Market Selloff: Time To Buy, Sell, or Hold?

Over the past month, the stock market has dropped by 20%. Largely due to the economic impact of the Coronavirus. As the feeling of panic continues to increase here in the U.S., our clients are asking:

Over the past month, the stock market has dropped by 20%. Largely due to the economic impact of the Coronavirus. As the feeling of panic continues to increase here in the U.S., our clients are asking:

Should we be buying stocks at these lower levels?

Is it going to get worse before it gets better?

How quickly do you think the market will bounce back after the virus is contained?

Having managed money for clients through the Tech Bubble, The Great Recession of 2008/2009, and countless market selloffs, while the circumstances are always different from crisis to crisis, there are patterns that seem to be consistent within each market selloff. Being able to identify those patterns is key in determining what the next move should be within your investment portfolio and I’m going to share those with you today.

DISCLOSURE: Throughout this article I will be using examples of industries and companies. These are not recommendations to buy or sell a particular stock. Please consult your investment professional for advice.

Is The Market Oversold?

When there is a market selloff, one of the key questions we’re trying to answer is: “Has the stock market overreacted to the risks that are being presented?” In answering this question, I think the key thing that investors forget is that a company’s stock price represents more than just one year of its earnings. When investors buy a stock it’s typically because they expect that company to grow over the course of multiple years and yield a generous return. Unexpected events like the Coronavirus without question impact those projections but it’s not uncommon for the market to overreact because it’s focused on what’s going to happen to that company’s revenue in the short term.

A good example of this are the airlines in the United States. Due to the Coronavirus companies have canceled conferences, people have canceled vacations, and sporting events have been postponed or are now being played without spectators. That is a direct hit to the airlines in the U.S. because prior to the Coronavirus they had projected a specific amount of revenue to be generated during 2020 based on all that activity. But here comes the key question. Many of the airline stocks in the U.S. have dropped by more than 50% in the past 60 days. If investors believe that the Coronavirus will eventually be contained in the coming months, are those airlines really only worth half of what they were 60 days ago?

Buffett’s Words of Wisdom

I hesitate to use Warren Buffett’s famous quote because it’s used with such frequency but it’s proven to be a valuable investment practice during times of uncertainty: “Be fearful when others are greedy and greedy when others are fearful.” While it’s easy to say, it’s very difficult to execute effectively. Buying low and selling high goes against every human emotion. It often means stepping into the most unloved names, at what would seem to be the worst time, and owning that decision. Right now those investments seem to be the airlines, hotels, cruiselines, oil companies, and other industries directly tied to travel and tourism.

This same concept also applies to the decision to “hold” or not sell your equity holdings when the market is in a panic. Even though no one likes to see their investment accounts lose value, if you were positioned appropriately prior to the start the Coronavirus pandemic, in my professional opinion, you should not be making any adjustments to your portfolio given the recent market events. If however, you were allocated too aggressively based on your own personal risk tolerance or time horizon, you have a much more difficult decision to make.

Short Term vs Long Term Risks

Market selloffs are typically triggered by two types of risks: short term risks and long term risks. Being able to identify which risk the market is facing should greatly influence the decisions that you are making within your investment portfolio.

I’m going to use the airlines again as an example. In my personal option, the Coronavirus represents a short-term risk to the airline industry. In an effort to contain the virus, conferences have been cancelled, companies have told their employees not to travel, people have canceled vacations, etc. But you have to ask yourself this question: “what’s likely to happen once the virus is contained?” Conferences may be rescheduled, business travel resumes, and people map out a new plan for their vacation. There is arguably pent up demand being created right now that the airlines will benefit from once the virus is contained.

Back when 9/11 happened, I viewed that risk as a longer term risk for the airlines because people could choose to permanently change their behavior and choose not to fly for a very long time based on that event. In the 2008 financial crisis, the banks had a long road ahead of them as they executed plans to dig out of their leveraged positions. Problems of this nature usually require more time to fix which is why these longer term risks can justify a move from stocks into bonds.

