The Hidden Tax Traps in Retirement Most People Miss

Many retirees are caught off guard by unexpected tax hits from required minimum distributions (RMDs), Social Security, and even Medicare premiums. In this article, we break down the most common retirement tax traps — and how smart planning can help you avoid them.

Most people think retirement is the end of tax planning. But nothing could be further from the truth. There are several tax traps that retirees encounter, which range from:

How RMDs create tax surprises

How Social Security is taxed

How Medicare Premiums (IRMAA) are affected by income

A lack of tax-specific distribution planning

We will be covering each of these tax traps in this article to assist retirees in avoiding these costly mistakes in the retirement years.

RMD Tax Surprises

Once you reach a specific age, the IRS requires individuals to begin taking mandatory distributions from their pre-tax retirement accounts, called RMDs (required minimum distributions). Distributions from pre-tax retirement accounts represent taxable income to the retiree, which requires advanced planning to ensure that that income is not realized at an unnecessarily high tax rate.

All too often, Retirees will make the mistake of putting off distributions from their pre-tax retirement accounts until RMDs are required to begin, which allows the pretax accounts to accumulate and become larger during retirement, which in turn requires larger distributions once the RMD start age is reached.

Here is a common example: Tim and Sue retire from New York State at age 55 and both have pensions that are more than enough to meet their current expenses. Both of them also have retirement accounts through NYS, totaling $500,000. Assuming Tim and Sue start taking their required minimum distributions (RMDs) at age 75, and since Tim and Sue do not need to take withdrawals from their retirement account to supplement their income, those retirement accounts could grow to over $1,000,000. This sounds like a good thing, but it creates a potential tax problem. By age 75, they’ll both be receiving their pensions and have turned on Social Security, which under current tax law is 85% taxable at the federal level. On top of that, they’ll need to take a required minimum distribution of $37,735 which stacks up on top of all their other income sources.

This additional income from age 75 and beyond could:

Be subject to higher tax rates

Trigger higher Medicare Premiums

Cause them to phase out of certain tax deductions or credits

In hindsight, it may have been more prudent for Tim & Sue to begin taking distributions from their retirement accounts each year beginning the year after they retired, to avoid many of these unforeseen tax consequences 20 years after they retired.

How Is Social Security Taxed?

I start this section by saying, based on current law, because the Trump administration has on its agenda to make social security tax-free at the Federal level. At the time of this article, social security is potentially subject to taxation at the federal level for individuals based on their income. A handful of states also tax social security benefits.

Here is a quick summary of the proportion of social security benefits subject to taxation at the Federal level in 2025:

0% Taxable: Combined income for single filers below $25,000 and joint filers below $32,000.

50% Taxable: Combined income for single filers between $25,000 - $34,000 and joint filers between $32,000 - $44,000

85% Taxable: Combined income for single filers above $34,000 and joint filers above $44,000.

One-time events that occur in retirement could dramatically impact the amount of a retiree's social security benefit, subject to taxation. For example, a retiree might sell a stock at a gain in a brokerage account, surrender an insurance policy, earn part-time income, or take a distribution from a pre-tax retirement account. Any one of these events could inadvertently trigger a larger tax liability associated with the amount of an individual’s social security that is subject to taxation at the Federal level.

Medicare Premiums Are Income-Based

When you turn age 65, many retirees discover for the first time that there is a cost associated with enrolling in Medicare, primarily in the form of the Medicare Part B premiums that are deducted directly from a retiree's monthly social security benefit. The tax trap is that if a retiree shows too much income in a given year, it can cause their Medicare premium to increase for 2 years in the future.

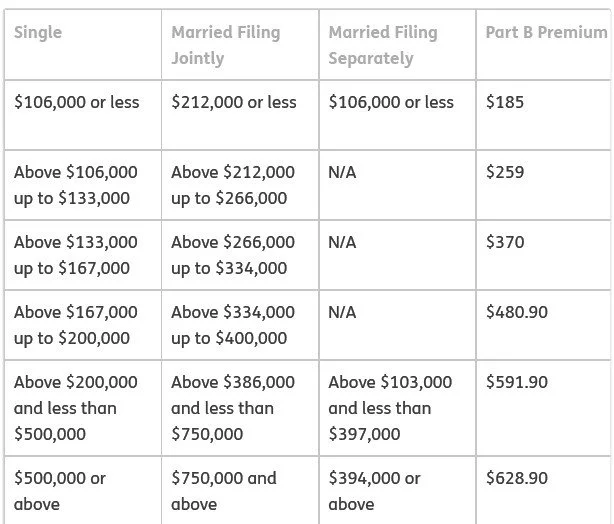

Medicare looks back at your income from two years prior to determine the amount of your Medicare Part B premium in the current year. Here is the Medicare Part B premium table for 2025:

As you can see from the table, as income rises, so does the monthly premium charged by Medicare. There are no additional benefits, the retiree just has to pay more for their Medicare coverage.

This is where those higher RMDs can come back to haunt retirees once they reach the RMD start age. They might be ok between ages 65 – 75, but once they hit age 75 and must start taking RMDs from their pre-tax retirement accounts, those pre-tax RMD’s can sometimes push retirees over the Medicare based premium income threshold, and then they end up paying higher premiums to Medicare for the rest of their lives that could have been avoided.

Lack of Retirement Distribution Planning

All these tax traps surface due to a lack of proper distribution planning as an individual enters retirement. It’s incredibly important for retirees to look at their entire asset picture leading up to retirement, determine the income level that is needed to cover expenses in their retirement year, and then construct a long-term distribution plan that allows them to minimize their tax liability over the remainder of their life expectancy. This may include:

Processing sizable distributions from pre-tax accounts early in the retirement years

Processing Roth conversions

Delaying to file for social security

Developing a tax plan for surrendering permanent life insurance policies

Evaluating pension and annuity elections

A tax plan for realizing gains in taxable investment accounts

Forecasting RMDs at age 73 or 75

Developing a robust distribution plan leading up to retirement can potentially save retirees thousands of dollars in taxes over the long run and avoid many of the pitfalls and tax traps that we reviewed in the article today.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why is tax planning still important in retirement?

Many retirees assume that once they stop working, tax planning ends. In reality, retirement can bring new tax challenges — including required minimum distributions (RMDs), Social Security taxation, and income-based Medicare premium increases — that require proactive management to avoid costly surprises.

How do required minimum distributions (RMDs) create tax surprises?

Starting at age 73 or 75 (depending on birth year), retirees must begin taking taxable withdrawals from pre-tax retirement accounts. These RMDs can push retirees into higher tax brackets, increase Medicare premiums, and cause more of their Social Security benefits to become taxable if withdrawals aren’t planned carefully in advance.

Can delaying IRA withdrawals until RMD age cause higher taxes later?

Yes. Deferring all withdrawals until RMDs begin can cause retirement accounts to grow substantially, leading to larger mandatory distributions later in life. Spreading withdrawals earlier in retirement can help manage tax brackets, reduce future RMDs, and potentially lower long-term taxes.

How is Social Security taxed at the federal level?

In 2025, up to 85% of Social Security benefits may be taxable depending on your combined income (adjusted gross income + tax-exempt interest + 50% of benefits). For joint filers, benefits become partially taxable above $32,000 and up to 85% taxable above $44,000.

What income sources can increase the taxation of Social Security?

Capital gains, part-time wages, insurance policy surrenders, or withdrawals from pre-tax retirement accounts can all raise taxable income and cause a greater portion of Social Security benefits to become taxable.

How do Medicare premiums (IRMAA) depend on income?

Medicare Part B and Part D premiums increase for retirees with higher incomes, based on a two-year income lookback. For example, your 2025 premiums are based on your 2023 tax return. Large one-time income events — such as Roth conversions or asset sales — can trigger higher Medicare premiums for two years.

What strategies can help retirees reduce tax traps?

Effective planning may include drawing down pre-tax accounts earlier, using Roth conversions in low-income years, managing capital gains, and coordinating income sources to control how much is exposed to higher taxes or Medicare surcharges.

Trump Has The Stock Market and Fed Cornered

The stock market selloff continues amid the escalation of the trade wars between the US and 180 other countries. It’s left investors asking the questions:

Where is the bottom?

Are we headed for a recession?

Unfortunately, the answers are largely rooted in the decisions that President Trump makes in the coming days and weeks. There have been talks about the Fed decreasing rate, tax reform getting passed sooner, negotiations beginning with 50 of the 180 countries that we placed tariff on, but in this article we are going to explain why all of these solutions may be too little too late when it comes to the overall negative impact that tariff are currently having on the US economy.

The stock market selloff continues amid the escalation of the trade wars between the U.S. and 180 other countries, and it’s left investors asking the questions:

Where is the bottom?

Are we headed for a recession?

Unfortunately, the answers are largely rooted in the decisions that President Trump makes in the coming days and weeks. There have been talks about the Fed decreasing rates, tax reform getting passed sooner, and negotiations beginning with 50 of the 180 countries that we placed tariffs on. In this article, we are going to explain why all of these solutions may be too little too late when it comes to the overall negative impact that tariffs are currently having on the U.S economy.

Trump Holds All of the Cards

In our opinion, the only way out of this market selloff is a policy pivot by the Trump administration on the latest round of tariffs - which could be announced ant any moment. Markets would likely respond very positively to any sign of relief. This could come in the form of a “pause” in the assessments of the tariffs for a specific number of days to provide time for negotiations to take place, or the Trump administration could reverse course, either walking back or reducing the tariff amounts that are currently being assessed.

Notice that I didn’t add to the list that “tariffs are either eliminated or reduced by successfully negotiating with 180 countries on which tariffs have been placed.” While this would typically be an option, we do not believe that the Trump administration has the manpower to successfully negotiate with 180 countries simultaneously in a way that would reduce or eliminate the tariffs before they negatively impact the global economy.

The magnitude of the tariff is a real problem, and we believe this to be one of the big missteps by the Trump administration in trade negotiations. The reciprocal tariffs are not based on the tariffs that are being levied against U.S. goods being imported by other countries, but rather a formula by the Trump administration that’s based on the trade deficit between the U.S. and these various countries, which is not prudently resolved through the assessment of tariffs.

For example, let's say that Japan assesses a 5% tariff against U.S. imports. Since the U.S. imports more from Japan than Japan imports from the U.S., this results in a trade deficit between the two countries. The Trump administration has decided not to levy a reciprocal tariff based on the 5% actual tariff levied against U.S. goods but rather is assessing a much larger tariff based on the amount of the trading deficit between the U.S. and Japan. However, this might not be the root cause of the trade imbalance. Another example: let's say the U.S. consumer prefers buying Japanese electronics, but there aren’t naturally many things that Japan buys or needs from the U.S. This would cause exports from Japan to exceed imports from the U.S., which is being driven largely by consumer demand, not tariffs. However, the Trump administration is now assessing sizable tariffs against Japan to try to reduce the trade deficit. In effect, this approach either forces Japan to buy more goods from the U.S. or for the U.S. consumer to buy less goods imported from Japan - even those products are preferred for their quality over alternatives from other countries.

In a way, the Trump administration is trying to use a hammer to fix a problem that requires a screwdriver. In addition, it was recently pointed out on an analyst call that since the United States spends more than it makes, we are naturally going to run deficits with other countries because we're purchasing more than we produce as a country. If we are concerned with the U.S. trade deficits, and although tariffs may be a contributing factor, the lion’s share of the problem may be the U.S. just outspending what we produce each year.

Tariffs are Paralyzing the Global Economy

While we have seen the tariffs being implemented this week, just the threat of tariffs has a paralyzing impact on both the U.S. and global economy. Since there is so much at stake in the negotiation of these tariffs, it causes companies to put off purchasing decisions, hiring decisions, new construction, and encourages companies to sit on their cash, not knowing which direction the economy will go from here.

Not only do we need a pause, delay, or elimination of the tariff to stave off a recession, but it needs to happen within a reasonable period of time, because the reduction in spending by consumers and businesses during this wait-and-see approach is already reducing the GDP in Q2, which could push the QDP negative in Q2 and potentially Q3. Two consecutive quarters of negative GDP is a recession.

Delay In Building New Factories

While the Trump administration's main goal with the trade negotiations is to bring more manufacturing back to the United States, these are multibillion-dollar decisions for these publicly traded companies. For example, it’s estimated that if Apple were to move forward with building a new multi-billion facility in the U.S., it might take them 10 years to build it. The catalyst for building it in the first place would be to avoid having to pay the tariffs on iPhones that are being imported from China. But if you're Apple, do you commit to spending billions to build a new factory in the US when in 4 years there could be a change in the administration in Washington and then the tariffs could be removed, making it no longer prudent to produce hardware in the United States? These are the decisions that these big multinational companies face before pulling the trigger on bringing manufacturing back to the United States.

Labor Shortage

Another reasonable question to ask is if all these manufacturing jobs come back to the United States, do we have enough workers to hire in the U.S. to run those factories? The unemployment rate in the U.S. is 4.2%, which is well below the 6% historical trend. With the Trump administration greatly limiting immigration into the U.S., it’s difficult to pinpoint where all these additional workers would come from within the U.S.

The Fed is Stuck

The Fed is stuck between a rock and a hard place. Normally, when there is weakness in the U.S. economy, the Fed will step in and begin lowering interest rates. However, tariffs are inflationary, so if the Fed begins reducing rates to help the economy while prices are moving higher because of the tariffs, it could result in another round of hyperinflation like we saw coming out of COVID. This may cause the Fed to stay on pause, meaning the markets may not receive any immediate help from the Fed in the near future.

Tax Reform

There is also the argument to be made that weakening the U.S. economy may allow larger tax cuts to be passed with the anticipation of the Trump tax cuts that are currently working their way through Congress. While this may very well be true, again, it’s a timing issue. Tax reform is a slow-moving animal, and even in the best-case scenario, we may not see the tax reform passed until August 2025 or later, but by then the U.S. economy could already be in a recession if the tariff issues are not resolved.

Waiting For the Recovery

The economy is truly balancing on the edge of a knife right now. An announcement at any moment from the Trump administration indicating a pause or reduction of the tariff could make the last few weeks just a bad dream. But it’s not just that relief happens, but that the U.S. economy likely needs to receive that relief soon to avoid too much damage from happening due to the economic paralysis in the interim. There are very few moments in history where so much is riding on policy coming out of Washington that it becomes difficult to predict which path the U.S. economy will follow in coming weeks and months. This is truly a situation where investors will have to assess the data each day and what the developing trends in the economic data are to determine whether or not changes should be made to their asset allocation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What impact are the new tariffs having on the U.S. economy?

The expanded tariffs are slowing economic growth by increasing costs for consumers and businesses, reducing global trade activity, and creating uncertainty that discourages companies from spending, hiring, or expanding operations. This “wait-and-see” approach can quickly lead to lower GDP growth and higher recession risk.

Why are markets reacting so strongly to the trade war?

Markets dislike uncertainty, and tariffs directly affect corporate profits, global supply chains, and consumer confidence. Investors fear prolonged trade tensions could lead to slower global growth and reduced earnings, which often triggers broad market selloffs.

What is the “cliff effect” of the tariff policy described in the article?

The Trump administration’s tariffs are being applied not only based on existing foreign tariffs but also on overall trade deficits. This means U.S. tariffs may be disproportionately large against countries where Americans buy more goods than they sell—amplifying economic strain and retaliation risk.

Could the Federal Reserve lower interest rates to help offset the tariffs?

The Fed faces a dilemma. Normally it would cut rates to support a weakening economy, but tariffs are inflationary, raising the price of imported goods. Lowering rates in an inflationary environment could risk accelerating price increases, limiting the Fed’s ability to act.

Can tax reform help offset the negative impact of tariffs?

Potential tax cuts could stimulate growth, but legislative changes take time. Even if new reforms are passed in 2025, they may arrive too late to prevent a short-term slowdown or recession caused by ongoing trade tensions.

What would trigger a market recovery?

A policy shift from Washington—such as pausing, reducing, or eliminating tariffs—could quickly restore confidence and drive a rebound in the markets. However, if relief is delayed, prolonged uncertainty could continue to weigh on both markets and economic growth.

Why are global companies hesitant to move manufacturing back to the U.S.?

Relocating production requires massive, long-term investments, and policy uncertainty makes it difficult for companies to commit. With tight labor markets and limited immigration, finding enough skilled workers to staff new factories in the U.S. also poses a challenge.

Trump’s Reciprocal Tariff: Renegotiating with the World

Yesterday, April 2, 2025, President Trump announced new tariffs, referred to as “reciprocal tariffs,” against more than 180 countries simultaneously. Both the magnitude of the tariffs and the number of countries against which they will be levied far exceeded market expectations. This raises new concerns for investors regarding how these new tariff policies will impact the US economy, both in the short term and long term.

While policy can be debated regarding whether or not the new tariffs will bring positive long-term change to the US economy, we believe that additional risk may lie in the method by which the new policy is being implemented. As we have seen in business many times, the right strategy, executed the wrong way, can lead to unexpected negative outcomes.

Yesterday, April 2, 2025, President Trump announced new tariffs, referred to as “reciprocal tariffs,” against more than 180 countries simultaneously. Both the magnitude of the tariffs and the number of countries against which they will be levied far exceeded market expectations. This raises new concerns for investors regarding how these new tariff policies will impact the U.S. economy, both in the short-term and long-term.

While policy can be debated on whether or not the new tariffs will bring positive long-term change to the U.S. economy, we believe that additional risk may lie in the method by which the new policy is being implemented. As we have seen in business many times, the right strategy, executed the wrong way, can lead to unexpected negative outcomes.

Separating Policy from Politics

As an investment advisor, it’s often challenging to present emerging trends in the markets and economy without the message sounding political, especially when policy coming from Washington is driving the trends. When making investment decisions for portfolios, we have found it to be increasingly important to separate politics and policy, requiring us to leave any political biases at the door.

Many investors struggle with this concept because half the country supports Trump, while the other half can’t stand him, and it’s often difficult for investors to set aside their personal and political biases when making prudent investment decisions. Admittedly, we are living in a time when it has never been more difficult to accomplish this, yet being able to separate the two has never been more important. A true challenge for both investors and investment advisors alike.

Trump’s Reciprocal Tariff Plan

Trump presented in his announcement yesterday that these are not just baseless tariffs, but rather reciprocal tariffs based on the current tariffs that exist in these 180+ countries on U.S. goods imported. More specifically, the Trump administration conducted a “current tariff” calculation, with U.S. reciprocal tariffs equal to 50% of the tariff amounts being imposed on U.S. goods by those countries.

The overall aim of this policy is to create a more level playing field when it comes to trade with our various trading partners with the simple solution of, “you drop your tariffs on us, and we will drop our tariffs on you”.

On the surface, from a pure policy standpoint, it makes sense that if Japan is levying 40%+ tariffs on goods imported from the U.S., and the U.S., on average, is only imposing a 2.5% tariff on goods imported from Japan, why is that fair? (I’m just using these tariff percentages for example, the actual tariff amounts are different) By having these large tariff imbalances, it makes the goods produced in the U.S. more expensive when sold abroad, which ultimately hurts manufacturing in the U.S. and the U.S. labor that supports our manufacturing industry.

According to the Trump administration, this tariff imbalance has been in existence for 20+ years, and has been accepted as the norm, but they made a clear statement yesterday that the time has come to end this imbalance.

I can understand how a tariff imbalance between trading partners can add to the U.S. deficit since tariffs on our goods imposed by other countries make U.S. manufactured goods more expensive when sold abroad, but if we levy little to no reciprocating tariffs, goods produced by those countries that are imported into the U.S. do not face those same price hurdles from the U.S. consumer. With our government deficits spiraling out of control, taking steps to create a better balance between exports and imports, or at least encouraging the consumer to purchase more U.S.-made goods, probably makes sense in the long-term.

From a pure policy standpoint, we must acknowledge that new reciprocal tariffs, while they may create economic disruption in the short-term, they may also reset the global table on trade to set the U.S. economy on a more sustainable path to prosperity over the long term without having to continue to rely on rising government deficits to finance the trade imbalances.

Risk Exists in the Improper Execution of The Strategy

Only history will be able to tell us whether the new trade policy being implemented will be successful or not, but we have greater concern over the method by which the new policy is being implemented. If you have trade imbalances with over 180 countries that you are trying to resolve, is it prudent to attempt to renegotiate 20+ years of policy with more than 180 countries in one public announcement? What is the likelihood that by choosing this approach, agreements will be reached with all 180 countries within the next few weeks to avoid unnecessary harm to the U.S. economy? The chances are slim.

This is where we feel the risk lies as the negotiation process begins with all 180+ countries, because the timeline to resolution is a pivotal piece in determining the impact on the U.S. economy over the next six months. In the past, President Trump focused trade negotiations on just one or two countries at a time, which made it easier to resolve, delay, or negotiate down “trade wars” fairly quickly. Now, attempting to negotiate with 180 countries at once seems unrealistic. While the proposed solution—“You drop your tariffs on us, and we’ll drop ours on you”—sounds simple, it underestimates the complexity of these trade relationships as each country negotiates to protect its own economic interests.

Investment In the U.S. & Jobs

It was a little surreal yesterday seeing the head of the U.S. Auto Workers Union providing full support for a Republican president during the tariff announcement since historically the unions have aligned themselves with the Democratic party, but I think it highlights some of the pain that is being felt in places like Detroit for all of the off shoring of manufacturing and labor over the past 10 – 15 years. While there is real risk to these trade wars and real economic risk to the rapid rollout of these new policies, it may encourage a return of manufacturing to the U.S. with companies like Apple, Toyota, and Nvidia investing hundreds of billions of dollars to build facilities within the U.S. to avoid the assessment of the tariffs. Again, time will tell.

Allocation Shift

While the long-term outcome of these new trade policies is unknown, for investors with short- to medium-term time horizons, I think it’s important to acknowledge the near-term risks given the magnitude of the tariffs, the number of countries against which they are being levied, and the speed of the rollout, to determine how this new policy could impact the U.S. economy over the next 6 months.

With that said, this is not a “run for the hills” moment. We acknowledge at this point the additional challenges that these new reciprocal tariffs present, as well as the unknown timeline for resolving these tariffs with our 180+ trading partners. We will need to closely monitor the economic data over the next few weeks and months to assess its impact on labor markets, the U.S. consumer, the overall economy, and, if necessary, respond with allocation changes within client accounts.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What are President Trump’s new “reciprocal tariffs”?

Announced on April 2, 2025, the new “reciprocal tariffs” impose U.S. tariffs equal to 50% of the tariff rates that other countries currently apply to American goods. The goal is to level global trade conditions by encouraging foreign governments to reduce their tariffs on U.S. exports.

How many countries are affected by the new tariffs?

More than 180 countries are included in the reciprocal tariff plan. The unprecedented scope and simultaneous implementation have raised concerns about how quickly and effectively trade negotiations can be conducted with so many nations at once.

Why could the rollout of these tariffs be risky for the economy?

While the policy aims to strengthen U.S. manufacturing and reduce trade imbalances, implementing tariffs across so many countries at the same time may disrupt global trade flows, slow economic growth, and increase market volatility before new agreements are reached.

Could the tariffs encourage more manufacturing in the U.S.?

Possibly. Higher import costs may motivate global companies to invest in U.S. production to avoid paying tariffs. However, labor shortages, high costs, and policy uncertainty may slow or limit how much manufacturing actually returns to the U.S.

How might the new tariffs affect investors and markets?

In the short term, markets may face volatility as investors react to potential supply chain disruptions, higher consumer prices, and slower global growth. Long-term impacts will depend on how quickly and successfully the U.S. negotiates tariff reductions with other nations.

What should investors watch for in the coming months?

Key indicators include GDP growth, consumer spending, and labor market data. Signs of a slowdown could pressure policymakers to modify or delay tariff implementation, while positive trade progress could stabilize markets and improve investor sentiment.

Is this a reason to make immediate investment changes?

Not necessarily. While short-term risks have increased, long-term outcomes are still uncertain. Investors should focus on diversification, monitor economic data closely, and adjust portfolio allocations only if sustained economic or market weakness emerges.

The March Selloff – Trouble on the Surface

March was a tough month for the stock market, with the S&P 500 Index dropping by over 5% for the month. With the new “Liberation Day” tariffs going into effect on April 2nd, many investors are asking if the new tariffs and the recent stock market correction warrant a change in investment strategy. Will the selloff continue, or are we in store for a market rally in April?

In this article, we will share our market analysis, highlight key economic data points to watch as the new tariffs are rolled out, and answer the question: Do recent events warrant a change in investment strategy?

After conducting hundreds of client meetings over the past 90 days, I would best describe investors' overall sentiment as “emotionally charged.” There is a lot of fear, anxiety, and uncertainty, with no shortage of media headlines on a daily, and often hourly, basis. Historically, in the short term, the market is not a fan of this type of environment which may have been a significant contributor to the more than 5% selloff in the S&P 500 Index in March. However, if there is a lesson that I have learned over the past 20 years in the investment industry, it’s that emotions can easily lead to investors making irrational investment mistakes, with “fear” serving as the captain of that team.

That then begs the question, how do you know when fear is warranted versus when fear is a distraction? The answer: look at the data. Data is unemotional. Data often reveals what’s really happening in labor markets, the economy, consumer behavior, the historical impact of policies coming out of Washington, and more. Data also enables us to examine the historical trends of similar data in the past and use them to forecast potential outcomes in the future.

Today, I’ll be sharing with you the key data points that may help determine where the markets go from here.

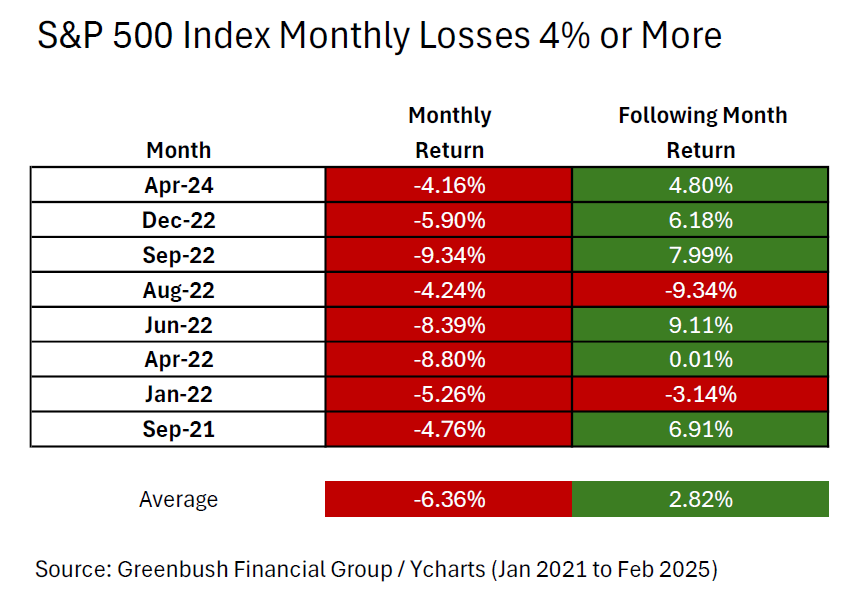

Data Point #1: 8

Prior to the recent 5%+ selloff in the S&P 500 Index in March, 8 is the number of times since January 2021 that the S&P 500 Index has dropped by more than 4% in a single month.

Data Point #2: -6.36%

For the 8 months that the S&P 500 Index dropped by over 4% in a single month between January 2021 and February 2025, -6.36% was the average monthly drop in the S&P 500 Index during that 8 month period. The S&P 500 was down 5.8% for the month of March.

Data Point #3: 6 of 8

Important next question: After the S&P 500 Index dropped by more than 4% in each of those months, did the losses historically continue, or did the market typically stage a recovery in the following month? In 6 of the 8 occurrences, the S&P 500 posted a positive return in the month following the 4%+ monthly drop.

Data Point #4: 2.82%

If we look at ALL eight 1-month periods following the month that the S&P 500 Index dropped by 4%+ in a single month, on average, the S&P 500 Index was up 2.82% in the following month.

Here is the chart with all the data for Data Points #1 through #4:

Trump 1.0 versus Trump 2.0

When President Trump announced the first round of tariffs in February 2025, we released an article comparing the market behavior we were seeing under Trump 2.0 versus the market trends and reactions to Trump’s policies during his first term (Trump 1.0).

Article: Trump Tariffs 2025 vs Trump Tariffs 2017

Again, more data. During Trump’s first term, he announced tariffs throughout the 4-year period, he signed waves of executive orders, there were multiple sizable sell-offs in the stock market, and market volatility remained high throughout his first four-year term. It was an “emotionally charged” environment similar to now. However, what we also pointed out in that article is that, ignoring the emotions, market volatility, and politics, the S&P 500 Index was up just over 16% annualized during the Trump 1.0 era.

Will history repeat itself? Since he just took office two months ago, we still need more time to collect the economic data to compare the trend. While we acknowledge that the tariffs being levied under Trump 2.0 are impacting more countries than those under Trump 1.0, the knee-jerk reaction from markets is similar today as to what we saw during Trump’s first term.

Tax Reform is Yet To Come

The news outlets right now are filled with headlines about new tariffs, federal employee layoffs, inflation risks, recession fears, and more. The one positive item that may be getting lost in the mix is that since the Republicans control Congress and the White House, there is a high probability that the Tax Cut and Jobs Act that were set to expire will get extended, and additional favorable tax provisions will most likely be passed either the second half of 2025 or in 2026.

Data Point #5: 5 of 7

Since 1945, Congress has passed 7 major tax reform bills. In 5 of the 7 years that major tax reform was passed, the S&P 500 Index posted a positive return for the year.

Data Point #6: 13.12%

If you total up the S&P 500 Index performance in each of the 7 years that tax reform was passed (both the positive and negative years), the S&P 500 Index averaged a 13.12% annual rate of return in the year that tax reform was passed by Congress. The explanation is easy: lower taxes means more money stays in the pockets of individuals and corporations, that money is then spent, and the U.S. is still largely a consumer-driven economy.

A special note here as well: if consumers and corporations have more money from lower taxes, that may help them weather some of the price increases resulting from the tariff activity.

Politics, Emotions, and Investing

March was a tough month for the markets. It’s never fun looking at a monthly statement following a 5.8% drop in the stock market. I shared with you today a few of the many data points that we are tracking across markets and the economy to assist our clients in making informed investment decisions that will enable them to meet their short-, medium-, and long-term financial objectives. In periods of heightened emotion, calm can often be found in looking beyond the politics and news headlines, and focusing on hard data and historical trends that can guide us in determining whether or not changes should be made to the asset allocation in client accounts.

Even after turning the page on a tough month for the market, we have yet to see a meaningful deterioration in the economic data within the economy. If the tariffs that are being implemented begin to have an significant impact on the economy, we would expect to see a meaningful rise in the unemployment rate as companies begin to lay off workers, a drop in manufacturing hours worked, a drop in new housing permits, and a steeper inversion of the yield curve, and we have yet to see a meaningful change in any of those data points.

It's also important to remember that one or two months of bad data is not a meaningful trend, and there is not a single indicator that, by itself, trips the alarm bells. Rather, it is a combination of multiple indicators over a multi-month period of time where meaningful trends develop and can be used in determining whether or not the current environment warrants a change in investment strategy.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Turning on Social Security Early? Keep Your Final Paystub to Avoid Penalties

Deciding to take Social Security benefits early can be a practical choice for many retirees, but it comes with potential challenges. One major consideration is the earned income penalty, which could reduce your benefits if you’re still earning income over a certain threshold. But there is a flaw in the Social Security system that sometimes incorrectly assesses the earned income penalty. When someone retires, oftentimes their income for the year is already above the $23,400 earned income threshold but very few retirees realize that if their social security benefit is not turned on until after they receive their final paycheck, the earned income penalty will not apply even though social security may attempt to assess the penalty anyways.

The good news? With proper planning and documentation, such as holding onto your final paystub, you can avoid unnecessary penalties and protect your benefits.

If you are planning to retire prior to your social security full retirement age, and you are also planning on turning on your social security benefits as soon as you retire, you have to be aware of a flaw in the social security system that may automatically prompt social security to attempt to assess an earned income penalty error against your social security benefit in the year that you retire.

Social Security Earned Income Penalty

If you elect to begin receiving Social Security benefits prior to your full retirement age, Social Security assesses a penalty against the Social Security benefits that you receive if your earned income exceeds a specific threshold. That limit in 2025 is $23,400. If you have earned income over $23,400, and you file for social security benefits prior to your FRA, social security will assess a penalty equal to $1 for every $2 over the $23,400 threshold.

For example, Scott retires at age 63; his full retirement age for Social Security is 67, but he elects to file for Social Security benefits as soon as he retires. Scott continues to work part-time and makes $35,000. Since Scott’s income is $11,600 over the $23,400 threshold, social security will assess a $5,800 penalty against Scott’s social security benefit in the following year.

Social security does not assess the penalty by requesting a check from Scott, instead, if Scott was receiving $2,000 per month in Social Security, then the following year they would withhold 3 months of social security payments from Scott, totaling $6,000 to cover the penalty, and then Scott’s monthly benefit would resume after the penalty months have been assessed.

Note: Social security does not withhold partial months for the penalty; if $100 is still owed in the penalty and the monthly SS benefit is $2,400, social security will withhold the full $2,400 monthly benefit to assess the final $100 penalty amount owed.

Flaw In Assessment of Social Security Income Penalty

There is a common flaw in the assessment of the Social Security earned income penalty in the year that an individual retires because it’s a common occurrence that prior to an individual actually retiring, they may have already earned more than the $23,400 income threshold with their employer prior to turning on their social security benefits. Will they be doomed and have to pay the SS penalty, or is there a way to appeal the earned income penalty in these cases?

Thankfully, it’s the latter of the two. In the year that you retire, if you stop working and then turn on your social security benefits AFTER you have stopped working, the income earned prior to the month that you turned on your social security benefits is ignored for purposes of the social security earned income penalty.

For example, Jen, age 64, works for ABC Company from January – May, and then fully retires May 30, 2025. Between January – May, Jen had a W-2 income of $40,000, well above the $23,400 SS earned income threshold. However, since Jen did not turn on her social security benefits until June, after she had received her final paycheck from ABC Company, the $40,000 in W-2 that she earned prior to turning on her SS does not count toward the $23,400 income penalty threshold.

However, here is the flaw. Social Security has no idea when Jen stopped working during the year. All social security knows is that Jen turned on her social security prior to her full retirement age, and according to her tax return filed in that year, her earned income was over the $23,400 threshold. Due to this flaw, we coach clients by saying, “expect social security to attempt to assess the earned income penalty, but keep your final pay stub which shows the date of your final payroll and the total W-2 amount, which should be the amount of earned income that was reported on your tax return”. It may also be helpful to obtain a letter from your employer verifying your final date of employment and the total W-2 income earned at the time of separation from service.

Individuals Who Retire but Then Work Part-time

There are situations where individuals retire from their primary career, turn on Social Security after receiving their final paycheck, but then later in that calendar year they work part-time or start a business that produces income. There is a special assessment of the Social Security earned income penalty for these individuals. The income earned prior to turning on their social security benefit is still ignored, but assuming that their income exceeds the $23,400 threshold before they retire, social security allows these individuals to continue to collect their social security benefit without penalty as long as:

Their monthly income received does not exceed $1,950 ($23,400 divided by 12 months) …..AND

The individual did not perform substantial services in self-employment. The definition of substantial services means devoting more than 45 hours a MONTH to the business or between 15 – 45 hours to a business in a highly skilled occupation.

Exceeding either of the thresholds listed above will trigger the penalty.

Full Retirement Age – No Income Limits

Once you have reached FRA (full retirement age) for Social Security, the earned income penalty no longer applies. You can then earn as much as you want in earned income, and the Social Security earned income penalty will not apply.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the Social Security earned income penalty?

If you begin receiving Social Security benefits before reaching your full retirement age (FRA) and continue to earn income from work, the Social Security Administration may reduce your benefit. In 2025, the income limit is $23,400. For every $2 you earn above that amount, $1 of your Social Security benefits is withheld.

How does Social Security apply the penalty?

Social Security doesn’t send you a bill. Instead, it withholds full months of future benefit payments until the penalty amount is repaid. For example, if your penalty is $5,800 and your monthly benefit is $2,000, Social Security would withhold three full months of benefits ($6,000 total).

What happens if I retire mid-year and already earned more than the limit?

If you stop working and turn on your Social Security benefits after retirement, your earnings from earlier in the same year do not count toward the $23,400 limit. However, because Social Security’s system doesn’t automatically know when you stopped working, it may incorrectly assess a penalty.

How can I appeal an incorrect earned income penalty?

Keep your final pay stub showing your last paycheck date and total W-2 income, and ask your former employer for a letter verifying your final date of employment. You can use these documents to appeal the penalty and demonstrate that your income occurred before you began receiving benefits.

Can I work part-time after turning on Social Security before full retirement age?

Yes, but limits still apply. As long as you earn less than $1,950 per month (the monthly equivalent of $23,400 per year) and do not perform “substantial services” in self-employment (more than 45 hours per month, or 15–45 hours in a highly skilled field), your benefits will not be reduced.

What happens once I reach full retirement age (FRA)?

Once you reach FRA, the earned income penalty no longer applies. You can earn as much income as you want without any reduction in your Social Security benefits.

Why is the earned income penalty considered a flaw?

The flaw arises because Social Security’s system uses annual income data from tax filings without knowing when during the year the income was earned. This often causes the system to mistakenly flag retirees who stopped working mid-year as exceeding the income limit, even when they are not subject to the penalty.

How To Protect A Roth IRA from the Medicaid Spenddown Process

Safeguarding a Roth IRA from the Medicaid spenddown process has long been a challenge for individuals preparing for long-term care. Unlike other assets, Roth IRAs cannot be owned by trusts, and their lack of required minimum distributions (RMDs) has historically left them vulnerable under Medicaid rules. However, a groundbreaking strategy recently developed in New York provides new hope for preserving the full value of these important retirement accounts. By voluntarily initiating RMDs on Roth IRAs, individuals can now protect these accounts from being depleted entirely during Medicaid qualification.

Topics Covered in This Article:

Challenges of Protecting Roth IRAs

The Role of Irrevocable Trusts

Understanding the Medicaid Spenddown Process

Voluntary RMDs for Roth IRAs

New York’s Innovative Strategy

Individuals often use Irrevocable Trusts or Medicaid Trusts to protect assets from future long-term care events. However, it’s historically been challenging to protect Roth IRAs from the Medicaid spenddown process due to the fact that:

Roth IRAs cannot be owned by a trust

Roth IRAs do not have an RMD requirement

It’s especially problematic with the rise in popularity of processing Roth Conversions in retirement to take advantage of lower tax rates, reduce future RMDs, and pass more Roth dollars onto the next generation, which is arguably the most valuable type of asset to inherit. Not only are Roth IRAs inherited tax free, but the beneficiary can earn investment returns within that Inherited Roth IRA for another 10 years before receiving the full account balance tax free.

Things have also gotten better for residents of New York with Roth IRAs because the full balance of a Roth IRA may no longer be subject to the Medicaid spenddown process, thanks to a new strategy from our friends in the trust and estate arena.

A Trust Cannot Own Roth IRAs

While trusts can be set up to own brokerage accounts, real estate, and checking accounts, one of the long-standing challenges associated with protecting a Roth IRA is that an individual cannot transfer ownership of an IRA to a trust. This obstacle has not changed, but another workaround to this limitation has surfaced.

No RMD Requirement for Roth IRAs

One of the advantages of a Roth IRA over a Traditional IRA is that a Roth IRA does not have a Required Minimum Distribution (RMD) requirement. For traditional IRAs and other pre-tax retirement accounts, individuals born after 1960 are required by the IRS to begin RMDs at age 75 and continue them annually thereafter. This is a way for the IRS to collect some income tax on all the tax-deferred balances in these pre-tax retirement accounts.

Roth IRAs do not have an RMD requirement, which is viewed as an advantage, except when it comes to a long-term care event and the Medicaid spenddown process.

When an individual experiences a long-term care event, Medicaid tallies up all of that individual’s “countable assets” to determine how much needs to be spent on their care before Medicaid will start picking up the tab. Traditional IRAs are not considered a “countable asset,” but the annual required minimum distributions (RMDs) from traditional IRAs are considered income that must be applied to that individual's cost of care.

For example, Jim has a $300,000 brokerage account and a $800,000 traditional IRA. He sets up an Irrevocable Trust to own his brokerage account, makes it past the 5-year look-back period, and then has a long-term care event at age 83 that requires him to enter a nursing home. The brokerage account is completely protected, not subject to spending down. However, the Traditional IRA has a $800,000 balance, still owned by Jim, and he is receiving a $45,000 per year RMD. Instead of Jim having to spend down the entire IRA account, he just needs to commit the $45,000 RMD towards his care, and Medicaid will cover the remaining expenses. Using this strategy, Jim has been able to preserve both his $300,000 brokerage account and his $800,000 Traditional IRA, less the annual required minimum distributions (RMDs), for his children.

Roth IRA Voluntary RMD

Historically, Roth IRAs have been considered a “countable asset” for purposes of the Medicaid spenddown process in New York because there is no RMD requirement to covert that countable asset into an income stream. Recently, however, professionals in the trust and estate arena have successfully protected Roth IRAs from the Medicaid spenddown process by voluntarily turning on RMD distributions from the Roth IRA account, even though RMDs are not required from Roth IRAs, and Medicaid has accepted this approach.

For example, Sarah has a $300,000 Roth IRA that would normally be subject to the Medicaid spenddown process. Sarah has a long-term care event, and her power of attorney contacts the custodian of the Roth IRA and instructs them to begin annual distributions from the Roth IRA based on the IRS RMD table. The voluntary Roth RMD amount will be counted toward Sarah’s income threshold for purposes of Medicaid and eventually applied towards the cost of her care. Now that Sarah has converted the Roth IRA to a retirement income stream, Medicaid no longer requires Sarah to fully spend down the balance in the Roth IRA before submitting her Medicaid application.

Disclosure: I am a Certified Financial Planner, not a trust and estate attorney. The information in this article was obtained through firsthand experience consulting with trust and estate attorneys in New York, as well as with clients who have undergone the Medicaid application process. For legal advice, please consult an attorney. Additionally, note that Medicaid rules vary from state to state. If you live outside of New York, the Medicaid rules in your state may vary from the rules covered in this article, which are specific to New York.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why are Roth IRAs difficult to protect from Medicaid spenddown?

Roth IRAs traditionally pose a challenge in Medicaid planning because they cannot be owned by a trust and have no Required Minimum Distribution (RMD) requirement. Without mandatory distributions converting the account into income, Medicaid typically treats the full Roth IRA balance as a “countable asset,” subject to spenddown before benefits begin.

Can a trust own a Roth IRA?

No. Federal tax law prohibits transferring ownership of an IRA—Roth or traditional—to a trust during the owner’s lifetime. This limitation prevents direct trust ownership of Roth IRAs as a Medicaid protection strategy.

Why don’t Roth IRAs have RMDs, and why does that matter for Medicaid?

Roth IRAs are not subject to RMDs during the account owner’s lifetime, which is normally an advantage for tax planning and estate growth. However, for Medicaid purposes, this lack of required distributions means the full account balance is considered a countable asset, unlike traditional IRAs, where only annual RMD income is counted.

What is the new “voluntary RMD” strategy for Roth IRAs in New York?

In New York, some estate attorneys have successfully used a new strategy that involves voluntarily initiating RMD-style distributions from a Roth IRA. By doing this, the Roth IRA produces income that Medicaid counts toward the individual’s care costs. In turn, the principal balance of the Roth IRA is no longer treated as a spendable asset.

How does the voluntary RMD approach work?

The power of attorney or account owner instructs the Roth IRA custodian to calculate and distribute annual withdrawals using the IRS RMD life expectancy table. Medicaid recognizes these withdrawals as income, allowing the Roth IRA itself to remain intact.

Does this strategy apply outside of New York?

Medicaid rules vary by state. The voluntary RMD approach has been accepted in New York, but other states may treat Roth IRAs differently. It’s important to consult a local elder law or trust and estate attorney before implementing this strategy.

Why would someone want to preserve a Roth IRA from Medicaid spenddown?

Roth IRAs are among the most valuable assets to pass to heirs because they grow tax-free and can continue to accumulate returns for up to 10 years after inheritance. Protecting Roth balances from Medicaid spenddown helps preserve this tax-free wealth for the next generation.

Should I speak to an attorney before using this strategy?

Yes. While financial planners can coordinate Medicaid and investment strategies, only a qualified trust and estate attorney can provide legal advice specific to Medicaid eligibility and trust structures.

Can You Break an Irrevocable Trust?

Irrevocable trusts are powerful tools for long-term care planning and asset protection, but what happens when you need to access those locked-away assets?

Our latest article, Can You Break an Irrevocable Trust?, dives deep into the options available if you find yourself in this situation. Learn about key topics like:

The strict limitations on accessing the trust principal

The grantor's rights to trust income

Pros and cons of adding a gifting provision to your trust

Revoking a trust – Full or partial

Changing the trust investment objective to generate more income for the grantor

Tax trap of realized gains within grantor irrevocable trusts

Whether you’re planning your estate, serving as a trustee, or navigating Medicaid rules, this comprehensive guide is packed with expert insights you shouldn’t miss.

Individuals will frequently set up an Irrevocable Trust and then transfer ownership of various assets, such as brokerage accounts, savings accounts, and real estate, into the trust to protect those assets from the Medicaid spenddown process in the event of a future long-term care need. As a part of the planning process, it is typically recommended that individuals only transfer assets into the trust that they will not need to access in order to meet future expenses. But what happens when someone realizes they have transferred too much into their trust, and they now need access to that asset? The options may be very limited.

Limited Access to Irrevocable Trust Assets

The primary reason that setting up an Irrevocable Trust, also known as a Medicaid Trust, can be an effective way to protect assets from a future long-term care event, is the “grantor” (the person giving the assets to the trust), it essentially giving away the ownership of that asset to their Irrevocable Trust. By transitioning ownership away from the grantor, if a long-term care event occurs, those assets do not need to be “spent down” for the grantor to qualify for Medicaid for the purpose of paying the costs associated with their long-term care.

In order for this strategy to work, the irrevocable trust has to limit the grantor’s access to the “principal” of the trust assets. In other words, if, as the grantor, you gift $100,000 into your Irrevocable Trust, you are not allowed to touch that $100,000 for the remainder of your life since you have “irrevocably” gifted those assets to your trust.

Grantors Typically Have Access to Trust Income

While the grantor is unable to access trust principal, most grantors of irrevocable trusts give the grantor access to any “income” generated by their trust. If the trust is holding investments, income refers to only the dividends and interest and does not include the “appreciation” in the trust assets, which is still considered principal.

Example: Sue gifts $200,000 in cash to her irrevocable trust, and then invests that $200,000 in stocks, bonds, CDs, and mutual funds. Over the course of the first year, the value of the trust grew from $200,000 to $220,000; $5,000 of that growth was dividends and interest, and the other $15,000 was the appreciation in the value of the investment holdings. If Sue’s trust document grants her access to the income generated by the trust assets, she would be allowed to withdraw the $5,000 in dividends and interest. However, she would not have access to the $200,000 initial investment or the $15,000 in gains from the appreciation of the underlying investment holdings, only the income from dividends and interest is available to the grantor.

Rules Vary from Trust to Trust

But what if the income is not enough? What if something has happened that now requires Sue, in the example above, to get access to $100,000 of the cash that she contributed to her Irrevocable Trust? The answer lies in the provisions that are built within Sue’s trust document.

This trust document governs what can and cannot be done with assets owned by the trust. Since trust and estate attorneys often take different approaches when drafting trust documents, the options are NOT UNIFORM for all irrevocable trusts. The grantor must work with the attorney drafting the trust to determine what fail-safes, if any, will be built into the trust document.

Gifting Rights

The trust document can voluntarily allow the trustee, who may or may not be the same person as the grantor, to make gifts from the principal of the trust to the trust’s beneficiaries. The grantor is typically not a beneficiary of the trust. A common scenario is a parent, or parents, are the grantor(s), fund the trust and select one of their children to serve as trustee (who oversees the trust assets), and then the beneficiaries of the trust are all of the children of the grantor(s).

If the trustee is given gifting powers, the trustee could gift cash directly from the trust to the grantor's children, and then the children could voluntarily turn around and gift cash back to their parents to cover expenses or pay expenses on their parents' behalf.

This is where trust documents vary as well. Some trusts, even with gifting power, do not allow the beneficiaries to make cash gifts back to the grantors, and in those cases, the kids (beneficiaries) have to pay the expenses directly on behalf of their parents (grantor), such as rent, medical expenses, roof, etc., without the parents every coming into contact with the cash that was distributed from the trust to the kids.

Caution: A note of caution when adding gifting powers to a trust. If you give the trustee the power to make gifts from the trust assets, you must 200% trust the person that you have selected to serve as your trustee. As financial planners, we have unfortunately seen a few cases of trustees abusing their gift powers, and it’s not a pretty sight.

Revoking A Trust

The trust document may also permit a full or partial revocation of the trust assets, resulting in the dissolution of the trust and the return of the trust assets to the grantor. Often, when a trustee seeks to revoke all or a portion of the trust assets, it requires the approval of all the trust beneficiaries. For example, if there are three children, and one of them is money-hungry and does not want to see their inheritance go back to their parents and be spent, they may be able to stop the trust revocation process by simply not agreeing to the revoke the trust assets.

Partial Versus Full Revoke

Some trusts allow a partial revocation of trust assets, while other trust documents only permit a full revocation if approved by the trust’s beneficiaries. Partial revocation can be an attractive option because it allows some of the trusts principal to be returned to the grantor, but any assets that remain in the irrevocable trust will continue to be protected from future long-term care events, assuming the trust has satisfied the Medicaid lookback period.

For example, parents fund a trust with $400,000 in cash, and 10 years after the trust is established, an unexpected medical event occurs requiring them to pay $50,000 which they don’t have. If the trust allows a partial revocation of the trust assets, the trustees and beneficiaries could agree to revoke $50,000 of the trust assets, return them to the parents, and the remaining $350,000 stays protected in the irrevocable trust.

However, we have seen trust documents that only allow a full revocation, which then makes it an all-or-nothing decision.

Change Trust Investment Strategy to Generate More Income

We have encountered situations where the trust document does not permit gifts, and it does not allow for partial or full revocation of the trust assets - so what options are left?

From a return of trust principal standpoint, the grantors may be out of luck, however, since most grantor irrevocable trusts give the grantors access to “income” generated by the trust assets, the grantors may be able to work with their trustee to change the investment holdings within the trust to produce more dividends and interest income. For example, if the trust was holding mostly growth stocks that do not pay dividends, the trustee could work with the trust's investment advisor to reallocate the portfolio to stocks and bonds that produce more dividend and interest income, which can then be distributed to the grantors to cover their personal expenses.

Tax Note: When reallocating irrevocable trust accounts, the trustee must be cautious of the taxable realized gains that arise from selling investments in the trust that have significantly appreciated in value. Since most of these Medicaid trusts are set up as “grantor” trusts, even though the grantor does not have access to the principal of the trust, the grantor is typically responsible for paying any tax liability generated by the trust assets. In other words, if the trust generates a significant tax liability from trade activity, the grantor may be required to pay that tax liability without being able to make a distribution from the trust assets.

Disclosure: I’m a Certified Financial Planner, not a trust and estate attorney. The information in this article was gathered through my firsthand interaction with trusts and our clients. This information is for educational purposes only. For legal advice, please contact an attorney.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What happens if I need access to assets that I transferred into an Irrevocable Trust?

Once assets are transferred into an Irrevocable (Medicaid) Trust, the grantor gives up ownership and access to the trust’s principal. In most cases, the only funds the grantor can access are the dividends and interest income generated by the trust. Access to principal is extremely limited and depends entirely on the language in the trust document.

Can the grantor of an Irrevocable Trust access the trust principal?

Typically, no. The primary reason assets inside an Irrevocable Trust are protected from Medicaid spenddown is that the grantor gives up access to the principal. Allowing the grantor to withdraw trust principal would jeopardize the protection of those assets from long-term care costs.

Can I receive income from an Irrevocable Trust?

Yes. Most Irrevocable Trusts permit the grantor to receive income generated by the trust, such as dividends and interest. However, capital gains and appreciation of trust assets are considered principal and remain off-limits to the grantor.

Can my trustee gift trust assets back to me?

Some trust documents include “gifting powers” that allow the trustee to make gifts to the trust’s beneficiaries, often the grantor’s children. Those beneficiaries can then use that money to pay the grantor’s expenses directly (but not give cash back to the grantor). Whether this is allowed depends on how the trust was drafted, so it’s essential to review the trust document.

