Russia & Ukraine: Where Does The Stock Market Go From Here?

Russia’s invasion of Ukraine continues to add uncertainty to global markets. It’s left investors asking the following questions:

Russia’s invasion of Ukraine continues to add uncertainty to global markets. It’s left investors asking the following questions:

What is the most likely outcome of the invasion?

How will this impact the U.S. stock market and global economy?

How high will oil prices go?

Should the U.S. be worried about a Russia cyberattack?

What is China’s role in this conflict?

Will the stock and bond market crash in Russia create a global liquidity event?

Does this change the Fed’s timeline for interest rate hikes?

Do we expect a relief rally or the market selloff to continue?

We will provide you with our answers to these questions in this market update.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Buying A Second House In Retirement

More and more retires are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

More and more retirees are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

Do you have enough retirement savings to maintain two houses in retirement?

Should you purchase the house before you officially retire or after?

Are you planning on paying for the house in cash or taking a mortgage?

If you are taking mortgage, where will the down payment come from?

Will you have the option to claim domicile in another state for tax purposes?

Should you setup a trust to own your real estate in retirement?

Adequate Retirement Savings

The most important question is do you have enough retirement income and assets to support the carrying cost of two houses in retirement? This requires you to run detailed retirement projection to determine what your total expense will be in retirement including the expenses associates with the second house, and the spending down of your assets over your life expectancy to make sure you do not run out of money. Here are some of the most common mistakes that we see retirees make:

They underestimated the impact of inflation. The ongoing costs associated with maintaining a house such as property taxes, utilities, association dues, maintenance, homeowners insurance, water bills, etc, tend to go up each year. While it may look like you can afford both houses now, if those expenses go up by 3% per year, will you have enough income and assets to pay those higher cost in the future?

They forget about taxes. If you will have to take larger distributions out of your pre-tax retirement accounts to maintain the second house, those larger distributions could push you into a higher tax bracket, cause your Medicare premiums to increase, lose property tax credits, or change the amount of your social security benefits that are taxable income.

A house is an illiquid asset. When you look at your total net worth, you have to be careful how much of your net worth is tied up in real estate. Remember, you are retired, you are no longer receiving a paycheck, if the economy hits a big recession, and your retirement accounts take a big hit, you may be forced to sell that second house when everyone else is also trying to sell their house. It could put you a in a difficult situation if you do not have adequate retirement assets outside of your real estate holdings.

Should You Purchase A Second House Before You Retire?

Many retirees wrestle with the decision as to whether to purchase their second house before they retire or after they have retired. There are two primary advantages to purchasing the second house prior to retirement:

If you plan on taking a mortgage to buy the second house, it is usually easier to get a mortgage while you are still working. Banks typically care more about your income than they do about your level of assets. We have seen clients retire, have over $2M in retirement assets, and have difficulties getting a mortgage, due to a lack of income.

There can be large expenses associated with acquiring a new piece of real estate. You move into your second house and you learn that it needs new appliances, a new roof, or you have to buy furniture to fill the house. We typically encourage our clients to get these big expenses out of the way before their paychecks stop in case they incur larger expenses than anticipated.

Mortgage or No Mortgage?

The decision of whether or not to take a mortgage on the second house is an important one. Sometimes it makes sense to take a mortgage and sometimes is doesn’t. Many retirees are hesitant to take a mortgage because they realize having a mortgage in retirement means higher annual expenses. While we generally encourage our client to reduce their debt by as much as possible leading up to retirement, there are situations where taking out a mortgage to buy that second house makes sense.

But it’s not for the reason that you may think. It’s not because you may be able to get a mortgage rate of 3% and keep your retirement assets invested with hopes of achieving a return of over 3%. While many retirees are willing to take on that risk, we remind our clients that you will be retired, therefore there is no more money going into your retirement accounts. If you are wrong and the value of your retirement accounts drop, now you have less in assets, no more contributions going in, and you have a new mortgage payment.

In certain situations, it makes sense to take a mortgage for tax purposes. If most of your retirement saving are in pre-tax sources like Traditional IRA’s or 401(k)’s, you withdrawal a large amount from those accounts in a single year to buy your second house, you may avoid having to take a mortgage, but it may also trigger a huge tax bill. For example, if you want to purchase a second house in Florida and the purchase price is $300,000. You take a distribution out of your traditional IRA to purchase the house in full, you will have federal and state income tax on the full $300,000, meaning if you are married filer you may have to withdrawal over $400,000 to get to the $300,000 that you need after tax to purchase the house.

If you are pre-tax heavy, it may be better to take out a mortgage, withdrawal just the down payment out of your IRA or preferably from an after tax source, and then you can make the mortgage payments with monthly withdrawals out of your IRA account. This spreads the tax liability of the house purchase over multiple years potentially keeping you out of those higher tax brackets.

But outside of optimizing a tax strategy, if you have adequate after-tax resources to purchase the second house in full, more times than not, we will encourage retirees to go that route because we are big fans of lowering your fixed expenses by as much as possible in retirement.

Planning For The Down Payment

If we meet with someone who plans to purchase a second house in retirement and we know they are going to have to take a mortgage, we have to start planning for the down payment on that house. Depending on what their retirement picture looks like we may:

Determine what amount of their cash reserves they could safely commit to the down payment

Reduce contributions to retirement accounts to accumulate more cash

If their tax situation allows, take distributions from certain types of accounts prior to retirement

Weigh the pros and cons of using equity in their primary residence for the down payment

If they have permanent life insurance policies, discuss pros and cons of taking a loan against the policy

Becoming A Resident of Another State

If you maintain two separate houses in different states, you may have the opportunity to have your retirement income taxed in the more tax favorable state. This topic could be an article all in itself, but it’s a tax strategy that should not be overlook because it can have a sizable impact on your retirement projections. If your primary residence is in New York, which is a very tax heavy state, and you buy a condo in Florida and you are splitting your time between the two houses in retirement, knowing what it requires to claim domicile in Florida could save you a lot of money in state taxes. To learn more about this I would recommend watching the following two videos that we created specifically on this topic:

Video 1: Will Moving From New York to Florida In Retirement Save You Taxes?

Video 2: How Do I Change My State Residency For Tax Purposes?

Should A Trust Own Your Second House

The final topic that we are going to cover are the pros and cons of a trust owning your house in retirement. For any house that you plan to own during the retirement years, it often makes sense to have the house owned by either a Revocable Trust or Irrevocable Trust. Trust are not just for the ultra wealthy. Trust have practical uses for everyday families just as protecting the house from the spend down process triggered by a long term care event or to avoid the house having to go through probate when you or your spouse pass away. Again, this is a relate topic but one that requires its own video to understand the difference between Revocable Trust and Irrevocable Trusts:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Can retirees afford to maintain two homes in retirement?

Owning two homes in retirement requires careful planning. Retirees should run detailed projections that include property taxes, insurance, utilities, maintenance, and inflation to ensure their income and assets can cover both homes without depleting savings too quickly.

Is it better to buy a second home before or after retiring?

Buying before retirement often makes financing easier since mortgage approvals are income-based. It also allows retirees to handle large, one-time expenses such as furnishing or repairs while they still have a paycheck.