Winners and Losers

Even with short term risk diversification is key. Just because a risk is a short term risk does not necessarily mean all companies are going to survive it. There is a risk to all companies that are impacted by market events that they run out of cash before the tide turns back to the upside. If you are an investor looking to buy into airlines at these lower levels, it's typically prudent to buy multiple companies in smaller increments, as opposed to establishing a large position in a single airline. Again, just an example, if you decide to buy stock in American Airlines, Delta, Southwest, and United Airlines, the risk of buying low is one of the four may run out of money before the virus is contained and they are forced with filing bankruptcy without a bailout from the government. If you put all of your money into one airline, you are taking on a lot more risk.

Buyer’s Remorse

One of the lessons I’ve learned from buying during a market selloff is you need to keep your long-term perspective. Meaning when you purchase a stock that has dropped significantly, there are forces acting on that company that could cause it to drop by more. You have to be comfortable with that reality and you have to possess the time horizon to weather the storm in the likely case that it could get worse before it gets better.

It’s all too common that investors purchase a stock thinking that since it’s already dropped 30%+ that it can’t possibly go any lower, only to watch it drop by another 30% and then feel pressured to sell it thinking they made a mistake. I call this “buyer’s remorse”. When you play the role of an opportunistic investor, it may take months or years for the benefit to be realized. Investing for a “quick pop” is a fool’s game, especially with the Coronavirus situation. No one knows how long it’s going to take to contain the virus, how badly Q1 and Q2 revenue will be hurt for companies, or will it end up causing a recession. Making the decision to buy stock at lower levels is usually based on the investment thesis that the stock market is overreacting to a relatively short term event and those companies getting hit the hardest will recover over time.

How Much Time Will It Take For the Market To Recover?

No one knows the answer to this question because we have never really been in this situation before. We have been through other epidemics in the past such as SARS, MERS, Swine Flu, and Ebola, but nothing that spread as quickly or as broadly around the globe as the Coronavirus. Since China was ground zero for the virus, the good news is we are already seeing significant progress being made at containing the virus.

As you can see via the blue line in the chart, at the beginning of February China was reporting thousands of new cases every day, but since the beginning of March the line flattens out, meaning the number new people getting infected is tapering off. If the United States follows a similar trajectory, we may see the rate of infection rise significantly in the upcoming days only to see the numbers taper off a month or two from now.

I would argue that we have an added advantage over China and Europe in that we had more time to prepare, we know more about the spread of the virus, and how to contain it. I think the lesson that we learned from Europe was you have to be aggressive in your containment efforts which is why you are seeing the extreme measures that the U.S. is taking to contain the spread of the virus. Those extreme containment efforts hurt the market more in the short term but will hopefully result in less damage to the economy over the longer term.

It’s really a race against time. The longer it takes to contain the virus, the longer it takes for people to get back to work, the longer it takes for people to feel safe traveling again, which results in more companies being put at risk of running out of capital waiting for the recovery to arrive. This is the reason why the Fed is aggressively dropping interest rates right now. Dropping interest rates does absolutely nothing to contain the virus or make people feel safe about traveling but it provides companies that are struggling due to the loss of revenue with access to low interest rate debt to bridge the gap.

A Recession Is Very Possible

A recession is defined as two consecutive quarters of negative GDP growth. With the global slowdown that has taken place in 2020, the U.S. economy may post a negative GDP number for the first quarter. Since it takes a while to bring global supply chains back online and for consumers to return to their normal spending behaviors, it's possible that the U.S. economy could also post a negative GDP number for the second quarter as well. By definition, that puts the U.S. economy in a recession. But it may end up being a very brief recession as the Coronavirus reaches containment, global supply chains come back online, pent up demand for goods and services is fulfilled, and U.S. households and businesses have the dual benefit of having access to lower oil prices and lower interest rates.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Teach Your Kids About Investing

