Rules for Using A 529 Account To Repay Student Loans

When the Secure Act passed in 2019, a new option was opened up for excess balances left over in 529 accounts called a “Qualified Loan Repayment” option. This new 529 distribution option allows the owner of a 529 to distribute money from a 529 account to repay student loans for the beneficiary of the 529 account AND the beneficiary’s siblings. However, this distribution option is not available to everyone, and there are rules and limits associated with these new types of distributions.

When the Secure Act passed in 2019, a new option opened up for excess balances left over in 529 accounts called a “Qualified Loan Repayment” option. This new 529 distribution option allows the owner of a 529 to distribute money from a 529 account to repay student loans for the beneficiary of the 529 account AND the beneficiary’s siblings. However, this distribution option is not available to everyone, and there are rules and limits associated with these new types of distributions.

State Level Restrictions

While the Secure Act made this option available at the Federal level, it’s important to understand that college 529 programs are sponsored at the state level, and the state’s allowable distribution options can deviate from what’s allowed at the Federal Level. For example, specific to this Qualified Loan Repayment option, the Secure Act began allowing these at the Federal Level in 2019, but New York did not recognize these as “qualified distributions” from a 529 account until just recently, in September of 2024.

So, if an owner of a NYS 529 account processed a distribution from the account and applied that amount toward a student loan taken by the beneficiary of the account, it often triggered negative tax events such as having to pay state income tax and a 10% penalty on the earnings portion of the distribution, as well as a recapture of the state tax deduction that was given from the contributions to the 529 account. Fortunately, some states like New York are beginning to change their 529 programs to more closely match the options available at the Federal level, but you still have to check the distribution rules in the state that the account owner lives in before processing distributions from a 529 to repay student loans for the account beneficiary and/or their siblings.

$10,000 Lifetime Limit

There are limits to how much you can withdraw from a 529 account to apply toward a student loan balance. Each BORROWER has a $10,000 lifetime limit for qualified student loan repayment distributions. It’s an aggregate limit per child. So, if the child has multiple 529 accounts that they are the beneficiary of, it’s an aggregate limit of $10,000 between all of their 529 accounts. This is true even if the 529 accounts have different owners. For example, if the parents have a 529 account for their child with a $30,000 balance and the grandparents have a 529 account for the same child with a $10,000 balance, there’s an aggregate limit of $10,000 between both 529 accounts, meaning parents cannot take a $10,000 distribution and apply it toward the child’s student loan balance, and then the grandparents distribute an additional $10,000 to apply to that same child’s outstanding student loan balance.

Sibling Student Loan Payments

In addition to being able to distribute $10,000 from the 529 and apply it towards the account beneficiary's outstanding student loans, the account owner can also distribute up to $10,000 for each sibling of the 529 account beneficiary and apply that toward their outstanding student loan balance. The definition of siblings includes sisters, brothers, stepbrothers, and stepsisters.

Parent Plus Loans

If the parents took out Parent Plus Loans to help pay for their child’s college, after distributing $10,000 to repay student loans in their child’s name, they could then change the beneficiary on the 529 to themselves and distribute $10,000 to repay any outstanding Parent Plus loans taken in the parent’s name since the parent is considered a different “borrower”.

Most but Not All Student Loans Qualify

Most Federal and private student loans qualify for repayment under this special 529 distribution option. However, there is additional criteria to make sure a private student loan qualifies for repayment. The list is too long to include in this article, but just know if you plan to take a distribution from a 529 account to repay a private student loan, additional research is required.

Forfeiting Student Loan Interest Tax Deduction

If a distribution is made from a 529 account and applied toward a student loan, it may limit the taxpayer’s ability to deduct the student loan interest when they file their taxes. The student loan interest deduction is currently $2,500 per year. Whether or not the distribution from the 529 will limit or eliminate the $2,500 tax deduction will depend on how much of the 529 distribution was made to repay the student loans cost basis versus earnings.

Example: If a parent distributes $10,000 from their child’s 529 account and applies it toward their outstanding student loan balance, and $6,000 of the $10,000 was cost basis (what the parent originally contributed to the 529) and $4,000 was earnings, the earnings portion of the distribution is applied against the $2,500 student loan tax deduction amount. So, any distributions made from a 529 to repay a student loan with earnings equal to or greater than $2,500 would completely eliminate the student loan tax deduction for that year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the 529 Qualified Loan Repayment option?

The Qualified Loan Repayment option allows 529 plan owners to use funds from a 529 account to repay student loans for the account’s beneficiary and the beneficiary’s siblings. This provision was introduced under the Secure Act in 2019.

Are all states required to allow 529 loan repayment distributions?

No. While the Secure Act allows these distributions at the federal level, each state determines whether they qualify as tax-free distributions under its own rules. For example, New York did not recognize these as qualified distributions until September 2024. Before that, loan repayments from a 529 could trigger state income tax, penalties, and loss of prior deductions.

What is the lifetime limit for 529 loan repayment distributions?

Each borrower has a $10,000 lifetime limit for student loan repayments made using 529 funds. This is an aggregate limit per borrower across all 529 accounts, even if the accounts are owned by different people.

Can 529 funds be used to pay a sibling’s student loans?

Yes. Up to $10,000 can be distributed for each sibling of the 529 account beneficiary to repay their student loans. Siblings include brothers, sisters, stepbrothers, and stepsisters.

Can 529 funds be used to repay Parent PLUS loans?

Yes. After using $10,000 for the child’s student loan, the 529 owner can change the beneficiary to themselves and take another $10,000 distribution to repay Parent PLUS loans in their own name.

Do all student loans qualify for repayment with 529 funds?

Most federal and private student loans qualify. However, private loans must meet specific IRS criteria to be eligible. Account owners should verify loan eligibility before making a 529 distribution for private student loans.

How does using a 529 to pay loans affect the student loan interest deduction?

Using 529 funds to repay student loans may reduce or eliminate eligibility for the $2,500 annual student loan interest deduction. The portion of a 529 distribution that represents earnings (not contributions) is counted against this deduction. For example, if $4,000 of a $10,000 529 distribution represents earnings, the full $2,500 deduction could be lost for that tax year.

Top 10: Little-Known Facts About 529 College Savings Accounts

While 529 college savings accounts seem relatively straightforward, there are a number of little-known facts about these accounts that can be used for advanced wealth planning, tax strategy, and avoiding common pitfalls when taking distributions from these college savings accounts.

While 529 college savings accounts seem relatively straightforward, there are a number of little-known facts about these accounts that can be used for advanced wealth planning, tax strategy, and avoiding common pitfalls when taking distributions from these accounts.

1: Roth Transfers Will Be Allowed Starting in 2024

Starting in 2024, the IRS will allow direct transfers from 529 accounts to Roth IRAs. This is a fantastic new benefit that opens up a whole new basket of multi-generation wealth accumulation strategies for families.