Should retirees pay cash or take a mortgage for a second home?

If retirees have sufficient after-tax savings, paying cash can reduce fixed expenses in retirement. However, taking a mortgage may make sense for those with most assets in pre-tax accounts (like 401(k)s or IRAs) to spread out tax liability over multiple years instead of taking a large taxable withdrawal all at once.

How should retirees plan for a second-home down payment?

Planning options include using cash reserves, adjusting pre-retirement savings contributions, or tapping equity from the primary home. Retirees should also weigh the tax consequences of withdrawing funds from pre-tax accounts.

Can retirees change their state of residency for tax savings?

Yes. If you split time between homes in different states, you may be able to claim domicile in a state with no income tax, such as Florida. Each state has specific rules about residency, so maintaining documentation—like voter registration and driver’s license—helps prove intent to change domicile.

Should a trust own your second home in retirement?

Using a revocable or irrevocable trust can help avoid probate, protect assets from potential nursing home spend-down, and simplify estate transfers. The right structure depends on your goals—revocable trusts offer flexibility, while irrevocable trusts provide stronger asset protection.

What are the biggest financial risks of owning two homes in retirement?

The main risks include underestimated inflation, loss of liquidity during market downturns, increased annual expenses that outpace retirement income. and unexpected maintenance costs. Retirees should ensure they have sufficient liquid assets and diversified income sources before committing to two properties.

Should You Pay Down Debt or Invest Idle Cash?

When you have a large cash reserve, should you take that opportunity to pay down debt or should you invest it? The answer is “it depends”.

It depends on: ….

When you have a large cash reserve, should you take that opportunity to pay down debt or should you invest it? The answer is “it depends”. It depends on:

What is the interest rate on your debt?

What is the funding level of your emergency fund?

Do you have any big one-time expenses planned within the next 12 months?

What is the status of your financial goals? (college savings, retirement, house purchase)

How close are you to retirement?

What type of economic environment are you in?

Understanding the debt secret of the super wealthy

All too often, we see people make the mistake of investing money that they should be using to pay down debt, and this statement is coming from an investment advisor. In this article, I am going to walk you through the conversation that we have with our clients when trying to determine the best use of their idle cash.

What Is The Interest Rate On Your Debt?

Our first question is typically, what is the current interest rate on your debt? As you would expect, the higher the interest rate, the higher the payoff priority. As financial planners, we look at the interest rate on debt as a risk-free rate of return, similar to a return that you might receive on a bank CD or a money market account. If you have a credit card with a balance of $10,000 and the interest rate is 15%, you are paying that credit card company $1,500 in interest each year. If you use your $10,000 in idle cash to payoff you credit card balance, you get to keep that $1,500. We considered it a “risk-free” rate of return because you don’t have to take any risk to obtain it. By paying off the balance, you are guaranteed to not have to pay the credit card company that $1,500 in interest.

If instead you decided to invest that money, you would have to invest in something that earns over a 15% annual rate of return to be ahead of the game. To obtain a 15% rate of return is most likely going to involve taking a high level of risk, meaning you could lose some or all of your $10,000 investment so it’s not an apple to apple comparison because the risk level is different. I will bluntly ask clients: “can you get a bank CD right now that pays you 15%?” When they say “no way”, then I repeat the guidance to pay down the debt because every dollar that you pay toward the debt is receiving a 15% rate of return which you are not paying to the credit card company.

A Tough Decision

A 15% interest rate on debt makes the decision pretty easy but what happens when we are talking about a mortgage that carries a 3% interest rate. Clearly a more difficult decision. Someone who is 40 years old, that has 25 years until retirement might ask, “why would I use my cash to pay down the mortgage with a 3% interest rate when I could be earning 8% per year plus in the stock market over the next 25 years?” The answer can be found in the rest of the variables below.

Emergency Fund

When unexpected events happen in life, it is common for those unexpected events to cost money, which is why we encourage our clients to maintain an emergency fund. Maintaining an adequate cash reserve prevents these unexpected financial events from disrupting your plans for retirement, paying for college, from having to liquidate investments at an inopportune time in the market, or worse to go into debt to pay those expenses. While it is painful to see cash sitting there in a savings account earning minimal interest, it serves the purpose of insulting your overall financial plan from setbacks cause by unplanned events which in turn increases your probability of achieving your financial goals over the long term.

What is the right level of cash to fund an emergency fund? In most cases, we recommend 4 to 5 months of your living expenses. There is a balance between having adequate cash reserves and holding too much cash. There is an opportunity cost associated with holding too much cash. By holding cash earning less than 1% in interest, you may be giving up the opportunity to earn a higher return on that cash, whether that involves investing it or paying down debt with it.

Here is a common scenario, let’s say someone has $50,000 in cash in their savings account, and 4 months of living expenses is $30,000, that means there is $20,000 in excess cash that could be potentially earning a higher return than it sitting in their bank account. If they are willing to accept some risk, they may be willing to invest that $20,000 in an attempt to generate a higher return on that idle cash, or the cash may be used to fund a college savings account or retirement account which could carry tax benefits as well as advancing one or more of their personal financial goals.

But what if you don’t want to take any risk with that additional $20,000? If you have a mortgage with a 3% interest rate, by applying that $20,000 toward the mortgage, it is technically earning 3% because you are not paying that 3% interest to the bank. Since the interest rate on the mortgage is probably higher than the interest rate you are receiving in your savings account, that cash is working harder for you, and you have the added benefit of paying off your mortgage sooner.

Big One-Time Expenses

Once we have determined the appropriate funding level of a client’s emergency fund and there is excess cash over and above that amount, our next question is “do you have any larger one-time expenses that you foresee over the next 12 months?” For example, you may be planning a kitchen renovation, purchase of a house, or tuition payments for a child. If you will need that excess cash to meet expenses within the next 12 months, you may want to just hold onto the cash. If you use the cash to pay down debt, you won’t have the cash to meet those anticipated expenses in the future, or if you invest the cash, and the value of the investment drops, you may not have time to wait for the investment to recover the lost value before you need to liquidate the investment.

Typically, when we talk about investing, whether it’s in stocks, bonds, mutual funds, or some other type of security, it involves taking more risk than just sitting in cash. The shorter the timeline on the one-time expense, the more risk you take on by investing the cash. Historically, riskier asset classes like stocks behave in more consistent patterns over 10+ year time periods, but it’s impossible to predict how a specific stock or even a bond mutual fund will perform over a specific 3 month period.

Now, if interest rates ever get higher again, and you can find a 6 month or 1 year CD, or money market that pays a decent interest rate, then you may consider allocating some of that short term excess to work in a guaranteed security. Be careful of products liked fixed annuities, even through they may carry an attractive guaranteed interest rate, many annuities have surrender fees if you cash in the annuity prior to a specified number of years.

Status Of Your Various Financial Goals

Our next series of question revolves around assessing the status of a client’s various financial goals:

When do you plan to retire? Are your retirement savings adequate?

Do you have children that will be attending college? Have you started college savings accounts?

You just bought a house. Do you have an adequate amount of term life insurance?

Do you expect to be in a higher tax bracket this year? We may need to find ways to reduce your taxes.

Do you have estate documents in place like wills, health proxies, and a power of attorney?

