Should You Put Your House In A Trust?

When you say the word “trust” many people think that trusts are only used by the uber rich to protect their millions of dollars but that is very far from the truth. Yes, extremely wealthy families do use trusts to reduce the size of their estate but there are also a lot of very good reasons why it makes sense for an average individual or family to establish

When you say the word “trust” many people think that trusts are only used by the uber rich to protect their millions of dollars but that is very far from the truth. Yes, extremely wealthy families do use trusts to reduce the size of their estate but there are also a lot of very good reasons why it makes sense for an average individual or family to establish a trust. The two main reasons being the avoidance of probate and to protect assets from a long-term care event. This article will walk you through:

• How trusts work

• The difference between a Revocable Trust and an Irrevocable Trust

• The benefits of putting your house in a trust

• How to establish a trust

• What are the tax considerations

What Is A Trust?

When you establish a trust, you are basically creating a fictitious person that is going to own your assets. Depending on the type of trust that you establish, the trust may even have it's own social security number that is called a “tax ID number”. Here is an example. Mark and Sarah Williams, like most married couples, own their primary residence in joint name. They decide to establish the “Williams Family Trust”. Once the trust is established, they change the name on the deed of their house from Mark and Sarah to the Williams Family Trust.

Revocable Trust vs. Irrevocable Trust

Before I get into the benefits of establishing a trust for your house, you first have to understand the difference between a “Revocable Trust” and an “Irrevocable Trust”. As the name suggests, a revocable trust, you can revoke at any time. In other words, you as the owner, can take that asset back. You never really “give it away”. Revocable trusts do not have a separate tax identification number. They are established in the social security number of the owner. A revocable trust is sometime referred to as a “living trust”.

With an Irrevocable Trust, once you have transferred the ownership of the house to the trust, it’s irrevocable, meaning you are never supposed to be able to take it back. The trust will own that house for the rest of your life. Now that sounds super restrictive but there are a lot of strategies that estate attorneys use to ease those restrictions and I will cover some of those strategies later on in this article.

In both cases, in trust language, the owner that gave property to the trust is called the “grantor”. I just want you to be familiar with that term when it is used throughout this article.

So why would someone use an Irrevocable Trust instead of a Revocable Trust? The answer is, it depends on which benefits you are trying to access by placing your house in a trust.

The Benefits Of A Revocable Trust Owning Your House

People transfer the ownership of their house to a revocable trust for the following reasons:

• Avoid probate

• They have children under the age of 25

• They want maximum flexibility

Avoid Probate

From our experience, this is the number one reason why people put their house in a revocable trust. Trust assets avoid probate. If you have ever had a family member pass away and you were the executor of their estate, you know how much of a headache the probate process is. Not to mention costly.

Let’s go back to our example with Mark & Sarah Williams. They own their house joint and they have a will that lists their two children as 50/50 beneficiaries on all of their assets.

When the first spouse passes away, there is no issue because the house is owned joint, and the ownership automatically passes to the surviving spouse. However, when the surviving spouse passes away, the house is part of the surviving spouse’s estate that will be subject to the probate process. You typically try to avoid probate because the probate process:

• Is a costly process

• It delays the receipt of the asset by your beneficiaries

• Makes the value of your estate accessible to the public

The costs come in the form of attorney fees, accountant fees, executor commissions, and appraisal fees which are necessary to probate the estate. The delays come from the fact that it’s a court driven process. You have to obtain court issued letters of testamentary to even start the process and the courts have to approve the final filing of the estate. It’s not uncommon for the probate process to take 6 months or longer from start to finish.

If your house is owned by a revocable trust, you skip the whole probate process. Upon the passing of the second spouse, the house is transferred from the name of the trust into the name of the trust beneficiaries. You save the cost of probate and your beneficiaries have immediate access to the house.

The Difference Between A Trust and A Will

I’ll stop for a second because this is usually where I get the question, “So if I have a trust, do I need a will?” The answer is yes, you need both. Anything owned by your trust will go immediately to the beneficiaries of the trust but any assets not owned by the trust will pass to your beneficiaries via the will. Trusts can own real estate, checking accounts, life insurance policies, and other assets. But there are some assets like cars and personal belongings that are usually held outside of a trust that will pass to your beneficiaries via the will. But in most cases, people have the same beneficiaries listed in the will and the trust.

Children Under The Age of 25

For parents with children under the age of 25, revocable trusts are used to prevent the children from coming into their full inheritance at a very young age. If you just have a will, both parents pass away when your child is 18, and they come into a sizable inheritance between your life insurance, retirement accounts, and the house, they may not make the best financial decisions. What if they decide to not go to college because they inherited a million dollar but then they spend through all of the money within 5 years? As financial planners we have unfortunately seen this happen. It’s ugly.