2: Anyone Can Start A 529 Account For A Child

Do you have to be the parent of the child to open a 529 account? No. 529 account can be opened by parents, grandparents, aunts, or friends. Even if a parent has already established a 529 for their child there is no limit to the number of 529 accounts that can be opened for a single beneficiary.

3: State Tax Deduction For Contributions

There are currently 38 states that offer either state tax deductions or tax credits for contributions to 529 accounts. Here is the list. There are no federal tax deductions for contributions to 529 accounts. Also, you don’t have to be the parent of the child to receive the state tax benefits.

4: A Tax Deduction For Kids Already In College

For parents that already have kids in college, if you have not already established a 529 account and you are issuing checks for college tuition, for states that offer tax deductions for contributions, you may be able to open a 529 account, contribute to the account up to the state tax deduction limit, and as soon as the check clears, request a distribution to pay the college expenses. This allows you to capture the state tax deduction for the contributions to the account in that tax year.

5: Rollovers Count Toward State Tax Deduction

If you just moved to New York and have a 529 with another state, like Vermont, you are allowed to roll over the balance of the Vermont 529 account into a New York 529 account for the same beneficiary and those rollover amounts count toward the state tax deduction for that year. We had a New York client that had a Vermont 529 for their daughter with a $30,000 balance, and we had them rollover $10,000 per year over a 3-year period to capture the maximum NYS 529 state tax deduction of $10,000 each year.

6: Not All States Allow Distributions for K – 12 Tuition Expenses

In 2018, the federal government changes the tax laws allowing up to $10,000 to be distributed from a 529 account each year to pay for K – 12 tuition expenses. However, if you live in a state that has state income taxes, states are not required to adopt changes that are made at the federal level. There are a number of states, including New York, that do not recognize K – 12 tuition expenses as qualified expenses so the earnings portion of those withdrawals would be subject to state income tax and recapture of the tax deductions that were awarded for those contributions.

7: Transfers Between Beneficiaries

529 rules can vary state by state but most 529 accounts allow account owners to transfer all or a portion of balances between 529 account with different beneficiaries. This is common for families that have multiple children and a 529 account for each child. If the oldest child does not use their full 529 balance, all or a portion of their 529 account can be transferred the 529 accounts of their younger siblings.

8: Contributions Can Be Withdrawn Tax and Penalty Free

If you ever need to withdraw money from a 529 account that is not used for qualified college expenses, ONLY the earnings are subject to taxes and the 10% penalty. The contributions that you made to the account can always be withdrawn tax and penalty-free.

9: 529 Accounts May Reduce College Financial Aid

The balance in a 529 account that is owned by the parent of the student counts against the FAFSA calculation. Fortunately, assets of the parents only count 5.64% against the financial aid award, so if you have a $50,000 balance, it may only reduce the financial aid award by $2,820. However, 529 accounts owned by a grandparent or another relative, are invisible to the FAFSA calculation.

10: Maximum Balance Restrictions

529 plans do not have annual contribution limits but each state has “aggregate 529 plan limits”. These limits apply to the total 529 balances for any single 529 beneficiary in a particular state. Once the combined 529 plan balances for that beneficiary reach a state’s aggregate limit, no additional contributions can be made to any 529 plan administered by that state. Luckily, the limits for most states are very high. For example, the New York limit is $520,000 per beneficiary.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Can 529 plan funds be rolled into a Roth IRA?

Yes. Starting in 2024, the IRS allows direct transfers from 529 plans to Roth IRAs under certain conditions. This rule lets unused education savings continue growing tax-free for retirement, offering families a powerful long-term wealth planning opportunity.

Who can open a 529 plan for a child?

Anyone—not just parents—can open a 529 plan for a child. Grandparents, relatives, and even family friends can establish and contribute to an account. Multiple 529 plans can exist for the same beneficiary, allowing flexible savings options across family members.

Do 529 plan contributions qualify for tax deductions?

There is no federal tax deduction for 529 plan contributions, but 38 states currently offer a state income tax deduction or credit. You don’t need to be the child’s parent to claim the state tax benefit if you are the account owner making the contribution.

Can parents claim a 529 deduction if their child is already in college?

Yes. In many states, parents can open and fund a 529 account, then immediately use the funds to pay qualified college expenses. This strategy captures a same-year state tax deduction while paying existing tuition bills.

Do 529 rollovers from another state qualify for tax deductions?

Often, yes. Some states, such as New York, allow rollovers from out-of-state 529 plans to count toward the annual state tax deduction limit, provided the funds remain for the same beneficiary.

Are K–12 tuition payments allowed from a 529 plan?

Federal law permits up to $10,000 per year in 529 withdrawals for K–12 tuition, but not all states recognize this as a qualified expense. In states that don’t, earnings may be subject to state income tax and potential deduction recapture.

Can 529 funds be transferred between children?

Yes. Most 529 plans allow tax-free transfers between siblings or other qualifying family members. This flexibility helps families reallocate unused education funds among multiple children.

What happens if 529 funds are used for non-education expenses?

Withdrawals of contributions are always tax- and penalty-free. However, earnings withdrawn for non-qualified expenses are subject to ordinary income tax and a 10% federal penalty.

Do 529 plans affect college financial aid eligibility?

Yes, but the impact is small. Parent-owned 529 assets count as parental resources on the FAFSA and reduce aid eligibility by only 5.64% of the account’s value. 529 plans owned by grandparents are not reported on FAFSA but may affect aid when distributions are made.

Is there a maximum amount you can save in a 529 plan?

While there’s no annual contribution limit, states impose aggregate balance limits per beneficiary, typically exceeding $400,000. For example, New York’s limit is $520,000 per student, after which no additional contributions can be made.

529 to Roth IRA Transfers: A New Backdoor Roth Contribution Strategy Is Born

With the passing of the Secure Act 2.0, starting in 2024, owners of 529 accounts will now have the ability to transfer up to $35,000 from their 529 college savings account directly to a Roth IRA for the beneficiary of the account. While on the surface, this would just seem like a fantastic new option for parents that have money leftover in 529 accounts for their children, it is potentially much more than that. In creating this new rule, the IRS may have inadvertently opened up a new way for high-income earners to move up to $35,000 into a Roth IRA, creating a new “backdoor Roth IRA contribution” strategy for high-income earners and their family members.

With the passing of the Secure Act 2.0, starting in 2024, owners of 529 accounts will now have the ability to transfer up to $35,000 from their 529 college savings account directly to a Roth IRA for the beneficiary of the account. While on the surface, this would just seem like a fantastic new option for parents that have money leftover in 529 accounts for their children, it is potentially much more than that. In creating this new rule, the IRS may have inadvertently opened up a new way for high-income earners to move up to $35,000 into a Roth IRA, creating a new “backdoor Roth IRA contribution” strategy for high-income earners and their family members.