What are your various financial goals over the next 10 years?

If we find that there is a shortfall in one of these areas, we may advise clients to use their excess cash to shore up a weakness in their overall financial picture. For example, if we meet with a client that has 3 children, ages 8, 5, and 3, and we ask them if they plan to help their children to pay for college, and they say “yes” but they have not yet determined how much financial aid they may receive, how much college is going to cost, and the best type of account to save money in to meet that goal, we will probably run projections for them, discuss how 529 accounts work, and potentially allocate some of their excess cash to fund those accounts.

How Close Are You To Retirement?

One factor that normally weighs heavily on our guidance as to whether someone should use excess cash to pay down debt or invest it is how close they are to retirement. Regardless of the market environment that we are in, we typically encourage our clients to reduce their fixed expenses as much as possible leading up to retirement. But when the stock market is going up by 10%+ and someone has $50,000 left on a mortgage with a 3% interest rate, they will ask me, why would I use my excess cash to pay down debt with a 3% interest rate when I’m earning a lot more keeping it invested in the market?

My response. I have been doing retirement projections for a very long time and when we do these projections, we are making assumptions about:

Annual rates of return on your investments

Inflation rates

Tax rates in the future

The fate of a broken social security system

How long you are going to live?

Probability of a long-term care event

These assumptions are estimated guesses based on historical data but who’s to say they are going to be right. In retirement you don’t have control over the stock market, inflation, or unexpected health events. The only thing you have full control over in retirement is how much you spend. The lower your annual expenses are, the more flexibility you will have within your plan, should one or more of the assumptions in your plan fall short of expectations. There will always be recessions but recessions are a lot more scary when you are retired and drawing money out of your retirement account, while at the same time your accounts may be losing value due to a drop in the stock or bond market. If you have lower expenses, it may allow you to reduce the distributions from your retirement accounts while you are waiting for the market to recover, which could greatly reduce the risk of running out of assets in retirement.

Type of Market Environment

While no one has a crystal ball, there are definitely market environments that we as investment advisors view as more risky than others. When economic data is providing us with mixed signals, there are geopolitical events unfolding that we have no way of predicting the outcome, or we are navigating through a challenging economic environment, it increases the risk level of investing excess cash in an effort to generate a return greater than the interest rate that someone may be paying on an outstanding debt. We definitely take that into account when advising clients whether to invest their cash or to use it to pay down debt.

The Debt Secret of The Super Wealthy

I have recognized a trend as it pertains to high net worth individual and how they invest, which is a concept that can be applied at any level of wealth. Having less debt, can provide individuals with the opportunity to take greater risk, which in turn can lead to a faster and greater accumulation of wealth.

If someone has no debt and they have $90,000 in cash to invest, because they have no debt, they may not need any of that cash to meet their future expense. Assuming they have a high tolerance for risk, they may choose to invest in 3 start-up companies, $30,000 each. Since investing in start-ups is known to be very risky, all three companies could go bankrupt. If 2 companies go bust, but the third company gets acquired by a public company that results in a 10x return on the investment, that $30,000 initial investment grows to $300,000, which subsidizes the losses from the other 2 companies, and still generates a giant return for the investor.

Someone with debt and corresponding higher fixed expenses to service the debt, may find it difficult and even unwise to enter into a similar investment strategy, because if they lose all or a portion of their $90,000 initial investment, it could upend their entire financial picture.

Just an additional note, investors that are successful with these higher risk strategies do not blindly throw money around at high risk investments. They do their homework but having no debt provides them with the opportunity to adopt investment strategies that may be out of reach of the average investor.

In summary, there are situation where it will make sense to invest idle cash in lieu if paying down debt but there are also situations that may not be as obvious, where it makes to pay down debt instead of investing the idle cash. Before just playing the interest rate game, it’s important to weigh all of these factors before making the decision as to the best use of your idle cash.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Should you pay down debt or invest excess cash?

The right choice depends on several factors, including your debt’s interest rate, the strength of your emergency fund, upcoming expenses, financial goals, time until retirement, and the current economic environment. In general, paying down high-interest debt (like credit cards) offers a risk-free return, while investing may make more sense when debt rates are low.

How does the interest rate on your debt affect this decision?

The higher the interest rate, the greater the benefit of paying it off. Eliminating a 15% credit card balance provides a guaranteed 15% “return” by saving that interest cost. With lower-rate debt (like a 3% mortgage), the decision becomes more nuanced and depends on your investment time horizon and risk tolerance.

Should you still keep an emergency fund before paying off debt?

Yes. Always maintain at least 4–5 months of essential living expenses in cash. Without a safety net, unexpected costs could force you back into debt or require you to sell investments at the wrong time.

What if you have large expenses coming up within a year?

If you’ll need cash within the next 12 months—for example, a remodel, tuition payment, or down payment—it’s often best to keep that money liquid rather than investing or using it to pay down debt. Short-term investments can fluctuate, and repaying debt may leave you cash-poor when expenses arrive.

How do your financial goals influence whether to invest or pay off debt?

If you’re behind on retirement savings, college funding, or insurance protection, using cash to shore up these goals may provide a better long-term payoff. Financial planning should focus on your broader goals, not just short-term returns.

Does proximity to retirement change the recommendation?

Yes. As retirement approaches, reducing fixed expenses—such as debt payments—can lower financial stress and improve flexibility. With less income predictability in retirement, a smaller expense base helps protect against market downturns or rising costs.

How does the economic environment impact this decision?

When markets are volatile or economic data is uncertain, using cash to pay down debt provides a guaranteed benefit with no risk. In strong, stable markets, investing excess cash may offer better long-term growth potential.

What is the “debt secret” of the super wealthy?

Many wealthy investors minimize personal debt, freeing up cash flow and reducing financial pressure. Having little to no debt may allow these individuals to invest in more risky investments with the goal of achieving higher returns, without jeopardizing their financial security.

How To Pay 0% Tax On Capital Gains Income

When you sell a stock, mutual fund, investment property, or a business, if you have made money on that investment, the IRS is kindly waiting for a piece of that gain in the form of capital gains tax. Capital gains are taxed differently than the ordinary income that you received via your paycheck or pass-through income from your business. Unlike ordinary

When you sell a stock, mutual fund, investment property, or a business, if you have made money on that investment, the IRS is kindly waiting for a piece of that gain in the form of capital gains tax. Capital gains are taxed differently than the ordinary income that you received via your paycheck or pass-through income from your business. Unlike ordinary income, which has a series of tax brackets that range from 10% to 37% in 2025, capital gains income is taxed at a flat rate at the federal level. Most taxpayers are aware of the 15% long term capital gains tax rate but very few know about the 0% capital gains tax rate and how to properly time the sale of your invest to escape having to pay tax on the gain.

Short-term vs Long-Term Gains

Before I get into this tax strategy, you first have to understand the difference between “short-term” and “long-term” capital gains. Short-term capital gains apply to any investment that you bought and sold in less than a 12 month period. Example, if I buy a stock today for $1,000 and I sell it three months later for $3,000, I would have a $2,000 short-term capital gain. Short-term capital gains are taxed as ordinary income like your paycheck. There is no special tax treatment for short-term capital gains and the 0% tax strategy does not apply.