As kids enter their teenage years, as a parent, you begin to teach them more advanced life lessons that they will hopefully carry with them into adulthood. One of the life lessons that many parents teach their children early on is the value of saving money. By their teenage years many children have built up a small savings account from birthday gifts,

As kids enter their teenage years, as a parent, you begin to teach them more advanced life lessons that they will hopefully carry with them into adulthood. One of the life lessons that many parents teach their children early on is the value of saving money. By their teenage years many children have built up a small savings account from birthday gifts, holidays, and their part-time jobs. As parents you have most likely realized the benefit of compounding interest through working with a financial advisor, contributing to a 401(k) plan, or depositing money to a college savings account. As financial planners, we often get the question: “What is the best way to teach your children about the value of investing and compounding interest? "

The #1 rule.......

We have been down this road many times with our clients and their children. Here is the number one rule: Make it an engaging experience for your kids. Investments can be a very dull topic to talk about and it can be painfully dull from a child’s point of view. All they know is the $1,000 that was in their savings account is now with their parent’s investment guy.

Ignoring the life lessons for a moment, the primary investment vehicle for brokerage accounts with balances under $50,000 is typically a mutual fund. But let’s pause for a moment. We have a dual objective here. We of course want our children to make as much money as possible in their investment account but we also want to simultaneously teach them life long lessons about investing.

The issue with young investors

Explaining how a mutual fund operates can be a complex concept for a first time investor because you have all of these companies in one investment, expense ratios, different types of funds, and different fund families. It’s not exciting, it’s intimidating.

Consider this approach. Ask the child what their hobbies are? Do they have a cell phone? Have them take their cell phone out during the meeting and ask them how often they use it during the day and how many of their friends have cell phones. Then ask them, if you received $20 every time someone in this area bought a cell phone would you have a lot of money? Then explain that this scenario is very similar to owning stock in a cell phone company. The more they sell the more money the company makes. As a “shareholder” you own a piece of that company and you receive a piece of the profits if the company grows. If your child plays sports, do they wear a lot of Nike or Under Armour? Explain investing to them in a way that they can relate it to their everyday life. Now you have their attention because you attached the investment idea to something they love.

A word of caution....

If they are investing in stocks it is also important for them to understand the concept of risk. Not every investment goes up and you could start with $1,000 and end the year with $500, so they need to understand risk and time horizon.

While it’s not prudent in most scenarios to invest 100% of a portfolio in one stock, there may be some middle ground. Instead of investing their entire $1,000 in a mutual fund, consider investing $500 – $700 in a mutual fund but let them pick one to three stocks to hold in the account. It may make sense to have them review those stock picks with your investment advisor for two reasons. One, you want them to have a good experience out of the gates and that investment advisor can provide them with their option of their stock picks. Second, the investment advisor can tell them more about the companies that they have selected to further engage them.

Don't forget the last step......

Download an app on their smartphone so they can track the investments that they selected. You may be surprise how often they check the performance of their stock holdings and how they begin to pay attention to news and articles applicable to the companies that they own.At that point you have engaged them and as they hopefully see their investment holdings appreciate in value they will become even more excited about saving money in their investment account and making their next stock pick. In addition, they also learn valuable investment lessons early on like when one of their stocks loses value. How do they decide whether to sell it or continue to hold it? It’s a great system that teaches them about investing, decision making, risk, and the value of compounding investment returns.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Establish an Employer Sponsored Retirement Plan?

Employer sponsored retirement plans are typically the single most valuable tool for business owners when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

Employer-sponsored retirement plans are typically the single most valuable tool for business owners when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

But with all of the different types of plans to choose from, which one is the right one for your business? Most business owners are familiar with how 401(k) plans work, but that might not be the right fit given variables such as:

# of Employees

Cash flows of the business

Goals of the business owner

There are four main stream employer-sponsored retirement plans that business owners have to choose from:

SEP IRA

Single(k) Plan

Simple IRA

401(k) Plan

Since there are a lot of differences between these four types of plans, we have included a comparison chart at the conclusion of this newsletter, but we will touch on the highlights of each type of plan.