Money Remaining In the 529 Account for Your Children

I will start by explaining this new 529 to Roth IRA transfer provision using the scenario that it was probably intended for; a parent that owns a 529 account for their children, the kids are done with college, and there is still a balance remaining in the 529 account.

The ability to shift money from a 529 account directly to a Roth IRA for your child is a fantastic new distribution option for balances that may be leftover in these accounts after your child or grandchild has completed college. Prior to the passage of the Secure Act 2.0, there were only two options for balances remaining in 529 accounts:

Change the beneficiary on the account to someone else

Process a non-qualified distribution from the account

Both options created potential challenges for the owners of 529 accounts. For the “change the beneficiary option”, what if you only have one child, or what if the remaining balance is in the youngest child’s account? There may not be anyone else to change the beneficiary to.

The second option, processing a “non-qualified distribution” from the 529 account, if there were investment earnings in the account, those investment earnings are subject to taxes and a 10% penalty because they were not used to pay a qualified education expense.

The “Roth Transfer Option” not only gives account owners a third attractive option, but it’s so attractive that planners may begin advising clients to purposefully overfund these 529 accounts with the intention of processing these Roth transfers after the child has completed college.

Requirements for 529 to Roth IRA Transfers

Before I get into explaining the advanced tax and wealth accumulation strategies associated with this new 529 distribution option, like any new tax law, there is a list of rules that you have to follow to be eligible to process these 529 to Roth IRA transfers.

The 15 Year Rule

The first requirement is the 529 account must have been in existence for at least 15 years to be eligible to execute a Roth transfer from the account. The clock starts when you deposit the first dollar into that 529 account. The planning tip here is to fund the 529 as soon as you can after the child is born, if you do, the 529 account will be eligible for Roth IRA transfers by their 15th or 16th birthday.

There is an unanswered question surrounding rollovers between state plans and this 15-year rule. Right now, you are allowed to rollover let’s say a Virginia 529 account into a New York 529 account. The question becomes, since the New York 529 account is a new account, would that end up re-setting the 15-year inception clock?

Contributions Within The Last 5 Years Are Not Eligible

When you go to process a Roth transfer from a 529 account, contributions made to the 529 account within the previous 5 years are not eligible for Roth transfers.

The Beneficiary of the 529 Account and the Owners of the Roth IRA Must Be The Same Person

A third requirement is the beneficiary listed on the 529 account and the owner of the Roth IRA account must be the same person. If your daughter is the beneficiary of the 529 account, she would also need to be the owner of the Roth IRA that is receiving the transfer directly from the 529 account. There is a big question surrounding this requirement that we still need clarification on from the IRS. The question is this: Is the account owner allowed to change the beneficiary on the 529 account without having to re-satisfy a new 15-year account inception requirement?

If they allow beneficiary changes without a new 15-year inception period, with 529 accounts, the account owner can change the beneficiary on these accounts to whomever they want……..including themselves. This would allow a parent to change the beneficiary to themselves on the 529 account and then transfer the balance to their own Roth IRA, which may not be the intent of the new law. We will have to wait for guidance on this.

No Roth IRA Income Limitations

As many people are aware, if you make too much, you are not allowed to contribute to a Roth IRA. For 2023, the ability to make Roth IRA contributions begins to phase out at the following income levels:

Single Filer: $138,000

Married Filer: $218,000

These transfers directly from 529 accounts to the beneficiary’s Roth IRA do not carry the income limitation, so regardless of the income level of the 529 account owner or the beneficiary, there a no maximum income limit that would preclude these 529 to Roth IRA transfers from taking place.

The IRA Owner Must Have Earned Income

With exception of the Roth IRA income phaseout rules, the rest of the Roth RIA rules still apply when determining whether or not a 529 to Roth IRA transfer is allowed in a given tax year. First, the beneficiary of the 529 (also the owner of the Roth IRA) needs to have earned income in the year that the transfer takes place to be eligible to process a transfer from the 529 to their Roth IRA.

Annual 529 to Roth IRA Transfer Limits

The amount that can be transferred from the 529 to the Roth IRA is also limited each year by the regular Roth IRA annual contribution limits. For 2023, an individual under the age of 50, is allowed to make a Roth IRA contribution of up to $6,500. That is the most that can be moved from the 529 account to Roth IRA in a single tax year. But in addition to this hard dollar limit, you have to also take into account any other Roth IRA contributions that were made to the IRA owner’s account and the IRA owners earned income for that tax year.

The annual contribution limit to a Roth IRA for 2023 is actually the LESSER of:

$6,500; or

100% of the earned income of the account owner

Assuming the IRA contribution limits stay the same in 2024, if a child only has $3,000 in income, the maximum amount that could be transferred from the 529 to the Roth IRA in 2024 is $3,000.

If the child made a contribution of their own to the Roth IRA, that would also count against the amount that is available for the 529 to Roth IRA transfer. For example, the child makes $10,000 in earned income, making them eligible for the full $6,500 Roth IRA contribution, but if the child contributes $2,000 to their Roth IRA throughout the year, the maximum 529 to Roth IRA transfer would be $4,500 ($6,500 - $2,000 = $4,500)

The IRA limits could be the same or potentially higher in 2024 when this 529 to Roth IRA transfer option goes into effect.

$35,000 Limiting Maximum Per Beneficiary

The maximum lifetime amount that can be transferred from a 529 to a Roth IRA is $35,000 for each beneficiary. Given the annual contribution limits that we just covered, you would not be allowed to just transfer $35,000 from the 529 to the Roth IRA all in one shot. The $35,000 lifetime limit would be reached after making multiple years of transfers from the 529 to the Roth IRA over a number of tax years.

Advanced 529 Planning Strategies Using Roth Transfers

Now I’m going to cover some of the advanced tax and wealth accumulation strategies that may be able to be executed under this 529 Roth Transfer provision. Disclosure, writing this in February 2023, we are still waiting on guidance from the IRS on what they may or may not have intended with this new 529 to Roth transfer option that becomes available starting in 2024, so their guidance could either reinforce that these strategies can be used or limit the use of these advanced strategies. Time will tell.

Super Funding A Roth IRA For Your Child

While 529 accounts have traditionally been used to save exclusively for future college expenses for your children or grandchild, they just become much more than that. Parents and grandparents can now fund these accounts when a child is young with the pure intention of NOT using the funds for college but rather creating a supercharged Roth IRA as soon as that child begins earning income in their teenage years and into their 20s.

This is best illustrated in an example. You have a granddaughter that is born in 2023, you open a 529 account for her and fund it with $15,000. By the time your granddaughter has reached age 18, let’s assume through wise investment decisions, the account has tripled to $45,000. Between ages 18 and 21, she works a summer job making $8,000 in earned income each year and then gets a job after graduating college making $80,000 per year. Assuming she made no contributions to a Roth IRA over the years, you would be able to make transfers between her 529 account and her Roth IRA up to the annual contribution limit until the total transfers reached the $35,000 lifetime maximum.