Long-term capital gains on the other hand are for investments that you bought and then sold more than 12 months later. When I say “investments” I’m using that in broad terms. It could be a business, investment property, stock, etc. When you sell these investments at a gain and you have satisfied the 1 year holding period, you receive the benefit of paying tax on the gain at the preferential “long-term capital gains rate”.

What Are The Long Term Capital Gains Rates?

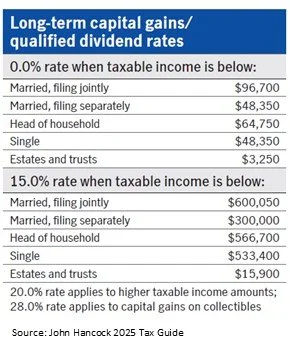

For federal tax purposes, there are 3 long term capital gains rates: 0%, 15%, and 20%. What rate you pay is determined by your filing status and your level of taxable income in the year that you sold the investment subject to the long term capital gains tax. For 2025, below are the capital gains brackets for single filers and joint filers.

As you will see on the chart, if you are a single filer and your taxable income is below $48,350 or a joint filer with taxable income below $96,700, all or a portion of your long term capital gains income may qualify for the federal 0% capital gains rate.

An important note about state taxes on capital gains income is that each state has a different way of handling capital gains income. New York state is a “no mercy state” meaning they do not offer a special tax rate for long term capital gains. For NYS income tax purposes, your long term capital gains are taxed as ordinary income. But let’s continue our story with the fed tax rules which are typically the lion share of the tax liability.

In a straight forward example, assume you live in New York, you are married, and your total taxable income for the year is $50,000. If you realize $25,000 in long term capital gains, you will not pay any federal tax on the $25,000 in capital gain income but you will have to pay NYS income tax on the $25,000.

Don’t Stop Reading This Article If Your Taxable Income Is Above The Thresholds

For many taxpayers, their income is well above these income thresholds. But I have good news, with some maneuvering, there are legit strategies that may allow you to take advantage of the 0% long term capital gains tax rate even if your taxable income is above the $48,350 single filer and $96,700 joint filer thresholds. I will include multiple examples below as to how our high net worth clients are able to access the 0% long term capital gains rate but I first have to build the foundation as to how it all works.

Using 401(k) Contributions To Lower Your Taxable Income

In years that you will have long term capital gains, there are strategies that you can use to reduce your taxable income to get under the 0% thresholds. Here is an example, I had a client sell a rental property this year and the sale triggered a long term capital gain for $40,000. They were married and had a combined income of $110,000. If they did nothing, at the federal level they would just have to pay the 15% long term capital gains tax which results in a $6,000 tax liability. Instead, we implemented the following strategy to move the $40,000 of capital gains into the 0% tax rate.

Once they received the sale proceeds from the house, we had them deposit that money to their checking account, and then go to their employer and instruct them to max out their 401(k) pre-tax contributions for the remainder of the year. Since they were both over 50, they were each able to defer $31,000 (total of $62,000). They used the proceeds from the house sale to supplement the income that they were losing in their paychecks due to the higher pre-tax 401(k) deferrals. Not only did they reduce their taxable income for the year by $62,000, saving a bunch in taxes, but they also were able to move the full $40,000 in long term capital gain income into the 0% tax bracket. Here’s how the numbers work:

Adjusted Gross Income (AGI): $110,000

Pre-tax 401(k) Contributions: ($62,000)

Less Standard Deduction: ($30,000)

Total Taxable Income: $30,100

In their case, they would be able to realize $66,600 in long term capital gains before they would have to start paying the 15% fed tax on that income ($96,700 – $30,100 = $66,600). Since they were below that threshold, they paid no federal income tax on the $40,000 saving them $6,000 in fed taxes.

“Filling The Bracket”

The strategy that I just described is called “filling the bracket”. We find ways to reduce an individuals taxable income in the year that long term capital gains are realized to “fill up” as much of that 0% long-term capital gains tax rate that we can before it spills over into the 15% long-term capital gains rate.

More good news, it’s not an “all or none” calculation. If you are married, have $60,000 in taxable income, and $100,000 in long term capital gains, a portion of your $100,000 in capital gains will be taxed at the 0% rate with the majority taxed at the 15% tax rate. As you might have guessed the IRS is not going to let you get away with paying 0% on a $100,000 in long term capital gains because you maneuvered your taxable income into the 0% cap gain range. But in this case, $36,700 would be taxed at the 0% long term cap gain rate, and the reminder would be taxed at the 15% long term cap gain rate.

Do Capital Gains Bump Your Ordinary Income Into A Higher Bracket?

When explaining this “filling up the bracket” strategy to clients, the most common question I get is: “If long term capital gains count as taxable income, does that push my ordinary income into a higher tax bracket?” The answer is “no”. In the eyes of the IRS, capital gains income is determined to be earned “after” all of your other income sources.

In an extreme example, let’s say you have $70,000 in ordinary income and $200,000 in capital gains. If your total ordinary income was $70,000 and you file a joint tax return, your top fed tax bracket in 2025 would be 12%. However, if the IRS decided to look at the $200,000 in capital gain income first and then put your ordinary income on top of that, your top federal tax bracket would now be 24%. That would hurt tax wise. Luckily, it does not work that way. Even if you realized $1M in long term capital gains, the $70,000 in ordinary income would be taxed at the same lower tax brackets since it was earned first in the eyes of the IRS.

Work With Your Accountant

Before I get into the more advanced strategies for how this filling up the brackets strategy is used, I cannot stress enough the importance of working with your tax advisor when executing these more complex tax strategies. The tax system is complex and making a shift in one area could hurt you in another area.

Even though these strategies may lower the federal tax rate on your long-term capital gain income, capital gains will increase your AGI (adjusted gross income) for the year which could phase you out of certain deductions, tax credits, increase your Medicare premiums, reduce college financial aid, etc. Your accountant should be able to run tax projections for you in their software to play with the numbers to determine the ideal amount of long-term capital gains that can be realized in a given year without hurting the other aspects of your financial picture.

Strategy #1: I’m Retiring

When people retire, in many cases, their taxable income drops because they no longer have their paycheck and they are typically supplementing their income with social security and distributions from their investment accounts. This creates a tax planning opportunity because these taxpayers sometimes find themselves in the lowest tax bracket that they have been in over the past 30+ years. Here are some of the common examples.

Example 1: The First Year Of Retirement

If you retire at the beginning of the calendar year, you may only have had a few months of paychecks, so your income may be lower in that year. If you have built up cash in your savings account or if you have an after tax investment account that you can use to supplement your income for the remainder of the year to meet your expenses, this may create the opportunity to “fill up the bracket” and realize some long-term capital gains at a 0% federal tax rate in that year.

Example 2: Lower Expenses In Retirement

We have had clients that were making $150,000 per year and then when they retire they only need $40,000 per year to live off of. When you retire, the kids are typically through college, the mortgage is paid off, and your expenses drop so you need less income to supplement those expenses. A portion of your social security will most likely be counted as taxable income but if you do not have a pension, you may have some wiggle room to realize a portion of your long-term capital gains as a 0% rate each year.

