3 years, 4 years, and 5 years. When the 1-year bond matures, you reinvest the proceeds into a new 5-year bond, keeping the “ladder” in place.

This structure offers two key benefits:

Hedging Interest Rate Risk: Since a portion of your ladder matures every year (or at regular intervals), you always have an opportunity to reinvest at the prevailing interest rate—whether rates go up or down.

Consistent Income and Liquidity: The maturing bonds provide cash flow that can be reinvested or used for spending needs.

In short, a bond ladder helps smooth out the effects of interest rate fluctuations while still generating steady income.

Types of Bond Ladders and How They Work

There isn’t just one way to build a bond ladder. The structure you choose depends on your investment goals, risk tolerance, and views on interest rates. Here are three common approaches:

1. Equal-Weighted Bond Ladder

How it works: Bonds are spread evenly across maturity dates (e.g., equal amounts in 1, 2, 3, 4, and 5-year maturities).

Why use it: This is the most straightforward approach. It balances risk and return by spreading exposure across time horizons, making it a good fit for investors who want predictability.

2. Barbell Strategy

How it works: Bonds are concentrated at the short and long ends of the maturity spectrum, with little or nothing in the middle. For example, you might own 1-year and 10-year bonds, but nothing in between.

Why use it: Short-term bonds provide liquidity and flexibility, while long-term bonds lock in higher yields. This strategy can be appealing when you expect interest rates to change significantly in the future.

3. Middle-Loaded Ladder

How it works: Bonds are concentrated in intermediate maturities (e.g., 3–7 years).

Why use it: Provides a balance between short-term reinvestment risk and long-term interest rate exposure. This can be attractive if you think the current yield curve makes mid-range maturities the “sweet spot” for returns.

Bond ladders can also vary by duration. Some investors create 5-year ladders, 10-year ladders, or 20-year ladders.

Why Build a Bond Ladder Instead of Using a Mutual Fund or ETF?

You might wonder: why not just buy a bond fund and let the professionals handle it? There are several reasons why individual investors prefer building their own bond ladders:

Predictable Cash Flow: With a ladder, you know exactly when each bond will mature and what it will pay. Bond funds and ETFs fluctuate daily, and there are no set maturity dates.

Control Over Holdings: You decide the maturity schedule, the credit quality, and the exact bonds in your ladder. In a fund, you’re subject to the manager’s decisions.

Reduced Interest Rate Risk: In a bond ladder, if you hold bonds to maturity, you get your principal back regardless of market fluctuations. Bond funds never truly “mature,” so you’re always exposed to price swings.

Potentially Lower Costs: By buying individual bonds and holding them, you avoid ongoing expense ratios charged by mutual funds and ETFs.

In short, a bond ladder offers clarity, predictability, and control that pooled investment vehicles can’t always match.

Why You Need Significant Capital for a Bond Ladder

While bond ladders offer many advantages, they aren’t practical for every investor. Building a well-diversified ladder requires a substantial amount of money for a few reasons:

Minimum Purchase Amounts: Many individual bonds trade in $1,000 or $5,000 increments. To build a ladder with multiple rungs across different maturities, you need enough capital to meet those minimums. When investing in short-term U.S. treasuries, sometimes the purchase minimum is $250,000.

Diversification Needs: A proper ladder spreads risk across multiple issuers and maturities. Doing this with small amounts of money is difficult, leaving you concentrated in just a few bonds.

Transaction Costs: Buying and selling individual bonds often involves markups or commissions, which can eat into returns if the investment amount is too small.

Income Needs: If you’re using the ladder to generate income, small investments may not produce meaningful cash flow compared to what’s achievable with funds or ETFs.

For these reasons, investors with smaller portfolios often turn to bond mutual funds or ETFs. These vehicles pool money from many investors, allowing even modest contributions to achieve diversification, professional management, and steady income without the large upfront commitment required by a ladder

Final Thoughts

A bond ladder can be an excellent strategy for investors looking to hedge interest rate risk, generate predictable income, and maintain flexibility. Whether you choose an equal-weighted ladder for balance, a barbell strategy for flexibility and yield, or a middle-loaded approach to target the sweet spot of the curve, the right structure depends on your unique goals.

And while bond mutual funds and ETFs may be convenient, an individual bond ladder provides unmatched control, transparency, and reliability.

If you’re considering adding a bond ladder to your portfolio, the key is aligning it with your financial objectives, income needs, and risk tolerance. Done correctly, it’s a time-tested way to bring stability and consistency to your investment plan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs)

What is a bond ladder and how does it work?

A bond ladder is a portfolio of individual bonds with staggered maturity dates, such as 1-, 2-, 3-, 4-, and 5-year terms. As each bond matures, the proceeds are reinvested into a new long-term bond, creating a cycle that provides steady income and helps manage interest rate risk.

How does a bond ladder help protect against interest rate changes?

Because bonds mature at regular intervals, you continually reinvest at current market rates. This means when interest rates rise, maturing bonds can be rolled into higher-yielding ones; when rates fall, the longer-term bonds in the ladder continue to earn higher fixed rates.

What are the different types of bond ladders?

Common structures include equal-weighted ladders (evenly spread maturities), barbell strategies (short- and long-term maturities), and middle-loaded ladders (focused on intermediate terms). Each structure balances risk, return, and flexibility differently.

Why might investors choose a bond ladder over a bond mutual fund or ETF?

An individual bond ladder offers predictable maturity dates, control over holdings, and stable cash flow if bonds are held to maturity. In contrast, bond funds and ETFs fluctuate in value and have no set maturity, which can expose investors to ongoing price volatility.

Who is a bond ladder best suited for?

Bond ladders typically work best for investors with larger portfolios who want predictable income and can meet minimum bond purchase requirements. Smaller investors may prefer bond funds or ETFs for diversification and lower entry costs. We advise consulting with your personal investment advisor.

What are the key advantages of using a bond ladder in a portfolio?

A bond ladder provides consistent income, reduces interest rate risk, and enhances liquidity through regular maturities. It also allows investors to match cash flow needs with future expenses while maintaining control over credit quality and investment duration.

What is the Value of My Pension?

In our latest article, we break down how to calculate the present value of your pension—a powerful way to compare your pension to your other retirement assets and make better long-term decisions.

Whether you’re 5 years from retirement or already collecting, this article will help you see your pension in a new light.

For many Americans approaching retirement, a pension represents one of the most valuable pieces of their financial picture. But while pensions may promise reliable income in the future, they can be hard to evaluate in present terms—especially if you’re trying to compare your pension to a 401(k), IRA, or a lump-sum offer from your employer. That’s where calculating the present value of your pension becomes useful.

In this article, we’ll break down what present value means, how to calculate it, and why it’s essential for retirement planning.

What Is Present Value and Why Does It Matter?

The present value (PV) of your pension tells you how much the future stream of income payments is worth in today’s dollars. It answers this question:

“If I had to replace my pension with a lump sum today, how much money would I need?”

This is especially important when:

You're offered a lump-sum payout option instead of monthly payments

You're comparing your pension to your other investments

You're trying to understand your net worth or financial independence readiness

Step 1: Gather the Details of Your Pension

To begin, you’ll need the following information, which you should be able to request from your employer or pension administrator:

Annual or monthly payment amount

Start date of pension payouts

Expected length of payments (based on life expectancy or plan rules)

Discount rate (assumed rate of return—typically between 4%–6%)

Let’s look at an example:

You’re eligible to receive $30,000 per year

Payments start at age 65

You expect payments to last for 20 years (Age 85 Life Expectancy)

You use a 5% discount rate

Step 2: Use the Present Value of an Annuity Formula

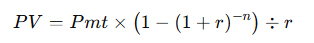

Most pensions pay a fixed amount each year. This makes them resemble a type of annuity. To calculate the present value of that annuity, use the formula:

Where:

PV = present value

Pmt = annual pension payment

r = discount rate (as a decimal)

n = number of years of payment

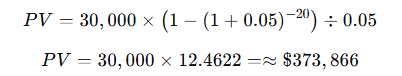

In our example:

So the present value of this pension is about $373,866.

Step 3: Adjust for the Time Until Retirement

If you're not retiring immediately, you’ll need to discount the result back to today’s dollars.

Let’s say you're 55 now, and payments begin at 65. That’s a 10-year delay. The formula becomes:

This means the value of your pension—in today’s dollars—is roughly $229,625.

How Should You Choose a Discount Rate?

The discount rate reflects your assumed rate of return if you invested that money yourself. When we create financial plans for individuals, we typically assume a rate of return of 6-7% before retirement and 4% in retirement for investments. Unlike a 401(k) or other investment account where the account owner assumes the investment risk, a pension is more of a “promise to pay” and the investment risk is assumed by the organization paying the benefit. When estimating the present value of a pension, we typically recommend using a more conservative rate of 4-5%. If you believe your rate of return would be higher if you invested the money yourself, that would increase the discount rate used in the calculation above and reduce the estimated present value of your pension.

Other Factors to Consider

Cost of Living Adjustments (COLAs)

If your pension increases each year to keep up with inflation, it’s worth more than a flat pension and requires a different calculation.Joint Life Payouts

If your pension pays for your spouse’s lifetime too, you’ll need to factor in their life expectancy as well.Taxes

Pension payments are typically taxed as ordinary income. This doesn’t change the present value math, but it matters when comparing to Roth accounts or after-tax investments.

When Calculating Present Value Can Help

Here’s when you might want to calculate your pension’s present value:

Deciding between a monthly pension or lump sum

Coordinating pension income with Social Security and investment withdrawals

Evaluating your retirement readiness

Planning how to split retirement assets in a divorce

It gives you a common-dollar framework for comparison—turning an income stream into a lump sum you can benchmark and plan around.

Final Thoughts

Your pension may be one of the most stable sources of income in retirement, but stability doesn’t always equal clarity. By calculating its present value, you equip yourself with a concrete number you can use in your overall retirement strategy. Whether you’re weighing a lump sum, planning for early retirement, or just seeking a clearer financial picture, this number helps turn your pension into a more actionable asset.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Should Your Investment Strategy Change when You Retire

Should your investment strategy change when you retire? Most people don’t realize how much the answer impacts taxes, income, and long-term security. Retirement isn’t the end of your financial planning—it’s the start of a new phase. Your goals shift from growth to income, and your investment strategy should evolve with them.

Retirement marks a major shift in your financial life: you move from saving and accumulating wealth to spending it. But does that mean your investment strategy should change the moment you stop working?

The answer isn’t a simple yes or no—it depends on your goals, income needs, and risk tolerance. Let’s explore what changes may be necessary, what can stay the same, and how to align your investment approach with the realities of retirement.

1. Accumulation vs. Distribution: A New Financial Phase

During your working years, your investment strategy likely focused on growth—maximizing returns over the long term. For most, in retirement, the focus shifts to income and moderate growth. Your portfolio now needs to:

Support monthly withdrawals

Last for 20–30+ years

Withstand market volatility without derailing your lifestyle

This shift doesn't mean abandoning growth altogether, but it does mean adjusting how you balance risk and reward.

2. Reassess Your Asset Allocation

One of the first things to review in retirement is your asset allocation—how your investments are divided among stocks, bonds, and cash.

A typical pre-retirement portfolio may be 70–100% in equities. But in retirement, many advisors recommend dialing that back to reduce risk.

Example:

If you have a $1 million portfolio:

A 60/40 allocation would mean $600,000 in diversified stock funds and $400,000 in bonds or other fixed-income assets.

A 40/60 allocation might suit someone who is more risk-averse or heavily reliant on portfolio withdrawals.

Mistake Alert:

Some retirees swing too far into conservative territory. While that may feel safe, inflation can quietly erode your purchasing power—especially over a 25- to 30-year retirement.

3. Add an Income Strategy

Now that you’re drawing from your investments, it’s essential to have a plan for generating reliable income and decreasing the level of volatility with your portfolio. This may include:

Dividend-paying stocks or ETFs

Bond holdings or short-term fixed income

The goal is to create stable cash flow while giving your growth assets time to recover from market dips.

4. Be Strategic With Withdrawals

Your withdrawal strategy has a major impact on taxes and portfolio longevity. The order you pull from different account types matters.

Example:

Let’s say you need $80,000/year from your portfolio. You might:

Take $40,000 from a taxable account (capital gains taxed at lower rates)

Pull $20,000 from a Traditional IRA (fully taxable as income)

Social Security $20,000 (up to 85% taxable)

This balanced approach spreads the tax burden, avoids pushing you into a higher bracket, and gives your Roth assets (if you have them) more time to grow.

Common Misstep:

Many retirees default to depleting all of their after-tax assets first, but by not taking withdrawals from their tax-deferred accounts, like Traditional IRAs and 401(k) accounts, they potentially miss out on realizing those taxable distributions at very low tax rates. Having a withdrawal plan that coordinates your social security, Medicare premiums, after-tax accounts, pre-tax accounts, and Roth accounts is key.

5. Stay Diversified—Reduce Volatility In Portfolio

Diversification and reducing volatility are key considerations when entering retirement years. When you take withdrawals from your retirement accounts, the investment returns can vary significantly from those of the accumulation years. Why is that?

When you were working and contributing to your retirement accounts, and the economy hit a recession, since you were not withdrawing any money from your accounts when the market rebounded, you likely regained those losses fairly quickly. But in retirement, when you are taking distributions from the account as the market is moving lower, there is less money in the account when the market begins to rally. As such, your rate of return is more significantly impacted by market volatility when you enter distribution mode.

To reduce volatility in your portfolio, you may need to:

Increase your level of diversification across various asset classes

Keep a large cash reserve on hand to avoid selling stocks in a downturn

Be more proactive about adjusting your investment allocation in response to changing market conditions

6. Don’t Forget About Growth

Retirement could last 30 years or more. That means your portfolio needs to outpace inflation, especially with rising healthcare and long-term care costs.

Even if you’re taking distributions, keeping 30–60% in equities may help ensure your money grows enough to support you in later decades.

Final Thoughts: Don’t “Set It and Forget It”

Your investment strategy should evolve with you. Retirement isn’t a one-time financial event—it’s a new chapter that requires ongoing planning and regular reviews.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Should your investment strategy change when you retire?

While the focus shifts from accumulation to income and preservation, your investment approach should evolve based on your goals, risk tolerance, and income needs. Many retirees move toward a more balanced portfolio that supports sustainable withdrawals while still allowing for growth.

What’s the difference between the accumulation and distribution phases?

During the accumulation phase (your working years), the goal is to grow wealth through regular contributions and long-term compounding. In the distribution phase (retirement), you rely on your savings for income, so the emphasis shifts to generating steady cash flow and managing risk.

How should retirees adjust their asset allocation?

Many retirees move from aggressive stock-heavy portfolios to more balanced allocations—like 60/40 (stocks/bonds) or 40/60—depending on their comfort with risk. However, being too conservative can expose you to inflation risk, which can erode purchasing power over time.

How can you generate income from your investments in retirement?

Common income strategies include using dividend-paying stocks, bonds, or fixed-income funds to provide a steady cash flow. A well-structured income plan helps cover expenses while allowing growth-oriented investments to recover from market downturns.

What’s the best order to withdraw funds from retirement accounts?

Strategic withdrawals can help minimize taxes and extend portfolio longevity. The right order depends on your income, Social Security, and Medicare situation.

Why is diversification so important in retirement?

Diversification can reduce portfolio volatility—critical during retirement, when you’re withdrawing funds. Selling assets during a market downturn can permanently harm portfolio growth. Diversifying across asset classes and maintaining a cash buffer may help reduce the impact of market volatility.

Should retirees still invest in stocks?

In most cases, yes. Even in retirement, equities are important for long-term growth and inflation protection. With retirees living longer, it’s not uncommon for retirees to maintain investment accounts for 15+ years into retirement.

How often should retirees review their investment strategy?

At least once a year—or after major life or market changes. Retirement isn’t static, and your investment strategy should adjust to reflect evolving income needs, health costs, tax law updates, and market conditions.

What’s the most common mistake retirees make?

Becoming too conservative too soon. Avoiding market exposure entirely can limit growth and increase the risk of outliving your savings. A balanced approach that manages volatility while maintaining some growth potential is ideal in most situations.

Understanding the Order of Withdrawals In Retirement

The order in which you withdraw money in retirement can make a huge difference in how long your savings last—and how much tax you pay. In this article, we break down a smart withdrawal strategy to help retirees and pre-retirees keep more of their hard-earned money.

When entering retirement, one of the most important financial questions you’ll face is: What’s the smartest order to pull funds from my various retirement accounts? Getting this order wrong can lead to unnecessary taxes, reduced portfolio longevity, and even higher Medicare premiums.

While there’s no universal rule that fits everyone, there are strategic guidelines that can help most retirees withdraw more efficiently and keep more of what they’ve saved.

1. Use Tax-Deferred Accounts (Traditional IRA / 401(k))

For clients who have both after-tax brokerage accounts or cash reserves as well as pre-tax retirement accounts, they are often surprised to find out that there are large tax advantages to taking distributions from pre-tax retirement accounts in the early years of retirement. Since all Traditional IRA and 401(k) distributions are taxed, retirees unknowingly will fully deplete their after-tax sources before turning to their pre-tax retirement accounts.

I’ll explain why this is a mistake.

When most individuals retire, their paychecks stop, and they may, tax-wise, find themselves in low to medium tax brackets. Knowing they are in low to medium tax brackets, by not taking distributions from pre-tax retirement accounts, a retiree could be wasting those low-bracket years.

For example, Scott and Kelly just retired. Prior to retirement their combine income was $300,000. Scott and Kelly have a cash reserve of $100,000, an after tax brokerage account with $250,000, and Traditional IRA’s totaling $800,000. Since their only fixed income source in retirement is their social security benefits totaling $60,000, if they need an additional $20,000 per year to meet their annual expenses, it may make sense for them to withdrawal that money from their Traditional IRAs as opposed to their cash reserve or brokerage account.

Reason 1: For a married couple filing a joint tax return, the 12% Federal tax bracket caps out at $96,000, that is relatively low tax rate. If they need $20,000 after tax to meet their expenses, they could gross up their IRA distribution to cover the 12% Fed Tax and withdrawal $22,727 from their IRA’s and still be in the 12% Fed bracket.

Reason 2: If they don't take withdrawals from their pretax retirement accounts, those account balances will keep growing, and at age 75, Scott and Kelly will be required to take RMD’s from their pre-tax retirement account, and those RMDs could be very large pushing them into the 22% Fed tax bracket.

Reason 3: For states like New York that have state income tax, depending on the state you live in, they may provide an annual state tax exemption for a certain amount of distributions from pre-tax retirement accounts each year. In New York, the state does not tax the first $20,000 EACH YEAR withdrawn from pre-tax retirement accounts. By not taking distributions in their early years and retirement, a retiree may be wasting that annual $20,000 New York state exemption, making a larger portion of their IRA distribution subject to state tax in the future.

For client who have both pre-tax retirement accounts and after-tax brokerage accounts, it can sometimes be a blend of the two, depending on how much money they need to meet their expenses. It could be that the first $20,000 comes from their Traditional IRA to keep them in the low tax bracket, but the remainder comes from their brokerage account. It varies on a case-by-case basis.

2. After-Tax Brokerage Accounts and Cash Reserve (Brokerage)

For individuals who retire after age 59 ½, the distribution strategy usually involves a blend of pre-tax retirement account distributions and distributions from after-tax brokerage accounts. When selling holdings in a brokerage account to raise cash for distributions, retirees have to be selective as to which holdings they sell. Selling holdings that have appreciated significantly in value could trigger large capital gains, adding to their taxable income in the retirement years. But there are typically holdings that may either have minimal gains that could be sold with very little tax impact or holding that have long-term capital gains treatment taxed at a flat 15% federal rate. Since every dollar is taxed coming out of a pre-tax retirement account, having after-tax cash or a brokerage account can sometimes allow a retiree to pick their tax bracket from year to year.

There is often an exception for individuals that retire prior to age 59½ or in some cases prior to age 65. In these cases, taking withdrawals from after-tax sources may be the primary objective. For individual under the age of 59 1/2 , if distributions are taken from a Traditional IRA prior to age 59 1/2, the individual faced taxation and a 10% early withdrawal penalty.

Note: There are some exceptions for 401(k) distributions after age 55 but prior to age 59 1/2.

For individuals who retire prior to age 65 and do not have access to retiree health benefits, they frequently have to obtain their insurance coverage through the state exchange, which has income subsidies available. Meaning the less income an individual shows, the less they have to pay out of pocket for their health insurance coverage. Taking taxable distributions from pre-tax retirement accounts could potentially raise their income, forcing them to pay more for their health insurance coverage. If instead they take distributions from after-tax sources, they could potentially receive very good health insurance coverage for little to no cost.

3. Save Roth IRA Funds for Last

Roth IRAs grow tax-free and offer tax-free withdrawals in retirement. Because they don’t have RMDs and don’t increase your taxable income, Roth IRAs are ideal for later in retirement, or even as a legacy asset to pass on to heirs. To learn more about creating generational wealth with Roth Conversions, watch this video.

Keeping your Roth untouched early in retirement also gives you flexibility in higher-income years. Need to take a larger withdrawal to fund a home project or major expense? Roth distributions won’t impact your tax bracket or Medicare premiums.

4. Special Considerations

Health Savings Accounts (HSAs):

If you have a balance in an HSA, use it for qualified medical expenses tax-free. These can be especially valuable in later years as healthcare costs increase.

Social Security Timing:

Delaying Social Security can reduce taxable income in early retirement, opening the door for Roth conversions and other tax strategies.

Sequence of Return Risk:

Withdrawing from the wrong accounts during a market downturn can permanently damage your portfolio. Diversifying your income sources can reduce that risk.

5. Avoid These Common Withdrawal Mistakes

Triggering higher Medicare premiums (IRMAA): Large withdrawals can push your income over thresholds that increase Medicare Part B and D premiums.

Missing Roth Conversion Opportunities: Processing Roth conversions to take advantage of low tax brackets and reduce future RMDs.

Tapping after-tax accounts too early: Maintaining a balance in a brokerage account can provide more tax flexibility in future years, and when it comes to estate planning these asset receive a step-up in cost basis before passing to your beneficiaries.

Final Thoughts

The order you withdraw your funds in retirement can significantly affect your taxes, benefits, and long-term financial security. A smart strategy blends tax awareness, income needs, and market conditions.

Every retiree’s situation is unique and working with a financial planner who understands the coordination of retirement income can help you keep more of your wealth and make it last longer.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the best order to withdraw funds from retirement accounts?

The “best” withdrawal strategy truly varies from person to person. A common mistake retirees make is fully retiring and withdrawing money first from after-tax sources, then, once depleted, from pre-tax sources. Depending on the types of investment accounts someone has and their income needs, a blended approach can often be ideal.

Why might it make sense to take IRA withdrawals early in retirement?

Early retirement years often come with lower taxable income, allowing retirees to withdraw from pre-tax accounts at favorable tax rates. Doing so can reduce the size of future RMDs and help avoid being pushed into higher tax brackets later in life.

How do after-tax brokerage accounts fit into a retirement income strategy?

After-tax brokerage accounts offer flexibility since withdrawals are not fully taxable—only gains are. They can help retirees manage their tax brackets from year to year, especially when balancing withdrawals from pre-tax and Roth accounts.

When should retirees use Roth IRA funds?

Roth IRAs are typically best reserved for later in retirement because withdrawals are tax-free and don’t affect Medicare premiums or tax brackets. They also have no required minimum distributions, making them valuable for legacy or estate planning.

How can withdrawal timing affect Medicare premiums?

Large distributions from pre-tax accounts can raise your income and trigger higher Medicare Part B and D premiums through the Income-Related Monthly Adjustment Amount (IRMAA). Spreading withdrawals over multiple years or using Roth funds strategically can help avoid these surcharges.

What are common mistakes to avoid when withdrawing retirement funds?

Common pitfalls include depleting after-tax accounts too early, missing Roth conversion opportunities, or taking large taxable withdrawals that increase Medicare costs. Coordinating withdrawals with tax brackets and healthcare needs can help prevent these costly errors.

How does delaying Social Security affect retirement withdrawal strategy?

Delaying Social Security reduces taxable income in early retirement, which can open opportunities for Roth conversions or strategic IRA withdrawals. Once benefits begin, managing income sources carefully helps minimize taxes and maximize long-term income.