If that $35,000 lifetime maximum is reached when she turns age 24, assuming she also makes wise investment decisions and earns 8% per year on her Roth IRA until she reaches age 60, at age 60 she would have $620,000 in that Roth IRA account that could be withdrawal ALL TAX-FREE.

Now multiply that $620,000 across EACH of your children or grandchildren, and it becomes a truly fantastic way to build tax-free wealth for the next generation.

529 Backdoor Roth Contribution Strategy

A fun fact, there are no age limits on either the owner or beneficiary of a 529 account. At the age of 40, I could open a 529 account, be the owner and the beneficiary of the account, fund the account with $15,000, wait the 15 years, and then when I turn age 55, begin processing transfers directly from the 529 to my Roth IRA up to the maximum annual IRA limit each year until I reach my $35,000 lifetime limit.

I really don’t care that the money has to sit in the 529 for 15 years because 529 accumulate tax deferred anyways, and by the time I hit age 59.5, making me eligible for tax-free withdrawal of the earnings, I will have already moved most of the balance over to my Roth IRA. Oh and remember, even if you make too much to contribute directly to a Roth IRA, the income limits do not apply to these 529 to Roth IRA direct transfers.

The IRS may have inadvertently created a new “Backdoor Roth IRA Contribution” strategy for high-income earners.

Now there may be some limitations that can come into play with the age of the individual executing this strategy, it’s really less about their age, and more about whether or not they will have earned income 15 years from now when the 529 to Roth IRA transfer window opens. If you are 65, fund a 529, and then at age 80 want to begin these 529 to Roth IRA transfers, if you have no earned income, you can process these 529 to Roth IRA transfers because you are limited by the regular IRA annual contribution limits that require you to have earned income to process the transfers.

Advantage Over Traditional Backdoor Roth Conversions

For individuals that have a solid understanding of how the traditional “Backdoor Roth IRA Contribution” strategy works, the new 529 to Roth IRA transfer strategy potentially contains additional advantages over and above the traditional backdoor Roth strategy. These movements from the 529 to Roth IRA are not considered “conversions”, they are considered direct transfers. Why is that important? Under the traditional Backdoor Roth Contribution strategy the taxpayer is making a non-deductible contribution to a traditional IRA and then processes a conversion to a Roth IRA.

One of the IRS rules during this conversion process is the “aggregation rule”. When a Roth conversion is processed, the taxpayer has to aggregate all of their pre-tax IRA balance together in determining how much of the conversion is taxable, so if the taxpayer has other pre-tax IRAs, it came sometimes derail the backdoor Roth contribution strategy. If they instead use the 529 to Roth IRA direct transfer processes, since as of right now it is not technically a “conversion”, the aggregate rule is avoided.

The second big advantage is with the 529 to Roth IRA transfer strategy, the Roth IRA is potentially being funded with “untaxed earnings” as opposed to after-tax dollar. Again, in the traditional Backdoor Roth Strategy, the taxpayer is using after-tax money to make a nondeductible contribution to a Traditional IRA and then converting those dollars to a Roth IRA. If instead the taxpayer funds a 529 with $15,000 in after-tax dollars, but during the 15-year holding, The account grows the $35,000, they are then able to begin direct transfers from the 529 to the Roth IRA when $20,000 of that account balance represents earnings that were never taxed. Pretty cool!!

State Tax Deduction Clawbacks?

There are some states, like New York, that offer tax deductions for contributions to 529 accounts up to annual limits. When the federal government changes the rules for 529 accounts, the states do not always follow suit. For example, when the federal government changed the tax laws allowing account owners to distribute up to $10,000 per year for K – 12 qualified expenses from 529 accounts, some states, like New York, did not follow suit, and did not recognize the new “qualified expenses”. Thus, if someone in New York distributed $10,000 from a 529 for K – 12 expenses, while they would not have to pay federal tax on the distribution, New York viewed it as a “non-qualified distribution”, not only making the earnings subject to state taxes but also requiring a clawback of any state tax deduction that was taken on the contribution amounts.

The question becomes will the states recognize these 529 to Roth IRA transfers as “qualified distributions,” or will they be subject to taxes and deduction clawbacks at the state level? Time will tell.

Waiting for Guidance From The IRS

This new 529 to Roth IRA transfer option that starts in 2024 has the potential to be a tremendous tax-free wealth accumulation strategy for not just children but for individuals of all ages. However, as I mentioned multiple times in the article, we have to wait for formal guidance from the IRS to determine which of these advanced wealth accumulation strategies will be allowed from tax years 2024 and beyond.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

What is the new 529 to Roth IRA transfer rule under the Secure Act 2.0?

Starting in 2024, owners of 529 college savings accounts can transfer up to $35,000 over their lifetime from a 529 directly to a Roth IRA for the account’s beneficiary. This gives families a new tax-free way to repurpose unused education savings.

What are the main requirements for a 529 to Roth IRA transfer?

The 529 account must be at least 15 years old, and contributions made within the last 5 years cannot be transferred. The 529 beneficiary and the Roth IRA owner must be the same person, and the beneficiary must have earned income in the year of transfer.

How much can be transferred each year?

Transfers are subject to the annual Roth IRA contribution limit—currently $6,500 per year (or less if earned income is lower). It may take several years to reach the $35,000 lifetime transfer cap.

Do income limits apply to 529 to Roth IRA transfers?

No. These transfers are not subject to Roth IRA income phaseouts, meaning high-income earners can use this rule even if they’re normally ineligible to contribute directly to a Roth IRA.

Can parents use this rule as a backdoor Roth IRA strategy?

Potentially. If future IRS guidance allows changing a 529 beneficiary to oneself without restarting the 15-year clock, high-income earners could fund their own Roth IRAs using this method—creating a new type of “backdoor Roth” strategy.

Are there potential state tax implications?

Yes. Some states may not treat 529-to-Roth transfers as qualified distributions, which could trigger state taxes or clawbacks of prior state tax deductions.

When will the IRS provide more guidance on this rule?

The IRS is expected to issue clarifications before the rule takes effect in 2024. Guidance will determine whether advanced strategies—like beneficiary changes or state conformity—are allowed.

Grandparent Owned 529 Accounts Just Got Better

A 529 account owned by a grandparent is often considered one of the most effective ways to save for college for a grandchild. But in 2023, the rules are changing………

A 529 account owned by a grandparent is often considered one of the most effective ways to save for college for a student. Mainly because 529 accounts owned by the grandparents are invisible to the college financial aid calculation (FAFSA) when determining the financial aid package that will be awarded to a student. But there is a little-known pitfall about distributions from grandparent owned 529 accounts but thankfully the rules have changed. In this article, we will review:

Advantages of grandparent owned 529 accounts

The FAFSA pitfall of distributions from grandparent owned 529 accounts

The FAFSA two-year lookback period

The change to the 529 rules

Tax deductions for contributions to 529 accounts

What if your grandchild does not go to college?