Assume this is a single filer. Here is how the numbers would work:

Social Security & IRA Taxable Income: $40,000

Less Standard Deduction: ($15,000)

Total Taxable Income: $28,000

This individual would be able to realize $20,350 in long term capital gains each year at the 0% fed tax because the threshold is $48,350 and they are only showing $28,000 in taxable income. Saving $3,053 in fed taxes.

Strategy #2: Business Owner Experiences A Low Income Year

If you have been running a business for 5+ years, you have probably been through those one or two tough years where either revenue drops dramatically or the business incurs a lot of expenses in a single year, lowering your net profits. Do not let these low taxable income years go to waste. If you typically make $250,000+ per year and you have one of these low income years, start planning as soon as possible because once you cross that December 31st threshold, you have wasted a tax planning opportunity. If you are showing no income for that year, you may want to talk to your accountant about realizing some long term capital gains in your brokerage account to realize those gains at a 0% tax rate. Or you may want to consider processing a Roth conversion in that low tax year. There are a number of tax strategies that will allow you to make the most of that “bad year” income wise.

Strategy #3: Leverage Cash Reserves and Brokerage Accounts

If you have been building up cash reserves or you have a brokerage account that you could sell some holdings without incurring big taxable gains, you may be able to use that as your income source for the year which could result in little to no taxable income showing for that tax year. We have seen both retirees and business owners use this strategy.

Business owners have control over when expenses will be realized which influences how much taxable income is being passed through to the business owner. If you can overload expenses into a single tax year instead of splitting it evenly between two separate tax years, that could create some tax planning opportunities.

Strategy #4: Moving To Another State

It’s common for individuals to move to more tax friendly states in retirement. If you live in a state now, like New York, that makes you pay tax on long term capital gain income, and you plan to move to Florida next year and change your state of domicile, you may want to wait to realize your capital gains until you are resident of Florida to avoid having to pay state tax on that income. This has nothing to do with the 0% Fed tax strategy but it might reduce your state income tax bill on those capital gains.

Bottom Line

There are few strategies that allow you to pay 0% in federal taxes on any type of gain. If you are a high income earner, this strategy may not work for you every year but there may be opportunities to use them at some point if income drops or when you enter the retirement years. Again, don’t let those lower income years go to waste. Work with your accountant and determine if “filling the bracket” is the right move for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the difference between short-term and long-term capital gains?

Short-term capital gains apply to investments held for less than one year and are taxed as ordinary income. Long-term capital gains apply to investments held for more than 12 months and receive preferential tax treatment at 0%, 15%, or 20% depending on your taxable income and filing status.

Who qualifies for the 0% long-term capital gains tax rate?

For 2025, single filers with taxable income below $48,350 and married couples filing jointly with income below $96,700 may qualify for the 0% federal capital gains rate. Taxpayers within these thresholds can sell long-term investments and pay no federal tax on the gain.

Can higher-income taxpayers still benefit from the 0% capital gains rate?

Yes. By lowering taxable income through pre-tax 401(k) contributions, charitable deductions, or strategic timing of income, higher earners can “fill the bracket” and move some or all of their capital gains into the 0% range. This is often most effective during years of reduced income, such as early retirement or a slow business year.

What does it mean to ‘fill the bracket’?

Filling the bracket involves realizing just enough long-term capital gains to stay within the 0% or 15% tax thresholds. By managing income levels—through retirement contributions or expense timing—you can take advantage of lower tax rates on your gains without triggering higher brackets.

Do capital gains push your ordinary income into a higher tax bracket?

No. The IRS calculates tax on ordinary income first, and capital gains are layered on top. Your wages or other ordinary income remain taxed at their respective brackets, and capital gains receive their separate preferential rates.

When is the best time to realize long-term capital gains?

Years with lower taxable income—such as the first year of retirement, a down year in business profits, or after a move to a tax-friendly state—are ideal times to realize gains. These windows can allow you to sell appreciated assets while minimizing or eliminating capital gains taxes.

How can retirees use this strategy?

Retirees often find themselves in lower income brackets, especially before required minimum distributions begin. By realizing capital gains strategically during these years, they can capture gains at the 0% rate and reduce future tax exposure on their investments.

Should you consult a professional before implementing this strategy?

Yes. Realizing capital gains affects your adjusted gross income, which can impact Medicare premiums, financial aid, and eligibility for tax credits. A tax advisor can model your situation to determine the optimal amount of capital gains to realize without creating unintended consequences.

Will The January Market Selloff Continue?

The markets have experienced an intense selloff in the first three weeks of 2022. As of January 21st, the S&P 500 Index is down over 7% for the month. There are only a few times in the past 10 years that the index has dropped by more the 5% in a single month. That begs the questions, “After those big monthly declines, historically, what happens next?”

The markets have experienced an intense selloff in the first three weeks of 2022. As of January 21st, the S&P 500 Index is down over 7% for the month. There are only a few times in the past 10 years that the index has dropped by more the 5% in a single month. That begs the questions, “After those big monthly declines, historically, what happens next?” Continued decline? Market recovery? We are going to answer that question in this article

The recent selloff has also been widespread. The selloff in January has negatively impacted stocks, bonds, crypto, while inflation continues to erode the value of cash. It has essentially created a nowhere to hide market environment. As of January 21, 2022, the YTD returns of the major indices are:

S&P 500 Index: -7.7%

Nasdaq: -12.0%

Small Cap 600: -8.5%

Agg (Bonds): -1.7%

Bitcoin: -24.1%

In this article I’m going to cover:

What has caused the selloff?

Do we expect the selloff to continue?

This Has Happened Before

How many times has the S&P 500 index dropped by more than 5% in a month over the past 10 years?

Answer: 4 times

February 2020: -18.92%

November 2018: -5.56%

December 2015: -6.42%

July 2011: -10.40%

Next question: How many times did the S&P 500 Index post a positive return 3 months following the month with the 5%+ loss?

Answer: ALL OF THEM

Mar 2020 – May 2020: 16.7%

Dec 2018 – Feb 2019: 9.5%

Jan 2016 – Mar 2016: 8.6%

Aug 2011 – Oct 2011: 4.0%

Don’t Make The Jump In / Jump Out Mistake

There is no doubt that the big, swift downturns in the markets bring fear, uncertainty, and stress for investors but all too often investors let their emotions get the better of them and the lose sight of the biggest economic trends that are at work. The most common phrase that I hear from investors during these steep declines is:

“Maybe we should just go to cash to stop the losses and then we can buy back into the stock market once the risks have passed.”

The issue becomes: when do you get back in? Following these big temporary sells offs in the market, it is common that the lion share of the gains happened before things feel good again. Investors get back in after the market has already rallied back, meaning they solidified their losses and they are now allocating money back into stocks when they have returned to higher levels.

We accurately forecasted higher levels of volatility in the market in 2022 when we release our 2022 Market Outlook video. It is also our expectation that with inflation rising and the Fed moving interest rates higher, the selloff that we have experienced in January, will not be the only steep selloff that we are faced with this year. Before we get into the longer- term picture, let’s first look at what prompted the January selloff in the markets.

What Caused The Market Selloff in January?