A revocable trust can put restrictions in place to prevent this from happening. There might be language in the trust that states they receive 1/3 of their inheritance at age 25, 1/3 at age 30, 1/3 at age 35. But in the meantime, the trustee can authorize distributions for living expenses, education, health expenses, etc. The options are limitless and these documents are customized to meet your personal preferences.

Maximum Flexibility

The revocable trust offers the grantor the most flexibility because they are not giving away the asset. It’s still part of your estate, it’s just not subject to probate. At any time, the owners can take the asset back, change the trustee, change beneficiaries of the trust, and change the features of the trust.

The Benefits Of An Irrevocable Trust

Let’s shift gears to the irrevocable trust. The benefits of establishing an irrevocable trust include:

• Avoid probate

• They have children under that age of 25

• Protect assets from a long-term care event

• Reduce the size of an estate

As you will see, the top two are the same as the revocable trust. Irrevocable trust assets avoid probate and are a way of controlling how assets are distributed after you pass away. However, you will see two additional benefit listed that were not associated with a revocable trust. Let’s look at the long-term care event protection benefit.

Protect Assets From A Long-Term Care Event

When individuals use an irrevocable trust to protect assets from a long-term care event, it’s sometimes called a “Medicaid Trust”. If you have ever had the personal experience of a loved one needing any type of long-term care whether via home health aids, assisted living, or a nursing home, you know how expensive that care costs. According to the NYS Health Department, the average daily cost of a nursing home is $408 per day in the northeastern region. That’s $148,920 per year.

For an individual that needs this type of care, they are required to spend down all of their assets until they hit a very low threshold, and then Medicaid starts picking up the tab from there. Now the IRS is smart. They are not going to allow you to hit a long term care event and then transfer all of your assets to a family member or a trust to qualify for Medicaid. There is a 5 year look back period which says any assets that you have gifted away within the last 5 years, whether to an individual or a trust, is back on the table for purposes of the spend down before you qualify for Medicaid. This is why they call these trusts a Medicaid Trust.

Medicaid Will Put A Lien Against The House

Now, your primary resident is not an asset subject to the Medicaid spend down. If your only asset is your house and you have spent down all of your other assets that are not in an IRA or qualified retirement plan, you can qualify for Medicaid immediately. So why put the house in an irrevocable trust then? While Medicaid cannot make you sell your primary residence or count it as an asset for the spend down, Medicaid will put a lien against your estate for the amount they pay for your care. So when you pass away, your house does not go to your children or heirs, Medicaid assumes ownership, and will sell it to recoup the cash that they paid out for your care. Not a great outcome. Most people would prefer that the value of their house go to their kids instead of Medicaid.

If you transfer the ownership of the house to an Irrevocable Trust, you can live in the house for the rest of your life, and as long as the house has been in the trust for more than 5 years, it’s not a spend down asset for Medicaid and Medicaid cannot place a lien against your house for the money that they pay out for your care.

So if you are age 65 or older or have parents that are 65 or older, in many cases it makes sense for that individual to setup an irrevocable trust, transfer the ownership of the house to the trust, and start the 5 year clock for the Medicaid look back period. Once you have satisfied the 5 year period, you are free and clear.

Frequently Asked Questions

When I meet with clients about this, there are usually a number of other questions that come up when we talk about placing the house in a trust. Here are the most common:

If my house is in a trust, do I still qualify for the STAR and Enhanced STAR property tax exemption?

ANSWER: Yes

If my house is gifted to a trust, do my beneficiaries still receive a step-up in basis when they inherit the asset?

ANSWER: As long as the estate attorney put the appropriate language in your trust document, the house will receive a step up in basis at your death.

What if I want to sell my house down the road but it’s owned by the trust?

ANSWER: It depends on what type of trust owns your house and the language in your trust document. When you sell your primary residence, as a single tax filer you do not have pay tax on the first $250,000 of capital gain in the property. For married filers, the number is $500,000. Example, married couple bought their house in 1980 for $40,000, it’s now worth $400,000, which equals $360,000 in appreciation or gain in value. When they sell their house, they do not pay any tax on the gain because it’s below the $500,000 exclusion.

If a revocable trust owns your house, you retain these tax exclusions because you technically still own the house. If an irrevocable trust owns your house, depending on the type of irrevocable trust you establish and the language in your trust document, you may or may not be able to utilize these exclusions.

Many of the irrevocable trust that we see drafted by estate attorneys that exist for the purpose of avoiding probate and protecting asset from Medicaid are considered grantor trusts. The estate attorney will often put language in the document that protects the assets from Medicaid but allows the grantor to capture the primary residence capital gains exclusion if they sell their house at some point in the future. But this is not always the case. If you establish an irrevocable trust for your primary residence, it’s important to have this discussion with your estate attorney to make sure this specific item is addressed in your trust document.