Paying K – 12 expenses with a 529 account

Pitfall of Grandparent Owned 529 Accounts

Historically, there has been a major issue when grandparents begin distributing money out of these 529 accounts to pay college expenses for their grandchildren which can hurt their financial aid eligibility. While these accounts are invisible to the FAFSA calculation as an asset, in the year that the distribution takes place from a grandparent owned 529 account, those distributions did count as “income of the student” in the year that the distribution takes place. Income of the student counts heavily against the need-based financial aid award. Currently, any income of the student above the $9,410 threshold counts 50% against the financial aid award.

For example, if a grandparent distributes $30,000 from the 529 account to pay college expenses for the grandchild, in that determination year, assuming the child has no other income, that distribution could reduce the financial aid award two years later by $11,480.

FAFSA Two-Year Lookback

FAFSA has a two-year lookback for purposes of determining income in the EFC calculation (expected family contribution), so the family doesn’t realize the misstep until two years later. For example, if the distribution takes place in the fall of the student’s freshman year, the financial aid package would not be reduced until the fall of their junior year.

Since we are aware of this income two-year lookback rule, the workaround has been to advise grandparents not to distribute money from the 529 accounts until the spring of their sophomore year. If the child graduates in four years by the time they are submitting the FAFSA application for their senior year, that determination year that 529 distribution took place is no longer in play.

Quick Note: All of this only matters if the student qualifies for need-based financial aid. If the student, through their parent’s FAFSA application, does not qualify for any need-based financial aid, then the impact of these distributions from the grandparent owned 529 accounts is irrelevant because they were not receiving any financial aid anyways.

New Rules Starting in 2023

But the rules have changed starting in 2023 to make these grandparent owned 529 accounts even more advantageous. Under the new rules, distribution from grandparent owned 529 account will no longer count as income of the student. These 529 accounts owned by the grandparents are now completely invisible to the FAFSA calculation for both assets and income, which makes them even more valuable.

Tax Deduction For 529 Contributions

There can also be tax benefits for grandparents contributing to 529 accounts for their grandkids. Certain states allow state income tax deductions for contributions up to a certain thresholds. In New York State, there is a $5,000 state tax deduction for single filers and a $10,000 deduction for joint filers each tax year. The amounts vary from state to state and some states have no deduction, so you have to do your homework.

What If The Grandchild Does Not Go To College?

What happens if you fund this 529 account for your grandchild but then they decide not to go to college? There are a few options here. The grandparent can change the beneficiary of the account to another grandchild or family member. The second option, you can just take a distribution of the account balance. If the balance is distributed but it’s not used for college expenses, the contribution amounts are returned tax and penalty-free but the earnings portion of the account is subject to ordinary income taxes and a 10% penalty since it wasn’t used for qualified college expenses.

K - 12 Qualified Expenses

The federal government made changes to the tax rules in 2017 which also allow up to $10,000 per year to be distributed from 529 accounts for K - 12 expenses. If you have grandchildren that are attending a private k -12 school, this is another way for grandparents to potentially capture a tax deduction, and help pay those expenses.

However, and this is very important, while the federal government recognizes the K – 12 $10,000 per year as a qualified distribution, the states which sponsor these 529 plans may not adhere to those same rules. In fact, in New York State, not only does New York not recognize K – 12 expenses as “qualified expenses” for purposes of distributions from a 529 account, but these nonqualified withdrawals also require a recapture of any New York State tax benefits that have accrued on the contributions. Double ouch!! These rules vary state by state so you have to do your homework before paying K – 12 expenses out of a 529 account.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Frequently Asked Questions (FAQs):

Why are grandparent-owned 529 accounts beneficial for college savings?

Grandparent-owned 529 accounts are not counted as assets in the FAFSA financial aid calculation, which can help maximize a student’s eligibility for need-based aid. Starting in 2023, distributions from these accounts are also excluded from the student’s income calculation, making them completely invisible to FAFSA.

What was the previous FAFSA pitfall with grandparent 529 distributions?

Before 2023, when grandparents made distributions from a 529 account to pay for college expenses, those withdrawals were considered “income of the student.” Since student income counts heavily against financial aid, these distributions could significantly reduce need-based aid two years later.

What changed with the FAFSA rules in 2023?

Under the new FAFSA rules, distributions from grandparent-owned 529 accounts are no longer treated as income to the student. This change eliminates the previous penalty and makes these accounts one of the most favorable tools for college funding.

Can grandparents receive tax benefits for 529 contributions?

Yes. Many states, including New York, offer state income tax deductions for contributions. In New York, the deduction is up to $5,000 for single filers or $10,000 for joint filers. Rules and deduction limits vary by state, so it’s important to review your state’s specific guidelines.

What happens if the grandchild doesn’t attend college?

If the grandchild doesn’t use the 529 funds for education, the account owner can change the beneficiary to another family member or withdraw the funds. Contributions can be withdrawn tax- and penalty-free, but earnings are subject to income tax and a 10% penalty if not used for qualified education expenses.

Can 529 funds be used for K–12 tuition?

Federally, up to $10,000 per year can be used for K–12 tuition expenses. However, not all states recognize K–12 expenses as qualified distributions. For example, New York does not and requires recapture of prior state tax deductions if K–12 withdrawals are made.

Are grandparent 529 distributions still reported on the FAFSA?

No. Beginning in 2023, both the value of grandparent-owned 529 accounts and any distributions from them are excluded from FAFSA’s financial aid calculation, eliminating the previous two-year lookback issue.

Potential investors of 529 plans may get more favorable tax benefits from 529 plans sponsored by their own state. Consult your tax professional for how 529 tax treatments and account fees would apply to your particular situation. To determine which college saving option is right for you, please consult your tax and accounting advisors. Neither APFS nor its affiliates or financial professionals provide tax, legal or accounting advice. Please carefully consider investment objectives, risks, charges, and expenses before investing. For this and other information about municipal fund securities, please obtain an offering statement and read it carefully before you invest. Investments in 529 college savings plans are neither FDIC insured nor guaranteed and may lose value.

Understanding FAFSA & How To Qualify For More College Financial Aid

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students to understand:

How is college financial aid calculated?

Are there ways to increase the amount of financial aid you can receive?

What are the income and asset thresholds where financial aid evaporates?

Understanding the FAFSA 2 Year Lookback Rule

The difference between financial aid at public colleges vs private colleges

In this article we will provide you with guidance on these topics as well as introduce strategies that we as financial planners use with our clients to help them qualify for more financial aid.

How is college financial aid calculated?

Too often we see families jump to the incorrect assumption that “I make too much to qualify for financial aid.” Depending on what your asset and income picture looks like there may be strategies that will allow you to shift assets around during the financial aid determination years to qualify for need based financial aid. But you first need to understand how need based financial aid is calculated.

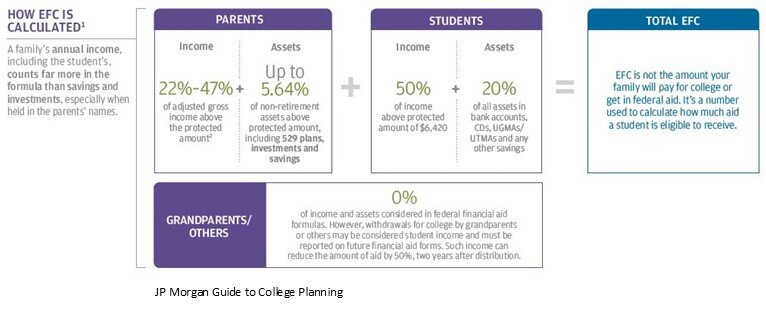

The Department of Education has a formula to calculate your “Expected Family Contribution” (EFC). The Expected Family Contribution is the amount that a family is expected to pay out of pocket each year before financial aid is awarded. Here is the general formula for financial aid:

It’s pretty simple and straight forward. Cost of the college, minus the EFC, equals the amount of your financial aid award. Now let’s breakdown how the EFC is calculated

Expected Family Contribution (EFC) Calculation

Both the parent’s income and assets, as well as the student’s income and assets come into play when calculating a family’s EFC. But they are weighted differently in the formula. Let’s look at the parent’s income and assets first.

Parent’s Income & Assets

Parents Income: The parent’s income is one of the largest factors in the EFC calculation. The percentage of the parents income that counts toward the EFC calculation is expressed as a range between 22% - 47% because it depends on a number of factors such as household size and the number of children that you have attending college at the same time.

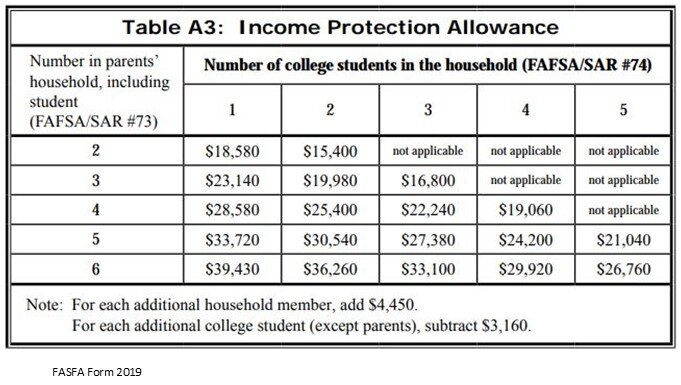

However, there is an “Income Protection Allowance” that allows parents to shelter a portion of their income from the formula based on the household size and the number of children attending college. See that chart below for the 2019-2020 FAFSA form:

Parents Assets: Any assets owned by the parents of the student are multiplied by 5.64% and that amount counts towards the EFC. Here are a few assets that are specifically EXCLUDED from this calculation:

Retirement Accounts: 401(k), 403(b), IRA’s, SEP, Simple

Pensions

Primary Residence

Family controlled business (less than 100 employees and 51%+ ownership by parents)

On the opposite side of that coin, here is a list of some assets that are specifically INCLUDED in the calculation:

Balance in 529 accounts

Real estate other than the primary residence

Even if held in an LLC – Reported separately from “business assets”

Non-retirement investment accounts, savings account, CD’s

Trusts where the student is a beneficiary of the trust (even if not entitled to distributions yet)

Business interest (less than 51% family owned by parents or more than 100 employees)

Similar to the Income Allowance Table, there is also a Parents’ Asset Protection Allowance Table that allows them to shelter a portion of their countable assets from the EFC formula. See the table below for the 2019-2020 school year.

Student’s Income & Assets

Now let’s switch gears over to the student side of the EFC formula. The income and the assets of the student are weighted differently than the parent’s income and assets. Here is the student side of the EFC formula:

As you can clearly see, income and assets in the student’s name compared to the parent name will dramatically increase the Expected Family Contribution and in turn decrease the amount of financial aid awarded. It is because of this, that as a general rule, if you think your asset and income picture may qualify you for financial aid, do not put assets in the name of your child. The most common error that we see people make are assets in an UGMA or UTMA account. Even though parents control those accounts, they are technically considered an asset of the child. If there is $30,000 sitting in an UTMA account for the student, they are automatically losing around $6,000 EACH YEAR in financial aid. Multiply that by 4 years of college, it ends up costing the family $24,000 out of pocket that otherwise could have been covered by financial aid.

EFC Formula Illustration

If we put all of the pieces together, here is an illustration of the full EFC Formula:

Grandparent Owned 529 Plans For The Student

As you will see in the EFC formula above, assets owned by the grandparents with the student listed as the beneficiary, like 529 accounts, are not counted at all toward the EFC calculation. This can be a very valuable college savings strategy for families since the parent owned 529 accounts count toward the Expected Family Contribution. However, there are some pitfalls and common mistakes that we have seen people make with regard to grandparent owned 529 accounts. See the article below for more information specific to this topic:

Article: Common Mistakes With Grandparent Owned 529 Accounts

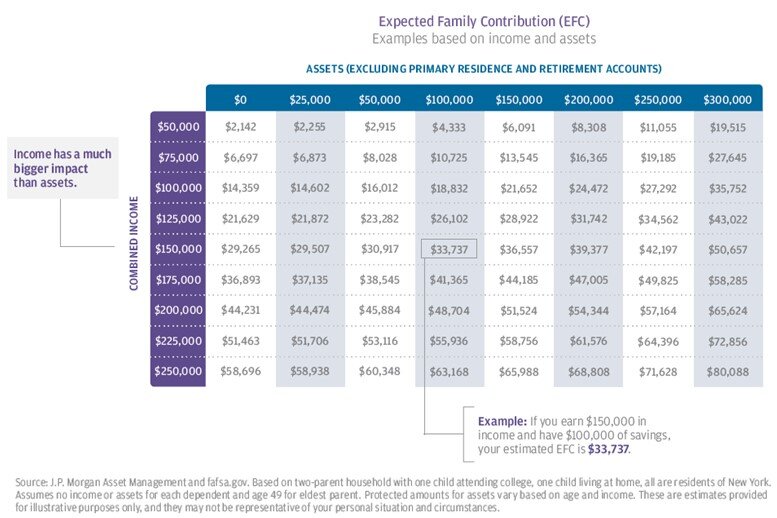

Financial Aid Chart

Our friends over at JP Morgan were kind enough to put a summary chart together for this EFC calculation which allows families to get a ballpark idea of what their Expected Family Contribution might be without getting out a calculator. The chart below is based on the following assumptions:

Two parent household

2 Children: One attending college and the other still at home

The child attending college has no assets or income

The oldest parent is age 49

Using the chart above, if the parents combined income is $150,000 and they have $100,000 in countable assets, the Expected Family Contribution would be $33,737 for that school year. What does that mean? If the student is attending a state college and the tuition with room and board is $26,000, since the EFC is greater than the total cost of college for that year, that family would receive no financial aid. However, if that student applies to a private school and the CSS Profile form results in approximately that same EFC of $33,737 but the private school costs $60,000 per year, then the family may receive need based financial aid or a grant from the private school equaling $26,263 per year.

Public Colleges vs. Private Colleges

It’s important to point out that FAFSA and the EFC calculation primarily applies to students that plan on attending a Community College, State College, or certain Private Colleges. Since Private Colleges do not receive federal financial aid they do not have to adhere to the EFC calculation that is used by FAFSA. Private college can choose to use to FAFSA criteria but many of the private colleges will require students to complete both the FAFSA form and the CSS Profile Form.

Here are a few examples of how the financial reporting deviates:

If the parents have a 100% family owned business, they would not have to list that as an asset on the FAFSA application but they would have to list the business as an assets on the CSS Profile form.

The equity in your primary residence is not counted as an asset for FAFSA but it is listed as an asset on the CSS Profile Form.

For parents that are divorced. FAFSA only looks at the assets and income of the custodial parent. The CSS Profile Form captures the assets and income of both the custodial and non-custodial parent.

Because of the deviations between the FAFSA application and the CSS Profile Form, we have seen situations where a student received no need based financial aid when applying to a $50,000 per year private school but they received financial aid for attending a state school even though the annual cost to attend the state school was half the cost of the private school.

Top 10 Ways To Increase College Financial Aid

Here is a quick list of the top strategies that we use to help families to qualify for more financial aid.

Disclosure: There are details associated with each strategy listed below that need to be executed correctly in order for the strategy to have a positive impact on the EFC calculation. Not all strategies will work depending on the financial circumstances of each household and where the child plans to attend college. Contact us for details.

Get assets out of the name of the student

Grandparent owned 529 accounts

Use countable assets of the parents to pay down debt

Move UTGMA & UGMA accounts to 529 UGMA or 529 UTMA accounts

Increase contributions to retirement accounts

Minimize distributions from retirement accounts

Minimize capital gain and dividend income

Accelerate necessary expenses

Use home equity line of credit instead of home equity loan

Families that own small businesses have a lot of advanced planning options

FAFSA – 2 Year Lookback

It’s important to understand the FAFSA application process because you have know when they take the snapshot of your income and assets for the EFC calculation in order to have a shot at increasing the financial aid that you may be able to qualify for.

FAFSA looks back 2 years to determine what your income will be for the upcoming school year. For example, if your child is going to be a freshman in college in the fall of 2020, you will report your 2018 income on the FAFSA application. This is important because you have to start putting some of these strategies into place in the spring of your child’s sophomore year in high school otherwise you could miss out on planning opportunities for their freshman year in college.

If your child is already a junior or senior in high school and you are just reading this article now, there is still an opportunity to implement some of the strategies listed above. Income has a 2 year lookback but assets are reported as of the day of the application. Also the FAFSA application is completed each year that your child is attending college, so even though you may have missed income reduction strategies for their freshman year, at some point the 2 year lookback will influence the financial aid picture during the four years of their undergraduate degree.

IMPORTANT NOTE: Income has a 2-year lookback

Asset balances are determined on the day that you submit the FAFSA Application

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

New York May Deviate From The New 529 Rules

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school,

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school, religious school, or homeschooling expenses. These distributions would be considered “qualified” which means distributions are made tax free.

Initially we expected this new benefit to be a huge tax advantage for our clients that have children that attend private school. They could fully fund a 529 plan up to $10,000 per year, capture a New York State tax deduction for the $10,000 contribution, and then turn around and distribute the $10,000 from the account to make the tuition payment for their kids.

New York Does Not Allow K – 12 Distributions

States are not required to adhere to the income tax rules set forth by the federal government. In other words, states may choose to adopt the new tax rules set forth by the federal government or they can choose to ignore them. The new tax laws that went into effect in 2018 will impact states differently. More specifically, tax payers in states that have both income taxes and high property taxes, like New York and California, may be adversely affected due to the new $10,000 cap (unchanged for 2025) on the ability to fully deduct those expenses on their federal tax return.

As of May 2025, New York does not recognize the K -12 distributions from 529 plans as “qualified”. Currently more than 30 states have announced that they will adhere to the new federal tax rules allowing K-12 qualified distributions from 529 accounts. On the opposite side of that coin, the following states do not recognize K-12 distributions as qualified: California, Illinois, Michigan, Minnesota, Nebraska, New Jersey, New York, Orgeon, and Vermont.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform: Changes To 529 Accounts & Coverdell IRA's

Included in the new tab bill were some changes to the tax treatment of 529 accounts and Coverdell IRA's. Traditionally, if you used the balance in the 529 account to pay for a "qualified expense", the earnings portion of the account was tax and penalty free which is the largest benefit to using a 529 account as a savings vehicle for college.So what's the

Due to a recent tax bill, there were some changes made to the tax treatment of 529 accounts and Coverdell IRAs. Traditionally, if you used the balance in the 529 account to pay for a "qualified expense", the earnings portion of the account was tax and penalty free, which is the largest benefit to using a 529 account as a savings vehicle for college. So what's the change? Prior to the Tax Cuts and Jobs Act (tax reform), qualified distributions were only allowed for certain expenses associated with the account beneficiary's college education. Starting in 2018, 529 plans can also be used to pay for qualified expenses for elementary, middle school, and high school.