There are a number of factors that we believe has caused this severe selloff in January:

COVID Omicron cases have surged

The Fed’s more hawkish tone

Rising interest rates

Tech sector selloff

COVID investment plays unwinding

Loss of enhanced child tax credit monthly payments

While that looks like a long list, at the risking sounding like a broken record, if you go back to the Market Outlook video that we released in December, all of these were expected. It’s only when unexpected events occur that we then have to shift our strategy for the entire year. Let’s look at each of these items one by one:

COVID Cases Have Peaked

One thing that caught the market by surprise over the past few months is how contagious the Omicron variant was and how many cases there would be. This caused the recovery story to stall as safety measures were put back into place to control the spread of the most recent variant. The good news is it looks like the cases have peaked and are now on the decline. See the chart below:

It's a little tough to see in the chart but the blue line represents the number of confirmed COVID cases. If you look all the way on the righthand side, as of January 20th, they have dropped dramatically. The 7-day moving average has dropped by about 100,000 cases. This trend supports our forecast that the economy will begin opening up again starting in February. We expect the reopening trade story to be part of the market rally coming off of this tough January for the markets.

The Fed’s Hawkish Tone

It's the Fed’s job to keep inflation under control so the economy does not overheat. Inflation has been running at rate of over 6% for the past several months and going into 2022, the Fed telegraphed making 3 rate hikes in 2022. After the Fed’s January meeting, an even more hawkish tone was found in those meeting minutes, suggesting that more than 3 rate hikes could be on the table this year. This caused interest rates to rise rapidly which hurt both stocks and bonds in January.

But let’s take a look at history. The last time the Fed started raising rates was in 2016. Between 2016 and 2018, they hiked the Fed Funds Rate 8 times. During that two-year period, the S&P 500 was up 15.8%. The lesson here is just because the Fed is beginning to raise rates does not necessarily mark the end of the bull market rally.

Rising Interest Rates

Interest rates rose sharply in January which put downward pressure on both stocks and bonds. Investor often have bonds in their portfolio to offer protection when the there are selloffs in the stock market but when interest rates are moving high and the stock market is selling off at the same time, both stocks and bonds tend to move lower together. The yield on the 10 Year Treasury jumped from 1.51% on December 31, 2021 to 1.86% on January 18, 2022. That does not sound like a big increase but in terms of interest rates that is a huge move in 18 days. (In percentage terms, over 23%)

We do expect interest to continue to rise in 2022 but not at the concentrated monthly pace that we saw in January.

Tech Stock Drop

Tech stock took a big hit in January. The Nasdaq is down 12% in the first three weeks of 2022. In the 2022 Market Outlook we talked about tech stock coming under pressure this year in the face of rising interest rate and a lesson from the 1970’s about the “Nifty Fifty”. These tech stocks tend to trade at higher valuations. Interest rates and valuation levels tend to have an inverse relationship meaning if a stock is trading at a higher valuation level (P/E), they tend to be more adversely affected compared to the rest of the market when interest rates move higher.

COVID Investment Plays Unwind

In January, stocks that were considered “stay at home” COVID plays, like streaming, home exercise equipment, and electronic document providers experience large corrections. Here are some of the names that fall into that space and their performance YTD as of January 21, 2022:

Netlfix: -33%

Peloton: -23%

DocuSign: -23%

Now that the United States has reached a level of vaccinations and positive COVID cases that would suggest that we are at or close to herd immunity, there seems to be a higher likelihood that future COVID variants may not cause extreme economic shutdowns that supported the higher valuation level of these “stay at home” investment strategies.

Loss of Child Tax Credit Payments

Since the Build Back Better bill did not pass in December 2021, the $300+ per month that many parents were receiving for the Enhanced Child Tax Credits stopped in January. While those monthly payments to families were only meant to be temporary, it was highly anticipated that they were going to be extended into 2022 with the passing of the Build Back Better bill. Not having that extra money every month could slow down consumer spending in the first quarter of 2022.

Do We Expect The Selloff To Continue?

No one has a crystal ball but I would be very surprised if we do not see a recovery rally in the markets over the next few months. I think people underestimate the amount of money that has been injected into the U.S. economy over the past 18 months. If you total up all of the COVID stimulus packages over the past 18 months, they total $6.9 Trillion dollars. Compare that to the TARP Stimulus package that saved the banks and housing market in the 2008/2009 recession which only totaled $700 Billion. A lot of that stimulus money has yet to be spent due to supply change and labor constraints over the past year.

It's our expectations that the supply chain, which is already showing improvement, will continue to heal as we move further into 2022, which will give rise to higher levels of consumer spending and in turn, higher corporate earnings.

Inflation will be the greatest risk to the economy in 2022, but if the recovery of the supply chain causes prices to stabilize and consumers have the cash and wages to pay these temporarily higher prices, the bull rally could continue in 2022. But again, it will be choppy. The market could experience numerous corrections similar to what we are experiencing in January that investors may have to hold through, especially as the Fed begins to announce interest rate hikes later this year. We expect patience to be rewarded in 2022.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

2022 Market Outlook

There are trends that are developing in the U.S. economy that we have not seen for decades. As inflation continues to rise at a rapid pace, we have to look back to the 1970’s as a reference point to determine how inflation could impact stocks, bonds, gold, and cash going into 2022. The most common questions that we have received from clients over the past few weeks are:

There are trends that are developing in the U.S. economy that we have not seen for decades. As inflation continues to rise at a rapid pace, we have to look back to the 1970’s as a reference point to determine how inflation could impact stocks, bonds, gold, and cash going into 2022. The most common questions that we have received from clients over the past few weeks are:

Will the stock market rally continue into 2022?

Will higher inflation derail the economy?

How will the market react to the Fed increasing interest rates in 2022?

A lesson from “The Nifty Fifty”

How will the labor shortage and supply chain issues impact the markets in 2022?

I plan to address all of these questions and more as we present our market outlook for 2022.

The Economy Will Continue to Strengthen

It’s our expectation that we will see the U.S. economy gain strength in the first half of 2022. Our economy is based primary on consumer spending and the consumer is charged with cash and ready to spend. The cash has come from record levels of government stimulus in 2020 and 2021, as well as rising wages across many sectors in the U.S. economy. Debt levels are also at historic lows as well. Due to the supply chain constraints, people could not spend the money, therefore they paid down their debt. Per the chart below, debt payments as a percent of U.S. households’ disposable income is at the lowest level in over 40 years.

Talk to any pool company and they will provide you with a clear picture of the pent- up demand. Some pool installers are fully booked through 2022 and are taking deposits for pools for 2023.

Back Orders At Record Levels

Many of the companies that we have spoken with across various industries have back orders at record levels. With back orders, the customer is already committed to buying a product from a company whether it’s a car, roof, gym equipment, etc., but they have yet to take delivery of that product. When the product is delivered, they normally submit full payment, and the company realizes the revenue. From an outlook standpoint, when companies have large back orders, it takes some of the risk off the table because it is not an “if the sales are going to be there to generate revenue” but rather “how quickly can the company deliver the product to their customers”.