What if my trust doesn’t allow gifting or revocation?

If neither gifting powers nor revocation clauses exist in the trust, the grantor cannot access the trust principal. However, the trustee may be able to adjust the trust’s investment strategy to generate more income, such as shifting from growth-oriented investments to dividend- and interest-paying assets, which can be distributed to the grantor.

Can an Irrevocable Trust be revoked or dissolved?

Some Irrevocable Trusts allow for full or partial revocation if all beneficiaries agree. A partial revocation allows specific amounts to be returned to the grantor, while the remaining balance stays protected. In other cases, only a full revocation is permitted, which would eliminate the trust’s Medicaid protection entirely.

What are the risks of allowing gifting powers or revocation rights in a trust?

Granting these powers requires a high level of trust in your chosen trustee and beneficiaries. Trustees with gifting authority could misuse or mismanage assets. Similarly, any ability to revoke or withdraw assets could weaken the trust’s Medicaid protection if not handled properly.

What are the tax implications of changing a trust’s investments?

Most Medicaid Irrevocable Trusts are “grantor trusts,” meaning the grantor pays income taxes on any investment activity within the trust. If the trustee sells appreciated investments to reallocate the portfolio, the grantor may owe taxes on the realized gains—even though they cannot withdraw funds from the trust to pay the tax bill.

Why is it important to work with an attorney when setting up or modifying a trust?

Trust provisions vary widely by attorney and state. Small drafting differences can determine whether the grantor can access income, allow partial revocation, or protect assets from Medicaid. Always consult a qualified trust and estate attorney before making or relying on any changes.

Mandatory 401(k) Roth Catch-up Details Confirmed by IRS January 2025

IRS Issues Guidance on Mandatory 401(k) Roth Catch-up Starting in 2026

Starting January 1, 2026, high-income earners will face a significant shift in retirement savings rules due to the new Mandatory Roth Catch-Up Contribution requirement. If you earn more than $145,000 annually (indexed for inflation), your catch-up contributions to 401(k), 403(b), or 457 plans will now go directly to Roth, rather than pre-tax.

The IRS just released guidance in January 2025 regarding how the new mandatory Roth catch-up provisions will work for high-income earners. This article dives into everything you need to know!

On January 10, 2025, the IRS issued proposed regulations that provided much-needed clarification on the details associated with the Mandatory Roth Catch-up Contribution rule for high-income earners that are set to take effect on January 1, 2026. Employers, payroll companies, and 401(k) providers alike will undoubtedly be scrambling for the remainder of 2025 to get their systems ready for this restriction that will be placed on 401(k) plans starting in 2026.

This is a major change within 401(k) plans, and it is not a welcome change for high-income earners, since individuals in high tax brackets typically like to defer as much as they can pre-tax into 401(k), 403(b), and 457 plans to reduce their current tax liability. Here’s a quick list of the items that will be covered in this article:

General overview of new mandatory 401(k) Roth Catch-up Requirement

Income threshold for employees that will be impacted by the new rule

Definition of “wages” for purposes of the income threshold

Will it apply to Simple IRA plans as well?

“First year of employment” exception for the new Roth rule

Will a 401(k) plan be required to adopt Roth deferrals prior to 1/1/26?

401(k) Mandatory Roth Catch-up Contributions

When an employee reaches age 50, they can make an additional employee deferral called a catch-up contribution. Prior to 2026, all employees were allowed to select whether they wanted to make their catch-up contributions in pre-tax, Roth, or a combination of both. Starting in 2026, the freedom of choice will be taken away from W-2 employees that have more than $145,000 in wages in the prior calendar year (indexed for inflation).

Employees that are above the $145,000 threshold for the previous calendar year, are with the SAME employer, and are age 50 or older, will not be given the option to make their catch-up in pre-tax dollars. If an employee over this wage threshold wishes to make a catch-up contribution to their qualified retirement plan (401K, 403b, 457b), they will only be given the Roth deferral option.

Definition of Wages

One of the big questions that surfaced when the Secure Act 2.0 regulations were first released regarding the mandatory Roth catch-up contribution was the definition of “wages” for the purpose of the $145,000 income threshold. The IRS confirmed in their new regulation that only wages subject to FICA tax would count towards the $145,000 threshold. This is good news for self-employed individuals such as sole proprietors and partnerships that have earnings that are more than the $145,000 threshold, but do not receive W-2 wage, allowing them to continue to make their catch-up contributions all pre-tax for years 2026+.

So essentially, you could have partners of a law firm making $500,000+, and they would be able to continue to make catch-up contributions all pre-tax, but the firm could have a W-2 attorney on their staff that makes $180,000 in wages, and that individual would be forced to make their catch-up contributions all in Roth dollars and pay income tax on those amounts.

Will Mandatory Roth Catch-up Apply to Simple IRA Plans?

Many small employers sponsor Simple IRA plans, which also allow employees aged 50 or older to make pre-tax catch-up contributions, but at lower dollar limits. Fortunately, Simple IRA plans have been granted a pass by the IRS when it comes to the new mandatory Roth catch-up contributions. All employees that are covered by a Simple IRA plan, regardless of their wages, will be allowed to continue to make their catch-up contributions, all pre-tax, for tax years 2026+.

First Year of Employment Exception

Since the $145,000 wage threshold is based on an employee’s “prior year” wages, the IRS confirmed in the new regulations that an employer is allowed to give employees a pass on making pre-tax catch-up contributions during the first calendar year that the company employs them. Meaning, if Sue is hired by Company ABC in February of 2025 and makes $250,000 from February – December in 2025, she would be allowed to contribute her 401(k) catch-up contributions all pre-tax if she is over 50 years old, since Sue doesn’t have wages with Company ABC in 2024, even though her wages for the 2025 were over the $145,000 threshold.

Some High-Income Employees Will Get A 2-Year Pass

There are also situations where new employees with wages over $145,000 will get a 2-year pass on the application of the mandatory Roth catch-up rule. Let’s say Tim is hired by a law firm as a W-2 employee on July 1, 2025, at an annual salary of $200,000. Tim automatically gets a pass for 2025 for the mandatory Roth catch-up, because he did not have wages in 2024 with that company. However, between July 1, 2025 – December 31, 2025, he will only earn half his salary ($100,000), so when they look at Tim’s W-2 wages for purposes of the mandatory Roth catch-up in 2026, his 2025 W-2 will only be showing $100,000, allowing him to make his catch-up contribution all pre-tax in both 2025 and 2026.

Will 401(k) Plans Be Forced to Adopt Roth Deferrals

Not all 401(k) or 403(b) plans allow employees to make Roth employee deferrals. Roth deferrals have historically been an optional provision within an employer-sponsored retirement plan that a company had to voluntarily adopt. When the regulations for the new mandatory Roth catch-up were first released, the regulations seemed to state that if a plan did not allow Roth deferrals, NO EMPLOYEES, regardless of their wage level, were allowed to make catch-up contributions to the plan.

In the proposed regulations that the IRS just released, the IRS clarified that if a retirement plan does not allow Roth deferrals, only the employees above the $145,000 wage threshold would be precluded from making contributions. Employees below the $145,000 wage threshold would still be able to make catch-up contributions pre-tax, even without the Roth deferral feature in the plan.

Due to this restriction, it is expected that if a plan did not previously allow Roth deferrals, many plans will elect to adopt a Roth deferral option by January 1, 2026, to avoid this restriction on their employees with wages in excess of $145,000 (indexed for inflation).

For more information on this new Mandatory Roth Catch-Up Contribution effective 2026, please see our article: https://www.greenbushfinancial.com/all-blogs/roth-catch-up-contributions-high-wage-earners-secure-act-2

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new Mandatory Roth Catch-Up Contribution rule?