Now, here is the most common mistake that we see people make when they sell their house that is owned by their irrevocable trust. You put your primary residence in an irrevocable trust six years ago so you are now free and clear on the five year look back period. You decided to sell your current house and buy another house or sell your house and put the cash in the bank. At the closing the buyers make the check payable to you instead of your trust. You deposit the check to your checking account and then move it into the trust account or issue the check to purchase your next house. Guess what? The 5 year clock just restarted. The money can never leave the trust. If your intention is to sell one house and buy another house, at the closing they should make the check payable to your trust, and the trust buys your next house.

Does the trust need to file a tax return?

ANSWER: Only irrevocable trusts have to file tax returns because revocable trusts are built under the social security number of the grantor. However, if the only asset that the irrevocable trust owns is your primary residence, the trust would not have any income, so there would not be a need to file a tax return for the trust each year.

Are irrevocable trusts 100% irrevocable?

ANSWER: There are tricks that estate attorneys use to get around the irrevocable restriction of these trusts. For example, the trust could make a gift to the beneficiaries of the trust and then the beneficiaries turn around and gift the money back to the grantor of the trust. Grantors can also retain the right to change who the trustees are, the beneficiaries, and they can revoke the trust. Bottom line, if you really need to get to the money, there are usually ways to do it.

How To Establish A Trust

You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,500 – $5,500. Before people get scared away by this cost, I remind them that if their house is subject to probate their estate may have to pay attorney fees, accountant fees, appraisal fees, and executor commissions which can easily total more than that.

In the case of a long-term care event, I just ask clients the question “Do you want your kids to inherit your house that you worked hard for or do you want Medicaid to take it if a long-term care event occurs down the road?” Most people reply, “I want my kids to have it.” Putting the house in an irrevocable trust for 5 years assures that they will.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Government Is Shut Down. Should You Be Worried?

The senate was not able to pass a temporary spending bill in the late hours of the night so as of Saturday, January 20th the government is officially shut down. But what does that mean? How will it impact you? What will be the impact on the stock market?

The senate was not able to pass a temporary spending bill in the late hours of the night so as of Saturday, January 20th the government is officially shut down. But what does that mean? How will it impact you? What will be the impact on the stock market?

Don’t Let The Media Scare You

The media loves big disruptive events. Why? The news is a "for profit" business. The more viewers they have, the more profits they make. What makes you watch more news? Fear. If the weather forecasts is 80 degrees and sunny, you just go on with your day. Instead, if the weather is predicting “The Largest Winter Blizzard Of The Century”, my guess is you will be glued to the weather channel most of the day trying to figure out when the storm will hit, how many feet of snow is expected to fall, and are schools closing, etc.

You will undoubtedly wake up this morning to headlines about “The Government Shutdown” and all of the horrible things that could happen as a result. In the short term a government shutdown or a “funding gap” is not incredibly disruptive. Many government agencies have residual funding to keep operations going for a period of time. Only portions of the government really “shut down”. The “essential” government services continue to function such as national security and law enforcement. The risk lies in the duration of the government shutdown. If Congress does not pass either a temporary extension or reach a final agreement within a reasonable period of time, some of these government agencies will run out of residual funding and will be forced to halt operations.

The news will target the “what if’s” of the current government shutdown. What if the government stays shut down and social security checks stop? What if the U.S. cannot fund defense spending and we are left defenseless? All of these scenarios would require a very prolonged government shutdown which is unlikely to happen.

How Often Does This Happen?

When I woke up this morning, my first questions was “how often do government shutdowns happen?” Is this an anomaly that I should be worried about or is it a frequent occurrence? The last government shutdown took place on September 30, 2013 and the government stayed shut down for 16 days. Prior to the 2013 shutdown, you have to go back to December 15, 1995. The duration of the 1995 shutdown was 21 days. Making the current government shutdown only the third shutdown between December 15, 1995 – January 20, 2018. Not an anomaly but also not a frequent event.

But let’s look further back. How many times did the U.S. government experience a shutdown between 1976 – 2018? In the past 42 years, the U.S. government has experienced a shutdown 18 times. On average the government shutdowns lasted for about 7 days. This makes me less worried about the current government shutdown given the number of shutdowns that we have overcome in the past.

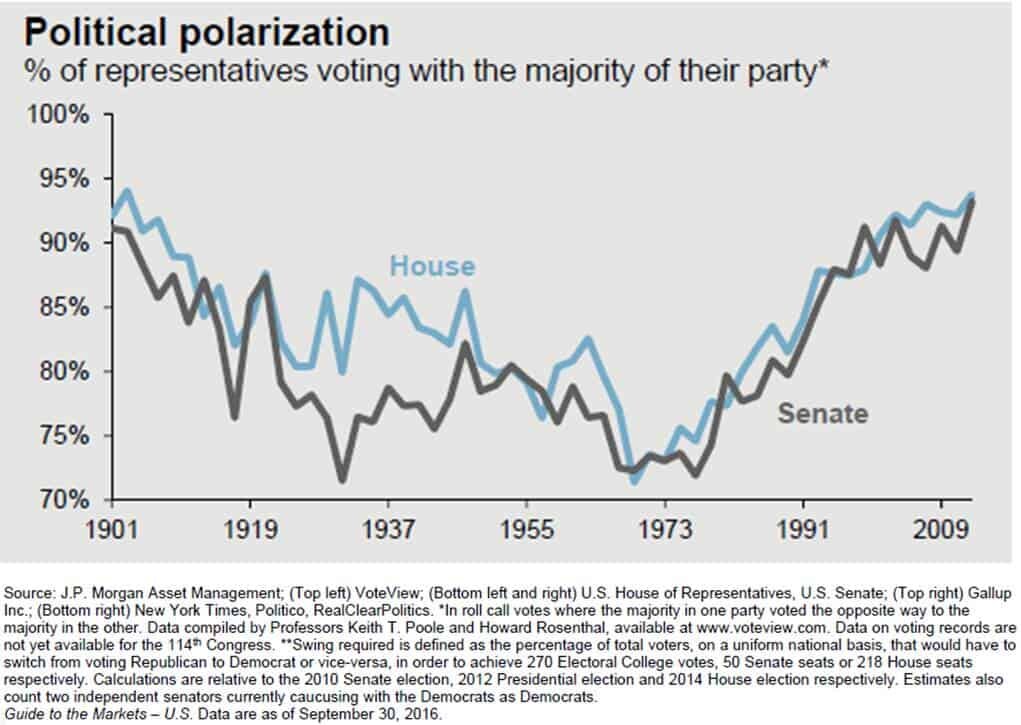

This Shutdown Could Be Longer

The only thing that worries me a little is the potential duration of the current government shutdown. I would not consider two data points to be a new “trend” but it is hard to ignore that the last two government shutdowns that occurred in 1995 and 2013 were much longer than the 7 day historical average. However, this could be the start of a new trend given how polarized Congress has become. It’s a clear trend that over the past 40 years fewer members of the Senate and House are willing to cross party lines during a vote. See the chart below: Back in 1973, only 73% of the members of Congress voted with the majority of their political party. It would seem rational to assume that during that time period members of Congress were more willing to step across the aisle for the greater good of the American people. Now, approximately 95% of the members of both the House and Senate vote with their own camp. This creates deadlock situations that take longer to resolve as the “blame game” takes center stage.

Impact On The Stock Market

In most cases, injecting uncertainty in our economy is never good for the stock market. However, given the fact that U.S. corporations are still riding the high of tax reform, if the government shutdown is resolved within the next two weeks it may have little or no impact on the markets.

If it were not for the recent passage of tax reform, my guess is this government shutdown may have been completely avoided. Not choosing a side here but just acknowledging the Democratic Party was delivered a blow with passage of tax reform in December. Since the spending bill requires 60 votes to pass in the Senate, it will require support from the Democrats. This situation provides the Democratic party with a golden opportunity to negotiate terms to help make up for some the lost ground from the passage of the Republican led tax bill. This challenging political environment could lengthen the duration of the government shutdown. However, it’s also important to remember that neither party benefits from a government shutdown, especially in a midterm election year.

Over the next two weeks, I would recommend that investors take all the media hype with a grain of salt. However, if a permanent or temporary spending bill is not passed within the next two weeks, it could result in increased volatility and downward pressure on the stock market as government agencies run out of cash reserves and begin to put workers on furlough. At this point, we are really in a “wait and see” environment.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Will The Value Of Your House Drop Under The New Tax Law?

It's not a secret to anyone at this point that the new tax bill is going to inflict some pain on the U.S. housing market in 2018. The questions that most homeowners and real estate investors are asking is: "How much are home prices likely to decrease within the next year due to the tax changes?" The new $10,000 limitation on SALT deductions, the lower

It's not a secret to anyone at this point that the new tax bill is going to inflict some pain on the U.S. housing market in 2018. The questions that most homeowners and real estate investors are asking is: "How much are home prices likely to decrease within the next year due to the tax changes?" The new $10,000 limitation on SALT deductions, the lower deduction cap mortgages interest, and the higher standard deduction are all lining up to take a bite out of real estate prices. The size of the bite will largely depend on where you live and the value of your house.