Supply Chain Constraints

The answer to the question “how quickly can they deliver?” relies heavily on how fast the global supply chain can get back online going into 2022. People have been slower to return to the workforce than originally expected, which means less people at the ports to unload container ships, less truck drivers to transport the goods from the ports to the stores, and less employees in stores to stock shelves. However, we see a number of new trends that should ease these constraints in 2022:

Individuals needing to return to the workforce after depleting stimulus cash reserves

Employer offering higher wages and sign on bonuses to attract employees

A higher level of vaccination rates in children, easing childcare constraints, and allowing more parents to return to the workforce

I think the economy has largely underestimated the impact of the childcare constraints on the ability for parents to return to the workforce. If your child has a cough, even though a test may reveal that they don't have COVID, they may not be able to return to school for a few days, requiring a parent to take time off from work.

Relief At The Ports

The two main ports in the U.S are the “twin ports” in Los Angeles and Long Beach; 40% of sea freight enters the U.S. through those two ports. Both have been working around the clock to unload ships and they are making significant progress. Mario Cordero, executive director of the Port of Long Beach, stated that in mid- November there were 111 ships off the coast of California waiting to be unloaded and within two weeks that number was reduced to 61 ships. However, it takes time for the goods to get off the ship, loaded onto a truck, and delivered to stores and businesses, but the trend is going in the right direction.

Record Levels of Cash Injection

Over the past 18 months, the U.S. Government has injected more cash into our economy than any other time in history. To put this in perspective, let's compare the dollar amount of the bailout packages during the Great Recession of 2008 / 2009, to the level of cash injection over the past 18 months. In the illustration below on the left side you will see the TARP Program which was the government bailout for the banks and the housing market in 2008 / 2009. On the right, you will see all of the stimulus program that the government rolled out in 2020 / 2021 to battle COVID.

The total cost of TARP was $700 Billion.

Over the past 18 months the government has injected almost $7 Trillion…………TRILLION……into the U.S. economy. That is 10 times the TARP program that was used to rescue the US economy in 2008/2009 when we almost lost the entire U.S. banking system.

To go one more step, below is a chart of the year over year change in the M2 money supply. This allows us to see how much cash is circulating within the U.S. economy compared to the prior year going all the way back to 1980.

Look at that mountain on the righthand side of the chart. We have had recession in the past which has required the government to inject liquidity, which are illustrated by the grey areas in the chart, but nothing to the magnitude of what we have seen over the past 18 months. Just a side note, this chart does not include the recent $1.2 Trillion dollar infrastructure bill that was already passed or the $1.75 Trillion Build Back Better bill that is deck.

A lot of this cash that has been injected into the economy has not been spent yet because due to the supply chain constraints, consumers and business have not been able to spend it. As the supply chain gets back online in 2022 and 2023, consumers and businesses will be able to put this cash to work which should be a boost to the U.S. economy.

Inflation, Inflation, Inflation

The great risk to the economy as we enter 2022 is undoubtedly rising inflation. We have all seen prices rise rapidly for just about everything we buy: groceries, gas, travel, etc. The supply chain issues have made this problem worse because the less goods there are, the more expensive they become. This leads us to the main question which is:

“Will inflation subside once the supply chain gets back online or are these higher levels of inflation that we are seeing now just the beginning?”

This is the question that everyone wants the answer to but it’s too early to tell. The only thing that's going to provide us with the answer is time, so we are going to be watching these trends unfold week by week, month by month, as the data comes in during 2022. In my opinion, there is an equal chance of both scenarios playing out. Scenario one, the supply chain improves throughout 2022, increasing the supply of goods and services, which in turn stabilizes prices, and the risk of hyperinflation begins to fade. Scenario two, either the supply chain does not heal fast enough, or wage growth continues to escalate, causing inflation rates to continue to rise, forcing the Fed’s hand to raise rates more quickly.

You have to remember that inflation only begins to do damage when prices rise to levels that consumers and businesses can no longer afford. Given the historic levels of cash that have been injected into the economy, it’s our expectation that even with prices rising over the next 6 months, that may not curb the consumers ability or desire to purchase those same goods and services at higher prices.

The Fed

The Fed has two main objectives:

Keep the economy at full employment

Keep inflation within its target range of 2% - 3%

As you can see in the chart below, the CPI (Consumer Price Index) which is the Fed’s main measuring stick for inflation has risen well above the Fed’s 3% comfort zone and continues to rise.

In November, it was reported that the year over year change in CPI (inflation) was 6.9%. That’s a big number. In response to these heightened levels of inflation, the Fed has increased its timeline for decreasing the amount of bonds that it is purchasing as well as escalating the timeline for their first interest rate hike. With these changes, the Fed is intentionally tapping the brakes, so the economy does not overheat and give rise to hyperinflation like we saw in the 1970’s. But it's important to understand that every time the Fed raises interest rates, it is working against economic growth because it makes lending more expensive. Less lending normally means less spending.

This change in the Fed stance is not necessarily an end all for the stock market rally. Investors have to remember the Fed is raising rates because the economy is strong which has caused prices to rise. Historically, as long as the Fed is able to raise rates at a measured pace, the economy and the market have time to digest those small increases, and the growth trend can continue. It is when the Fed has to raise rates in large increments in a relatively short period of time, it creates more of an abrupt end to an economic expansion. Think of it this way, if the interest rate on a 30-year mortgage go from 3.25% to 3.50% it’s not going to necessary derail the housing market. But if that 30-year mortgage rate goes from 3.25% to 5% in short period of time, that could cause a huge drop in housing prices because people will no longer be able to afford the mortgage payments to purchase a house at these elevate prices.

The Nifty Fifty

Looking at that inflation chart that I showed you earlier, it’s been 30 years since the Core CPI index has been over 3%. People that just started investing within the last 30 years have not seen the impact of inflation on stock, bonds, cash, and other asset classes. The last time the U.S. economy experienced higher inflation for a prolonged period of time was the 1970’s. There are a lot of important investment lessons that we learned in the 1970’s but one of them that bears mentioning is the lesson of the “Nifty Fifty”.

The Nifty Fifty was the name given to a group of stocks in the 1970’s that were the darlings of the stock market. Companies like McDonalds, Polaroid, Disney, IBM, Johnson & Johnson were names within the Nifty Fifty. This group of stocks are similar to the FANGs that we have today which include Facebook, Amazon, Netflix, and Google.

Why the comparison? Coming out of the 1960’s there was prolonged bull market rally, similar to the one we have today, these Nifty Fifty stocks were the growth engines of the market, and as such they traded at very high valuations (P/E ratios) compared to their peers in the stock market. Many of the Nifty Fifty stocks had P/E ratios above 50 times forward earnings. To put that in perspective, right now the S&P 500 Index has a P/E of about 21x forward earnings. When higher inflation shows up, it traditionally has a larger negative impact on stocks that are trading at higher multiples compared to stock that have lower P/E ratios. This is because higher interest rates erode the present value of those future earnings that are baked into the price of those stocks. When higher inflation showed up in the 1970’s, many of stocks in the Nifty Fifty dropped by over 60%. Investors need to remember, when the economy is good and inflation is low, the market tends to care less about valuations. When inflation increase and/or the economy slows down, all of a sudden valuations will begin to matter again to investors.