Kindergarten – 12th Grade Expenses

Tax reform included a provision that will allow owners of 529 accounts to take tax-free distributions from 529 accounts for K–12 expenses for the beneficiary named on the account. This is new for 529 accounts. Prior to this provision, 529 accounts could only be used for college expenses. Now 529 account holders can distribute up to $10,000 per student per year for K – 12 qualified expenses. Another important note, this is not limited to expenses associated with private schools. K – 12 qualified expense will be allowed for:

Private School

Public School

Religious Schools

Homeschooling

529 Accounts Will Largely Replace Coverdell IRA's

Prior to this rule change, the only option that parents had to save and accumulate money tax-free to K – 12 expenses for their children were Coverdell IRA's. But Coverdell IRA's had a lot of hang-ups

Contributions were limited to $2,000 per year

You could only contribute to a Coverdell IRA if your income was below certain limits

You could not contribute to the Coverdell IRA after your child turned 18

Account balance had to be spent by the time the student was age 30

By contrast, 529 accounts offer a lot more flexibility and higher contribution limits. For example, 529 accounts have no contribution limits. The only limits that account owners need to be aware of are the "gifting limits," since contributions to 529 accounts are considered a "gift" to the beneficiary listed on the account. In 2025, the annual gift exclusion will be $19,000. However, 529 accounts have a provision that allow account owners to make a "5 year election". This election allows account owners to make an upfront contribution of up to 5 times the annual gift exclusion for each beneficiary without trigger the need to file a gift tax return. In 2025, a married couple could contribution up to $190,000 for each child to a 529 account without trigger a gift tax return.If I have a child in private school, they are in 6th grade, and I'm paying $20,000 in tuition each year, that means I have $140,000 that I'm going to spend in tuition between 6th grade – 12th grade and then I have college tuition to pile on top of that amount. Instead of saving that money in an after-tax investment account, which is not tax sheltered, and I pay capital gains tax when I liquidate the account to pay those expenses, why not set up a 529 account and shelter that huge dollar amount from income tax? It will probably save me thousands, if not tens of thousands of dollars in taxes, in taxes over the long run. Plus, if I live in a state that allows tax deductions for 529 contributions, I get that benefit as well.

Income Limits and Tax Deductions

Unlike Coverdell IRA's, 529 accounts do not have income restrictions for making contributions. Plus, some states have a state tax deduction for contributions to 529 account. In New York, a married couple filing jointly receives a state tax deduction for up to $10,000 for contributions to a 529 account. A quick note, that is $10,000 in aggregate, not $10,000 per child or per account.

Rollovers Count Toward State Tax Deductions

Here is a fun fact. If you live in New York and you have a 529 account established in another state for your child, if you rollover the balance into a NYS 529 account, the rollover balance counts toward your $10,000 annual NYS state tax deduction. Also, you can rollover balances in Coverdell IRA's into 529 accounts and my guess is many people will elect to do so now that 529 account can be used for K – 12 expenses.

Contributions Beyond Age 18

Unlike a Coverdell IRA, which restricts contributions once the child reaches age 18, 529 accounts have no age restriction for contributions. We will often encourage clients to continue to contribute to their child's 529 account while they are attending college for the sole purpose of continuing to capture the state tax deduction. If you receive the tuition bill in the mail today for $10,000, you can send in a $10,000 check to your 529 account provider as a current year contribution, as soon as the check clears the account you can turn around and request a qualified withdrawal from the account for the tuition bill, and pay the bill with the cash that was distributed from the 529 account. A little extra work, but if you live in NYS and you are in a high tax bracket, that $10,000 deduction could save you $600 - $700 in state taxes.

What Happens If There Is Money Left In The 529 Account?

If there is money left over in a 529 account after the child has graduated from college, there are a number of options available. For more on this, see our article "5 Options For Money Left Over In College 529 Plans"

Qualified Expenses

The most frequent question that I get is "what is considered a qualified expense for purposes of tax-free withdrawals from a 529 account?" Here is a list of the most common:

Tuition

Room & Board

Technology Items: Computers, Printers, Required Software

Supplies: Books, Notebooks, Pens, Etc.

Just as important, here is a list of expenses that are NOT considered a "qualified expense" for purposes of tax-free withdrawals from a 529 account:

Transportation & Travel: Expense of going back and forth from school / college

Student Loan Repayment

General Electronics and Cell Phone Plans

Sports and Fitness Club Memberships

Insurance

If there is ever a question as to whether or not an expense is a qualified expense, I would recommend that you contact the provider of your 529 account before making the withdrawal from your 529 account. If you take a withdrawal for an expense that is not a "qualified expense," you will pay income taxes and a 10% penalty on the earnings portion of the withdrawal.

Do I Have To Close My Coverdell IRA?

While 529 accounts have a number of advantages compared to Coverdell IRA's, current owners of Coverdell IRAs will not be required to close their accounts. They will continue to operate as they were intended. Like 529 accounts, Coverdell IRA withdrawals will also qualify for the tax-free distributions for K – 12 expenses including the provision for expenses associated with homeschooling.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Divorce: Make Sure You Address The College Savings Accounts

The most common types of college savings accounts are 529 accounts, UGMA, and UTMA accounts. When getting divorce it’s very important to understand who the actual owner is of these accounts and who has legal rights to access the money in those accounts. Not addressing these accounts in the divorce agreement can lead to dire consequences

The most common types of college savings accounts are 529 accounts, UGMA, and UTMA accounts. When getting divorce it’s very important to understand who the actual owner is of these accounts and who has legal rights to access the money in those accounts. Not addressing these accounts in the divorce agreement can lead to dire consequences for your children if your ex-spouse drains the college savings accounts for their own personal expenses.

UGMA or UTMA Accounts

The owner of these types of accounts is the child. However, since a child is a minor there is a custodian assigned to the account, typically a parent, that oversees the assets until the child reaches age 21. The custodian has control over when withdraws are made as long as it could be proven that the withdrawals being made a directly benefiting the child. This can include school clothes, buying them a car at age 16, or buying them a computer. It’s important to understand that withdraws can be made for purposes other than paying for college which might be what the account was intended for. You typically want to have your attorney include language in the divorce agreement that addresses what these account can and can not be used for. Once the child reaches the age of majority, age 21, the custodian is removed, and the child has full control over the account.

529 accounts

When it comes to divorce, pay close attention to 529 accounts. Unlike a UGMA or UTMA accounts that are required to be used for the benefit of the child, a 529 account does not have this requirement. The owner of the account has complete control over the 529 account even though the child is listed as the beneficiary. We have seen instances where a couple gets divorced and they wrongly assume that the 529 account owned by one of the spouses has to be used for college. As soon as the divorce is finalized, the ex-spouse that owns the account then drains the 529 account and uses the cash in the account to pay legal fees or other personal expenses. If the divorce agreement did not speak to the use of the 529 account, there’s very little you can do since it’s technically considered an asset of the parent.

Divorce agreements can address these college saving accounts in a number of way. For example, it could state that the full balance has to be used for college before out-of-pocket expenses are incurred by either parent. It could state a fixed dollar amount that has to be withdrawn out of the 529 account each year with any additional expenses being split between the parents. There is no single correct way to address the withdraw strategies for these college savings accounts. It is really dependent on the financial circumstances of you and your ex spouse and the plan for paying for college for your children.

With 529 accounts there is also the additional issue of “what if the child decides not to go to college?” The divorce agreement should address what happens to that 529 account. Is the account balance move to a younger sibling? Is the balance distributed to the child at a certain age? Or will the assets be distributed 50-50 between the two parents?

Is for these reason that you should make sure that your divorce agreement includes specific language that applies to the use of the college savings account for your children

For more information on college savings account, click on the hyperlink below:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.