3 Bites That Will Hurt

The Trump tax reform made three significant changes to the tax laws that will impact housing prices:

Capped state and local tax ("SALT") deductions at $10,000 (includes property taxes)

Lowered the deduction cap on the first $750,000 of a mortgage

Doubled the standard deduction

The New Standard Deduction

There is a reason why I'm starting this analysis with the doubling of the standard deduction in 2018. For many households in the U.S., the doubling of the standard deduction will make the cap on the SALT deductions irrelevant. Let me explain. Below is a comparison of the standard deduction limits in 2017 versus 2018:

In 2018, a married couple filing a joint tax return would need over $24,000 in itemized deductions to justify not taking the standard deduction and calling it a day. For a married couple, both W-2 employees, $7,000 in property taxes, $9,000 in state income taxes, if those are their only itemized deductions, then it will most likely makes sense for them to take the $24,000 standard deduction. So the $10,000 cap on property taxes and state income taxes becomes irrelevant because it’s an itemized deduction. This will be a big change for many U.S. households. In 2017, that same family may have itemized because their property and state taxes exceeded the $12,700 standard deduction threshold.

For taxpayers age 65 and older, the new tax law kept the additional standard deduction amounts: $1,250 for single filers and $2,500 for married filing joint which are over and above the normal limits.

$10,000 Cap On State & Local Taxes

Starting in 2018, taxpayers are limited to a $10,000 deduction for a combination of their property taxes, school taxes, and state & local income tax. For states that have both high property taxes and high income taxes like New York, New Jersey, and California, homeowners will most likely be looking at a larger decrease in the value of their homes versus states like Florida that have lower property taxes and no state income taxes. The houses with the higher dollar value may experience a larger drop in price.

If you live in a $200,000 house, the property / school taxes are $5,000, and you decided to sell your house, the family looking to buy your house may already be planning on taking the $24,000 standard deduction at that income level, so the new tax cap would not really decrease the “value” of the house to the potential buyer.

On the flip side, if you own a $600,000 house, your property/school taxes are $18,000, and you are looking to sell your house, the new $10,000 cap will most likely have a negative impact on the value of your house. As you might assume, the individuals and families with the higher incomes that could afford to purchase a $600,000 house will naturally be the homeowners that will continue to itemize their deduction in 2018. So owning that $600K house in 2018 comes at an additional annual cost to the buyer because they lose $8,000 in property tax deductions. For individuals and families in the top federal tax bracket (37%), the cost to live in that house just went up by $3,120 per year. I have personally already had two clients call me that just purchased a house in 2017 with property taxes above the $10,000 cap and they said “I might not have purchased this big of a house if I knew I was not going to be able to deduct all of the property taxes”.

$750,000 Deduction Cap On Mortgages

Prior to 2018, taxpayers could only deduct interest on the first $1,000,000 of a mortgage. For all new mortgages, beginning in 2018, the cap was reduced from $1,000,000 to $750,000. The new tax law grandfathered the $1M cap for mortgages that were already in existence prior to December 31, 2017. Obviously this change will only impact very high income earning individuals and families living in houses valued at $1M+ but it still may have a negative impact on the prices of those big houses. I say "may" because if you can afford a $3M condo in Manhattan, you may not care that you lost a $7,500 tax deduction.

It Depends Where You Live

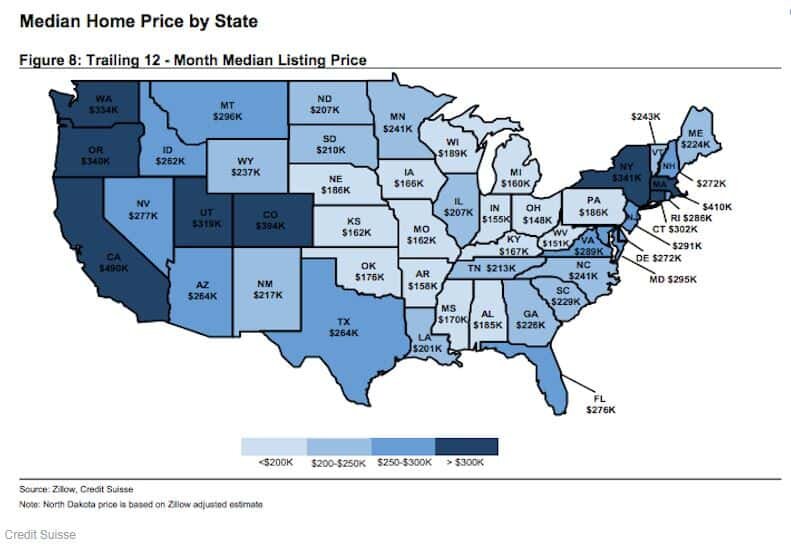

Given these changes to tax law, it seems likely that the states with higher property taxes and higher home values will be the most vulnerable to price adjustments. Below is a map, from Zillow and Credit Suisse, showing the median home price by state:

Let's also locate the states that have a high concentration of mortgages over $500,000. As mentioned above, this may put price pressure on homeowners trying to sell houses above the new $750,000 mortgage interest deduction threshold:

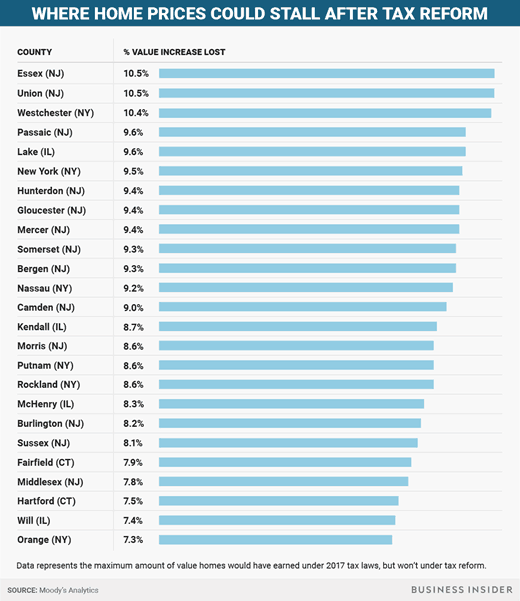

And the "Non-Winners" are New York, California, and New Jersey. Moody's published a list of the 25 counties that are expect to lose the largest percentage of value. Note, that only six of those counties are located outside of New York or New Jersey:

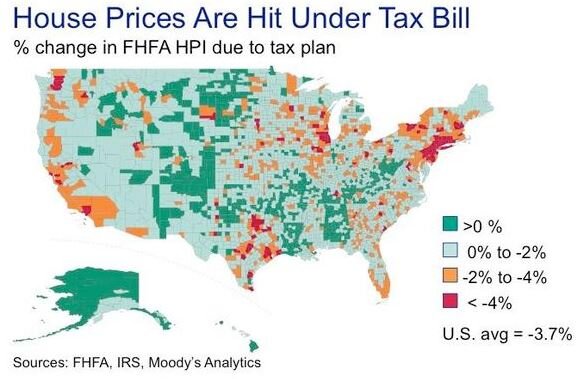

To bring it all together, Moody's and FHFA published the illustration below showing the percentage change in the Federal Housing Finance Agency – House Price Index as a result of the new tax bill:

It's safe to assume that geographically, the negative impact that the new tax rules will have on the U.S. house market will occur in concentrated pockets as opposed to a widespread reduction in housing prices across the country.

Do Not Move To Alaska Just Yet!!

Before you show the chart above to your family at dinner tonight with a “Go Alaska” hat on, I urge you to read on. (Disclosure, I have nothing against Alaska. I was born in Fairbanks, Alaska) If you live in one of the “red spots” on the heat map above or in one of the counties in the list of “where home prices could stall after tax reform”, the charts above do not necessarily mean that at the end of 2018 your house is going to be worth 5% less than it was at the beginning of 2018. Moody’s has done the comparison of the tax bill passing versus no tax bill. If prior to the tax bill being passed it was estimated in 2018 that homes in your area were going to increase in value by 5% and the heat map above shows a 4% drop as a result of tax reform, then that means instead the value of your home growing by 5% it may only grow by 1%.

As with any forecast, it’s anyone’s guess at this point how the math will actually work itself out but in general I think it will be more positive than the consensus expects.

House Values Under $250,000 – Status Quo

Given the changes to the tax law, if you live in a house that is valued under $250,000, regardless of where you live, the downward pressure on the price of your house as a result of tax reform should be minimal. Why? Most buyers in this range will most likely be electing the standard deduction anyways so the new $10,000 cap on SALT deductions should have little to no impact. This should even be true for states that have high property taxes because the homeowners would need over $24,000 in itemized deductions before the $10,000 cap would potentially hurt them tax wise.

The Sandwich: House Values $250,000 - $750,000

The homeowners at the highest risk of a reduction in the value of their house are located in what I call “The Sandwich”. They have a house that is valued somewhere between $250,000 – $750,000 and they live in a high property tax state. While Congress touts that the doubling of the standard deduction is a “fix all” for all of the tax deductions that have been taken away, it’s unfortunately not. There are a number of individuals and families that are in the income range customarily associated with buying a $250K – $750K house that may actually pay more in taxes under the new rules.

Taxpayers in this group are also moving from their “starter house” in their first “big house”. Unlike the super wealthy that may care less about paying an extra $5,000 in taxes per year, for an upper middle class family that has kids, that is saving for college, and contributing to 401(k) plans, the loss of that tax benefit may mean they can’t take a family vacation if they buy that bigger house. Less buyers in the market for houses in this “Sandwich” range translates to lower prices.

How much lower? Probably nothing dramatic in the short term because the U.S. economy is doing so well. When the economy is growing, people feel secure in their jobs, wages are going up, workers are getting bonuses, and that provides them with the additional income needed to make that larger mortgage payment and pay a little more in taxes.

My concern would be for someone that is planning to purchase a house and then sell within the next 5 years. If the economy goes into a recession, people start losing their jobs, and the U.S. consumer starts look for more ways to stretch their dollars, the homeowners that stretched themselves to buy the bigger house based on the big bonus that they received when the economy was humming are at a big risk of losing their house. In addition, there may be fewer buyers in the market because families may not want to waste money on property taxes that they can’t deduct.

The Millionaire Club: House Values $750,000+

It would seem that houses in the $750,000+ range have the most lose to for two reasons. First, homeowners in this category pay the highest property taxes and they are typically not electing the standard deduction at this income level. Second, home buyers at this price point would also be negatively impacted by the lower $750,000 cap on the mortgage interest deduction.

But I doubt this will be the case. Why? There is only so much lake front property. If you make over $5M per year and you fall in love with a lake house in upstate New York that has a $1.5M price tag, while you could try to find a similar lake house in a more tax friendly state, if you make $5M per year, what’s another $15,000 in expenses for buy your first choice.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The House Passed The Tax Bill. What's The Next Step?

Last night the house passed the Tax Cut & Jobs Act Bill with ease. Next up is the Senate vote. It’s important to understand the House and the Senate are voting on two different tax reform bills. Below is a chart illustrating the main differences between the House version and the Senate version of the tax reform bill.

Last night the house passed the Tax Cut & Jobs Act Bill with ease. Next up is the Senate vote. It’s important to understand the House and the Senate are voting on two different tax reform bills. Below is a chart illustrating the main differences between the House version and the Senate version of the tax reform bill.

As you can see, there are a number of dramatic differences between the two bills. The easy part was getting the House to approve their version because the Republican Party own 239 of the 435 seats. In other words, they own 55% of the votes.

The Senate Vote

Next, the Senate will put their tax reform bill to a vote. The vote is expected to take place during the week of Thanksgiving. However, in the Senate , which the Republican have the majority, they only have 52 of the 100 seats. In this case, they would need at least 50 “Yes” votes to get the bill approved in the senate. It’s 50, not 51 votes, because in the event of a “tie”, the Vice President gets a vote to break the tie and he is likely to vote “Yes” to keep tax reform moving along.

Reconciliation Process

Once the House and Senate have approved their own separate tax bills, they will then have to begin the reconciliation process of blending the two bills together. This will be the difficult part. The two tax bills are dramatically different so there will be a fair amount of grappling between the House and the Senate committees as to which features stay and which features get tossed out or adjusted as part of the final tax bill. In the end, the final tax reform bill cannot add more than $1.5 Trillion to the national debt over the next 10 years. Otherwise, the bill would need to return to the Senate and would require “60” votes to approve the bill. There is a slim too no chance of that happening.

Tax Reform by Christmas

President Trump wants the bill on his desk to sign into law before Christmas. While it seems likely that the Senate will pass their tax bill next week, the battle will take place in the reconciliation process that will begin immediately after that vote. It’s a tall order to fill given that there are only six weeks left in the year and how different the two bills are in their current form. However, don’t underestimate how badly the Republican party wants to put a run on the scoreboard before the end of the year. If they get tax reform through in the last week of the year, it’s an understatement to say that it will be an intense final week of December for year-end tax planning. Stay tuned for more………

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can I Use My 401K or IRA To Buy A House?

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down payment given all of the taxes and penalties that I would have to pay?" This article aims to answer both of those questions and provide you with withdrawal strategies to help you avoid big tax consequences and early withdrawal penalties.

401(k) Withdrawal Options Are Not The Same As IRA's

First you have to acknowledge that different types of retirement accounts have different withdrawal options available. The withdrawal options for a down payment on a house from a 401(k) plan are not the same a the withdrawal options from a Traditional IRA. There is also a difference between Traditional IRA's and Roth IRA's.

401(k) Withdrawal Options

There may be loan or withdrawal options available through your employer sponsored retirement plan. I specifically say "may" because each company's retirement plan is different. You may have all or none of the options available to you that will be presented in this article. It all depends on how your company's 401(k) plan is designed. You can obtain information on your withdrawal options from the plan's Summary Plan Description also referred to as the "SPD".

Taking a 401(k) loan.............

The first option is a 401(k) loan. Some plans allow you to borrow 50% of your vested balance in the plan up to a maximum of $50,000 in a 12 month period. Taking a loan from your 401(k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of 59.5. 401(k) loans, like other loans, change interest but you are paying that interest to your own account so it is essentially an interest free loan. Typically 401(k) loans have a maximum duration of 5 years but if the loan is being used toward the purchase of a primary residence, the duration of the loan amortization schedule can be extended beyond 5 years if the plan's loan specifications allow this feature.

Note of caution, when you take a 401(k) loan, loan payments begin immediately after the loan check is received. As a result, your take home pay will be reduced by the amount of the loan payments. Make sure you are able to afford both the 401(k) loan payment and the new mortgage payment before considering this option.

The other withdrawal option within a 401(k) plan, if the plan allows, is a hardship distribution. As financial planners, we strongly recommend against hardship distributions for purposes of accumulating the cash needed for a down payment on your new house. Even though a hardship distribution gives you access to your 401(k) balance while you are still working, you will get hit with taxes and penalties on the amount withdrawn from the plan. Unlike IRA's which waive the 10% early withdrawal penalty for first time homebuyers, this exception is not available in 401(k) plans. When you total up the tax bill and the 10% early withdrawal penalty, the cost of this withdrawal option far outweighs the benefits.

If You Have A Roth IRA.......Read This.....

Roth IRA's can be one of the most advantageous retirement accounts to access for the down payment on a new house. With Roth IRA's, you make after tax contributions to the account, and as long as the account has been in existence for 5 years and you are over the age of 59� all of the earnings are withdrawn from the account 100% tax free. If you withdraw the investment earnings out of the Roth IRA before meeting this criteria, the earnings are taxed as ordinary income and a 10% early withdrawal penalty is assessed on the earnings portion of the account.

What very few people know is if you are under the age of 59� you have the option to withdraw just your after-tax contributions and leave the earnings in your Roth IRA. By doing so, you are able to access cash without taxation or penalty and the earnings portion of your Roth IRA will continue to grow and can be distributed tax free in retirement.

The $10,000 Exclusion From Traditional IRA's.......

Typically if you withdraw money out of your Traditional IRA prior to age 59� you have to pay ordinary income tax and a 10% early withdrawal penalty on the distribution. There are a few exceptions and one of them is the "first time homebuyer" exception. If you are purchasing your first house, you are allowed to withdrawal up to $10,000 from your Traditional IRA and avoid the 10% early withdrawal penalty. You will still have to pay ordinary income tax on the withdrawal but you will avoid the early withdrawal penalty. The $10,000 limit is an individual limit so if you and your spouse both have a traditional IRA, you could potentially withdrawal up to $20,000 penalty free.

Helping your child to buy a house..........

Here is a little known fact. You do not have to be the homebuyer. You can qualify for the early withdrawal exemption if you are helping your spouse, child, grandchild, or parent to buy their first house.

Be careful of the timing rules..........

There is a very important timing rule associated with this exception. The closing must take place within 120 day of the date that the withdrawal is taken from the IRA. If the closing happens after that 120 day window, the full 10% early withdrawal penalty will be assessed. There is also a special rollover rule for the first time homebuyer exemption which provides you with additional time to undo the withdrawal if need be. Typically with IRA's you are only allowed 60 days to put the money back into the IRA to avoid taxation and penalty on the IRA withdrawal. This is called a "60 Day Rollover". However, if you can prove that the money was distributed from the IRA with the intent to be used for a first time home purchase but a delay or cancellation of the closing brought you beyond the 60 day rollover window, the IRS provides first time homebuyers with a 120 window to complete the rollover to avoid tax and penalties on the withdrawal.

Don't Forget About The 60 Day Rollover Option

Another IRA withdrawal strategy that is used as a “bridge solution” is a “60 Day Rollover”. The 60 Day Rollover option is available to anyone with an IRA that has not completed a 60 day rollover within the past 12 months. If you are under the age of 59.5 and take a withdrawal from your IRA but you put the money back into the IRA within 60 days, it’s like the withdrawal never happened. We call it a “bridge solution” because you have to have the cash to put the money back into your IRA within 60 days to avoid the taxes and penalty. We frequently see this solution used when a client is simultaneously buying and selling a house. It’s often the intent that the seller plans to use the proceeds from the sale of their current house for the down payment on their new house. Unfortunately due to the complexity of the closing process, sometimes the closing on the new house will happen prior to the closing on the current house. This puts the homeowner in a cash strapped position because they don’t have the cash to close on the new house.

As long as the closing date on the house that you are selling happens within the 60 day window, you would be able to take a withdrawal from your IRA, use the cash from the IRA withdrawal for the closing on their new house, and then return the money to your IRA within the 60 day period from the house you sold. Unlike the “first time homebuyer” exemption which carries a $10,000 limit, the 60 day rollover does not have a dollar limit.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.