SEP IRA PLAN

This is the only employer-sponsored retirement plan that can be set up after 12/31 for the previous tax year. So, when you are sitting with your accountant in the spring and they deliver the bad news that you are going to have a big tax liability for the previous tax year, you can establish a SEP IRA up until your tax filing deadline plus extension, fund it, and take a deduction for that year.

However, if the company has employees who meet the plan's eligibility requirement, these plans become very expensive very quickly if the owner(s) want to make contributions to their own accounts. The reason is that these plans are 100% employer-funded, which means there are no employee contributions allowed, and the employer contribution is uniform for all plan participants. For example, if the owner contributes 15% of their income to the SEP IRA, they have to make an employer contribution equal to 15% of compensation for each employee who has met the plan's eligibility requirement. If the 5305-SEP Form, which serves as the plan document, is set up correctly, a company can keep new employees out of the plan for up to 3 years, but often it is either not set up correctly or the employer cannot find the document.

Single(k) Plan or "Solo(k)"

These plans are for owner-only entities. As soon as you have an employee who works more than 1000 hours in a 12-month period, you cannot sponsor a Single(k) plan.

The plans are often the most advantageous for self-employed individuals who have no employees and want to have access to higher pre-tax contribution levels. For all intents and purposes, it is a 401(k) plan, with the same contribution limits, ERISA protected, they allow loans and Roth contributions, etc. However, they can be sponsored at a much lower cost than traditional 401(k) plans because there are no non-owner employees. So there is no year-end testing, it's typically a boilerplate plan document, and the administration costs to establish and maintain these plans are typically under $400 per year compared to traditional 401(k) plans, which may cost $1,500+ per year to administer.

The beauty of these plans is the "employee contribution" of the plan, which gives it an advantage over SEP IRA plans. With SEP IRA plans, you are limited to contributions up to 25% of your income. So if you make $24,000 in self-employment income, you are limited to a $6,000 pre-tax contribution.

With a Single(k) plan, for 2025, I can contribute $23,500 per year (another $7,500 if I'm age 50-59 or 64 or over or $11,250 if I’m age 60-63) up to 100% of my self-employment income and in addition to that amount I can make an employer contribution up to 25% of my income. In the previous example, if you make $24,000 in self-employment income, you would be able to make a salary deferral contribution of $23,500 and an employer contribution of $500, effectively wiping out all of your taxable income for that tax year.

Simple IRA

Simple IRA's are the JV version of 401(k) plans. Smaller companies that have 1 – 50 employees that are looking to start are retirement plan will often times start with implementing a Simple IRA plan and eventually graduate to a 401(k) plan as the company grows. The primary advantage of Simple IRA Plans over 401(k) Plans is the cost. Simple IRA's do not require a TPA firm since they are self-administered by the employer and they do not require annual 5500 filings so the cost to setup and maintain the plan is usually much less than a 401(k) plan.

What causes companies to choose a 401(k) plan over a Simple IRA plan?

Owners want access to higher pre-tax contribution limits

They want to limit to the plan to just full time employees

The company wants flexibility with regard to the employer contribution

The company wants a vesting schedule tied to the employer contributions

The company wants to expand investment menu beyond just a single fund family

401(k) Plans

These are probably the most well-recognized employer-sponsored plans since, at one time or another, each of us has worked for a company that has sponsored this type of plan. So we will not spend a lot of time going over the ins and outs of these types of plan. These plans offer a lot of flexibility with regard to the plan features and the plan design.