I’m making this point as a word of caution; the Nifty Fifty and the FANG have a lot of similarities. Even though, at this point, I do not expect a hyper inflationary environment like the 70’s, a rise in inflation may have a similar impact on stocks trading at a higher valuation. Netflix current trades a PE of 55, Amazon (P/E 66), Microsoft (P/E 38). The market looked at the Nifty Fifty similar to how I hear investors talk about the FANG stocks now, “how can they ever go down?” Also from a psychological standpoint, investors often find it difficult to sell holdings that have made them a lot of money, and these FANG stocks have increase in value a lot over the past 10 years. There is also the tax hit that investors incur in taxable accounts when unrealize gains turn into realized gains.

To be clear, this is not a recommendation for investors to go sell of their FANG stocks, it’s about understanding the trends that have played out in history, how those trends may compare to where we are now when assessing risk, opportunity, and the investment decisions that we may face in 2022.

2022 Outlook Summary

Brining all of these variables together, we expect the first half the year to bring with it strong economic growth which should be a favorable environment for risk assets. But…….we don’t anticipate that it will be a smooth ride in 2022 for equity investors. As the Fed implements its anticipated interest rate hikes, there could be a number of selloffs throughout the year that will test the patience of investors. If inflation does not get out of control, those selloffs could be an opportunity for investors to put cash to work, as the market shakes off the scary headline risks and the growth trend continues. We expect the labor shortage and supply chain issues to improve in 2022, which should help to ease some of the inflation fears as prices begin to stabilize in 2022 and potentially drop going into 2023.

The second half of the year will depend largely on the trend of inflation. If inflation runs hotter than expected, it could begin to have an impact on consumer spending as prices rise above what consumers are willing to pay, and it could force the Fed to increase the magnitude or frequency of rate hikes in 2022. Either of those two items could potentially erase or decrease the gains the U.S. stock market may have achieved in the first half of the year.

With higher levels of volatility almost a given for 2022, investor may have to resist the urge to sell out of their stock positions and retreat to bonds or cash knowing that an inflationary environment is an enemy of both high-quality bonds and cash. Overall, investors will have to pay closer attention the economic and inflation data throughout the year to determine if pivots should be made in their investment strategy, especially as we enter the second half of the year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Why Are Long-Term Care Insurance Premiums Skyrocketing?

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain……

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain:

Why this is happening

Are these premium increases going to continue?

Options for managing the cost of these policies

If you cancel the policy, alternative solutions for managing the financial risk of a LTC event

Premium Increases & Insolvency

Unfortunately, it’s not just the current premium increases that are presenting LTC policyholders with these difficult decisions. Within the letters, some of these insurance carriers are threatening that if they’re not able to raise premiums by 250% within the next 6 years, that the insurance company may not have enough assets to pay the promised benefit. What good is an insurance policy if there’s no insurance company to pay the benefit? I won’t mention any of the insurance companies by name but here is some of the word for word statements in those letters:

“This represents a 69% rate increase in the premiums for your policy.”

“A.M. Best has downgraded its rating of (NAME OF INSURANCE COMPANY) financial strength to C++ in September 2019, indicating A.M. Best’s view that (NAME OF INSURANE COMPANY) has marginal ability to meet its ongoing insurance obligations.”

“Please be aware that as of 06/06/21 over the next 3-6 years we are planning to seek additional rate increases of up to 250% for lifetime benefits”

This creates a very difficult decision for the policyholder to either:

Keep the policy and pay the higher premiums

Cancel the policy

Make adjustments to the current policy to make it more affordable in the short-term

These Policies Are Not Cheap

In most cases, these long-term care insurance premiums were not cheap to begin with. Prior to these premium increases, it was not uncommon for a robust policy in New York to cost between $2,500-$4,000 per year, per person. LTC policies tend to carry a higher cost because they have a higher probability of paying out when compared to other types of insurance policies. For example, with life insurance, they expect you to pay your premiums, you live a long happy life, and the insurance policy never pays out. Compare this to the risk of a long-term event, where in 2021 HealthView Services produced a study that stated:

“An Average healthy 65-year-old couple living to their projected actuarial longevity has a 75% chance that one partner will require a significant level of long term care. There is a 25% probability that both partners will need long-term care” (source: Think Advisor)

Couple that with the fact that long-term care expenses are very high and insurance companies have to charge more in premiums to balance the dollars in versus dollars out.

With these premium increases now in play, some retired couples are faced with a situation where they previously may have been paying $5,000 per year for both policies and they find out their premiums are going up by 70%, increasing that annual cost to $8,500 per year.

Affordability Issue

So what happens when a retired couple, on a fixed amount of income, gets one of these letters, and realizes they can’t afford the premium increase. They essentially have two options:

Cancel the policy

Make amendments to the policy (if the insurance company allows)

Let’s start off by looking at the amendment option. Many insurance companies, in exchange for a lower premium increase, may allow you to reduce the benefits offered by the policy to make it more affordable. You may have options like

Extending the elimination period

Reducing inflation riders

Reducing the daily benefit

Reducing the maximum lifetime benefit

Reducing home care options

These are just some of the adjustments that could be made, but remember, you are taking what you have now, and watering it down to make it more affordable. Caution, at some point you have to ask yourself:

“If I reduce the benefits of this policy, will it provide me enough coverage to meet my financial needs should I have a long-term event?”

If the answer is “No”, then you may have to look more closely at the option of canceling the policy. But what happens if you cancel the policy and you are now exposed to the financial risk of a long-term care event? Answer, you will have to identify another financial strategy to manage that risk. Two of the most common that we have implemented for clients are

Self-insuring

Setting up Medicaid trusts

Self-Insuring Alternative

The way this solution works is you are essentially setting money aside for yourself, acting as your own insurance company, should a long-term care event arise later in life, you will have money set aside to pay those expenses. If you were previously paying an insurance company $4,000 per year for your LTC policy, then cancel the policy, you would set up a separate investment account where you continue to deposit the amount of the premium payments that you were previously making each year so there will be a pool of assets to draw from should a long-term event arise.

But, you have to run projections to determine how much money is estimated to be in those accounts at future ages to make sure it is sufficient to cover enough of those costs that it won’t put you in a tough financial situation later on. There is an upside benefit to this strategy that if you never have a long-term care event, there are assets sitting there that your beneficiaries could inherit. If instead that money was going toward long-term care insurance premiums and there’s not a long-term care event, all that money has essentially been wasted. However, this strategy does take more planning because your self-insurance strategy may be not cover the same dollar for dollar amount that your LTC policy would have covered if a long-term care event arises.

Medicaid trust

Understanding how Medicaid trusts works is a whole article in itself and we have a video dedicated just to this topic. But the general idea behind the strategy is this, if you have a long-term event and you do not have a LTC insurance policy, you essentially have to spend through all of your countable assets to pay for your care. Note, the annual costs of assisted living or a nursing home is often $100,000+ per year. For those that do not have assets, Medicaid will often pay for the cost of assisted-living or nursing home care. By setting up a trust and placing your assets in a trust ahead of time, if those assets are owned by the trust for a specific number of years, if there is a long-term care event, you do not have to spend those assets down, and Medicaid picks up the tab for your care. Like I said, there’s a lot more detail regarding the strategy and if you’d like to know more watch this video: