Do I Make Too Much To Qualify For Financial Aid?

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment.

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment. Anyway, I have heard the statement, "well they will just have to take loans" but what parents don't realize is loans are a form of financial aid. Loans are not a given. Whether your children plan to attend a public college or private college, both have formulas to determine how much a family is expected to pay out of pocket before you even reach any "financial aid" which includes loans.

College Costs Are Increasing By 6.5% Per Year

The rise in the cost of college has outpaced the inflation rate of most other household costs over the past three decades.

To put this in perspective, if you have a 3 year old child and the cost of tuition / room & board for a state school is currently $25,000 by the time that child turns 17, the cost for one year of tuition / room & board will be $60,372. Multiply that by 4 years for a bachelor's degree: $241,488. Ouch!!! Which leads you to the next question, how much of that $60,372 per year will I have to pay out of pocket?

FAFSA vs CSS Profile Form

Public schools and private school have a different calculation for how much “aid” you qualify for. Public or state schools go by the FAFSA standards. Private schools use the “CSS Profile” form. The FAFSA form is fairly straight forward and is applied universally for state colleges. However, private schools are not required to follow the FAFSA financial aid guidelines which is why they have the separate CSS Profile form. By comparison the CSS profile form requests more financial information.

For example, for couples that are divorced, the FAFSA form only takes into consideration the income and assets of the parent that the child lives with for more than six months out of the year. This excludes the income and assets of the parent that the child does not live with for the majority of the year which could have a positive impact on the financial aid calculation. However, the CSS profile form, for children with divorced parents, requests and takes into consideration the income and assets of both parents regardless of their marital status.

Expected Family Contribution

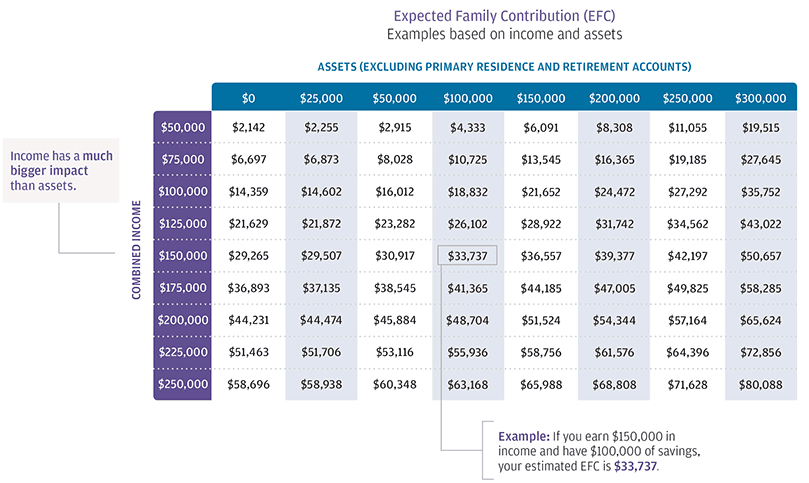

Both the FAFSA and CSS Profile form result in an "Expected Family Contribution" (EFC). That is the amount the family is expected to pay out of pocket for their child's college expense before the financial aid package begins. Below is a EFC award chart based on the following criteria:

FAFSA Criteria

2 Parent Household

1 Child Attending College

1 Child At Home

State of Residence: NY

Oldest Parent: 49 year old

As you can see in the chart, income has the largest impact on the amount of financial aid. If a married couple has $150,000 in AGI but has no assets, their EFC is already $29,265. For example, if tuition / room and board is $25,000 for SUNY Albany that means they would receive no financial aid.

Student Loans Are A Form Of Financial Aid

Most parents don't realize the federal student loans are considered "financial aid". While "grant" money is truly "free money" from the government to pay for college, federal loans make up about 32% of the financial aid packages for the 2016 – 2017 school year. See the chart below:

Start Planning Now

The cost of college is increasing and the amount of financial aid is declining. According to The College Board, between 2010 – 2016, federal financial aid declined by 25% while tuition and fees increased by 13% at four-year public colleges and 12% at private colleges. This unfortunate trend now requires parents to start running estimated EFC calculation when their children are still in elementary school so there is a plan for paying for the college costs not covered by financial aid.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Divorce: Make Sure You Address The College Savings Accounts

The most common types of college savings accounts are 529 accounts, UGMA, and UTMA accounts. When getting divorce it’s very important to understand who the actual owner is of these accounts and who has legal rights to access the money in those accounts. Not addressing these accounts in the divorce agreement can lead to dire consequences

The most common types of college savings accounts are 529 accounts, UGMA, and UTMA accounts. When getting divorce it’s very important to understand who the actual owner is of these accounts and who has legal rights to access the money in those accounts. Not addressing these accounts in the divorce agreement can lead to dire consequences for your children if your ex-spouse drains the college savings accounts for their own personal expenses.

UGMA or UTMA Accounts

The owner of these types of accounts is the child. However, since a child is a minor there is a custodian assigned to the account, typically a parent, that oversees the assets until the child reaches age 21. The custodian has control over when withdraws are made as long as it could be proven that the withdrawals being made a directly benefiting the child. This can include school clothes, buying them a car at age 16, or buying them a computer. It’s important to understand that withdraws can be made for purposes other than paying for college which might be what the account was intended for. You typically want to have your attorney include language in the divorce agreement that addresses what these account can and can not be used for. Once the child reaches the age of majority, age 21, the custodian is removed, and the child has full control over the account.

529 accounts

When it comes to divorce, pay close attention to 529 accounts. Unlike a UGMA or UTMA accounts that are required to be used for the benefit of the child, a 529 account does not have this requirement. The owner of the account has complete control over the 529 account even though the child is listed as the beneficiary. We have seen instances where a couple gets divorced and they wrongly assume that the 529 account owned by one of the spouses has to be used for college. As soon as the divorce is finalized, the ex-spouse that owns the account then drains the 529 account and uses the cash in the account to pay legal fees or other personal expenses. If the divorce agreement did not speak to the use of the 529 account, there’s very little you can do since it’s technically considered an asset of the parent.

Divorce agreements can address these college saving accounts in a number of way. For example, it could state that the full balance has to be used for college before out-of-pocket expenses are incurred by either parent. It could state a fixed dollar amount that has to be withdrawn out of the 529 account each year with any additional expenses being split between the parents. There is no single correct way to address the withdraw strategies for these college savings accounts. It is really dependent on the financial circumstances of you and your ex spouse and the plan for paying for college for your children.

With 529 accounts there is also the additional issue of “what if the child decides not to go to college?” The divorce agreement should address what happens to that 529 account. Is the account balance move to a younger sibling? Is the balance distributed to the child at a certain age? Or will the assets be distributed 50-50 between the two parents?

Is for these reason that you should make sure that your divorce agreement includes specific language that applies to the use of the college savings account for your children

For more information on college savings account, click on the hyperlink below:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

NY Free Tuition - Facts and Myths

On April 9th New York State became the first state to adopt a free tuition program for public schools. The program was named the “Excelsior Scholarship” and it will take effect the 2017 – 2018 school year. It has left people with a lot of unanswered questions

On April 9th New York State became the first state to adopt a free tuition program for public schools. The program was named the “Excelsior Scholarship” and it will take effect the 2017 – 2018 school year. It has left people with a lot of unanswered questions

Do I qualify?

How much does it cover?

What’s the catch?

Can I move my finances around to qualify for the program?

This article was written to help people better understand some of the facts and myths surrounding the NY Free Tuition Program.

Who qualifies for free tuition?

It’s based on the student’s household income and it phases in over a three year period:

2017: $100,000

2018: $110,000

2019: $125,000

MYTH #1: “If I reduce my household income in 2017 to get under the $100,000 threshold, it will help my child qualify for the free tuition program for the 2017 – 2018 school year.” WRONG. The income “determination year” is the same determination year that is used for FASFA filing. FASFA changed the rules in 2016 to look back two years instead of one for purposes of qualifying for financial aid. Those same rules will apply to the NY Free Tuition Program. So for the 2017 – 2018 school year, the $100,000 free tuition threshold will apply to your income in 2015.

MYTH #2: “If I make contributions to my retirement plan it will help reduce my household income to qualify for the free tuition program.” WRONG. Again, the free tuition program will use the same income calculation that is used in the FASFA process so it is not as simple as just looking at the bottom line of your tax return. For FASFA, any contributions that are made to retirement plans are ADDED back into your income for purposes of determining your income for that “determination year”. So making big contributions to a retirement plan will not help you qualify for free tuition.

What does it cover?

MYTH #3: “As long as my income is below the income threshold my kids (or I) will go to college for free.” DEFINE “FREE”. The Excelsior Scholarship covers JUST tuition. It does not cover books, room and board, transportation, or other costs associated with going to college. Annual tuition at a four-year SUNY college is currently $6,470. Here are the total fees obtained directly from the SUNY.edu website:

Tuition: $6,470 Covered

Student Fee: $1,640 Not Covered

Room & Board: $12,590 Not Covered

Books & Supplies: $1,340 Not Covered

Personal Expenses: $1,560 Not Covered

Transportation: $1,080 Not Covered

Total Costs $24,680

When you do the math for a student living on campus, the “Free” tuition program only covers 26% of the total cost of attending college.

What’s the catch?

There are actually a few:

CATCH #1: After the student graduates from college they have to LIVE and WORK in NYS for at least the number of years that the free tuition was awarded to the student OTHERWISE the “free tuition” turns into a LOAN that will be required to be paid back. Example: A student receives the free tuition for four years, works in New York for two years, and then moves to Massachusetts for a new job. That student will have to pay back two years of the free tuition.

CATCH #2: The student must maintain a specified GPA or higher otherwise the “free tuition” turns into a LOAN. However, the GPA threshold has yet to be released.

CATCH #3: It’s only for FULL TIME students earning at least 30 credit hours every academic year. This could be a challenge for students that have to work in order to put themselves through college.

CATCH #4: This is a “Last Dollar Program” meaning that students have to go through the FASFA process and apply for all other types of financial aid and grants that are available before the Free Tuition Program kicks in.

CATCH #5: The free tuition program is only available for two and four year degrees obtained within that two or four year period of time. If it take the student five years to obtain their four year bachelor’s degree, only four of the five years is covered under the free tuition program.

Summary

There are many common misunderstandings associated with the NYS Free Tuition Program. In general, it’s our view that this new program is only going to make college “more affordable” for a small sliver of students were not previously covered under the traditional FASFA based financial aid. Given the rising cost of college and the complexity of the financial aid process it has never been more important than it is now for individuals to work with a professional that have an in depth knowledge of the financial aid process and college savings strategies to help better prepare your household for the expenses associated with paying for college.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.