We will issue a special note about the 401(k) market. For small business with 1 -50 employees, you have a lot of options regarding which type of plan you should sponsor but it's our personal experience that most investment advisors only have a strong understanding of 401(k) plans so they push 401(k) plans as the answer for everyone because it's what they know and it's what they are comfortable talking about. When establishing a retirement plan for your company, make sure you consult with an advisor who has a working knowledge of all these different types of retirement plans and can clearly articulate the pros and cons of each type of plan. This will assist you in establishing the right type of plan for your company.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Need to Know College Savings Strategies

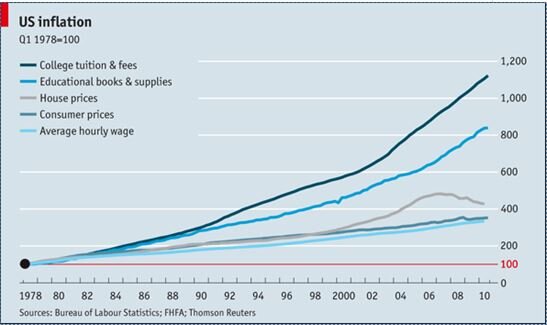

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control.

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control. The year over year increase in the cost of tuition and fees since 1978 to date has far outpaced any reasonable rate of inflation, and demands a new look at college savings strategies. In the chart below, you will see the increase in the price of college tuition and fee versus other comparable expenses over the past 30 years. Its mind blowing!!

Fund A 529 Account*

As far as college savings strategies go, there are very few options that beat 529 accounts as a savings vehicle for college. In these accounts you make after tax contribution to the account and when the amounts are withdrawn, as long as those withdrawals are attributed to a qualified college expenses, the earnings generated by the account are tax free. Depending on the state you live in you may be eligible to receive a state tax deduction for contribution up to specified dollar amount. In New York, single filers receive a NYS tax deduction up to $5,000 and married filing joint $10,000.

Also for financial aid purposes these account are looked at very favorably in the EFC (Expected Family Contribution) calculation. They are looked at by FASFA as an asset of the "parent" not the asset of the "child". There are many contribution and withdrawal strategies associated with these accounts that can produce big tax benefits for individuals accumulating savings for themselves or their children.

Roth IRAs Are Not Just For Retirement

When clients have the dual goal of saving for retirement and saving for college, the Roth IRA is often times a great option. Even if you make too much to contribute directly to a Roth, you can implement a "non-deductible IRA to Roth IRA conversion strategy" that will allow you to still get money into a Roth IRA.

Contributions to Roth IRAs are made with after tax dollars but unlike a traditional IRA if you hold a Roth IRA for at least 5 years and make withdrawals after age 59 1/2 you pay no tax on the earnings.

Here is one college savings strategy technique: You are allowed at any time and at any age to withdrawal the contribution portion of your account balance from a Roth IRA tax and penalty free. For example, if I contribute $5,000 to a Roth IRA and 5 years later it is worth $10,000, I can contact my IRA provider and request that they distribute just my basis ($5,000) and leave the earnings in the account to continue to accumulate tax free. You can then use that basis distribution to fund college expenses but the earnings in the Roth IRA continue to accumulate tax free.

Maximize Your Financial Aid

There are strategies that can be implemented leading up to the filing of the FASFA form that can increase that amount of financial aid that you receive. When you apply for financial aid, FASFA has a complex EFC calculation that takes a snapshot of your assets and income to determine how much financial aid you will qualify for. There are ways to shift assets and shelter income from this calculation that can save individuals and families thousands of dollars when it come to paying for college. Here are a few of the strategies that can help to improve a EFC calculation:

Save money in the parents or grandparents name, not the childs name

Pay off consumer debt, such as credit cards and auto loans

Spend down the students asset and income first

Accelerate necessary expenses (such as computer purchase) to reduce cash

Minimize capital gains

Maximize your contributions to a retirement plan

Do not withdrawal money from a retirement plan to pay for college

Ask grandparents to wait to give grandchildren money until after college

Trust funds are generally ineffective at sheltering money from EFC

Prepay your mortgage

Contribute to 529 plans owned by the parent or grandparent

Choose the date to submit the FASFA carefully

About Michael...

Hi, Im Michael Ruger. Im the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.